Is there any investment option which can mimic the risk-return profile of a Debt mutual fund and is also a tax efficient one like an Equity oriented Mutual Fund? Do we have such an investment avenue? Yes is the answer.

Arbitrage Funds have the risk-return profile which is similar to Debt funds and they are also tax efficient ones. An Arbitrage mutual fund is similar to say a Liquid Debt Fund in terms of Returns and is like an Equity fund with respect to Tax implications. It is generally a risk-free investment option.

In this post, let us understand – What is the meaning of Arbitrage? What are Arbitrage Funds? How do Arbitrage Mutual Funds work? What is the tax treatment of capital gains on Arbitrage Funds? Arbitrage Funds Vs Debt Funds.

What is Arbitrage?

Arbitrage is the practice of taking advantage of a price difference between two or more markets. This can be done by exploiting the differences in the price of a Financial Security or Asset or Product (goods) by simultaneously buying and selling it in different markets. It is a short-term trading opportunity.

Let’s understand the concept of Arbitrage with an example.

Mr Saravana runs a decent hotel which serves only South Indian Tiffin Items. His hotel is very famous for Idlis. He sells Idli at Rs 10 per piece. The cost price of one Idli is Rs 7. So, he earns a net profit of Rs 3 (Rs 10- Rs 7) for each Idli sold. He is not happy with the quantum of net-profit. He wants to increase his profit margin without increasing the selling price.

One day, he tasted idlis in a near-by Bus stand canteen. The quality and taste of the Idlis are same. But the selling price of each Idli is Rs 5 only (whereas he is selling one Idly for Rs 10). So, he decides to buy Idlis from the canteen at Rs 5 and to sell at his hotel for Rs 10 each. In this scenario, he can make a profit of Rs 5 (Rs 10 – Rs 5).

What are Arbitrage Funds? How do Arbitrage Funds work?

The above practice of buying from one market and selling at a slightly higher price in a different market is called as ‘Arbitrage Opportunity’.

These kind of investment or trading opportunities exist in Financial Markets too. The financial securities like Stocks can be bought in CASH market and can be sold in DERIVATIVES market at a higher price.

For example – Share price of XYZ company can be quoting at Rs 1,000 per share in NSE Cash market (National Stock Exchange) and Rs 1,010 per share in Futures & Options market for the next month. So, an investor or fund manager can buy shares of XYZ at Rs 1,000 and at the same time sells XYZ share in F&O at Rs 1,010. On settlement date (Expiry day), the investor can make a profit of Rs 10. ( A Futures contract is a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future.)

So, Arbitrage Fund is the one which tries to exploit the pricing imbalances (mispricing) which are available in the cash and derivatives markets. The strategy of an arbitrage fund is to trade in Cash & Derivatives market with an aim to generate debt fund like returns.

Another arbitrage opportunity can be when there is a difference in the prices of a Share quoted in the NSE & the BSE.

Portfolio of an Arbitrage Fund

The fund objective of a typical Arbitrage Fund in India is to generate reasonable returns by predominantly investing in arbitrage opportunities in the cash and derivatives segments of the equity markets and by investing remaining balance in debt and money market instruments (like Debentures, Commercial Paper, Certificate of Deposits etc.,).

For example : ICICI Prudential Equity Arbitrage Fund’s investment objective is ‘to generate low volatility returns by using arbitrage and other derivative strategies in equity markets and investments in short-term debt portfolio.’

As of 30th Nov, 2017 this arbitrage fund has a portfolio allocation of 66% in Equity & Equity derivatives, around 22% in Debt Securities, 3% in Money Market Securities and around 6% as idle cash.

Arbitrage funds can be classified as Arbitrage (or) Arbitrage Plus funds depending on the respective scheme investment strategy. Arbitrage Plus Funds’ execute investment strategies that may involve relatively more risk than usual arbitrage funds.

Below are some of the top performing and best Arbitrage Mutual Fund Schemes 2016-17. These are Direct Plans with Growth option.

