We have 11,681 Mutual Fund Schemes that are currently available in the market (Equity & Debt Schemes). That’s a huge number, right? It is a challenging task for any investor to identify and invest in best mutual funds.

A ‘good mutual fund scheme’ is the one that consistently manages to outperform its category returns and also it’s Benchmark’s.

Equity mutual funds are one of the best wealth creation tools for your long-term financial goals like; retirement planning, kid’s education goal, kid’s marriage expenses etc., For medium term financial goals, you can rely on balanced or hybrid mutual funds. In fact, you can create the entire investment plan with mutual funds alone.

I had published on article on ‘Best Equity mutual Fund schemes 2015’ almost 12 months back. Below is the top 15 mutual funds (category wise) list as per my old article.

- Large-cap fund category

- UTI Equity Fund

- ICICI Pru Focused Blue-chip Equity Fund

- UTI Opportunities Fund

- Diversified or Multi-cap category

- Franklin India Prima plus

- ICICI Prudential Dynamic Fund

- HDFC Capital Builder

- Small & Mid-cap fund category

- UTI Midcap

- HDFC Midcap

- Franklin India Smaller Companies Fund

- Hybrid – Equity oriented category

- HDFC Balanced

- ICICI Prudential Balanced Fund

- TATA Balanced Plan A

- ELSS / Tax saving category

- Franklin India Tax shield

- ICICI Pru Tax plan – Regular Plan

- Axis Long Term Equity Fund

Let me now present you the latest & updated list of the best mutual funds for SIPs (or) lump sum investments in 2016 and beyond.

Methodology to select Top Performing Equity MF Schemes to invest in 2016:

I have tried my best to analyze and identify top three best equity mutual fund schemes across five different Fund categories – Large Cap, Multi-cap, Small & Mid cap, Balanced and ELSS tax saving categories.

Below parameters have been considered for short-listing the 15 top performing Equity mutual funds that can be considered in 2016 and beyond.

- I have considered the past returns generated by these funds for the last 1 year, 5 year, 10 year period and since inception.

- Funds with a good track record for the last 5 to 10 years have been preferred. I have considered only those funds which are at least 6 years old.

- Equity Funds which have low risk grade have been given comparatively higher rank. Due importance have been given to Standard Deviation, Alpha, Beta, Sharpe Ratio and overall Risk grades of the funds. (Read : ‘How to compare & select the right and best Mutual Fund Scheme based on the Risk Ratios?‘)

- I have considered Expense ratio as one of the criteria.

- This year besides moneycontrol, valueresearchonline and Morningstar portals, I have also used few ‘mutual funds calculators’ available at freefincal.com portal.

- Morningstar portal’s ‘mutual fund screener’ has been used to filter funds based on fund performance & risk (risk adjusted), standard deviation, fund portfolio & expense ratio.

- The fund returns Vs fund category returns have been given due importance.

- Like last time, in this review too I have not considered the STAR ratings of funds provided by ranking agencies. Usually these star ratings reflect the short term (1 or 2 year’s) performance of the funds.

Top 15 Best Mutual Funds in India for 2016

Below are some of the top performing best mutual funds that you can consider for investing in 2016 and beyond.

(Click on the above image to open it in a new browser window)

Let us now look at some more details of each of the fund categories.

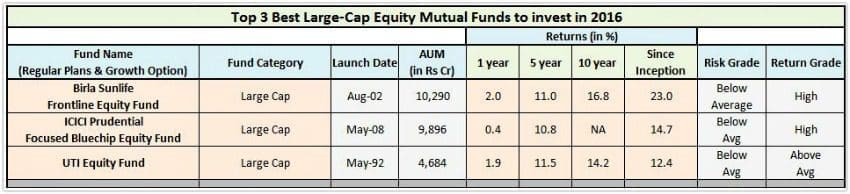

Top performing Large Cap Equity Mutual Funds for SIPs in 2016:

- When compared to last year’s best large cap funds list, UTI Opportunities Fund has been replaced by Birla Sunlife Frontline Equity fund. Though this fund was not in the 2015 list, I have mentioned it as one of the best Equity large-cap funds to watch out for.

