Capital asset typically refers to anything that you own for personal or investment purposes. It includes all kinds of property; movable or immovable, tangible or intangible, fixed or circulating.

Capital assets are further classified as Financial Assets and Non-Financial Assets. Financial assets are intangible and represent the monetary value of a physical item. Stocks (Shares) and mutual funds are the best examples of Financial Assets.

The profit (if any) that you make on your mutual fund investments when you redeem or sell the MF units is referred to as Capital Gains. It can be a Short Term Capital Gain (STCG) or a Long Term Capital Gain (LTCG) depending upon the ‘Period of Holding’. The tax that is applicable on these profits is known as ‘Capital Gains Tax’.

In this post let us understand: What are the factors that determine the tax status of mutual funds? – What are the tax implications on mutual fund investments? – Mutual funds taxation & capital gains tax rates on mutual funds for Financial year 2017-2018 (Assessment year 2018-2019).

Factors determining the tax status of mutual funds

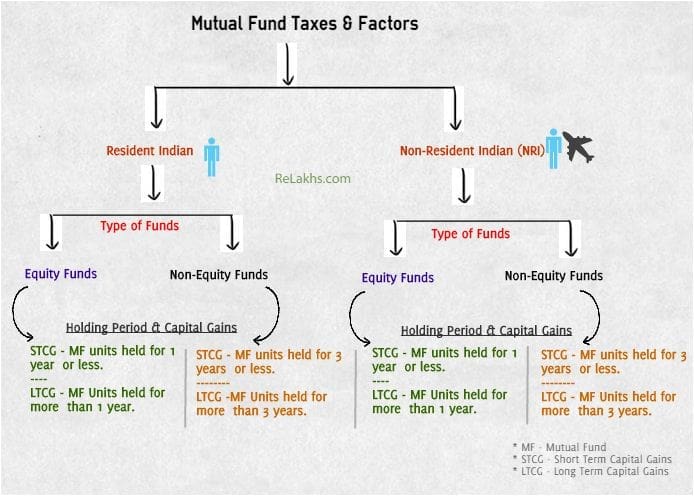

The capital gains tax on mutual fund withdrawals is based on the factors as below;

- Residential Status

- Fund Type (whether the fund is an Equity-oriented fund (or) a Non-Equity Oriented Fund)

- Holding Period (Duration of your investment)

1. Residential Status & Mutual Funds Taxation

The capital gains tax rates are determined based on the residential status of an individual / investor. Residential status can be either ‘Resident Indian’ or ‘Non-Resident India” (NRI).

2. Type of Funds & Mutual Funds Taxation

What are Equity-oriented Mutual Funds? – MF schemes that invest at least 65% of its fund corpus into equity and equity related instruments are known as equity mutual funds. Examples are : Large cap, Mid-cap, Balanced funds (equity oriented), Sector funds etc.,

What are Non-Equity Mutual Funds? – MF schemes that hold less than 65% of their portfolio in equities and equity related instruments are known as Non-Equity Funds / Debt funds. Examples are : Liquid Mutual funds, Money Market funds, Gold funds, Infrastructure debt funds, Balanced funds (Debt oriented) etc.,

3. Period of Holding & Capital Gains on Mutual Funds

Capital gains on Mutual funds could be either long term capital gains or short term capital gains, depending on your investment horizon.

- Long Term Capital Gains

- If you make a gain / profit on your investment in a Equity Mutual Fund scheme that you have held for over 1 year, it will be classified as Long Term Capital Gain.

- If you make a gain / profit on your investment in a Non-Equity Mutual Fund scheme (or in a Debt Fund) that you have held for over 3 years, it will be classified as Long Term Capital Gain.

- Short Term Capital Gains

- If your holding in a Equity mutual fund scheme is less than 1 year i.e. if you withdraw your mutual fund units before 1 year, after making a profit, then the profit will be considered as Short Term Capital Gain.

- If you make a gain / profit on your Debt fund (or other than equity oriented schemes) that you have held for less than 36 months (3 years), it will be treated as Short Term Capital Gain.

Capital Gains Tax Rates on Mutual Funds for FY 2017-18 (AY 2018-2019)

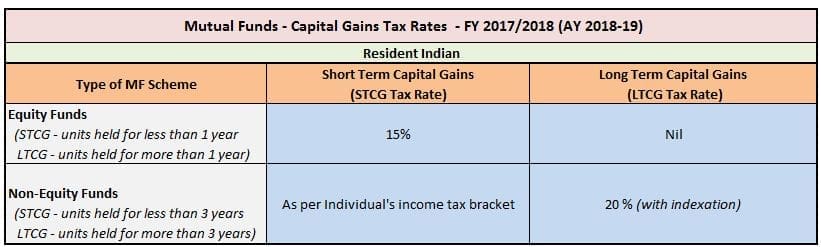

Capital Gains Tax Rates on Mutual Fund Investments of a Resident Indian are as below;

- The STCG (Short Term Capital Gains) tax rate on equity funds is 15%.

