Many home loan borrowers consider taking a Joint Home Loan as a practical option to get higher loan amount and also to avail Income Tax Benefits. Joint Debt has become a part of the Household finance these days.

One of the primary benefits of a joint loan is that it increases the borrowing capacity of the prospective home buyers. The combined repaying power of the applicants (two or more) is considered while sanctioning a higher loan amount.

A joint home loan not only allows you to share your debt burden but also allows you to extract maximum benefits offered by the IT Act.

As per the existing Income Tax Laws, both the individuals (loan applicants) can claim income tax deductions on the principal repayment under section 80c and on the interest amount under Section 24. The maximum amount that can be claimed as tax deduction depends on the use of the property ie whether it is a ‘Self occupied property’ or a ‘Let-out property’.

What is a Joint Home Loan? – A joint home loan is a loan which is taken by more than one person.

Who is a co-borrower? – A Co-borrower is a person with whom you take the home loan jointly.

Who is a co-owner? – A Co-Owner is an individual that shares ownership in an asset with another individual / group.

Joint Home Loan & Eligibility rules / Conditions

- Generally a Joint Home Loan can be taken by a maximum of SIX persons (minimum being two applicants).

- A co-borrower (loan applicant) may or may not be the co-owner of the property. But, banks may usually recommend a co-borrower to also be a co-owner of the property. Do note that, being a co-borrower for a house does not automatically make one a co-owner.

- Repayment of a joint home loan is the collective responsibility of both the borrower and co-borrower(s) and each of them is liable for the loan.

- If the loan applicants are married couples then it is a perfect arrangement for home loan providers. The couple is at liberty to decide if they want to be co-owners or if only one of them wants to be a co-borrower.

- If the loan applicants are Father & son or Father & unmarried daughter then Lenders generally insists on the son / daughter being the Primary Owner of the property. (This can be applicable when Mother & unmarried daughter are the borrowers)

- If the loan applicants are ‘brothers’ then banks insists on they being the co-owners of the property.

- Generally, friends or unmarried couples living together are not allowed to take joint housing loans.

Joint Home Loan & Income Tax Benefits

- Section 80c – As per this section, the repayment of principal amount of up to Rs 1.5 Lakh can be claimed as tax deduction by the applicants individually. All the co-borrowers can avail tax benefits. If there are two co-borrowers then the maximum total tax deduction under Section 80c can be up to Rs 3 Lakh (subject to actual principal repayment amount).

Example : Where the husband and wife as co-borrowers are paying a total of Rs 1 Lakh as Principal element of the home loan EMI, each of them can avail tax exemption of Rs 50,000 individually.

- Section 24 – As per this section, the interest payment of up to Rs 2 Lakh (for Self occupied property) can be claimed by the home loan borrowers. If there are two co-borrowers then the maximum total tax deduction under Section 80c can be up to Rs 4 Lakh. (The maximum interest amount that can be claimed as tax deduction u/s 24 is unlimited for a Let-out property).

Example: Where the husband and wife as co-borrowers are paying a total of say Rs 2.5 Lakh as Interest element of the home loan EMI, each of them can avail tax exemption of Rs 1,25,000 individually (assuming the share in the home loan as 50:50)

- Ownership -To avail the income tax benefits on a Joint Home loan, the co-borrower of the loan has to be the co-owner of the property. So, if you are a co-borrower but not a co-owner of your property then you can not avail the income tax benefits. (Co-ownership is mandatory to avail income tax benefits. So, if you and your spouse are co-borrowers for a property owned by another family member then you are not eligible to claim any tax benefits, as you don’t own the property.)

- Ownership Share – The share in tax exemption that each co-borrower gets is in proportion to the ratio of ownership in the property. Therefore, it is advisable for joint owners to procure an ownership sharing agreement stating the ownership proportion on a stamp paper as legal proof of the ownership.

Suggestions

- Highest tax bracket: The tax benefits are applicable in ratio of ownership in the property and therefore the ownership of property should be carefully decided keeping in mind the re-payment capacity of both the borrowers. A co-borrower who is earning well and is in the higher income tax slab rate can opt for higher share in ownership / Loan EMI.

