Budget 2017-18 & the Finance Bill 2017 have been tabled in Parliament. The income tax rate for those earning between Rs 2.5 lakh and Rs 5 lakh has been halved to 5%. Except this change, all other Income Tax Slab rates have been kept unchanged by the Finance Minister for the Financial Year 2017-18 (Assessment Year 2018-2019).

Tax planning is an important part of a financial plan. Whether you are a salaried individual, a professional or a businessman, you can save taxes to certain extent through proper tax planning.

The Indian Income Tax act allows for certain Tax Deductions / Tax Exemptions which can be claimed to save tax. You can subtract tax deductions from your Gross Income and your taxable income gets reduced to that extent.

Let us understand all the important sections and new proposals with respect to Income Tax Exemptions FY 2017-18. I hope you find this list useful and helps in planning your taxes well in advance.

List of Income Tax Exemptions FY 2017-18 / AY 2018-19 (Chapter VI-A deductions list)

Section 80c

The maximum tax exemption limit under Section 80C has been retained as Rs 1.5 Lakh only. The various investment avenues or expenses that can be claimed as tax deductions under section 80c are as below;

- PPF (Public Provident Fund)

- EPF (Employees’ Provident Fund)

- Five year Bank or Post office Tax saving Deposits

- NSC (National Savings Certificates)

- ELSS Mutual Funds (Equity Linked Saving Schemes)

- Kid’s Tuition Fees

- SCSS (Post office Senior Citizen Savings Scheme)

- Principal repayment of Home Loan

- NPS (National Pension System)

- Life Insurance Premium (Read : ‘Best Term insurance plans‘)

- Sukanya Samriddhi Account Deposit Scheme

(Read : ‘Tax Saving Investment Options u/s 80c | In whose name can they be Invested?’)

Section 80CCC

Contribution to annuity plan of LIC (Life Insurance Corporation of India) or any other Life Insurance Company for receiving pension from the fund is considered for tax benefit. The maximum allowable Tax deduction under this section is Rs 1.5 Lakh.

Section 80CCD

Employee can contribute to Government notified Pension Schemes (like National Pension Scheme – NPS). The contributions can be upto 10% of the salary (salaried individuals) and Rs 50,000 additional tax benefit u/s 80CCD (1b) was proposed in Budget 2015.

As per Budget 2017-18, the self-employed (individual other than the salaried class) can now contribute up to 20% of their gross income and the same can be deducted from the taxable income under Section 80CCD (1) of the Income Tax Act, 1961, as against current 10%.

To claim this deduction, the employee has to contribute to Govt recognized Pension schemes like NPS. The 10% of salary limit is applicable for salaried individuals only and Gross income is applicable for non-salaried. The definition of Salary is only ‘Dearness Allowance.’ If your employer also contributes to Pension Scheme, the whole contribution amount (10% of salary) can be claimed as tax deduction under Section 80CCD (2).

Kindly note that the Total Deduction under section 80C, 80CCC and 80CCD(1) together cannot exceed Rs 1,50,000 for the financial year 2016-17. The additional tax deduction of Rs 50,000 u/s 80CCD (1b) is over and above this Rs 1.5 Lakh limit.

(Read : ‘NPS Scheme – Pros & Cons‘)

Contributions to ‘Atal Pension Yojana‘ are eligible for Tax Deduction under section 80CCD.

Section 80D

Deduction u/s 80D on health insurance premium is Rs 25,000. For Senior Citizens it is Rs 30,000. For very senior citizen above the age of 80 years who are not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above. (Family includes: Self, spouse, dependent children and parents).

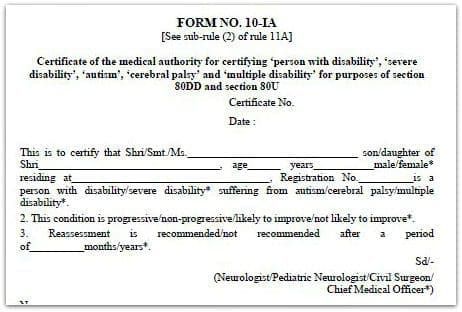

Section 80DD

You can claim up to Rs 75,000 for spending on medical treatments of your dependents (spouse, parents, kids or siblings) who have 40% disability. The tax deduction limit of upto Rs 1.25 lakh in case of severe disability can be availed.

To claim this deduction, you have to submit Form no 10-IA.

