We all would like to maintain a balance between professional and personal life . Both are equally important to lead a successful, happy and healthier life. All doctors suggest us to eat a healthy balanced diet.

Investing in Balanced Mutual Funds is not much different. Balanced funds are also known as Hybrid Mutual Funds. In this post let us understand more about types of balanced funds and investment returns from these funds (especially equity oriented balanced funds).

What are Balanced (or) Hybrid Mutual Funds?

Mutual funds are broadly classified as either Equity or Debt,based on where the funds are invested.

- Equity funds primarily invest in stocks/shares.

- Debt funds primarily invest in Bonds, Government securities and Fixed interest bearing instruments.

- BALANCED FUNDS invest in both equity and debt instruments.

What are different types of Balanced Funds?

Balanced mutual funds can be Equity oriented or Debt oriented hybrid plans.

If the average equity exposure of a balanced fund is more than 60% and the remaining 40% is in debt products then it is treated as a Balanced Fund – Equity oriented. This means major portion of the fund’s assets are invested in equity.

If the average debt exposure is around 60% and equity is 40% then these funds are treated as Balanced funds – Debt oriented. (These proportions can vary among different balanced funds).

Benefits of investing in Balanced Mutual Funds:

- Diversification : The funds are invested in both equity and debt financial securities leading to diversification of investments.

- Asset Allocation & Re-balance : Balanced funds regularly re-balance the portfolio based on market conditions & asset allocation limits. An investor is, thus, saved the hassle of manually re-balancing the portfolio

- Low volatility : Balanced funds are less risky compared to pure Equity funds. Equity portion will provide the capital appreciation through stock prices appreciation and dividend income. Whereas, Debt portion can provide stability through interest income and appreciation in Bond prices.

- Balanced funds have debt component in their asset allocation. Due to this they may suffer lesser losses during market downturns when compared to Equity funds.

- These funds can be a better bet for first-time equity investors. These are also suitable for the investors who want to protect the downside during market downturns and want to benefit during market upswings. Remember that balanced funds may not out-perform the Equity funds during market upswings (Bull run).

- Balanced funds can be a useful investment option to meet critical Financial Goals like Retirement Planning, Kid’s Higher Education etc.,

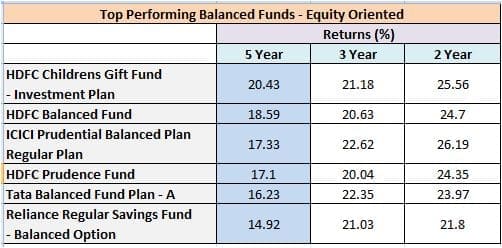

Top performing Equity Oriented Balanced Funds

Systematic Investment Plans (SIPs) Returns of Balanced Equity Oriented Funds

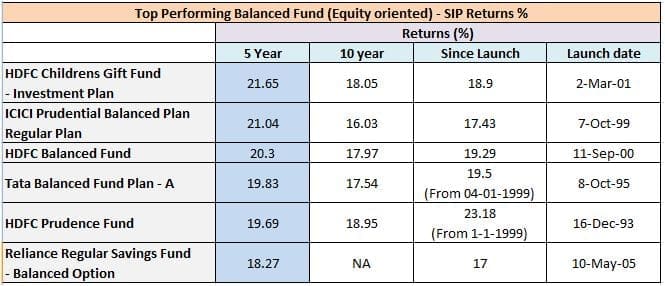

The above table gives us idea about the SIP returns. I have assumed the monthly SIP amount as Rs 1,000.

Again, HDFC’s Children Gift Fund (Inv plan) tops the table with annualized returns of around 22% in the last 5 years. One more observation we can make on some of the very old funds. Example – HDFC’ s Prudence fund which was launched way back in 1993. This fund has generated SIP returns of around 23.18% in the last 15 years. The same fund tops the list in 10 year category, with returns of 18.95%.

The above past returns prove that investors will benefit if they stay invested for long periods of time.

What are the average returns of Balanced funds category?

The Below table gives us overall idea about the average returns generated by all balanced funds as a category.