- The STCG tax rate on Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate.

- The LTCG (Long Term Capital Gains) tax rate on equity funds is NIL.

- The LTCG tax rate on non-equity funds is 20% (with Indexation benefit)

Capital Gains Tax Rates on NRI Mutual Fund Investments for the Financial Year 2017-18 (Assessment Year 2018-19) are as below;

- The STCG tax rate on equity funds is 15%.

- The STCG tax rate on Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate. (Tax Deducted at Source – TDS @ 30% is applicable)

- The LTCG tax rate on equity funds is NIL.

- The LTCG tax rate on non-equity funds is 20% (with Indexation) on listed mutual fund units and 10% on unlisted funds.

Mutual Funds Taxation Rules on Dividends

- Dividends on Equity Mutual Funds : The dividend received in the hands of unit holder for an equity mutual fund is completely tax free. The dividend is also tax free to the mutual fund house.

- Dividends on Debt Funds : The dividend income received by a debt fund unit holder is also tax free. But, the mutual fund company has to pay a dividend distribution tax (DDT) before distributing this dividend income to its Unit-holders. DDT on Debt Mutual Funds is 28.84%.

NRI Mutual Fund Investments & TDS Rate

Below are the TDS rate applicable on MF redemptions by NRIs for AY 2018-19.

Budget 2017-18 Update :

Base Year & Indexation : The base year for calculation of Indexation is going to be 2001. It will have an affect (mostly positive) on investments where indexation benefit is available when calculating Capital gain taxes.

- For example: Suppose you are holding on to your investments made in debt funds (or) Property before 2001, the Fair Market Value (NAV) as on 1 st April, 2001 will be considered as cost of acquisition for calculating capital gains. This will help the investor to reduce the capital gains taxes.

- As of now, the base year is 1981. To calculate the capital gains at the time of selling any property purchased before 1981, its purchase price is now calculated on the basis of the fair market value of 1981. Calculation at the fair market value of 2001 will increase the cost of acquisition and lower the capital gain.

Budget 2018-19 update :

As per the existing tax rule, equity investors need not pay any tax on long term capital gains. If investments in equity mutual funds or Stocks are sold within a year, gains will be treated as short term capital gains and taxed at 15 %. The finance minister in his Budget 2018-19, has proposed to tax long term capitals gains of over Rs 1 lakh at 10% without indexation benefit. For more details, kindly go through my latest article, click here….

Hope this post is informative. Do you check your capital gains statement(s) every year? Do you include your capital gains taxes (if any) in Income Tax Returns (ITR). Share your comments.

Continue reading :

- Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

- Mutual Funds Capital Gains Taxation Rules FY 2018-19 (AY 2019-20) | Capital Gains Tax Rates Chart

- Different Asset classes (Stocks, Real Estate, Debentures, Gold etc.,) have different Tax implications – How are Investment Returns taxed?

(Assumption – STT (Securities Transaction Tax) is payable) ( Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

Hi,

Thanks for the very helpful article.

I have a question very specific to STCG.

Lets say i have invested 30,000 in equity and got interest of 3,000

Total valuation: 33,000 ( 10% interest )

I have withdrawn 30,000 within a year and 3,000 is kept as it is.

How will be the tax calculated on withdrawn amount or it will be NIL?

Dear Siddhesh,

Plz note that you make gains and dont get ‘interest’ from MFs.

The redemption happens based on First-in and First-out method.

The units worth Rs 30k will be redeemed and the tax will be calculated on the gains made on these redeemed units.

Hello Sreekanth,

what will be tax on 30k considering lumpsum purchase and unit allotment? how it will be calculated considering tax slab 2.5lakh to 5lakh ?

Dear Siddhesh,

The STCG tax rate on equity funds is 15%.

Hi Shreekanth,

Thank you for all the helpful information and latest rules update to the needy people. I appreciate it and hope you will update as well.

Keep it up.

Thank you for your appreciation dear Vijay!

Keep visiting ReLakhs.com .

Shreekanth can u pls clarify me on this..

LTCG on debt mutal more than 3 years would be 20% with Indexation.

This tax is cut by the AMC (when I redeem after 3 years) or will I have to calculate and pay the tax on my own ?

Thanks

Dear Vishwas,

As a Resident Indian (Tax Assessee), you need to calculate the LTCG and pay taxes accordingly.

AMCs cut TDS for NRI MF investors though..

