The National Savings Schemes (NSSs) are one of the very popular saving schemes in India. These are regulated by the Ministry of Finance. They offer complete security of investment combined with attractive returns.

These schemes also act as instruments of financial inclusion especially in the geographically inaccessible areas due to their implementation primarily through the Post Offices, which have reach far and wide.

It is estimated that nearly $137 billion or over Rs. 9 lakh crore are currently tied up in small savings schemes.

Some of the very popular schemes which fall under NSS are as below

- PPF (Public Provident Fund)

- Sukanya Samriddhi Scheme

- Monthly Income Scheme

- Senior Citizen Savings Scheme

- KVP (Kisan Vikas Patra)

- NSC (National Savings Certificate)

- Time Deposits &

- Recurring Deposits

Small Saving Schemes Interest Rates 2016 – New norms w.e.f. April 2016

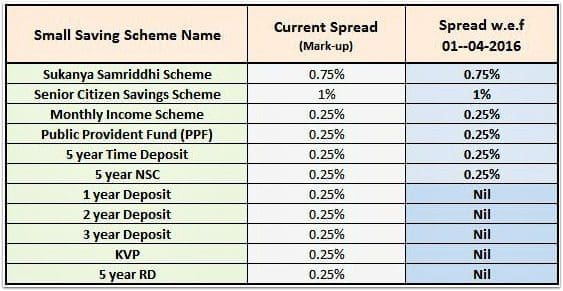

- As per the current norms, the interest rates of these small saving schemes are linked to the yield of government bonds of comparable maturity (with a small mark-up) and are revised once a year. Mark-up here refers to ‘Spread’.

For example : The interest rate on PPF has a mark-up of 25 basis points over and above the G-Sec rate (Govt Bonds rate). So, if comparable maturity G-sec rate is say 8.5% then the interest rate on PPF will be determined as 8.75%. (One Basis Point is equivalent to 0.01%)

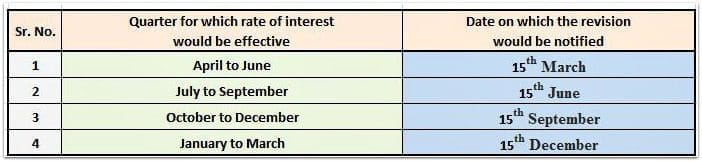

- The government has decided to revise Small Saving Schemes Interest Rates on a Quarterly basis starting from 1st April, 2016.

- The rates of interest applicable on various small savings schemes for the quarter from April to June 2016 effective from 1.4.2016 would be notified on 15th March, 2016.

- The saving schemes like Sukanya Samriddhi, Senior Citizen Savings Scheme and Monthly Income Scheme enjoy ‘spreads’ over the G-sec rate of comparable maturity viz., of 75 basis points (0.75%), 100 bps (1%) and 25 bps respectively. These mark-ups / spreads have been left untouched by the Government.

- Similarly the spread of 25 basis pointss that long term instruments, such as the 5 yr Term Deposit, 5 year National Saving Certificates (NSC) and Public Provident Fund (PPF) currently enjoy over G-Sec of comparable maturity, have been left untouched.

- The 25 bps (0.25%) spread that 1 year, 2 year and 3 year Term Deposits, KVPs and 5 yr Recurring Deposits have over comparable tenure Government securities, shall stand removed w.e.f. April 1, 2016 to make them closer in interest rates to the similar instruments offered by the banking sector.

- The interest rates on a 10 year National Saving Certificate (discontinued since 20-12-2015), 5 year National Saving Certificate and Kisan Vikas Patra is compounded on half-yearly basis. This shall be done on an annual basis from 1st April, 2016.

- Premature closure of PPF accounts shall be permitted in genuine cases, such as cases of serious ailment, higher education of children etc,. This shall be permitted with a penalty of 1% reduction in interest payable on the whole deposit and only for the accounts having completed five years from the date of opening.

