The Employees’ Provident Fund Organization (EPFO) has around Rs.27,000 crore lying in inoperative accounts. There are chances that a small portion of this unclaimed money is yours. Many employees feel that the EPF account transfer is a cumbersome process and is a painful experience. It is often observed that we just ignore to transfer the funds to the existing EPF account.

But, things are changing for the better. The EPFO has been implementing good initiatives and you can now transfer your EPF funds online and you can also withdraw EPF funds online.

In case, you have not been contributing to EPF Scheme for a while and has not withdrawn/transfer the funds from your old EPF accounts then there are chances that your old EPF account(s) would have become IN-OPERATIVE.

As per the EPFO’s earlier definition of Inoperative Account – EPFO does not pay interest on the EPF account, where no contributions (no activity) have been received for 36 or more months continuously. EPFO considers this type of account as an ‘Inoperative EPF Account.’

However, during the FY 2016-17, the Ministry of Labour announced that interest will be credited on in-operative accounts too. Since then, there has been no clarity on this topic.

Interest on Inoperative EPF accounts – Latest Update

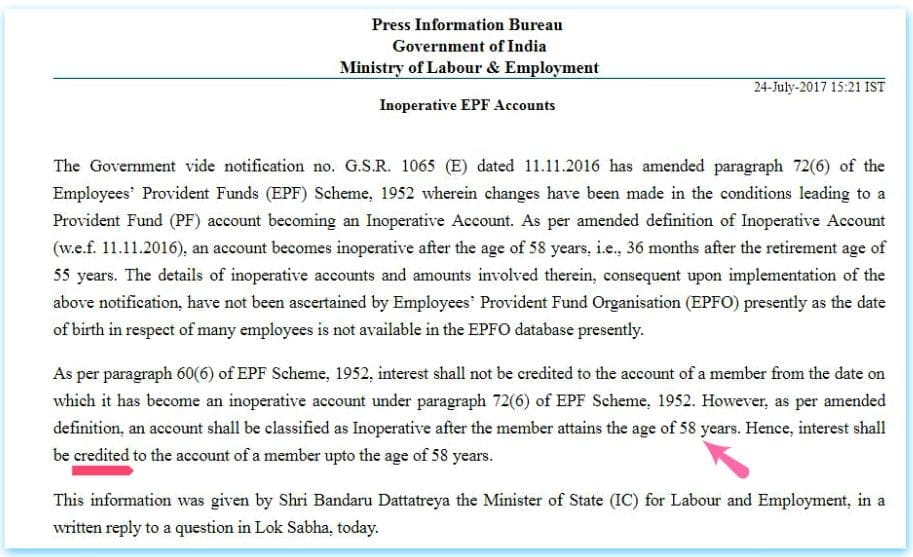

As per the EPFO, the retirement age of an EPF member is considered as 55 years. The PF body will pay interest on all EPF accounts (if full balance is not withdrawn) till up to the members’ age of 58 years. The rate of interest is as declared by the EPFO from time-to-time (every Financial Year).

New Definition of Inoperative EPF account : As per the amended definition, an EPF account becomes ‘inoperative’ after the age of 58 years i.e., 36 months after the member’s retirement age of 55 years.

Latest Related Article : Why should you Withdraw Old EPF Account Balance? | Consequences for non-withdrawal of EPF balance

So, it is now clear that an EPF account can be classified as Inoperative after the member attains the age of 58 years only.

If you are contributing to EPF Scheme, suggest you to check and verify the correctness of your personal details that are linked to UAN, especially your Date of Birth.

Latest update (16-Nov-2017) : If an employee who is a member of EPF scheme, quits or retires from his employment and continues holding the accumulated PF balance, he/she has to pay tax on interest from the date of unemployment. So, the interest on EPF is tax-exempt only when the member is employed and the Interest credited to an employee provident fund (EPF) account after an individual ceases to be in employment is taxable in his/her hands in the year of credit. Interest that has been accrued post employment is taxable. This is as per the recent order by Income tax appellate Tribunal.

