Are you looking for that investment which can offer higher return than your Fixed Deposits? Are you searching for a better investment avenue to invest lump sum money for your short-term financial goals?

Then, Monthly Income Plans (MIPs) offered by Mutual Funds can be one of the best investment options for you. MIPs can provide better returns than Bank Deposits / Post office Savings Schemes, but you should be willing to take slightly higher risk.

MIPs are suitable for risk-averse investors who do not want to take high risk (or) who do not want to invest in Equities or Equity oriented products, but can afford to take low or medium risk.

What are Monthly Income Plans (MIPs) ?

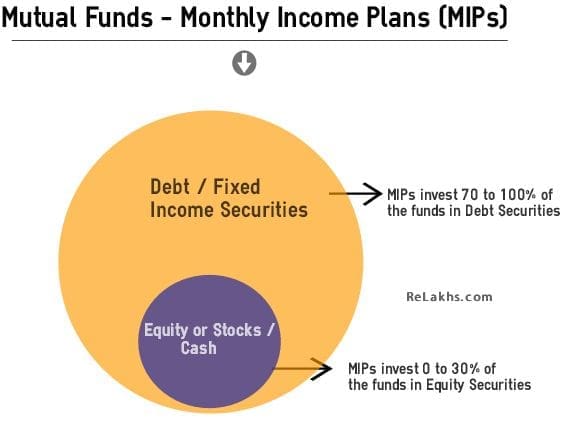

Monthly Income Plans (MIPs) are primarily ‘Debt oriented schemes’. These funds invest in a mix of equity and debt in the proportions of 20:80 or 30:70 or other proportions of similar kind. The objective of these funds is to provide enhanced regular returns to risk-averse investors by taking small positions in equity assets.

The major chunk (70 to 100%) of fund corpus is invested in interest yielding Debt instruments like ‘commercial paper, certificate of deposits, government securities, bonds, treasury bills etc., The remaining portion ( 0 to 30%) of the fund corpus is invested in Equity securities (stocks / shares).

The debt portion ensures stability, safety and consistency, while the equity instruments in the portfolio boost the returns. MIPs are market-linked products (to the extent of their equity portfolio).

Generally MIPs fall under Hybrid – Debt category of mutual funds. Depending on the percentage of equity exposure that MIPs take, they can further be classified into MIP Aggressive or MIP Conservative Plans.

MIPs which invest in equity securities in the range of 15% to 30% can be treated as “MIP Aggressive Plans” (Hybrid – Debt oriented aggressive schemes). These MIPs may offer slightly higher returns when compared to “MIP Conservative schemes”. But, do note that the improved returns come at a higher risk.

Do Monthly Income Plans provide regular income?

MIPs aim to provide investors with regular pay-outs (through dividends). But, it is not mandatory for the mutual fund MIP scheme to provide regular income, as dividends are paid at the discretion of the fund house and subject to availability of distributable surplus.

Monthly Income Plan & options

- MIP Dividend Option (Income option) – MIPs with dividend option provides you an income in the form of dividends. The dividends received by the investor are tax-free. The mutual fund company deducts DDT (Dividend Distribution Tax) at the rate of around 28.8% and then pays you the net dividend amount. To receive dividend income, you have to opt for Monthly Pay-out or Dividend Pay-out option. Kindly note that the quantum of dividends may not be fixed.

- MIP Growth Option – If you select ‘growth’ option, you will not receive any payments (dividends). You will get your returns only on selling the units. Since the fund does not pay out any dividends the NAV is much higher than that of the dividend option for the same fund or scheme. If you do not want regular income then you may opt for ‘growth’ option.

Top 4 Best MIP Mutual Funds in India for 2016- 2017 (Conservative plans)

Below are the top rated Hybrid – Debt oriented & Conservative MIP schemes. (Returns given in the below table are for regular schemes)

- SBI Magnum MIP Fund : This fund has allocated around 13.6% of its corpus to Equities and around 83% of the Fund’s corpus has been invested in Debt-oriented securities. SBI MIP fund has ‘average’ risk grade and ‘above average’ return grade. This fund’s ‘Direct Plan‘ scheme has generated around 14% in the last one year. Regular scheme has given 12.67% return.

- Birla Sunlife MIP II Savings 5 Fund – This fund has around 9% exposure to equities (stocks). Though this fund has lower exposure to Equity than SBI MIP fund, it has been generating similar returns. The expense ratio is reasonable when compared to other MIP conservative funds. This fund also has ‘below average’ risk grade and ‘average’ return grade.

