We often get to hear a term called as ‘Self occupied Property (House).’ This comes into picture, when we talk about, House Rent Allowance (or) while calculating the Income from House property (or) while claiming the tax deduction on home loan interest amount.

So, what is a Self occupied property in terms of Income Tax?

Definition of a Self occupied property (SOP)

A self occupied property is one which is owned and used by you for your own residential purpose. You have to occupy the property throughout the year. Thus, a property or a house not occupied by the owner for his/her residence cannot be treated as a self-occupied property.

There is an exception to the above rule. If the following conditions are satisfied then the property can be treated as self-occupied and the annual value of a property (considered while calculating ‘Income from House Property’) will be NIL.

- If you (tax payer) own a property;

- If such property cannot be occupied by you, by reason of the fact that owing to your employment, business or profession carried on at any other place (other than the place where your self occupied property is there), you have to reside at other place in a building not owned by you;

- If the property mentioned in (a) above is not let-out at any time during the year. (The property should not be let-out fully or part thereof);

- No other benefit derived from such property.

(The Gross Annual Value (GAV), also called just the Annual Value, of a property is used in calculating the tax or rent which should be applied to the property).

Let us now understand few more points on Self-occupied property, like –

- What if I have one or more self-occupied properties? Which one should I choose as self-occupied property?

- Is my HRA fully taxable if I have a self-occupied property?

- How much can I claim as Income tax deduction under Section 24b, on the Interest amount paid for my home loan?

- If my self-occupied property is partly Let-out, what are the tax implications? Can I consider it as both let-out as well as SOP for claiming tax deductions?

- My self-occupied property is jointly owned (co-owned) then what are the tax implications?

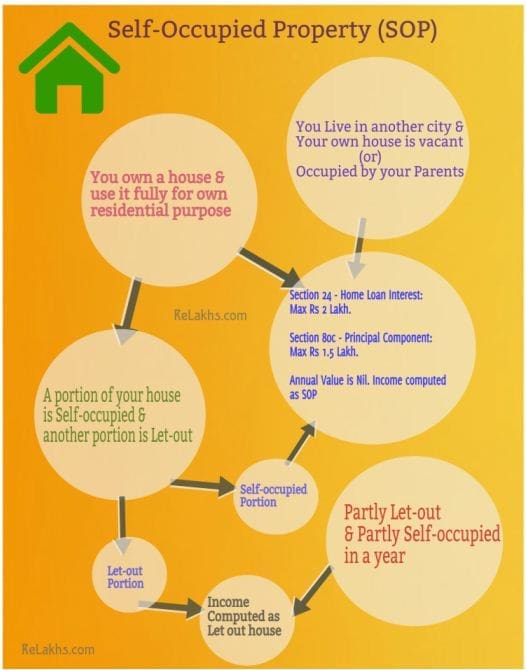

(Click on the above image to open it in a new browser window.)

Do you own one or more Self occupied properties?

You may have a query like this one – ‘I own a house in Bangalore and plan to purchase another one. From income tax perspective, how many houses can be treated as self occupied? ‘

Answer is, only one residential property can be claimed as self occupied. Even If you occupy (or may be your parents) more than one property for your residential purpose, only one house is treated as Self Occupied Property. Which one to choose as SOP? It is left to your discretion. The other(s) are treated as “Deemed to be let out” (DLOP) properties.

Latest update (02-Feb-2019) : Budget 2019 – Currently, income tax on notional rent (on deemed to be let out property) is payable if one has more than one self-occupied house. No tax on notional rent on Second Self-occupied house has been proposed. So, you can now hold 2 Self-occupied properties and don’t have to show the rental income from second SoP as notional rent. This is with effective from FY 2019-20 / AY 2020-21.

You may kindly go through this interesting ET article @ ‘It won’t be easy to claim 2 house properties as self-occupied for tax purposes‘.

You also need to know that you may also have to pay wealth tax on the second house as only one residential property is exempted from it. However, if you give your second house on rent for more than 300 days in a year, it will not be subject to wealth tax.

Self occupied house property for business purpose?

If you use your SOP house for carrying on your business/profession then income from such property is not chargeable to tax under the head “Income from House property.” (This is covered under the head Profits & Gains of Business & Profession).

Self Occupied Property & HRA (House Rent Allowance)

If you live in your own house, the HRA given by your company is fully taxable. In this case, you are not entitled for HRA and the entire HRA amount is taxable. There are few exceptions to this, as below.

- What if you own a house and you are employed in a different place/city? In this case, you can claim HRA exemption.

- You may occupy a rented house and you may also have a own property in the same city/town. Then, in this case, are you entitled for HRA exemption? Is it taxable? First thing is , your self-occupied property will be treated as a ‘let-out’ property (even if it is left vacant). Secondly, you are entitled to receive HRA and it is not taxable. But, do remember that this is a tricky situation. Your reasons for staying in a rented house should be reasonable and justifiable (during tax scrutiny, if any).

- Another scenario can be – you stay in a rented property in a different city (due to your employment/business requirements) and your family (parents) stay in your own self occupied property. Under this scenario, you can definitely claim HRA exemption. Your own house is treated as SOP and annual value is treated as NIL. Even if your own property is kept vacant, it is still treated as SOP only.

