TDS or tax deducted at source is a process of collecting Income Tax at source by the GOI (Government of India). It is a deduction of tax from the original source of income. It is essentially an indirect method of collecting tax which combines the concepts of “pay as you earn” and “collect as it is being earned.”

TDS is calculated and levied on the basis of a threshold limit, which is the maximum level of income after which TDS will be deducted from your future income/payments.

TDS is deducted as per the Indian Income Tax Act, 1961. TDS is controlled by the Central Board for Direct Taxes and it is a part of the Indian Revenue Service Department.

Let us understand about TDS with an example;

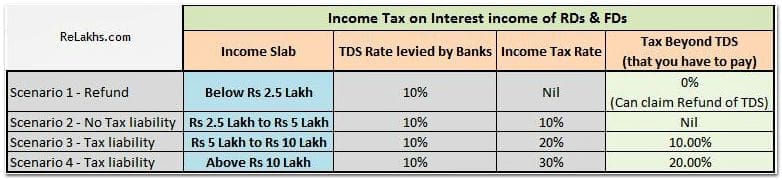

You book a Bank Fixed Deposit for Rs 5 Lakh for 1 year @ 10% pa interest rate. You will earn an interest income of Rs 50,000 after one year. Bank will deduct TDS at the rate of 10% i.e., Rs 5,000 (10% of Rs 50,000) and deposits this Rs 5,000 with Income Tax Department (on behalf of you). Bank issues you a TDS certificate (Form 16A) which reflects this deduction. (Read : Understanding your Form 16A)

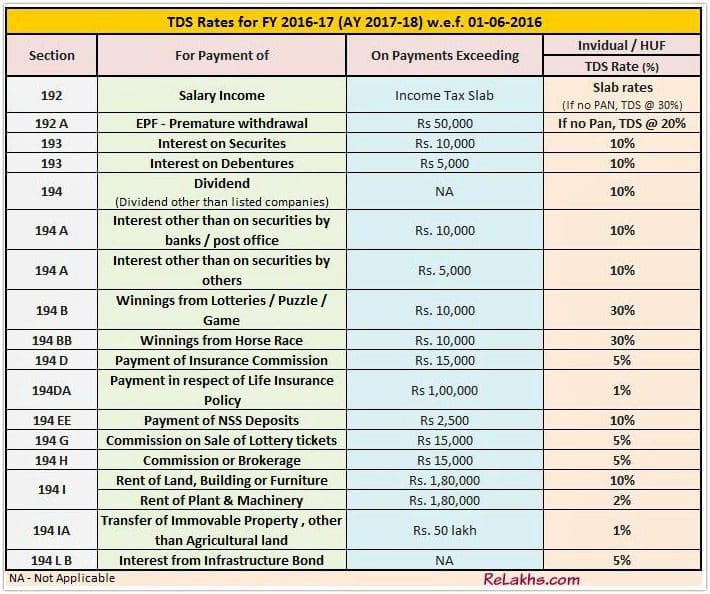

Besides interest income earned on bank deposits, TDS is levied on various incomes & expenditures. Salary income, lotteries, interest income from post office, insurance commission, rent payment, early EPF withdrawals, sale of immovable property etc. fall under the ambit of TDS.

Tax Deducted at Source : Types & TDS rates for FY 2016-17 (AY 2017-18)

Based on the Budget 2016-17 proposals, following are the revised TDS threshold limits & rate of TDS applicable for the Financial Year 2016-17 (Assessment Year 2017-18).

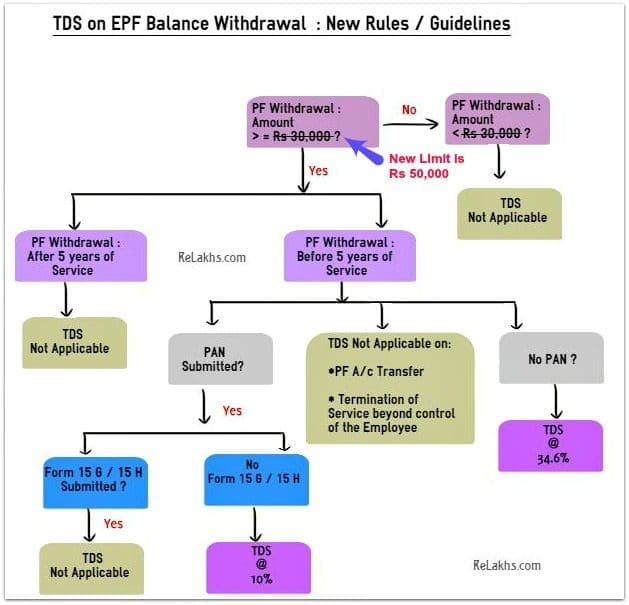

- EPF (Employees Provident Fund) – TDS is levied on the premature withdrawal of PF. It has been proposed to increase the threshold limit from the existing Rs. 30,000/- to Rs. 50,000/- for the purpose of deducting of TDS. This will be effecgtive from 1st June 2016. (Read : EPF withdrawals & new TDS rules)

