National Pension Scheme – Why NPS is not a good Investment?

A long-term investment option for your retirement planning should ideally have below features;- It should be simple and easy to understand

- Should be flexible

- Should have high liquidity

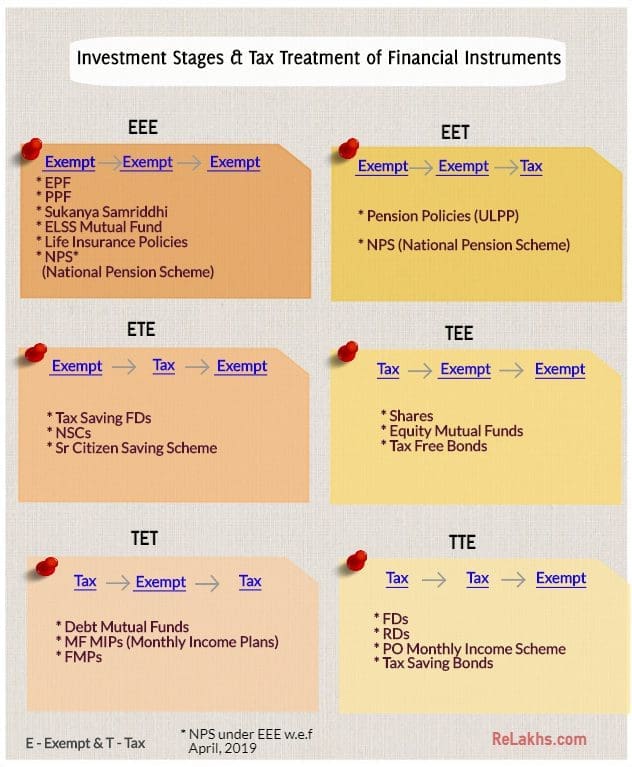

- Should be a tax efficient product and ideally should fall under Exempt – Exempt – Exempt category.

- You should be able to withdraw the whole corpus at the time of retirement and you should be allowed to re-invest the corpus as per your choice/requirements.

- Lock-in Period : National Pension Scheme has a high lock-in period. The retirement age is fixed at 60 years. You can not withdraw the entire corpus till your reach 60 years of age. If you look at other tax saving investment options like PPF, ELSS, EPF, NSC etc., then they all have low lock-in period. PPF has a 15 year lock-in period, 3 year lock-in period for an ELSS fund, you can withdraw EPF if you are unemployed for 2 months and so on.

- Pre-mature withdrawal :

Up to 10 years, no partial withdrawals are allowed. Partial withdrawal up to 25% of own contribution (excluding contribution from the employer) only is allowed after 10 years for defined expenses. In the latest rule change, PFRDA (Pension Fund Regulatory And Development Authority) has relaxed the withdrawal norms to the effect that now the subscribers can withdraw upto 25% of contributions starting from the third year of opening of NPS (National Pension System) account. These revised NPS Partial Withdrawal rules are effective from January 10, 2018.- These defined expenses are for higher education, medical treatment & construction of house. There are certain other restrictions as well for making partial withdrawals.

- Latest update (20-Jan-2018) : ‘Latest NPS Partial Withdrawal rules (2018) | Revised NPS Premature withdrawal rules‘.

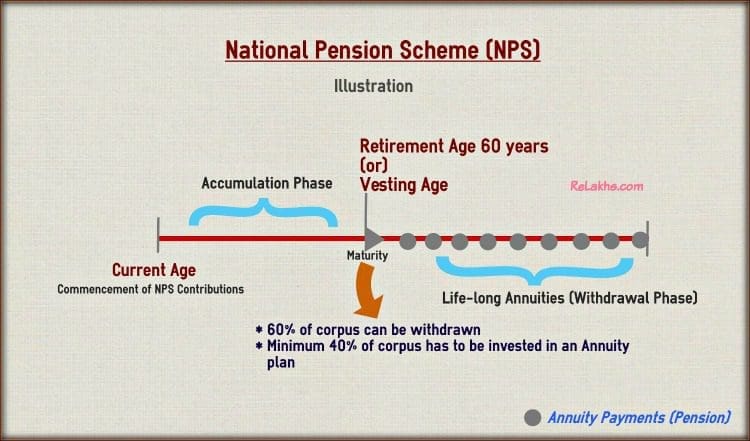

- Withdrawal at maturity : After attaining 60 years of age, you are allowed to withdraw only 60% of the total Corpus amount.

