“A sum of Rs 27,000 crore is lying as ‘unclaimed amount‘ in the EPF accounts”. That’s a huge amount!

The reasons for not claiming EPF Scheme benefits can be due to ignorance/ negligence on part of the EPF members, procedural delays by the EPFO or ‘no-claim’ made by the nominees/legal-heirs after the death of the subscribers.

As an EPF subscriber, you may be well aware of the EPF Withdrawal claim submission procedure that needs to be followed by the PF members. But, are you aware of the EPF Death Claim Procedure? God forbids, in case of an unfortunate event, will your nominee/legal-heir be able to claim EPF, EPS and EDLI Scheme benefits without any hassle? Do they know the EPF Death Claim Settlement Procedure? Let’s discuss..

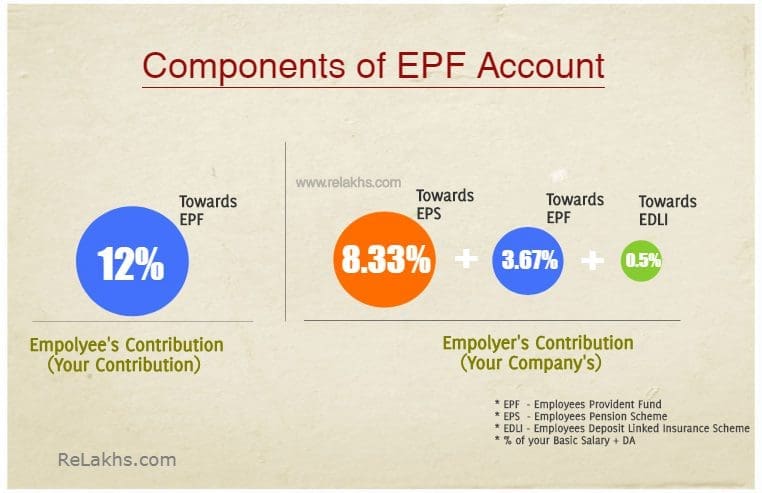

EPF Account Components & Scheme Benefits

If you are a salaried person and contributes to EPF Scheme, you may kindly take out your monthly pay-slip and check, you can notice that every month 12% of your “salary” is contributed towards EPF account. Your total monthly contribution is routed towards Employees’ Provident Fund.

Your employer also contributes 12% of the salary to your EPF a/c. But your employer’s monthly contribution is routed towards various components of PF.

Out of this 12% of your employer’s monthly contribution, 8.33% goes towards EPS (Employees Pension Scheme) and only 3.67% is invested in Employees’ Provident Fund (EPF). So, you contribute 12% of your basic salary and your employer contributes 3.67% of your basic salary towards EPF deposits.

Your Employer also contributes for EDLI Scheme (Employees Deposit Linked Insurance) premium for maximum of 0.5% of Rs 15000 i.e. Rs 75 per month. An employee gets a life insurance cover of Rs 2.5 lakh to Rs 6 lakh (maximum).

How to make EPF Death Claim by Nominee/Legal-heir?

Let’s now understand the important points and the procedure to claim EPF, EPS & EDLI Scheme benefits on death of a Subscriber (EPF member).

EPF Withdrawal Claim on death of a Subscriber

Upon the death of an EPF member, the Employees Provident Fund amount is paid to the nominee that was nominated at the time of opening of the account. If there was no nominee assigned then the EPF amount is paid to the immediate members of the family (legal-heirs).

EPS Pension Claim on Death of an EPF member

A PF Scheme member’s family becomes eligible for the monthly pension benefits in the following cases:

- In case of death of the member while in service and the employer has deposited funds in his/her EPS account for at least one month (or)

- If the member has completed 10 years of service and dies before attaining 58 years of age (or)

- In case of death of the member after the commencement of the monthly pension.

Who can claim EPS Family Pension? -On the death of the employee, EPS pension is payable to ;

- The spouse and two children below 25 years of age.

