Mutual Funds are the best tools for long term wealth creation. Investors in Mutual funds get the twin benefits of diversification and also management of their funds through professionals.

SEBI introduced reforms in the mutual fund sector in 2013. Thanks to these reforms, Direct Mutual Fund schemes are gaining popularity not only with just corporate or high net worth individuals but also with the retail investors.

What are Direct Mutual Fund Schemes?

Although the Asset Management Companies (AMC) allowed this much before the year 2011, direct investment in mutual funds has become famous only recently. Direct mutual funds plans are those where AMC / mutual fund Houses do not charge distributor expenses / trail fees / transaction charges. ‘Direct’ means no intermediaries.

Direct mutual fund schemes have lower Expense Ratio than that of Regular plans. This is the main reason why the NAV of a direct plan will be higher than the NAV of a regular plan of the same scheme.

Direct Mutual Fund Plan Vs Regular Mutual Fund Plan

Let us now understand the differences between Regular and Direct Plans in Mutual Funds with an example;

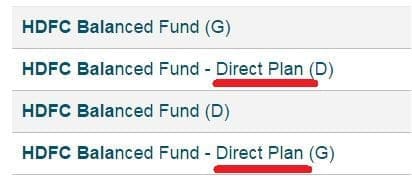

In the above example, we can observe that HDFC Balanced fund has four options, 2 regular schemes and 2 direct schemes. Kindly note that ‘D’ means ‘Dividend Plan’ and it does not mean ‘Direct Plan’. (G stands for Growth option.)

- Expense Ratio : The Direct plans have lower expense ratio than Regular plans. The expense ratio of HDFC Balanced fund – Regular plan is 2.07% (as on Mar 2015) . Whereas, the expense ratio of HDFC Balanced fund – Direct Plan is 1.20%.

- NAV : The Net Asset Values of Regular and Direct plans of the same scheme differ. The NAV of Direct Plan will be higher than the NAV of a Regular plan. The NAV of HDFC Balanced fund – Regular plan is Rs 109.85 whereas the NAV of HDFC Balanced fund – Direct Plan is Rs 111.97.

- Returns : The difference in returns generated by a Regular plan and a Direct plan of a scheme is expected to range between 0.50 and 1 percent. This difference will compound year on year. The last two year CAGR (Compounded Annual Growth Rate) of HDFC Balanced fund – Direct fund (monthly SIP) is 22%. Whereas, HDFC Balanced fund – Regular plan has given return of around 20.97% during the same period.

In the case of both regular and direct mutual funds, the investment objective, asset allocation pattern, risk factors and the investment mix are same. A scheme’s portfolio will be the same for both, Regular plan and Direct Plan.

How to invest in Direct Mutual Fund Plans?

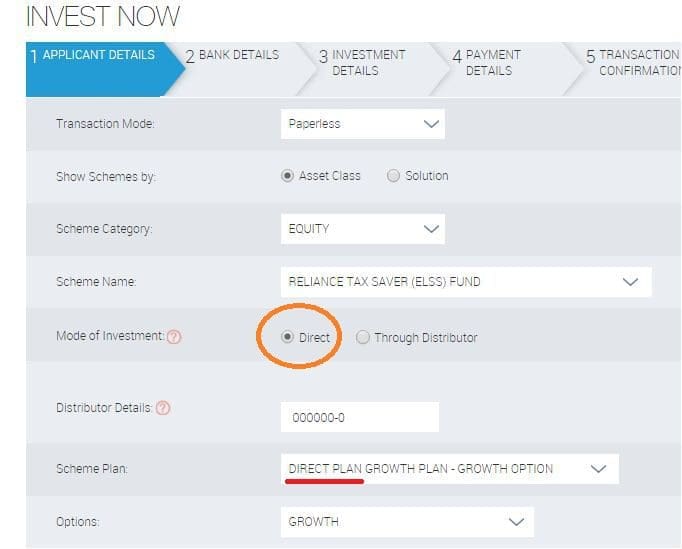

- You can buy Direct plans online by visiting respective mutual fund house websites. For example, below screenshot has been taken from Reliance Mutual Fund’s website. When you are making an online investment, you can find two options ie ‘direct’ and ‘through distributor’. Select ‘Direct’ if you would like to invest in Direct plan of a scheme.

