Are you working hard to keep everything in your life BALANCED? I am sure, who does not want to lead a balanced life.. Staying balanced in the midst of your life is a true feat.

A well balanced life is very much essential for personal effectiveness, peace of mind and living well. We all would like to maintain a balance between professional and personal life. Both are equally important to lead a successful, happy and healthier life. We need to have a right and well-balanced diet to be healthy and fit.

Investing in Balanced Mutual Funds is not much different. Balanced funds are also known as Hybrid Mutual Funds. Personally I prefer investing in balanced funds to achieve my medium and long-term goals. I am a strong advocate of Balanced Funds. (Read : My Mutual Fund Portfolio)

Whether you are a new or an experienced investor, investing in balanced funds can be fruitful. They can give you Diversified Equity funds like Returns but with a lower risk profile.

Last year in the month of June (2016), I had published an article on ‘ Best Balanced Mutual Fund Schemes ’. One year gone by, so let’s review the performance of these top performing balanced funds and let’s have a look at the new list. But, before that, let’s discuss on the basics of Balanced Funds.

What are Balanced (or) Hybrid Mutual Funds?

Mutual funds are broadly classified as either Equity or Debt,based on where the funds are invested.

- Equity funds primarily invest in stocks/shares.

- Debt funds primarily invest in Bonds, Government securities and Fixed interest bearing instruments. (Related reading : ‘Types of Debt Funds‘)

- BALANCED FUNDS invest in both equity and debt instruments.

What are different types of Balanced Funds?

Balanced mutual funds can be Equity oriented or Debt oriented hybrid plans.

If the average equity exposure of a balanced fund is more than 60% and the remaining 40% is in debt products then it is treated as an Equity Oriented Balanced Fund. This means major portion of the fund’s assets are invested in equity (stocks).

If the average debt exposure is around 60% and equity is 40% then these funds are treated as Balanced funds – Debt oriented. (These proportions can vary among different balanced fund schemes).

As per my last review on Top performing Balanced Funds, I had earlier suggested below schemes ;

- HDFC Balanced Fund

- TATA Balanced Fund

- ICICI Prudential Balanced Fund

- Birla Sun life Balanced ’95 Fund

- SBI Magnum Balanced Fund

- HDFC Children’s Gift Fund

As HDFC Children’s Gift Fund may not be suitable to everyone, so I have included a regular balanced fund in its place, which is L&T Prudence. (Last year, I have suggested to keep an eye on L&T Prudence’s performance.)

If you have invested in any of the above Funds, you may continue with your investments in them.

Top Performing & Best Balanced Mutual Fund Schemes & Returns Analysis

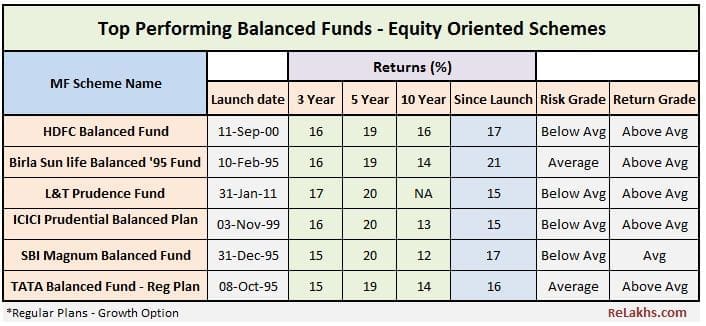

Below are the top and consistent performances under Balanced (Equity oriented) category ;

- There are around 61 Balanced (Equity oriented) Schemes. The Category’s average returns have been around 12% for the last 5 years.

- HDFC Balanced fund has been one of the best consistent performer under ‘Hybrid-Equity’ fund category. The fund’s last ten year record is as good as some of the best pure Equity funds. This fund generally allocates 70% of its corpus to Equities and the remaining balance is invested in Debt Securities. The fund’s investment strategy has been aggressive when it comes to allocation of corpus to mid/small stocks, when compared to its peers. This fund has a very low portfolio turnover (Portfolio turnover is a measure of how frequently assets within a fund are bought and sold by the managers). The last 5 and 10 year returns are 19% and 16% respectively.

