As per the provisions of Income Tax Act, there are certain investments/deposits on which no tax is required to be deducted without any limit of the amount of such interest. Tax is not deducted on any interest paid on any savings account or deposit in any of your recurring deposit account, be it with any bank, or Co-operative credit society or Cooperative bank. But, this provision will be amended soon.

The budget 2015-2016 has put RDs (Recurring Deposits) at par with FDs (Fixed Deposits) for TDS (Tax Deducted at Source) purpose. Banks will deduct TDS on Recurring Deposits (RDs) too, from 1st June, 2015.

If you receive more than Rs 10,000 as interest from your RDs, your bank will deduct Tax and directly pay this tax to the Govt of India (on behalf of you). You will receive TDS certificate (Form 16 A) from your bank.

Remember, TDS doesn’t end your Tax Liability. Interest on RDs & FDs is fully taxable as income at the rate applicable to you. So even if TDS has been cut, you might have to pay more tax, depending on your income tax slab.

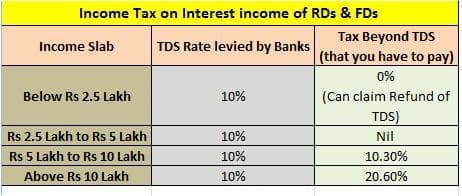

Income Slabs – TDS on Recurring Deposits – Income Tax beyond TDS rate

What is the additional income tax rate that you need to pay over and above the TDS? This is dependent on your income tax slab.

- If your taxable income is below Rs 2.5 Lakh and banks deduct TDS (you can submit Form 15 G/H to avoid TDS), you can claim back TDS as refund in your Income Tax Returns (ITR).

- If your income is between Rs 2.5 Lakh to Rs 5 Lakh, you need not pay any extra income tax. Because, the income tax rate of 10% matches with Bank’s TDS rate which is also at 10%.

- If your income is in the range of Rs 5 Lakh to Rs 10 Lakh, you need to pay 10.30% beyond the TDS rate.

- If your income is over Rs 10 Lakh, the differential tax rate of 20.60% needs to be paid.

Important points to be noted ;

- Interest income on your Savings Bank Account up to Rs 10,000 is tax free as per Income Tax Act 1961. Do not get confused this with the above point. Interest on your Savings a/c balance is different from the interest income on a FD / RD.

- The rate of TDS deducted by banks is 10% on interest income, provided your PAN number is available with the bank. If the bank doesn’t have your PAN in its records, TDS is deducted at 20% on interest income.

- This limit of Rs10,000 is per bank (not per bank branch).

Read my article on “Recurring Deposit Taxes & Fixed Deposit Taxes” for a detailed explanation on various aspects of RD & FD taxes and how they work.

( Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

Sir

I have Rd with BOB monthly rs2000 in my 26as section 194A amount paid/credited Rs 1142 shown

But tax deducted is nil. Now I am in tax slab of 5 to 10 Laks whether I have to pay income tax how to pay how to show in itr please help me

Dear Koteswara,

Yes, you have to disclose this income in your ITR under the head ‘income from other sources’.

Sir I tried to pay tax on line the by the challan 280 for the intrest on FD and RD after filling every thing in The bank site is asking to fill up penalty payment code as 11c or N11c

which code I have to choose 11c or N11c

Dear koteswara ..Without looking into the details, not advisable to suggest you. Kindly take help of a CA.

MY RD ACCOUNT FOR A OF PERIOD OF FIVE YEAR .AND THE INSTALLMENT DEPOSIT IN MY SALARY ACCOUNT FORM SBI. I WANT TO KNOW ABOUT THIS AMOUNT TAXABLE OR NOT. PLEASE GUIDE ME.

Dear Rajeev,

The interest income from RD is subject to TDS and it is taxable.

Kindly read: FDs & RDs – Income tax implications.

I have opened RD of Rs. 2000/ in SBI. they have charged accumulated interest. Why is it so? what is accumulate interest? Is it payable to customers or not?

Dear Ekta ..Are you referring to TDS? interest income on RDs is now tax deductible.

