In Budget 2017-18, the current central Govt has announced that a new Pension Scheme would be launched for Senior Citizens with a guaranteed rate of return. This is similar to Varishtha Pension Bima Yojana (2014) Scheme which was launched during 2014-15.

Varishtha Pensin Bima Yojana (VPBY) is a Government subsidized scheme announced for Indian Citizens aged 55 years and above,which was first introduced in the Union Budget 2003-04 (Atal Vajpayee ji’s tenure). An One time premium payment of Rs 2.66 Lakh would give a lifelong monthly pension of Rs 2, 000 and the assured return was 9% p.a.

VPBY was re-launched during 2014-15 and Indian Citizens aged 60 years and above were eligible to invest in this pension scheme. Under this scheme, one time premium payment of Rs 6,66,665/- gives a lifelong monthly pension of Rs 5000 (maximum).

The Govt has now launched a similar scheme which is called as ‘Pradhan Mantri Vaya Vandana Yojana’ (PMVVY) on 4th May, 2017. Like VPBY, PMVVY is also a Pension scheme for Senior citizens who are above 60 years of age. The assured return on PMVVY would be 8%.

Features of PMVVY 2017-18 | Govt Pension Scheme

Below are the key features of Govt’s latest Pension scheme for senior citizens, PMVVY 2017;

- Indian Citizens aged 60 years and above are eligible to invest in PMVVY.

- The plan is open for subscription from

04-May-2017 to 03-May-2018. The scheme has been extended up to March 2020 (as per Budget 2018-19). - One time premium payment of around Rs 1,50,00/- fetches a monthly pension of Rs 1,000 for 10 years. (Under PMVBY, the pension was for life-long.)

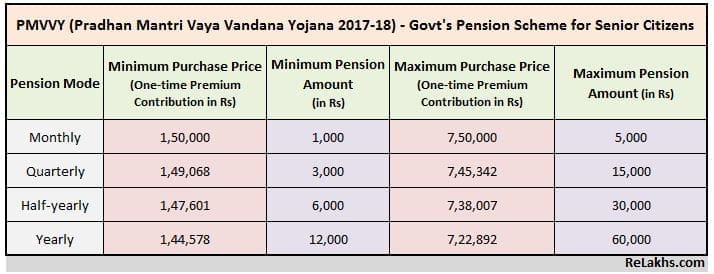

- One time premium payment of Rs 7,50,000/- would give a monthly pension of Rs 5000 (maximum). Below are the premium (purchase price) and pension details of PMVVY Scheme;

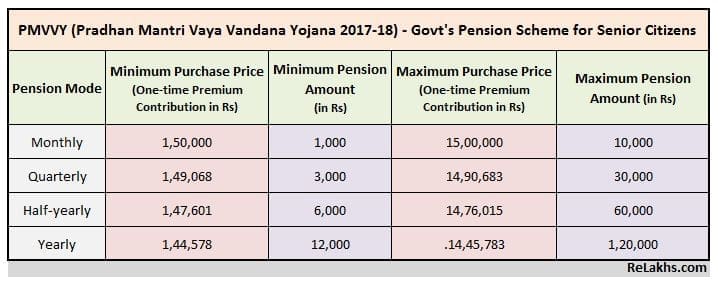

- As per Budget 2018-19, the maximum investment permissible has been increased to Rs.15 lakhs for a monthly pension of Rs 10,000. I have updated the above table with the maximum purchase price (i.e., Rs 15 Lakhs) and respective periodic maximum pension amounts as below;

Ceiling of maximum pension is for a family as a whole i.e. total amount of pension under all the PMVVY policies issued to a family under this plan shall not exceed the maximum pension limit. The family for this purpose will comprise of pensioner, his/her spouse and dependents.- As per Budget 2018-19, the investment limit of Rs 15 lakh is per Senior Citizen.The investment limit of Rs 7.5 lakh per family in the earlier scheme has been enhanced to Rs 15 lakh per senior citizen in the modified PMVVY, thereby providing a larger social security cover to the Senior citizens.Therefore, if your spouse is also a senior citizen, he/she can invest Rs 15 lacs in PMVVY too. Therefore, the two of you can invest a maximum of Rs 30 lacs in PMVVY scheme and can receive Rs 2.4 lakh as yearly pension (max).

- The policy term is for 10 years.

- Policyholder can opt for monthly, quarterly, half yearly or yearly pension payment.