Section 80DDB

An individual (less than 60 years of age) can claim upto Rs 40,000 for the treatment of specified critical ailments. This can also be claimed on behalf of the dependents. The tax deduction limit under this section for Senior Citizens is Rs 60,000 and for very Senior Citizens (above 80 years) the limit is Rs 80,000.

To claim Tax deductions under Section 80DDB, it is mandatory for an individual to obtain ‘Doctor Certificate’ or ‘Prescription’ from a specialist working in a Govt or Private hospital.

For the purposes of section 80DDB, the following shall be the eligible diseases or ailments:

- Neurological Diseases where the disability level has been certified to be of 40% and above;

(a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson’s Disease

- Malignant Cancers

- Full Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

- Chronic Renal failure

- Hematological disorders

- Hemophilia

- Thalassaemia

Section 80CCG

Tax Benefits of Rajiv Gandhi Equity Savings Scheme (

Section 24 (B) (Loss under the head Income from House Property)

- Tax benefit on loan repayment of second house will be restricted to Rs 2 lakh per annum only (even if you have multiple house the limit is still going to be Rs 2 Lakh only and the ceiling limit is not per house property).

- The unclaimed loss if any will be carried forward to be set off against house property income of subsequent 8 years. In most of the cases, this can be treated as ‘dead loss‘.

- I believe that this is a major blow to the investors who have bought multiple houses on home loan(s) with an intention to save taxes alone.

- As of now (till FY 2016-17), interest paid on your housing loan is eligible for the following tax benefits ;

- Municipal taxes paid, 30% of the net annual income (standard deduction) and interest paid on the loan taken for that house are allowed as deductions.

- After these deductions, your rental income can be NIL or NEGATIVE and is called ‘loss from house property’ in the latter case.

- Such loss is currently allowed to be set off against other heads of income like Income from Salary or Business etc. which helps you to lower you tax liability substantially.

Section 80E

If you take any loan for higher studies (after completing Senior Secondary Exam), tax deduction can be claimed under Section 80E for interest that you pay towards your Education Loan. This loan should have been taken for higher education for you, your spouse or your children or for a student for whom you are a legal guardian. Principal Repayment on educational loan cannot be claimed as tax deduction.

There is no limit on the amount of interest you can claim as deduction under section 80E. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier.

Section 80EE

This was a new proposal which had been made in Budget 2016-17. The same will be continued in FY 2017-18 / AY 2018-19 too. First time Home Buyers can claim an additional Tax deduction of up to Rs 50,000 on home loan interest payments u/s 80EE. The below criteria has to be met for claiming tax deduction under section 80EE.

- The home loan should have been sanctioned during FY 2016-17.

- Loan amount should be less than Rs 35 Lakh.

- The value of the house should not be more than Rs 50 Lakh &

- The home buyer should not have any other existing residential house in his name.

- Such eligible home buyers can claim exemption of Rs. 50,000/- for interest on home loan under section 80EE from assessment year beginning from 1 st April 2017 and subsequent years.

Section 80G

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act. This deduction can only be claimed when the contribution has been made via cheque or draft or in cash. In-kind contributions such as food material, clothes, medicines etc do not qualify for deduction under section 80G.

The donations made to any Political party can be claimed under section 80GGC.

W.e.f FY 2017-18, the limit of deduction under section 80G / 80GGC for donations made in cash is reduced from current Rs 10,000 to Rs 2,000 only.

Section 80GG

The Tax Deduction amount under 80GG is Rs 60,000 per annum. Section 80GG is applicable for all those individuals who do not own a residential house & do not receive HRA (House Rent Allowance).

The extent of tax deduction will be limited to the least amount of the following;

- Rent paid minus 10 percent the adjusted total income.

- Rs 5,000 per month.

- 25 % of the total income.

(If you are claiming HRA (House Rent Allowance) of more than Rs 50,000 per month (or) paying rent which is more than Rs 50,000 then the tenant has to deduct TDS @ 5%. It has been proposed that the tax could be deducted at the time of credit of rent for the last month of the tax year or last month of tenancy, as applicable.)

Rebate under Section 87A

Tax rebate of Rs 2,500 for individuals with income of up to Rs 3.5 Lakh has been proposed in Budget 2017-18.

- Only Individual Assesses earning net income up to Rs 3.5 lakhs are eligible to enjoy tax rebate u/s 87A.

- For Example : Suppose your yearly pay comes to Rs 4,50,000 and you claim Rs 1,50,000 u/s 80C. The total net income in your case comes to Rs 3,00,000 which makes you eligible to claim tax rebate of Rs 2,500.