- Winnings from Horse Race – The threshold limit has been increased from Rs 5,000 to Rs 10,000.

- Payment of Insurance Commission – The limit has been decreased from Rs 20,000 to Rs 15,000.

- Commission or brokerage – New threshold limit is Rs 15,000 and the existing limit is Rs 5,000 only.

- Payments to contractors – The TDS threshold limit has been proposed to increase from Rs 75,000 to Rs 1 Lakh.

- Payment of NSS Deposits (National Saving Schemes) – TDS rate has been decreased from the existing 20% to 10%.

- Commission on sale of lottery tickets – TDS rate has been decreased from the existing 10% to 5%.

- Commission or brokerage – TDS rate has been decreased from the existing 10% to 5%.

- Payment in respect of Life Insurance Policy – TDS rate has been decreased from the existing 2% to 1%. (TDS at the rate of 2% of maturity proceeds will be deducted in case life insurance policies where the sum assured is less than 5 times of the premium paid for policies issued on or before 31st March 2012 or where the sum assured is less than 10 times of the premium paid for policies issued on or after 1st April 2012.)

Misconceptions on Tax Deducted at Source (TDS)

One of the biggest misconceptions that exist in the mind of many honest taxpayers is that since they receive their salary/ other payment after deduction of Tax at Source (TDS) and thus they are not required to file their Income Tax return (ITR), assuming that their tax liability has been discharged. Following are some of the common misconceptions on TDS;

- No TDS means no Tax liability

There is a common misconception / myth that if there is no TDS then the schemes or investments are tax-free.

For example – If an employee withdraws his EPF money before 5 years of service and if the withdrawal amount is less than Rs 50,000 then TDS is not applicable.

But, this does not mean that the withdrawal is Tax-free. It is just that there is no need for an employer (Deductor) to deduct TDS on these types of withdrawals. However, the onus of paying taxes (if any) on this EPF amount lies with the employee.

So, whether it is EPF withdrawals within 5 years or National Savings Certificates (5 year tenure) or any other investments, the interest income is taxed until and unless it is specifically mentioned that the income from that scheme is tax free. For example PPF enjoys tax benefit for which its interest is non-taxable. (Read : Tax treatment of various financial investments)

- TDS deduction removes tax liability completely

- It’s a misconception that, if the employer has deducted TDS, you need not worry about filing your income-tax return. Your employer deducts TDS on your salary income only, whereas you may have income from other sources (like interest income from Bank Deposits, rental income etc.,) and you have to include those in your Tax Returns.

- Another misconceptions is – ‘No additional Income-Tax is payable, if taxes are already deducted (TDS) on income’. Actually, depending on nature of income, TDS rates vary. On salaries, employers adjust the rate such that the entire tax liability of the employee is deducted by the year-end. On fixed deposit interest, banks charge TDS at 10 per cent. But if the deposit holder does not provide his permanent account number, banks deduct tax at 20 per cent.

If your income tax slab rate is different to that of the TDS rate then you may have to pay the ‘balance tax’ or in some cases you can claim ‘refund’ too. It is advisable to be aware of TDS rates on various incomes that you have.

The TDS rate can be say 10% , whereas your are in the 20% tax slab, in this case you have to pay the differential tax (this can be Advance Tax or Self-Assessment Tax). If you are not a tax assessee then you can claim the TDS amount as refund by filing your Tax Returns. If you are in 10% tax bracket and the TDS rate is also 10% then there is no need to pay any additional tax.

Most of the Senior Citizens submit Form 15H to avoid TDS. In many cases, senior citizens feel if they have done this, they are not liable to pay tax. But if you have two or three fixed deposits in separate banks and you submit a Form 15G or 15H in all the banks, you will have to pay tax if the total interest from all the fixed deposits exceeds the taxable income limit.

Like most of us, the Government doesn’t like to wait for its money. It wants us to pay tax dues or at least a portion of it as and when we get our incomes. So, make sure you meet the compliance requirements which are related to TDS.