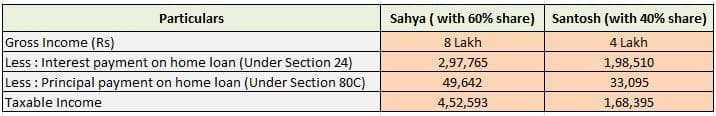

Example : Santosh & Sahya (husband & wife), both are independent salaried individuals. Sahya is in higher income tax slab rate when compared to Santosh. They acquire a home loan of Rs 50 Lakh @ 10% for a tenure of 20 years. The EMI on this home loan is Rs 48,251. As Sahya is in higher tax bracket, they decide to have 60:40 ownership ratio. Sahya wants to pay 60% of the EMI amount to take the maximum benefit of tax savings.

Liability: All co-borrowers are jointly and severally liable to repay the loan. So, it is prudent to consider entering into an agreement about the splitting of loan liability with other co-borrower(s) to avoid any clashes in future.

Liability: All co-borrowers are jointly and severally liable to repay the loan. So, it is prudent to consider entering into an agreement about the splitting of loan liability with other co-borrower(s) to avoid any clashes in future.

- Insurance: It is advisable that all the borrowers should take separate Term insurance plans (better to avoid Mortgage insurance) to mitigate the financial burden on one spouse / co-borrower in case of other’s demise. This way he /she can get the best out of the tax savings.

- Unfortunate Events: In case of divorce or a co-borrower files for insolvency or a co-borrower passes away, it becomes co-borrowers’ responsibility to pay the entire loan. The repayment record of a joint home loan reflects in the credit score of all co-borrowers. So, in the event of any unfortunate incident, it is advisable to identify an alternate co-borrower (if it is not possible to convert a joint home loan to a single loan).

FAQs on Joint Housing Loan

- If I buy a house jointly with my spouse and take a joint home loan, Can we both claim income tax deduction? – Yes, if your spouse has a separate source of income, both of you can claim tax deductions individually.

- My husband and I have jointly taken a home loan. He pays 60 percent of the EMI and also has 60% share in the property . What will be our individual tax benefits? – The tax benefits are dependent on the share of ownership. So, both of you can claim tax deductions in the ratio of ownership i.e., 60:40.

- I have a home loan in which I am a co-applicant along with my wife. However, recently she resigned from the job and now the total EMI amount is paid by me. What is the total income tax exemption that I can avail of? – As long as you are co-owner & co-applicant of a home loan, you can claim tax benefits. If you are the only one who is repaying the loan, you can claim the entire tax benefit for yourself (provided you are an owner or co-owner). You can enter into a simple agreement with the other borrower(s) stating that you will be repaying the entire loan amount.

It is evident that besides the benefits that a joint home loan brings along, it is important for both partners (or all the co-borrowers) to understand their responsibilities towards the loan and its implications.

Though joint home loan makes you eligible for higher loan amount and also offers tax benefits, do not over leverage yourself. Do prioritize your financial goals and then take a decision to acquire a housing loan jointly.

Latest update (Budget 2017-18) : Tax benefit on loan repayment of second house will be restricted to Rs 2 lakh per annum only.

Continue reading :

- Income Tax Deductions List FY 2019-20 | List of important Income Tax Exemptions for AY 2020-21

- Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) [whatsapp]

Join our channels

Hi,

We (Me and my wife) purchased a house in joint name and took a loan jointly. My wife is a homemaker and I pay entire loan amount from my individual bank account. Total interest per year is around 360000/-. Can I claim 200000/- on interest deduction? (As my office is saying that I can claim only 180000/- (50% of 360000). Further, if I can, please provide suitable IT act/ supporting documents to submit in office.

Thanks and regards,

Please advise on a joint home loan between mother and only son in a ratio of mother (60%) and son (40%) both are salaried, but son wants to pay the entire emi and mother will only act as a coowner of the property

and coborrower of the property

Dear Rakesh,

If mother is not going claim the tax benefit then Son can enter into a simple agreement, get it signed by the mother and submit it to his employer. Make sure the EMIs deduct solo (son’s) bank account.

for claiming HRA benefit what documents are needed to submit employer

Hi Sreekant, hope you’re well. Me and my spouse are co-owners and Co borrowers and my wife is a bank employee. Our EMI is being directly deducted from her salary A/C and I transfer funds to her A/c. Our flat has no ratio value declaration. Till now we both have claimed and no objection have come up.

My questions are

1. Can we both claim exemption under 80c?

2. What are rules regarding Housing Loan Interest Deduction and principle for both of us?

3.If no exemption to both of us as per IT rule then how to rectify this?

