Reserve Bank of India (RBI) has issued a notification on 11th March 2015, authorizing 28 banks to open Sukanya Samriddhi A/c. SSA (Sukanya Samriddhi Account / Yojana) is a Small Savings Scheme launched by our honorable PM Shri Narendra Modi. Sukanya Samriddhi Account/Khatha is a Government’s Small Savings Special deposit Scheme for girl child. This scheme is specially designed for girl’s higher education or marriage needs.

Where can I open Sukanya Samriddhi A/c?

Below is the list of banks where you can open Sukanya Samriddhi Account. RBI has authorized these banks to accept Sukanya Samriddhi Applications.

- State Bank of India (SBI)

- State Bank of Patiala (SBP)

- State Bank of Bikaner & Jaipur

- State Bank of Travancore (SBT)

- State Bank of Hyderabad (SBH)

- State Bank of Mysore (SBM)

- Andhra Bank

- Allahabad Bank

- Bank of Baroda (BOB)

- Bank of India (BOI)

- Punjab & Sind Bank

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- Indian Bank

- Indian Overseas Bank (IOB)

- Punjab National Bank (PNB)

- Syndicate Bank

- UCO Bank

- Oriental Bank of Commerce (OBC)

- Union Bank of India (UBI)

- United Bank of India (UBI)

- Vijaya Bank

- Axis Bank Ltd

- ICICI Bank Ltd.

- IDBI Bank Ltd.

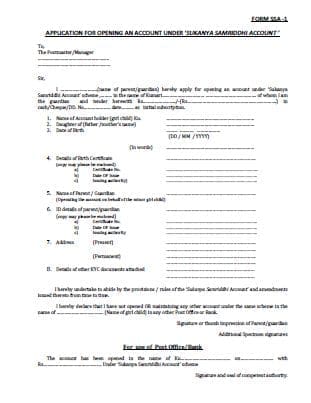

Sukanya Samriddhi Account – Application Form

Click on the below image to download Sukanya Samriddhi Account (SSA) application form (Sukanya Samriddhi A/c opening form in PDF format).

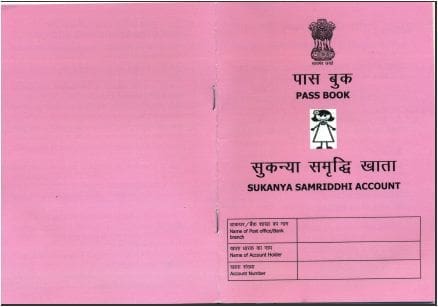

Click on the below image to download the specimen of Sukanya Samriddhi Account Passbook (5 pages).

Kindly note that Sukanya Samriddhi A/c can also be opened in Post office (Daak Ghar. Sukanya Samriddhi Yojana Account can be transferred from a bank / post office branch to other bank / post-office branch.

Latest News : Interest Rate on SSA has been increased to 9.2% for Financial Year 2015-2016. This is effective from 1st April 2015.

For more details on Sukanya Samriddhi Account interest & maturity amount calculations, terms & conditions, features, tax benefits (Section 80C) details etc., kindly read my below articles;

2016 to 2017 detailas

If SSY account is transferred in bank before completion of financial year for example a/c transferred post office to bank in the month of January and transferred a/c opened in bank on 4th January. At the end of 31st March how much interest bank will add from January to March or for the complete financial year April to march.

Dear VYAS ..I believe they should give full interest amount as credit entry.

Hello Sreekanth,

I am a regular reader of your blog. All your posts are very informative & can be easily understand by a common man.

Thank you for all your efforts really appreciated… Keep up the good work.

I have a small query on SSY. I know ICICI bank is one of the authorized bank to open SSY account.

I would like to know is online fund transfer allowed by ICICI bank ? I mean can we do NEFT & transfer fund to SSY account held with ICICI bank ?

Dear Vishal,

I am not sure on this.

Kindly check with your banker and this should be possible i guess.

Do update the status here, will be helpful to other readers. Thanks!

Kindly confirm about the documents requiement for opening sukanya smridhi yojana account in SBI Bank.

Dear Ram Prakash,

* Birth certificate of the Girl Child.

* Address proof of the parent or legal guardian.

* Photo Id proof of the parent or legal guardian.

Hi Srikanth,

My loyal apprication for your service. Very useful info from your blog.

Pls let me know is there any other scheme better than SSA. I was blessed with a baby girl on 12 may this year. Planing for savings on her name.

I have a plan of investing more for next year’s will that be allowed.