If you are eligible to submit Form 15G/15H, make sure you do it at the beginning of the financial year itself. Kindly note that false declarations for TDS avoidance can result in penalties and interest charges. So, avoid doing it!

Continue Reading :

my salary 25000 per month

so how much deducted tds

Dear Sreekanth,

I want to make a withdrawal from my PF account with less than 5 years of service. I do have a PAN number. So the tax deducted should be 10 % ? I will appreciate your confirmation ?

Also, I would like to seek your professional help in PF and tax matters. Can you please send your contact information on my email if possible. Thanks.

Dear Vishal,

If Form 15G is applicable, and is submitted along with withdrawal form, TDS is not deducted.

However kindly note that no TDS does not mean no tax liability. EPF balance if withdrawn before 5 years is a taxable income.

I have recently stopped offering one to one Financial planning services. You may kindly reach me through Contact page.

Dear Sreekanth,

Thanks very much for your reply ! I had a quick follow-up question and will appreciate your advice.

I had moved out of India a few years ago and DO NOT HAVE AN AADHAR CARD but DO HAVE A PAN CARD. The company documents state that Aadhar card is a document they need but they are not clearly stating if I can use the PAN card instead of the Aadhar card.

Can you please advise if one can submit some other document instead of the Aadhar card ? As I am out of the country, getting an Aadhar card may not be possible for me or too long of a process.

Thanks in advance.

Vishal.

Dear Vishal,

Aadhaar is not mandatory to withdraw EPF balance.

Yes, you need to enclose a copy of your PAN card through your employer.

Read : New Composite EPF claim (Non-Aadhaar form).

Dear Sreekanth,

THANK YOU once again ! Your knowledge and consideration is greatly appreciated.

Best,

Vishal.

Hi Mr Sreekanth Reddy

I have no job, age 52.

for example, I have FD Rs 35Laks 2017-2018/ 1 yr/ ROI 7.50% (submitted F15G to bank& pan card)

So Interest income Rs 2,62,500 (from FD)

1) Will bank will deduct 10% TDS Rs 26250?

2) How I can STOP BANK to deduct above TDS? like Form15G any other Form is there?

thanks

Balaji Subbu

Dear Balaji,

1 – If your interest income is above basic exemption limit, form 15 g can not be submitted.

If you have submitted it, bank may not deduct TDS. But kindly note that no TDS does not mean no tax liability. You need to file your ITR.

Hi Mr Sreekanth Reddy

Pls take my REAL case & advise me

1) Will bank will deduct 10% TDS Rs 26250?

2) How I can STOP BANK to deduct above TDS? like Form15G any other Form is there?

thanks

Balaji Subbu

Dear Balaji,

Kindly read :

TDS – on FDs/RDs

Form 15G/H.

1. As per govt. order TDS on Post Office RD commission is reduced from 10% to 5% and

No TDS will be deducted if TDS amount on Post Office RD commission is less than 15,000/- during the financial year.

2. It means TDS will be deducted after few months when TDS amount goes above 15,000/- i.e.

Months RD commission Accumulated RD commission TDS Due 5% Accumulated TDS Actualy TDS deduceted

April 30,000 30,000 1,500 1,500 00

May 30,000 60,000 1,500 3,000 00

June 30,000 90,000 1,500 4,500 00

July 30,000 1,20,000 1,500 6,000 00

Aug 30,000 1,50,000 1,500 7,500 00

Sep 30,000 1,80,000 1,500 9,000 00

Oct 30,000 2,10,000 1,500 10,500 00

Nov 30,000 2,40,000 1,500 12,000 00

Dec 30,000 2,70,000 1,500 13,500 00

Jan 30,000 3,00,000 1,500 15,000 00

Feb 30,000 3,30,000 1,500 18,500 18,500

Mar 30,000 3,60,000 1,500 1,500

sir, i have completed my five year of service in an organisation. now i have to withdraw my provident fund which might be one lakh and twenty thousand( appx calculation), now suggest is there is any tds liablity if so then the case what should i have to do.

Dear avdesh ..Are you still employed? In case, you have resigned and remaining unemployed for more than 60 days, you can submit New EPF composite Withdrawal form.

If you have contributed to EPF for more than 5 years , the withdrawal amount is not subject to Income Tax.

