As a caring parent you would always want your child to get the very best. With growing standard of living, the Kid’s education expenses are consistently rising. I believe the average rate of education inflation (the rate at which education expenses are rising) is around 10% to 15% depending on the location.

In this post let us understand – How to calculate the future value of Kid’s Education Goal amount? How much should you save/invest for your kid’s College education?

Calculate the Future Value of Kid’s Education Goal Amount

For calculating the future cost of education expenses, you need below details:

- Kid’s age

- No of Years remaining to attend college

- Current value (cost) of College Education. You may have to do little bit of research to find out the average cost of college education in your preferred location.

- Education Inflation (We can safely assume this as minimum 10% 🙂 )

Let us do the calculation with an example.

Example – Mr Sundaram wants to plan for his kid’s higher education. Child’s age is 5 years and will attend college in 12 years from now. As per his research, he came to know that the current cost of Engineering Education in his city is around Rs 5,00,000. He wants to find out what is the Future cost of his goal?

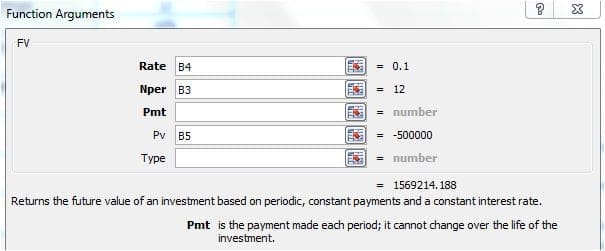

I have used MS-Excel’s FV function to calculate the future value of goal amount. (FV Function variables are Rate 10% from B4 cell, Duration 12 years from B3 cell and Current cost of education Rs 5 Lakh from B5 cell).  So, at 10% inflation rate the college expenses of Rs 5 Lakh will become Rs 15.69 Lakh in 12 years. Mr Sundaram has to accumulate this amount for his Kid’s education.

So, at 10% inflation rate the college expenses of Rs 5 Lakh will become Rs 15.69 Lakh in 12 years. Mr Sundaram has to accumulate this amount for his Kid’s education.

(For detailed explanation on “How to calculate Future Value?’ – Click here )

How much do I need to invest for my Kid’s education?

Mr Sundaram now knows that he requires around Rs16 Lakhs in 12 years from now. He further wants to calculate how much he has to save every year to achieve the goal amount. He also wants to find out how much he should save if he opts for Fixed Deposits (or) Mutual Funds (or) Stocks?

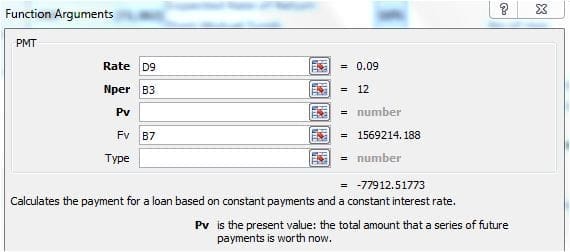

I have used MS-Excel’s PMT function to calculate the required Yearly Savings amount for Kid’s education. ( PMT function’s variables are D9-Rate-9%, B3-Term-12 years and B7 -Target Goal Amount-Rs 15.69 Lakh).

Scenario 1 (If Savings are invested in Fixed Deposits)

Mr Sundaram has to save Rs 77,913 per year for the next 12 years to achieve his goal amount of Rs 15.69 Lakh. The yearly savings amount is invested in Fixed Deposits which may give 9% returns. (You may refer the above “PMT function” image on how to calculate.)

Scenario 2 (If Savings are invested in Mutual Funds)

Mr Sundaram has to save Rs 73,382 per year for the next 12 years to achieve his goal amount of Rs 15.69 Lakh. The yearly savings amount is invested in Mutual Funds and he expects 10% returns from Mutual Funds.

Scenario 3 (If Savings are invested in Shares)

If Mr Sundaram decides to invest in Stocks then he has to save Rs 65,023 per year for the next 12 years to achieve his goal amount of Rs 15.69 Lakh. The stock investments may give him returns of 12%.