Thank you in advance.

Dear Subeer,

I am doing good thank you! Trust the same with you!

1, 2 & 3 – Yes, in the default ratio of 50 ; 50.

Related articles :

* Understanding Tax Implications of Income from House / Property

* Income Tax Deductions List FY 2020-21 | New Vs Old Tax Regime AY 2021-22

Hi Sreekanth, had a quick query.. my husband and I are co-borrowers and co-owners of a flat.. my husband is selling a site for which is the sole owner (gift deed not possible due to shortage of time). What component of the loan can he repay (within a year of new purchase of flat) to save on capitals gains tax – will it be 50% of the property value or 50% of the loan amount? Thanks in advance.

Dear CJ,

Kindly go through the below article and revert if you have any more queries..

How to save Capital Gains Tax on Sale of Land / House Property?

Thanks for your quick response, my query is a little more specific. My husband and I bought a flat this January 30th (2020) with an HDFC loan. We are co-owners and co-borrowers (both 50%). We are selling a residential site (bought many years ago) in a few days. If we manage to do it before Jan 30th, can we use this sale money to pay part of my flat loan and save on some capital gains tax? If yes, can we use it to pay the bank 50% of the property value or 50% of the loan amount as the site is registered only in my husband’s name and we do not have time to make a gift deed of 50% in my name. Really appreciate your help on this. Thanks.

Dear CJ,

If you use the capital gain amount to clear loans then tax on LTCG cannot be saved.

I believe that no exemptions can be claimed.

Hi Sreekanth

I had purchased a flat in Sep-2018 in my(Govt. employee) and my wife’s(Pvt. employee) name.

Home loan is also on our names. But the 100% EMI is paid by myself (my bank a/c, not a joint a/c) only,

there is no contribution from my wife in EMIs.

Till now, rent earned was shown 50%-50% in our tax returns (in FY 2018-19 ITR).

But in Dec-2019, my wife quit her job.

1. Can I claim 100% home loan interest + principal amount now as she is unemployed ?

2. Can the rental income be claimed by me 100% or it still need to be 50-50% ?

Please elaborate the tax implications for FY 2019-20 and FY 2020-21.

Hello Sir

I want to take a home loan for Self and my Brother. I am a salaried person and my Brother do work in wages…but one problem is property is in My mother’s name alone… then how can I take home loan on my mother’s property for construction house for both me and my Brother…. please guides us sir…

Dear Shrikant, in one of your replies you said that when husband and wife are the co-owners and co-borrowers but husband only pay the entire i.e. 100% EMIs, then he can claim 100% tax benefits subject to entering into an Agreement in between the two. Can you please share or quote the rule position of latest IT Act to that effect so that I can submit the same to my employer/department along with that Agreement? Please..

Dear Sanjay,

You may kindly check with your employer on this.

Coz some employers agree a simple agreement and some do no.

As of now, I do not have the IT circular..will check..

Sir ,

I have a home loan in which I am a co-applicant along with my wife but home is with the name of my wife only. She is housewife and I am paying 100% loan EMI.

can i claim tax benefits ?

Dear Anand,

As you are not the owner/co-owner of the property, you can not claim tax benefits on home loan..

Hi Sreekanth,

I have a question for the home loan. As I took a loan in which I am the borrower and my mother is co-borrower. And in registry I am the owner and my mother is co-owner. Now I will pay complete loan emi and my mother is a house wife and there is no income by my mother. I told this thing in my office and they are telling in this case you can get only 50 tax benifit. I told them I will make an agreement to state that I will pay complete emi’s and all emi will be deduct form my account, there is no contribution by my mother in emi.

Please suggest what should I do in this case.

Thanks

Dear Hitesh,

Ideally, you can claim tax benefits as per your ownership share in the property.

However, You can enter into a simple agreement with the other borrower(s) (your mother) stating that you will be repaying the entire loan amount or higher EMI, this can be on stamp paper and mutually agreed upon.

You can submit this agreement / self-declaration to your employer.

Is there any specific format or template for this agreement? Then please share if you can.

My Email : khatrihitesh$$@gmail.com

Dear Hitesh,

You may consider below format (this is not a starndard one, you may edit it as per your requirement).