Self Occupied House/Property – Home Loan – Income Tax Benefits FY 2023-24

I f you have taken a loan to purchase your Self occupied property, you are eligible for few income tax benefits/tax deductions under old tax regime (only) for FY 2023-24.

- The Interest payable on home loan of a ‘self–occupied‘ property ‘ can be claimed as tax deduction. Under Section 24 (b) of The Income Tax Act. Tax Deduction on home loan interest for a self–occupied property is up to Rs 2 lakh.

- Under Section 80C – Deduction on repayment of principal amount on home loan is up to Rs 1.5 lakh.

- To acquire self occupied property, If you go for a joint home loan along with your spouse in the ratio of let’s say 50: 50, then both of you can claim these benefits separately. So the combined limit will be Rs 3 lakh (principal component) under Section 80C and 4 lakh (Interest component) under Section 24.

- An additional income tax deduction of up to Rs. 1.5 lakh for interest paid on home loans borrowed during 01-04-2019 to 31-3-2020 has been proposed in Budget 2019-20. This will be available under New Section 80EEA. That takes the total deduction to upto Rs 3.5 lakhs (existing Rs 2 lakh limit + Rs 1.5 lakh new proposal). This new Tax deduction is applicable on loan taken to buy a a self-occupied ‘affordable housing property’ only. Properties costing up to Rs 45 lakh are considered as affordable.

(If you take home loan for repair/renovation/reconstruction of your self occupied house, then the maximum Tax deduction limit on account of interest is Rs 30,000 only)

Self Occupied Property – A portion of it is Self-occupied & another portion is Let-out: Tax implications

This scenario can be like this – You have bought a two- storey (floors) building through a home loan. You have occupied one floor and rented out the other one throughout the year. In this case, income of each portion has to be computed separately, as if the let-out portion were Let-out property and the Self-occupied portion were SOP.

How to claim housing loan interest on this partly let out property? The home loan interest amount can be apportioned (shared) between the let-out portion and SOP.

For Example : Mr Kejriwal owns a Duplex Flat in New Delhi, which has two floors with separate entry for each floor. He has given one floor on rent and another one is self-occupied by him. His housing loan interest amount is Rs 5 Lakh in a Financial Year. Can he claim interest amount for let-out and self-occupied portions separately?

The answer is, YES. The property is treated as 50% let-out and 50% as SOP. The total interest amount has to be divided equally i.e., Rs 2.5 Lakh per portion.

The maximum interest amount that he can claim u/s 24 (b) for self occupied property & Let-out portion is Rs 2 Lakh only. So, out of Rs 2.5 Lakh, he can only claim Rs 2 Lakh as tax deduction.

There is no maximum ceiling limit (on interest amount) for Let-out portion. So, He can go ahead and claim the entire Rs 2.5 Lakh as tax deduction.

(Kindly note that the apportionment of the interest amount can be done based on plinth area (or) built-up floor area (or) any other reasonable basis).

Self Occupied Property – Partly Let out & Partly Self occupied (Time-basis)

If your property is self-occupied for part of the year & let-out for remaining part of the year, then the income from your House property shall be calculated for the whole year as ‘Deemed Let-out Property’ only. There won’t be any ceiling limit to One can claim tax deduction on “payment of interest amount” of up to Rs 2 lakh on home loan. I believe that it is not treated as Self Occupied Property.

How to calculate Income from House property?

Firstly, we have to determine the Gross Annual Value. The gross annual value of up to two self-occupied properties is zero. Whereas in case of Let out house, it is the rent collected.

| GROSS ANNUAL VALUE OF THE PROPERTY |

| Less: Municipal Taxes paid by owner |

| = Net Annual Value (Gross Annual Value – Property Tax) |

| Less: 30% standard deduction on NAV ( under Section 24(a) of the Income Tax Act) |

| Less: Interest on home loan (allowed under Section 24(b)) Less: Interest on home loan (allowed under Section 80EE) (if eligible) |

| = Income from house property |

Latest news : Budget 2016-17 – Home Loan Tax Benefits & Self Occupied Property :

Existing rule : To claim tax benefits on home loan of a Self-occupied Property, the construction has to be completed within 3 years from the end of the Financial Year in which the capital (home loan) borrowed.

New Provision (effective AY 2017-18) :

In view of the fact that housing projects often take longer time for completion, it is proposed that clause (b) of section 24 be amended to provide that the Deduction under the said provision on account of Interest paid on Home Loan for acquisition or construction of a self-occupied house property shall be available if the acquisition or construction is completed within FIVE years from the end of the financial year in which capital was borrowed.

This amendment will take effect from 1st day of April, 2017 and will, accordingly apply in relation to assessment year 2017-2018 and subsequent years.

Do you find this post informative? Kindly share your comments 🙂

Continue reading :

- Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

- Income Tax Deductions List FY 2023-24 | Under Old & New Tax Regimes

- What is Mutation of Property? How to apply for Mutation of Property?