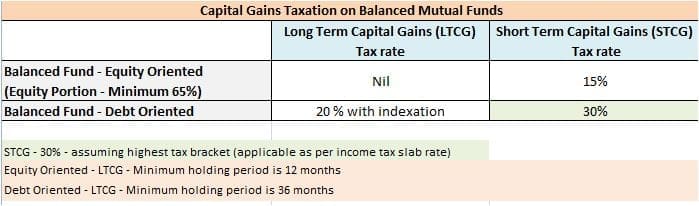

Capital Gains Taxation of Balanced Mutual Funds

Capital Gains Taxation of Balanced Mutual Funds

In terms of taxation, the balanced mutual funds that invest at least 65% in equity ((Equity oriented) attract no tax liability on Long Term Capital Gains. (The units of these funds should be held for more than 12 months).

In terms of taxation, the balanced mutual funds that invest at least 65% in equity ((Equity oriented) attract no tax liability on Long Term Capital Gains. (The units of these funds should be held for more than 12 months).

The interpretation of data can sometimes be very tricky. For a different set of time periods, balanced funds might have given lesser returns. If our expectations are reasonable then I am sure balanced funds will deliver. I believe returns of 10% and above from a balanced fund (equity oriented) is a bonus.

Everything in life..has to have balance. It applies to investments too. I am sure you agree with me. Do you hold any balanced mutual funds? Share your views..Cheers!

(All the above plans are indirect plans, returns > 1 year are annualized and are Growth plans. Kindly keep in mind, past performance is no guarantee of future results- Image courtesy of Jeroen van Oostrom at FreeDigitalPhotos.net)

Join our channels

Sir,

I am Narasimha. The article is very good. I kindly request you to revise the content of this page (along with funds data) with the latest details. This article belongs to 2014 (very old). It will be helpful to the readers if the data presented is the latest data. Please dont mind about my comment.

Thanks !!

Dear Narasimha ,

I have written one more article on Balanced funds (latest one, 2016)..Kindly visit & read …

RAMANA says: 20-01-2017-9PM

Dear Sir,

I suddenly found your blog and really appreciate your service. I am 55 years old.,I will retire ,Dec’16.My retirement fund will be Rs20 Lacs.My two DAUGHTERS are studying in USA& 2ND DAUGHTER BTECH FINALYEAR. I want to invest in Mutual fund 3YEARS. what are the funds to be invested. I am not take any risk. want a regular income of Rs 30,000 for my household expenditure.Please advise me.

Reply

Dear RAMANAIAH Ji,

Is it that you would like to invest in MFs for 3 years and also want regular income during these 3 years?

Are you planning to withdraw this corpus after 3 years?

Kindly read: List of best investment options!

Sri Reddy,I will retire this month,Dec’16.My retirement fund will be Rs 80 Lacs.My two sons are studying in Plus2.I want a regular income of Rs 30,000 for my household expenditure.Please advise me.

Dear Rama Rao Ji,

You may consider investing in Senior Citizen Savings Scheme (assuming you are a senior citizen), Post office MIS scheme, set up Systematic withdrawal plan in a Dynamic bond (growth) or conservative MIP fund (growth).

Kindly read:

List of investment options.

Best Debt funds.

Best MIP Funds.

Sir,Please give the formula for Retirement corpus calculation.Not able to find it in your article.

Dear Rama Rao ji,

You may go through this article : Retirement planning & Calculator.

well written article sir. I have a query. Suppose I have invested 50,000 /- Rs in a debt mutual fund on April 2015, then again I have invested 30,000 Rs in say Aug 2016. Now after 5 years in Nov 2021 I want to redeem 100 units amounting Rs 40,000. Then how the tax will be calculated and how indexation will apply here. My doubt is that there is some no of units which will be 5 yr old and some units will be 6 yr old. in this case how i will calculate tax. And please also tell us that in which ITR form this should be shown and where. thanks in advance.

Dear Vivek,

The capital gains will be levied as per ‘First in & first out’ method w.r.t to MF units.

You have to show the gains under ‘Capital Gains’ section.

Kindly read:

MF taxation rules.

