LIC’s Jeevan Rakshak (Plan No.827) is a new Endowment Assurance Plan. This is a non-linked and with profits policy. Life Insurance Corporation (LIC) will be launching this plan on 19th August,2014.

Key features of LIC Jeevan Rakshak Plan:

- Sum Assured (SA) : The Minimum SA is Rs 75,000 and the Maximum allowed is Rs 2 Lakh

- Policy Tenure : Minimum 10 years and maximum allowed is 20 years

- Age entry (Life Assured’s) : Minimum is 8 years and maximum is 55 years.

- Maximum maturity age – 75 years

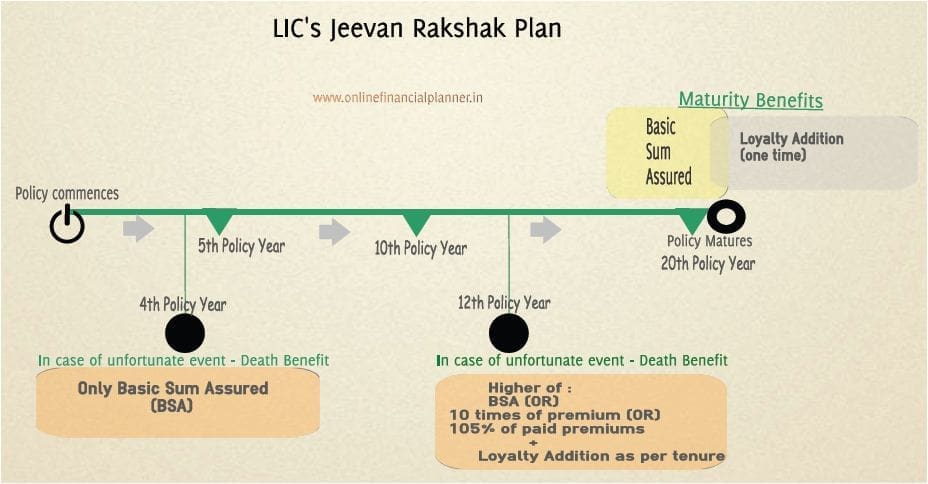

- Death benefit before 5 years of policy existence –Basic Sum Assured (BSA)

- Death Benefit anytime after the 5th year – Higher of BSA or 10 times of annualized premium or 105 % of all premium paid as on date of death plus Loyalty Addition (LA) (if any)

- Maturity Benefit – Basic Sum Assured (BSA) plus Loyalty Addition

- Loan – Loan can be taken on the policy after 3 premium payment years

- In case of surrendering the policy then no Loyalty Addition is payable

- LA is applicable only after 5 years

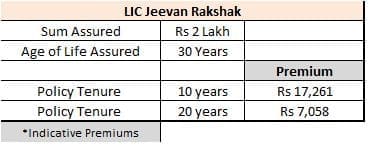

LIC Jeevan Rakshak Premium quotes:

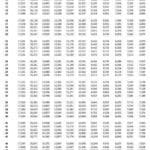

LIC Jeevan Rakshak Premium quotation chart for SA of Rs 2 Lakh : (click on the below image to enlarge)

How does LIC Jeevan Rakshak Policy work?

Let us understand how a 20 year LIC Jeevan Rakshak policy works.

How to calculate returns of LIC Jeevan Rakshak Policy ? (Endowment Policy Calculator)

Let us now calculate the returns of the 20 year Jeevan Rakshak plan. I have used IRR (Internal Rate of Return) function of MS Excel. (Incase if you are unable to view the below calculator then kindly refresh your browser)

Life insurance premium quote – Jeevan Rakshak (Vs) LIC’s Online Term Insurance :

In the above example, we have seen that the policy holder (30 years old) has to pay a premium of Rs 7,058 for a Sum Assured of Rs 2 Lakh. The expected return from this policy is around 6%. For a premium of Rs7,500 (Rs 625 pm) the policyholder can get Rs 75 Lakh coverage through LIC’s e-Term plan (online Term insurance plan).

Kindly note these important points before opting for Jeevan Rakshak:

- The average return on endowment policies will be around 4% to 6%. You may find better investment avenues in the financial markets. In the above calculation the returns are around 6%.

- As you can analyze from the above example, the rate of return largely depends on the amount of Loyalty Addition paid.

- Kindly remember that no Loyalty Addition is paid if the policy is surrendered. And it is applicable only after 5 years of policy existence.

- Section 80 C limit has been increased to Rs1.5 Lakh. Now there is every chance that you may be convinced or lured to buy this policy to save taxes. Tax benefits on Life insurance may reduce the cost of insurance. But, it should not be THE deciding factor.