- Understanding Tax Implications of Income from House / Property

- 5 ways of transferring your Immovable (or) Real Estate Property

- Budget 2019 – Rs 1.5 lakh Additional Income Tax deduction on affordable home loans | Section 80EE

(Post last updated on 23-Sep-2023)

Me and my husband have a joint loan. We don’t stay in that house. It is rented out. In same city we stay in another area in a rented house. My husband claims the HRA whereas i don’t. He also takes the rent from owned property and i don’t. I also don’t pay the rent of the current house. I want to take the benefit of House Loan how should i do it as a let-out property or self-occupied property

Dear shweta,

Is the house jointly owned by both of you??

yes. both loan as well as house is jointly owned by us

Dear shweta,

Then advisable to show your share of rental income from the property and can also claim tax benefit on EMI payments.

Related articles :

* Understanding Tax Implications of Income from House / Property

* Joint Home Loan : Eligibility rules & Income Tax Benefits

* Income Tax Deductions List FY 2020-21 | New Vs Old Tax Regime AY 2021-22

but i do not take any benefit of the rental income. it just complicates that we both take HRA benefit by paying rent 50-50, then take rent 50-50 and claim house benefit also 50-50

Dear shweta,

That’s how the law has been framed..one can take the applicable tax benefits as per the ownership share..

I have two flats in Kolkata,

a) in the first one I stay, whereas

b) the second one is lying vacant, occasionally I visit there and is under Home Loan.

What would be the income tax implication for the second one in AY 2020-21

Dear Dr Abhijit,

The gross annual value of up to two self-occupied properties is zero.

Do you occupy the second one as well? Or are you planning to give it on rent?

No I have no plan to give it on rent right now it is lying vacant. Occasionally I go and stay for few hours. Do I have to show deemed rent?

Dear Abhijit,

I believe that you may have to show it as ‘deemed to be let-out’ one..

Hi Sreekanth,

My husband is about to buy a flat in Pune city on his own name, he cuurently lives in Mumbai;

I am cuurently working in pune & living in pune.

As i am not co-owning this property & if i live in his new flat will i be able to claim HRA ?

Dear Kranti,

Yes, you can claim.

A taxpayer is entitled to claim the HRA exemption for rent paid to his or her spouse provided there is documentation to prove that the arrangement is genuine.

Claiming exemption for the house rent allowance (HRA) by paying rent to the spouse has been a contentious issue (can be subject to scrutiny).

Kindly get Rental agreement done and pay in non-cash mode.

If the rent is > Rs 8,333 pm you need to quote your spouse’s PAN number.

Also, your husband has to show this as rental income in his ITR filing.

Related article link..

Tax paying parent does not own house,stays in son’s house without paying rent.What should he fill in house property section of ITR 1 of AY 2019-20 as the property is neither owned nor rented.

Dear Prasad,

Do they both live in same city/location? Is the son claiming HRA?

Hi. I own a property in Gurgaon. I am now shifting to a bigger property in Gurgaon (1 km away) on rent. The first property will be used by my parents (no rental income).

1. Can I claim HRA on my new rented property? (despite same city nature)

2. Will I have to pay tax on deemed notional rental income for first property?

thanks

Hi,

1 – Yes.

2 – You can consider it as a Self-occupied property.

My son and daughter in law purchased a flat on 26th July 2018. They are staying with parents in another house paying a rent of Rs. 16000/- to his father. Newly purchased home is vacant. Now he plan to shift in february 2018 Can he claimed HRA exemption up to March 19

Dear Aleykutty ji,

Yes, he can claim..

Related article : Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

Dear sir, I purchased a house in 2007 with home loan, afterwards i have forced closed the loan and my brother stays in that house. Now i have purchased a house in 2018 with home loan and it is also occupied by me .So how to calculate the tax liability?

Dear SK,

You can declare the house occupied by your brother as ‘Let-out’ property and then one occupied by you as ‘Self-occupied’.

You can show the rental income from let-out property in your income tax return.

Can claim tax benefit of up to Rs 2lakh u/s 24 towards the interest amt paid for self-occupied property.

Kindly read :

* Understanding Tax Implications of Income from House / Property

* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

Dear Sreekanth,

Thanks you for so many clarifications, however I have a slightly different case, Iam living in SOP on 3rd floor, and my mother has knee complications, so for her I had to take a rented apartment on the ground floor of another building nearby.

My mother is fully dependent on me, The rent agreement of this rented flat is on my name and Iam paying rent for it.

So in such a case, can I claim HRA exemption.

request to kindly guide please.

Dear Sanjay,

As you are living in your own house (SOP), I believe that you can not claim HRA in this scenario, though you are paying the rent on behalf of your parents.

Yes, I am staying in my Own house,

Thanks a lot for the clarification

Dear Sreekanth,

I have a house property in a city and i gave it for rent. I haven’t taken home loan for my house. My office is far from my house, so I live in the same city in a rented house. I am claiming HRA for the rented house. But the tax benefit i get from HRA is minimal compared to the rent received from my house property. Can i show my house as self occupied instead of claiming HRA for my rented house? Thanks for your help.

Dear Kavitha,

Is your Tenant claiming Rent as his/her HRA?

No, my tenants are not claiming HRA. It is a single building with 3 houses(3 floor) in it. But no one is claiming HRA .

Thanks for your reply.

Dear Kavitha,

In such a scenario, you may claim tax benefit but you may have to update your employee records in your Company accordingly and should not show rental income in your ITR.

But, its always advisable to be honest!

Thank you Sreekanth. One last question.

Can I show my house(above said) as self occupied and stop claiming tax benefit for HRA?