- There are roughly around 135 Large cap oriented Equity mutual fund schemes that are currently available in the market. The average returns from large-cap fund category over a 5 year & 10 year period are around 6.89% & 11.56% respectively. Birla’s fund has not only outperformed it’s category returns and also its benchmark returns with a wide margin. All three funds have ‘Below Average’ risk grade. Birla & ICICI funds have ‘HIGH‘ return grade. UTI Equity fund has out-performed the other two large cap funds during last 5 year period.

- Some more large cap funds to watch out for are; Franklin India Bluechip fund, ICICI Top 100 fund & Religare Invesco Growth Fund. HDFC Top 200 has given decent returns for the last 10 years, but off-late the returns have been not up to the mark. The fund has ‘HIGH’ risk grade.

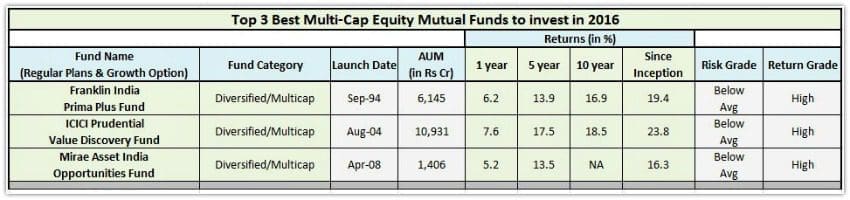

Best Diversified Equity Mutual Fund Schemes :

- Franklin India Prima Plus fund is still one of the most consistent diversified or multi-cap funds. This fund is one of the oldest equity funds. The fund has lagged behind its benchmark only in three of the last 19 years.

- When compared to last year’s best Diversified Equity funds list, ICICI Prudential Dynamic Fund & HDFC Capital Builder Fund have now been replaced by ICICI Prudential Value Discovery Fund & Mirae Asset India Opportunities fund.

- ICICI Prudential Value Discovery Fund has given excellent returns. You can view this fund as a ‘contrarian fund’. The fund generally buys and holds stocks that are trading at a discount to their intrinsic value.

- Mirae Asset India Opportunities fund invests around 75% of its portfolio in large-cap stocks and the remaining in mid or small cap stocks. This can be one of the main reasons for its good performance in the recent years.

- All three funds have ‘Below Average’ risk grade and have ‘High’ return grade.

- Franklin India High Growth Companies fund is another fund to watch for in Flexi-cap fund category.

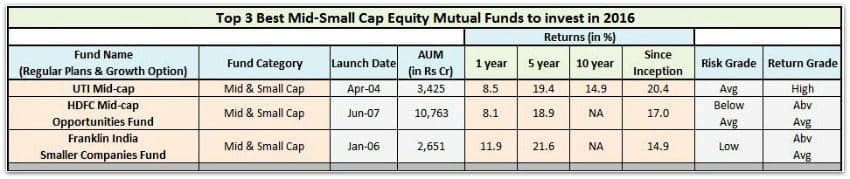

Best Small & Mid-cap Mutual Funds for SIP in 2016 :

- There is no change in the best small & mid-cap equity funds list.

- There are around 123 Small & Mid cap mutual fund schemes. The average returns have been around 15.35% from this category over the last 5 year period.

- Small & Mid cap funds are the ones which can give you high double digit returns if you remain invested for longer period.

- Keep a close eye on BNP Paribas Mid-cap & Mirae Asset Emerging Blue-chip funds too. Both these funds have LOW risk & HIGH return grades.

Top 3 Best Balanced Mutual Funds for SIP :

- Kindly note that there is no change in the best balanced funds list too.

- There are around 53 Hybrid or balanced equity oriented funds. The average category returns for the last 10 years have been around 11.85%.

- Child plans of Mutual Funds like HDFC Children’s Gift fund have also been giving good returns. But there are certain terms & conditions associated with investments in these kind of funds. Kindly read my article : ‘Children’s Gift Funds – Review’.