- Birla Sunlife’s Balanced Fund (’95) is one of the oldest available balanced funds and has also been a consistent performer. This fund has an allocation of around 71% (May 2017) of its corpus to Equities and around 19% has been invested in Debt oriented securities. Around 23% of its Equity allocation has been invested in Banking & Financial Services sector.

- L&T Prudence Fund, though relatively a new entrant in this category, it has been performing really well for the last few years or so. It has beaten its benchmark and peers by impressive margins over the last four years. The Fund’s risk grade is ‘below average’ and return grade is ‘above average’. It has an allocation of around 69% to Equities. The fund’s investment strategy has been a ‘multi-cap’ approach with slightly higher allocation to Mid/small cap stocks. Whereas, it does not take much risk with Debt securities and primarily allocates debt corpus to less risky bets like Sovereign Debt, Bonds & Treasury investments. We need to see how this fund performs in a bear market (as this fund has been launched in 2011 only).

- ICICI Prudential Balanced Fund has an Equity allocation of around 65% and around 28% of its corpus is invested in Debt securities. Its performance during the last 5 year period has been quite impressive.

- SBI Magnum Balanced Fund has been inconsistent until 2011 (with patches of bad and good performances). However, this fund has been performing well since 2011-12. This fund typically maintains a 75-25 equity-debt mix. The equity part is multi-cap, with 50% allocation to Large cap stocks and 50% allocation to mid/small cap stocks. In the Debt portion, about 50% is invested in G-Secs.

- TATA Balanced fund has been one of the star performers under Balanced Funds category. However, its performance has not been up to the mark for the last 1-2 years. The fund’s three and five year returns have beaten its benchmark by around 10% and its category by 5% points. But the margin of out-performance has narrowed in the last 1 -2 years. Its standard deviation has been slowly inching higher. Nevertheless, it is still one of the best consistent performers for the last 10 years or so. Its 10 year returns have been around 14%, next best to HDFC Balanced fund.

- Two more balanced funds to watch out for are Franklin India Balanced Fund & DSP Blackrock Balanced Fund. Let’s keep a track of their performances.

Best Equity Oriented Balanced Mutual Fund Schemes & Risk Ratios

Let’s have a look at the Risk ratios of these top performing & best Balanced Mutual Fund Schemes;

(Sorted based on overall ‘Fund Risk Grade’) (Source : Valueresearchonline.com)

In case, you have to pick a balanced fund out of these top performing balanced funds as per your requirements, you need to give importance to both returns and measures of volatility. You may analyze various ratios as given in the above image and select the one which is the best for you.

Ideally, the fund should have lower Standard Deviation, low Beta, high Alpha and so on..

Suggest you to kindly go through my article ‘how to pick right mutual fund scheme?‘ for the detailed explanation on various types of risk ratios.

The main benefits of investing in a balanced fund are;

- Diversification : The funds are invested in both equity and debt financial securities leading to diversification of investments.

- Asset Allocation & Re-balance : Balanced funds regularly re-balance the portfolio based on market conditions & asset allocation limits. An investor is, thus, saved the hassle of manually re-balancing the portfolio. But it is prudent not to remain invested in these funds till your reach your Financial Goal target year. You may have to switch to safer investment avenues as you reach your target year. (Related reading : ‘List of best Investment Options‘)

- Low volatility : Balanced funds are less risky compared to pure Equity funds. Equity portion will provide the capital appreciation through stock prices appreciation and dividend income. Whereas, Debt portion can provide stability through interest income and appreciation in Bond prices.

- Long Term Capital Gains : In terms of taxation, the balanced mutual funds that invest at least 65% in equity (Equity oriented) attract no tax liability on Long Term Capital Gains. The units of these funds should be held for more than 12 months. (Related Reading : ‘Capital Gains on Mutual Fund & Tax implications‘)

- You can consider balanced funds for your medium to long-term goals like Retirement Planning or for Kid’s Higher Education goal planning.