I have a flat in Greater Noida UP which is vacant.

I am living on rent at Dwarka New Delhi.

I am working in PSU and getting HRA.

Can I claim rebate on rent paid for income tax purpose

Dear mano ..Yes, you can claim HRA.

Related articles :

* Understanding Tax Implications of Income from House / Property

* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

Dear Sreekanth,

I’ve two home loans. One for self-occupied and another one for let-out property. Home loan interest paid towards self – occupied property is Rs. 2,42,238/- and home loan interest paid towards let-out property is Rs. 2,39,096/- . I’m aware that now the max. limit in each of these case one can claim is Rs. 2,00,000/-

In my case, can I get tax exemption for 2,00,000 + 2,00,000 = 4lakhs or for both the properties I can get exemption of only 2 lakhs ?

Dear Pradeep,

You can claim up to Rs 2 Lakh only (for both houses put together).

Kindly go through below articles ;

* Understanding Tax Implications of Income from House / Property

* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

Dear Sreekanth

I have paid two instalments of my house loan in the month of feb & mar 18. I have resided in a rented house. Can I claim HRA for 10 mths and 2 mths in self occupied proper

Dear Tanmoy ..Yes, you can claim both for the respective periods.

Related articles :

* Understanding Tax Implications of Income from House / Property

* Income Tax Deductions List FY 2018-19 | List of important Income Tax Exemptions for AY 2019-20

I am a government servant living in own house and not claiming any HRA exemption. Can I claim property tax paid to Municipal authority in my income tax return

Dear sunilkumar,

Yes, you can claim it under the head ‘income from house property’.

Kindly read :Understanding Tax Implications of Income from House / Property

sir, I having a house self occupied and owned jointly by me andmy husband. Whether i have to show the details of annual value etc in the ITR for AY 2018-19. No portion is let out or we are getting any income from the property and we are paying the property tax promtly. whether both can simply declare it as SOP in ITR. A reply is solicited.

with regards

parvathi

Dear parvathi,

The rental annual value is NIL in case of Self occupied property.

If you have taken a home loan then you can claim tax benefits on it.

Kindly read : Understanding Tax Implications of Income from House / Property

I have a housing loan with a nationalised bank. I had repaid sum of Rs. 4.21 lacs in the month of July 16 and thereafter no repayment has been made.

The bank issues me certificate of loan repayment for 4.21 lacs with Principal repayment of 373000/- lacs and Rs. 48000 towards interest stating that the interest repayment is considered upto June 16 as interest repayment for further period is not done. however my loan account shows debit interest from July till March 17 which is stated to be unpaid as no repayment has been done after July 16

Is the bank right in issuing such certificate or am I eligible for the entire rebate of interest charged to my loan account during the financial year 2016-17

Please guide

Dear VASANT .. You can claim entire interest payment done in FY 2016-17 (subject to ceiling limit of up to Rs 2 Lakh if it is Sop).

Kindly read : IT deductions list for FY 2017-18.

Hi Sreekanth,

I have 1 SOP in HYD and other one getting ready in BLR(work location),

1. in HYD Jointly owned by me and my dad, though i am paying the complete EMI(HDFC), so far i am claiming the complete TAX benefit. My parents are staying here, so SOP

2. BLR one yet to get ready and registration is pending(another month), will be staying there. This one is loaned from SBI(self) and i am paying a pre EMI so far without any benefit. This will be converted soon to actual EMI once process towards registration and will be SOP.

So far i understand that only one property can be claimed as SOP and other will be LOP/DLOP.

I am confused on which one to declare SOP and which one DLOP. How can i get most of TAX benefit out of these. My HYD house loan is very less compared to BLR house.

Have few questions

1. Should i declare my BLR house as SOP once occupied or declare it now, anyways i will be moving next month. As this one has greater loan amount.

2. Which part of loan(int/principal) can i claim for my HYD house. under which section

3. How can i claim my pre-EMI amount. i heard i can spread the interest paid so far into 5 years after occupation. but under what section.

Regards,

Mohan

Dear Mohan,

Kindly note that from FY 2017-18, the maximum loss on income from house property (properties) is up to Rs 2 Lakh only.

So, if you are paying interest payments of more than Rs 2 Lakh then it does not make any difference as of now. But anyways you can claim the property which has higher loan amount as Let out one and claim the other one as SoP. (Tax laws may change any time 🙂 )

Kindly read :

Income form house property & tax implications.

IT deductions list for FY 2017-18.

Under construction property & tax implications.

Thanks for the reply, will go through the articles

DEAR SIR

MAY I KNOW .. I AM A DOCTOR HAVING LEGAL OPD CLINIC BUSINESS (PARTIAL AREA) IN RESIDENTIAL FLAT AND AT THE SAME TIME I HAVE HOME LOAN ON FLAT. CAN I CLAIM DEPRECIATION FOR THE PART USED AS OPD CLINIC

DR. KIRTIKUMAR PILANKAR

Dear KIRTIKUMAR .. Kindly consult a CA.

Hi Shreekanth,

Before I post my Query, A Great thanks for helping us out with your valuable suggestions.

I currently stay in Greater Noida ( Delhi NCR ) and possess a Flat for which I pay Home Loan. I now want to shift to my parents place by paying a Rent to my Mom ( Around INR 12K – 14K ) which is in a different City (Ghaziabad) but in Delhi NCR itself.

