I am sure most of us might have heard about one of the popular savings tool called Recurring Deposit (RD). Infact most of us might have started the investment plan with an investment in RD or Fixed Deposit (FD). These are excellent investment/saving tools to accumulate a corpus for short term goals like creating an emergency fund, creating a corpus to meet Kid’s yearly education fees, saving for big time purchases like LED TV etc., They are safe and provide guaranteed returns.

Financial products like RDs and FDs are very simple to understand and invest. Now, almost every bank provides you the option to invest in these deposits through online mode. Many banks do provide lot of innovative and flexible Recurring Deposits now (For example – ICICI Bank’s iWish Flexible RD). But, when it comes to Recurring Deposit Taxes and Fixed deposit taxes – how they work with respect to tax implications is still a big question mark (confusing point) for many of us.

In this post let us understand – Whether the interest earned on Fixed Deposits and Recurring deposits is tax free? Is recurring deposit interest is taxable or not? How are RD maturity and FD maturity amounts treated in terms of taxation? Should I pay taxes every year on RD/FD or should I pay the income tax on the maturity date of my RD/FD? How is TDS (Tax Deducted at Source) applicable on Recurring deposit (RD) and FD? Budget 2015 – Is TDS now applicable on Recurring Deposits (RDs)? How to calculate interest amount on RD and FD? Do they have any income tax benefits or exemptions?

From your Income Tax Returns point of view, it is very important to understand the below points. I have seen many investors ignoring (or may be not aware of) the Fixed deposit taxes and Recurring Deposit taxes in their Income Tax Returns (ITR). I am sure you might have heard or seen your friend(s) receiving ‘compliance notices’ from Income Tax department for not showing these Time Deposits (FDs & RDs) in ITRs.

Tax implications on Fixed Deposits

- There are no income tax benefits or deductions applicable for Fixed Deposits. The interest income earned on Fixed deposits is taxable. (5 year Tax saving Bank Deposit have tax exemption under Section 80c, but the interest income earned is taxable on these deposits too.)

- Banks do not deduct TDS if the Interest income earned on Fixed Deposits is less than

Rs 10,000Rs 40,000 per year (from AY 2020-21). That does not mean this is a tax-free income in your hands. You still need to add this as ‘income from other source’ when you file your Income Tax Returns. (If the interest exceeds Rs 40,000 in a financial year, the bank will deduct 10 per cent tax before crediting the interest to the account.) - Interest income on your Savings Bank Account up to Rs 10,000 is tax free as per Income Tax Act 1961. Do not get confused this with the above point. Interest on your Savings a/c balance is different from the FD interest.

- Individuals who do not have taxable income and do not have any other source of income can submit Form 15 G (or) Form 15 H (above 60 years old person-senior citizens) to their banks to avoid TDS. NRIs cannot submit these forms. If your interest income itself is above the income tax exemption limit (for a given Financial Year)then you are not eligible to submit these forms. Remember that you need to submit Form 15 G or Form 15H every year. Banks may ask you to mention the details about your other Bank(s) FDs too.

- If your interest income on a Fixed Deposit is more than Rs 40,000 then you need to show the entire interest income when you are filling your Tax returns. If banks have deducted TDS on this income, you can capture this information in the “TDS Sheet” of your Income Tax Returns form.( Banks deduct TDS on FDs at 10 per cent only if the interest exceeds Rs 40,000 in a financial year. But your actual income tax slab may be say 30%. So, you need to pay the income taxes according to your slab.)

- An important aspect which one needs to keep in mind is that you have to furnish your PAN (Permanent Account Number) number to the bank. If you fail to furnish the PAN number, the bank shall deduct tax at the rate of 20% instead of 10% generally applicable.

Recurring Deposit Taxes – How do they work?

As per the provisions of Income Tax Act, there are certain investments/deposits on which no tax is required to be deducted without any limit of the amount of such interest. Tax is not deducted on any interest paid on any savings account or deposit in any of your recurring deposit account, be it with any bank, or Co-operative credit society or Cooperative bank.Banks Deduct TDS on your Fixed Deposits but not on Recurring Deposits. “No TDS on RD is charged,” this does not mean, it is a tax free income. It’s a misconception.- The interest income earned on your RD is not exempted from income tax. It is taxable.

- You need to add the interest income as ‘income from other source’ when you file your IT returns.