- Annuity Plan :

- At least 40% of the accumulated wealth in the NPS account needs to be utilized for purchase of annuity/pension plan when you turn 60 years.

- Let’s understand this with an example : If your total corpus is Rs 100 at the time of retirement (60 years), you can withdraw Rs 60 as a lump-sum amount and Rs 40 (minimum) has to be used to buy an Annuity plan from a Life insurance company. Out of the sixty rupees, Rs 20 will be taxable as per your income tax slab at the time of retirement

- (Latest update : Dec 2018 – W.e.f 1st April, 2019, this Rs 20 would also be tax-exempt) and the Rs 40 is tax-free amount. From FY 2018-19, this partial tax-exemption on NPS withdrawal is now extended to self-employed individuals also .

- Kindly note that the taxes are applicable on the corpus amount and not just on the Gains. (The minimum quantum of investment in Annuity product depends on WHEN you choose to exit from the NPS account).

- If you invest Rs 40 (lump sum) in an Annuity plan offered by a life insurance company, they in-turn will give you pension/annuity at periodic intervals. Unfortunately, even this annuity income or pension income is taxable as per the current laws.

- Annuity income is taxable under the head ‘income from other sources’. Why do you want to receive an income which is chargeable to tax during your ‘retirement age’?

- NPs falls under EET Category : The contributions made during the accumulation phase are exempt from income taxes, the returns earned during the accumulation phase are exempted but at maturity the corpus amount (60%) is subject to taxes. Latest Update (Dec 2018) : This 60% withdrawable corpus is made tax-exempt w.e.f. April, 2019. So, we can consider NPS under EEE category. But, do note that Annuity income earned is still a taxable income.

- The contribution to Tier-I account of NPS is only eligible for tax benefits.

- Latest Update (Dec 2018) : Contribution by government employees (only) under Tier-II of NPS will now be covered under Section 80 C for deduction up to Rs 1.5 lakh for the purpose of income tax provided there is a three-year lock-in period. This is w.e.f April, 2019.

- Low Annuity rates :

- The annuity rates offered by the life insurance companies are pretty low. Kindly remember that the pension amount is dependent on the annuity rates.

- What is annuity rate? – In return for a lump sum; the money you have saved in your pension pot, an annuity provider (insurance company) will give you an annual income for the rest of your life.

- The yields on annuity products offered in the market today are in the range of 5 to 7% only. This is low when compared to other conservative products like Debt mutual funds, Senior citizens Savings Schemes, Post office MIS, or MF MIP Schemes etc.,

- So, low annuity rates (pension rates) may not beat inflation.

- I personally believe that it is like you accumulate wealth and lose all the wealth to Annuity Plan Provider.

- Types of Funds & Allocation :

- NPS Scheme has three different types of Funds – i) Equity fund, ii) Corporate Bonds & iii) Government Securities. Under Equity Fund option, subscriber is allowed to invest only up to 50% of contribution amount. When you are investing for longer period, why should you restrict your equity exposure to just 50%? In case of Govt employees, the total equity portion of the tier I account cannot be more than 15% (increased up to 50% w.e.f. April, 2019). Government employees also do not have the option to change the contributions made to each fund.

- Latest Update (29-Nov-2016): The existing ‘Life Cycle Fund’ with 50% max equity exposure is renamed as ‘Moderate Life Cycle Fund’. The new allocation option would be ; 50% equity exposure till the age of 35 and reduces it by 2% every year till the age of 55. A new fund option called ‘Aggressive Life Cycle Fund (LC-75)’ has been introduced. The fund invests 75% in equities till age of 35 and then cut exposure by 4% every year. The cuts will slow down to 3% per year between 45-50 years and to 1% per year between 50 and 55 years.

- Latest update (04-March-2017) : With effective from 1st April 2017, NPS subscribers can change their investment option and asset allocation ratio ‘twice’ in a year than the existing once in a year.

