ELSS or Equity Linked Savings Scheme of Mutual Funds are one of the best tax saving cum long-term wealth creation investment tools. The investments made in ELSS schemes are eligible for income tax deduction under Section 80c.

For salaried employees, the deadline to submit the Investment Proofs to save income tax is fast approaching. Most of the employers collect the investment documents sometime between January and March. It is often observed that during this period many investors/employees who have not done their tax planning rush to buy unwanted life insurance policies or some other low-yielding tax saving investment products.

Do note that ELSS Tax saving mutual funds come with a lock-in period of three years; the lowest among all the tax saving options that are available under Section 80C. (PPF’s lock-in period is 15 years, Tax saving Bank Fixed Deposit’s is 5 years, National Saving Certificate’s is 5 years etc.,)

I had written an article on ‘Best Tax Saving Mutual Funds to invest in 2015’. The Top 5 best ELSS funds listed in that post (2015) were;

- Axis Long Term Equity Fund

- Franklin India Tax shield Fund

- ICICI Prudential Tax Plan

- Canara Robeco Equity Tax Saver Fund

- Religare Invesco Tax Plan

Let me present you the latest & updated list of the best ELSS tax saving mutual fund schemes that can be considered for long-term investments in 2016 and beyond.

If you have already invested in any of the above funds, you may continue with them and keep a track of your investments. If you are new to ELSS funds, you may consider the below Top performing ELSS tax saving MF Schemes.

Top 10 Best ELSS Tax saving Mutual Funds

There are around 95 ELSS funds under Tax Planning / ELSS Fund category. In the last five and ten years the average returns generated by ELSS fund category are around 10% & 12% respectively.

Let me first list down the top performing Equity Linked Saving Schemes purely based on the investment returns (past performances). I have considered both lump sum as well as SIP returns for the past 5 years to 10 year period. I have considered only those funds which are at least 6 years old.

- Axis Long Term Equity Fund

- Reliance Tax Saver Fund

- BNP Paribas Long Term Equity Fund

- Franklin India Taxshield

- Religare Invesco Tax Plan

- Birla Sunlife Tax Plan

- TATA India Tax Savings Fund

- ICICI Prudential Long Term Equity Fund – Tax Saving – Regular Plan

- IDFC Tax Advantage Fund

- Canara Robeco Tax Saver

HDFC Tax Saver Fund is missing from the list when compared to my top 10 2015 list. Kindly note that ICICI Pru Tax Plan has been renamed as ICICI Pru Long Term Equity Fund.

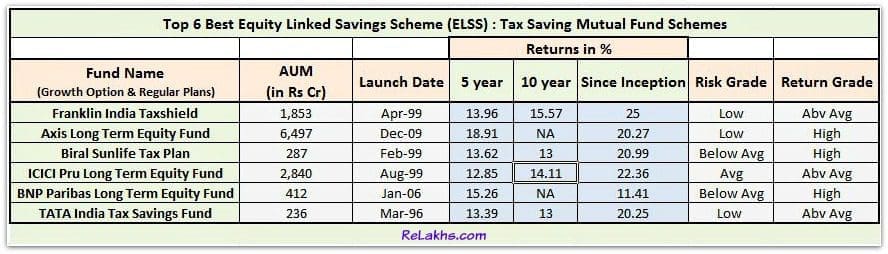

Top 6 Best ELSS Mutual Fund Schemes for SIPs or Lump Sum Investments in 2016

Below parameters have been considered to shortlist the 6 top performing ELSS mutual funds that can be considered in 2016 and beyond;

- I have considered the past returns generated by these funds for the last 5 year, 10 year period and since inception.

- Funds with a good track record for the last 5 to 10 years have been preferred. . I have considered only those funds which are at least 6 years old.

- ELSS Funds which have low risk grade have been given comparatively higher rank. Due importance have been given to Standard Deviation, Alpha, Beta, Sharpe Ratio and overall Risk grades of the funds.

- I have considered Expense ratio as one of the criteria.

- This year besides moneycontrol, valueresearchonline and Morningstar portals, I have also used few ‘mutual funds calculators’ available at freefincal portal.

- Morningstar portal’s ‘mutual fund screener’ has been used to filter funds based on fund performance & risk (risk adjusted), standard deviation, fund portfolio & expense ratio.

- The fund returns Vs fund category returns have been given due importance.

- Like last time, in this review too I have not considered the STAR ratings of funds provided by ranking agencies. Usually these star ratings reflect the short term (1 or 2 year’s) performance of the funds.

Top 6 Best ELSS Mutual Funds in India

Below are the top performing and highly rated ELSS Funds to invest in 2016.