Latest News : The budget 2015-2016 has put RDs at par with FDs for TDS purpose. Banks will deduct Tax Deducted at Source (TDS) on Recurring Deposits too, from 1st June, 2015. Remember, TDS doesn’t end your Tax Liability. Interest on RDs & FDs is fully taxable as income at the rate applicable to you. So even if TDS has been cut, you might have to pay more tax.

Budget 2018- 19 & New Section 80TTB

For Senior Citizens, the Interest income earned on Fixed Deposits & Recurring Deposits (Banks / Post office schemes) will be exempt till Rs 50,000 (FY 2017-18 limit is up to Rs 10,000). This deduction can be claimed under new Section 80TTB. However, no deductions under existing 80TTA can be claimed if 80TTB tax benefit has been claimed (the limit for FY 2017-18 & FY 2018-19 u/s 80TTA is Rs 10,000).

Section 80TTA of Income Tax Act offers deductions on interest income earned from savings bank deposit of up to Rs 10,000. From FY 2018-19, this benefit will not be available for late Income Tax filers.

Budget 2018-19 has also proposed to raise the threshold for deduction of tax at source (TDS) on interest income of Bank / Post office / Co-operative Bank deposits for senior citizens from Rs 10,000 to Rs 50,000 (u/s 194A). This is applicable for FY 2018-19 / AY 2019-20. (Related Article : ‘List of Income Tax Exemptions for FY 2018-19‘)

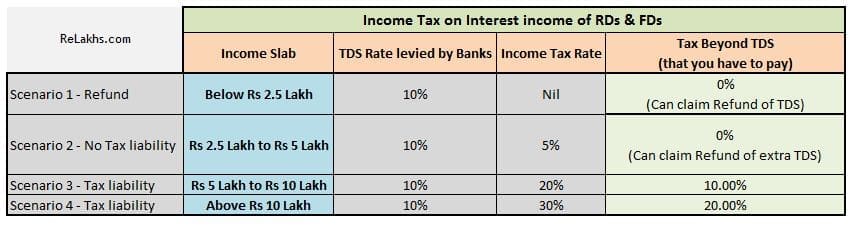

How much Income Tax do I need to pay on FD’s & RD’s interest income?

- If your taxable income is below Rs 2.5 Lakh and banks deduct TDS (you can submit Form 15 G/H to avoid TDS), you can claim back TDS as refund in your Income Tax Returns (ITR)

- If your income is between Rs 2.5 Lakh to Rs 5 Lakh, you need not pay any extra income tax. Because, the income tax rate of 10% matches with Bank’s TDS rate which is also at 10%.

- If your income is in the range of Rs 5 Lakh to Rs 10 Lakh, you need to pay 10.30% beyond the TDS rate.

- If your income is over Rs 10 Lakh, the differential tax rate is 20.60%.

When to pay income tax on my Recurring Deposit (RD) or Fixed Deposit (FD)?

Now that we are clear about Recurring deposits taxes and Fixed deposits taxes, we also need to understand when to show the interest income for paying the applicable income taxes?. Do we need to pay taxes on this income every year or when the deposit matures?

The answer is, the taxes on Bank FD (over and above the TDS amount) and full tax amount on RD can be paid either in every financial year (or) on maturity. We can choose when to pay the taxes on FD and RD on maturity, instead of each Financial Year. But, once opted (when to pay the taxes) we need to stick to the same method. (Actually in accounting terms these are known as ‘Mercantile’ or ‘Cash’ accounting methods).

Is Fixed Deposit/RD Interest Of Minors Taxable?

Sometimes, you may open FD or RD deposit account in the name of your minor kid. If you have opened a FD in your minor child’s name, you need to pay tax on the entire interest income. The income is clubbed with your income.

Another interesting point is, what happens if your child becomes a MAJOR before the FD/RD matures?

In this case, if you have been paying taxes on FD/RD every year, the RD/FD’s interest income is taxable in the your hands as long as your kid is a minor. As soon as he/she becomes a major, it is treated as his/her income. Your child is liable to pay the taxes.

If you chose to pay taxes on FD/RD maturity date, the tax liability vests on you (if your kid is still a minor), else your kid (who is a major) is liable to pay the applicable taxes (if any).

Though it is headache to pay the taxes every year, it is better to show the interest income every year in your ITR. Else, you may receive compliance notice about time deposits for FD/RD amounts (if these are not included in your ITR). (Do not get scared when you receive these kind of IT notices. You can reply to Income Tax department about the method you have chosen. But do reply to these notices.)

How to calculate the interest income on RDs ?