To Whom It May Concern

You may consider below format ;

I ………………………………….working as …………………… (designation) in ……………………(name of the organization and branch) bearing employment no……………………., availed joint housing loan from the ………………… (name of the bank and branch) bearing loan account no………………………………… I here by declare that the interest amount mentioned in the provisional certificate is claimed by me to the extent of Rs…………….. and regarding the principal amount which mentioned in the provisional certificate is claimed by me to the extent of Rs……………………..

Date:

Place:

Signature

hi, Sreekanth,

Me and my husband have purchased a flat from a joint homeloan. We are sharing EMI’s 50% each from a joint account. Can i claim tax benefit on 100% principal amount and only 10% for interest part. My husband wants to take benefit of 90% interest part this year. Kindly clarify.

Dear Shweta,

I believe that kind of arrangement may not be possible.. Ideally, by default the joint owners has to claim tax benefits as per their Ownership share in the property.

Dear Sir,

I and my wife has taken a housing loan in the joint name and the property is owned by both jointly. As per my understanding we can claim Income Tax Exemption in 50:50 ratio of the principal and interest payment. My Query is: Is it possible that I can claim IT exemption for only Principal Amount and my wife can claim IT exemption for only Interest Amount ?

Thank you.

Dear Cherian,

You may not be able to claim like that (though Tax law is unclear on this..).

Related article : Income Tax Deductions List FY 2019-20 | List of important Income Tax Exemptions for AY 2020-21

Hello Sir,

Me and my mother have a joint home loan where I am co-owner in property and also co-borrower in loan…

All deduction of loan instalment is from my mother bank account.

I am an employee in one organization till now I am just transferring some half amount into my mother bank account and showing 50% for a tax benefit in my income tax return.

is there any way I can show all amount (100%) as a tax benefit in my income tax return.

in short, I want to show full home loan benefit from my account is there any way?

Dear joy,

Both of you can submit a request of change of bank account to your lender, get the future EMIs deducted from your bank account.

Ideally, the tax benefits have to be claimed proportionately based on the ownership share in the property.

If you are going to pay 100% EMI, you can draft a simple agreement, get it signed by your mother and submit it to your employer.

To pay 100% emi do I need to change bank account of my mother with mine for EMI deduction or should I just transfer amount to my mother bank account ?

Dear Joy ..Advisable to get the EMIs deducted from your bank account!

What if I transfer all instalment money to my mother account and show 100% tax claim in my account

Dear Jigar,

It is your choice to make things simple or complex!

It may not be a wrong-way of doing..but can be inconvenient to you in case of any (tax) scrutiny, to justify your stand..

Hi Sreekanth Reddy,

I have read your blog. And still has this doubt.

I and my wife are co borrowers and co owners of the housing loan and property respectively. My wife is a house wife. I am paying the whole EMIs. What are the ways to claim full tax rebate. I have read some of your answers but did not get clarity

1) Is it possible to ask for the Bank to give loan statement on my name itself even though it is joint home loan?

2) If we have to draft an agreement. What is it? Is it on Stamp paper? or just a declaration from her? Is there any format?

Can you please help me out

Dear Praveen,

Ideally, the tax benefits have to be claimed as per the ration of ownership (50:50 by default).

In case, you are paying 100% EMI, you can pay it from your individual Sole Bank account and get a normal agreement from your Spouse. You can submit this agreement (that she is not going to claim tax benefit on home loan payments) to your Employer (if employed).

Thanks for the reply.

Agreement should be on legal stamp document or just a self-declaration kind of document?

Dear Praveen..I think self delcaration should be ok..

Thank you very much Sreekanth. I appreciate your quick responses to our queries as well.

Your blog clarified most of my doubts. I verified with my employer and they also confirmed that self-declaration is sufficient.

You are welcome dear Praveen!

Keep visiting ReLakhs.com..

Hi EveryOne ,

we are 2 brothers married and 1 sister married with one property in my fathers name who is retired now of independant house ground floor ,

1.We 2 brothers wanted to construct 2 floors one for each taking the joint home loan

are we eligible for tax exemption

if not can you suggest what needs to be done to get joint home loan and tax exemption for both of us (brothers)

Dear Naveen,

If the property is your father’s name alone then both of you (home loan applicants) can not claim tax benefits.

Your father can make two/three of you as joint owners through a Gift Deed.

Kindly read :

* 5 ways of transferring your Immovable (or) Real Estate Property

* Joint Home Loan : Eligibility rules & Income Tax Benefits

* Got a Gift? Find out, if it is Taxable or Tax-free?