- Equity funds Investment Strategy : Till last year (2015), equity funds of NPS were mirroring the returns of the index because pension funds were supposed to invest in index stocks (Large Cap Stocks) only. But from September 2015, fund managers (SBI/ICICI/UTI/LIC/HDFC/Kotak/Reliance) have been allowed to invest in a larger universe of stocks and follow an active investment strategy that does not mirror the index. But, most the fund managers are yet to follow or implement these new guidelines. Most of the funds do not even have more than 10% of their equity corpus allocated to non-nifty stocks (mid-cap stocks).

- The contribution to Tier-I account of NPS is only eligible for tax benefits.

Join our channels

Hi Sreekanth,

I am 28 and I had started contributions to Superannuation Fund six years back. Now,an option has arisen in my company to opt out of it and transfer all its accumulations to a NPS account.

I desperately want to close my superannuation account and withdraw all its accumulations but since that is not possible,should I create a NPS account and then transfer all the SAF’s accumulated money to it.

PS: The growth of money in the SAF has been pathetic – 25% over the course of 6 years.

Thanks in advance.

Regards,

Rohit

Dear Rohit,

You may go through this article : Transfer of EPF to NPS is possible now! But, should you Switch from EPF to NPS?

Hi Sreekanth,

Thanks for sharing the link.

Would like to know your advice on my case though.

I have an ICICI Group Superannuation.Considering my profile,would you advise creating a NPS account and transferring all SAF’s funds to it and closing the SAF account or something else.

PS- I have both EPF and Superannuation account for the past 6 years and both are paid through salary by my employer.

Regards,

Rohit

Dear Rohit,

I believe that NPS can be a better option when compared to super annuation, if you have long-term horizon..

Great,Thanks!

Hi Sreekanth,

I am 34 & I have exhausted my 80C limit through PF contribution, ELSS (Axis), Term Insurance & Home loan.

I have 2.5k monthy SIP running in each of the following MFs:

1) SBI Magnum Midcap Fund (G)

2) Mirae Asset Emerging BCF (D) (G)

3) SBI Small Cap Fund (D) (G)

4) Motilal Multicap 35 Fund (D) (G)

5) SBI Small Cap Fund (D) (G)

As i am in 20% tax bracket, should i invest 50k in NPS to save tax.

Else suggest some retirement corpus options with free will to withdraw the money.

Thanks in advance.

Regards,

Sankar Kumar.

Dear Sankar,

Individually the above listed funds are good, but your portfolio has a higher concentration of Small/Mid-cap funds and has a very high risk profile.

You may re-look at your portfolio.

If you are looking at liquidity as one of your investment objectives then NPS is not a product to opt for.

Kindly read :

* List of all Popular Investment Options in India – Features & Snapshot

* Mutual Fund Portfolio Overlap Comparison Tools

* Best Mutual Fund Schemes to invest Now!

I m west Bengal state government employee. No nps schem provide for wb govt. Employee in wb govt rules.

Can I invest in NPS scheme individual ?

Dear Mr SARKAR,

Yes, you can invest..

Kindly go through the above points and take an informed decision!

Hi Sreekanth, Thanks for the great article. Please provide some details on Rate of Return of NPS. Thanks.

Dear Yogesh,

You may go through my latest article on NPS Funds’ Returns @ Best NPS Funds 2019 – Top NPS Fund Managers

Hi Sreekanth,

Thanks for this article. My question is with regard to additional tax benefit for investment up to Rs 50,000 in NPS. I am a government employee, already having nps tier 1 account so if I invest Rs.50k in tier 2 for additional tax benefit then, when can I redeem this amount from tier 2 ? Is this amount under lock-in-period ? how much ? As far as I know, in tier 2 account, the subscriber can deposit and redeem any time so, is there anything special about this investment of Rs.50k ?

Dear Pankaj,

Contribution by government employees (only) under Tier-II of NPS will now be covered under Section 80 C for deduction up to Rs 1.5 lakh for the purpose of income tax provided there is a three-year lock-in period. This is w.e.f April, 2019.