(Source: Times of India & Moneycontrol)

Latest news (26-May-2018) : EPF interest rate for 2017-18. EPFO notifies 8.55% as interest Rate on EPF for the year 2017-18, lowest in 5 years.

Continue reading :

- EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

- How to trace my old & Inoperative EPF account online?

- How to track the status of EPF claims online?

- How to consolidate multiple Old EPF accounts?

(Post published on 25-July-2017)

Hi Sreekanth,

I want to transfer my old EPF account with my current employer. Interest for FY 2019-2020 has been credited now. If i apply for transfer of account request, will the transfer amount include accumulated interest on old account for FY2020-2021 till the date of request of transfer account?

Dear Sanjeev,

Yes, you will receive the interest amount as well!

Thanks Sreekanth for your reply. This means amount that will be transferred to current account will be more than Closing Balance of the Last Year. Am i right?

Hi Sreekanth,

I am awaiting for your response. Since I did not find answer to my query from many blogs and responses, just wanted to make it sure what you have answered is correct in the other way. Hope you understand… Once again i am reiterating the same as below:

I am applying for transfer of old PF account to the current account. Last contribution made in the old account in Aug 2019. I am applying for transfer request in Jan 2021. Will the transfer amount include accumulated interest from Mar 2020 to Jan 2021 on old account? Since you answered ” I will get the interest as well”. This means to me that Transferred amount will be more than the closing balance of FY2019-2020. i.e. Closing Balance of FY2019-2020 + Accumulated Interest (Mar 2020 to Jan 2021) = Transferred amount to Current Account. Am I right?

Dear Sanjeev ,

Yes, your understanding is correct.

You may request Annexure-K through grievance portal, it will have all transaction statement entries on your EPF account.

Dear Sreekanth,

Thanks for your response. And Yes, I had applied for Account Transfer and the approved amount included interest. This information will be highly useful for others who may be having a doubt over transferred amount just like me. Thanks once again

Hi Sreekanth.

Thank you for this article.

Can i keep money in an EPF account even after 3 years / 36 months ? I understand based on new definition of inoperative account my account won’t fall in this category as i am not near the age of 55 OR 58.

I am currently outside India and will be completing 3 years soon since no contribution been made to EPF account. I understand interest would continue to get credited even in this case.

I would like to understand whether i should continue with my account by keeping funds invested or is there any implication ?

Dear Chintan,

After 3 years of no contributions, the EPF account is declared technically ‘in-operative.’ However it continues to earn interest at the rate declared by the EPFO for active EPF accounts (as per the latest notice). However additional paperwork is required to revive an inoperative EPF account or to withdraw from it.

After 7 years of no contributions, the EPF balance is transferred to the ‘Senior Citizens Welfare Fund.’ In this case, the EPF balance continues to earn interest, but at a different rate from that declared by the EPFO.

You can still claim your money from the Senior Citizens Welfare Fund, but proving ownership becomes a lot harder, especially if your ex-employer has failed to maintain proper records.

After 25 years in the Senior Citizens Welfare Fund (and hence 32 years of no contributions), your EPF balance is forfeited to the Government of India. This event is called ‘escheat’ in legal terminology.

Thank you Sreekanth.

“Additional paperwork is required to revive an inoperative EPF account or to withdraw from it” – please let know whether paperwork is all online OR need to visit an EPFO office in person ?

if you can let know your view whether is it good to withdraw now or continue earning interest from EPFO atleast till completion of 6-6.5 years from the point no contribution has been made ?

Dear Chintan,

Do you have any plans to get employment in India and contribute to EPF scheme again??

Hi Sreekanth,

Yes i do have but may be after 5 years or so.

Dear Chintan,

If you would like to re-invest the epf claim amount in a better way then you can try withdrawing it.

Hi Sreekanth,

Given return from other investments, i think EPF seems better as of now, i will prefer to keep it invested for next 3 years or so i.e till 2024 by that time it will be like some 72 months since no contribution.

do you see any issues in withdrawing at that time apart from some additional paperwork ?

Dear Chintan,

Is your PF maintained by your employer’s PF Trust?