Kindly read this article : FDs & RDs – Tax implications.

Dear Sreekanth:

As per the latest rules, is TDS applicable on POST OFFICE Recurring Deposits ? Or is it applicable only for BANK RDs?

Pl clarify.

Thanks in advance

Dear Jeyaram..I believe that TDS is applicable. Read : Latest TDS rates chart 2016-17..

Dear Sreekanth,

Please clarify if TDS on RDs, as revised in Finance bill 2015 is applicable to NRIs also or they continue to remain exempted.

Thanks,

Dear SS..I believe that it is applicable to NRIs also.

sir, i have got a recurring account for a period of 2years.The total interest of which is more than 10,000/-.As per the new IT rule,tds would be deducted.but sir although my gross income is nearly 4lac per annum and showing the 80 c deductions ,my total tax payable is zero.now do i need to furnish a 15 G form to the bank so that no TDS is deducted out of the RD interest?

Dear Santunu,

As your expected income is more than Rs 4 Lakh, you should not submit Form 15G.

You can claim the refund (if any) of TDS which has been deducted when you file your Income tax Returns.

Mr Sreekanth,

I have RD that I opened for 15 months and is due maturity in Dec-2015. I am outside the country and also work outside.

1) Do I have to pay any other tax over my TDS?

Thanks,

Ketan

Dear Ketan,

If your TDS is say 10% and your total income (indian income) falls in 20% bracket, then you have to pay the differential tax amount when you file your ITR.

Kindly read : TDS & Misconceptions.

That brings up a question as to indian citizens who stay and work abroad and don’t have any income (based on NOT getting any salary in india), how will they pay income tax or should they pay income tax?

Dear Ketan,

If they do not have any income (salary or any other form) from the sources in India, NRIs (if they are) are not required to pay any income tax.

Kindly read : NRI taxation rules.

Thanks for the insight Sreekanth. I truly appreciate your help. Keep up the good work.

Keep visiting dear Ketan 🙂

Dear Sreekanth

Below mentioned table is RD product of central bank of India. Now If I go for 1 year @7.75%, Rs 8000/m=1 lakh plus then what would be the maturity value scenario. I’m service man and fall in 10% IT rule.

Cent Lakhpati

Period in Years Rate of interest Monthly Installment (Rs.) Maturity Value (Rs.)

1 7.75 8000 Rs. 1 lakh Plus

2 7.75 3850 Rs. 1 lakh Plus

3 7.50 2480 Rs. 1 lakh Plus

would be very grateful to know from you.

Thanks.

Dear Niran..the maturity value is already provided right? May I know what exactly would you like to know?

Hi Sir,

I have the joint Post office RD with my wife from 2011 march onwards, I am salaried but spouse is housewife. Could you please help me to understand, whether TDS is applicable for us from June,2015 onwards Only and do I need to show only from june,2015 interest in the returns of my wife.

Dear Srini,

Kindly note that TDS is applicable from June 2015 only, but interest earned on RD has always been taxable.

Also, suggest you not to invest in RDs for long-term. Kindly read my article – Avoid investing in FDs/RDs for long-term.

Hi,

Sir i have RD in HDFC bank of 1000 Rs per month for the period of 5 years at the rate of 8.25%. So am i liable to interest income tax ?

RD will mature on September 2016.

Dear Kiran,

Do not invest in RDs for long-term, may I know why you have invested in RD, any specific financial goal?

Hi,

First of all thanks for reply. There is no specific financial goal. I am a student, so just for the savings purpose.

So should i liquidate it or wait for maturity. Thank you sir.

Dear Kiran,

If you want to accumulate wealth (assuming you can afford to take risk), consider investing future installments in a balanced fund SIP.

Keep the accumulated balance in RD/FD for your ‘unforseen expenses’.

Dear Srikant,

1. Will TDS for RD in post office be applicable even to people who have invested before this ‘TDS on RD’ rule came into existence?

2. Do they tax us on the maturity amount as well?

Hi Shreekanth,

Can you explain the RD account interest rate given by HDFC bank.