A query

I had invested in UTI Debt fund in fy 2017-18 and redeemed it in FY 2018-19. so STCG is applicable. Also I had got the proceeds of NABARD bonds in FY 2018-19. this was invested 10 yrs ago and the LTCG on these bonds will be taxable after indexation

I will incur loss on sale of equity shares held for less than a year in FY 2018-19. Can I offset the capital loss incurred by this ( considering it as short term capital loss ) against the capital gains made in the other two investments ?

Dear Dr Rajeev,

Yes, you can..

Kindly go through this article..

I need a clarification of LTCG:Debt funds.

I have invested a sum of Rs 5000000 in a short term fund. I also set up a monthly with drawal of Rs 40000 for a period of 3 years. up on completion of the 3 year period I had redemmed my investment in the fund. Now advise me as I had withdrawn Rs.14.8 lakh in total only from my principle amount what is the tax implication.

Dear Jayaraman,

For each monthly withdrawal , you need to calculate the Gains (Short term / long term) and pay the taxes accordingly.

The same is applicable on total units redemption .

Latest article :

Mutual Funds Capital Gains Taxation Rules FY 2018-19 (AY 2019-20) | Capital Gains Tax Rates Chart

SHORT TERM CAPITAL GAIN TAX ON DEBIT MFIF INDIVISUL IN 30%TAX SLAB WHETHER 15%OR 30%

Dear Radheshyam,

STCG from the sale of equity shares or equity oriented mutual funds on which STT is charged on sale transaction are taxed at 15.45% (including education cess) instead of your normal slab rates. So if you are an individual who comes in the 10% tax bracket, then you would have to pay more on these gains, but if you fall in the 20% or 30% tax bracket, then this special rate of 15% is beneficial for you.

Also, you cannot avail any deductions under Chapter VI-A (like deduction under Section 80C, 80D, etc.) from these gains. Further, the relaxation of reducing your capital gains amount in case your total taxable income is less than the minimum exemption limit of Rs 2,50,000 is also available.

sir

in IT FORM 2 which section will i use for entering TDS done by mutual fund house on my NRI debt fund as tax on STCG.

Dear srpal,

You need to provide TDS details under TDS Schedule (column).

iam nri equity STCG DEDUCTED at 15% that amount 2 lakh which is less than 2.5 lakh as I don’t have any indian income can I get equity stcg back if I submit return

Dear vasu ..Yes, you can claim it as Refund (if any) by filing ITR for the respective Assessment Year.

No indexation benefit on LTCG on debt mutual funds. Please check properly. Please read Sec 112 repeatedly. Thanks.

I have STCG of Rs 3000 for Debt Fund this year. I have about Rs 50000 STCLosses (for equity MFs) carried forward till last year. Can the STCG from Debt Fund Rs 3000 be adjusted against the STCLosses of Rs 50000 and Rs 47000 (50000-3000)carried forward for the next year? Or I have to add this in my income and pay tax as per my slab?

Dear Bhaskar,

Yes, I believe that you can set off the STCL with STCG.

Related article : How to set-off Capital Losses on Mutual Funds, Stocks, Property, Gold, Bonds & Debentures?

If my income is rupees 270000 including STCG from debt oriented mutual fund of rupees 30000 than how much tax i have to pay?

Dear Ankit ..You may kindly use the income tax calculator available at this link…

Hello Mr Reddy ,

I am an NRI with a house in India which I rented (35000 per month ), I also have housing loan for same house ( completed 6 years of repayment and 9 years to pay (about 19lahks) ) I also pay Income tax because of rent.

Now My question is I have 20 lakhs to payback loan .

1. Should I payback loan ? and save interest of loan

2. Whatever I get rent I want to invest in MF ( Please note I am new to MF market )

3. Calculating all risks and investing in little safe funds after 10 years what percentage saving I can see after 10 years ) ? OR JUST INVERT 20LAKHS IN MF

4. Can I reduce IT return paymets with this idea?

5. If at all I have to do gain , calculation for loan against MF how to do , pls expain with exxample pls

Dear rumesh,

May I know your other important financial goals and their time-frames?

thank you ,

To be frank as of now I do not hv time frame just save money smarter.

Dear rumesh,

Then, you may invest in equity oriented funds.

Kindly read :

FATCA Compliance for MF Investments.

How to get cKYC done?

You may opt for ELSS funds and can claim tax deduction u/s 80c.

Read :

Best ELSS Funds

Best Equity funds.

I will consider your advice.

As I decided to close house loan and invert my house returns in MF ,

As I understand I can get tax reduction only upto 1.5 lakhs of inverstment. Correct?

Remaining I have to invert in EQUITY with moderate risk. Please confirm ?