Dear Sravan,

First priority – Get yourself adequately insured (if not). Kindly buy a term plan & Personal accident insurance cover.

Kindly read:

List of articles on the key aspects of Personal Financial Planning.

List of best investment options.

Kid’s Education goal planning & Calculator.

My girl child DOB is 28Augs 2015, Can i open ssa a/c. & can we open this account

Yes dear Premteja.

Yes dear.

What about NRIs – are they eligible for this scheme

HI Sreekanth,

The information you provided was very useful. Actually I am planning to start Invest for my New born baby girl. I think this scheme was best suite for the baby.

Dear Sir,

My girl child DOB is 11 July 2014, Can i open ssa a/c. & can we open this account in this or next month (January 2016 or Feb. 2016

Dear Ravinder,

Yes, you can open SSA.

Sir ,i had opened ssa accnt. in one of the postoffice, can I deposit the sum in any of the postoffice(say interstate postoffice) ,as I often away frm native

Thank you

Dear Gaurav..that should be ok i guess. Kindly carry SSA Passbook with you when you visit a post office branch.

I APPROCH ALLAHABAD BANK FOR STARTING SSA A/C ,BANK STAFF NOT KNOW ANY THING ABOUT SSA A/C

Dear varghese ..Visit nearest post office branch.

Sir, my daughter d.o.b is 21/03/2005 Can i opened SSA for my girl child, which bank is best to open a/c and i want to contribuit Rs 1500 Per month after my child age 21 Year what amount returned.

Dear Sanjay,

You can open the account. You may approach any bank or post office branch. Try opening at SBI. Click here to download the calculator ..

Hi Dear,

I would like to know what is the best date for next deposit (yearly or monthly basis)to get maximum returns & which one is good, monthly deposit or yearly deposit.?

Thanks & Regards

Hi, ICICI Bank i think very few branches are accepting.

I think RBI should take action on this

Thanks!

Mayank

If I save 1 lakh in Sukanya can husband show 50k for tax proof and I show 50K. How exactly can the parents show that for tax proofs

Dear Esther,

Only the depositor has to claim the tax benefits u/s 80c.

Do u mean only guardian(either father or mother) in the account of the girl child can claim the deduction? So only one of them can use it for tax reduction? If guardian is mother and she later quits job can the father show it for his tax as he would pay the amount.

Dear Esther..i am not sure about your second query.

Dear Esther,

It should same as PPF. Only Guardian who has name mentioned on Passbook/Account can claim the benefit.

regards,

Anurag

pal muze mera a/c post office se banka me khulwana ho to kya karana padega

Sir this finacial year for ssy interest rate is 9.2. The next 14 years interest rate will increase or decreese

Dear Salahuddin…Mostly it will be on par with PPF interest rates..

I am interested in Skanya samriddhi scheme. However, I want to make an account with bank with fd of Rs.1.30 lakhs and interest portion to be transferred to the Sukanya schme directly by bank. Is it possible to make this. Either Post Office or bank. Kindly clarify immediately.

Dear Iyappan,

I guess, Online transfer / Direct debit / ECS transfre facility is not provided for SSA accounts. However, kindly check with your banker if this facility is available.

pls give detail that at the time of maturity the girl child can withdraw the money by herself or the with drawl can be done by the legal guardian who opens the account ?

Dear Jayanth,

As far as I know, the girl child has to withdraw the funds.

can you confirm it that who can withdraw amount ? parent or girl child ?

Dear vishwanath..Girl child can withdraw the maturity amount.

Dear Sir,

i have opened my girl child account today ,right now i m in delhi on rented and having delhi voter id ,when i will go back to my native place den can i withdraw amount in my home town sbi bank or i have to come to delhi again for withdraw the amount after maturity.pls help

Dear Anil,

You can transfer your SSA a/c too.

hi! we have a ppf a/c on my child name. Shall i open sss a/c also

Dear Lakshmi,

Kindly go through my article : Kid’s Education planning goal.

I had open Sukanya Samruddi Account in my nearest post office, now i heard this is available in banks also, is there a way where in i can transfer SSA account to my SBI or IDBI bank. Request advise on this.

The main reason is through online i can transfer to the account, currently in most of the post offices there is no online facility, i heard they are going to make online, but not sure when they will be online.

Dear Pratap,

Yes, there is no update or clarity on online facility and by when will it be ready..so we need to wait for this to happen.

Yes, you can transfer the account from post office to a bank. Kindly contact your post office branch for the transfer.

I have two girl chld I want to open sukanya samriddhi youja a/c for both the child in corporation bank vivek vihar delhi branch but the Banks says no facilty to open the above account then what can I do.