(Read: ‘Top & Best Equity Oriented Balanced Mutual Fund Schemes – 2016‘)

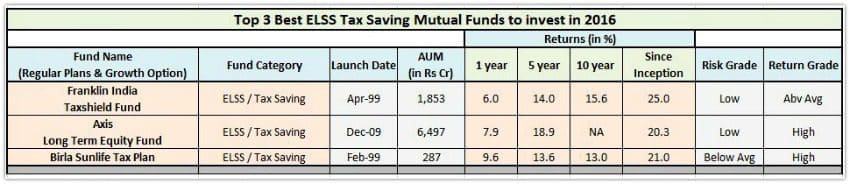

Top 3 Best ELSS Mutual Funds Schemes :

- For more details on best ELSS Funds, you may kindly read my latest article on ‘Best ELSS funds to invest in 2016‘.

My Portfolio

I have investments in the below mutual funds. These are my MF picks. As of now, I have decided to continue with them in 2016 too.

Some Important Points to ponder about Mutual Fund Investments :

- I have tried to list some of the best performing equity mutual funds here. To get good returns, it is not compulsory that that you have to invest in atleast one fund from each category. Kindly do not over clutter your portfolio. Select 2 to 3 good funds based on your financial goal(s).

- Kindly do not invest in too many funds especially within the same fund category. Over-diversification is not beneficial and may lead to high portfolio overlap.

- If you are new to mutual fund investments or do not have time to invest manually, the best way to invest in equity mutual funds is through SIPs (Systematic Investment Plans).

- Goal based portfolio – You can invest in same set of funds for different long-term financial goals but with different SIP amounts (based on your existing resources, goal amount, goal priority & time-frame).

- Portfolio Return – If one of the schemes in your MF portfolio is not performing well, do not immediately churn your portfolio. Also, do not churn your portfolio very often based on fund star ratings. The negative consequences of regularly churning the portfolio are undeniable. Do track that scheme’s performance for sometime (say 1 or 2 years) before deciding to drop it from your portfolio. Sometimes, it is prudent to analyze the overall portfolio performance than to get too worried about individual fund’s performance.

- You may allocate and invest more monies in Small & Mid-cap oriented funds for long-term goals.

- Suggest you not to remain invested in equity oriented funds till the goal target year. You may consider redeeming MF units by starting SWP (Systematic Withdrawal Plan) may be 2 to 3 years before the goal year. You can re-invest this amount in safe investment avenues.

- Invest in Equity funds based on your future goals & financial resources and not based on your current age. For example – If you are a retiree (say 65 years) and have regular income which is more than your monthly living expenses, you can surely invest a portion of your surplus income in hybrid or equity oriented mutual funds.

- Understand the risks associated with equity mutual funds. Kindly do not invest for quick gains or based on tips.

- Continuously track and monitor your mutual fund portfolio. If possible invest through online platforms. You can prefer investing in Direct Plans of MF Schemes to Regular plans. Direct plans can give you slightly better returns than regular ones.

- Some of your goals especially short-term ones can be achieved by investing in best Debt Mutual Funds.

- Last but not the least, remember “Mutual Fund investments are subject to market risks. Past performance may or may not be sustained in future.”

In case if your fund(s) are not in the above list, it does not mean that you need to replace them immediately. As mentioned earlier, it is a tough task to not only identify best mutual funds but also to be with the best consistently. As long as your overall portfolio returns are in line with your expectations (should be realistic) , remain invested with your existing mutual fund schemes.

If you are a DIY investor (Do-It-Yourself), trust your MF picking skills & your conviction. In case, if you take mutual fund agent or advisor’s help , kindly take informed decisions.

Kindly share your views and comments on the above best mutual funds list.

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (References : moneycontrol, valueresearchonline, freefincal & morningstar)

Join our channels

Hello Sreekanth,

Writing after long time. I’m sure there are many like me who want better understanding of below case.

– Salary let’s say 12 LPA.

– HRA, PF, Medical, Telephone, Uniform already provided as per regulatory.

– Investment done up to 1.5L

– After that as well, as per my calculation, one has to pay roughly 70k-80k as annual TDS.

How to save this 70-80K by any mean? Or there is no way at all? 🙂

Thanks,

Dhaval

Dear Dhaval,

You may kindly go through this article : List of important tax exemptions for FY 2017-18 / AY 2018-19.

Hi Sreekanth! I wish to invest Rs 1 lakh in lumpsum for 5 yrs may be 50k-50k each if u suggest two good funds.A balance mf will be a good option??Or should I invest in short term gilt funds.Time horizon may be increased to 7-8 yrs.