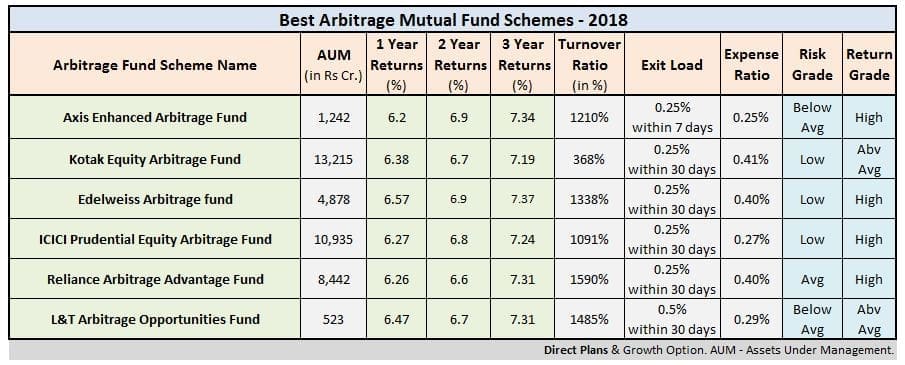

Best Arbitrage Funds – 2018

I have reviewed the performance of the funds under Arbitrage fund category and have provided the new list in the below table. I have replaced HDFC Arbitrage Fund and IDFC Arbitrage Fund, included Axis Enhanced Arbitrage Fund & Edelweiss Arbitrage Fund.

- The Arbitrage fund category average returns in the last one year was around 5.5% and in the last 2 to 3 years the returns have been around 7%.

- The returns from Arbitrage funds have slightly decreased over the last couple of years. The returns on these funds are mainly dependent on the fund manager’s ability to spot arbitrage opportunities. As more funds and more monies chase the arbitrage opportunities, the returns can reduce. If you observe the AUM of all the funds have increased tremendously in the last couple of years. ICICI Pru Equity Arbitrage Fund’s AUM has increased from Rs 1,000 cr in 2016 to around Rs 11,000 cr in 2017.

- Continuing with ‘Idli’ example; If hotel customers realize that same quality idlis are available at Rs 5 in the near-by canteen, the profits made by Saravana will surely come down. (or) The canteen owner can increase the price of each Idly and the arbitrage opportunity can vanish from the market.

- The current FD rates for 1 to 2 year tenure are around 6 to 7%. But Arbitrage funds are more tax efficient than FDs. So, if you are planning to invest in FDs (time deposits) for short term, you may still consider investing in Arbitrage Funds.

- Arbitrage funds have given average returns of 5 to 6% in the past one year, while liquid and short-term funds have given around 6.5% and fixed deposits have yielded 6.75%. Investors in the 5% tax bracket might not find this very attractive, but those in the 20% and 30% tax brackets certainly will. In the 30% tax bracket, the post-tax yield of debt funds will be around 4.5% while bank deposits will give roughly 4.75%.

- Post-tax returns = Pre-Tax returns * { (100-Tax Rate) / 100 }

- If you decide to invest in an Arbitrage Fund, consider opting for a Direct plan. Below table gives us an idea about why investing in a Direct Plan is better than investing in a Regular of the same scheme. I have provided details on ICICI Prudential Equity Arbitrage Fund here. The returns generate by the Direct Plan is better than the Regular Plan returns. The Expense ratio of the Direct plan is 0.27% and for the Regular Plan it is 0.87%.

(You may like reading : ‘What are Direct Mutual Fund Plans?‘ & ‘Equity Mutual Fund Direct Plans Vs Regular Plans – Comparison of Returns‘)

Taxation of Arbitrage Funds

It is very important that you as an investor should know about the tax treatment & tax adjusted returns of an investment option before making any investment decisions.

From the above Returns table it is very clear that Arbitrage Funds can generate returns which are comparable to Short Term Debt Funds or Liquid Debt Funds and Fixed Deposits. So, what’s special about these funds when compared to Debt Funds or even Fixed Deposits??