- You can also invest in direct mutual fund schemes through MF Utility.

- If you are investing in MFs offline (physically) then you just need to mention or tick the option ‘Direct plan’ in Mutual Fund Investment form. After this, even if the agent or the distributor of the scheme puts his/her ARN code, they will not get any commissions from the investment.

- If you do not find ‘Direct plan’ option in application form, you can mention ‘DIRECT’ in the ARN column. Even if the agent code is missing in the ARN column, it will become a direct plan by default.(ARN means AMFI Registration Number. ARN is the unique code which is used to identify the MF agent / advisor.)

(KYC compliance is mandatory to invest in mutual funds. If your PAN is not KYC compliant, you may get eKYC done now. eKYC is a new online facility offered by some of the AMCs.)

How to switch from regular to direct mutual fund plans? (for existing MF investors)

If you are an existing investor of a regular mutual fund scheme, and would like to convert your mutual fund from regular to direct plans, then you have to opt for a ‘Switch’.

In order to convert an existing regular fund to a direct fund, you need to submit ‘switch request’ to the concerned Asset Management Company (fund house). Based on your written switch request, the units under Regular plan will then be converted as Direct plan units.

For example : You can download and submit forms like ICICI MF’s Regular to Direct Switch Form & HDFC MF’s Regular to Direct Switch Form format.

Regular to Direct – Switch – Exit Loads & Tax Implications

If you are switching from Regular scheme to Direct scheme, this is considered as normal redemption (exit) only. Such transfer shall be considered as a Redemption (from regular plan) and a fresh investment (into direct plan). So ‘Exit Loads’ (if any) will be applicable. However if you have invested in Regular fund without mentioning any distributor code then ‘exit load’ is not applicable.

Since the ‘switch’ is considered as normal redemption request (exit), you have to be aware of the tax implications. Based on whether the capital gains are short term or long-term, respective taxation rules are applicable. Kindly read my article on MF capital gains taxation rules for more information.

Also, TDS is applicable on the ‘switch requests’ submitted by NRIs.

Important points & my Opinion on Direct Mutual Funds

Below are some of the important points on Direct Mutual Funds;

- Kindly note that all types of mutual funds can be switched except Exchange Traded Funds.

- For ELSS or any mutual fund schemes that have a lock-in period, you are eligible to move to Direct Plans once units complete their lock-in period. Your investments into direct plans will have a fresh lock-in of 3 years.

- Kindly note that investing through ‘ICICI Direct’ or any online distribution platform does not mean you are investing in Direct plans of mutual funds.

- Note that buying from a Bank, such as HDFC Bank, means you are using a distributor. Even if you buy an HDFC Mutual Fund, HDFC Bank acts as a distributor. The only way to buy “Direct” is to have “Direct” in the fund scheme name. If the scheme doesn’t say “Direct” in your statement report, you are paying commissions.

- Difference in Investment returns generated between Regular and Direct plans is the highest in Equity oriented Schemes. In debt funds, the expense ratio of the regular plans is not too high hence the difference in returns is lower.

- Direct plans of equity funds are not rated / ranked by the Rating agencies as they have not completed three years.

- Fund houses like HDFC, ICICI Prudential, Reliance, Birla Sun Life and Franklin Templeton have over 20% of equity assets in direct plans coming from retail investors.

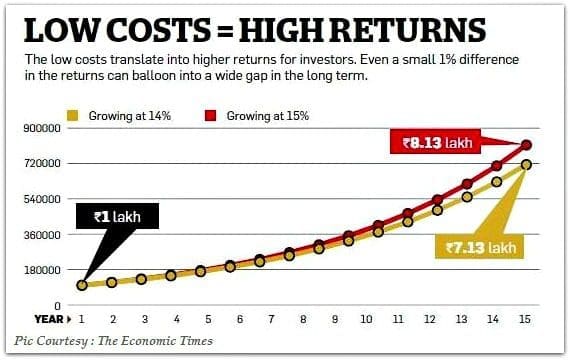

The investment return generated by a Direct mutual fund scheme can be say 1% higher than the returns offered by a Regular plan. Even a difference of this 1 percentage point can balloon into a huge gap due to compounding in the long term.