Dear Shekhar ..You may consider an equity oriented balanced fund & one Large cap fund. Ex: HDFC Balanced Fund & ICICI Focused bluechip

Read : Best Mutual funds 2017

HI there,

I would like to seek your advice for effective management of different Mutual SIP, we are a couple with 2 children and like to plan for education for in 6 years duration and my retirement on long term basis.

My present allocations are below, please suggest if it needs any changes

Birla Sun Life Frontline Equity Fund – Direct Plan (G) 4000/-

Franklin India Bluechip fund growth 4000/-

ICICI Prudential Value Discovery Fund (G) 5000/-

IDBI NIFTY index fund 5000/-

Motilal Oswal MOSt Focused Midcap 30 Fund – Direct Plan 6000/-

ICICI Prudential Balanced Fund (G) 2000/-

Your advice is much appreciated

Thanks

Suri

Dear Suri Ji,

The listed funds are good ones.

For medium term goal (6 year), you may consider corpus allocated in Balanced fund, can contribute more to it (if required).

Kindly read :

Retirement goal planning calculator

Kid’s education goal planning.

List of important articles on Personal Financial Planning

Hello Srikanth,

I am looking for a long term equity fund say 15 years, planning to invest rs 1 lakh currently. Can you please suggest me some good funds ?

Note: I would like to go with complete equity based instead of debit based since I strongly believe the return of equity market in long term.

Dear Giri .. Kindly read :

Best Equity funds 2017

How to select right mutual fund scheme?

Hi Sreekanth,

Want your suggestion,

At present, I am having 3 SIPs (SBI Bluechip Fund, DSPBR Micro Cap and Franklin High Growth Com Fund).

I have to add three more funds (balance, diversified, sector fund) in my present portfolio considering my long time investments so which balance fund, diversified fund and sectorial fund I should pick for my portfolio.

Kindly suggest me the three funds for SIP to make my portfolio complete.

Dear Vishal,

Franklin HGF can be considered as a multi cap oriented fund, but with slightly higher allocation to large cap stocks.

You may pick a balanced fund like HDFC balanced or SBI balanced fund.

Sector funds – If you understand the risks Vs return trade off, can allocate small allocation to Infra fund, may perform well over the next few years.

Hi Sreekanth,

I am investing 5000 monthly through SIP in Axis long term ELSS Direct Plan. I am further planning to invest in below fund

1. Birla Sun life Tax plan(Direct)-2000 Monthly

2. Franklin India Taxshield Fund(Direct)-1000 Monthly

Can you please suggest if I am going in right direction.

Dear Om Prakash,

May I know investment time-frame?

Suggested articles:

How to pick right mutual fund scheme?

MF Portfolio overlap analysis tools.

Hi Sreekant! i am new to mutual fund. want to plan a baby within 1 yr.i want to invest 5000 in sip route for my child education. want ur suggestion in which fund i will start . my age is 31.kindly guide

Dear SWADHIN,

You may kindly start with one balanced fund and one Large cap fund.

Ex : HDFC Balanced fund & Birla Frontline equity fund.

Kindly read:

Kid’s education goal planning.

List of important articles on Personal Financial planning.

Hi sreekanth, Thanks for this very good article

For last 10 months i m investing in the below funds by SIP

1) Franklin india smaller cos. fund DG Rs4000

2) Franklin india high growth DG Rs2500

3)ICICI pru value discovery DG Rs3500

4) TATA balanced fund DG Rs2750

5) DSP micro cap DG Rs3000

the returns are very low and TATA fund is in negative. Can i discontinue or invest more when NAV is low? As per your Suggestion for 2017, TATA balanced is not in list…If advice for redeem,Pls suggest good funds . my goal is 7 to 8 years.

Can i invest one new large cap fund or Balanced fund?

Dear subbiah,

All the listed funds are good ones, you may continue with them.

Hi Sreekanth, Thanks for this very good article. Based on this, I have shortlisted the below 2 mutual funds for SIP. My goal is wealth creation over the period of 5-7 years.

i) Mid & Small : Franklin India Smaller Companies Fund

ii) Diversified : ICICI Prudential Value Discovery Fund

Please confirm if I can go ahead & buy.