- The amount of tax rebate u/s 87A is restricted to maximum of Rs 2,500. In case the computed tax payable is less than Rs 2,500, say Rs 2,000 the tax rebate shall be limited to that lower amount i.e. Rs 2,000 only.

- The Tax Assesse is first required to add all incomes i.e. salary, house income, capital gains, business or profession income and income from other sources and then deduct the eligible tax deduction amounts u/s 80C to 80U and under section 24(b) (Home Loan Interest) to come up with the net taxable income.

- If the above net taxable income happens to be less than Rs 3.5 lakhs then the tax rebate of Rs 2,500 comes in to the picture and should be deducted from the calculated total income tax payable.

Section 80 TTA

Deduction from gross total income of an individual or HUF, up to a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account with a bank, co-operative society or post office can be claimed under this section. Section 80TTA deduction is not available on interest income from fixed deposits.

Section 80U

This is similar to Section 80DD. Tax deduction is allowed for the tax assessee who is physically and mentally challenged.

Conclusion

It is prudent to avoid last minute tax planning. Do not invest in low-yielding life insurance polices or in any other financial products just to save taxes. It is better you plan your taxes based on your financial goals at the beginning of the Financial Year itself. Plan your taxes from April 2017 itself, instead of waiting until late December 2017 (or) January 2018.

(Read : ‘Best ELSS Tax Saving (Sec 80c) Mutual Fund Schemes for FY 2017-18‘)

It is OK to pay some taxes when you can not save or cannot invest in right financial products. But, do not invest just to save TAXES. The cost of buying wrong financial products may outweigh the cost of taxes. Tax Planning is not a goal but a tool. Remember “Tax Planning alone is not Financial Planning.”

Also, kindly understand the tax treatment of the selected investment products across the different investment stages (i.e., investment, accrual & withdrawal) and then invest. (Read : ‘Tax treatment of various Financial Investments‘)

I believe that the above list is useful for your Tax Planning purposes. The above Income Tax Exemptions FY 2017-18 are applicable for financial year 2017-2018 (Assessment Year 2018-2019).

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (Post first published on : 27-March-2017)

Join our channels

Thanks for sharing lot of knowledge

medical reimbursement for the month of february 2018,but payment recive in april 2018,please tell me tax paid by me or not tax paid in year 2018-19 return

Dear Sanjay,

If the money received through a claim under a medical policy from insurance company, it is only a reimbursement of expenditure already incurred by the policyholder. As this does not amount to profit or income for the insured person, this money is not taxable.

Interest on House loan paid is Rs 2 Lac for a jointly owned and co-borrowed loan.

Can both husband and wife claim Rs 2 Lac each to this Rs 2 Lac interest meaning they paid 2 lacs total but exemption they will claim Rs 2 Lacs each total 4 lacs – it is correct .. ?

Dear Mr BORA,

If the total interest paid in a FY is Rs 2 lakh.

Individually, both of them can claim Rs 1 lakh each (assuming the ownership ratio as 50:50).

deduction under 80EE of rs 50000/- can be availed or not if possesion of house is not received.

please clearify

dvatnani**@rediffmail.com

Dear Mr Vatnani,

Yes, sec 80EE tax benefit is available even on under-construction properties..

Sir senior citizen below 80 year how can I get tax exemption on intrest earned from bank fd for one year

Dear AMREESH ji,

I am assuming that you would like to know about new Section 80TTB.

Suggest you to kindly go through this article : FY 2018-19 Section 80TTB | Tax Exemption of Rs 50,000 on Interest Income to Senior Citizens

Dear Mr,.Reddy I am a senior citizen the total expenditure on my medical treatment including doctor’s consultations during FY 2017-18 is around Rs.20,000/- how much rebate & under which section of IT Act I can avail.

Dear Mr GUPTA,

If you have a salary income with medical allowance, you can claim as reimbursement of medical bills (by submitting it to your employer) up to Rs 15k.

If you pay medical insurance premium then that can be claimed u/s 80D.

Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions u/s 80D.

Related article :

Health Insurance Tax Benefits (under Section 80D) for FY 2018-19 / AY 2019-20

Dear sir, I want to know whether 80gg concession is applicable for women in contractual job getting consolidated salary from education deptt. RMSA. How to calculate 10% of total income.

Dear Rajiv,

Section 80GG is applicable for all those individuals who do not own a residential house & do not receive HRA (House Rent Allowance).

