LIC Jeevan Lakshya is a new plan introduced (in March 2015) by Life Insurance Corporation of India (LIC of India). Jeevan Lakshya plan is a Limited Premium Payment policy. It is a traditional endowment assurance plan.

The main feature of this new plan is, the payment of premiums is limited to a term shorter than the policy term. LIC Jeevan Lakshya Policy provides Annual Income Benefit to the nominee. In case of unfortunate event of death of policy holder, 10% of sum assured will be paid on every policy anniversary till the policy maturity. Also, a lump sum amount will be payable at the time of maturity irrespective of survival of policy holder.

Features of LIC Jeevan Lakshya Plan

- Minimum Entry Age : 18 years

- Maximum Entry Age : 50 years

- Minimum Policy Term : 13 years

- Maximum Policy Term : 25 years

- Premium Paying Term (PPT) : Policy Term – 3 years

- Minimum Basic Sum Assured : Rs 1 Lakh

- Maximum Basic um Assured : No limit

- Maximum maturity age : 65 years (policy-holder)

LIC Jeevan Lakshya – Optional Policy Riders

- LIC Accidental Death and Disability Benefit Rider : This rider can be opted at any time within the Premium Paying Term (PPT) of the Basic Plan. The benefit cover under this rider shall be available during the policy term. In Case of death during the policy term, an Amount equal to the “Accident Benefit Sum Assured” will be payable to the nominee. In case of accidental permanent disability, an Accident Benefit Sum Assured will be paid in the form of dividing the amount into equal monthly installments spread over 10 years and all the future premiums for Accident Benefit rider are waived off. The maximum sum assured offered under this rider is Rs 1 crore (subject to the limit of Basic Sum Assured).

- LIC New Term Assurance Rider: This rider is available only at the time of taking the policy. The maximum sum assured offered under this rider is Rs 25 Lakh.

Death Benefit & Maturity / Survival Benefit under LIC Jeevan Lakshya Policy

- Death Benefit :

- If Death Occurs during the policy term 10% of the basic sum Assured (as annual income benefit) will be paid to the nominee every year from the year of death till the date of policy maturity.

- At the end of the policy term/ maturity date, nominee will be paid Sum Assured on death (110% of sum assured) + Vested simple Revisionary Bonuses + Final Additional Bonus (If Any).

- Maturity Benefit : On survival of the policy holder till the end of the policy term, Maturity Amount = Sum Assured + vested Simple Revisionary bonuses + Final Additional bonus (FAB – if any) will be paid to the policyholder.

Illustration (example) of LIC Jeevan Lakshya Plan

Mr.Pandey (25 years) purchases LIC Jeevan Lakshya Policy with a Sum Assured of Rs 10 Lakh . He opts for 20 years as the policy term and the premium paying term is 17 years (20-3 years).

Death Benefit in Pandey’s case : If Mr Pandey passes away after 5 years from the date of policy purchase, the death benefit payable to his nominee will be;

- From 6th year to 20th year, nominee will be paid with sum of 1 Lac every year. (10% of basic sum assured)

- At the end of the policy term after 20 years, nominee will receive 11 Lac (110% of sum assured) + Accrued Bonuses + FAB (Final Additional Bonus, if any)

Maturity Benefit : Suppose if Mr.Pandey survives till the policy term maturity, the maturity benefit payable to him will be:-

- Maturity amount = 10 Lac + Bonus + Final Additional Bonus (if any)

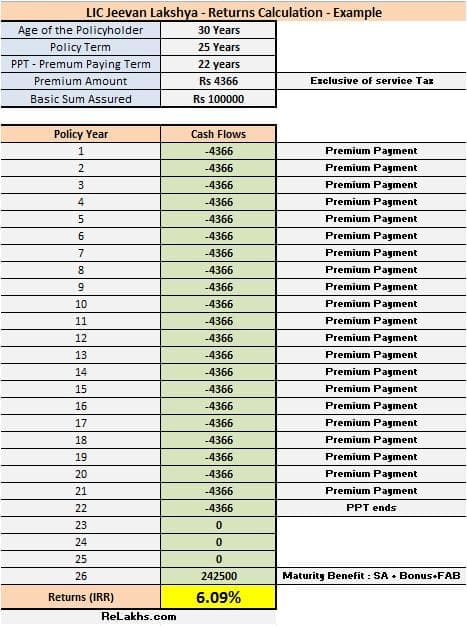

LIC New Plan – Jeevan Lakshya Policy – Returns Calculation

I have calculated the returns using IRR (Internal Rate of Return) function of MS Excel. In the above example, policy duration is 25 years and the Premium Payment Term is 22 years (25-3 years). At the beginning of 26th year (policy maturity), the policy holder will get around Rs 2.42 Lakh. I have assumed Rs 45 per Rs 1000 Sum assured as Yearly bonus and Rs 300 as Final Additional Bonus.