Dear Amit,

Approach the nearest post office branch or any nationalized banks like SBI.

i want know my savings account balance in post office under SSA schme333

Dear sir/madam

I want to open SSA account in sbi bank. Now I have little bit confused that before maturity SSA a/c if my daughter gets married then how can i widrow money from SSA account.

Dear Sanjan,

You can withdraw fund amount either on maturity or on marriage, whichever happens first.

Dear Sir/Mam

We have three girl children s, so i can open all of three ? SSA

Dear Ravi,

You can open two SSA accounts only. (Do you have twins?)

I was open a sukaniya account in post office. Now i want to know that Can I transfered the sukaniya account from post office to SBI Bank. If it is possible then please inform me the process.

Dear Ambesh,

Approach nearest SBI branch and they will guide you.

Thanks for the sharing useful information..

It;s really very helpful..

Thank you Deepak. Keep visiting!

Dear Sir,

I have opened SSA account in a post office. Can i deposit the premium amount at anywhere post office? if not when the govt goes to convert this SSA account into computerized?

Please reply sir…

Dear John,

I am not too sure about when computerization is going to take place (online facility). I believe you can deposit from any post office branch (you may transfer the SSA a.c)

Thanks for all the good post. When are SBI likely to activate Sukanya Samruddhi account. From where can we get these details. Thanks for not advising to go to nearest post office. regards

Dear Gangadhar,

The best way to get info is to visit the nearest SBI branch at your location.

I visited SBI,Kakkanad,Kochi,Kerala branch two weeks back and they said that Sukanya Samridhi account opening has not yet started for them. Have the private banks in the list started off?

Dear Shiyas,

I believe that most of the banks are yet to accept SSA applications. Suggest you to approach nearest post office branch.

my nearest sbi branch maneger say we can open ssy a/c becouse no gide lines will isue by the head office my brach code 11947 ghaziabad u.p.

Dear Uma Shanker,

Visit nearest post office branch.

Hello Sir,

We are indian. My daughter is us citizen. But she has pio card. Can we take ssa from bank or post office.

Dear Dolly,

The govt gazette does not talk about the NRI’s (or other Nations’ citizens’) eligibility to invest in SSA. Waiting for more clarity..Will update you ASAP..

Hello Sir,

But in LIC Nri can take lic policies after completing a form for non resident indian. LIC is a govt company. Please let me know and clarify soon.

Thanks,

Dear Dolly,

NRIs are not eligible to invest in Small Savings Schemes like Public Provident Fund, Post office small savings schemes etc.,

SSA falls under the category of small savings scheme, but there govt gazette does not say anything abt this.

Yes, NRIs can buy life insurance policies from a Life insurance company based in India.

Can I open the SSA account in State Bank of India in this month of April. Is it implemented in SBI or in any Banks ?

Dear Renu,

I beleive not all the branches of authorized banks are accepting SSA applications. You may visit your nearest post office branch to open SSA.

Dear Sir,

I want open this account in SBH ( State Bank of Hyderabad ) bur the Branch people says i don’t know about the A/C… what i Do..?

Dear Kubendiran,

Visit your nearest post office branch.

Thank you very much sreekanth…..

After read this comments, going to open this account…..

Dear sir, i want to know about national pension system(n p s a/c).where i open this type of a/c. nd what intrest rate we get in this.

Dear Hitendra,

Visit this website “NPS” for more info.

Dear sir,sbi branch rura kanpur dehat u p. Dont know abt sukanya smridhi a/c

Dear Hitendra,

You may contact any nearest post office branch.

Dear Reddy,

I happened to read the below in this link http://goo.gl/coVSMg

Pl guide me if its true, main concern over returns being taxable.

Tejas Says:

03/21/2015 At 1:28 AM

I had compared the same with LIC. And I found LIC better than the sukanya samriddhi.

Here is the comparison. If I have missed somewhere let me know.

Sukanya Samrudhi Yojana

Its a Post Office New Scheme

Sukanya Samrudhi yojana…

9.1% Rate of Interest Compounded…

For example Pay Rs 12000 for 14yrs & Get Rs 6lac on 21st yr…

======================

LIC has better option than this….

======================

1. Payment Term

—————————

In post you have to pay Rs.12000 for 14 years

In LIC you have to pay Rs.22500 but for 9 years only

2. Insurance

—————————

In case of death of Father

In post family still have to pay 12000 per year till 14th year

In LIC no need to pay and family gets 6 lacs immediately in case of accidental death (in case of natural death 3 lacs plus bonus)

Hence concept of insurance is more important.