Important Points to Ponder upon

- You can consider the above yearly savings amount (I have provided a calculator below. You can use it to know your goal amount) as the minimum contribution amount that you need to save/invest. As and when your income increases you can keep contributing more towards your yearly savings. Accordingly, you can re-calculate the required Target goal amount as explained above.

- If you choose to invest in mutual funds (or) stocks then it is better to move your fund to Safe Investment avenues like Fixed deposits, atleast 2 or 3 years before the Target goal year. By doing this you may prevent the accumulated fund from eroding. (Read : ‘Best Equity Mutual funds‘)

- Besides these savings, have a good life insurance coverage. Consider taking Term insurance plan (if you do not have). It is better to avoid Child Education Insurance plans. I believe Balanced Mutual Funds with the combination of Term Insurance plan may prove to be a good decision. (You may like visiting my post on “Best Balanced Mutual Funds.”)

- Do not buy a financial product just because the scheme name has “Child plan” on it. Understand the features, benefits and risks associated with that investment option.

- Regularly monitor and track your investments. Also, be informed regularly of the cost of education for various courses.

- After reaching the goal year, based on the fee payment conditions (like one time payment or per year basis) you may still need to manage the fund carefully.

Download Calculator – Kids’ Education Goal amount . (In-fact you may use this calculator for any accumulation goals like vacation planning, Marriage expenses etc.,)

Liked the post? Please share it with your friends. What is the average per year increase of cost of college education in your location? Kindly share your comments.

Continue reading :

- List of Articles on the key Components of Personal Financial Planning

- Retirement Planning in 3 Easy steps

- The importance of numeracy in becoming Financially Literate!

- How much Term Life Insurance Cover do I need? | Online Insurance coverage Calculator

(Image courtesy of photostock at FreeDigitalPhotos.net)

Join our channels

Investing in your child’s education is a crucial financial consideration. While it’s important to calculate the required investment, it’s equally essential to strike a balance between financial planning and realistic expectations. Assessing the potential costs and starting early allows for a smoother investment journey, ensuring your child’s educational aspirations are well-supported without compromising your overall financial stability. Finding this balance empowers you to make informed decisions, securing a brighter future for your child without undue financial strain.

Hi

I have 14k sip for a 15 years goal as child educational expenses with 60:40

All are in regular – plan and running ….

Invesco India Contra – 2,025

Motilal Oswal Multicap 35 -2,025

Principal Multicap -2,025

Tata Equity P/E Fund -2,025

Aditya Birla Sun Life Corporate Bond -2,700

Reliance Prime Debt Fund -2,700

As per return they are good as a over all portfolio and as per category and index bench mark.

What is your opinion for the above fund selection ?

I plant to invest sip of 30K per month (as per retirement planning and 7% inflation) to the same funds but in Direct mode

Is this a wise decision?

Dear bubai,

Kindly check the portfolio overlap for the four Equity funds and revert to me with your analysis.

1 & 4 are Value oriented schemes.

2 & 3 are mutlicap funds.

You may add an hybrid equity (balanced) and/or Mid-cap fund for our long-term Retirement goal. (1 Diversified equity fund + Balanced fund + Mid-cap fund).

Related article :

Mutual Fund Portfolio Overlap Comparison Tools

Hi… I was trying to calculate using PMT(how much to invest an year for the future value of my goal). It is showing result in ‘$’ how to change the calculation to indian rupees?

If I choose a balanced and a large cap fund for my medium term goal(education), should i consider average rate of return of both of these funds, say 15% for large cap and 9 % for balanced and take their avg i.e. 12% as the rate of return for the PMT function?

thanks and Regards

Dear Yavika ..You may just multiple the result with Indian rupee equivalent.

For ex: 1 $ = Rs 65.

Yes, you may expect 10 to 12%.

Hi,

I’m 37 yr old with 2 year old daughter. I’m planning to invest in her education,marriage, my retirement and term insurance.

Presently I have two mortgage of total approx 80000.

What mix of investments do you suggest?

Hi,

Term insurance : Read – Best online term insurance plans.

You may consider investing in Equity oriented Funds, can be through SIPs (Systematic Investment Plans).

Suggested articles:

List of investment options!

List of important articles on Personal Financial planning!

Retirement goal planning calculator.