For example : If you invest Rs 1 Lac in a Regular plan which generates say 14% return in 15 years, the accumulation amount can be Rs 7.13 Lakh. The same Rs 1 Lac if you choose to invest in a Direct plan which generates say 15% return in 15 years, the accumulation amount can be Rs 8.13 Lakh. This extra 1 percent difference in the return can create a big impact in the final accumulated value over a long period.

If you invest in Direct mutual fund plans through multiple fund house websites, tracking your MF portfolio can be a bit challenging task. In this scenario, you can create dummy portfolio on web portals like Economic times or moneycontrol.com and can track your portfolio online. One more option is to invest in Direct plans offered by various fund houses through common platform like Mutual Fund Utility.

Though Direct Mutual Fund plans give higher returns, they are meant for investors who know which funds to buy. If you are not comfortable or do not have the expertise to identify good funds as per your financial goals, it is better to take the services of a Mutual Fund agent. You may also consider taking the help of a fee-only Financial planner to buy direct plans.

In the race to get higher returns, it could be disastrous if you invest in a wrong Direct mutual fund product and make 10% lower returns than its fund category. Instead you can invest in a suitable Regular plan through an advisor who can guide you. A Direct Plan will work well if you have the required knowledge and infrastructure.

(You may read my article : ‘Best & Top Equity Mutual Funds‘.)

I believe if you are making fresh mutual fund investments or creating new SIPs, you can surely consider investing in Direct mutual funds provided you know which funds to buy. While the process may look little complicated in the initial stages, it should be easy while investing in subsequent schemes.

For the existing investments, be aware of the exit loads, tax implications and applicability of lock-in period (if any) before you switch from Regular plans to Direct mutual fund plans.

Do you invest in Direct plans of Mutual funds? Kindly share your views and comments.

Continue reading :

- ‘Mutual Fund Direct Plans Vs Regular Plans | Comparison of Returns & Analysis‘

- Why your Best Mutual Fund Schemes may not remain as ‘the best’?

- When should you sell your Mutual Fund Schemes? | When to exit a Mutual Fund?

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (References : Moneycontrol, Valueresearchonline & Economic Times.)

Join our channels

Hi Sreekanth,

I have SIP for Tata Hybrid Equity Fund – Regular plan – Growth.

I have been investing in it through SIP for last 3 years. But the returns are not good at all. Please suggest where should I switch by stopping the SIP in this plan

Regards

Mandar

Dear Mandar,

You may switch to other better performing balanced (Hybrid) fund like HDFC Hybrid equity fund.

Kindly read :

* Why your Best Mutual Fund Schemes may not remain as ‘the best’? | Categorization & Rationalization of MFs

* Best Mutual Funds 2018-19 | Top Equity Funds post SEBI’s Reclassification

Hi, I am first time investor. Interested in tax saving MF direct plans. Can I use MyCAMS app? Will they charge me for this service.

Or any other alternatives

Dear Amar,

You can opt for MyCAMS. MyCams allows you to invest in both – Regular & Direct Plans. So choose based on your preference.

You may also check out MF industry sponsored platform MFUTILITY as well.

Hi i have invested in following MF since 2017 through a distributor

ICICI PRUDENTIAL BALANCED FUND – GROWTH

SBI BLUE CHIP FUND-REGULAR PLAN GROWTH

DSP BLACKROCK MIDCAP FUND – REGULAR PLAN – GROWTH

HDFC TOP 200 FUND – GROWTH OPTION

Now i want to invest DIRECTLY, what are the issues involved and how to go about it.

Thanks

Dear Rajeev ..

Kindly read :

Switching to Direct Mutual Funds From Regular MFs? Keep in mind these handy tips!

Why your Best Mutual Fund Schemes may not remain as ‘the best’? | Categorization & Rationalization of MFs

Hi Sreekanth,

I am a first time investor and want to start the SIP for SBI blue chip direct plan through MyCams .