Hi Sir

I have taken cc/over draft loan in a canara bank against collateral security for the business purpose. and I took MOD(MEMORANDUM OF DEPOSIT OF TITLE DEEDS) for the bank for the loan purpose.that mod charges was around 60000 Rs. is it possible for claiming any tax deduction ?

and my company material ( plastic hoses) was fired by some person.I have an fir copy . is it possible for claiming any tax deduction ?

and I have taken personal loan using my car in HDB finance for the business purpose. is it possible to take interest of personal loan for claiming any tax deduction ?

Dear Ganesan,

I believe that tax benefit is not available for the above three scenarios.

Hi Sreekanth

I own a house and claiming HBA interest under section 24(1). AsI am having only one house and purchased first time in the year 2011, Can I get exemption under section 80EE also.

Dear Ashwath,

Provided you meet below other criteria as well;

The home loan should have been sanctioned during / after FY 2016-17.

Loan amount should be less than Rs 35 Lakh.

The value of the house should not be more than Rs 50 Lakh &

The home buyer should not have any other existing residential house in his name.

What is the maximum exemption on dividends on AY 2018.19?

What is the meaning of Dividends, Gross on ITR2 for AY 2018.19?

Dear Narain,

Up to Rs 10 lakh of dividends (on stocks) received is not subject to taxes.

Under what clause of the IT act the exemption of Rs 10 lakhs of dividend is allowed? Pl reply

Dear Natarajan,

Dividend received (up to rs 10 lakh) from an Indian company which has suffered dividend distribution tax is exempt from tax under section 10(34).

Very helpful

Sir,

Is Gratuity exemption upto Rs 20 lakhs available for A.Y. 2018-19?

Dear Chandrasekhar ..I believe it is applicable for AY 2018-19. You may kindly re-check this with a CA too..

Hi Sreekanth Sir

I'm a defence personal, am I eligible for transport allowance tax exemption bcoz I'm receiving monthly 1893 Rs.

Please tell me how much and under which section.

And

Can I fill medical exemptions for small treatments like fever, eye, dental treatment, or small blood tests etc.

Bcoz my family is paying more than 20k per year.

And please provide a detailed list of exemptions for defence personal.

Thanks

Dear Mohit ji,

You can claim Transport or conveyance allowance of up to Rs 1,600 pm in FY 2017-18 / AY 2018-19 under section 10(14)(ii) of Income Tax Act.

You may go through THIS LINK for list of allowances and benefits available for the salaried.

SIR,

I AM AN RETIRED BANK OFFICER

PENSION DRAWN FOR APRIL 2018- 33600/-

TOTAL PENSION FOR THE FY 2018-19 — 4,03,200

EXEMPTIONS — STD DEDUCTION — 40000/-

HEALTH INSURANCE PREMIUM – 12000/-

ANNUAL MEDICAL CHECK-UP – 5000/-

( MAX ADMISSIBLE )

———

57000/-

NET TAXABLE INCOME 3,46,200

TAX @ 5 % ABOVE Rs.3.00 lakhs 2,310

tax rebate U/S 87A 2,500/-

TAX LIABILITY NIL

SIR,

PLZ CLARIFY WHETHER I AM RIGHT IN CALCULATION

P.V.RAO

AGE 64 YEARS

Dear Sir,

Standard deduction of Rs 40,000 is available from FY 2018-19 / AY 2019-20 only.

Kindly read : Rs 40,000 Standard Deduction from FY 2018-19 | Does it really benefit the Salaried?

You may kindly refer to this income tax calculator AY 2018-19..

Sir,

I am referring my estimated income from pension during FY 2018-19 only. Please guide me on the query raised.

pvrao

Dear Sir,

Yes, your calculation is correct.

Hi ShriKanth,

I have taken home loan from a bank for a flat which is now on rent. Can I take a loan from family members or relative on the same rate of interest as that of bank and prepay part of bank loan. In that case can I claim rebate under section 24 for interest part of both the loans. If yes What paper formality will be reqd.

Dear Hanuman,

Yes, you can.

If you take a loan from a recognised lender, you will be able to avail of the tax benefits under Section 80C and Section 24.

If you do not take the loan from a recognised lender but do so from a relative or friend, then you only get part of the tax benefit.

The interest you pay is eligible for deduction under Section 24.

However, you will not get the benefit of principal repayment under Section 80C..

To be eligible for the deduction of principal payment, the loan has to be from a list of recognised lenders such as banks, financial institutions or your employer company.

Ensure that you take the loan by cheque. When you repay, make sure you do it by cheque only.

Get a statement from the lender (Friend/relative) stating the amount paid by you every year.

When you take a loan, document it legally. Make sure that it has the lender’s name and your name, the loan amount, the repayment tenure and the rate of interest.