- When a child reaches 25 years of age, the second child below 25 yrs of age will be given pension and so on.

- If the child is disabled, he/she may a get pension till his death – In any case, only 2 children will receive the pension at a time.

- In case of member not having a family, the pension is payable to single nominated person.

- If not nominated and having dependent parent the pension is payable first to Father and then on father’s death to Mother.

Life Insurance Claim under EPF Account EDLI Scheme?

The Employees’ Deposit Linked Insurance Scheme(EDLI) is an insurance cover provided by the Employees’ Provident Fund Organization (EPFO). A nominee or legal heir of an active member of EPFO gets a lump sum payment of up to Rs 6 Lakhs Rs 7 lakh in case of death of the member during the service period (active EPF member).

- The insurance cover provided under EDLI Scheme depends on the salary drawn in the last 12 months of the employment before death.

- There is no minimum service period for availing EDLI benefits.

- An EPFO member is only covered by the EDLI scheme as long as he/she is an active member of the EPF. His family/heirs/nominees cannot claim it after he leaves service with an EPF registered company.

- The insurance benefits can be availed by the PF Subscriber’s family members, legal heirs or nominee(s). (Family – except major sons, married daughters with major sons, and married grand-daughters).

- In case the member was last employed under an establishment exempted (Private Trust) under the EPF Scheme 1952, the employer of such establishment should furnish the PF details of last 12 months under the Certificate part and also send an attested copy of the Member’s Nomination Form.

How to claim EPF, EPS or EDLI Scheme Benefits?

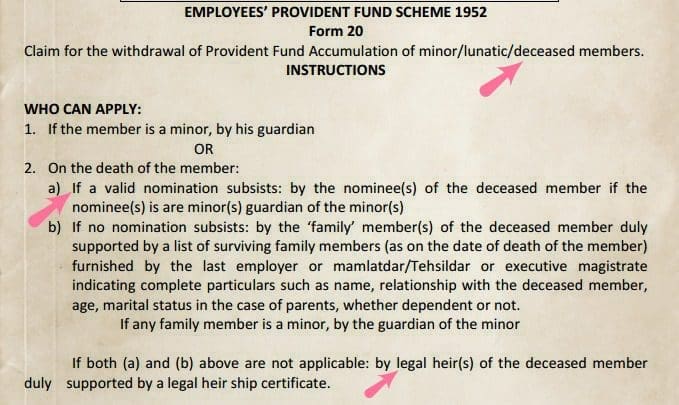

Earlier, to claim EPF, EPS and EDLI insurance amount, the nominee of a PF member had to submit multiple Claim forms to the EPFO. Form 20 for EPF Withdrawal, Form 10D to claim EPS Pension benefit and Form 5(IF) for EDLI Scheme benefit.

However, the EPFO has recently introduced a ‘Composite Claim Form’ in death cases and has also set a time-line of 7 days to process all EPF Account related Death Claims.

You can download EPF Composite Claim Form for EPF, EPS or EDLI and submit the filled form to the concerned EPFO Regional office.

You need to get the member’s last employer’s sign and seal on the composite claim form. In case, the company is closed then you (claimant) can get the claim form signed by the bank manager of your bank account.

The documents that need to be enclosed with EPF Composite Death Claim Form are;

- Death Certificate of the EPF Member.

- Joint photograph of all the claimants (nominees/legal-heirs).

- Date of Birth certificate of children claiming pension (if any).

- EPS Scheme Certificate (if applicable).

- A copy of cancelled cheque or attested copy of first page of bank Pass Book.

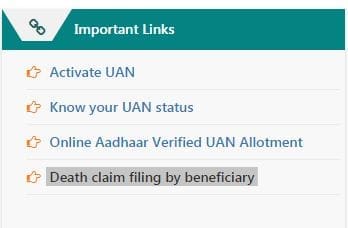

How to do EPF Death claim filing by nominee/beneficiary online?

The EPFO has recently launched an online provision to submit PF death claim forms by the member’s beneficiary.