Banks issue/send ‘interest certificate’ or ‘TDS certificate’ on your FDs & RDs every year. So, regarding FDs you are very clear about TDS and there is no confusion regarding the FD interest calculation part also. (Most of the banks have made these certificates available online. You can visit your bank’s website and download them).

Since Banks do not deduct TDS on Recurring Deposits, they do not issue TDS certificates for RD investments. So, the calculation of the total interest income earned on your RD(s) in a given Financial year can be quite cumbersome. (Also, most of the bank offer RDs on a quarterly compounding basis).

I suggest you to visit the below links to calculate the RD interest income.

- RD calculator (Corporation Bank website) (This RD interest calculator considers investment in BEGIN mode. Lets say you book RD on a monthly basis, then it is assumed that the investments are made in the beginning of every month.) (You need to deduct the total invested RD amount from total maturity amount, to get the interest amount for a specific period.)

- Freefincal.com

When do you pay FD/Recurring deposit taxes? Do you show the FD/RD interest in your Income Tax Returns (ITR) every Financial year? Do share your views and comments. Cheers!

Continue reading :

- Latest TDS Rates FY 2019-20 | TDS Rate Table for AY 2020-21

- How to fill new Form 15G / Form 15H?

- When to submit Form 15G / Form 15H? | Details & Clarifications

- FY 2018-19 Section 80TTB | Tax Exemption of Rs 50,000 on Interest Income to Senior Citizens

(Image courtesy of hin255 at FreeDigitalPhotos.net)

Join our channels

Hello Sir

It would be very much helpful if you could give me an advice on my issue detailed below:

I had an RD at SBI (earlier SBT) in the name of my daughter. The RD Scheme was presented in 2014 as “TWINKLE” with highlighted benefits that “No tax on Maturity and on completion of tenure Full Maturity Value will be Returned”. My daughter was 12 yrs old in 2014 and I joined the scheme with my daughter as first name and myself second name. The monthly deposit was Rs. 10,000/- for a period of 6 years. But in June 2020 the maturity amount received was lesser by an amount of Rs. 32,000/-. The bank says that tax has been deducted as per the new income tax provisions. My doubts (not yet clarified by the bank) are these;

1. Is my tax liability is for the interest amount I received from June 2015 only?

2. The maturity amount was deposited by the bank in June 2020 to my bank account (till that time my daughter had no bank account or PAN card). But the amount is not reflected so far in my 26AS. Does it mean that the tax has not been paid in my name?

3. My daughter turned 18 only after maturity of the RD (in July 2020 ie; after just 1 month of maturity and she got a PAN Card only after that). Is there any chance of showing the interest amount as income in her name?

4. As a solution for this, the bank (manager) asked to take a PAN card for my daughter and produce it so that they will try to get the amount refunded through revision of income tax statement filed by them. Is this possible?

5. As stated earlier the RD scheme named as “TWINKLE” offered that no tax will be deducted. Was it not the responsibility of the bank to inform me (and naturally all such customers) that it has been made taxable and maturity amount will be less than what is claimed in the brochure? Also, I was not given with the option of deciding whether tax to be paid yearly or on maturity. Can I approach Banking Ombudsman seeking a solution for this, based on the above two arguments?

Dear Ashok ji,

1 – Yes can be.

2 – Kindly check with your banker about the non-reflection of TDS in your Form 26AS. Did they issue you Form 16A?

3 – No, as it is matured before she attained 18 years, hence the income gets clubbed in your name. (But, note that banks generally show TDS in the name of Primary account holder. So, kindly check with them if TDS has been deducted in your name or not??)

4 – Yes, they (Bank) can rectify the TDS entries. If TDS is shown in your daughter’s name, she can file ITR and claim refund.

5 – Kindly note that interest income on FD/RD is taxable.

Related article : 15 Q&As on Fixed Deposit Interest Income Taxation Rules (FY 2020-21)

Thank u so much for spending time for me. The comment is much helpful for me to get an insight into my own problem. Thank u..

I am a retired individual of 61 years old & my income is from INTEREST on FDs & NCDs.

My question is on method of reporting of Interest on some Fixed Income Instruments which I have recently invested in.

In the past had requested INTEREST Certificate from my bank for reporting CUMULATIVE 5 year tenure FDs interest income in my ITR.

However, recently in Jan’19, in the current FY I have invested in the following instruments where interest will be paid/received periodically:

1) Rs 3L in 3 Companies NCDs where I have opted for the ANNUAL INTEREST payment option. Interest will be received in NEXT FY.