The reason for shifting is that I want to be with my parents, but since my Dad is retired I dont want to financially burden and hence would be paying the rent and this would make my flat be Empty ( Which is fine with me)

My Query is that Can I claim both HRA & Tax Benefit on my loan and would there be any IT implications in doing so.

Dear Prateek,

Yes, you can claim tax benefits & HRA, both.

Hi Sreekanth,

First of all let me congratulate you on helping us out.

I am facing a problem and I seek a solution for it.

I purchased a piece of land and constructed a house over it. I took a joint home loan with my spouse for the construction. The initial loan was from HDFC wef Jul 14 which was transferred to LIC wef Jul 16.

At the time of claiming IT rebate i submitted a completion certificate with an issuing date of Mar 16 along with LIC documents of Jul 16. Now my accts dept is treating my house building loan as loan taken for repairs and giving me a benefitn of 30,000 only. Please guide me.

Thanks

Dear Rohit,

May I know the reason stated by your Company’s Acc dept?

Did you get the possession of the house?

Here my current situation….

I own two homes in the same city (joint home loans with spouse). I stay rented at a different home in the same city.

What we pay –

Home 1 – Around 2,00,000 interest

Home 2 – Around 7,00,000 interest (including pre-emi calculations)

HRA – Around 2,50,000 a year (after all hra calculations)

What we receive –

Income Home 1 – Around 1,75,000 (after deductions etc)

Income Home 2 – Around 2,25,000 (after deductions etc)

Question 1- Can I declare HRA and home loan interest in the following manner…

Self – Interest for home loan 1 and home loan 2 (2,00,000 + 2,00,000) & declare income of home loan 1 (1,75,000)

Spouse – HRA (2,00,000) and home loan 2 (2,00,000) & declare income of home loan 2 (2,25,000)

Any insights will be much appreciated.

Dear Raghav,

May I know who is receiving HRA? Are properties jointly owned?

For FY 2016-17 – Interest payments of Rs 2 Lakh and Rs 7 Lakh can be claimed fully u/s 24.

From FY 2017-18 – this will be limited to Rs 2 Lakh only.

Kindly read: Budget 2017, key Direct Tax proposals.

Thanks for the answers…

May I know who is receiving HRA? Are properties jointly owned?

The property is jointly owned.

For FY 2016-17 – Interest payments of Rs 2 Lakh and Rs 7 Lakh can be claimed fully u/s 24.

From FY 2017-18 – this will be limited to Rs 2 Lakh only.

isnt it 2 lakhs limit only for the let our property ? In my case doesn’t this become 4 lakhs since it is joint home loan?

Also for self occupied it is again another 2 lakhs right ?

Dear Chintu / Raghav,

(Kindly post your queries/responses with the same Displayname)

Yes, each tax assessee would get to claim up to Rs 2 Lakh. In jointly owned property, it is up to Rs 4 Lakhs (for both owners put together).

However, I believe that this Rs 2 Lakh limit is for all the multiple properties owned by the individual.

Hi Sreekanth,

I have a home loan for self occupied flat for which I am taking tax benefits. Now I am planning to take up top up loan.

I learnt from nationalized bank that there will be separate account for top up loan. In such case, bank would issue two separate interest certificates. So, how can I take additional tax benefit for top up loan? Can I show two interest certificates for tax benefit for self occipied flat?

Kindly advice.

Regards

Thanks

Madhu

Dear mtl,

Yes, you may do so, but up to Rs 2 Lakh u/s 24 for interest payments.

Hi Team,

I need some help from you, its related to Let out property. Actually I have two flats one I have purchased in 2014 and got the possession for the same in April 2016 and in Aug, 2016 I purchased another flat. Both the flats are in outskirts of the city so both have been rented out. This time I was able to declare only one flat in Let Out Property as for the other flat I am yet to pay the property tax and EB name transfer is also not done. So my questions are:-

1. Can I declare both the properties as Let Out and also claim HRA because I am staying in rented flat near to my office and both my flats are more than 30 kms hence I need to rent both of them.

Note: In my company portal while declaring Income tax, I was able to submit details for only 1 flat only so the company HR told me that I can claim for other flat while filing returns.

2. As for the year 2017-18, govt has put the cap of 2 lakh on the home loan interest on Let Out properties similar to Self Occupied property so I wanted to know if I show both the properties as Let Out then 2 lakh interest cap is overall or this limit is for each property?

3. Can I show the pre EMI interest for my first flat for which I had taken loan in Jan 2014 and I got the possession of the same in April 2016? As I didnt submit or declared anything in Income tax for my first flat in 2016, can I declare the same (pre EMI, interest paid, princial paid) in FY 2017??

Dear Hoshang,

1 – Yes, you may do so.

2 – I believe it is for overall. Read : Budget 2017 & important Direct Tax proposals

3 – Kindly read : Under-construction property & Tax implications.

Thanks a lot Sreekanth for your quick response. I also want to know as the overall cap is of 2 lakhs for LOP(whether there is one or more) so how this carry forward of loss of interest amount resulting from multiple properties will work? I know that we can claim it in 8 subsequent years but i want to understand how it will work because if a person is paying 4 lakhs of interest on LOPs after deducting rent and 30% NAV still he will be paying more interest only which means atleast for next 3-4 years he will be paying more tax as the limit is only upto 2 lakhs. So that carry forwars benefit will only benefit of the net loss from LOP becomes less than 2 lakhs.