- SBI Magnum MIP Floater Fund – This fund has around 13% exposure to equity securities, 25% in Debt securities and around 61% in Money market instruments. It has generated returns of around 11.41% in the last five years. But fund has high expense ratio. This fund has ‘low risk’ grade and ‘average’ return grade (as per valueresearchonline.com).

- ICICI Pru MIP Scheme – It has around 13% exposure to equity and the remaining portion of the fund corpus has been invested in debt securities (84%) & 3% as cash. This fund has ‘ above average’ risk grade and ‘average’ return grade.

Top 6 Best MIP Schemes – Aggressive plans

Below are the top rated Hybrid – Debt oriented & Aggressive Monthly Income Mutual Fund schemes. (Returns given in the below table are for regular schemes)

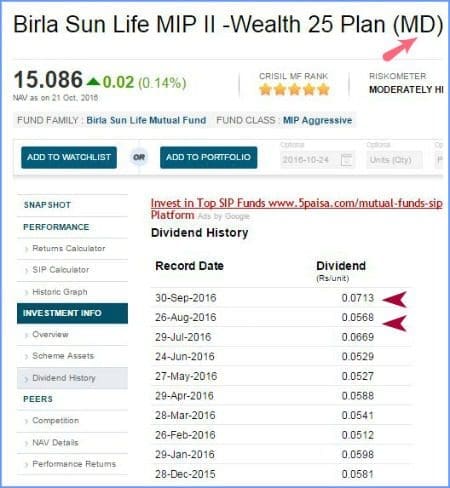

- Birla Sunlife MIP II Wealth 25 Plan – This fund has around 30% equity exposure and is the main reason for fund’s out-performance. If your investment horizon is around 2 to 4 years, you may consider investing in this fund. This fund has ‘below average’ risk grade and ‘above average’ return grade. The direct scheme of this fund has generated return of around 17.48% in the last one year (regular scheme has generated 16.24% returns).

- Latest update (28-March-2017) : As per a notification by Birla AMC, the Asset allocation and investment pattern of this fund has been modified and this is with effect from 12-April-2017. The fund now can invest up to 10% (max) in Units issued by REITs. So, up to 40% (30% in Equities + 10% in units of REITs) can be allocated to Medium to High risk Securities. So, it is advisable to invest in this fund with a medium to long-term view.

- Latest update (28-March-2017) : As per a notification by Birla AMC, the Asset allocation and investment pattern of this fund has been modified and this is with effect from 12-April-2017. The fund now can invest up to 10% (max) in Units issued by REITs. So, up to 40% (30% in Equities + 10% in units of REITs) can be allocated to Medium to High risk Securities. So, it is advisable to invest in this fund with a medium to long-term view.

- ICICI Prudential MIP 25 Plan has 23.6% exposure to equity and around 73% of the fund’s corpus has been invest in Debt securities. Kindly note that this fund has ‘high’ risk grade and ‘high’ return grade.

- HDFC MIP LTP : This has 24.6% exposure to equity and around 73% of the fund’s corpus has been invested in Debt securities. Kindly note that this fund has ‘average’ risk grade and ‘average’ return grade.

- Kotak MIP Regular Plan : This fund has allocated around 20% of its corpus to Equities and around 70% of the Fund’s corpus has been invested in Debt-oriented securities.

- UTI MIS Advantage Plan : This has 24% exposure to equity, 30% to Debt securities and around 36% of the fund’s corpus has been invest in Money Market securities. This fund has ‘average’ risk grade and ‘ above average’ return grade.

- Franklin MIP Fund : This fund has allocated around 19.6% of its corpus to Equities and around 70% of the Fund’s corpus has been invested in Debt-oriented securities.

MIPs for Lump Sum investment (and/or) Regular Income (Dividend Option Vs SWP)

- Lump sum Investment for accumulation : Let’s say your investment objective is to make one-time investment with a 2 to 4 year time-horizon, but would like to have less exposure to Equity, then investing in an aggressive MIP fund with Growth option can be a better choice.

- Lump Sum Investment for Regular Income : If your investment objective is to invest a lump sum amount in an MIP fund and would like to receive regular & fixed (monthly/quarterly/yearly) income then investing in MIP fund with Growth & Systematic Withdrawal options can be a prudent choice. Below are the reasons to justify this suggestion;

- Dividend Income plan can give you periodic income. But, the fund may or may not declare it and moreover the quantum of payment can vary (as indicated in the below image).

- Though the Dividend income received by you is tax-free, the fund house deducts DDT (Dividend Distribution Tax) of around 28% and then pays you the dividend. So, if you are in 10% or 20% tax bracket, opting for a MIP-Dividend payout plan is not a tax-efficient choice.