Read : EPF withdrawals & new TDS rules.

what is the rate of Tds on advertisement

Hi. Can you let me know TDS for Brokerage and Service tax for Brokerage… Thank you

Dear Vasu,

For FY 2016-17, TDS on brokerage is @ 5%, and the threshold limit is Rs 15,000.

HI MY SALARY IS 25000.BREAK UP = G BASIC=17000+HRA=5000+CONVENYANCE=3000

TDS WILL DEDUCT? IF YES THEN HOW?

As per tax rate, income up to Rs. 300,000 exempted from tax . if your income exceed from Rs.300,000 than you will be entitle for tax.

Hai.. I am a Govt. Employee. My mother is suffering from cancer. Due to which I have incurred expenditure an an aomunt of Rs.3,00,000/- for secure treatment to my mother ill-health in referral hospital and the same has reimbursed by the Deptt.,. Further, it is to inform that I have not been drwan or paid any Medical allowance .

Hence, I request to kindly ratify whether the above medical reimbursement amount is to be taken as perquisite for the purpose of income .

Hi,

In My 26as , TDS is mentioned as -6000, what’s does that means?

Thanks,

Amrutha

Dear Amrutha,

When the errors of TDS Returns or in the challan details uploaded by the bank are rectified, the original credit entries are reversed by way of a debit entry (indicating a negative sign) in Form 26AS.

Sir, TDS on Insurance Agency commission (194D) is 5% now. Whether it is for the commission received/receivable on or after 01/06 2016 for the financial year 2016-2017 only. Because the new TDS rate is said w.e.f.01/06/2016. Or it may be the the commission received/receivable from 01/04/2016 to 31/03/2017. If so if any additional amount of TDS which already deducted in 10% slab from 01/04/2016 to 31/05/2016 may be adjusted towards the payment made from 01/06/2016 to 31/03/2017. PLEASE CLARIFY

Towards servicing of machine and invoicing with Service Tax, what will be the rate of TDS to be deducted. please clarify whether it is coming under 94C or 94J and rate of TDS, please

Dear Kumar..Kindly consult a CA.

we need clarification regarding tds rate applicability on Firm u/s 194C.

Please advise it is 1% or 2%

Dear Anil,

If the payments are made to ‘Individual / HUF / Sub-contrator ‘ then TDS rate is 1%.

If the payments are made to other than individual then TDS rate is 2% on the Contract Value.

Dear Sreekanth ji

if labour is paid during financial year to more than 50 individuals amounting to Rs.8000/- to Rs.10000/- each, what shall be the rate of TDS and what is the threshold limit for labour work. Labour was paid to these indviduals for making gold and silver jewellery.

Dear ANUJ ..Suggest you to consult a CA.

My rental income 6 Lakha per annual , what will be the TDS rate.

Dear Badsha ..It’s @ 10%.

TDS are applicable on Purchase of Packing Material & Cataloging Expenses?

if applicable, under which Section & How Many Percentage(%)?

Purchase of Packing Material is not attract of TDS but cataloging expenses ( where labour charges is involve ) is 1% in case of proprietorship concern and other 2% excluding ST & Cess.

Dear Sir,

I am purchasing a flat from an NRI. I am getting different TDS rates ranging from 13%-20.66%. What is the correct TDS that i should deduct from the agreement value and when?

Dear Sameer..I believe that tds rate is 20.6% (if sale price is less than Rs 1 cr) & 22.66% if it is more than Rs 1 cr.

Dear Sir,

I have income from tuition fees. Is it possible to file Income Tax Return…?

Kindly suggest.

Thank you,

Sujata

Dear Sujata ..yes, you can file ITR 4 or ITR-4S.

Please guide me if TDS on property purchase filed wrong Form26QB instead of Form27Q while seller is NRI.

Dear Nilofar,

I believe that the buyer has to contact AO (your Jurisdictional Assessing officer) and can request him/her to correct/rectify the TDS payment.

AO can cancel the challan 26QB and refund the TDS. You may have to file fresh TDS with Form 27Q and penalties (if any).

Thanks for this valuable information sir !!!!

This is nice mechanism to solve the problems of someone which are required by them. keep it continue Mr. Sreekanth Reddy I will appreciate you.

Thank you dear Kundan.

HOW CAN I WITHDRAW MY TDS AMOUNT ,

WHAT IS MINIMUM DURATION TO GET THE TDS AMOUNT

Dear IMRAN..You can file your ITR and can claim TDS as refund (if any).