1)Does myCams platform allows to invest in SIP for this fund ? Because when I selected this fund this asked me to invest Rs 5000 which is the minimum investment. This is because it is MF and not SIP. Can you guide me how to start SIP through myCams.

Dear Raj,

Yes, you can invest in this fund through myCams.

The minimum first investment for this fund is Rs 5,000 (as per fund house) and then you can set up SIP (make additional investments) with a minimum amount of Rs 1,000.

An Excellent Article Indeed…

Learned a lot…..Thanks

Thanks Sreekanth for this information.

Dear Sree

I want your help here. I have two questions.

I already have a portfolio which is mix of regular and direct NAV with lumpsum investments. However I have four SIPs in direct NAV. All of these were purchased in the offline mode. I was maintain the portfolio in a excel file but that was tedious process. I have registered on the CAMS website and now I get statement once a month which is generally incorrect. If I book profits they show it as complete redemption. So I can’t rely on their statement anymore. I want to maintain an online portfolio where I can manage the existing investments in DIRECT nav and add more in DIRECT nav.

2. Can you suggest any names. I am told scripbox, investza, fundsindia etc but I don’t their reliability as a distributor. Plus since I have spent some time in the field I am actually not looking for advise, but only the platform to buy and sell. Platforms like ICICI Direct offer great services but only to buy regular mutual funds.

Waiting for your reply

Robin

Dear Robin,

Have you checked MF Utility platform?

Hello Sreekanth,

Thanks for your wonderful post. It has confirmed my understanding that Direct Plans for MF are better than Regular Plans and it is worth switching to direct plans if you are knowledgeable enough to select your funds.

I still have some queries and I would be happy if you can clarify them.

I have a 3 in 1 online trading account with ICICI Direct. I have invested in 5-6 SIPs in different AMCs @Rs.1K/SIP/month for the last 2 years.

Now, if I want to switch over to direct plans with AMCs directly, can I use the same Demat a/c that I had with ICICI Direct ? Or should I open a new Demat a/c ?

Also, will I be able to do all the transactions and see my portfolio online 24/7 with Portals such as MF Utility etc.?

Thanks & Regards

Prabhu

Dear Prabhu,

Having Demat account is not mandatory. However, you may use same Demat account.

As per MFU, it is possible to track all your funds.

You may read their FAQs..

Dear Srikanth,

Could you please help me sort out the following scenario.

I have recently invested in 5 Mutual funds SIP, via my distributor/broker, 1000 INR per month for each fund in the SIP, and all 5 are regular plans. I later heard about the direct plan and got to read your article. Now that I have these 5 SIPs running, is it possible to switch from these regular plans for all SIPs to direct plan/schemes ? I have done a bit of research myself, and here is what I have got:

1. I reached out to my distributor and told them I need to switch to direct plan, they said minimum investment for direct plan is 2 lakhs, and also SIPs don’t have direct plans. I am not very sure if this is correct, may be you can help.

2. I reached out to the respective AMCs of the 5 funds which I have invested for help, since I was unable to register in their Websites for statements. The response from AMCs was that the mutual funds may be held in demat mode that could be the reason. Upon further enquiry and checking cdsl statements, I realized all my SIPs are in demat form. And when I asked my distributor to convert this to physical form, they said its not possible, the only way out is to stop all the SIPs and start again. Is that true ?

Appreciate your opinion here, I hope your expertise can help me decide whether I can convert my existing 5 SIPs to direct plans, which is the goal here.

Dear Anoob,

1 – Sorry to say that your distributor is absolutely incorrect !

2 – you can switch from a regular plan to a direct plan. It is entirely up to you to decide whether you want to inform the mutual fund advisor. However, be sure to opt choose the direct option while making the switch online. If you are doing it offline, your application form should clearly state ‘direct’ after the name of the scheme and also in the place of ARN code. Though many mutual fund houses have stopped levying exit load on switching to direct plan from the regular plan of the same scheme, you should check whether your fund house also follows the same policy. You should also consider whether the switching will invite any capital gains taxes as switching is considered a redemption from the existing plan and a new purchase in the new plan. You should consider these two aspects before taking a final call.

One more option is, to discontinue existing SIPs and start investing in same funds but Direct plans through Fund house websites or through online platforms like MF Utility.