- Whether you are in 10 or 30% tax bracket, MIP Fund with Growth & SWP option can be considered if your withdrawals are for more than 3 years, because the Long term capital gains are taxed at 10% or 20% (with indexation benefit). The total tax liability will be less than the dividend distribution tax charged in the case of dividend option. This can increase your return on the investment.

- In SWP option, you can decide the frequency and quantum of payout. But kindly note that if your withdrawal amount is more than the capital appreciation then the payout is made from your Principal amount.

Mutual Fund Monthly Income Plans & Tax implications

- Mutual Fund MIP Schemes are treated as Debt oriented schemes (non-equity funds). So, the Long Term Capital Gains (LTCG) taxes are applicable on the units which are held for 3 years or more.

- Short Term Capital Gains (STCG) taxes are applicable on the units which are held for less than 3 years.

- STCG tax rate on MIPs is as per the investor’s income tax bracket and LTCG tax rate is at 20% (with indexation).

- If you opt for dividend option then any dividend income received from Monthly Income Plans is tax-free in the hands of investors.

Important Points to ponder about Mutual Fund MIP Investments :

- The performance of MIPs is greatly affected by interest rates in the economy (as majority of the fund’s corpus is invested in fixed income securities). So, MIPs tend to perform well when the interest rates fall (when there is a downward trend in the interest rate cycle). You can observe that MIPs (as listed in the above TOP MIPs tables) have performed well in the last one year or so, as RBI started to cut interest rates again. I believe that MIP schemes may continue to perform well in the next couple of years too.

- If you have a lump sum amount which needs to be invested for say 1 to 3 years then MIPs can be a better alternative to bank fixed deposits.

- You can also create SIPs (Systematic Investment Plans) in MIPs to realize your short-term goals.

- MIPs can be a decent bet if you are looking for regular income.

- Do watch out for ‘Exit Loads’, as most of the MIP Schemes charge an exit load of around 1% if you redeem the units in less than one year of holding.

- I believe that the ideal investment horizon in MIPs can be around 2 to 4 years.

- You may consider investing in Direct Plans of MF MIPs to get slightly better returns than Regular plans.

There are few other alternatives to MF MIPs like Arbitrage funds, Fixed Maturity Plans (FMPs), Post office Monthly Income Plan etc., But, I believe that Mutual Fund Monthly Income Plans can be a better option for a conservative investor who is looking for better returns by taking limited exposure to stock market. Monthly Income Plans schemes offered by mutual funds are definitely worth considering.

Continue reading :

- Best Lump sum investment options for Retirees / Senior Citizens | Best Saving options to invest Retiral benefits’.

- Best Investment options in India

- Why your Best Mutual Fund Schemes may not remain as ‘the best’? | Categorization & Rationalization of MFs

(Source : Moneycontrol & valueresearchonline. Returns are for Regular Growth schemes & on lump sum investments, as on 21-Oct-2016. Funds’ equity exposure details as of Sep 2016)

( Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

Sir..could I be suggested good income generating funds for my daughters education.we are joining her in lkg standard within a month.Help me out in this aspect.I am comfortable for investing 5000 per month

Dear PraneethRaj,

Are you looking for investment options which generate periodic income or for wealth accumulation for your long-term goal??

Hi Sreekanth,

How are you doing? I’m Senthil from Madurai, Tamilnadu now in UAE, i would like to get advice from you Lumpsum investments for MIP income due to my unstable job condition.

Could you please suggest me which is best option for monthly or quaterly income near about more than 10% interest P/A with minimal risk without losing capital.

Is that RBI Bank bonds investment is better? i heared some few indian broker heve selling the RBI Bonds which is giving 10 to 12% interest P/A who is the trustable broker in india ? for buy and invest lumsum (The Bank Bonds it was big scam by Harshad Mataha issues and sell duplicate bank bonds to people after govt found the scam and arrested him)

If you assist and guide me to invest for MIP income with good returnes my life is get balanced better way. finally i have little lumpsum which is saved last 10years saving for my pension income is last stage.

Thank you for your such a excellent guidence to people really appreciate you.

Kindest regards,

Senthil

Dear Senthil,

Finding a product which can give 10% return with low risk and safety of capital is mostly next to impossible thing!

RBI Bonds which is giving 10 to 12% interest?? Could you kindly share any links on this?

Related articles :

* List of all Popular Investment Options in India – Features & Snapshot

* Lump sum Investment options for Retirees/Senior Citizens | Where to invest my Retiral benefits to get Regular Income?

Hello Srikanth,

Can you please guide on current best MIP’s to invest for steady SWP for monthly inflow over a longer duration (5-8 years)? Also please advise on taxation on the earnings when in the highest tax bracket?