Hi Sreekanth,

Yes it’s maintained by Accenture and has its own trust.

Dear Chintan,

If you are confident that your employer can provide support for EPF withdrawal in future then you may continue holding the funds..

Hello Sreekanth,

I resigned from Infosys and have joined a US based org. For last 3 years Infosys kept on sending emails to withdraw or transfer funds in their trustee PF and threatened that account will become in-operable otherwise. I asked them to abt balance accrued in my PF account but they never replied. Also told them that I do not intend to withdraw funds and I should be able to keep them until 58 yrs of age. But instead they simply credited all the amount in my account which was used as salary account. Seems like they wanted to pay me off to avoid interest payment. Can I dispute this somewhere?

Dear Amankul,

Yes, an EPF member can maintain the funds till the retirement age. As per the EPFO circular, interest is payable even if there are no contributions.

Without you withdrawing the funds, how did they process the claim?

However, do note that the interest accumulated during the non-contribution phase is a taxable income.

Related article : EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

Yeah even I’m lamented tht settlement happened without my consent. No cancelled check was provided for account verification. Have email proofs to back what I posted.

Dear Amankul,

Suggest you to escalate the issue with the internal HEAD of the depts (HR/Finance) @ infosys..

Oh I don’t expect anything from them(esp for ex). For last few years was trying to follow up to get statement of my PF account. No replies, top bureaucracy. Not sure if this can be raised with EPFO commissioner.

Dear Amankul,

Yes, you can escalate this issue .

Hi Sreekanth,

I had 9L+ in my PF account. Out of which I applied partial PF withdrawal for almost the full amount(say 8L+) in Mid-February.

Usually interest gets credited for PF account for APR-MAR window I believe. So my doubt is will interest be applied for that full amount at least till January (From APR 2019 – JAN 2020) ?

Dear Muthu,

For FY 2018-19, the interest would have got credited by now (generally during july to dec)..

Hi Sreekanth,

Yea it got credited for 2018-18 window. I want to know abt 2019-20. I have just applied for almost full pf withdrawal using form 31(for partial withdrawal) 2 days back. So want to know whether interest would be credited for this year 2019-20? Would interest have been accumulated till January?

Dear Muthu ..ideally.. the interest is payable till jan..but will be credited in next fiscal year only..

You may also check with EPFO via this link..

Hi Sreekanth,

I worked in some company A from January 2014 to May 2014. But the final settlement was not done with that company hence my PF is also not credited to my PF account for the may month. Then I joined company B worked there for more than 5.5 years. Company B has it’s PF member ID and UAN is linked with it.

The company A ‘s PF account is not linked with UAN. Now I have applied for the final settlement with company A whose PF account I think is dormant now. If the company A wants to credit the PF of the may month as a part of final settlement, is there any issue ? Now the company A has to create a new member ID ? I don’t want to give them my UAN, as I don’t want the job history of company A to appear in my UAN. Please help me with this.

Dear Sylvester,

If your current UAN is linked to Aadhaar then they may not be able to create new UAN.

Member-Id is nothing but your EPF account, which you may already have right??

You can request your company-A to transfer the funds (PF/EPS) to your latest EPF account..

I have still not received Interest Credit to my PF account for FY 2018-19. Can you let me know when Interest is credited.

Dear Babu,

The interest for FY 2017-18 has been credited during Aug to Dec 2018.

Kindly note that the interest for FY 2018-19 will be credited during Jul to Dec 2019.

Related articles :

* EPF a/c interest calculation : Components & illustration (Employees’ Provident Fund)

* EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

Hi Srikanth,

I lost my job 2 years back. I did not withdraw my EPF corpus then, thinking it’s my savings for retirement. Meanwhile, EPF office has credited interest for FY17-18 in December 2018 with transaction date as 31-March-2018. Since it was way after filing my last year’s ITR, I could not refer it during last year’s ITR.

My questions are;

1. Should I show the EPF interest earned for FY17-18 in this year’s ITR (as the amount was actually credited in December 2018)?