Which ITR form to file?

many thanks.

Hi, i want to have 50lakh by 2029. How much i should invest and where to get that amount for my child education.

Dear Aman,

Kindly read this article : Kid’s Education goal planning & calculator @ https://www.relakhs.com/calculate-kids-education-goal-amount/

Dear Sreekanth,

What is the best way to invest Rs 10 lacs with an investment time frame of 1 year, giving me a good “tax free” returns?

Dear Dudeja ..I believe there is no such investment option – 1 year with good tax-free returns.

Kindly note that gains (if any) on equity oriented funds are tax-free if units are held for more than 12 months, but 1 year is a too short to consider Equity funds/Shares.

Read:

List of best investment options!

Dear Sreekanth,

By 1 year i meant that it can stretch upto 1.5 years but not more than that. Considering STP of liquid fund to equity fund for 10 lacs for 1 year period, will it give me a tax free return or liquid fund will be taxed?

STP from “balanced fund to large cap fund”, does it seems a good option?

Transfer of fund from liquid fund to equity fund by STP, will that transfer be considered as exit load for liquid fund? Also, will that transfer be taxed considering it to be withdrawal from liquid fund?

Dear Dudeja,

1 – STPs from liquid fund to Equity fund are considered as normal redemptions, so any gains on Liquid fund units will be taxed accordingly.

Read: MF taxation rules.

2 – Any applicable exit loads on Liquid funds will be levied.

3 – As suggested in previous comment, investment in an equity fund with an horizon of around 1 or 1.5 years is not advisable.

Dear Sreekanth,

This means that every transfer of money from liquid fund to equity fund will push me into tax and further the gains from liquid fund will be taxed on withdrawal. Also, trasnfer of money will be considered as exit load.

Won’t I will have to inculcate a huge amount of taxes/fees? This will make my net return even lower than FDs.

Also, what should be then a best investment horizon for STP?

Hi Sri,

I had one year old child and want to invest 1 lakh rupees in his name.

Is HDFC’s Children Gift Fund opt for long term ( 10-15 years)?

Dear karthikeyan..Though it is a good fund there are certain drawbacks. You may opt for regular balanced funds.

Kindly read: Children’s Gift funds – review.

Thanks Sri,

Can u suggest any good regular balanced funds for my requirement. Am not familiar in this

Dear karthikeyan ..HDFC or TATA balanced funds.

Thanks Sri

New to investment

Planning to start SIP with a amount of 5000 pm from Aug-2016 for long term

Can you please guide and advice me in opting the best available plans.

Dear Pavan..

Kindly read:

Best Equity funds.

How to select the right MF scheme based on Risk ratios?

MF Portfolio overlap analysis tools.

Hi Sree

I am living outside India, aged 38 and new to MFs. Was thinking about investing in MFs in India and gradually build reasonable investment portfolio in MFs through SIP. Do you think it is it is right approach? How can I start investing, which funds should I consider, how much amount should I consider to start with (my idea is Rs 10,000 pm and learn for a year or so) and after 3 years where should I reach as regards to my investment pm.

Dear Kulbhushan,

May I know your investment objective/financial goals?

Yes, SIP mode is the best way to invest in Equity oriented mutual funds.

Kindly go through below articles;

What are Direct Mutual Fund plans?

What are Large/Mid/Small cap funds?

My MF portfolio picks.

How to create solid investment plan?

Best Equity Funds.

List of best investment options.

Dear Sree

Many thanks for your quick revert and leaving enough of links for me to understand prelims of financial planning.

I think I am sufficiently covered for meeting any emergency or my short term needs. Also I have been investing regularly over years in PPF and Insurance plans and ULIPs. Now I am looking to invest for 10-15 years time horizon where I could beat inflation in India. Ultimate goal is to generate sufficient corpus of funds for one child education (8 years), marriage (15 years) and retirement (20 years).

Could you please suggest me how much to invest in which MFs through SIP route and time limits. May be I can also invest a lump sum amount is a few MFs.

Looking forward for your very useful advice.