A word of advice! – In case, you (EPF member) haven’t yet updated your EPF account nomination details then kindly do it immediately. It is very important! Also, do update/change your nominee details after you get married.

In case of death of a member, advisable to file the death claim by the beneficiary, maximum within 3 years of the date of death of the subscriber.

I hope you find this article useful and informative! Do share this information with your family members. Cheers!

Continue reading:

- New EPF Rules 2021 | Latest Amendments

- How to submit Online EPF Death Claim by Beneficiary? | Latest Online Procedure

- How to do EPF e-Nomination with Beneficiary Aadhaar & Photo? | Latest & New Online Procedure

- Nominee Vs Legal Heir : Who will inherit (or) own your Assets?

- Online EPF Withdrawal Facility : Details & Procedure

- Tax Implications of EPF, PPF & NPS Withdrawals (Full / Partial) & Maturity proceeds

- Provident Funds – Types & Tax Implications

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (Post first published on : 26-June-2019)

Join our channels

the widow of the deceased person has got a letters of administartion from high court to claim PF /EPS/ EDLI/ gratuity

she has minor child who is 17 year old

husband used to work for multinational which has a provident fund trust.

as the LOA from is categorical that only the widow has right to claim all is it neccesary to still give details of minor daughters, her bank account and aadhar etc.?

the company where husband was working is insisting on daughters aadhar. daughter doesnt have aadhar

can the mother as a natural guardian of the child opt out of the claim in favour of her mother ?

can the child when he she turns major opt out of claim as a nominee when she turns 18 ?

My father was a EPS pensioner and now after his death, we want to claim widow pension for my mother. We have filled up the Composite Claim form for Death Cases, but it asks for Signature and verification by the employer. Is this necessary or only my mother’s signature (claimant) is sufficient? Thank you!

Hi Srikanth Sir,

My name is Shiva,

My mother use works in muncipal Nagara Panchayithi died in 2014, My father also died on same day,our fate.

Pf Active member for 2 years.

Initially we have submitted Claim,file sent back reason is employer not paid 2011-2012 yearly pf amount.

At that time my sister is not married.

Now we want to submit the claim, should we apply both sis and me as dependents or only on name of mine.

And very important one, respective nagarpanchayath pf consultant saying that we are not Elgible for EDLI thing mentioning like employee should die in duty time only then only can claim edli benefit. make us to fill two claim forms Separately for each one me and my sis even after there is composite claim form. EDLI contribution will have every employee or any exception. Kindly help us Sir, we will be very thankful to you.

My husband has not linked his all old PF account to UAN number. I do not have any of the all old PF numbers and pension numbers. Need your help and guidance to claim the money. For my kids education.

Dear Author,

I have a question. After the death of member, spouse will get the pension amount. And if the nominee is also died getting pension amount for 2 to 3 year. Can legal heir can withdraw the remaining pension amount. If No, then what would happen to the remaining pension amount of 8.33% deposited in EPS for all these long period. If yes, what is the procedure.

Thanking you,

Regards

If Employee and nominee both (husband & wife) dies. Since there is only one nominee then will all amount goes to child even if child was not assign as nominee?

Hi Sir,

Please confirm how much time it will take for after document submission for death claim, pension and pf claim ?

Regards

Deepak Rajora

Hello Author,

Thanks for the detailed article. Nicely Written. Can you please confirm what happens if some of the nominees pass away. How does that distribution happen between surviving nominees?

Dear Shashi,

Ideally, an EPF member can/should change/update the nomination details then!

Related article : Nominee Vs Legal Heir : Who will inherit (or) own your Assets? | Importance of WILL

All Required Form and Document for Employee Death Claim

Hi Srikanth, How to calculate EDLI in case of death of an employee who worked less than 1 year. (9 Months)

Dear Dakshinamoorthy,

There is no minimum service period for availing EDLI benefits.

The procedure for claiming is same as given in the article..

Dear Sreekant– kudos you are doing a great job of educating general public.