2. If not, how should I handle this?

Note that typically EPFO credit interest for last financial year in the second quarter (Oct-Dec) of current financial year. So I cannot show it in the current year’s ITR (as due date is 31-July). Can I show it next year’s ITR?

Please answer my queries. Thank You.

Dear Vai .. Kindly refer to our discussion on this query @ Forum..

Thank you very much Sreekath for quick response. Your website/blog is very much informative and valuable for all, I highly appreciate your efforts !!

Dear Sreekant,

I left my job on February 1st 2019. what do you suggest that should i withdraw the whole amount or should keep it for 36 months more as it would still earn interest. Also could i partially withdraw some amount as i have a medical emergency.

Also how can I withdraw the whole amount online as i only get the option of form 31 which is for partial withdrawl.

Kindly suggest

Dear Rahul,

May I know your next career move?

As per the latest EPFO notification there is no concept of Dormant accounts. You may get interest beyond 36 months also.

Related article : EPF partial withdrawal options and rules..

Hi Sreekanth,

quit my job in Jun-2016 and i have some amount in my EPF account and i did not withdraw it till now. can i keep that EPF account or shall i withdraw money from it?

when it will become a dormant account and what will happen to dormant account/

Thanks, rams

Dear Rams,

As per the EPFO’s notification issued in FY 16, all in-operative EPF accounts get interest payment from April 2016 onwards.

In your case, you should get the interest amount on your PF balance. Suggest you to cross-check this by submitting a grievance request to the EPFO via this link..

I quit my job from Jan 1st, 2014 at the age of 50, did not take any other employment and withdrew my entire PF ( final settlement ) only in August 2017. I have received interest up to end March 2017. However no interest has been paid for the period April-August 2017.

As I have not yet attained the age of 58,shouldn’t I be getting the interest for the above period as per the Nov 2106 amendment and definition of inoperative accounts ?

Dear PN,

Yes, ideally the interest amount for the said duration is also payable.

You may submit your grievance to the EPFO via this link..

I submitted my grievance on the EPFO link as suggested. They have replied that an account is classified as UDA, 3 years after the last contribution is made and accordingly my account is classified as UDA for the FY 2017-18 and hence no interest would be paid for Apr-Aug 2017.

Dear PN,

The notification regarding payment of interest on EPF accounts came around July 2017 (as given in one of the images in article). But, with retrospective effect from Apr 2016.

Looks like, at the same time you had withdrawn the funds and hence they might be referring to old rules.

FYI, UDA- Unclaimed Deposit Account..

Hi,

I had EPF account with previous employer which had contributions till 2003. I switched job in 2003. New company had PF as exempted trust. I did not withdraw any money from previous (non-exempted) epf account. Now if I wish to withdraw money, until what period, interest will be paid? 2006 as it would have become inoperative from 2006? Or it should credit interest for entire period till today as per new rule?

Hi,

As per the EPFO’s notification issued in FY 16, all in-operative EPF accounts get interest payment from April 2016 onwards.

Hi Srikanth,

I resigned from my company (manages the pf through an exempted trust) while on deputation out of India. Now, I don’t want to withdraw my PF funds. How long can I have account as dormant? Also I got an email from my employer that he may transfer inoperative

Provident Fund corpus to the Senior Citizen’s Welfare Fund.

Also I read that the interest earned on pf without employment is subject to tax. Is it payable as per the income tax slab?

TIA

Naveen

Dear Naveenkumar,

As per the EPFO, an EPF member can keep the funds in EPF account till 58 years of age.

How long your PF account has been dormant? What are the conditions laid down by your Employer’s Trust regarding Dormant accounts?

I believe that your ex-employer has to credit interest. Kindly go through this article..

Yes, the interest earned on PF account during non-contribution phase is a taxable income and is taxed as per the individual’s slab rate.

Related articles :

* EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

* Tax Implications of EPF, PPF & NPS Withdrawals (Full / Partial) & Maturity proceeds

Hi Srikanth,

I was relieved from my previous company in Dec 2012 and joined another company but forgot to transfer PF account . My PF online statement with previous employer shows final payment from employer in Feb 2013 . It shows both employer and employer contribution in Feb 2013 . From which date my PF account was supposed to become inoperative account as per previous definition . Will 36 months have to be calculated from Dec 2012 or from Feb 2013 . Requesting clarification .