Small Savings Schemes Revised Interest Rates for the quarter from January 2017 to March 2017

The rates of interest applicable on various small savings schemes for the quarter from Jan to Mar 2017 effective from 1.1.2017 would be as below;

- The new rate of Interest on Sukanya Samriddhi Scheme (SSA ) is 8.5%.

- The new rate of Interest on PPF (Public Provident Fund) would be 8%.

- The interest rate on Senior Citizen Savings Scheme (SCSS) is 8.5%.

- New interest rate on Kisan Vikas Patra (KVP) would be 7.7%.

- The rate of interest on 5 year National Savings Certificate (NSC) is 8%.

- New interest rate on post office MIS (Monthly Income Scheme) is 7.7%.

- The rate of interest on a 5 year Post Office RD (Recurring Deposit) would be 7.3%.

Latest News (22-Nov-2016) : Old High Denomination Notes (500 & 1000) can not be deposited in Small Savings Schemes offered by Post Offices & Banks.

Latest News (31-Dec-2016) : To protect senior citizens from falling interest rates, Prime Minister Shri Narendra Modi in his address to the nation on Saturday said that they would be given guaranteed interest rate of 8 % on deposits up to Rs. 7.5 lakh. The provision of special interest for senior citizens (those above 60 years of age) will be applicable for 10 years, and the interest will be paid on a monthly basis.

(Reference : PIB)

i start sip in 2015, after 2year i want incresed sip but the mf amc called me they are not able this. they called me you cancelled your old sip and then new sip start to more amount . this case what i do ……

Dear javed,

You may continue with your current SIP and also start a new SIP with the balance amount.

I am having account only in Indian Bank & ICICI Bank. Are The Indian Bank or ICICI Bank accepting SCSS? If they are not accepting & if I open in another Bank like Canara or PNB, will they transfer the interests from SCSS by ECS?

Dear Subramanian,

I am not sure about Indian bank, but ICICI Bank offers SCSS.

Dear Srikant

Is SCSS comes under 80 c DEDUCTIONS

THE POSTAL WEB STATES ” Investment under the scheme qualifies for the benefit of section 😯 C of the income tax Act,1961 from 1-4-2007.”

But the post personal say it is not acceptable under 😯 C.

Kindly clarify,

Thanks

Dr.M.K.Raman

Dear MKRaman ..he amount deposited in SCSS is also allowed to be claimed as a deduction under Section 80C.

I WANT MIS SCAME ,AND INTREST GO DIRECT IN SUKNYA ACCOUNT IT POSSIBLE OR NO

Hi Suresh,

It is possible ,You can transfer the Interest to Sukanya account or Recurring Account.

Whether I can contribute in PPF a/c of my 24 years old daughter and claim tax benifit in 80-c

Dear malkeet ..Kindly read this article : Tax Saving investment options u/s 80c : In whose name can they be invested?

Post Office Mothly Income Schemes (MISS) offers only 7.7% interest rate (interest reduced for every quarter). Post Office Senior Citizens Savings Scheme (SCSS) offers 8.50% quarterly. I am a Senior Citizen with no pension benefits and depending only on interest income for my monthly expenses. Bank interest is also reduced to a great extent every year. I have to renew my investment in P.O. M.I.S in this month. Please advise whether I should go in for Post Office MIS or Post Office SCSS at this juncture.

Dear Sivaramakrishnan Ji,

Considering your profile, you may renew them.

Do have a look at Secured NCDs with non-cumulative option as a possible alternative for some portion of your investible corpus.

Kindly read:

List of investment options.

Retirement planing & calculations.

Hi Sreekanth,

The VPF returns become tax free if we are with the Firm more than 5yrs, is this irrespective of when we enroll for VPF in that particular company or is the count of years(5yrs) from the date we opt for VPF inn that Firm.

Regards,

Kiran

Dear Kiran..Are n’t both the questions one and the same??