Dear RAJAT,

You may go ahead. Kindly consider allocating higher % of investment to Diversified fund.

Sir

I have been following your page on mutual fund and SIP which is written in simple and lucid language which is self explanatory.

My age is 45 years and I am into pharma sales. I have just started investment into mutual fund and SIP from last year.

I need guidance from you regarding my portfolio.

My portfolio is as given below

Franklin India Ultra Short Bond Super Ins(G)-50000(Liquid Liquid Plus)–STP

Franklin India High Growth Companies Fund-1000(G)

Franklin India Smaller Companies Fund-1000(G)

Axis Mid Cap Fund-1000(G)

ICICI Pru Value Discovery Fund-1000(G)

I have started the investment from last year September 2015.

Please guide me if the portfolio is okay or not. My estimated period is for 8-10 approximately.

Dear Arindam,

I have answered your query in the Forum section, click here to reply..

I have quite a few MF which I think require some rejig;

All non SIP investment has a Value of appx 8 Lacs in which SBI- ELSS alone has MV of 5 lacs and lock in period is over. Please suggest which to move and I have no intention to sell the MFs.

RELIANCE REGULAR SAVING FUND (REGULAR) Expired SIP

HDFC LONG TERM ADVANTAGE FUND (Reg) Expired SIP

RELIANCE GROWTH FUND (REGULAR) Expired SIP

SBI MAGNUM GLOBAL FUND (REGULAR) Expired SIP

SBI MAGNUM TAX GAIN FUND (REGULAR) Expired SIP

SBI MAGNUM TAX GAIN FUND (DIRECT) Expired SIP

TATA EQUITY OPPORTUNITIES FUND (DIRECT) Expired SIP

DSP BLACK ROCK TAX SAVER FUND Reg Expired SIP

Please

—————————————

Below are the current running SIP and I am investing Avg Rs. 3000 per month.

FRANKLIN INDIA SMALLER COMPANIES FUND (DIRECT)

FRANKLIN INDIA HIGH GROWTH COMPANIES FUND (DIRECT)

HDFC TOP 200 FUND (REGULAR)

ICICI PRUDENTIAL VALUE DISCOVERY FUND (DIRECT)

RELIANCE SMALL CAP FUND (DIRECT)

DSP BLACK ROCK MICRO CAP FUND (REGULAR) Recently started

I think some SIP needs to be relooked, please suggest your views. my objective is wealth building with long term horizon.

Thanks in advance

Dear Rishi,

The existing SIPs looks fine.

You may kindly check the portfolio overlap among the funds especially the ones which are from the same fund category. For ex: Reliance small cap and DSP micro cap. In case, the overlap is high say >50%, you may drop one of the fund.

Read:

MF portfolio overlap analysis tools.

How to select the right mutual fund scheme?

Hi Sreekanth, I have to redeem some of my mutual fund holdings but only those units which has completed 1 year to avoid short-term gain. My question is how to redeem those selected units from my ongoing sip? or how to avoid short term capital gains at the time of partial redemption from an sip.

Thanks and Regards

Dear Anil,

For tax purposes, units of mutual funds schemes should be considered as separately date-stamped. That is, every unit will carry a date of allocation that would be the exact date of net asset value (NAV) allocation for that unit. For example, if you have made 60 installments of investments, there would be 60 different blocks of units in your folio (sometimes called tax-lots). When you sell, if you sell the entire holding, you simply would have to determine how many long-term units and how many short-term units you have sold (based on the period of holding for each tax lot) and pay taxes accordingly.

If you sell partially, then you need to determine which units have been sold using the first-in-first-out (FIFO) method. For example, if you redeem 50% of your investment, you should think of it as redeeming the earliest X number of units that would total up to the amount of your redemption and do the analysis of how many long-term and short-term units there are in that set. It is not easy to do this by hand when you have 60 installments to consider, so you might want to take the help of a tax preparation software or a tax attorney or can ask your broker to provide capital gain statement.

(above info source : livemint.com)

Dear Anil,

Kindly check this Capital Gains calculator , click here..

Sreekanth, Thank you very much for the detailed explanation and giving those supporting urls.