Dear Anil,

The date is based on when your ex-employer has last contributed to EPF..

As of now, there is no concept of In-operative EPF ac, as interest is payable even on PF accounts.

If you are employed and currently contributing to EPF scheme, kindly get your PF funds transferred from old EPF ac to latest/new EPF account.

Related articles :

* Online EPF Transfer | How to transfer PF funds to another EPF account Online?

* What happens to EPS on Transfer of EPF account (or) when you switch Jobs?

Thanks Sreekanth ,

I have already transferred my account to current employer . But issue is they have denied me interest from Dec 2015 to March 2016. As per them it was inoperative period post 36 months . They again started giving interest from April 2016 . But I have lost interest for five months . Are they justified in denying interest of five months .

Dear Anil,

As per the EPFO’s notification issued in FY 16, all in-operative EPF accounts get interest payment from April 2016 onwards.

If your ex-employer has contributed to EPF till Feb 2013 then your EPF ac would have become inoperative by Feb 2016. But, for these three years, interest is payable and again from Apr 2016, interest is payable on your PF ac.

In case, you need more info then you may kindly submit your grievance to the EPFO through this link..

I have taken vr from 1st September 2015.I hv not yet withdrawn my p.f.no contribution since then.will the interest acurred till my withdrawal be taxed?& up to what period p.f.will pay interest in this case

Dear Mr PATTNAIK,

Yes, interest on EPF during non-contributory period is a taxable income.

EPFO will pay interest to the member’s EPF account up to his/her age of 58 years..

Hi Shreekant,

I observed that the PF passbook of my PF account of previous organisation isn’t showing interest accumulated for 2017-2018.

It shows interest updated upto 31 Mar 2017 only.

I had left that organisation in Aug 2016 & since then the PF account is not having any further contributions.

What should I do so that the PF account reflects the interest credited & updated balance as of 31Mar2018?

Another question is why is the Pension Contribution doesn’t earn any interest despite the money lying with EPFO.

Can you please elaborate on below:

1. Will the final Pension corpus have nay interest accured?

2. How is the monthly pension calcualted on the Pension corpus after employee turns 58 years?

Thanks,

Abhijit

Dear Abhijit,

The interest has not yet been credited to all the EPF members. Not sure, the reason for the delay. But, you are eligible to get the interest on accumulated balance..

Pension is paid on the basis of certain calculation on the accumulated EPS balance. Interest is not payable on EPS balance.

You may kindly go through this link for EPS pension calculation.

Dear Sreekanthji,

What is the procedure to transfer EPF account from One company(EPF maintained in un-exempted EPFO) to a company(EPF maintained in Exempted/Trust)?

Dear Shailesh,

You may route the transfer request through your current employer via offline mode (can submit Form 13).

Hi Sreekanth,

thank you for knowledge sharing

i left my company ABC in sept -2013..and left this PF Account idle

now i want withdraw this ammount

1)will i get interest period for 3 years..from 2013-2016 only? or till date (2013-2018) as per new EPF rules?

when i contacted in regional PF office(bagalore) they told me interest will credited for only three years not after that period

i submitted pf withdrawal claim in pf office and waiting for the amount settlement

can i raise the grievance if i wont get interest till date?

Plz let me know

Dear sakala,

As per the EPFO’s notification issued in FY 16, all in-operative EPF accounts get interest payment from April 2016 onwards.

If no contributions have been made to your EPF ac from 2013, you account would have still got interest payments for next 3 years based on ‘3 year rule’ at that time.

From 2016 onwards, based on new rule, your account would have again started receiving interest payments.

Hi,

I have the same issue where I left the Job in April 2014 and got the interest ONLY till April 2017 and no interest paid after that.

Can you double check the rules and confirm ? Is there any case where the interest is paid beyond 3 years, so that we can refer that to EPF office

Regards

Dear ramana,

Did you withdraw the funds? If so, date?