Hi sreekanth,

1.can i encash the amount before maturity period of NSC which has a tenure of 5 years… in KVP we have the chance of cancelling the bond before 2 and half years.. likewise does NSC also have the same chance of cancelling bond before 1 and half year or certain time period..?

2. i want to invest 2 lakhs under NSC scheme or KVP scheme.. will i get tax deduction.. or they will charge tax on it..

if so how much they will charge tax on my 2 lakh investment?

please clarify my 2 doubts.. there is no clarity for these question…

Dear Sai,

Premature encashment is allowed in mainly three reasons only, as listed below:

Death of the holder/holders

Order by a court

Forfeiture by a pledge (government officer).

NSC investments are eligible for 80C deductions (up to Rs 1.5 Lakh u/s 80c). However, the interest income on NSCs is taxable.

my question

1.My plan my son education school fees RS.30,000 for EVERY years This Plan better MIS ?

2.Apply my son name age 2 any age limit ? withdrawn Amount option father allow or not ?

3.invest Rs 4.5 lakhs per account months interest Rs 2788.50 any TAX charges?

4.Months interest 2788.50 auto debit my son name saving a/c ?

Dear feroz,

The interest income on MIS is a taxable income.

If you invest it in minor kid’s name, the interest income has to be clubbed to your income and you have to pay taxes accordingly.

Kindly read:

Kid’s education goal planning & calculator.

The monthly payout can be received as direct Credit to Post office savings account.

List of important articles on Personal Financial Planning.

Hi Sreekanth,

This is a very useful article on small savings schemes.

In the update you have written that interest rate for senior citizens will be of 8% (guaranteed). Does it mean that, it will be fixed throughout?

Yes dear Deepa, it will be fixed through the deposit tenure.

Incase of post office schemes, do post offices accept 15G, 15H form incase the depositor is non earning and wants to get TDS exemption?

Dear vikrant..Yes, they do accept.

I have purchased N S C in the year 13/14,14/15,15/16,Each year 50000/-

Now I want to show the interest accrued u/s80c,so how much int,is accrued in the year 16/17.

I am assuming the changed interest rates are for new investments, is that right? Existing investment should continue to earn whatever interest rate it has locked in. Can you please confirm?

Dear Cvan,

Yes, except PPF & SSA schemes.

Thanks! Since ppf interest is accrued at the end of the year, how are they calculating it if the rate changes every quarter?

Dear Cvan .. The interest amount is calculated as per the varying interest rates..

DearSreekanthji

I understand that wife and husband can open senior citizen saving scheme account upto30lakhs,for 15lakhs the firstholder being the wife and for the other15lakhs the first holder being the husband, the wife depositing out of her savings and the husband out of his savings.Now the question is if one of the holders dies during the currency of the account ,can the other holder continue the accounts with the 30lakhs limit until the maturity of the scheme viz 5years or the account where the deceased person was the first holder has to be closed on his/her death.

Dear vijayanvarma Ji,

In such situation, the spouse may continue the account on the same terms and conditions as specified under the SCSS Rules. However, if the second holder i.e. spouse has his / her own individual or joint account, the aggregate of his/her account and the deposit amount in the other joint account of the deceased spouse should not be more than the prescribed maximum limit ie Rs 15 lakh.

In case the maximum limit is breached, then the remaining amount shall be refunded, so that the aggregate of the individual account and deceased spouse’s joint account is maintained at the maximum limit.

Thank you very much sir.It would have been better if Govt. made a concession on the upperlimit, on humanitarian grounds, in the case ofdeath of the spouse.If accounts are maintained in two different post offices, the trouble to find out the excess over the maximum permissible limit and to get the excess refunded will be mind boggling considering the way post offices in the country work at present

Agree with your views. Kindly do check this with Post office staff too. In case if you get to know more info, plz share it here. Thank you!