Thank you very much for your prompt response.

Just FYI, I called up these AMCs in the meantime and enquired about switching these 5 SIPs to direct plan, but they said since the MF units are allocated in demat form, I need to first rematerialize them, stop the SIPs and start in direct plan again.

The only question I have is whether it is worth it to terminate these 5 SIPs, rematerialize them and start the direct plan of these 5 SIPs separately, considering the SIP processing fees have already paid off. Appreciate if you could just provide your thoughts here. I know in the long run, there is a huge margin that i may lose but I am also thinking about convenience here.

Dear Anoob,

Instead as suggested, you may just stop future SIPs in these regular plans and just hold on to the current units.

Set up new SIPs in the same schemes but Direct plans and continue your investments.

Hi Sreekanth,

First of all, thanks a lot for creating such a nice blog for new investors like me.

I’m planning to start a Mutual Fund Investment in SIP mode for atleast 10 years duration. Now I have few questions:

1. You have mentioned about CAMS and one other online platform for direct investment. Which one is more convenient for new investors and is there any transaction fee or agent fee involved?

2. Like I mentioned I want to invest for long term: Is it a good to have 40% is mid-small cap fund & 60% in large cap/blue chip fund? Is it a good idea? If not please suggest a better one or if its good please suggest few funds in those categories.

Thanks, Sunil.

Dear sunil,

1 – MF Utility platform is industry sponsored one and no fees/charges are applicable for using this one. Other platforms may levy certain subscription charges based on the value added features they provide.

2 – For long-term, you may allocate more monies to Midcap and diversified cap funds.

Kindly read :

What are Large cap / mid cap funds?

Best Equity funds

How to pick right mutual fund scheme?

Dear Sir,

May I buy mutual funds in direct mode from CAMS office? If yes, is there any additional charge I have to pay to the CAMS? Please guide.

Thank you.

Dear Chatterjee .. Yes, you can buy Direct plans from them, no additional fee is involved.

Kindly note that you need to check ‘Direct’ option in application form.

Thank you Sir, for your reply.

Hello,

I have been investing via FundsIndia in Quantum LT Equity Fund-Direct (G). Now according to new requirements distributors cannot invest in Direct plans, hence I have been asked to switch to Regular, and they automatically started a regular plan for me from my SIP in April.

What should I do with my existing direct MF which I am investing since last 4 years?

I want to continue in direct plan, can I go to quantum MF and continue investing in the same folio as a SIP?

Or should I switch and move all my money from Direct to regular plan in FundsIndia. Will I loose money in this, as I think this will be like a new investment, and I would end up buying new NAVs for the regular plan, from my direct money? Please advise.

Dear Abhi,

Yes, you can visit Quantum amc website and can make SIP under the same Folio number.

There is no need to switch from Direct to Regular.

Hi Sree,

Thanks for wonderful post on Direct Funds over Distributors.

I already start investing with Scripbox, however I want to invest my future SIPs in direct mutual funds.

1. Can I stop the existing distributor SIP and start fresh SIP in direct fund? I can leave my money in existing SIPs for longer time as I don’t need immediately.

2. Can I stop my current SIP and exit after 5 years as these are Equity schemes?

Regards,

Vasu

Dear Vasu,

1 – Yes, you may do so.

2 – Yes, you are allowed to do so..

Read : MF Utility online platform for direct mutual fund schemes..

“I believe if you are making fresh mutual fund investments or creating new SIPs, you can surely consider investing in Direct mutual funds provided you know which funds to buy. ” – Can you elaborate? What do you mean by which funds to buy?

Dear Srejith ..The funds that meet your requirements, the ones which you believe that are suitable as per your financial goals, investment objectives & time-frame..

Hi,

I am looking at a investment of 20,000 in mutual funds. I constantly go through your articles and have certain funds in my mind picked from your article on best MF for 2017. Can you suggest me a portfolio which has a mix of ELSS (tax saving) & other funds. My risk appetite is low. . I want to go for direct plans. Will that be fine..??

Dear NJ,

You may go through below articles,

Best Equity funds.

Best ELSS funds.

My MF portfolio.

How to select right mutual fund scheme?