Dear Vinay,

May I know the level of dependency on this SWP income?

Note that MIPs have been recatogarized as ‘Conservative Hybrid’ Funds.

Related articles :

* MF taxation rules

* Mutual Fund Schemes Categorization and Rationalization – Types of MF Schemes | SEBI’s Latest Guidelines

Hi Suraj,

I was having property in Mumbai Suburb and was not getting a good rent from that property. So, I decided to sell. Now I have around 15 Lakh in my hand which I want to invest. Please give me some guidance. Thanks

Hi,

May I know your investment objective(s) and time-horizon for this??

Nice Post shared! Thanks for sharing it.

Dear Sreekanth,

I started a monthly SIP of 1 lakh each(For 3years) in BSL MIP II Wealth 25 plan (Direct growth) 6 month back to accumulate corpus for regular income. Initially I planned to start SWP after 3 years. Now I decided to start SWP after 5 years. Is it a wise decision to continue in this fund after completion of SIP or switch to Balanced 95 fund after 1 year for getting a LTCGT efficient return.Please advise ?

Dear Kumar ..If you can afford to take risk, balanced fund can be an ideal choice for a 5 year horizon..

Hi Sree, Good morning !

My current investment details :

Axis LTE Mutual Fund( Tax) 4,000

Franklin Mutual Fund(Tax) 4,000

Franklin Smaller co Mutual Fund 4,000

Mirae Emerging Bluechip -Direct (G) 4000

LIC Quartley installment ₹ 5,163.00

i am looking for your advice on the below :

Lets say if i need to invest 30 K ( subject to inc or dec) each and every for one year or one and half of year…

what would you suggest me..

note : only my aim would be if in case after 1.5 years if i plan to buy some properties i need that all amount once at a time

Dear sudhakar,

Are these investments in MF for short term, 1.5 year?

All those for long term…. Now I have 30 to 40 k each month where I want accumulate for 1.5 yrs to plan to buy some property ….. So I am thinking where and how I use this money each month to make it profit

Dear Sudhakar,

Your long portfolio is ok.

For short term, suggest you to put in RD or Short term debt fund (if you are ok to take risk).

Kindly read :

What are Debt funds?

Best Debt funds

Best Arbitrage funds

thank you so much shree…

Just an curiosity.

when i look at other funds for 1 year returns i could see huge returns… should i not invest in those?

Mid and small Cap –

Birla Sun Life Small & Midcap Fund – GROWTH

L&T Emerging Businesses Fund-DP (G)

Large Cap

ICICI Pru Top 100 Fund – Direct (G)

Balanced

ICICI Pru Balanced Fund- Direct (G)

HDFC Prudence Fund – Direct (G)

Diversified Equity

Tata Equity P/E Fund – Direct (G)

Thematic – Infrastructure

IDFC Infrastructure – Direct (G)

L&T Infrastructure -Direct (G)

Dear sudhakar,

These are equity oriented funds and can be a very high risk investment if your time-frame is short term.

Kindly note that the past performance may or may not be repeated in future (say next 1 year).

would that be ok if in case if i split these amount as 5k each to diff equ funds from the above ones if i am fine with taking moderate risk

Hi,

First you deserve a big thanks for replying to each and every query.

I am seeking an advise from you.

After investing on my SIPs(12K : Equity LC-4K, MC-2*2K, Balaced4K, ) and PPF(2K) I can save upto 85K/month. I am thinking to save 25k in saving acc each month. I already have emergency fund FD. Now I am looking for good options to invest rest of the 50-60K monthly.

One thought was to create FD for 30-30days and after few month when it becomes 3-4L, invest in some MIPs and repeat this cycle OR Instead of FD I can invest in short debt or arbitrate fund, may be 10k for 5 funds every month OR I should take 1 or 2 more SIPs worth 10K and invest 40K in FD or Debt fund. I am confused in this point. Please advise so that I won’t regret on my decision.

Kind Regards,

Chandra

Dear Chandra,

If you are already maintaining sufficient emergency fund corpus, why would you like to invest in FDs for short term?

Doing FD for short term was to convert it into big amount. For example 1st month fd for 1L, 2nd month 1L +1L of last month, 3rd month 1L + 2L of last month. So after few months I can have good amout that I can spend in MIP fund as lumpsum.

So my question was is it right way to invest your monthly saved amount or I should break it and invest in bebt short fund or liquid funds?

Dear Chandra ..Instead of investing lump sum, may be it is not wise enough to make the same installments in MF schemes?