Sir janna hai ki sapoze agar ham 3lakh monthly scheme me deposit karte hai to monthly kitna milega aur phir 5 year ke baad kitna. Milega 5lakh me add

I’m 27 years old man & I want to invest 500/ month for 5 years in post office. Which scheme is best

Dear raj kumar..Why do you want to invest in Post office schemes only? May I know your investment objective?

Kindly read: List of best investment options!

Post office RD of 5 years @7.30% p.a w.e.f.01/10/2016.

Sir i was retired on 1st oct 2016 nd my age is 46 nd senior citizen is applicable for only for one month for me as i am retired from army….sir can u suggest me wht should i plan to invest nd in which senior citizen scheme…..

Dear Suraj,

Generally, a retiring employee becomes eligible for Senior Citizen Savings Scheme after attaining age of 55 years or 60 years in some cases.

However, exception is made in case of Defence Personnel (other than Civilian Defence Employees ) who can join in SSS schemes at any age after retiring from defence jobs.

May I know your investment objective and time-frame?

Dear Srikanth

Do you provide the services of a financial adviser. I am an employee so remains busy and cannot concentrate on efficient fund investment. Similarly although I file my annual returns of both me and my wife personally. But at times it is elaborate. Do you provide the financial consultant type services, which include that you take care of funds investment and other advisory decisions (Family financial adviser), and accordingly charge for it on annual basis. If not, Plz suggest some reputed and dependable names. I ‘ll be grateful…

Dear Dr Rakesh..I have recently stopped offering one-to-one consultancy services. However you may post your queries on your Personal Finances at http://www.relakhs.com/forum and will surely get back to you at the earliest.

Can I operate Postal accounts (MIS, Term Deposits etc.. ) online?

Dear Ravi..I dont think online provision is available as of now, but I heard that they are implementing online services soon.

Sir, I am 62 years old. I wish to invest a sum of Rs.5,00,000. Can you suggest the best option for me? I have no pension or any other form of income.

Dear Kalyani Ji,

You may consider Post office Senior Citizen Savings scheme and/or MIS scheme.

Sir can i know the 3rd quarter rate of interest

Dear Amarnath ..I believe that the latest rates have not been announced yet. Will update the post as soon as they are available.

Hi Sir,

I want to invest very small amount like 200/month or 300/month for 2 or 3 or 5 years in Post Office.

Which is the best scheme to invest in Post Office?

Thanks,

Mayur

Dear Mayur ..May I know your investment objective? (Long-term savings / tax saving / monthly income etc.,)

what is mean by PPF how to used the tax exemption pls give the idea. .how much to be invest min. how much money.

Dear Aranvinth ..PPF stands for Public Provident Fund. It is one of the best Long term savings scheme and very tax efficient one.

It has a lock-in period of 15 years and the tenure can be extended (optional) in blocks of 5 years (extension can be N number of times). It can be opened at Post office branch or at banks like SBI/ICICI.

The minimum investment of Rs 500 has to be maintained even for accounts extended beyond 15 years.

Sir,

I am going to retire within 6 months with lump sum 80 lakhs total savings. I want 20000 per month for family expenditure. So can you please guide me where and how should i deposit the money by caring tax and inflation rate.

Waiting for valuable reply.

Dear sujit Ji,

May I know your current age, do you have any financial liabilities/obligations? Do you have health insurance cover?

Do you have any other sources of income?

Sir

Post office saving account interest Rs4000per year and bank saving account interest rs 30000 so how much amount taxable in above case.

Dear Pyramid,

Under Section 80TTA, interest income on Savings Account (Bank or post office) of up to Rs 10,000 can be claimed as tax deduction.

Above Rs 10,000 the income will be charged to tax.

I understand that the upper limit for POMIS for joint account is Rs.9 Lakh. For example can have one joint POMIS account in the name of my wife as first deposited and my name as joint deposited with Rs. 9 Lakh amount and another POMIS account with my name as first depositer and my wife as joint depositer with Rs.9 Lakh amount? Is this permitted? Please inform

Dear KShah,

The maximum limit per person is Rs 4.5 Lakh, whether it is in one account or in multiple accounts.