Hi Sreekanth,

Very nice write up. I am 35 years old and my child age is 4 months. I Start to do a SIP for my child education – that is required during his college education after passing class 12.

As you shown in the example with data , I can invest max 60-65 thousand yearly for his education purpose for the upcoming 15 years.

What MF you suggest me to start the SIP ?

By the way I have HDFC prudence MF for last 2 years with SIP 5000/ pm.

Thank you,

/shankha

Dear shankha,

You can continue with HDFC Prudence.

Can consider adding a Large cap fund, one diversified equity fund and one mid-cap funds to your portfolio.

Suggested articles:

How to pick right mutual fund schemes?

Best Equity funds.

MF portfolio overlap analysis tools.

List of important articles on Personal Financial planning.

Hi ,

why you suggest me Large-cap fund and Diversified or Multi-cap Fund instead of Small & Mid-cap fund for a period of 10 + years for child education ?

Thank you,

/shankha

Dear shankha,

I have suggested mid-cap fund too.

You can consider creating a diversified portfolio, may be with slightly higher allocation to mid cap fund.

Thank you.

I short – 1 will maintain 3 funds for upcoming 10 years . Can you suggest what I should choose in this case

1) HDFC prudence MF for last 2 years with SIP 5000/ pm

2) child education – Max 6-7 thousand pm

3) Retirement – Max 10 thousand pm

Can you suggest what i should choose for (2) and (3)

Thank you,

./shankha

Dear shankha ..As suggested in my previous comment, kindly read : Best Equity funds.

Hi Sreenath,

I want to invest around 5 lacs in lumpsum mutual funds scheme for 15 yrs.Can you please suggest is this the right time to enter.Also please suggest some good funds

Dear Richa,

As your investment horizon is long term, you may kindly go ahead and execute your investment plan.

Kindly read:

How to select right mutual fund scheme?

Best Mutual funds 2017.

MF portfolio overlap analysis tools.

Dear Sreekanth,

Thanks a lot for the guidance. Very precise and Excellent article. Made my calculations easy. Thanks a lot.

regards

RAJ

Thank you dear Raj..Kindly share the articles with your friends.

Happy new year 🙂

Hi Sreekanth,

First off, thanks a ton for putting up such useful information in such a easily understandable way with illustrations, explanations and for your supportive and thoughtful responses to all reader queries. Keep it up !

I want to invest 4K in suitable debt funds per month towards my goal of saving for my child’s education needs, 8 years away. I’m saving 6K in monthly SIPs in diversified equity funds towards the same goal.

I want to know which are the debt funds which will be suitable for this purpose.

Thanks.

Dear Jayanthi,

Thank you for your kind words!

So, you would like to have 60:40 allocation between Equity & Debt funds??

Kindly read below articles;

Types of Debt Funds.

Best Debt Mutual Funds.

Best Monthly Income Plans of Mutual Funds.

Hi Sreekanth,

Yes, 60:40 allocation is my plan, 2 years prior to when I’m likely to require the money, I want to move a proportionate chunk of my equity investments into Debt.

I read up the information on Debt funds as you have suggested.

I would like to not risk any loss of capital in the debt portion of my investment.So, as liquid funds are the least risky in the Debt category, would it be prudent to start an SIP in one of the best in class liquid funds ?

Also, would it be wise to move my equity assets into this same liquid fund as my goal year approaches ?

On a different note, I would like to understand what the various debt market instruments are – treasury bills, commercial paper, bankers’ acceptances, deposits, certificates of deposit, bills of exchange, what they mean and how do they work. I want to understand for myself how the risk-return values are calculated for each, based on the nature of the instrument.

Can you please guide me on where I can get this information. Thanks a lot.

Dear Jayanthi,

Your strategy of switching to Debt funds before one year of target year, is good.

Liquid funds are safest out of the all debt fund types.

Kindly search in Google, plenty of info is available on debt securities.

I’ll do that. Thanks Sreekanth.

Dear Shreekant,

I would like to have your esteemed comments on LIC’s following two plan for my new born son.

1) LIC JEEVAN TARUN PLAN834-4-OPTION 4

2) LIC NEW CHILDREN MONEY BACK PLAN 832.