For income tax purpose, the arbitrage mutual funds are classified as Equity oriented funds.

- Long Term Capital Gains on Arbitrage Fund

- If you make a gain / profit on your investment in an Arbitrage Mutual Fund scheme that you have held for over 1 year, it will be classified as Long Term Capital Gain.

The long term capital gains on Arbitrage Fund are tax-free. With effective from 1st April 2018, the long term capital gains on Equity funds are taxable @ 10%. (Kindly read : ‘10% LTCG tax on sale of Stocks & Equity mutual fund units‘)

- Short Term Capital Gains

- If your holdings of an Arbitrage Equity mutual fund scheme are less than 1 year old i.e. if you withdraw your mutual fund units before 1 year, after making a profit, then the profit will be considered as Short Term Capital Gain.

- The capital gain tax rate of 15% is applicable on Short Term Capital Gains of Arbitrage Fund.

- Kindly note that if you are in 30% income tax slab rate, the interest income on Fixed Deposits will be charged at 30% (as per your income tax slab rate).

- The Short term Capital gains on Debt mutual funds too are taxed at 30% (as per your income tax slab rate) if the holding period is less than 3 years.

(Related Article : ‘Mutual Fund Taxation rules.‘)

Important Points to ponder upon before investing in Arbitrage Mutual Fund Schemes

- Arbitrage Funds can generate more and better returns when markets are volatile. The volatile markets can create arbitrage opportunities. But, do not invest in Arbitrage funds with an objective to get double digit returns. The returns at best can be in the range of 5 to 8%.

- These funds can generate better returns if major portion of fund corpus is invested in mid or small cap stocks or derivatives as they can be very volatile.

- If you opt for ‘Dividend’ option, then DDT (Dividend Distribution Tax) is not applicable on the dividend declared by the funds. The dividends received from Arbitrage Funds are tax-free.

- Though these funds mimic debt funds like risk profile but they cannot be considered as pure alternatives to Debt mutual Funds. In a declining interest rate scenario, Gilt Funds or Short-Term Debt Funds or even Dynamic Bond Funds can outperform Arbitrage Funds. In the first half of the 2015, Income Funds or Dynamic Bond funds (Debt funds) & Short-Term debt funds have outperformed the arbitrage funds thanks to the interest rate cuts.

- Kindly note that though these funds are treated as Equity funds w.r.t. taxation, but they may not generate returns like equity funds in the long-term.

- If you are looking for a tax efficient investment option for short term goals (1 to 2 year goals), you can consider investing in arbitrage funds.

- You can invest lump sum amounts in these funds for short-term goals. Systematic Investment Plan (SIPs) in these funds may not really make sense.

- You can consider these funds as one of the saving options when you are building your emergency fund.

- When your Financial Goal Target Year is nearing, you can switch from high risk investment options to these funds which have low-risk & are tax-free (more than 1 year).

- These funds have a very remote chance of generating negative returns. Even in 2008 when stock markets crashed, arbitrage funds gave positive returns in India.

- As these are risk-less opportunities, the returns may not be double digits.

- Arbitrage Funds can be a better choice if you are in the tax slabs of 20 to 30%, when markets are very volatile and when the interest rates are stable or increasing.

- Do watch out for Exit Loads of these funds. They can be higher than the debt funds.

- Arbitrage Funds are not allowed to SHORT in Cash Markets in India. So in a bear market their performances can suffer.

- These funds have high turnover and high transaction costs. (If a fund has 100% turnover, the fund replaces all of its holdings over a 12-month period. This is known as Turnover Ratio.)

Do you invest in Arbitrage Funds? Do you believe that these are good substitutes for Fixed Deposits? Kindly share your views. Cheers!