The combined limit under your head must not cross Rs.4,50,000.

Just look how each central govt is befooling the native people. Earlier PO MIS was really lucrative for a regular income @8% pa for a tenor of 6 yrs with a maturiy bonus of 7.5% then in the year 2011, the so called secular cheats reduced the tenor to 5 yrs and abolished the bonus but raised the interest rate to 8.4%. Up to this, the situation was somehow acceptable. Now the sangh paribar cheats additionally reduced the interest rate to 7.8%! Where is the charm now?

Yes I agree. This is loot

Dear Sreekanth

I have opened a PPF account in Sept 2003. I heard there is an option to extend after 15 years, for a block of 5 years.

if so

1.when should I take action or any letter of form to be send to the Post master or I have to go in person, before march 2017 or march 2018

2.can I invest further in the coming block years.

3.how many such block years we can extend..

Dear Anbarasan,

1 – Your EPF account maturity year would be April 2019.

The choice to extend the PPF account with subscription has to be made within one year from the maturity of the account. If this is not done, then by default the account is deemed to have been extended without further contribution for a period of five years. You have to submit Form H at the post office or bank where the account is held if you intend to continue with the subscription.

2 – Yes.

3 – The PPF account has no limit on how many times it can be extended after the initial 15 year block matures.

thank you for your valuable comments..

appreciations for the quick response Mr Sreekanth

Sir,

I have Rs Three Lakhs. Now want to invest in Post office. Which is best MIS OR NSC OR KVP.

Pl inform me sir.

Dear NAGESH,

May I know the reason for shortlisting these schemes? Your investment objective & time-frame?

Hi Sree,

I would like to open PPF account for IT 2016-2017 purpose. Pls advise on the below queries

1) what is the cycle for every year ? Is it Jan – DEC or April – April

2) If i would like to submit this as tax exemptions for 2016 – 2017 cycle then within which month i have to complete my payment

3) For example if i pay 1.5 Lakhs in August 2016 or in Dec 2016. How the interest will get calculated??

Is it on a prorated basis or whenever i pay i will be eligible for 8.1 % interest.

Thanks,

Shreeramyaa

Dear Shreeramyaa,

1 – Its April to March.

2 – You can invest lump sum amount also. Even if you do investment in the month of March and fail to submit Investment proofs to your employer, you can claim tax deductions when filing your income tax return.

3 – The interest will be calculated for the remaining part of the FY.

hi as of now i dont have any savings .thought to save for my kid am single .could u please tell me which plan is best for my kid study.i heared that in postal we have one scheem that have to pay 500 per mounth for 18 years and we will get 25 lacks on 18 th year..is it really true.please get back to me

Dear Anusha,

Post office Scheme for Girl child is : Sukanya Deposit Scheme.

Kindly read my review : Sukanya Samriddhi A/c – Details & Review.

May I know if you have any existing Life & Health Insurance policies?

You may kindly go through below articles and revert to me;

Blocks of Financial Planning Pyramid.

Kid’s Education goal planning calculator.

If Life is unpredictable, insurance can’t be optional.

I want to invest one lac . for one year. FDR in bank or in Post Office is benefical.please guide.

Dear Rekha..Any one should be fine.

hello sir,

I have started my PPF account in mar 2016, will be interest gets changed now to 8.1 or the interest will be changed only for the new applicants

Dear sekar ..Interest rate gets changed..the new interest rate is applicable.

Mr Reddy, can you please share with us the source on which you have given the reply of the new interest rates on old SCSS deposits. In my understanding the interest rates on small saving schemes are NOT floating except PPF. Please reconfirm.

Dear Mr Aggarwal,

Yes, kindly note that except PPF and Sukanya Samriddhi Yojana (SSY), the interest rates on other products will remain same (as mentioned in the certificate/deposit).