Dear Hoshang,

Your understanding is correct.

That’s why in most of the cases (major part of home loan tenure), these loses can be just Dead loses.

Hi Sreekanth,

I live in bangalore, I have an apartment , which is let out. Also I have a house in a plot in the suburbs. However I stay close to the office in a rental home to avoid traffic. Both properties are owned fully by me. The house in the plot is vacant . I should be able to get treat the interest on home loan for the vacant house in the plot as self occupied house, then the apartment as let out along with HRA. Kindly provide your guidance.

Dear Arvind,

You can claim HRA and treat the two properties as Let-out ones.

Read:

Income from house property & tax benefits.

Budget 2017 limits loss on property to Rs 2 Lakh!

I own 2 House Properties. 1 in my name and the other is jointly owned by my Son. I reside at Property 1 which is owned by me (SOP) and my son resides at Property 2. Will property 2 be considered as DLOP for me? If yes till what extent?

Also can my son claim it as his SOP and still do I need to consider it as DLOP?

Dear Jinav Ji,

As you own two houses, and you are declaring the property solely owned by you as SOP, the other property has to be declared by you as DLOP only. I believe that he can declare it as his SoP.

Dear Sreekanth ji,

If my Son will declare it as his SOP do I still need to declare it as my DLOP? Can one property be both SOP and DLOP?

Thank You for quick reply

Dear Jinav ..Yes, it can be.

Hi Shreekanth,

I have 2 flat in the same locality. In both the flats my wife(Housewife) is a co-owner.

1st one has no loan but rented out. The other one is SOP and there is a home loan on it.

How much share can I can show for my in Income tax for the first flat.

Thanks in advance.

Dear Gaopal,

You have to declare rental income as per your share in the property (first one). By default it would be 50:50.

I am central govt employee and living in govt alloted house in delhi , can i claim rebate on income tax from interst part part of housing loan from bank in NCR region kindly clearify under section 24

Dear Mr Pant..Are you declaring it as a Let-out property?

I have a flat in Nasik an Pune on which Home loan is availed. I work in Pune and I am staying in a rented property.

Can I claim Interest on Housing Loan for both properties and also avail HRA.

Dear Tejaswani..Yes, you can declare both the properties as Let-out one and also claim HRA.

I am a retire scientist but staying in a rented house. I HAVE own house which is 7 km away from the rented house in the same place. Kindly advice me can I avail house rent claim of Rs 5000/per month.

Dear Karisiddaiah,

Yes, you can claim HRA as the own house can be declared as Let-out property in ITR.

i staying in Pune city Goverment Quater i had not received HRA & I purchased one house property in same city can i claim interest exemption u/s 24.

Reply

Dear Smita,

Yes, you can claim ..

Hi Shreekanth,

I have got the possession of my unit in Gurgaon few days back. I am planning to put it on rent, however not sure if i will get tenant by March or it will be vacant for FY 16-17. I am staying on Rent in Noida and would like to know if i can claim the unit as let out or deemed to let out unit and claim the entire Housing Loan interest paid u/s 24 + pre construction interest (1/5th) to claim it as a part of let out property. Or will it be considered as Self occupied property if it stays vacant till March.

Thanks

Deepak

Dear Deepak,

You can declare it as a Let-out property kept vacant and claim interest payments u/s 24. (Rental income would be NIL).

Thanks Shreekanth for your prompt reply. So it means i can claim the entire interest paid (3.5 lac) for this FY and not just 2 lacs as per self occupied rule.

Best Regards,

Deepak

Dear Deepak,

Self-occupied rule?

In case, you declare it as SoP then ceiling limit would be Rs 2 Lakh only.

Kindly read: Budget 2017 & Key direct tax proposals.

Hi Sreekanth,

Request you to kindly answer my query as below.

There is one property in Delhi which is registered on my mother’s name only, however, in the housing loan against that property I am the primary applicant and my mother is mentioned as a co-borrower.

I just wanted to check if

1 – I can take the deduction (100%) for the interest paid on housing loan.

2 – If I can split the deduction (50:50) between me and my mother.

PS – Provisional Interest Certificate issued by the bank has both of our names in it.

Dear Amit,

1 & 2 – No. As you are not co-owner or owner of the property (Kindly read : Joint home loan & tax implications)

Hi Sreekanth!

Please review the following case :-

A company owns two flats, for one of the houses, bank loan was taken for construction. House No. 2 is given on a monthly rent of Rs 10,000.

In the Agreement of purchase, house is meant only for residential purpose.

1. Will there be any income under Income from House Property?

2. Will interest on bank loan be allowed as an expense while calculating Gross Total Income of the company?

3. Will the first house against which bank loan is obtained be treated as an SOP? I dont think a company can possibly own a SOP

Dear Sagar,

It has to be treated as commercial property and let-out one.

Read: Income from house property & tax benefits.

Dear Sreekanth,

As it is to be treated as commercial property, interest expense will be allowed under Business or profession right? The flat will be used for residential purpose of employees and directors.