Umesh

Dear rumesh,

Section 80C limit is Rs 1.5 Lakh.

Kindly read : List of income tax exemptions for FY 2017-18.

If you would like to take moderate risk, you may consider equity oriented balanced funds for medium term (say for 5 to 10 years).

Hi Sreekanth, please let me know the tax implication of these funds when I sell them..

Birla SL Savings Direct-G

DHFL Pramerica Ultra Short Term Direct-G

ICICI Pru Long-term Direct-G

From your post I figured it will be “as per individual tax slab” if I sell it with in 3 years and 20% when I sell it after 3 years. Is it applicable for FY 16-17 as well ?

Is this applicable for all my 3 funds ?

Dear Boopathi,

Birla Sun Life Savings Fund & DHFL fund are Debt funds (Ultra short term fund).

ICICI Prudential Long Term Fund is also a Debt fund (Dynamic bond fund).

Yes, your understanding is correct and yet its applicable for FY 2016-17 & also for FY 2017-18 as well.

Really thanks for the quick response and your appreciative information.

But one thing i want to clear that if someone not falling under any of the tax bracket means less than 2.5 lakhs invests 5lakhs or more from past savings in LT debt fund therefore capital gain should be taxed at 20% with indexation.so what he do at the time of redemption,will he have to file IT return or nothing to do as because he doesn’t fall’s under IT bracket.hope u understand my question.Also give some review for sbi Magnum balanced direct growth fund for 3 or 5 years.

Dear Dipak ..If your only source of income is STCG on debt mutual funds, and if it is less than basic exemption limit then tax on STCG is not applicable.

Dear Sreekanth,

I have the ICICI ULIP policy (lifetime) which was started from 1st Jun 2006 and I was paying till 2016 (10 years and 3 months – Monthly 2000 123 months 123×2000 = 246000). The current value looks good. Policy status is in force. Fund value is 437525 and capital gain is 191525. If I surrender this policy, will there be any tax for long-term capital gain? Can I get the full amount if I surrender the policy? My understanding was there would be locking period for my last three year’s monthly EMI (Rs.2000 each month) Because I had claimed for tax benefits and I could able to claim till completed lock in periods (7 years). Please advise.

Dear Rajendran,

As you have completed five years, there will be no surrender charge and the surrender value will also be tax free. The surrender value of ULIP is otherwise added to your income and taxed as per applicable slab rate if surrendered before five policy years.

Kindly read : Tax benefits can be revoked.

Thank you sir for the quick reply and guiding me. I will keep visit your websites and also share with my friends. Thank you once again for the service.

SIR I WANT TO KNOW THAT WHETHER AMC DEDUCT ANY TAX ON CAPITAL GAINS OR WE HAVE TO INFORM ABOUT THAT TO IT DEPARTMENT WHILE FILLING RETUNS.

ALSO WANTS TO KNOW,

1-IF ANYONE NOT FALLING UNDER IT BRACKET I.e. 250000.

WHICH OF THE CAPITAL GAINS IN ABOVE TWO CASES ARE TAXED AT 20% WITH INDEXATION.

3-IF ANYONE NOT FALLING UNDER IT BRACKET BUT INVESTS 4 TO 5 LAKHS AND CAPITAL GAINS TO 3LAKHS DOES IT IS TAXABLE AT 20% WITH INDEXATION.

OVERALL MY QUESTION IS 20% TAX TAX ON LONG TERM CAPITAL GAIN FROM DEBT FUNDS ARE RELATED TO INCOME TAX BRACKET OR IT IS RELATED TO AMOUNT OF INVESTMENT WITH THE AMOUNT OF CAPITAL GAIN RECEIVED.

SORRY FOR THE AWKWARD QUESTION.

LOOKING FORWARD TO GET YOUR KIND INFORMATION.

Dear Dipak,

If you are a Resident Indian then Mutual Fund houses will not deduct any TDS on redemption of MF units. The investor has to calculate the taxes (if any) on Capital gains (if any) and need to disclose it in his/her Income Tax Return.

The LTCG on sale of Equity funds are tax-exempt and can be reported under ‘Exempt Income’ section of ITR.

1 – 20% with indexation is levied on None-equity funds LTCG.

2 – It is not related to income tax bracket. The tax rate on LTCG on debt funds is 20% with indexation.

Dear Srikanth,

I need a financial advice for my father. My father is 59yrs old and he wants to invest 5lakh lump sum as onetime investment, so that my mother will get 10-15k/month as income after his demise. Could you please advice on where should he invest? on whose name (Father/Mother) the investment is adviceable?

Father’s age-59yrs, self-employed.

Mother’s Age- 54yrs, House wife.

I hope you would do the needful, Thanks in advance.

Dear Prasad,

So, the income is not required now??

