Indian Finance Minister, Shri Arun Jaitley has tabled today, the Union General Budget 2015-16 in Parliament. The Finance Minister has kept the Personal Income Tax rates unchanged.

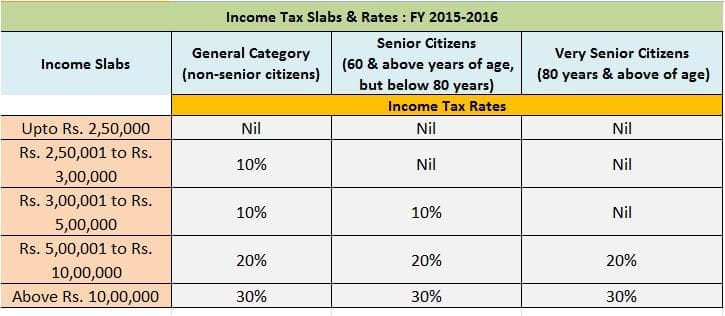

Below are the Income Tax Slabs & Rates for FY 2015-16 or AY 2016 -17.

(FY is Financial Year. AY is Assessment Year)

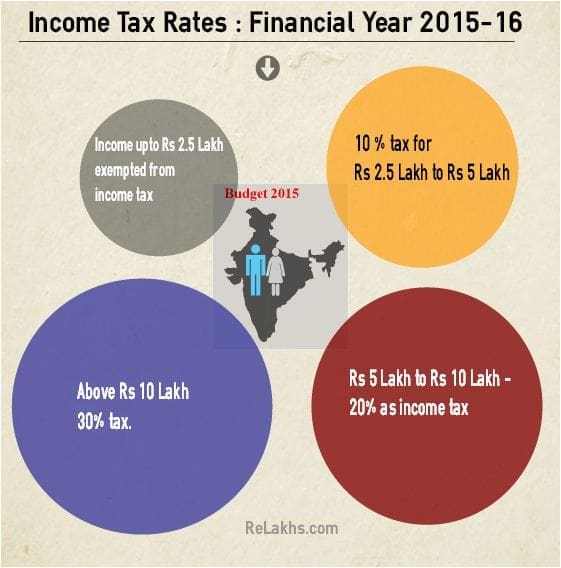

Latest Income tax Rates for FY 2015-16

The above Income tax rates are for General category (Men / Women who are below 60 years of age).

The below table gives you clear idea about Income tax slabs / rates for all Tax payer categories. (For general category, Senior Citizens & Very Senior Citizens).

The education cess on income-tax @ 2% for fulfillment of the commitment of the Government to provide and finance universalized quality based education and 1% of additional surcharge called ‘Secondary and Higher Education Cess on tax and surcharge is proposed to be continued for the financial year 2015-16 for all taxpayers.

Surcharge at the rate of 12% on individuals, HUFs, AOPs, BOIs, artificial juridical persons, firms, cooperative societies and local authorities having income exceeding Rs 1 crore.

Details of tax deductions proposed are as follows:

- Deduction u/s 80C Rs 1,50,000 is same.

- Deduction u/s 80CCD has been increased by Rs 50,000 towards New Pension Scheme. The total contribution has been increased from Rs 1 Lakh to Rs 1.5 Lakh

- Deduction on account of interest on house property loan (Self occupied property) Rs 2,00,000.

- Deduction u/s 80D on health insurance premium Rs 25,000, increased from Rs 15000. For Senior Citizens it has been increased to Rs 30,000 from the existing Rs 20,000. For very senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure. (Kindly read : Medical Insurance Premium & Income Tax Benefits for Ay 2016-17)

- Exemption of transport allowance Rs 19,200 (Increased from Rs 800 pm to Rs 1600 pm).

- Payments (Interest & maturity amounts) on Sukanya Samriddhi Account Deposit Scheme is exempted from Income Tax Under Section 80c. So it comes under Exempt – Exempt – Exempt tax category. It looks better than PPF (Public Provident Fund) now.

Other Tax related proposals

- Tax-free infra bonds proposed for funding irrigation, rail & road infrastructure projects. (Read : All you want to know about new Tax Free Bonds 2015-16)

- Service tax rate increased from 12.36 % to 14%.

- Wealth tax to be replaced with 2% additional surcharge on taxable income over Rs 1 cr.

- 100% TAX DEDUCTION on contributions made to SWACHH BHARAT & CLEAN GANGA initiatives.

- PAN must for any sale exceeding Rs 1 Lakh. (Read : “List of Financial Transactions where quoting PAN is mandatory“)

- Additional deduction of Rs 25,000 is allowed for differently-abled persons, increasing the limit from Rs 50,000 to Rs 75,000 (under Section 80 U) . It is also proposed to increase the limit of deduction from Rs 1 lakh to Rs 1.25 lakh in case of severe disability.

- Deduction limit of Rs 60,000 on expenditure on account of specified diseases is enhanced to Rs 80,000 in the case of senior citizens (Under Section 80DD of the Income Tax Act).

- For the benefit of senior citizens, service tax exemption will be provided on Varishta Bima Yojana.

You may like reading below posts;

- List of Income Tax deductions & limits for FY 2015-16 (or) AY 2016-17.

- Income Tax Declaration & Investment Proofs to be submitted to your employer.

- Budget 2016-17 : Income Tax Rates for FY 2016-17 (or) AY 2017-18

Join our channels

Sir

I am drawing TA of Rs. 800pm+DA onTA.

Can I claim Income tax exemption of (TA+DA on TA )?

Dear Aneesa,

Conveyance allowance/ Transport Allowance :

Granted to employee to meet his/her expenditure for the purpose of commuting between place of his residences and the place of his duty.

It is exempted up to Rs.800p.m.

I believe that DA is fully taxable.

Hi shreekant..I am a retired journalist I need your help to clarify me flowing tax commitment s..1. I am 66yrs old. I sold my house July 2015 and bought a semi commercial property being used as shop in Ulsoor market area on august 24.. I have completed due process of tax formalities for the year ended march 2016..got some refund so for the excess tax paid. But due to family compulsions..age factors and recent govt policies I wanted to dispose of the property..2. I need tk know what wiil be the capital gain tax if I sell it now . 3. I have received rent fro. The premises for which TDs is dedudu ed..some internet from bank deposit of ABT 1.2 lakhs will be the only additional I come..property bank accounts are all in joint Names

with my wife..so can you advice the tax commitment or is it right to sell the property now..I have an offer now and also family requirement to go ahead..what do you suggest..tks.. vtvasu** @gmail.com.another id. Tks again

P’s. I just saw your blog in f. B and decided to seek your suggestion. Tsk

Dear Vasudevan Ji,

If Land or house property is held for 36 months or less then that Asset is treated as Short Term Capital Asset. You as an investor will make either Short Term Capital Gain (STCG) or Short Term Capital Loss (STCL) on that investment.

Short Term Capital Gains are included in your taxable income and taxed at applicable income tax slab rates.

Kindly read: How to save Capital Gains Tax on Sale of Land / House Property?

sir i have a query i am business during one year if in my account having 20lakh rupees submitted b/w 1 January to 1 December and before 1 December i have risen 18lakh rupees then at what type tax will be used on me. tell me soon sir i am confused.

Dear Rajkumar,

Are these cash transactions?

As long as you file your ITR correctly, it should not be of any issue.