Thanks, not only for your reply but also for such quick reply. I wish almighty give you all strength to continue this generous work.

Thank you dear Pankaj for your kind words.

Keep visiting ReLakhs.com !

That is quiet an information. I did recently hear about NPS and I was planning to invest in it. And the of course I though of it just considering the immediate Tax exemption. Now I have clarity on this product and I do not want to go for it.

Thank you Sreekanth.

Dear Sheel,

Glad you find this blog post useful to you! Cheers.

Keep visiting ReLakhs.com

Will 40% principal amount invested into annuity be returned to nominee in case of demise of the account holder (say at the age of 70)

Dear Vishal,

It depends on the type of Annuity plan chosen by the Subscriber..

Hi Sreekanth,

People contribute Rs 50,000/yr towards NPS. I am 29yrs old. If I do SIP of 5-6k per month in small cap funds for the next 30 yrs, do you think that will be the best retirement planning or replacement of NPS?

Dear Vineet,

In investment planning, Asset allocation is equally important. One should not depend entirely on one asset to achieve your long term goal. Investing in Debt is also important.

In case of equity allocation, yes, you may prefer investing in MFs to NPS. Kindly pick a multi-cap fund and mid-cap/small cap fund for your long term goal.

Related articles :

* Best Mutual Funds 2018-19 | Top Equity Funds post SEBI’s Reclassification

* Retirement Planning in 3 Easy steps

* List of Best Investment Options in India

HI Sreekanth,

What is your view on the Tier II in NPS. It is completly flexible with very low expense ratios. Also with new aggresive guideline of 75% in stocks is it not the best investment option

Dear kolukula .. Even then I would prefer to invest in Equity mutual funds which are more transparent, tax effective, and have wider choice.

Dear Sir,

I want to invest Rs.20,000 per month through SIP mode for short capital gain in option to FD/RD, so request you to suggest suitable Debt fund(Short Term,Ultra Short Term, MIPs ,Liquid)

Regards,

Ajay Mokani

Dear Ajay,

Kindly go through below articles ;

Types of Debt funds.

Best Debt funds.

Best MIP Funds.

MF Taxation rules.

Hi Sreekanth,

I am 35 & I have exhausted my 80C limit through Employee PF,School fees,sukanya etc.

I have 15k monthy SIP in good equity MFs , & for debt portion I was investing approx 3k p.m. in PPF which will now offer 7.9% only

Can i invest in NPS instead of PPF for debt portion of my portfolio , it will also help me save tax as I am in 20% bracket?

Thanks

Manish

Dear Manish,

I believe you might have gone through the above article.

With the given product structure, personally I will not put my money in NPS product, though it offers additional tax saving of up to Rs50k.

Read: List of best investment options!

My Self Vijay, my age is 40 , from march-2017 i have started investing in NPS. I am planning to invest Rs. 5000/ month.

Am i doing this correct ??

Please help ..

Vijay

Dear vijay ..As mentioned in the above article, NPS is not a great choice based on current product structure & taxation rules.

Personally, I prefer not to invest in NPS.

Very nice article Sreekanth.

I need some guidance with my financial planning:

I have divided my financial planning in three time parts short (3 years), mid (8 years), long (retirement).

And I am doing investment in PPF, VPF, ELSS.

So my doubt is:

1. all the investment done in ELSS, can it be considered for long term planning or not. If not do I have to plan all three time horizons separately than my tax savings investments.

2. Balanced-Large Cap-Mid Cap which of these is best for mid term planning ? keeping my 35% investment in Debt, so i want to know where to put rest 65% amount.

Thanks in advance.

Dear sadhli,

1 – Yes, can be considered for Long term goal(s).

2 – Large & balanced funds can be considered.

Thanks Sreekanth.

I have done my asset allocation as below:

a. Retirement: ELSS (Axis Long Term) 70%, VPF 30%

b. Long Term (10+ years): Large Cap (ICICI Focused Bluechip) 40%, Mid Cap (HDFC Mid Cap) 30%, Debt (UTI Dynamic)30%

c. Mid Term (6-9 years): Balanced Fund (HDFC Balanced) 70%, Debt (Birla Sun Life Short Term Fund) 30%

d. Short Term (4 years): Debt Fund (Birla Sun Life Floating Rate Fund) 100%

1. Could you please review and let me know if any fund needs to be replaced by other or need to be added/removed.

2. Is it advisable to invest in Dynamic funds in lump-sum instead SIP ?

Dear Sadhli,

You may kindly go ahead with your investment plan.