- The assured return is 8% p.a. Effective annually yield works out to 8.30% for monthly pension.

- In the event of unfortunate demise of the pensioner (policyholder), the premiums paid (purchase price) will be returned to the nominee/legal heir of the pensioner.

- The pension income is taxable in the hands of pensioner. The tax rate depends on his/her income tax slab.

- Life insurance Corporation (LIC) will be the exclusive administrator for PMVVY scheme. You can be purchase this scheme offline as well as online through Life Insurance Corporation (LIC) of India which has been given the sole privilege to operate this Scheme.

- Loan up to 75% of purchase price is available after completion of minimum 3 policy years. Interest on the loan will be recovered from your pension amount.

- PMVVY Pension Policy can be surrendered during the policy term under exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. The Surrender value payable will be 98% of purchase price.

- Pension Payment will be through ECS or NEFT.

- I believe that income tax benefits are not available on Purchase price (premium contribution) of PMVVY under Section 80C. Also, the pension amount is a taxable income in the hands of pensioners.

- This scheme has been added to the ‘service tax’ exemption list.

LIC’s 8% Return Pension plan PMVVY & Benefits

Benefits payable under Pradhan Mantri Vaya Vandana Yojana are as below ;

- Pension Amount : Pensioner will get the pension during the policy term, pension in arrears (at the end of each period as per mode chosen by you) will be payable. For example : If you opt for monthly pension mode then after one month of policy date you will start receiving the pension amount.

- Death Benefit under PMVVY : On the death of the pensioner during the policy term (10 years), the Purchase Price will be refunded to the nominee (or legal heirs in absence of nominee).

- Maturity Benefits : On survival of pensioner to the end of the policy term, Purchase Price and final installment of the pension will be paid to the pensioner. (Under VPBY 2014 Scheme, only death benefit is available and maturity benefit is not available)

My opinion on PMVVY Pension Scheme

Below are the Pros & Cons of this scheme ;

- Lock-in period & Liquidity: The policy term is for 10 years. The premium amount is a one time payment and gets locked up. The pensioners cannot withdraw the amount to meet any unforeseen expenditure (under exceptional circumstances). If you have limited retirement corpus or income generating options then think twice before you opt for this plan.

- Individuals who are recently retired: An Individual who has just retired (say 60 years) may still has long life expectancy. Just because you have attained a retirement age does not mean that you have to invest in Pension oriented products. It may not be prudent to straight away go for pension plans like these. The main financial goal for a retiree would be to get a stable income. But at the same time, this income also has to grow every year to meet the raising expenses / inflation (especially food/medical). The rate of income growth should atleast meet (if not beat) the rate of inflation growth.

- Retirees who have taxable income: For retirees who are in taxable income brackets, better tax efficient options would be debt mutual funds or tax-free bonds (if available).

- Other alternatives : You can also have a look at Post office Senior Citizen Savings Scheme (tax benefit on investment is available), Post office MIS Scheme, 8% GoI bonds (interest income is payable every 6 months), hybrid balanced mutual funds, NCDs etc. (Read : ‘Latest Post office Small Saving Schemes Interest Rates 2017-18‘)

- Stable Regular Income: Senior citizens who can not manage the retirement corpus on their own and want stable returns can opt for this plan. However, you may consider other investment options along with this scheme. (Read : ‘List of best Investment options‘)

- PMVVY plan Vs Bank Deposits: The current interest rates on bank deposits are very low and may remain same for next couple of years or so. Someone who is seriously looking to invest the retirement money in Bank Fixed deposits may consider this plan.

Considering the rate at which the inflation (medical,food prices etc.,) is rising, the retirees are better off in identifying a product mix which can beat the inflation rate. These investment options can be identified based on the risk taking capacity, age and goals. Retirees who are aged above 75-80 years may find these type of pension plans more suitable.

Continue reading :

- Retirement planning in 3 easy steps (Download Calculator)

- Lump sum Investment options for Retirees/Senior Citizens | Where to invest my Retiral benefits to get Regular Income?

- List of all Popular Investment Options in India – Features & Snapshot

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (Post first published on : 05-May-2017) (This post would be updated/edited with more details at the earliest, if required)

Join our channels

If i buy PMVVY in mumbai and later settle in bangalore should i transfer the policy to bangalore ?

Dear Govindarjan,

As the benefits are paid directly to your active bank account, change of address may not be really required..

But you can submit ‘change of address’ request to the LIC Servicing branch and get it updated.

Thanks dear