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

(Post Published on : 18-May-2016)

Join our channels

Hi,

thanks for the article, very informative as always. I have been reading about them and all doubts are cleared. going to invest in Arbitrage fund.

one small question regarding Emergency Fund. When we build emergency fund, and if it’s not used during one years’ time, what to do we do? Continue to hold in the same (liq fund in my case)? even if the amount is more, like 4 – 6 lakhs?

thanks

Dear Yavika,

The reason/objective for building an EF is we do not know when we would be requiring it and how much (amount) we would be requiring..

So, there is no straight answer to your query.

If you have other sources of income, good insurance cover (especially health cover for self+Family/Personal accident cover) etc then you can take a call to withdraw some monies from your EF and re-invest it for some other Fin goals.

Related article :

What is an Emergency Fund? | Why, Where & How much to save?

Why your Best Mutual Fund Schemes may not remain as ‘the best’? | Categorization & Rationalization of MFs

THANKS A LOT. ALWAYS PROMPT IN RESPONDING!

Are there any scenarios in which arbitrage fund can give negative returns?

I just recently invested in ICICI arbitrage fund and after 2 days it shows a loss on Rs200/- (no dividend declared yet).

So just wondering how risky they can be and how come they became negative ?

Any inputs?

Also, i think its always better to go for dividend option as dividend is tax free and in case you make you mind to sell it within an year, its all tax-free unlike growth fund. Please give some insight on this as well and downside for dividend option (like in case some charges or tax is attracted on it).

Dear Gautam,

The probability of getting negative returns from an Arbitrage fund is very low. But they do come with certain risks, like fund manager’s inability to identify hedging risks etc.,

One can expect returns of around 6 to 8% over 12 months+ period.

Yes, dividends are tax-free in the hands of Unit-holders. But do note that they are not guaranteed.

Also, kindly note that every dividend from a fund directly reduces the fund’s net asset value (NAV) to that extent, as it represents an outflow from the fund.

Neat article! Thanks very much.

Also read another article about company FD’s in which you explained about sachet wesbite. I was unable to see option to post a comment there hence writing here to thank you for simplifying and spreading the word about Sachet.

🙂

Dear Roshni ..Looks life some tech glitch…thank you for letting me know..

Hi Sreekanth,

Very informative and helpful article.

Have 2 questions.

1. Heard about some funds like HDFC Equity Savings, Birla Sun Life Equity Savings Fund etc, which even though artbitrage fund, also has components of equity and debt in it. What is your view on them ?

2. I have surplus cash, which I can invest for a period of 3-4 years. Should I consider investing in Equity Savings like the above, in Debt funds or in MIPs ? Also , do you suggest if I should consider the same in SIP or in a lumpsum ?

Thanks

Dear Giri,

1 – The mentioned funds are Hybrid – Equity oriented funds. These are similar to normal Equity oriented balanced funds like HDFC balanced fund / TATA balanced fund etc.,

2 – If you can take little bit of risk, may be an MIP fund is suitable.

Read:

Best MIP funds.

SIP Vs lump sum investment

Hi..

Your post about arbitrage funding is very informative, thanks for sharing this. If I’m looking for an interest free investment (1 year, may renew and continue in future), will you recommend arbitrage funding as the best option? Any suggestions for 2017 investment resources for this?

Thanks!

Dear Andy ..It can be one of the better options, if you want normal returns & tax-free returns (12 months + time frame).

You may consider above funds.

Hi Sreekanth garu

can you throw more light on following points

1) Any loss of capital in Arbitrage funds during bearish markets or only less returns are expected

2) If emergency fund can be formed with Arbitrage funds why not with SIP, any specific reason why SIP is not a good idea for this fund

Can you suggest best pure Arbitrage fund for 2017.

Regards

Dear Suru,

1 – Returns are not guaranteed. Low returns are possible when a fund manager fails to pick/identify arbitrage opportunities that are available in market, also when markets are less volatile. Safety of capital cant be totally guaranteed, but very remote chance of it happening.

2 – It is not good or bad as such, matter of convenience. If one has to withdraw the units, has to calculate taxes (if any) on capital gains based on the units holding period. Long term capital gains, units held more than 12 months, are tax-exempt.