I am aware that rental income of Rs 10000 per month from House no 2 will be taxed under Income from House Property.

Dear Sagar..Suggest you to consult a CA in person and take advice.

Dear Sreekanth

Thanks for such informative detail.

I have a query , currently i have a home in bangalore which is purchase with a loan and have claimed the IT rebate on that interest and principle .

I too have bought a property in Cochin which is rented out , will it possible to claim exemption on the 2nd home and what additional benefit will i be able to claim form the 2nd home .

Can you guide me .

Thanks

Dear Sandy,

Have you taken home loan on the second property too?

Kindly read: Income from house property & tax benefits ..

Hi Sreekanth

Yes i have taken loan on the 2nd property and it is rented out , the house i am staying is declared as SOP and has the highest interest so have been using that for the 2 Lakh exemption .

Dear Sandy,

You can claim interest payments as tax deduction u/s 24 on second property as well.

Kindly read: Income from house property & tax benefits.

Kindly note that Budget 2017, has been proposed to limit the loss from ‘income from house property’ head to Rs 2 Lakh only and the unclaimed loss can be carried forward to next assessment years. This would be from AY 2018-19 onwards.

Hi,

I live on Rent in Noida and I have my own flat in Greater Noida. My flat is right now vacant.So, can I claim both HRA and Housing Loan Interset? Are Noida and Greater Noida treated as different cities or same?

//Thanks

Dear Amit,

I believe that you can claim HRA & declare the own property as ‘Let-out property kept vacant’.

Hi Sreekanth,

I bought an under construction house in Oct 2016, home loan sanctioned in Oct 16. I started my EMI (principal and interest) from Nov 16. My question is can I claim u/s 80EE in this year or next year. Since my house is still under construction and expected to complete next year, my expected principal and interest comes to only Rs. 1.15 lacs which is less than the limit of 2 lac (incl 80EE). Hence, can this spill over be claimed in next year. I am not exceeding 1.50 lac in this year and I missed the 80EE benefit. Whereas next year payout would be definitely more than 1.50 lac, hence since I didn’t claim 80EE this year, can I claim 80EE benefit next year.

Dear Neema,

The law is silent on the point that whether this Section is applicable to already constructed houses or under-construction house. In the absence of any specific instruction, it is always assumed that it is applicable to everyone i.e. it is applicable to all types of houses.

First time Home Buyers can claim an additional Tax deduction of up to Rs 50,000 on home loan interest payments u/s 80EE. The below criteria has to be met for claiming tax deduction under section 80EE.

The home loan should have been sanctioned in FY 2016-17.

Loan amount should be less than Rs 35 Lakh.

The value of the house should not be more than Rs 50 Lakh &

The home buyer should not have any other existing residential house in his name.”

Hi Sreekanth,

I own a house in Bangalore which I have given on rent and I live myself as well in a different rented apartment in Bangalore only, In this scenario can i claim HRA and Housing Loan Benefit by showcasing my own house as let Out ?

Dear Sumit..Yes, you can claim both..

Hi,

I was living on rent for the period Apr-16 to Jun-16 and then I got possession in July and shifted to own house. Can I claim HRA for the said duration and simultaneously claim deduction under sec 24 for house LOAN INTEREST.

Thanks.

Dear Shwet..Yes, you may do so.

Dear Sir,

I have my own 1 BHK house (loan free) in pune but due to big family we have shifted to 2BHK home in (Same building). Also We have not kept/given our own 1bhk in rent.

Please let me know can i claim HRA for the rented flat.

Dear snehil ..Yes, you can claim HRA and declare your own property as Deemed to be let-out one.

Me and my Husband both are working and we owned 2BHK flat in Pune. Both of us has taken loan wherein he is Principal borrower and I am secondary.

Its a newly constructed building which has completed on 10 Oct 2016. We have bought this flat for our own stay. Will I or husband be liable to pay property tax?

If yes, Can you please explain how we calculate property tax, supposing the value of the property is 55 Lac?

Dear Archana,

Yes, you can deduct the property tax when calculation your ‘income from house property‘.

For Property tax details you have to visit your nearest Pune Corporation office/help centre.

hi Sreekanth,

I own a flat in Mumbai where my wife and 2 children live. I work and stay alone in Pune, and am renting an apartment there. I bought a second flat in my building in June 2016 where I plan to bring my aged mother. I took a loan for the second flat and paid it off in Oct 2016. The interest amount paid is around 31,000.

1. Can I claim HRA exemption for the rented flat in Pune.

2. Can I claim exemption under Section 24 for the Interest paid towards my housing loan.

Dear Vicky,

You can claim HRA for the months of Arpr & May.

Yes, you can claim tax deduction u/s 24 (provided it is not an under-construction property and the possession is given).

Sreekanth,

Thank you for your quick response.

The two flats i Own are in Mumbai, whereas the flat I am renting is in a different city, Pune. Can I not claim HRA for the full year Apr to Mar?