You can submit your grievance to the EPF via this link..

Yes, I withdrew funds in May this year as there is no interest is coming.

Hi,

Which reference should I mention while raising the grievance?

Dear Ramana,

May this year? May 2018??

Ideally, you should have got the interest from May 17 to May ’18. You may quote your old EPF number and just inquire about the non-payment of interest for the said period.

Did you check your EPF passbook and see if there was any interest related entry in it??

Hi,

Here is the reply I got from EPFO.

It is informed that after processing your grievance,the following action(s) has been taken:

As on date no circular/orders have been issued/received by/from Head Office New Delhi to/in this Office for crediting interest to the inoperative PF A/cs i.e. beyond 36 months from the date of last receipt of contribution.

Dear ramana,

That’s surprising!

Suggest you to file RTI and inquire about this!

Hi Sreekanth, I had a question regarding the pf withdrawal as, I am trying to claim all pf amount as I have left my job 3 years before and I have not yet withdrawn my pf and I want to withdrawal whole pf and I am trying to withdraw online it says the age is 34 and you are not eligible for 90% withdrawal why this happens as I have not continued my UAN further so I should be eligible for all my PF amount with whatever the interest government is paying on the pf amount even I cannot check how much interest Government have paid please help as I want to claim the whole PF it says I will get the PF after age 58 please advice what should I do.

Dear Shirish,

Are you trying to submit partial withdrawal (Form 31)?

Hi Sreekant,

I am trying to withdraw whole amount for my PF, as I have not continued that PF account and now I want to withdraw the whole PF amount what I paid. I tried to apply online but when I was applying for the same I did not get any option to claim the whole amount I as getting partial withdrawal (Form 31) option and it was return that I can only wthidraw the PF after 58 so please help me I want to withdraw the whole amount.

Dear shirish,

Kindly note that Form 31 is for partial withdrawal.

Looks like your ex-employer has not updated your Date of Joining and/or Date of Leaving the organization, hence you are unable to view Form 19 (for full EPF withdrawal) and Form 10c (for EPS).

Suggest you to check if these details are available under Service history tab of uan portal.

If not available, kindly contact your ex-employer.

Dear sreekanth, I am 61years old and with drawn all prior PF accmalated money for earlier 30years of working.. and now recently had worked for 4’years 6 months till July’2016..and could not get job any where for 8months, and again joined another job from 1st,April’2017 and worked till Dec’2017 for 9months.

Q1: My total service would be considered as more than 5years or not, please confirm.,so that my accumulated amount is not taxable.

Q2: How long i can leave may my PF with PF office to enjoy better interest rate than out side FD in banks.,

Q3: My pension money is accumalated as Rs28,000/00, can I get back this amount or pension paid to me.

Request to help me with your recommendations please.

Regards,

Ravi SV.

Dear Ravi Ji,

1 – Did you transfer the funds from EPF (2016) ac to the latest one (2017)? If so, the total service period is >5years. If not, suggest you to get the transfer done.

2 – As you are more than 58 years of age now, I believe that EPFO may not credit the interest (if no contributions are being made).

3 – Yes.

Dear Sreekanth hi,

Good evening..and thanks for your class cations.

1) I had already transferred funds to the present employer, same UAN number.,and contribution was made till Dec’17 from the just left employer.

2) in that case, when the PF contribution is made till Dec’17, may be my account is active still and why don’t I get interest on accumalated amount PF, for another Two more years.

If you confirm that I don’t get interest, then better I will withdraw entire money.

Please clarify once.

Regards,

Ravi SV.

Dear Ravi ji,

Kindly note that under normal circumstances the EPFO pays interest income on all EPF accounts till an EPF member attains the age of 58 years.

So, you may kindly re-check the applicability of interest payment in your case with your ex-employer or the EPFO.

Kindly read : EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

Let us consider a man who quits job before retirement. And he doesn’t claims his pf for several years. Now the question is that for how long will he get interest in it?