Have you invested in any of the balanced mutual fund schemes? Do you believe that one should include a balanced fund in his/her long term MF portfolio? Kindly share your views. Cheers!

(References : moneycontrol.com, valueresearchonline.com, morningstar.in & freefincal.com) (Post Published on : 19-June-2017)

Join our channels

i had invested in the erstwhile HDFC Prudence growth and dividend too. It had given me good returns for the last two years. After the midcap collapse, dividend tax and merger i am not very sure of the perfomance of the new avtar of this MF. Now its known as HDFC balanced advantage fund. i could see too many negatives. The AUM has reduced to 1500 Cr and the fundmanager has changed.

Would request your views

Thanks

Regards

Anil

Dear Anil,

May I know your investment objective and time-frame?

If you would like to stay invested in a typical balanced fund, you may get out of it and move to HDFC Hybrid Equity Fund (HDFC Balanced fund).

Kindly read :

* Best Mutual Funds 2018-19 | Top Equity Funds post SEBI’s Reclassification

My objective is monthly income and wealth accumulation/principal protection. HDFC prudence had been doing well in both. It was giving me a dividend of 1% monthly plus around 4% annual appreciation. But from April onwards i have observed a reduction in monthly income, probably due to dividend distribution tax, and it has started eating into my capital

Dear Anil,

If one your investment objectives is ‘capital protection’ then it is advisable not to invest in Mutual Funds especially Equity oriented ones.

This article cleared all my doubts regarding Balanced Mutual Funds. It has been really very helpful. Thank you.

Hello Sreekanth,

Wanted to know as to where do i invest 1 lac lumpsum (recd. as security deposit towards lease of apt.) considering the fact that i would need to return the same if the lease not continued post 11 mths.

Please advise on the same.

Have a nice evening.

Roy

Dear Roy.. You may consider investing it in a Liquid Mutual Fund.

Thank you Sreekanth

Hi Sree,

I have been following your articles for over a year now and must thank you for the valuable advise to the readers of your informative blogs.

I am 40 years old and for last almost one year investing 5K each thru SIPs in Hdfc balanced, ICICI focused bluechip, SBI Multicap, icici value discovery and hdfc midcap opp. funds for different financial goals.

I have received a lumpsum amount as bonus and also one of the bank FD has matured recently, totaling to about 12 Lacs. Could you please advise where to invest this sum for a medium term horizon of 4-6 years?

Dear Raj,

You may invest this amount through STP route in HDFC balanced fund and ICICI Bluechip fund.

You can pick Liquid funds from respective fund houses, invest the lump sum amount in them and set up STPs to equity funds.

For ex : ICICI Pru Liquid plan -> STP -> ICICI Focused

HDFC Liquid fund -> HDFC Balanced fund.

Thank you for your appreciation!

Thanks, Sree.

And for how many months STP should be set for this amount? And for both the funds the date of STP should be same or different?

By the way, I am not Ajharudin:)

Dear Raj,

Somehow, I sense that this year the equity markets can be very volatile till the time of next General elections.

You may follow two strategies, one -> STP approach and second -> Invest manually the additional lump sum amounts in your portfolio of existing funds.

You may set up STPs for 12 months or so.

Wonderful presentation thanks for the details..

Hi,

I am following your blog for sometime now. Just need your advice on the below portfolio i am having

1> HDFC balanced Fund – 2k – i am running it for last 1 year

2> Franklin India PRIMA PLUS-GROWTH – 2k – i am running it for last 1 year (total 3 year)

3> Franklin India BLUECHIP FUND-GROWTH – 2k – i am running it for last 1 year (total 3 year)

I am planning to invest another 8k in SIP- please suggest me something which will give good return in next 5 year time. Also suggest me if I can take Franklin Funds out and invest in somewhere else or continue with those. I am currently 36 year old.

Thank you in advance.

Dear deepak ..You may continue with these funds and can invest additional sums in these funds itself..