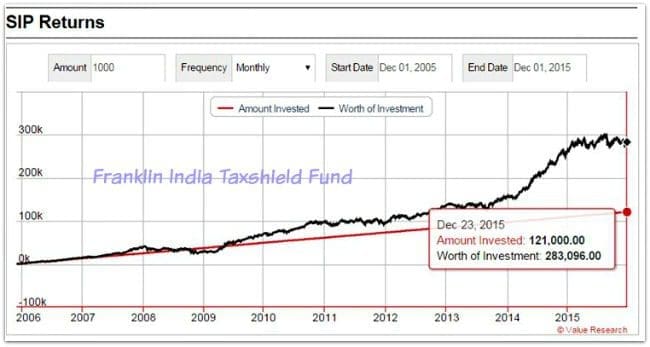

- Franklin India Taxshield

- It is one of the oldest ELSS funds with a proven track record in all market conditions (bear & bull phases).

- Since inception the fund has given returns of around 25%.

- It has LOW risk grade.

- This ELSS fund’s strategy has been to buy quality large caps or emerging large caps at a reasonable price.

- The fund’s portfolio has around 70% exposure to Large Cap companies.

- Banking & Financial Services sector has an allocation of 26% and followed by Automotive sector with an allocation of around 12%.

- Franklin Taxshield ELSS fund is best suited for conservative equity investor who would like to get decent investment returns with a low-risk profile.

- If you have invested in a Systematic Investment plan (SIP) of Rs 1,000 per month for the last 10 years, the accumulated investment value would have been Rs 2.83 Lakh.

- Axis Long Term Equity Fund

- This fund has one of the highest AUMs in the Equity MF market.

- The fund performance in the last 5 year period has been stupendous, with a returns of around 19%

- This fund too has a LOW risk grade.

- I have made investments in this ELSS fund. (You may like reading : ‘My Mutual Fund Portfolio – My MF Picks‘)

- This fund can be considered as a true MULTI-CAP fund within ELSS fund category. This fund has maintained a 55-60% allocation towards large-cap stocks and 35-40% in mid-cap stocks.

- This fund also has invested primarily in Banking sector & Automotive stocks.

- Birla Sunlife Tax Plan

- It is also one of the oldest ELSS funds.

- Since inception of this fund it has given returns of around 21%.

- Portfolio allocations show the fund to be more small-cap oriented than its peers, with a 15-22 per cent allocation to Small-Cap Stocks.

- This fund has taken a hard knock in bear markets of 2001 and 2008.

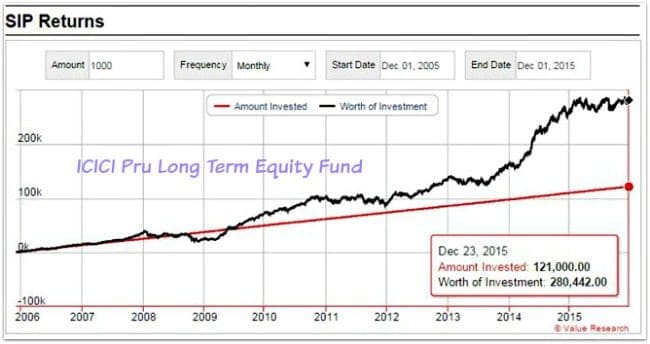

- ICICI Prudential Long Term Equity Fund

- ICICI Pru Tax plan has been renamed as ICICI Pru LTE fund.

- This fund has been consistently beating the benchmark (Nifty 500) and the ELSS fund category in 13 of the last 15 years.

- The fund’s portfolio has around 65 to 70% exposure to Large Cap companies.

- If you have invested in a Systematic Investment plan (SIP) of Rs 1,000 per month for the last 10 years, the accumulated investment value would have been Rs 2.80 Lakh.

The other funds to watch out for are BNP Paribas Long Term Equity Fund, TATA India Tax Savings Fund, Reliance Tax saver, Religare Invesco Tax Plan, DSP Blackrock Tax Saver and IDFC Tax Advantage Fund.

- Reliance Tax Saver has been performing well for the last few years. Kindly note that this fund has one of the highest Standard Deviations in ELSS fund category. It has HIGH risk grade.

- TATA Tax Saving Fund‘s standard deviation is one of the lowest of all. It has ‘low fund risk grade.’ But getting abnormal returns from this fund may not be possible.

- Canara Robeco Equity Tax Saver Fund has given returns of 16.5% during last 10 years. This is one of the highest among all the above funds. The fund has an AVG risk grade.

Important points

- Your investment in ELSS funds is LOCKED for a period of 3 years. So, Long Term Capital Gains taxes are not applicable. But, do not invest in ELSS fund(s) with a mind-set of redeeming the fund units as soon as the lock-in period gets over. Kindly note that these are risk-oriented products. You may have to stay invested for longer period to get decent risk-adjusted investment returns.

- ELSS funds can create long-term wealth for you. Suggest you not to opt for Dividend option.