Thanks again

Dear Kulbhushan,

If possible, can you share the details of your insurance policies (like policy name, tenure & commencement date).

How much to invest? – Suggest you to go through below articles;

Kid’s Education goal planning calculator.

Retirement Planning calculator.

Yes, you can invest lump sum for your long-term goal like Retirement.

Hi Sree,

I am trying to invest in HDFC MF online. While doing the transaction for HDFC Balanced Fund or Small & Midcap Funds,it is showing Min SIP Amount of 5000. I want to start the SIP of 2000. Is it not possible to start SIP of 2k online ? whereas if I go offline its possible…

Thanks in Advance…

Dear Ashmit..May be thats the initial investment, afterwhich you can invest/SIP with Rs 2k. Kindly check with HDFC MF customer care too.

Hi when u try for lumsum investment min amount is 5000, and for sip min amount is 500 per month.

Hi Sreekanth,

I make it a point to come back to your blog whenever I can. Today I read about Balanced funds and MIP funds.

I have a saving of 10 lakhs which I need to invest for 3-5 years as I do not need the money now.

Please suggest which ones can I go for. Funds that can give atleast 20% annualised returns is something I would ideally want to go for. Please let me know your opinion.

Kindest regards.

Dear Ksam,

20% can be an unrealistic expectation that too for a time-horizon of less than 5 years.

You can consider investing in combination of Short term debt fund + balanced fund (higher allocation for say next 3 years or so) + MIP fund.

Congratulations on completing 2 years with this amazing blog.

I Already have kept some money in Short term debt funds.

What exactly do you advise should be the % distribution of the 10 lakhs.

Eg.

3 lakhs lumpsump In HDFC balanced fund

3 lakhs lumpsump in Tata balanced fund

4 lakhs in birla Sunlife mip plan.

Please advise if this looks fine. Please suggest the best way of investing this hard earned money 🙂

Kindest regards.

Dear Ksam,

Thank you!

You may allocate a bit more to MIP fund if you need this money say in 3 years. Funds are good ones.

Dear shrikanth,

Accidentally hit your blog page and got addicted. Thanks for spreading financial awareness among masses.

My family is blessed with daughters. My two brothers and a sister all blessed with 2 daughters. I want to invest 50k on each daughter to gift them in their marriages. The eldest one is 13 year and remaining 10, 7, 6, 6,5 .I would like to Invest as one time until their marriage. Kindly advice funds name, tax implications if any, I will redeem myself on the respective occasion.

After reading your blog I buy term plan ICICI and may take family floater from star health next week. I will follow your financial planning advice(articles) with basics first, then, I will seek advice for investment after few months.

Thanks

Dear Satish,

Thank you for kind words.

Suggest you to go through below articles and revert to me;

1 – Use calculator available in this article to arrive at approx savings amount : Kid’s Education or marriage expenses goal.

2 – Gifts & Tax implications.

Thanks Sreekanth,

I went through both the articles. This is gift investment, a reasonable and safe instrument will do. I read your best Debt mutual funds in India article. Therefore my understanding as follows,

For 13 year old daughter I will opt for short term debt and remaining all, shall I make a balanced fund like HDFC/TATA.

Should I do it lump sum or SIP as I have surplus cash. Is it advisable to do in one investment rather than dividing in each daughters name? If so, can I withdraw partial amount whenever occasion arises.

Appreciate your guidance and advice.

Thanks

Dear Satish,

The target goal year even for the eldest kid can be around 7 years (minimum) right?

If so, you may consider investing in a balanced fund for say next 2 to 4 years and afterwards you may switch /invest in safe investment avenues (FDs+RDs+Debt funds etc).

You can make lump sum investments in balanced funds. But kindly understand the risks associated with equity oriented funds before investing your funds.

Sreekanth,

Indebted to you for the advice.

Cheers….

Dear Srikanth,Your article on Top Balanced Mutual Funds is about one and a half year old.Kindly update with latest return on these mutual funds.

Dear Dr Bansal..The returns might have changed but as of now my picks are same as far as Top balanced funds list goes.

However, let me re-check the list again and will surely consider your suggestion. Thank you!