Hi Sreekanth,

My friend has purchased a land in FY 2010-11.

Now he along with his wife (in the year 2018-19) has constructed the house jointly on the above said land.

Loan was taken for construction of building jointly and EMI is being paid by both of them.

Now the interest on loan borrowed by both of them even though the land is registered by single person.

If no, is there any alternative to claim interest by both the people.

Regards

Sai Kumar

Dear Sai,

If the property is owned by only one of them then only that person can claim tax benefits on home loan.

Alternative is, he can gift an ownership share to his spouse. Prior to this, they need to inform the Lender/banker on this, take their consent.

Kindly read :

* 5 ways of transferring your Immovable (or) Real Estate Property

* Gifts & Tax implications!

Hi Sreekanth, this query is for a friend. My friend and her husband bought a flat which they are living in currently. Both of them work as salaried professionals. But the flat is registered in the name of the wife and the loan is also in her name from SBI Bank (w.e.f. Dec 2018). So at the moment only she is able to take advantage of IT benefits.

Now that they realise that they both could have availed tax benefits, what will be the process of ensuring the husband is also able to get tax benefit (of interest and principal) for the same property. Please note that they don’t have any other property.

Dear Natasha,

She can execute a Gift Deed by gifting an ownership share in the property to her husband.

If she gifts 50% share then both of them can claim 50:50 tax benefits on home loan.

They need to inform their banker on this and take consent.

Related articles :

* 5 ways of transferring your Immovable (or) Real Estate Property

* Got a Gift? Find out, if it is Taxable or Tax-free?

* Can a Mortgaged property be Gifted, Willed or Inherited?

Hi Shreekant, Thanks for the super quick response.

Also another query. As she has taken a loan in this year financial (2018-19), the stamp duty and registration amount which is more than 2 lakhs would be part of the deduction in Sec 80 C for her. But the limit is only upto 1.5 lakh. If she adds her spouse this year through gift deed, would he also be able to claim 50% of the stamp duty and registration amount under section 80 c (as part of the 1.5 lakh).

Or is there any other way both of them can ensure that they get maximum tax benefit of the registration charges paid.

Dear Natasha,

Yes, if the gift deed is done then both of them can claim the 80c benefit.

If the charges are say Rs 2 lakh and ownership share is 50:50, then they can claim Rs 1 lakh each u/s 80c. Kindly note that the overall threshold limit of 80c is Rs 1.5 lakh each.

“For claiming stamp duty deduction u/s 80c, you must possess the house also i.e. Payment for under-construction is not allowed. In simple words both payment of expenses and possession of the house must be in the same fiscal year for claiming expenses.”

Thanks Sreekanth .. your answer truly helps..Heartfelt thanks for your quick and detailed response 🙂

You are welcome dear Natasha.. Keep visiting ReLakhs.com for all your personal finance related matters..cheers!

Dear Can you post the steps to avail Tax benefits on second hoem.

Can we gift deed the first home to our kids name and avail sec 80 c ??

Dear DANDAPANI,

Once you Gift the property, the ownership changes and you may not be eligible to claim tax benefits.

You may go through below articles for more details;

* Understanding Tax Implications of Income from House / Property

* Can a Mortgaged property be Gifted, Willed or Inherited?

* 5 ways of transferring your Immovable (or) Real Estate Property

Hi Sreekanth,

I have taken home loan from LIC Housing Fianance as a co-borrower. The land is registered in my father’s name and I’m not a co-owner. When I tried to submit for tax exemptions through my company, they are rejecting it by telling I need to be a owner or co-owner of property. When i initially enquired with LIC before taking loan mentioning my father is non- earning member and I’m not co-owner but would I be eligible for tax exemptions, they said yes. Now after taking loan and my IT filing application is getting rejected and I’m not sure what to do next. I enquired with LIC again multiple times they are telling there are lot of people who have taken loans in such a way and taking IT exemptions but I didnt get a contact detail of person who is doing in such a way. Can you suggest here please.

Dear Sagar,

Your employer is right. One needs to be an owner/co-owner to claim tax exemption on home loan.

Your Lender is misleading you..

Your Father can execute Gift Deed and can gift you a share in the property. But, you need to inform your Lender (LICHFL)

Kindly read:

5 ways of transferring your Immovable (or) Real Estate Property

Gifts & Tax implications!