Dear Abhirup..Suggest you to kindly go through my latest article on this topic..click here to read..

If a person moves out of country and decides

1. Stay in the other country for say 2 years (or X Years)

2. Stay in the other country permanently

What is the implication on withdrawing EPF after say two years, or during retirement… will it be considered as interest earned during non working period and will it be taxed?, Technically the person is working but not in india and not contributing so what are the implications

Also, seems like EPF recommends employees to not withdraw the EPF in between job changes, but this will make people think to continue invested as the return ~9% (30% tax) will be about 6% only

Dear Murali,

As per the IT ruling, we can infer that the interest credited during non-contribution period is a taxable income.

I left one Company in Sept 2007 and joined another Company in Oct 2007. The transfer process of PF from the new employer to the new employer took lot of time. In fact the first application was lost and then another application was made. Finally the transfer took place in May 2013. But no interest has been paid after 3 years after 2007, i.e no interest from 2010. Please advise what I should do

Dear Mr BANERJEE,

Are you currently employed and contributing to EPF scheme again?

As per the EPFO’s notification issued in last FY, all in-operative EPF accounts get interest payment from April 2016 onwards.

I am currently working in TCS, which maintains its PF trust.

So If i dont withdraw my PF amount after my Employment with TCS, will I get interest upto age of 58 years even if TCS maintains its PF trust?

Dear Bhargav..I believe that you should receive the interest payment, you may kindly cross-check with your employer as well.

Thanks for your clarifiction.

I also want to about the TDS on PF Interest.

Will TDS be deducted on interest if I withdraw PF amount after 5 year of service?

Dear Bhargav,

Ideally TDS is not deducted on PF withdrawals if service period is more than 5 years.

Kindly read : EPF withdrawals & new TDS rules….

First of all, many thanks for such a nice help you are doing. Above all, your reply to individual comments/questions is really appreciated. I am also hopeful to get some response to my query.

My case is really unique and tricky. I worked 1 year 7 months in India and then 3 years in Germany. During my assignment in Germany, my social security was paid to my Indian EPF account (as per agreement between India and Germany). I now want to withdraw full amount through the new online withdrawal facility. But, I do not have any resident or NRO savings account in India. I only have NRE account which does not allow credit from Indian accounts. So, I guess I must open an NRO account, then link that account to my UAN (of course, my old employer needs to approve that). But, here comes the problem and my concern. Any deposit to NRO account gets 30% flat TDS! Also, since my service (and therefore contribution to EPF) was less than 5 years, EPFO would already deduct 10% as TDS before transferring to my NRO account. That means, I will get instead of N amount (my current EPF total balance), only (N – N/10) * (1-3/10). How is that fair – double tax of already taxed income. How shall I avoid it? Shall I have to file tax in India to claim over taxed amount?

Thank you very much and best regards

Dear Sandeep,

30% TDS in case of NRO accounts is on Interest income, am I right and not on the deposit amount??

“Interest earned on Non Resident Ordinary Account (NRO) is taxable. A TDS of 30% is applicable on it. ”

Yes, if service period is less than 5 years, the EPFO can deduct TDS and also such withdrawal is a taxable income.

However, if you do not have any other income or your Indian income is less than basic exemption limit, you can file your Income Tax Return and can claim the TDS as REFUND.

Kindly read : EPF withdrawals & new TDS rules..

Hi,

Your posts are super helpful, thank you.

I have recently applied for PF Withdrawal with the reason as NRI.

I have submitted PAN and 15G form.

My employment service is under 5 years with an Indian firm.

FP has been processed and credited to my account.

According to Passbook, my EPF total (Employer+Employee contribution) is around 3,80,000 and Pension amount is around 21,000.

It seems that TDS is deducted on both EPF and Pension amounts as the credited amount is lesser than the ones mentioned in Passbook. EPF is deducted by 10% and credited around 3,49,000 whereas Pension is deducted by 7% and credited around 19,000. Hope that’s the right calculation.

My question is will this TDS available in my TDS certificate for the current financial year. If so, when it will appear there? Amounts were credited beginning of this month and these TDS deduction entries are not yet available in my 26A TDS form. Any idea when it will appear?