2) Rs9L in LIC’s PMVVY scheme for Senior Citizens @8.30%, have opted for the ANNUAL INTEREST payment option. Interest will be received in NEXT FY

3) Rs 15L in SCSS (Senior Citizen’s Scheme) where QUARTERLY INTEREST option is default & 1st Qtrly Interest will be usually credited on 1st April 2019, after the FY end.

4) Rs 5L in Bank FD where QUARTERLY Interest option was chosen & 1st Qtrly Interest will be credited only in next FY.

I had planned to report these incomes in next FY only after receiving actial credit. Please advise on how to report in case you do not agree.

(Both LIC as well as Companies whose NCDs I hold will not provide ACCRUED INTEREST Certificates for tax reporting purposes.)

Dear SK ji,

You can declare the income in next FY/AY. But, suggest you to also check your Form 26AS for this Financial year 2018-19, in case there has been any TDS deducted, you may have to file your ITR accordingly for AY 2019-20.

Related articles :

* When to submit Form 15G / Form 15H? | Details & Clarifications

* Lump sum Investment options for Retirees/Senior Citizens | Where to invest my Retiral benefits to get Regular Income?

* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

* Income Tax Deductions List FY 2019-20 | List of important Income Tax Exemptions for AY 2020-21

Does Fixed deposits attract capital gain tax sir ??

Dear Yank,

The interest income earned on FDs/RDs is not classified as Capital Gains.

It has to be declared under the income head ‘Income from other sources’ when filing Income Tax Return.

Such interest income is taxed at individual’s tax slab rate.

investments in post offices are in problem because kissan bikass patra term deposit etc are produced by a pssbook where post offices do not show yearly div and int then how a tax payer will show it to i tax return in every year

Dear swapan ..One can manually calculate the taxes on yearly basis and disclose them in ITR.

Or can show the accumulated income on maturity date for the concerned Financial Year/Assessment Year.

Hi Shrikant.

Thanks for the valuable info. My doubt is if the RD Ac was in name of my husband and he is getting matured amount in cash, can I deposit cash in my Ac and pay tax over interest income in my tie?

Dear Srajput,

As the interest amount gets accumulated in his name, it is taxable in his hands only.

Hi Srikanth,

I own two house,for which i am paying House loan.please suggest how better i can benifit for TDS.please give me clarity on this.

please do needful

Thanks

Niranjan Reddy

Dear Katha,

Kindly go through below articles :

* Understanding Tax Implications of Income from House / Property

* Misconceptions on TDS (Tax Deducted at Source)

* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

Hi Sreekanth,

Thank you so much for such a clear guidance. I just want to get a confirmation regarding one Recuring Deposit I had with Post office (5 year RD scheme) which matured in Dec’17. I did not get any yearly interest statement from Post Office and there was no mention about any TDS deduction upon maturity. I got a cheque from post office for the final amount.

As per my understanding I should compute the interest as

Interest = Maturity Amount – Total Amount Deposited

I should then show this interest under the head “Income from Other Sources” and then accordingly pay tax on the same.

Can you kindly suggest if this is correct or any other way of computation? Also is there anyway to minimize the income tax on this?

Once again appreciate all the good guidance you have been providing through your blogs.

Thanks and Regards,

Ajinkya Joshi

Dear Ajinkya,

Your understanding is correct.

There is no provision to reduce the tax outgo in this case.

Thank you for your appreciation!

hai sir last yeasr i opened R D A/C in Thaigaraja cooperative bank in bagalore 15months i need to pay 2500 some month i am paying later along with 50rs fine that is ok but they are taking 9rs for GST,So for this need to know i need to pay gst for this kindly reply me

Dear Kavya,

Kindly note that GST rate on bank service charges is 18% .

yes sir that i nw what i am asking means for RD A/C also we should pay GST or what

Dear kavya ..Yes, GST rate is applicable on service charges on all types of bank accounts..

Hi Sreekanth.

My CTC is in between 8 to 9 Lakhs.

I have home loan upto April and closed the same recently.

I am having Insurance for 10K per annum and kids school fees.

I need to come out from TDS please let us know the savings plan in postal to save my TDS

Dear Mr Khan,

Tax saving should not be the sole criteria to pick investment products. Suggest you to create an investment plan based on your financial goals and may select the financial products that are tax efficient as well.