Do note that you may have to re-balance your portfolio and move to safer investment avenues (if required), as your goal year nears.

2 – There is no right or wrong answer.

Understood.

As you mentioned to move to safer avenues, like moving to debt from equity, is it possible for you to suggest how that can be planned as I am completely a newbie in this field so would need guidance

Dear Sadhli,

Let’s say your target goal year is 10 years from now.

Either you can maintain a desired Equity to Debt ratio from beginning and re-balance the portfolio to maintain fixed Debt to Equity ratio.

(or)

You may invest in Equity 100% and lets say after 7 years from now, for the next 3 years you can gradually redeem the equity fund units and mover to other safe avenues (relatively) like Fixed deposits, debt funds, etc. so that the capital appreciation is protected.

But over these 7 years, you have to continuously monitor your Portfolio value so that you can ensure that expected goal value can be achieved in 10 year period.

Thanks Again Sreekanth.

I prefer your first suggestion to keep the Equity – Debt ratio throughout by rebalancing.

But here too I have concerns (apologies for so many questions as I want to learn this financial planning myself so have many doubts)

1. For long term goal – If my debt portion is PPF (my PPF will mature in 6 years as its been 9 years with me so far). And we can’t pull out money from it then how can rebalancing be done ? only one way from Equity to Debt ? But then the existing PPF amount will also contribute to the Debt gain in one FY. Then how it can be done ?

2. If not PPF then which Debt fund is safer for 10+ time window. As I am not sure Dynamic bonds are less riskier than Short Term Debt funds.

3. Are short term debt funds a good option for 7+ and 10+ window or any other less risky Debt Funds can be looked upon.

Dear sadhli,

1 – You may withdraw PPF amount after 6 years from now and re-invest in other debt products depending on the goal target year. Else, you may extend PPF by 5 more years, again depending on when you require this corpus money.

2 & 3- For long-term horizon, Dynamic bonds can be a better choice. Yes, they do come with certain amount of risks. PPF is a better choice, if stable returns are of high priority.

Hi Sreekanth,

I am in 30% tax bracket with close to 35L base salary. I exhaust my 80C with PPF. Now if I take NPS, I can not only deduct 50K with 80CCD(1B) but also 10% of my base with 80CCD(2) through employer contribution. So, I can save 30% tax on almost 4L income…a cool tax saving of 1.2L. So NPS sounds pretty attractive to me….

What am I missing?

Thanks,

A

Dear Amit,

Kindly go through the article.

I prefer to invest in a product which is easy to understand and have greater flexibility.

Tax saving should not be the sole criteria when choosing a long-term savings product.

Of-course, NPS may be made more tax-efficient and flexible in near future 🙂 ..

Hi Shree,

You mentioned that equity mutual funds are taxable in the beginning , but as per my knowledge if this MF’s is held for more than 1 year they are completely tax free. So just wanted to clarify are equity MF taxable?

Dear Tejal,

Are you referring to any particular sentence in the above article, plz let me know..will correct it..

Yes, Long term capital gains on Equity funds (12 months + holding period) are tax-exempt.

i dont completely agree with you regarding NPS. When planning for retiremnet is a long term goal, then why a need for a high liquidity? a reasonable amount of liquidity is offered after 10 years even in NPS for real emergencies if they arise.. and it is not mandatory to withdraw 60% as lumpsum, please highlight that as well..

also i request if u could provide a comparison of NPS with universal pension schemes available in mature economies like US, UK , Switzerland, Australia, Canada.. which have well established pension funds active..

Dear Adarsha,

Thank you for sharing your views.

But my point is simple, given a choice I would prefer an investment option which has high liquidity, easy to understand (do not want to refer to rules book), tax efficient, have more flexibility (investment allocation choices) etc.,