Thanks

Hi

Since the Govt has reduced rates on Small Saving schemes in order to remove the distortions in interest rates, more and more LIC agents are now misleading prospective investors that LIC plans can give better returns than SS schemes.

I doubt their claim since LIC only promotes traditional plans (endowment and money-back). By law, at least 85% proceeds from these plans need to be invested in Government securities. Since yield on Government securities itself has fallen to around 7.80% to 7.85% and expected to fall much further in coming years, how can LIC claim to give better returns on its plans.

When the truth about LIC plans is that they have never given return of more than 7% in its recent history. One can easily get that information from your other article ( declared rates of return on LIC policies). LIC has thousands of employees and agents on whom LIC spends crores of rupees. In such a scenario, how can LIC guarantee better return than SS schemes is beyond my imagination.

Can you through some light?

Thanks

Dear Rupali,

I agree that the underlying assets/securities are debt instruments (mostly), hence the returns generated by LIC on these investments may have to come down. We are aware that LIC bonus rates can vary year to year, we may have to wait and see if bonus rates will come down or not for next FY.

One needs to ask for the ‘Guarantee’ of returns in written form. Its just a mis-leading statement/claim.

Dear sir I want to invest my money which is more interest than banks and with no risk. Pl advice thank you

I’m senior citizen

Dear kashyap Ji..May I know your investment objective? Are you looking at periodic income or is it for accumulation?

Kindly read : List of investment options!

Dear sRikanth, my daughter marriage may be done within 1 year. So I want to invest in more return scheme than normal fixed deposit interest at same time I can’t take much risk. I have gold present worth 300000 rs .so Pl suggest me whether it is good to sell it and invest in some where.

Dear kashyap Ji,

Considering the horizon (1 year), kindly do not take any risk now, you may continue with your FDs.

Sir,

Pl let me know that if RD is opened upto 31 Mar 2016, the maturity value will remain the same i.e. Rs 746.53 for Rs 10/- RD which will be maturing in Mar 2021.

Thanking You

Regards,

Nem Kumar Jain

Mob: 9450111316

Dear Nem..Yes, it will remain the same.

Dear Srikanth:

Reg the latest revision of SS rates from 01 Apr 2016 , few clarifications please-

a. If I invest in 5 Year NSCs on or before 31 March, the existing rates is locked for all 5 years. Pl confirm

b. If i invest in Monthly Income Scheme + Postal Recurring Deposits on or before 31st March, is the existing rate locked for all 5 years (MIS @ 8.4% and RD @ 8.4) ? Or will it keep changing every qtr? pl confirm

c. When we invest in 5 year NSCs, I get to know we need not consider interest income for tax purposes till 5th year , when the whole interest accumulated to be considered taxable. Pl clarify how it works.

Thanks in advance

Dear Jeyaram,

a – Yes.

b – The interest rates can keep changing depending on the Govt’s notification(s).

c – Kindly go through this useful article..

Is post office investments are fully guaranteed by central govt? Where as in banks gives insurance guarantee of one lakh rupees per account in per bank.

Dear Rajagopalan..No insurance cover is available on post office deposits.

Yes Bank FDs have Rs 1 Lakh cover..

Read: Are banks deposits safe/guaranteed?

Thanks Sreeji

If interest rate changes for scss, is it applicable to existing old deposits also…..?

Dear Krishna..Yes, revised rates are applicable to new & existing deposits too.

I think, this revision is not applicable to existing A/cs. Will you pls so me the notice/circular for this? Thanks!

Dear Hisema,

If an individual has already invested in say 5 year NSC bond then the interest rate is locked and he/she will get same interest rate which is mentioned in the certificate. If someone makes an investment in NSC in April 2016, then new revised rate would be applicable.

However, say investments in PPF/SSA etc the revised rates are applicable on all a/cs (new as well as existing).

I think the new rates will be applicable only on fresh deposits in SCSS.When the rates had increased from 9% to 9.3% ,at that time only the fresh deposits got the new rate,because the SCSS is also having a fixed tenure of 5 years and has a penalty for premature withdrawal.

