The National Savings Schemes (NSSs) are one of the very popular saving schemes in India. These are regulated by the Ministry of Finance. They offer complete security of investment combined with attractive returns.

These schemes also act as instruments of financial inclusion especially in the geographically inaccessible areas due to their implementation primarily through the Post Offices, which have reach far and wide.

It is estimated that nearly $137 billion or over Rs. 9 lakh crore are currently tied up in small savings schemes.

Some of the very popular schemes which fall under NSS are as below

- PPF (Public Provident Fund)

- Sukanya Samriddhi Scheme

- Monthly Income Scheme

- Senior Citizen Savings Scheme

- KVP (Kisan Vikas Patra)

- NSC (National Savings Certificate)

- Time Deposits &

- Recurring Deposits

Small Saving Schemes Interest Rates 2016 – New norms w.e.f. April 2016

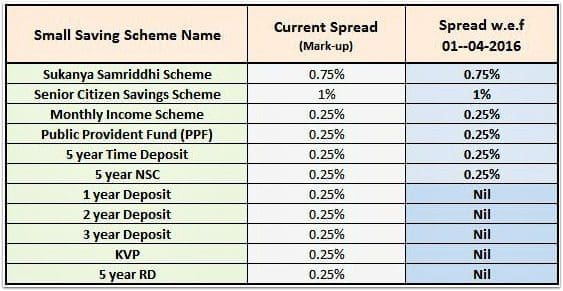

- As per the current norms, the interest rates of these small saving schemes are linked to the yield of government bonds of comparable maturity (with a small mark-up) and are revised once a year. Mark-up here refers to ‘Spread’.

For example : The interest rate on PPF has a mark-up of 25 basis points over and above the G-Sec rate (Govt Bonds rate). So, if comparable maturity G-sec rate is say 8.5% then the interest rate on PPF will be determined as 8.75%. (One Basis Point is equivalent to 0.01%)

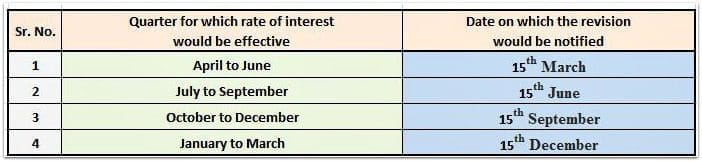

- The government has decided to revise Small Saving Schemes Interest Rates on a Quarterly basis starting from 1st April, 2016.

- The rates of interest applicable on various small savings schemes for the quarter from April to June 2016 effective from 1.4.2016 would be notified on 15th March, 2016.

- The saving schemes like Sukanya Samriddhi, Senior Citizen Savings Scheme and Monthly Income Scheme enjoy ‘spreads’ over the G-sec rate of comparable maturity viz., of 75 basis points (0.75%), 100 bps (1%) and 25 bps respectively. These mark-ups / spreads have been left untouched by the Government.

- Similarly the spread of 25 basis pointss that long term instruments, such as the 5 yr Term Deposit, 5 year National Saving Certificates (NSC) and Public Provident Fund (PPF) currently enjoy over G-Sec of comparable maturity, have been left untouched.

- The 25 bps (0.25%) spread that 1 year, 2 year and 3 year Term Deposits, KVPs and 5 yr Recurring Deposits have over comparable tenure Government securities, shall stand removed w.e.f. April 1, 2016 to make them closer in interest rates to the similar instruments offered by the banking sector.

- The interest rates on a 10 year National Saving Certificate (discontinued since 20-12-2015), 5 year National Saving Certificate and Kisan Vikas Patra is compounded on half-yearly basis. This shall be done on an annual basis from 1st April, 2016.

- Premature closure of PPF accounts shall be permitted in genuine cases, such as cases of serious ailment, higher education of children etc,. This shall be permitted with a penalty of 1% reduction in interest payable on the whole deposit and only for the accounts having completed five years from the date of opening.

Small Savings Schemes Revised Interest Rates for the quarter from January 2017 to March 2017

The rates of interest applicable on various small savings schemes for the quarter from Jan to Mar 2017 effective from 1.1.2017 would be as below;

- The new rate of Interest on Sukanya Samriddhi Scheme (SSA ) is 8.5%.

- The new rate of Interest on PPF (Public Provident Fund) would be 8%.

- The interest rate on Senior Citizen Savings Scheme (SCSS) is 8.5%.

- New interest rate on Kisan Vikas Patra (KVP) would be 7.7%.

- The rate of interest on 5 year National Savings Certificate (NSC) is 8%.

- New interest rate on post office MIS (Monthly Income Scheme) is 7.7%.

- The rate of interest on a 5 year Post Office RD (Recurring Deposit) would be 7.3%.

Latest News (22-Nov-2016) : Old High Denomination Notes (500 & 1000) can not be deposited in Small Savings Schemes offered by Post Offices & Banks.