My query – can e-nomination on UAN portal be done post death of the subscriber ?

Dear Aditya,

Legally/Ethically, is n’t it wrong??

My sister’s husband is passed away. She is having 10yr old son. What are the formalities to claim and features

Dear Shri,

Please go through the points given in the above article.

If nomination has been mentioned (can check with the employer as well), can claim through EPFO portal as beneficiary.

Hi Sir,

I submitted death claim on October 2020 and still not received any response from them.How much time will they take to credit the PF and EDLI amount as it is around 5months but still not credited?

Dear Pandu,

Ideally it should have been processed by now (generally they take 2 to 4 weeks).

You may kindly submit a grievance request to them, via this link..

Related article : EPF Whatsapp Helpline Number for Grievance Redressal | Whatsapp Contact numbers of EPFO Regional Offices

SIR OUR EMOPLYER WAS PASS AWAY HOW MAKE JD WITH OUT SIGNATURE CALL ME 8197380404

Hi Sir, i have submitted death claim on 10dec 2020 offline and have not recived any response.

How many days will it take to process the claim ?

Dear Ramya,

the EPFO has recently introduced a ‘Composite Claim Form’ in death cases and has also set a time-line of 7 days to process all EPF Account related Death Claims.

Suggest you to submit a grievance redress request to them via this link..

Related article : EPF Whatsapp Helpline Number for Grievance Redressal | Whatsapp Contact numbers of EPFO Regional Offices

DOB CERTIFICATE IS COMPALSARY FOR CLAIMING DEATH PERSON PF ?

Dear Saurabh,

The documents that need to be enclosed with EPF Composite Death Claim Form are;

Death Certificate of the EPF Member.

Joint photograph of all the claimants (nominees/legal-heirs).

Date of Birth certificate of children claiming pension (if any).

EPS Scheme Certificate (if applicable).

A copy of cancelled cheque or attested copy of first page of bank Pass Book.

Hi sreekanth, please share me your no. I need to understand more on this..please share ur no.

Dear pavithra,

I do not provide suggestions over phone, apologies!

In case, you dont want to publish your query here (in public domain), you may kindly reach me through the Contact us page..

In case death of member unmarried his father govt servent and mother is house wife. Is mother or father is eligible for pension

Dear Hari,

As per the EPFO’s rules – only DEPENDENT parents can claim the EPF pension.

“As per the EPF Act, only defined family members can be nominated in an EPF account.”Under the EPF Act- (i) in the case of a male member ”family” means his wife, his children (whether married or unmarried), his dependent parents and his deceased son’s widow and children…..”

“Family, in respect of whom nomination may be made, is defined differently for the purpose of Provident Fund Scheme and Pension Scheme. In the case of EPF, a member has an option to nominate even his/her parents, apart from spouse and children. However, in the case of EPS, a member can nominate only his spouse and children.”

“In case of EPS if the person is unmarried, then pension will be payable to dependent father/mother.”

In this case pension contribution amount is paid to father/ mother or not

Dear Hari,

Legally, as they are not dependent, pension is not payable.

Kindly check with the concerned employer as well..

hi br just information employees working unexpected is was death any help in family member pf money depend person no but children bank deposit

Dear Sir,

Our employee was Suicided at his 36 Year of Age on 14.12.2020 and he was EPF Member for more than 6.5 years .His wife is eligible for EDLI Claim and Monthly Pension as a legal hire.

Hi i trying to apply for Death claim filing by beneficiary but i m getting error msg date of death is less than nomination date what it means

The same thing I am getting. What you did for that?

Dear Sonali,

Suggest you to kindly take help of the EPF subscriber’s employer..

Dear sir,

Your doing excellent service by solving queries of innocent people.

My queries are

1. Can E nomination be filled after death of person ?

2. If yes, Can Online EPF Death Claim be made by Beneficiary?

3. Is legal heir certificate compulsory for filing S.no 2.

Your response would be highly useful.

I also have the same question. Do you know the answer to the question?