So, the expected returns from LIC Jeevan Lakshya can be around 6%.

My Opinion on LIC Jeevan Lakshya Plan

Should you buy LIC Jeevan Lakshya policy? Is this a good plan?

Generally, the returns from ‘Limited Premium Payment Endowment Plans’ can be somewhere in the range of 5.5% to 7 %, which does not help in funding long-term goals. The returns are very much dependent on the bonus rates ( Simple Reversionary and Final Additional Bonuses) that LIC declares every year.

Kindly stay away from these kind of plans if you are expecting higher Rate of Returns. Do not buy this plan just because it offers you Tax Saving benefits. There are better Tax Saving Investment options available in the market. For example, PPF (Public Provident Fund) will give you better returns than these kind of Endowment Plans (if safety of capital and tax benefits are your priority).

(Kindly read my articles – “Is Term insurance plan a waste of your money?” & “Top 7 Best Online Term Insurance Plans“)

Kindly be aware of the financial products that you buy. Let me know your views on LIC Jeevan Lakshya plan. Do share your comments. Cheers!

Continue reading :

- Traditional Life Insurance Plan – A terrible Investment option?

- If Life is unpredictable, INSURANCE can’t be optional

- Life insurance : How to get rid off unwanted life insurance policies?

Join our channels

Hello sreekanth, as a new parent I took this LIC policy 833 at birth of my child in 2019. In view of saving money for her future education and marriage. With sum assured Rs 2650000 maturity at 25 years with riders benefit. Now after reading negative reviews of this policy I m in confused state with quarterly premium of Rs 32000 . If there is a better option for child future investment then please suggest or shall I continue with this?

Dear Anjana,

May I know if you are an earning member of your family?

If yes, do you have sufficient life insurance cover in your name??

Related article : How much Term Life Insurance Cover do I need? | Online Insurance coverage Calculator

hi

i purchased jeevan lakshya and paid Rs 04x 3363. i want to quit. is it the right time, how much i shall get i f i surrender after 03 years

Dear Arun,

You may receive 30 to 50% of total premiums paid as Surrender value (if the policy year is 3rd or in 4th year).

Suggest you to kindly inquire on this with your Insurer.

Related articles :

* Traditional Life Insurance Plan – A terrible Investment option?

* Term Insurance : Is it just a waste of your money?

* Life insurance : How to get rid off bad insurance?

hi Shreekanth, thank you so much for the details. What is a locking period, I got this policy as one of my uncle was forcing me. Now I have paid for say some 6 months, I now feel that an RD (in Post office)has better returns than this.

I want to close this but my uncle is saying that, i can’t close it until I have paid for 3 years. if I close now, I won’t get anything is that true.

Dear kamali,

You can surrender the policy if you had paid the premium for three years.

If your requirement is to have adequate life cover, this plan will not meet your requirements/expectations.

Suggest you to buy a Term insurance plan (if you want to have adequate life cover) and then can discontinue this policy.

Kindly read :

Life insurance : How to get rid off bad insurance?

Thanks for the prompt response.

even if I get a Term insurance plan, I will have to pay this Jeevan Lakshya for 3 years right?

There is no lock-in period as such.

If you discontinue the policy now, you will not get back any amount. But, its better not to compound your mistake. Kindly go through the above suggested article.

(By the by, we are testing our blog comment alerts feature, may I know if you have received my previous reply as an email-alert to you??)

yup, I’m a QA Engineer myself, u are asking the correct person related to testing.

I received both your comments as an email alert,

when I click on them -> I am navigated to this page as expected.

But every time, I have to click on the checkbox *Notify me when someone replies to my comment*. this is obsolete, If I am adding a comment and then giving my email address it’s understood that I need a reply and want to be notified about it.

That’s nice! Thanks for your feedback. Will let my Tech team know about this.

Hi, This is a Very good plan for investment.

Please contact me on my email id if anyone want to purchase any LIC insurance plan

Please contract me Best LIC plan 8130364338

I am NRI. I just need to invest in some kind of insurance preferably LIC which giver higher maturity lumpsum or like pension with life cover

Dear krishna,

If life cover is your requirement, you may buy a Term insurance cover.

If you want better returns on maturity, kindly do not mix insurnace & investment together.

Read:

Traditional life insurance plans – a terrible investment option?

Best online term insurance plans.

List of best investment options

I am 45 years old. I want policy which will give me Rs.150000/- on maturity, policy should be 10 years of 13 years or 15 years, monthly premium kindly let me know

Dear Balchander ..May I know the reason/objective for planning to take a life insurance policy?