- The maximum Sum Assured offered in this plan is just Rs2 Lakh. This amount is payable on death or maturity. So, the value of Rs 2 Lakh is very less (say after 20 years).

- If you can afford to take risk (depending on your age & financial goals) then it may be a wise decision to avoid these kind of endowment policies. The returns on these policies are below the average rate of inflation.So, they do not create wealth for you.

Before buying life insurance policy try to evaluate if the sum assured is sufficient to cover your life? Is the premium affordable? Can the family members lead the same standard of living in case of any unfortunate event?

(You may like visiting my post on “How to get rid off bad insurance?”)

“You don’t buy life insurance because you are going to die, but because those you love are going to live.” Life insurance is a must. Choose the right policy and cover. Share your thoughts and comments.

Join our channels

jeevan rashak 827 what is the loyalty addition. sum assured 200000 term 15 years

Dear Sir, hope you are doing well

I’m a avid reader of you website and seeing your enthusiasm and passion to reply each queries on the posts so honesty and in a simplistic way, It gave me the courage to ask the question.

I’m very new to this and slowly learning about investment and taxes. I have never done this before but I’m really glad there are people like you who are doing this great job of helping people make the wise decision about there hard-earned money.

So my father is in serious dilemma right now, whether to go on with following polices or Stop it and invest in better option.

As I mentioned before, due to limited knowledge back then, the agent got him involve in other policies without explaining its pros and cons. I want to seek your advice on it, so to make a wise decision and how can we optimize the money.

1. Jeevan Anand ( 815) – taken on 13/03/2014 Sum assured – 3,00,000 End – 13/03/2029 (father)

2. Jeevan Anand ( 815) – taken on 13/03/2014 Sum assured – 2,00,000 End – 13/03/2029 (mother)

3. Jeevan Rakshak (827) – taken on 08/03/2016 Sum assured – 2,00,000 End – 08/03/2026 (father)

4. Jeevan Rakshak (827) – taken on 08/03/2016 Sum assured – 2,00,000 End – 08/03/2026 (mother)

Looking forward to hearing from you

Thanks

Dear Yogesh,

Thank you for being my blog’s loyal reader!

May I know, if your mother and father require Life insurance cover? Do they have dependents and financial obligations?

I don’t think they necessary require a life insuance cover. But I’m also not clear and would like to know if a person need it or not.

We are a family of four, me and my sister are currently studying in college.

Dear Yogesh,

Are both of you dependent on your Parents? Do they have financial obligations?

May I know your father’s age, is he employed or self-employed?

Kindly read :

* How much Term Life Insurance Cover do I need? | Online Insurance coverage Calculator

Yes, we both are dependant on him.

My father is a government employee. His age is 54.

Dear Yogesh,

Ideally, he should have sufficient life insurance cover through a Term life insurance plan (assuming he does not have one).

If he does not have any major health issues, can try taking a Term plan (for minimum cover like Rs 25 lakhs or so).

Once he take it, can make these 1 & 2 plans PAID-UP.

3 & 4 plans can be surrendered.

could you please elaborate what are the benefits of making

2 policies Paid-up and other surrender ?

Also one of the reason he was subscribed to save taxes for 80C?

Which Term plan would you suggest according to my sittuation, i guess I have given you a onverall picture

Dear yogesh,

As you/your father has already paid 6 policy year premiums, advisable to get these PAID-UP.

You may go through this article to understand about Paid-up and surrender.

Basic Term plan from any insurance company can be taken by your father.

Read : Best Term life insurance plans..

Sir, Is this the right time to take decision on all these four policies or does it make a difference to wait for a year or two?

Could you please explain why you suggested surrendering the Jeevan rakshak not doing paid up?

Dear yogesh,

As suggested, your father can first try buying a Term plan. Considering his age, it can be a challenge to get higher sum assure (or) the premium quote can be on the higher side comparatively. Once he buys a term plan, can take a decision on these four policies..

Paid up option : As your father has paid nearly 6 out of 15 policy year premium amounts.

Surrender option : As the policies are still new, can reinvest the surrender value in a better alternative.

can we make all 4 policies paid up. as surrender value is way less than the paid up?

Honestly I need your help on this as we can’t make up the mind where to invest the money after these polices, make FDs, government bonds, NPS.

Dear Yogesh,

Yeah, you can..but the accrued benefits will be payable to your father only on policies’ maturity dates..

If you are not surrendering them then you dont get surrender value for re-investment..

But we will get paid up amount in jeevan anand, when we declare paid up right after it, no need to wait for maturity?

Is there something I’m missing?

Dear Yogesh.

No.

Did you understand the difference between Paid-up Vs Surrender? Did you go through this previously suggested article : Life insurance : How to get rid off bad insurance?

Now I get it, sorry.