3. TAX FREE RETURNS

—————————

In LIC

premium – 22500

Need to pay – 9yrs

Total premium – 2lac

On 21st year

get Rs 6,32,000 totally TAX FREE.

In Post

premium – 12000

Need to pay – 14 yrs

Total premium – 1.80 lac

On 21st year

get Rs 6,07,000 TAXABLE

4. Gauranteed Calculation

—————————

In post 9.01% gauranteed for 2014-15 next year onwards it may change

In post calculation is based on bonus and bonus history of LIC is gaurateed

– See more at: http://goo.gl/coVSMg

Dear Kavitha,

LIC plan returns are mainly dependent on bonus rates, which may or may not be the same every year. They are also not guaranteed.

The returns from the traditional life insurance plans can be around 6% max. Taxation benefits are applicable for both.

It is better not to mix insurance with investment.

if we open an account with the amt of 1000/-

after,next month onwards can we increase the money?and how the intereset will be calculate?

Dear Shirisha,

Yes, deposit amounts can vary. Interest is calculated on monthly balance basis.

Dear shirisha,

There is no limit in number of transactions in a financial year . only limitation is in amount, means your total deposit during the FY should be restricted up to a maximum of Rs.1.5 lakhs only. One major merits in post office/Sukhanya Samrudhi when compared to LIC is that if a lapse occured during a financial year during any FY, it can be possible to deposit in the next FY with a nominal fine of Rs.50 only

Dear Rakesh,

Thank you for sharing your views.

Dear Sreekanth

I would like to know the difference between opening this a/c in a post office and a bank. Do we get access to online facilities if we open this a/c in bank. I am looking for ease of accessibility, like, online transfer of money to this a/c, checking balance. Transferring the a/c from one city to other etc..

Regards

Murali

Dear Murali,

As of now, i dont think online depositing is available. Let’s hope that the value added services are made available soon.

Yes, you can transfer the account to a different location anywhere in India.

As per Office Memorandum of Ministry of finance , the facility to deposit the subscription will be made available in banking sector.Online banking facility to that particular Sukhanya Samrudhi Account will not available because of the Account Holder (As per RBI Guide lines ) is minor . During my visit to bank ,they are still not in a receipt of circulars about Sukhanya Samrudhi Scheme (SSA)

Dear Rakesh, thank you for sharing your views & experience.

Dear Sreekanth………. indian overseas bank they dont know about this scheme please update the information to the bank.

Thank you so much sir for your great post.

Dear Sir,

The clause about ’14 years’ is not clear. Is it that we can invest till the girl attains 14 years of age or we can invest for 14 years from the date of opening the account.

And what if the girl child is 10 years old when opening the account? Can we invest 5 years only or till she attains 21?

Regards,

Swaminathan

Dear Swaminathan,

As per Govt’s gazette, the contributions can be made for 14 years from the date of account opening.

VERY VERY USEFUL GIRL CHILDS THANK U SIR

IDBI,bhagatpur Balia has denied that they dont have any information regarding such type of account

SBI branch at Katwaw in West Bengal told that they did not know the scheme.

Has the banks started accepting to open this account, since I visited SBI yesterday, ie 12 March 2015 and the staff asked me that its happening at post office, may be they will take a week or so to start rolling out…

Dear Dilip,

RBI has issued a notification to 28 banks, authorizing for opening SSA accounts. Looks like, Banks may take some more time before they start accepting the application forms..

Post office branches have started opening the SSA accounts.

Since its March, no bank will open account. Banks may start opening account from 1st week of April.

Dear Sanyam,

Thank you for sharing your views.

Banks have received the RBI’s notification on 12th march 2015. Also, they are not yet ready with the required infra set-up (software requirements) to execute the account opening formalities. Whereas, some of the main Post office branches are accepting the applications, most of the branches received the circular (their internal circular dated 21-01-2015)) in the month of January itself.

Since its March, no any bank will open sukanya account. Banks may start opening account from 1st week of April. it is possible or not. and one thing transfer money at sukanya account from our account are possible or not.

Please help on this…

Dear Vishvdeep,

You may try opening the account in Post office.

Are you referring to online deposit facility?

Dear Sreekanth … I shard your post to my friends also and one more thanks from all of those to your hard work.

Thank you Pankaj.

Good job Reddy sir.

Thank you Shweta…!

thanks for update

Thank you Sreekanth. Great work, A complete guidance to all of those who are searching for Sukanya Samriddhi A/c and its procedure.

Dear Pankaj,

Thank you for your appreciation!