Regards,

Arun

Dear ARUN,

You may kindly read my reviews on these Plans;

LIC JEEVAN TARUN PLAN – Review

LIC NEW CHILDREN MONEY BACK PLAN – Review

Hi Srikanth,

I wanted to invest 5K per month. Can you please advice me on the investment areas which make me financially better.

Regards,

Laxman Jaiswal

Dear Laxman ..Kindly let me know your investment horizon (time-frame)??

Read:

Best Equity funds.

List of best investment options.

Plz guide me, I want to invest 3000 Rs PM. So I confused to invest in sip,share or ppf account. Plz guide me how can invest. My thinking is 2000 in sip and 1000 for ppf

Dear shrinivas ..May I know your investment objetive(s) & time-frame?

Read : How to create a SOLID investment plan?

Dear Sreekanth

Thank you for putting down a lot of useful information regarding the personal finance.

I am 29 years old married with 2 years old daughter and 1 year old son. I did not buy any term insurance plan since my family is not dependent entirely on me. I am investing 1 Lakh per year in Sukanya Samriddhi Scheme since 2015.

Presently I am holding 2 mutual funds:

1. SBI Blue Chip Fund (G) – SIP – 4000 /-

2. L& T India Prudence Fund – Direct (G) – SIP – 2000 /-

I am planning to invest 8000 rupees per month for the below funds:

1. Mirae Asset Emerging Bluechip Fund (G) – 3000/-

2. DSP – Black Rock MicroCap Fund (G) – 3000 /-

3. Kotak Select Focus Fund (G) – 2000 /-

Please advise if the above MF allocation is proper or do I need to modify it. My goal is towards my kids education, marriage and retirement planning. My investment horizon is at least 15 years. Also I would like to know if it is better to go for a Direct Mode rather than Regular Mode for the above Mutual Funds.

Thanks.

Dear Samir,

Still, you may re-think and evaluate your life insurance requirement again.

You may also consider buying a Personal Accident cover with Disability risk cover.

Read : Best Personal Accident insurance plans.

Good selection of funds. I could notice that you have decent funds across all fund categories – balanced, multi-cap, large cap ,Mid & small cap.

You may reduce the quantum of allocation to large cap fund and invest more in mid/small cap funds for next few years as your investment horizon is >10 years.

Kindly read below articles;

Kids Education goal planning & calculator.

Retirement planning goal & calculator.

Direct plans Vs Regular plans – Comparison of returns.

Hello Mr. Reddy,

Awesome work and enjoyed reading your articles.

I am 33 year old married with 2 year old son and having term insurance 50 lakh and 3 lakh health insurance for family

Currently I hold 5 mutual funds namely HDFC prudence, HDFC top 200, ICICI focused blue-chip, reliance small cap and reliance tax saver fund investing 2k each per month. Please advise is the MF allocation is proper or do I need to modify focusing my sons education and his marriage.

Also currently I am living on rent and want to save some money for my house purchase and initial installment. And I can add another 10K in MF. Please advise and suggest where and which is the best way to invest and allocate money for future financial security.

Dear Raj,

There are better alternatives to Reliance small cap (Ex – Franklin smaller companies fund).

Rest of the funds are fine.

Read:

Best Equity funds.

How to select the right mutual fund based on risk ratios?

MF overlap analysis tools.

Property purchase – May I know the time-frame??

Read: List of articles on important aspects of Personal Financial Planning.

Hey thanks a lot for the swift response. Another 5 years for property purchase

Dear Raj ..You can invest in a balanced fund for next 3 to 4 years and switch to safer investment avenues in the 4th year.

Read: Best balanced funds.

Dear Sreekanth:

Hope you are doing fine today.

I planning for retirement plan & child education plan. My age is 35 and would like retire at 60. I can invest around 20k p.m. Could you please advise what would be best option.

Dear Nooruddin,

Kindly go through below articles & you may revert to me;

Retirement planning calculator.

List of best investment options.

List of important articles on Personal Financial Planning.

Thanks for the detailed good article.

I have shortlisted these 10 funds as my portfolio (for my daughter’s education and marriage -aged 9). Please review it and suggest if i should drop few of them or go with all of them for long term.

Franklin smaller co.