Also, sonmeone recommended to invest the money in IDFC FD or saving A/c. would you suggest doing that?

Dear Yogesh,

No need to be sorry plz!

Once your father reviews his insurance requirements, can consider re-investing the surrender value in a product as per his investment objectives and time-horizon.

If ‘safety of capital’ is important, can consider saving in Bank FDs.

Read : List of all Popular Investment Options in India – Features & Snapshot

could you please help me calculate the surrender value of jeevan rakshak policies?

The premiums of one policy is 17763 and other is 16960 approx.

I’m curious, How is the surrender amount treated while filling income tax return?

Also, if we surrender the two policies, that means we have also premium money left for further investment. right?

Dear Yogesh,

Suggest you to contact your LIC agent or concerned LIC branch to know the exact SV.

As, premiums have been paid for two years, the SV wont be taxable.

Yes,you are right!

Does one need to surrender the policy before premium due date? what are the implication if one does after that?

Also, how to show the surrender value in income tax return to not be included in taxable income?

which policy is best for me to buy kindly help me

Dear Manjunatha ..Kindly go through the links that I have suggested earlier.

You may buy a term insurance plan from any company that meets your requirements.

Dear sir my name is manjunatha.G iam working in private company & my salary is rs15000..iam decided to take lic policy then my friend suggested to me to take a lic jeevan rakshak ….it is an offer gave by DO in lic we want to pay rs 3000 for each year & policy is 20 years.i decided to take it but i confused kindly do the needful please & tell me which policies is best for my daughter with low premium iam already taken lic komal jeevan to my son,,,plz plz help me

iam instrested to save monthly rs 500

Dear Manjunatha,

Suggest you to ignore buying this policy, if your requirement is life insurance cover, consider buying a Term insurance plan.

Read:

Traditional life insurance plan – a terrible investment option?

Best online term insurance plans.

Dear Seekanth Reddy,

my relation joined a policy jeevan rakshak plan at that age is 33 years, male(year 2015)

sum assured is 2 lac

term 15 year

premium .3857(with tax) Half Yearly( 3 half yearly installments completed)

and agent said that i gain 2lacs rs on maturity date

Recently that person died in september with the reason heart attack , so this is early claim,my relation already submitted all early claims to lic office .The process is completed in october 3rd week

Still my relation dont get any response from lic, How to know the process is going or not.

i want some information of this issue and how to apporach them, please send your feedback on this, asap

thank you.

Satish

Dear satish,

Kindly take help of your LIC agent or visit the nearest LIC office to know the claim status.

Dear Sreekanth,

few days before only i joined this plan (Maturity amt 1.5 Lakh, Premium 3218 half year), also i have Jeevan Anand 149 (Maturity amt 1.5 Lakh, Premium 3098 half year) but this one cover after the maturity. Please suggest me which one is best?

Dear Sudhakar,

If life cover is your requirement, you may ignore/discontinue these kind of traditional plans.

Read:

Traditional Life Insurance Plan – A terrible Investment option?

Term Insurance : Is it just a waste of your money?

If Life is unpredictable, INSURANCE can’t be optional

Sir I have a plan to invest 12000p.a. in insurance. Which is the best in the following two

1. 4500p.a. term plan of 2000000 for 30 years+7500 F.D. per year for 30 years

2. 12000 p.a. endowment plan of rs.300000/- for 30years.

i think the first one is best…is it right?

Dear SUDHEESH,

May I know the reason or objective for planning to invest in FD for such a longer period?

Kindly read: Avoid investing in FDs/RDs for longer periods..

Kindly avoid buying an Endowment plan if your requirement is to get a life cover. Suggest you to buy a term plan only and invest the balance amount in other investment options as per your financial goals.

Read:

Best Term insurance plans.

Term insurance Vs Endowment plans.

Best investment options in India.

I think FD is much safer than any other investment. If there is any problem of Tax arise, I have to invest in PPF. Please give your suggestion for a regular investment of a Rs. 5000/- per month for long term.

Dear SUDHEESH..

Kindly read: Are you aware of this interesting fact about bank FDs?

So, most of the investment products do have certain risks associated with them.

If your investment horizon is long term, consider investing in equity mutual funds.

Read:

Best investment options in India

Best Equity funds.

plz give more informatin of this policy as i m doing my project work…..like exclusion inclusion term premium of the policy advantage and disadvantager

Sir I am new I want to know the premium calculation for 827 Rakshak pls send your support thanks. (9444111816)

Dear Venugopal,

Let me know what do you want me to send?

Sir,

Plz tell me, how to calculate return on lic policy. you are generally said the lic gives the return only around of 4% to 6 %. plz clarified me with example.

Dear Rinku,

I have given an example with calculation and also provided online calculator in the above article.

You can find one more example here…