- You may select one ELSS fund for tax saving cum investment purposes. It is advisable not to invest in too many funds within the same fund category. (You may like reading : “MF portfolio overlap analysis tools‘)

- You may also consider investing in Direct Plans of ELSS Mutual Fund Schemes. (Read : ‘How to invest in Direct Plans of MF schemes?‘). If you are a newbie to Mutual funds then do consult a good investment advisor or mutual fund agent.

- Do not get confused between ULIPs (Unit Linked Insurance Plans) and ELSS funds. Kindly note that ULIPs are insurance products.

Have you invested in any of the above Best ELSS mutual funds? Do you also believe that ‘Mutual Fund ELSS’ is a good tax saving instrument? Kindly share your views and comments.

Continue reading : ‘Best Equity Funds to invest in 2017‘.

( Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (References : moneycontrol, valueresearchonline, freefincal & morningstar. Charts Source : Valueresearchonline)

Hi Sreekanth,

You have suggested Franklin Taxshield/Birla Tax plan / DSP Tax saver on 13th mar. as of today stock markets are at 2 years all time high . for tax purpose i need to invest 1.5 lacs lumpson. Considering the market high ,

1. do u suggest investing in ELSS at this time ? if yes in which one

2. or i just put in PPF etc for this time and start monthly SIP from April.

I dont need this 1.5 lacs money for next 10 – 20 years so investing for long term.

Thanks

Vishal

Dear Vishal,

If your investment horizon is 10+ years, you may go ahead and invest in ELSS fund(s).

Do you contribute to EPF scheme?

i have left dollar rat race this year at young age 🙂 now doing social service and devotion in a village. so no EPF. and since this is my first year in india , just figuring out all this ELSS etc.

you are doing great service via this blog.

Thank you dear Vishal. Best wishes 🙂

Hi Sreekanth,

Please suggest me Best ELSS Mutual fund Investements for only 3 years of locking period which gives me good returns grade with low risk grade.

1. I am interested to invest 6 lakh rupees in ELSS Mutual Fund, but only for three years period of time. let me know if it is suggestable to invest in multiple ELSS Fund instead of whole amount in single ELSS Mutual Fund.

2. Please suggest me if this is right time to invest in ELSS Fund for 3 years period, as i m interested to invest in Current month May 2017.

Thanks and Regards,

Mandip Singh

Dear Mandip,

1 & 2 – If you need this money in 3 years, investing in an ELSS fund can be a risky affair.

Sir,

I want to invest total 3 lakhs in ELSS funds for two members of my family (1.5 each) as lumsump in current FY.

Please suggest me good Funds in this category suitable for me.

Dear Sunny,

Suitable for you (or) for your family members?

May I now their investment horizon?

Our horizon is wealth creation in long term for our HUF firms.we shall be investing in ELSS for HUF’S in upcoming years as well.we are not time bound.

Dear sunny,

You may consider Franklin Taxshield/Birla Tax plan / DSP Tax saver.

Dear Sree,

What’s your view on DSP Blackrock Tax Saver ?

I can see Franklin Tax shield or Birla Tax plan is suggested more than DSPBR tax saver in number of forums though DSPBR is consistent and produced more returns than these funds in 5 year and 10 year period. However I couldn’t see no negative comments on DSPBR tax but also no strong recommendations. Why is that so.. I understand that the DSP’s Standard deviation is more than Franklin. But the risk of standard deviation will be reduced when you invest longer time horizon.

Other than am I missing any critical point here ? Kindly advise.

Can you advise please.

Dear Hari,

It is very tough to understand an investors’ requirements online, so most of the times I do refer funds which are more consistent (low SD).

DSP tax saver is a decent fund.

Tats right Sree! If i need to choose between Franklin tax, dspbr tax and birla tax, which one you suggest based on long term like 10 years and to reap good returns… Kindly advise..

Dear Hari..You may consider Franklin or Birla fund.

Hello Sreekanth Reddy first of all we are very grateful to you for your prompt and valuable advises.I invested Rs 80000/- (50K + 30K) in Axis Long term Equity Fund-Growth during last two years.

*I want to invest Rs 30K in ELSS FOR FISCAL YEAR 2016-17, i just want to know in which fund i should invest?

* Whether is it right time to invest in ELSS, as all ELSS funds are soaring at high price and What would be the ideal way to invest?

Dear ASHISH,

You have just two months left for FY 16-17 to end, so no other choice but to invest in an ELSS fund now (if this is your preferred tax saving option).

You may consider to invest in Axis LTE fund itself or Franklin Tax shield fund (assuming you do not have any other MF schemes in your portfolio).

I want to invest in 1.5 lakhs in MF having 80 C benefit.