DEAR SHREEKANT SIR

PLEASE GUIDE ME IF INCOME IS 250000+INTEREST INCOME IS 200000 LAC .THEN TOTAL INCOME & INTEREST INCOME BOTH ARE TAXABLE IF YES THEN HOW TO CALCULATE TAX

Dear Vijay…Use this calculator, click here..

calculator…lol…ur advise is not making any sesne .. you should proived complete details with examples so that person could resolve their query asap….

a person may also know about the calculator , but usse pata hi nahi ki karna kya h to calculator ka achaar daalega !!!!!!

hopefully samajh aaya ho and ab ap revert kijiye inhe solution k saath ..!!

Hey Suchita, instead of finding negative sense in others … why can’t you do say directly and positively

30% or 30.9% for 194b ?

Dear Nagarjuna..To be precise yes it is 30.9%.

Income tax 30%, Edu Cess 2% and SHEC 1% on tax).

30.9%

kindly also mention the different types of form VAT.with EXAMPLE.(just like you did in TDS)

waiting sir

thanks

dear sir please guide me regarding VAT, WHAT IS VAT , and how it is generated ,like you mentioned the TDS in very much detail .please give some light on VAT also.please.

WHAT IS TDS DEDUCT COMMISSION BROKRAGE 194H

15000 PER 5%

5000 PER 5%

Sir

The Limit of Rs. 10,000/= is only in case of Savings Bank Account Interest.

yes sir this is only for savings bank account interest under section 80TTA.

dear sir

if a govt. person having yearly salary around 240000/- now he not to pay any tax on it. If he also having interest income around 15000/- so should he fill 15G form or not. And if he fill it then what should the bank did, they reverse the tds amount or not. He also investing in lic and mutual fund around 20000/-

Dear sanjeev,

If your interest income is below basic exemption limit and tax liability (gross income – tax deduction) is also below basic exemption limit then you can submit Form 15G.

You can claim tds (if any, deducted) as refund by filing ITR.

You can file Income Tax Return and take the TDS in consideration for claiming and take Refund of TDS deducted by the bank on Interest income.

Dear Sir ,

Nearly i have canvassed a student to a Institution. So they offered me a 10 % ( 17000 INR) as commission. but they deducted 20% as TDS from my commission and they told me that is because i don’t have a pan number.

Is it a correct calculation…?

Dear Anvar..Yes they are right in doing so.

Suggest you to apply for PAN & then can claim the TDS as refund by filing ITR.

vat is value added tax mean when interstate sales trading is done. for example you are selling goods worth Rs. 40000/-

and 5% is vat as per vat slab vat amount Rs.2000/- is vat amount . Total amount Rs 42000 you will charge to party.

vat slabs may be other due to vat slab percentage are different in every state .

Sir This is right for deductor to deduct the TDS at 20% when the deductee not provide his/her PAN card the the deductor. If you provide the PAN card then the rate will be the rate which is prescribed for the specific income.

dear Sonam

Tds will not be deducted on photo shoot bcz it is not more thn 30 k in a year under sec 194j profession or legal charges .

so u can pay full amount

Dear Manish..Thank you for this info.

DEAR SIR,

IN THE NEW TDS CHART SECTION 194C CONTRACTOR SUB CONTRACTORS NOT MADE ANY DETAILS THAT MEAN FROM 01.06.2016 ONWARDS TDS NOT APPLICABLE FOR CONTRACTORS SO PLEASE CLARIFY AND CONFIRM REGARDING 194C.

HELLO

SIR IF I AM PAYING SOMEONE TO RS 25K AGAINST HIS BILL. AND HE IS GIVING ME THAT BILL IS FIRST AND LAST TIME HIS BILL NARRATION IS (CHILD ARTIST FOR MY PHOTO SHOOT) SO DO I HAVE TO CUT HIS TDS OR NOT

Ms. Sonam there is no any TDS will be deducted by you because the limit under section 194J is not touch and the amount pay to the child artist is only Rs. 25000.

Is Form 15 G or 15 H is mandatory ? If it is not submitted what can be done by Bank? Whether TDS will be levied against F.D invested for more than 5 (Five) Years ?

Dear Banerjee..If interest income is more than Rs 10k, banks will deduct TDS.

Read: Misconceptions on TDS.

Hi Reddy,

Your pictorial explanations is eye catching for easy understanding, go ahead

Thanks Mr Reddy.

A very very good excellent job giving full details.

Thanks a lot Mr.Sreekanth for your valuable info ..

Thank you for providing the brief info related to TDS..

Thank you for this valuable information !!! This chart helps me to learn so many things. Great job Mr Sreekanth Reddy .