Thank You Sreekanth garu,

Can Arbitrage fund be used as an alternative to Bank FD or liquid fund? As interest rates are decreasing on FDs, being in 30% tax bracket, is it advisable to park surplus money (contingent emergency fund, may be horizon with more than 1 year ) in arbitrage fund?

Also, kindly analyse about Inflation indexed National Saving Securities-Cumulative which gives return of 1.5% more than the inflation, as an emergency fund or as an alternate to bank FD

Dear Suru,

You may surely consider Arbitrage fund for Emergency fund, but do not put entire corpus in an Arbitrage fund, do hold some amount in Cash + FDs.

IINSS for emergency fund?

But I believe that pre-mature withdrawal is allowed after 3 years only (For senior citizens above 65 years, the premature redemption is allowed after one year.)

Sreekath,

I am a retired pensioner with my goai 3 years away, i wish to invest Rs. 10 lakh lump sum, with low risk healthy growth theme. Arbitrage wil give low return. Can you discuss good options with good growth potential.

Jaspal Singh

Dear Jaspal ji,

Low risk can lead to low returns..so let’s accept this fact!

As your time-frame is just 3 years away, kindly do not take undue risk and put your capital at risk.

You may consider a mix of Short Term Debt fund + MIP Fund + Arbitrage fund.

Hi Sreekanth,

I have started 2 SIP of 5k each in arbitrage funds (1.ICICI Arbitrage 2. SBI Arbitrage ) in Feb 2016. I am not getting expected returns from these funds; I can not blame these funds as Avg. Arbitrage fund returns are also way low then expected.

What should I do ? Should I continue SIP or should I redeem my money after 1 year lock-in period & invest in some other debt funds. As I am saving this money for my short time goal (lets say after 1.5 years).

Dear Sanket..May I know what is your expected returns from Arbitrage Funds for say in 1 year? and from Debt Funds?

Is the tenure, 1.5 year from now?

Hello Sreekanth,

I was expected more than 8 % returns from arbitrage funds as more than 65% arbitrage fund is invested in Sensex & sensex is giving on an avg 12% return per anum.

I do have few other debt funds in my portfolio they are giving expected returns around 7% to me in 1 year. But returns from 2 arbitrage funds are less than liquid fund this year. I was expecting Arbitrage funds will give acceleration to my portfolio but on the other hand they are the worst performing fund for me.

Tenure is not exactly 1.5 years it may be +/- 3 to 5 months as I am doing this saving for my first home down payment of around 10 lakhs or more.

Me & my wife are doing SIP of 15k each i.e. 30 k/month in following funds

1. BL Sunlife Medium Term – 5k

2.Franklin India Low Duration Fund- 5k

3. ICICI Pru. Equity Arbitrage- 5k

4. SBI arbitrage- 5k

5. SBI Magnum Gilt Long Term- 5k

6. UTI dynamic bond – 5k

So my question was should I switch those 2 arbitrage SIP to some Dynamic/Gilt/Credit Opportunity/Short Term funds ? or

continue doing it as Arbitrage is attached with Tax free gain after 1 years?

Note: We both are in 10% tax bracket.

I know my query is bit personal but appreciated if you provide some inputs.

Dear Sanket,

Kindly note that Arbtirage funds’ investment strategies are different to pure Equity funds. The losses as well as gains can be limited w.r.t to the investments made by these funds. Hence the returns are generally abnormal or more.

If you would like to get better returns and for around 1.5 years duration, you may switch to your existing debt funds (may be gilt/short term debt funds).

Dear Sir

I have invested more than 3000000/-in debt funds last year.

Being NRI just want to know when I redeem my investment TDS will be applicable.

LTCG & STCG also will be applicable

Can I refund back my TDS if I file return?

If yes then how much amount can get back?

Pls advise

Dear Chandni,

Yes, TDS is applicable on NRI MF redemptions.

You can claim the refund of TDS say if your income (India) is below the tax slab.

Kindly read: Mutual Fund Taxation rules.