ICICI Prudential Balanced Advantage Fund

Reliance Small Cap

UTI Transportation and Logistics Fund

Tata Balanced Fund

ICICI Pru Value Discovery Fund-Reg(G)

ICICI Pru Exports & Other Services Fund-Reg(G)

Franklin India High growth co

Idbi India Top 100

HDFC Mid-Cap Opportunities Fund(G)

ICICI Pru FMCG Fund-Reg(G)

I try to add spare lumsum amount every 3 months (about 20K total). I distribute the total money in each of these (excluding the sector funds).

Dear Neha,

May I know the reason or strategy for shortlisting 10 (too many) funds?

Kindly go through below articles;

MF portfolio overlap analysis tools.

What are Large/Mid/Small-cap funds?

My MF picks & my Mf portfolio.

Best Equity funds 2016.

As such there was no particular reason for that. I just thought to distribute the investment for lower risk. And i now think that these are too much. So just trying to get an answer for , which one should i remove from my portfolio as per your thoughts. If you can help, it will be great.

Dear Neha,

Given a choice, I will consider keeping below funds;

Franklin smaller co.

Tata Balanced Fund

ICICI Pru Value Discovery Fund-Reg(G)

Franklin India High growth co

HDFC Mid-Cap Opportunities Fund(G)

Good Work Sreekanth, just got to know about your posts from my friend and glad that I am reading through this. Thanks for all the useful information

Thank you dear Prabhu. Keep visiting 🙂

Hi Sreekanth,

I have two kids aged 5 and 3 years. Kindly suggest best ways to invest for their education. I can invest up to 20000 per month. And what would be the best time frame to accumulate money for my kids education.

I have SBI term insurance plan and health insurance provided by my company.

Thanks,

Shanthi.

Dear Shanthi,

Suggest you to take Personal accident policy & health insurance (independent one) too.

Read :

Best Personal Accident insurance policies.

Best Portals to compare health insurance plans.

Kid’s education goal:

Read : Kid’s education goal planning & calculator.

Best Investment options.

i have 1 daughter age 3 and son age 1

i dont have MF and SIP

only term insurance total 1.20 cr in 3 different companys

01.icici pru life icare protect 40 lakhs (2011)

02.Exide life my term insurance 25 lakhs ( 2013 )

03.Birla sun life 56 lakhs (2014)

and Health insurance 5 lakhs and critical illness 20 lakhs

my child future can’t saving amount in case anything happen my died my cover 1.20 cr my child and wife future expenses

and addition income plan i try

which plan child insurance ULIP or sip or SSY

help me

Dear feroz,

Kindly avoid buying Child plans.

You may consider taking a stand-alone Personal accident policy.

Kindly read : Best Personal accident plans.

You may start creating your Equity oriented MF portfolio.

Read:

Best Balanced funds.

Best Equity funds.

How to invest in Direct plans of MFs?

1.Who best policy PA in 2015?

2.Why avoid me MF or SIP

ok my age 36 today starting SIP fund 1000 p/m for 25 yrs in child marriage in case any thing happen died after 2 yrs loss money or return fund for 2 yrs paid amount 25ooo and loss marriage plan

better child insurance addition wavier premium rider no loss money company wavier premium so benefit SA+wavier + maturity amt

3.Any SIP or MF child future wavier plan?

one time investment 1 lakh MF or FD or Etc maturity after 25 yrs return who high return ?

Dear Feroz..i am unable to understand your queries..

1.which company best claim ratio 2015 personal accident policy?

2.child name one time investment 1 lakhs term 25 yrs which best plan?

Dear Feroz..As of now I do not have data on claim ratios for PA policies. You may read : Best Personal Accident insurance plans.

Why do you want to buy an insurance plan on child’s name?

any choice any option and in-case any thing happen my died how do save amount child marriage?

Dear Feroz..So, you as a parent should have insurance cover and not on your child’s name. Kindly buy a term plan on your name at the earliest.

Hi Sreekanth!

I have very less idea about mutual funds and SIPS’s. I am a 30 year old and have twin daughters who are 1 year old.

I have already invested 1.5 lakh per year for each in Sukanya Samriddhi Yojana.