Yeah that’s where I needed your advice. As I mentioned in my first comment, I was thinking to start investing in debt ultra short fund or liquid fund or MIP around 50K per month. I am already investing 16K in equity funds for long term(8-10yrs). I have a short term goal of 5L in 24 months. So would you suggest investing in short or ultra short debt fund? or in any other MF?

Dear Chandra,

You may pick Short term debt fund, Arbitrage Fund, and conservative MIP Fund.

Thanks Sreekanth. Last question I want to ask is, do I need more SIPs? I already running 4 SIP (All Equity for long term goal.) Should I start 3 more funds (Short term debt fund, Arbitrage Fund, and conservative MIP Fund) for short team(24) goal?

Dear Chandra ..Each of these funds fall under different categories, you may pick any of them or all of them after going through their features & risk profile. It is not a must to have 3 funds from these 3 fund categories..

Dear Sreekanth,

My father aged 76 wants to invest 10 lakh rupees for some monthly income. He is looking at maintaining the investment for 5-10 years, and needs return more than 8%. He is ok to take a little bit of risk. What are his options, and which option would you recommend?

Thanks,

Roy

Dear Mr Roy,

Can have a look at any new Secured NCD issues, Post office MIS / Sr.Citizen savings scheme, Mutual fund MIP (with Systematic withdrawal option), mutual fund Short term debt fund (with SWP option), RBI GoI 8% bonds (interest income payable every 6 months) etc.,

Read : List of best investment options.

Thank you so much Sreekanth

Dear Srikanth,

I am looking for an alternative to FD. As we know the FD rates are around 7%. Can you please advise MFs and category of MFs with moderate risk and can return 10 to 12%?

Dear Raghavendra ..May I know your investment time-frame?

Kindly read: List of best investment options!

Hello Mr Sreekanth !

At the outset, I appreciate your selfless endeavour of advising. I am a retired PSU executive with no pension scheme and hence depend on the generation of interest/STCG on my FDs with corporates & MFs for my monthly expenses.

I seek two advices :

1. My previous FD with a corporate house with average 11% interest is coming to an end. The revised interest being offered by them is 8.6%. I would like to invest this lump-sum into a hybrid Aggressive Debt Fund and create a SWP. Which Fund is likely to give average more than 1% monthly gain ?

2. I have heavy investments in SBI’s Pharma & Global Funds. They are both doing badly since I invested in them in Oct`15. Your suggestions for a switch over ?

Thanking you in anticipation,

yours sincerely

ANIL SHARMA

Dear Anil Ji,

1 – Are you referring to monthly dividend payout or Capital appreciation?

2 – May I know your investment objective for these investments? and timeframe ??

hi,

Currently, I am holding NRI status and want invest 2 Cr to get best monthly income in india. Can you please help me out. I saw many FD is also having monthly payout scheme but seems interest rate is lower than 7% or lower.

Appreciated for your prompt reply.

Regards

Dear Aruna,

Are you looking at fixed and regular payout?

Are you totally dependent on the income generated on this corpus? For how long (years) would you like to receive this income? May I know your expectation on quantum of income?

Hi Sreekanth,

My emergency fund (Rs. 100000) is just laying down in my saving account from quite some time. But I think it should be invested in some liquid fund etc. to get better returns and liquidity at the same time.

So it would be great if you can help me in proper allocation of this amount, which will be required only at the time of emergency(i.e. job loss/medical etc.)

Thanks and Regards

Anil

Dear Anil,

You may consider mix of some of these options : Cash + Saving a/c balance + Liquid fund / Arbitrage Fund + FD.

Read:

Best Debt mutual funds.

Best Arbitrage Funds.

List of investment options

Dear srikanth Reddy

I am saleem i am 47 years old i am working in Dubai i am Returning to india next month Due to job loss

i am having around 35 lacks i want invest in monthly Regular scheme i need monthly 35000Rs

to survive my family this is the only income i am having i am having my own house

please suggest good monthly income fund

Thanks saleem

Dear saleem Ji,

May i know, for how long you would like to receive this periodic income? Are you planning to take up a job in India? Do you have adequate life (self) & health insurance cover (for self& family)?

Thanks for Replying I need monthly income at least for 3 years mean while I will start business I am having helth insurance 5 lakh I will do for family

Suggest me Regular income

Dear Saleem,

Considering your profile, you may consider Fixed deposits only as the safest option (but do note that interest rates are low now).

Other options you can consider are :

Post office MIS Scheme (max investment allowed is Rs 4.5 lakh), you can get fixed monthly income , lockin period is 6 years.

Any Secured Non-cumulative NCDs for 2 to 3 years.

Kindly read : List of best investment options!