Kindly go through below articles :

* Investment Planning – How to create a solid investment plan?* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20* List of Best Investment Options in India

I want to invest on rd in post office for 5 years and want to pay tax on intrest that is earned annually. But post office official says they can only tell the maturity amount and can not give detail of intrest earned every year. How would i be able to calculate annual intrest earned. can i divide the total intrest earned in five years by five and pay tax every year.

Dear Prince .. You can choose to pay tax on maturity year itself.

Or You can calculate year wise and disclose the income in ITR every FY.

Hi Sreekanth,

I’m a foreign national on a long term student visa and do not have any income here.

1. How much maximum interest I can earn per year from FDs or RDs without having to pay any taxes?

2. How much maximum interest I can earn per year from regular savings account without having to pay any taxes?

3. Would these 2 amounts be considered separately or would they be added?

Dear Marek,

1 & 2 – Up to Rs 2.5 Lakh, but banks can deduct TDS and you can file income tax return and claim the REFUND of TDS (if any).

Both would be added under the head ‘income from other sources’.

Kindly note that interest income on Saving account up to Rs 10,000 is tax-free.

If interest earned is more than 10,000 then balance amount will be taxable as before i.e considered as Income from Sources and taxed as per your slab rate.

Read : Latest income tax rates FY 2017-18.

Thanks Sreekanth,

Something is still not clear for me in your answer.

You say: “1 & 2 – Up to Rs 2.5 Lakh”, which means that for Savings account (that’s point 2) the tax-free interest income would be 2.5 Lakh and at the same time you say : “interest income on Saving account up to Rs 10,000 is tax-free”

Can you please clarify.

Dear Marek,

The basic exemption limit is Rs 2.5 Lakh, so any income which is below this limit is tax-exempt.

In case if the interest income on FDs/RDs/Saving account is above Rs 2.5 Lakh it’s taxable income.

Thanks again!

I must say you have an excellent website covering so much useful information.

I have another question which I’m not sure where to post, so I’ll ask it here if you don’t mind.

Do the foreign nationals on a long term student visa and long term residence permit have to file the tax report to ITD over their assets (bank accounts, investments, properties etc.) that they own in their home countries?

Dear Marek,

If you have taxable income in India, when filing your taxes you need to report / declare your Foreign Assets & liabilities in Income Tax Return form.

Dear Sreekanth,

Thanks very much for all your great answers. I am similar to Marek, above, same kind of visa and living in India long term–no work, only a small interest income. In 2009 I had one year when I had taxable income in India from an FD. But I then moved that money back to my home country and since then I have had only a few hundred rupees interest annually on my Savings account. This year I received a compliance message from the Tax Dept asking if I had any taxes to pay, and asking that I file a tax return.

However, when I go to my online account of the Indian Tax website, there is no mention under issues pending for me to answer any question about why I have not paid any taxes. So I cannot reply to their query about not paying any taxes there.

I am hoping not to have to file a Tax return as I have no future plans to have any taxable income in India for the rest of my life and would prefer not to have to start filing a tax return every year going forward.

Thanks very much for your insight!

James

Dear James,

You can a raise a ticket @ e-Nivaran portal quoting your notice details, you may ask the IT dept to provide more details on the compliance notice and the possible resolution.

Hi Sreekanth,

I am looking for a short term investment plans to settle my Bank Loan (5L)

I don’t have any investments and savings till today, but now I would like to open RD or FD to repay my Loan ASAP. So that I can start saving money for my future.

Also, I started to earn more from last month. Now I am planning to settle down all my debts and to save my tax

Please advise.

Dear Rahul..You have plans to book RDs/FDs, kindly go ahead and clear your high interest rate loan(s) ASAP.

Kindly read : Best investment options.

Hi

I am planing to sell my flat owned by me and my husband.

I request your guidance on the following :

1. How to get the payment ? Would it be exactly 50% each ?

2. If I wish to receive 100%, then any clause in the sale deed could be included where my husband’s consent could suitably worded ?

3. I need some assistance on arriving at capital gain and the corresponding tax that we need to pay. Would you be able to give this support ? If so, please let me your contact details.

Thanks

Choodamani

Dear Choodamani,

1 – Depends on the ownership share in the property..(by default 50:50 can be considered).

2 – IF so, he may have to execute Gift Deed or Relinquishment deed, to give up his share in the property.

Read: 5 ways of transferring a Real Estate Property!

3 – You may kindly consult a CA.

Thanks for your immediate response.

I am in Chennai. Would it be possible to refer some CA ?

Thanks again.

Choodamani