Dear farida..Yes, I got it checked.

Except PPF and Sukanya Samriddhi Yojana (SSY), it will not affect any of your past investments, including SrCSS, MIS and NSC.

One can open SrCSS before 1st April and can get the current interest rate.

Hello Srikanth,

I have some money of Rs 1 Lakh and would like to fetch some good returns. I would like to keep invested for 5+yrs. Request your suggestions for the same either MF’s or FD or Bonds etc…

Regards,

Nandeesh

Dear Nandeesh,

Kindly go through below articles, can be useful to you.

Best Balanced funds

Best MIP funds

List of best investment options.

Best Debt funds.

Dear Sreekant, If my wife files form 15 H, does she have to file her returns? is it necessary?

Dear El..It depends on other sources of income too. Kindly read : Misconceptions on TDS.

Hi Sreekant, is SCSC scheme in post office the best interest rates? need your help.

Dear El..It is indeed a good savings option.

Read : List of best investment options.

Hi Reddy,

If an employee has to take loan on his PF account, what are the rules and procedures? by mentioning which reason he will get a hassale-free loan? how much of the total amount is sanctioned as loan? How is this loan treated at the time of retirement or full withdrawal?

Dear sangeetha,

Kindly red this post: EPF partial withdrawals – rules.

Hi Sreekanth

Thanks for the info. I want to know that these rates are applicable with PPF and SSY account held with private banks also. As i have my PPF and SSY account of my daughter in ICICI Bank.

Thanks in Advance

Dear Ankur..Yes they are applicable.

Dear Mr Srikanth,

My wife is not working now. Can I invest total 4.5 lacks from my earning in my PPF , my wife’s PPF and my daughter’s SSA account or there is any total limit?

Thanks in Advance.

Dear Debendra,

You can invest PPF in your name/spouse to the extent of Rs 1.5 L only.

There is maximum limit for SSA ie rs 1.5L, you can claim Rs 1.5 L u/s 80c.

Sir, thanks for your reply. As per my understanding when I opened a SSA account for my daughter, postmaster told me that max I can invest 1.5L per year. Please clarify this.

Also, regarding investment in spouse PPF ac, I checked in internet, people are suggesting there is no problem if she invest herself in PPF ac after taking the money from her spouse. Please clarify this too.

Dear Debendra,

Apologies, the maximum deposit limit for SSA is Rs 1.5 L.

If your spouse is investing by herself then no issues. But your previous question was if you can invest in her name.

Yes, you can gift/loan her the amount and then she can invest in PPF.

But do note that if you gift her the money, the income earned on her PPF a/c will be clubbed to your income.

Also, she can claim the tax deduction u/s 80c when filing her Income tax returns (if any).

Thanks for your quick reply sir. One last question, Do I need to declare in my IT return every year whatever income earned in her PPF account and do I need pay any income tax for that?

Eventually, She cannot take out the money till 15 years after opening the account. So, do I need to club the income earned in her PPF ac when she will withdraw after 15 years?

Dear Debendra,

The best possible option is that you show this as loan amount (interst free) and she then can invest this amount by herself in her PPF ac.

Also read : Gifts & Income Tax implications.

Sir, i and my spouse both are working in a Bank. I have a little baby girl. We want to open sukanya samiridhi ac in the name of baby girl. My question is how me and my spouse get benefit ted by opening the account in the name of baby girl.

Regards, sanjay

Dear Sanjay,

If you are the depositor, you can claim Tax deduction of up to rs 1.5 Lakh per FY u/s 80c.

Kindly read my review : SSA – Details & Calculations.

Dear Mr Srikanth

Are there any restrictions for an NRI becoming a joint holder of an account with banks/post offices where the first named holder is a resident Indian

Dear Vijayan,

RBI allows Residents of India to include non-resident close relative in their resident bank accounts on ‘former or survivor’ basis. However, such non-resident relative shall not be eligible to operate the account during resident’s lifetime.