Hi Sreekanth,

I recently bought LIC Jeevan Lakshaya (with profits) policy. The guaranteed sum of which is 12.5 lac and the tenure is 22 years. I am paying an annual premium of around Rs 65ooo. The policy document doesn’t mention about the actual return except the guaranteed sum. Can you help me understand what would be the tentative return i.e. maturity benefit and death benefits?

Thanks

Ashish

Dear ashish,

You may get maturity returns of around 6%. Do you any other life insurance policies?

Read:

Traditional Endowment life insurance plan – a terrible investment option?

If life is unpredictable, insurance cant be optional.

Term insurance + PPF Vs endowment plans.

Thanks for your reply, Sreekanth!

It means I’ll get around 6% compounded interest on my annual premium (Rs 65K) which comes to around 13 lac + guaranteed sum (Rs 12.5 lac) on maturity. i.e. around 26 lac or so.. Please correct me if I’m wrong. Also, there is one more benefit called Final Additional Bonus (FAB). Any idea how much FAB would be in my case?

Dear ashish ..6% includes everything. It is advisable to avoid investing in these kind of plans.

If you do not have adequate life cover, you may buy a term plan.

If returns are your priority then there are better tax-efficient investment avenues.

In case if you have a term plan and invested sufficiently and are ok with 5 to 6% returns, then you may stay invested in these kind of plans.

Kindly read:

LIC bonus rates for 2016-17.

List of investment options!

Term insurance + PPF Vs Endowment life insurance plans.

Thanks a ton for your suggestions. I read your articles…Very helpful, indeed. I’ve two queries:

1. Suggest me a good term insurance policy. I am thinking of going with either Kotak or hdfc. Whar do you suggest?

2. I’ve a Birla Sunlife Vision Plan for which i pay Rs 60,000 as annual premium though I’m not sure about the returns. The policy doc says that the policy term is ”to age 100′ while the premium paying term is 27 years. The guaranteed survival benefit is about 24 lac. It looks like similar to LIC policies which yields terrible returns. What’s your opinion on this policy?

Please suggest.

Dear ashish,

1 – Any term pan as long as it meets your requirements and affordable can be bought.

2 – Birla Sun Life Vision Plan is a Traditional non-participating Whole Life Plan. You may discontinue this one too but after buying a Term plan.

Read:

How to get rid off unwanted life insurance policies?

Traditional life insurance plan – a terrible investment option.

Hi Sreekanth,

I’ve started investing in Mutual Funds after reading your blogs. I really appreciate the time you are taking to write such blogs and sharing your knowledge.

I’ve following queries, could you please share your thoughts ?

1. I’ve taken 75L HDFC term insurance plan recently. But I already have LIC BIMA Gold #174; 20 yrs policy; ~10k premium; taken in 2005 matures in 2025. Should I discontinue this policy as I already have term insurance?

2. I don’t have any PA insurance policy. Do you think I should take one? I have not opted for any accident riders in my HDFC term policy as most of the online forums suggested to take separate policies dedicated for accidents to get the better benefits( disability/partial disability etc..).

3. My company provides 5 L medical insurance that covers my family and mother as well. Do you still recommend to take Family Floater policy? The only advantage i see is, company policy will not be useful just in case if I loose my job and need medical attention before I could get new job. Are there any other benefits apart from this?

Dear Ravi,

1 – You can consider making it a PAID-UP policy.

Read: How to get rid off unwanted life insurance policy?

2 – Yes.

Read: Best Personal Accident Insurance plans.

3 – Your company provided cover might not be available after your retirement. The same benefits might not be available in new company (if you join new company). The group cover terms & conditions might get changed at the time of renewal.

Suggest you to buy a stand-alone health plan.

Read:

Best Family floater health insurance plans.

Best portals to compare health plans.

Evaluate these factors when buying a health plan.

Thanks Sreekanth.

Ravi A

Hi,

For the following example (Discussed above) :

Mr.Rohit purchase LIC Jeevan Lakshay Policy with following details.

Age -25 years

Policy term – 20 years

Premium paying term – 17 years

Basic sum assured – 10 Lac

Death Benefit: Suppose Mr.Rohit passed away after 5 years from the policy purchase date. Death benefit payable to nominee will be:-

From 6th year to 20th year nominee will be paid with sum of 1 Lac every year. (10% of basic sum assured).

At the end of policy term after 20 years nominee will receive 11 Lac (110% of sum assured) + Bonus

Question :

“Rohit’s family (as he is not there) do not need to take care of the policy premium for the rest of the years (i.e. from 6th to 20th year) or the policy should be Inforce.”

Yes, dear Arnab .