Can you suggest SIP’s or mutual funds or debt funds for 10 – 20,000 per month to help me accumulate good money and please suggest time duration.

I have no particular goals.

Also, I’m very particular that I don’t lose my primary investment money.

My monthly earnings – 1 lakh per month (30% bracket).

Any help will be sincerely appreciated.

Thanks and regards!

Dear Vineetha,

You are the best person to decide on your investment time-horizon, based on your financial goal(s).

Do you have adequate life / health insurance covers?

If you would like to accumulate good amount of money then you have to take risks.

No Sreekanth.

Not opted for either health or life insurance cover yet.

My father always thought health insurance is a waste of money, now he thinks otherwise.

Is 30 years the right age to get insured?

Thanks and regards!

Dear Vineetha,

Infact, I believe that 30 years is the right time to take health/life insurance covers.

Kindly read below articles;

Why Insurance is important?

Best Term insurance plans.

Best Family floater health insurance plans.

Best Personal Accident insurance plans.

Thanks a lot for your time and advice 🙂

Hi Sreekanth,

I want to save some money for my parents future, they are now in 50s, I want to basicaly invest somewhere so that they can get a monthly in come for there later days, if I can invest 2-3 lakhs what will be the optimal or best plan I can go for.

Dear Shailu,

When they do require periodic income? Is it starting from now or in future (goal year)?

Do they have adequate health insurance cover?

Are they dependent on you financially?

Hi Sreekanth, I like your blog as it is easy and simple for layman. I have 2 questions.

1) I have Rs 100000 surplus to invest (after exhausting PPF and four equity MFs) if I want to invest one time for 3 or 5 years which is the best investment option. Don’t want to invest in multiple MFs as it will complicate record keeping.

2) If any of my MF schemes don’t do well, after redeeming where should I direct the money to create a surplus instead of putting in idle Savings or FDs.

Dear Suresh..Kindly share more details about 4 equity MFs.

I have the below

1) Icici focussed bluchip Direct

2) DSP Black rock Top 100

3) ICICI Value Discovery

4) HDFC balanced

Dear Suresh,

Invested funds are good ones individually.

But 1 & 2 are from the same fund category – Large cap. This may lead to portfolio overlap. You may consider to exit from one fund and add one Mid cap fund like UTI midcap / Franklin smaller co’s fund for long-term.

Invest Rs 1 Lakh in HDFC balanced fund ( 3 to 5 year time-frame).

Read my articles;

Best Equity funds

MF portfolio overlap analysis tools.

Isn’t it a better option to put 100000 in a debt fund and open a STP to another mid-cap equity fund? I believe this will get better returns over the period.

Dear Tarun ..Choice is yours. But kindly note that STP transactions are treated as Redemptions and Capital gain taxes (if any) are applicable.

Thanks for the response, this probably answers my today’s query as well. I am new to investment field and still in learning phase. Until today I was under impression that the best way to park lump-sum amount (around 7-8 lakhs) is STP only. But probably I need to start from scratch on this plan. Could you please advise what could be the best option to invest this amount? This lump-sum amount is available for long term and it is calculated after creating sufficient FD’s for next 2-3 years. Also ELSS SIP’s are in place as well.

Thanks in advance !

Dear Tarun ..If investment horizon is long-term, you may invest the lump sum (Rs 1 Lakh) in an equity fund.

Read: Best Equity funds.

Thanks again Sreekanth !

Now if I want to invest remaining lump-sum amount for 1 and 2 years time frame (based on when I need that money). Is FD the best option to invest for short time frames of 1-2 years or less? Please advise.

Dear Tarun,

Arbitrage funds can be one of the option (considering 1 year + horizon & safety of capital).

Kindly read :

Best Arbitrage Funds.

Debt Funds Vs FDs.

I have 4 SIPs

1.Balanced- rs 1000/- 5 yrs

2.Multi cap- rs 1000/- 5 yrs

3.Elss Rs4000/- 12 yrs

I want to add a Mid cap to the mix for SIP of Rs1000 for 5 yrs. Can u please advise I am looking at 2 options the more stable FT Smaller cos or the high risk &reward Mirae asset blue chip

I

Dear Ganesh,

You may consider FT smaller / UTI mid-cap fund.