How is the reliance tax shild fund

Hi Sreekanth,

My FIL is about 60 years old. He wanted to invest 1 lakh per year for about 7 years. He is looking for tax saving (EEE), life insurance and investment with guaranteed returns. Which product will suit him better. Please advise.

Just an update.. Actually he is 61 years old.

Dear Ram,

Tax saving with EEE + guaranteed return + time-frame of 7 years – tough requirements..

Kindly read:

Tax treatment of various financial investments.

List of investment options!

Hi Srikanth garu,

I am working in PSU. I am in 20% tax bracket with annual salary close to 6.5 Lacs. By saving under 80C fully, my taxable income comes below 5 Lacs. My 80C is now close to 1 Lac (with Term Plan & EPF). I can save 20% Tax (10,000) and get 5000 rebate (total 15,000 in one go) by investing Rs.50,000. Even though I understand from your blogs that investments should not be done for Tax savings, my future is little confused with PRC (Pay revision) and personal reasons (house purchase, transfer etc.).

Now, I am confused whether to invest this Rs.50,000 in PPF or ELSS or Sukanya Samruddi. I won’t touch this money for next 7 yrs. or may be more.

If you recommend ELSS then kindly explain difference between Dividend & Growth and Direct & Regular plans. Which one is best. Also, what are the charges involved investing in ELSS / MFs.

Dear Sanjay,

PPF & SSA are very long term saving schemes.

If you are unsure about the investment horizon (long term) and expected investment horizon is around 7 years, you may go ahead with an ELSS fund with Growth option, like Franklin Taxshield.

You can invest in MF through the company website and opt for Direct plan, no fees is applicable.

You can also consider industry sponsored online platform like MF Utility (no fees is applicable).

Kindly read:

What are Direct plans?

Regular plans Vs Direct plans – Returns analysis

MF Utility online platform.

Hi Sreekanth,

Great blog… very impressed..

I am looking to invest in ELSS funds for long term to get the tax deduction under 80C. I am interested only in low risk grade direct funds. I am 40 years old. After reading your blog I decided to invest…

– monthly 10,000 rupees (5000 each) on these two funds SIP.

– planning to use MF utility

Franklin Indian taxshield DIRECT growth

Axis long term equity DIRECT growth

1. Is this a good approach or do you suggest anything better?

2. Do I need any forms from MF utility to show my investment for tax deduction? How does it work?

3. Is there any other fees in MF utility instead of buying directly from AMC?

Dear Ram,

You may go ahead with the listed choices.

You can request for MF statement, which can be used to claim tax deduction.

No fees is applicable.

Hi Sreekanth,

Thanks for your valuable time and prompt reply to every query.Hats off

I am very new to all these things. I want to invest 35000/- INR every month. Purpose is mainly to have good returns out of it. Tax saving under 80c is already achieved by other things.

So, in which and how long should i invest for good returns.

Regards,

Amit

Dear Amit,

May I have details about your Financial goals, investment objectives and time-frame??

Kindly read: Financial Planning pyramid.

Hi Sreekanth

I am 32 years old now.

Frankly speaking i have no goal in mind so far, i was paying home loan EMI upto last december. i sold out that home but have no plans to buy a home at this moment.

As i was regularly investing the money in EMI from past 6 years and i still want to continue that practice, many people suggested me about RD,ELSS /Mutual Funds etc… but i am unsure which can provide better returns on my savings.

I am OK with 5 to 6 years of tenure, with 35000 INR investment per month.

Regards,

Amit

Dear Amit,

You may invest in an Equity oriented balanced fund and one Large cap fund. Ex : HDFC Balanced fund & Birla Equity oriented fund.

Read:

Best Equity funds.

How to pick right mutual fund schemes?

Dear Sreekanth,

I am Kamesh here and I want to invest 50k yearly age @37 now. My mother age is 62 years she want to invest 50k. Please suggest us which option better suits for us i.e like ULP, NSC, FD, SIP or ELSS. Please suggest about the funds in detail.

Thanks In Advance.

Dear Kamesh,

May I know your (both) investment objectives & time-frames?

Kindly read:

Best Investment options.

Financial Planning Pyramid.

Hi Sreekanth,

We both are looking for 10 to 15 years long term. like ICICI Wealth builder etc..

Regards,

Kamesh

Dear Kamesh,

Its an ULIP.

You may be better off investing in Equity oriented mutual funds.

Kindly read:

Best Equity funds.

How to pick right mutual fund schemes?

Hi Sreekanth,

Could you please advice us which funds will be suitable for me and my mother or children. We will invest in those things.

Regards,

Kamesh

Dear Kamesh,

You may pick one each from Large cap, Mutli-cap, mid-cap and balanced fund from the Best equity funds list.

Ex : Birla frontline equity, Franklin Prima plus, Mirae Asset Emerging bluechip and HDFC Balanced fund.