Latest News (31-Dec-2016) : To protect senior citizens from falling interest rates, Prime Minister Shri Narendra Modi in his address to the nation on Saturday said that they would be given guaranteed interest rate of 8 % on deposits up to Rs. 7.5 lakh. The provision of special interest for senior citizens (those above 60 years of age) will be applicable for 10 years, and the interest will be paid on a monthly basis.

(Reference : PIB)

Join our channels

i start sip in 2015, after 2year i want incresed sip but the mf amc called me they are not able this. they called me you cancelled your old sip and then new sip start to more amount . this case what i do ……

Dear javed,

You may continue with your current SIP and also start a new SIP with the balance amount.

I am having account only in Indian Bank & ICICI Bank. Are The Indian Bank or ICICI Bank accepting SCSS? If they are not accepting & if I open in another Bank like Canara or PNB, will they transfer the interests from SCSS by ECS?

Dear Subramanian,

I am not sure about Indian bank, but ICICI Bank offers SCSS.

Dear Srikant

Is SCSS comes under 80 c DEDUCTIONS

THE POSTAL WEB STATES ” Investment under the scheme qualifies for the benefit of section 😯 C of the income tax Act,1961 from 1-4-2007.”

But the post personal say it is not acceptable under 😯 C.

Kindly clarify,

Thanks

Dr.M.K.Raman

Dear MKRaman ..he amount deposited in SCSS is also allowed to be claimed as a deduction under Section 80C.

I WANT MIS SCAME ,AND INTREST GO DIRECT IN SUKNYA ACCOUNT IT POSSIBLE OR NO

Hi Suresh,

It is possible ,You can transfer the Interest to Sukanya account or Recurring Account.

Whether I can contribute in PPF a/c of my 24 years old daughter and claim tax benifit in 80-c

Dear malkeet ..Kindly read this article : Tax Saving investment options u/s 80c : In whose name can they be invested?

Post Office Mothly Income Schemes (MISS) offers only 7.7% interest rate (interest reduced for every quarter). Post Office Senior Citizens Savings Scheme (SCSS) offers 8.50% quarterly. I am a Senior Citizen with no pension benefits and depending only on interest income for my monthly expenses. Bank interest is also reduced to a great extent every year. I have to renew my investment in P.O. M.I.S in this month. Please advise whether I should go in for Post Office MIS or Post Office SCSS at this juncture.

Dear Sivaramakrishnan Ji,

Considering your profile, you may renew them.

Do have a look at Secured NCDs with non-cumulative option as a possible alternative for some portion of your investible corpus.

Kindly read:

List of investment options.

Retirement planing & calculations.

Hi Sreekanth,

The VPF returns become tax free if we are with the Firm more than 5yrs, is this irrespective of when we enroll for VPF in that particular company or is the count of years(5yrs) from the date we opt for VPF inn that Firm.

Regards,

Kiran

Dear Kiran..Are n’t both the questions one and the same??

Hi sreekanth,

1.can i encash the amount before maturity period of NSC which has a tenure of 5 years… in KVP we have the chance of cancelling the bond before 2 and half years.. likewise does NSC also have the same chance of cancelling bond before 1 and half year or certain time period..?

2. i want to invest 2 lakhs under NSC scheme or KVP scheme.. will i get tax deduction.. or they will charge tax on it..

if so how much they will charge tax on my 2 lakh investment?

please clarify my 2 doubts.. there is no clarity for these question…

Dear Sai,

Premature encashment is allowed in mainly three reasons only, as listed below:

Death of the holder/holders

Order by a court

Forfeiture by a pledge (government officer).

NSC investments are eligible for 80C deductions (up to Rs 1.5 Lakh u/s 80c). However, the interest income on NSCs is taxable.

my question

1.My plan my son education school fees RS.30,000 for EVERY years This Plan better MIS ?

2.Apply my son name age 2 any age limit ? withdrawn Amount option father allow or not ?

3.invest Rs 4.5 lakhs per account months interest Rs 2788.50 any TAX charges?

4.Months interest 2788.50 auto debit my son name saving a/c ?

Dear feroz,

The interest income on MIS is a taxable income.

If you invest it in minor kid’s name, the interest income has to be clubbed to your income and you have to pay taxes accordingly.

Kindly read:

Kid’s education goal planning & calculator.

The monthly payout can be received as direct Credit to Post office savings account.

List of important articles on Personal Financial Planning.

Hi Sreekanth,

This is a very useful article on small savings schemes.

In the update you have written that interest rate for senior citizens will be of 8% (guaranteed). Does it mean that, it will be fixed throughout?

Yes dear Deepa, it will be fixed through the deposit tenure.

Incase of post office schemes, do post offices accept 15G, 15H form incase the depositor is non earning and wants to get TDS exemption?

Dear vikrant..Yes, they do accept.