If he is not dependent on this corpus amount, he may consider depositing in Post office MIS Scheme in the name of your mother. (max allowed is Rs 4.5 Lakh).

Dear Sreekanth,

Thanks for your suggestion.

Yes, my father doesn’t need the corpus amount. isn’t the interest earned taxable in Post office MIS plan?

What is your suggestion on splitting 5lakh and invest in Balanced Mutual funds like HDFC Prudence Fund and ICICI Balance funds which have an option of Systematic Withdrawal Plan (SWP)? is profit on these funds taxable? are there any better SWP plans? If my mother starts withdrawing the monthly income after 5yrs, will she get the target income of 10k/month with these plans?

Dear Prasad,

Yes, it is a taxable income.

We can not predict the returns on equity oriented funds.

Better suggestion is, if regular income is not on immediate basis, your father can invest in balanced funds for next few years (in your mother’s name), let the wealth grow, after few years you can take call to set up SWP in the same funds (or) switch to little bit safer options and then set up SWP.

Dear Sreekanth,

Thank you very much for your advise. I really appreciate your valuable suggestion and time. Could you also please suggest me the best balanced funds? Which you think will do good in next 5 yrs?

Dear Prasad ..We cant predict the future, but we can shortlist the consistent ones based on their long term track record.

You may consider funds like HDFC balanced fund, TATA balanced fund, SBI or ICICI Balanced funds..

Thank You very much.

I am gonna invest in Kotak tax saver fund with a 2o year horizon.

Is this a good fund to start an SIP.?

8k per month

Dear rajeesh ..There are better funds than this fund.

Kindly read : Best ELSS tax saving funds for FY 2017-18

I recently tarted 4 SIPs, 3 1k and another 2k with bluechip corporate india as the broker, i had no knowledge of Direct and Regular Plans , thanks to ur blog i have come to know of this , i had also given the OTM mandate for monthly deductionthe first SIP has been deducted and , now my question is can i switch to direct plan from regular plan? and i believe as part of STCG 15% of tax needs to paid on the gains as i am still in the starting stage i can risk switching over and can escape with least damage…what is your view sir ? and can i continue the SIP with the same portfolio Number by from the website of the AMC ??

All of them barring one ELSS are in equity

Dear Chaitanya ..Yes, you can switch and can invest in Direct plans under same folio, (yes, subject to taxes on CG). ELSS units you can redeem, so you can stop future SIPs and opt for Direct plan for future SIPs.

Very well explained. Thank you for this article.

STCG on redemption of Liquid Fund is to be shown under “Income from Other Sources” or under ” Income from Capital Gains I schedule in the I T Return.

Dear Rakesh ..Its income from CG section..

Thanks Mr Sreekant

Hello Sreekanth ,

Wish you good luck for this blog.

I am a NRI and want to invest in mutual funds. Their are so many MF plans in the market. Please guide me to

A. invest in a tax free mutual fund (1) short term MF (max 2 years @ low risk high return) (2) Long term MF (maximum 20 years @ low risk high return).

B. How i can do the paper work while working out of india ?

C. How to select a Perfect MF based on their history as per our retirement goals ?

Thanks

Dear Pritesh,

A – Minimum lock in period of a Tax saving ELSS fund is 3 year.

Red:

Best ELSS MFs for FY 2017-18

Best Equity funds 2017.

B – Is your PAN KYC compliant? Are you an USA based NRI?

Read:

What is cKYC?

What is ekyc?

What is FATCA form?

c – Read :

How to select right mutual fund scheme?

Retirement goal planning..

dear sreekanth,

i am NRI and residense in middle east. i have started investment in mutual fund and i am looking to invest in liquid fund with dividend re investment option could u advise me if in case of redemption after three month do i need to pay tax for stcg or it will deduct at a time of redemption . as my status is nri so i m not filing any it return . if in case is not deducted do i need to file return . your quick response for the above would be highly appreciated.

Dear Rahul,

TDS is deducted in your case. It is a taxable income.

Read:

Do I need to file my ITR?

NRI & Taxation rules.

Dear sreekanth, thanks for reply and i appreciate your quick response. I would like to one more query.

In equity mutual fund at the time of redemption after one year if capital gain more than 2.5 lac will this amount is taxable ? Do i need to file the itr in both case whether is taxable or nil tax . Current residense ..nri..

Dear Rahul,

Any amount of LTCG on Equity funds is tax-exempt.

But advisable to file ITR and declare this LTCG under Exempt Income section .

Thanks for your valued suggestion. I have one more query .i am investing in mutual fund every month via lumpsum but not equal amount .is it effect my return ? In comparrision to sip. I have started 3 sip investing and 2 fund started with lumpsump but every month i am also investing same fund via lumpsum but unequal amount.pls advise am doing right approach for good return as i understand mix of sip and lumpsum make good return.