Hi Sreekanth, many thanks for your article. Helpful – but just to double check, please help address my query as follows. I have 2 properties – 1 in Noida and 1 in Gurugram. I live with my parents in New Delhi. The Noida property has been rent out for entire 12 months and the Gurugram property for 7 months. I understand from this article that none of them can be claimed as SOP and rental incomes from both properties will be needed to be shown in ITR submission. Please help to confirm the understanding. If I have understood incorrectly, please advise for the same. I don’t have any outstanding loans on both properties. Thanks and Regards, Amit

Dear Amit,

Yes, you can declare both properties (own) as Let-out ones and rental incomes have to be shown in your income tax return.

Hi Sreekanth, many thanks for your kind response and confirmation. Regards, Amit

Hi Sreekanth,

I have taken a home loan jointly with my mother for a property in Ranchi (in me & my mother’s name (Co-Owners)). I live in Bangalore in a rented flat. I am producing a declaration from my mother that she is not claiming any tax benefits from this property(As suggested by my company’s finance dept). My questions are:

1. Can I Take benefit for both – HRA and Home loan (as My parents are staying in the owned flat in Ranchi) ?

2. If I declare it to be let-out property, can i show the income from rent as 0 (zero)?

Also, please mention any special the documents/declaration I need to furnish.

Dear Ranjan,

1 – Yes.

2 – No. You need to declare rental income.

Sreekanth garu,

Thanks for the most informative document, request you to answer my query.

I bought a house in my home town and gave it for rent (8000Rs/month), I am paying loan on the same, Principle : 39416 Toward Interest : 362499.

I am staying in another place for work purpose and paying rent and claiming HRA for it, my query is, how would tax interest part be calculated on the loan amount considering 39416(principle) would go in 80C?

would it be Interest – rent received = tax benefit?

362499-96000=266499

Dear pavan,

Yes, EMI has two components namely Principal & Interest repayments.

Principal part can be claimed under section 80c.

Interest repayments can be claimed u/s 24.

Suggest you to read this article : Income from house property & tax benefits.

Hi – I have a house with 2 floors. I live on Ground floor and Tenants have occupied 2nd and 3rd floor. Though my house stands on a single site does it come under the definition of ‘ one property’. Can I use ITR 1 in this case to file my returns where I can club both the rents and show as ‘ one’ from let out prop?

Regards, John

Dear John,

I believe that if property is entirely self occupied or entirely let out. ITR-1 is an appropriate form (subject to other conditions).

Kindly read : Which ITR form to file?

Dear Sreekanth,

Thank you for sharing the knowledge you have acquired and doing this service.

I have one doubt and need further clarification, in this regards.

I am a salaried person, lives in Delhi. I own a house where the ground floor is a let out property and the 1st floor used for residential purpose by me. For the rental, I am already paying the tax due to which I received lesser amount every month as compared to the original rent agreement.

So my query is:

1) While filing the return, do I need to pay the taxes again as “income from property” or it can exempted by submitting the tax deduction calculation sheet received from the let out party.

Also, I get the tax deduction details after completing the 2016 financial year, so do I need to mention this in my office tax declaration form or it can be showed while submitting the return file?

2) In the current scenario, is there any way by which I can avail the benefit of HRA too?

Dear GKumar,

I am unable to understand this “For the rental, I am already paying the tax due to which I received lesser amount every month as compared to the original rent agreement.” ??

You can declare it to your employer and if that is not possible, you can disclose when filing your income tax return.

2 – As you are residing in your own house, kindly note that you can not claim HRA.

Hello Sreekanth,

I have a home loan and currently my employer is asking for the PAN details of lender (SBH in my case) as per the new notification S.O. 1587(E) dated 29th April 2016 (#2. (3)) . The Bank tells me that they do not share the PAN details. Who is right and who is wrong?

BR,

Nithin

Dear Nithin,

Your employer is correct.

Hi SreeKanth,

Thanks for the very informative article. Here is my query,

I bought an apartment during May 2016 in the city where I live. As the apartment was in finishing stage I didnt take moratorium period for my housing loan. I started paying EMI from June and received possession of the apartment in Oct 2016. Currently interior work is in progress and I stay in a rented house. Apartment would be ready by Jan 2017 end and am planning to occupy by Feb 2017. my query is

1. Will I be able to claim HRA for the period April 2016- Jan 2017? and also housing loan interest

2. Can I claim whole interest paid for the FY year or only 2 lakhs, or any other ? .

3. how would you call this case? is it self occupied property kept vacant?

Looking forward to hear from you. Thanks in Advance

One more question, as am not sure if I will occupy my house or rent out.

1. In which case I can claim full HRA and full interest paid for loan, is it for self occupation of property or for let out. ?

In both case I can do only from February 2017. On Tax beneficial wise which is better. Please suggest.

Dear Sbanta..From taxation viewpoint alone, renting out can be a better option.

Dear sbanta,

1 – Yes, both can be claimed.

2 – If is for self-occupation then Rs 2 Lakh , else entire interest payment can be claimed.

Read: Income from house property & tax benefits.

3 – What is your plan? Are you going to give it on rent?

Hi Sreekanth,

This is Surya from Bangalore. I purchased 2BHK in Bangalore, in that my parents are staying. I am staying in rented house. can I claim both HRA and home loan benefits?

Dear Surya,

You may claim HRA and declare the own property as Let-out one to claim tax deductions. Kindly note that you then need to declare Rental income too.

In case, you would like to declare it as a SOP, you may have to justify your claim of HRA & tax exemption on SOP. (this can be possible, if your property is far from your work location).