Dear Ramesh,

Yes, TDS deducted is applicable for FY 2017-18 (if deducted in this FY).

I believe that they may appear by this month end, may be EPFO is yet process the TDS batch of entries..

If you note that TDS is deducted on EPS as well, kindly do update the status here..can be useful for other blog readers and myself…thank you!

Hi,

Good Afternoon,

I have Two Question:

1) Can an employee increase his PF deduction above 20% of salary. IS anything in PF ACT about maximum ceiling?

2) Is interest earned on above 20% will be taxed or not?

Dear Dixit,

1 – Yes, voluntary PF contributions are allowed (VPF).

2 – It is tax-exempt income.

this mean no limt of VPF, i can even go upto 100%

hELLO sREEKANTH

mY DATE OF BIRTH IS 1951. i JOINED A COMPANY IN 2009 AND THEREAFTER pf WAS DEDUCTED FROM MY SALARY AND ALSO COMPANY ALSO CONTRIBUTED. i RESIGNED IN mAY 2017 AFTER COMPLETING 8 YEARS. pLEASE ADVISE WHETHER i WILL GET INTEREST ON THE pf.

Dear Rukmani ji..Yes, you will get the interest amount.

Hi Srikanth,

I was working in private organisation for 15+ years and quit and started my own business since 2 years. I have not withdrawn my EPF balance (contributed during my service in private company) thinking that I will get interest (tax free). When I recently checked my EPF account, the balance remains the same as it was 2 years back. Does this mean no interest has been added to my balance for these 2 years as there was no contribution. Or will I get the interest at the time of withdrawal. Pl. clarify and also advise if I can keep this money in EPF itself till I am 55, so that the total amount is tax fee. Thanks.

Dear Surya .. Even if this new rule is not in-force, you should get interest for the last two years..even as per the old definition, an EPF a/c can become inoperative only after 3 non-contributing years…

So, suggest you to submit a grievance to the EPFO online..click here…

Thanks Sreekanth for clarifying/suggestion, I will raise grievance to EPFO on this online.

Pl. also suggest if I can continue to keep this money in EPF itself for say another 5-6 years, so that I can get decent interest and the total amount is tax free at the time of withdrawal. Thanks.

Dear Surya,

EPF / PPF is a good debt oriented savings product.

In case, you can afford to take risk and have longer investment horizon, you may consider products like ELSS schemes..

Dear Sir,

I found compliance notice at my IT portal asking me to furnish information or reason for not filing of the returns for the FY2013-14. I check my email and didn’t receive any notification mail regarding this and I don’t know when it was raised.

I didn’t file the IT returns because I don’t have tax liability and I thought IT returns are not compulsory if the taxable income is below 5 lakhs. Is it correct?

In Fy2013-14 my salary (only) income was 2.7lakhs and the tax amount has been deducted by my employer and paid to dept. I have short term capital loss of Rs.11,000/- in share market.

FYI, I didn’t file the IT return in FY2012-13 too. I had started the trading from September 2012 and ended in loss of Rs.27,000-/. My salary income was same as FY2013-14.

Please assist me what should I do and how to find the due date for this compliance.

Dear Srinivasan,

If your tax liability is NIL, you may just respond to the notice online with the relevant reason.

Kindly read :

How to respond to non-filing of ITR notice?

Do I need to file my ITR?

Hi Srikanth

I have received the below message form io.helpdesk@epfindia.gov.in

Dear Member, your Inoperative helpdesk reference ID: xxxxxxxxx, has been closed with closing remarks “please submit form 19 & 10c along with id proof cancel cheque for further action.

can you advice on this please. what i should do for further.

Dear kothan,

You are eligible to withdraw EPF amount.

You need to submit withdrawal forms along with the suggested proofs.

You may contact your ex-employer too.

Hi

What will happen if someone goes to abroad for job ( More then 3 Yr) .

Dear Tanusree ..Even in that case, EPFO will pay interest on the EPF account till 58 years of age (member’s age).