Dear Rahul,

There is no right & wrong approach (style of investment).

Personally, I invest via SIPs and also make additional / lump sum investments in same funds.

Read : SIP Vs lumpsum investment.

Hello Sreekanth,

Thanks for the insight of valuable information.

I have few queries and need your valuable suggestion.

Already Invested plan

—————————–

1. Last year I buyed HDFC Prudence Fund -Regular (D) through HDFC bank manager – 16lakh. It is giving me dividend every month 15k+. can I continue this plan ?

New Investment planning Lumsum – Lock Period Term : 8 years

———————————————————————————

1) Dividend-Balanced – HDFC Prudence Fund – Direct Plan (D) – 30 lakh

2) Growth-Balanced – ICICI Prudential Balanced Fund – Direct Plan (G) – 25 lakh

3) Growth-Balanced – HDFC Prudence Fund – Direct Plan (G) – 15 lakh

New Investment planning SIP – Monthly – Lock Period Term: 15 years

—————————————————————————————

1) Large Cap – ICICI Pru Top 100 Fund (G) – 5k

2) Small & Mid Cap – L&T Midcap Fund (G) – 5k

3) Small & Mid Cap – HDFC Mid-Cap Opportunities Fund (G) – 5k

4) Thematic – Infrastructure – L&T Infrastructure Fund (G) – 5k

5) Balanced – HDFC Balanced Fund – Direct (G) – 5k

Need your guidance

————————–

1) Can I invest on the above funds as an NRI or use my wife to buy this as they are resident ? What is the advantage ?

2) Are the above MF and SIP are advisable fund for the respective period? Is it good for long run ?

3) How can I buy this direct funds ? ( through MF Utility or any other best) – were no commission and easy to handle all funds in one view.

4) As per my understanding the funds I opted are Equity and long-term, so it will fall under Long Term Capital Gains and it will be taxable based on the residential status at the time of sale of fund.

What would be the tax liability if NRI and resident in Middle East ?

What would be the tax liability resident ( back to India) ?

5) Any other fund which you recommend for long term better then the above ?

Looking forward to your help

Dear raju,

1 – Do you need Dividend income? Are you dependent on this income for meeting your living expenses? Is this for consumption or are you re-investing anywhere else?

There is no lock-in period for balanced fund. (I believe you have just mentioned the investment time-frame as 8 years, am I right?)

2 – Any specific strategy / objective for investing multiple Balanced funds?

3 – No specific adv or dis adv for NRI vs RI. (But read : NRIs & FATCA compliance)

4 – Can consider MF Utility if no fees is the main criteria.

5 – Kindly note that Long term capital gains on Equity funds are tax-exempt for both NRIs as well as Resident Indians. For taxation rules, kindly go through above article.

Kindly read :

Best MF schemes 2017.

NRI & Taxes.

1. Dividend income : I am re-invest the dividend income on the mentioned 5 SIP Plan.

2. yes, your correct I mentioned keep time frame of my investment.

3. No specific strategy, but objective is to get good return at 8 years and at 15 years with less risk.

In directly Investing 60 lakh in balanced were the risk is low.

Let me know if you have any best investment plan for me.

Thanks

hello,

Being a housewife i invest very small amount like 5000/- or 6000/- in equity based mutual fund though my demat account and also redeem the amount after it gains some amount within 2-3 months.I don’t have any other source of income so i don’t file the IT return.Please tell me if any short term capital gains attracts in my case.If yes,then will it deducted by its own or i need to file return for that.

Dear Mitra,

You need to disclose the Short term capital gains while filing your ITR and calculate your tax liability (if any).

MFs do not deduct taxes on capital gains.

The investment strategy followed by you, can be a very risky one!

HI,

I have a query regarding Debt MF STCG tax on dividend reinvested for Indian resident.

Here is scenario using 5000 rupees invested in Ultra Short term fund as Monthly dividend reinvestment.

1. On 3-Feb-2017, invested INR 5000 . At NAV INR 1034.6303, got units 4.833

2. On 28-Feb-2017, received dividend INR 20.94. Reinvested at NAV 1032.5107, got units 0.02

3. On 6-Mar-2017, sold all units 4.853 at NAV 1033.5483 and received amount INR 5015.81 in my bank account.

Can you please help me in understanding my capital gains/loss in this and how its calculated.

THx

Anand

Dear Anand,

You have a Short term Capital Loss.

Capital gain(STCG) = Redemption amount- Purchase cost – Dividend reinvested.