Such accounts will be treated as resident bank accounts and will be subject to all the regulations applicable to a resident bank account. Cheques, instruments, remittances, cash, card or any other proceeds belonging to the NRI relative shall not be eligible for credit to this account.

Besides, the NRI relative shall operate such account only for and on behalf of the resident for domestic payment and not for creating any beneficial interest for himself.

If due to any eventuality, the non-resident account holder becomes the survivor of such an account, it shall be categorized as Non-Resident Ordinary Rupee (NRO) account according to the extant regulations, RBI said. The onus will be on the non-resident account holder to keep the bank informed to get the account categorized as NRO account and all such regulations as applicable to NRO account shall be applicable.

So in layman terms, if Sukanya Samridhi Scheme is 9.2% currently, will it go up or down?

So you’ll continue to get a 75 bps additional interest on SSA scheme even after any reset in base rates.

Dear Hariprasad,

As mentioned in the article, the interest rate spread on SSA is currently at 0.75% over and above the G-Sec rate. This SPREAD (extra return) will remain the same.

But kindly note that the interest rate can be revised or changed or fluctuate on Quarterly basis now.

The revised interest rate will be applicable to entire tenure of the invested NSS scheme or from April 1 they will floating rate instrument i.e. if i invest in 5 yrs NSC in may 2016 the interest rate fixed will applicable for whole 5 yrs or it will reset quarterly?

Dear Dharmesh,

The interest rate on NSC will remain same as given in the certificate.

However, the key point here is , the interest rate offered can be different if you wish to buy new (one more) NSC certificate say after two quarters, as the interest rates will be revised on quarterly basis.

Also note that the interest rate is available at half-year compounding basis currently which will be changed to annual basis. So, we may see lower effective interest rate on NSCs.

Good article Sreekanth. I have come to know recently that a person can open a Senior Citizens Savings account with some public sector banks also. Can you confirm this?

Dear Kamelia..Yes, banks are also offering this scheme.

Thanks Sreekanth. I know that SBI is offering the schemes. But which other banks are offering them?

Dear Kamelia..

ICICI Bank is the only PVt bank which is offering this scheme I guess.

At present, 24 Nationalized banks and one private sector bank, as per list below, are authorized to handle the SCSS, 2004. It may be noted that only designated branches of these banks have been authorized to handle SCSS, 2004.

State Bank of India

State Bank of Hyderabad

State Bank of Bikaner and Jaipur

State Bank of Patiala

State Bank of Mysore

State Bank of Travancore

Allahabad Bank

Andhra bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

IDBI Bank

ICICI Bank Ltd.

Thanks Sreekanth. I didn’t know this info. Opening an account with Post Office is very tedious. It’s better to go to Banks if they offer the same schemes. They have better infrastructure.

Dear Mr.Srikanth,

Thank you very much for your valuable suggestions and financial information .

I want to invest INR One lakh in April minimum for 3-5 years .Please guide me which is better fund to invest in 2016.

Also in addition above i want to gift to my nephew on his 1st Birthday INR 30000 as a investment.Previously i was planning for post office NSC for 5 year. Can you please suggest me which is better ?

Dear Jitendra,

For a 5 horizon – Consider a balanced fund. Ex – HDFC Balanced fund / TATA balanced fund.

Suggest you to give it as CASH and let his parents invest in his name as per their requirements, preferably in Equity mutual funds for his future education goal expenses.

Thanks for sharing valuable information, indeed analysis.

Regards,

http://www.expertmile.com

hi,

i would like to invest my money arround 5 lakh into a better scheme for upto 3 years. so, which scheme should i choose for bettet interest.

Dear chaitali,

If you are aware of mutual funds, you may consider Dynamic Bonds or MIP Scheme.

Read:

Best Debt Funds.

Best MIP Funds.