Let am investing intial amount 1000.00 for a term of 12 months with an interest rate 8.2% pa,

How the maturity value given by bank is 12543.00. even if bank deduct TDS on interest as earn 10%.

Thanks

Prasad

Dear Debaprasad..what is the frequency of compounding?

Mr.Sreekanth Reddy,

i have an doubt if we keep Rs.10 Lakhs in the Saving bank account for one year , or more then Rs.5 lacs ,do we need to file tax returns befor 31.08.2015. if you can help me with this information,i shall be helpfull.thank you,

Dear Syed,

It depends on the source of the income (Rs 10 Lakh). It is better you file your taxes if you invest Rs 5 / Rs 10 Lakh in FD.

Dear sir,

My gross income is 3.2lacs. Although,due to Nsc & Pf deduction am not in income tax slab. But I do have 6 fd’s with different banks. of 49k. 2 with PNB, 2 WITH SBI, 2 WITH UCO Bank.

I have not given my PAN in UCO. As amount was below 50000. Now, According to new rule which Problem I can face & Do I haveto file return. Kindly guide.

Dear Pankaj,

Yes you have to file your ITR. Kindly show all the incomes (gross income, interest income on FDs, interest income from Savings a/cs etc.,) and then pay taxes (if any) accordingly.

Hi,

I have RD which will mature in Aug 2015. Till now no TDS was deducted. What would be TDS deduction – on interest for the current year or on whole amount?

Thanks

Dear Kshitij,

TDS is applicable on the interest income.

I have a rd of 1000 in bob of 10 years so I want to know weather is there any tds or I will get full maturity amount of 194000 after 10 years

Dear Nitesh,

Whether TDS is deducted or not, the interest amount is taxable (if your income is above basic exemption limit).

Kindly read my artilce – “FD & RD – Tax implications“.

Hi Sir,

if i have saving account and fd same in the bank. and i have earned 12000 interest through saving account and 15000 earned through fd in a year then 10%tds apply fd and saving account both or single????

Thanks,

Nitesh

Dear Nitesh,

TDS is applicable only in the case of RD / FD and not on the savings bank a/c interest amount.

Hi Sir,

Is TDS applicable for Savings account ? for ex if i am earning 15000 interest in a year then are the banks gonna apply 10% TDS on 5000 and deduct 500 from my total 15000 ???

Thanks,

Vignesh

Dear Vignesh,

TDS is not applicable in case of Savings Bank Account.

Under Section 80TTA, interest income of up to Rs 10,000 from Savings A/c can be claimed as tax deduction.

However, any interest amount earned over and above Rs 10,000, you need to pay taxes as per your income tax slab/rate.

Do note that Rs 10,000 is the total deduction allowed by combining all the saving bank accounts interest.

Hi Shreekanth,

Nice work on the article. Could you please clarify, if the banks would consider the interest earned on RD in Apr 2015 and May 2015 as well for considering the 10k limit. Or only the interest earned from Jun 2015 will be considered.

Thanks,

Swetha

Dear Swetha,

I believe the banks will consider for full FY 2015-2016.

Hi,

Good works. Keep it up. Now coming to the point, does this cap on interest on FD/RD is based on interest income from FD and RD independently or combinely ? I mean for FD cap is 10k and for RD – 10k ? Or FD and RD together limit is 10k ?

And also your suggestion regarding investing in RDs, whether to continue or not ?

Advance Thanks.

Dear Sir,

Banks have been instructed to deduct TDS on all interest payments exceeding Rs 10000 in any FY (as per Section 194A of IT Act).

So, I believe that the Rs 10k limit is both combined. Also, the limit of Rs 10k is now not per bank branch but it is per bank.

The decision to continue RDs or not depends on your financial goals. It is just that RDs have been made on par with FDs with respect to TDS.

Hi,

I have a FD for 1 Lac in HDFC Bank & a RD of 1 Lac in UCO Bank . The intrest for both combined is more than 10 K . Kindly clarify if TDS will be deduced or not .

Dear Mahadevan ..No. But it is a taxable income.

Read:

TDS & Misconceptions.

RDs/FDs – Tax implications.