Dear Sir,

Recently I withdrew all the remaining 80% of my investment amount fr0m the NPS scheme and exited it in the current financial year (2016-17). Please tell me how to calculate Capital Gain Tax on the total amount I have received. What will be my tax liability as per the existing rules of the NPS scheme.

I look forward to hearing from you at your earliest convenience.

Needless to add I’ll be very thankful to you for your advice.

Thanking you, in anticipation.

Faithfully, yours

Sanjay kumar srivastava

Dear sanjay,

May I know if you are a govt employee & your age? For how long have you been contributing to NPS?

Suggested reading : Review on NPS Scheme!

Dear Sir,

First of all let me thank you very much for your prompt reply.

I am an employee of a private organization (a PGT in a college), aged about 48. I had been contributing to NPS since September 2011 and I received the remaining amount of about 25000 by the end of 2016.

Thanking you, in anticipation.

Faithfully, yours

Sanjay kumar srivastava

Dear sanjay,

But a pvt sector employee can exit from NPS, after contributing to NPS for minimum 10 years. Am I right?

And that too 80% of the withdrawn amount has to be used to buy an Annuity product.20% can be withdrawn.

However, if accumulated pension is less than Rs 1 lakh, the NPS subscriber can withdraw full 1 Lakh without purchasing the Annuity product.

Dear Sir,

I have EPF facility in my institution in place of NPS, and my corpus was, indeed, less than -far less than- one lac; actually , it was a mere about Rs 25000/-. Hence the present situation; the 20% of which I withdrew some few months back.

Now , sir, the problem I am faced with is how to calculate Capita Gains on this amount. I am preparing to file my return for the current financial year.

Thanking you, in anticipation.

Faithfully, yours

Sanjay kumar srivastava

Dear sanjay,

I believe that the withdrawn amount is treated as your income and charged as per your income tax slab rate.

Kindly consult a CA.

Hi Sreekanth,

Very informative article! I am not clear how the capital gain tax is deducted?

I have redeemed 3000 from one of debt fund within 4 months but didn’t see any capital gain tax amount is there.

Thanks,

Navneet

Dear Navneet,

Kindly note that fund house won’t deduct Tax on gains (if any).

You have to show the short term capital gain in your income tax return and pay taxes accordingly.

Hi Sreekanth,

Thanks for the prompt reply.

How to I calculate capital gain tax after indexation to show in my ITR? Does MF house share Capital gain or tax with Income Tax department via Form 26AS?

Dear Navneet,

As mentioned in my previous comment, fund house does not levy CG tax, so it wont be reflected in Form 26AS.

You can request for a Capital gain statement from your AMC or distributor or Registrar and then you can disclose it in your ITR.

Kindly read: How to get Mutual Fund Consolidated Statement & Capital Gain statement online?

Hi Sreekanth,

Please bare with me as I have started investing in MF from this year only.

Can you please share the formula to calculate capital gain tax? If MF does not disclose any income to Income Tax department, Can someone hide the same while filing ITR?

Dear Navneet,

We are now seeing the consequences of hiding ‘income details’, as the IT dept is now very much efficient and they can easily track the details (if required). So, advisable not to do that.

Kindly go through this article : Capital Gains on Stocks & MFs (equity).

You may download mutual fund capital gains calculator…

Hi Sreekanth,

As you have shared the link to get the consolidated statement CAMS Mail back service for Consolidated Account Statement for all mutual fund Schemes.

I downloaded the statement but it contains only purchase, sip & redemption but no capital gain

Dear Navneet,

You have to request for Capital Gain statement (Consolidated Realized Gain Statement) and not CAS.

Hi Sreekanth,

As you commented I can not get the capital gain statement from CAS. Does that mean I have to request every MF house to send me the capital gain list?

It looks a length task as I have 7 – 8 funds of different houses in my portfolio. Is not there a single place to request the same for e.g MF Utility to transact across almost all fund houses

Dear Navneet,

CAS is just a transaction statement, whereas Realized gain statement is a Capital gain statement.

You can request capital gain statement for multiple funds serviced by CAMS / Karvy in one go.

Kindly read my article on ‘how to get CAS & capital gain statement online?‘ again, I have given details on how to get CG statement too.

Hi

I want to plan for long time for my child education. I know kisna yojana in Post office which makes double the money after 100months(8yrs.4mts). My question are

1. I am I doing right investment. or is there any better option available.

2. after 8yres what ever money I get. do tax get deducted in that.

3. now if I invest in that, can that be consider for tax deduction

———————————————————–

I even want to know about short time mutual fund investment.

1.ex I invest 50000 after 3 months what amount I get.

2.the amount I invested (50000) is there chance of losing that also.or for sure I will get my 50k back

3. which is best short mutul plan

please do help me.Your best at making things understand regarding tax

thank you

Dear Syed,

The interest earned from KVP is taxed as per the Income Tax slab applicable to the investor on redemption.

Kindly note that returns on Mutual fund investments are not guaranteed.

Read below article, you may use available calculator to project expected corpus for your Kid’s education. You may revert to me with more queires 🙂

Kid’s education goal planning..

Hi Sreekanth,

Very informative post. I have a mutual fund TEMP INDIA CORP BOND OPPORTUNITIES GROWTH. I have invested via SIP from 2012-2014. If i redeem the fund now, will there be any tax on it?

Thanks,

Pramoda

Dear Pramoda ..This is a non-equity fund (debt fund), so taxes on Long term capital gains (if any) will be applicable.

I’m holding funds in 2-3 liquid funds for a period of less than 1 year. If I pull out my funds now will it be taxable as per my IT slab?

Yes dear Raghuma ..

Hi Sree,

Appreciate if you help explain the tax liability on Birla Sunlife MIP II WEALTH 25 Plan

STCG and LTCG. Thank you.

Regards,

Samir

Dear Samir,

MIPs are considered as Debt funds / non-equity funds.

If you make a gain / profit on your investment in a Non-Equity Mutual Fund scheme (or in a Debt Fund) that you have held for over 3 years, it will be classified as Long Term Capital Gain. The STCG tax rate on Non-Equity funds (or) Debt funds is as per the investor’s income tax slab rate.

If you make a gain / profit on your Debt fund (or other than equity oriented schemes) that you have held for less than 36 months (3 years), it will be treated as Short Term Capital Gain. The LTCG tax rate on non-equity funds is 20% (with Indexation benefit)

Dear Sreekanth,

I am retiring in April’17. I have a few queries on mutual fund investments.

1) I would like to invest about Rs.500 K in lump sum in some very good equity funds with sound track record of capital appreciation and dividend payments (yearly) to supplement my post retirement earnings. Require suggestions on such funds with suggested fund allocation.

2) Presently I have a SIP in ELSS (G) of Reliance MF which will complete the SIP tenure of 3 years after about 6 months. Once, the SIPs are completed I would like to immediately switch the accumulated units to Dividend option of the same fund of Reliance MF to supplement my earnings. my questions are – a) Whether that is permissible? b) Whether I will have to pay any STCG tax on such switch?

3) I would like to make investments in debt funds through SIP route to take care of my various annual payment obligations, e.g., life and health insurance premium. The SIPs will be for longer horizon, say five years, but drawings will be made annually for required amount to pay insurance bills. I know there will be STCG implication of 20% but even then expected earning post tax will probably be higher than Bank Recurring Deposits post TDS and tax on interest income. Is my strategy correct? If so, kindly suggest a few very good debt funds with high returns in growth option.

Thanking you in advance.

Dear Alok Ji,

1 – Are you going to be heavily dependent on this Dividend income to meet your living expenses?

Kindly read :

Retirement planning & calculations

Best Equity funds 2017.

2 – Kindly note that the units allotted under each ELSS fund SIP are locked for 3 years. You cant redeem or switch them. Also, dividend and growth options are treated as two different schemes, so taxes on capital gains (if any) are applicable.

3 – Kindly note that even Debt funds are subject certain risks. In case if you can hold on to your investments for just over a 12 months , you can consider an Arbitrage fund. Other options can be Liquid funds. In case if you would like to take little bit more risk then you may consider Systematic withdrawal plan of Conservative MIP fund-growth option.

Read:

Best Arbitrage funds.

Best MIP funds.

Best Debt funds.

List of best investment options.

Hi Sreekanth,

Thanks for your prompt response.

Of course I’m not heavily dependent on dividend income. I just want to supplement my post retirement income through a tax efficient way.

So what I understood from your response is that it would be better to invest lump sum in arbitrage fund and conservative mip funds with growth option and go for swp commencing after one year from investment to avoid any tax. Is my understanding correct?

Thanks once again.

Alok Basu

Dear Alok,

Yes, for arbitrage fund – any redemption or switch or SWP withdrawals after 12 months of holding would be tax-free.

This is not the case with MIP Funds. After 3 years of holding, any withdrawals would be subject to Long term capital gain taxes, less than 3 years Short term CG taxes can be applicable.

Kindly read: MF taxation rules.

Hi Sreekant,

I read your posts and thanks for sharing such great information I am 39 years old and plan to invest a amount of 3 lakhs in mutual funds wither lumpsum or over a period of 6 months. I can stay invested for 5 years. Could you suggest some good mutual fund

Dear Imran..You may pick one Balance fund and one large cap fund.

Ex – HDFC Balanced fund / Birla Frontline equity fund.