Health Insurance or Mediclaim insurance is a must-have for all. Considering the rate at which medical costs are rising, it is very important to have sufficient medical insurance coverage. Absence of health insurance may wipe out your savings. Having sufficient coverage will safeguard you and your dependents from getting into financial crisis during hospitalization or critical illnesses’ treatments or accidents.

Besides medical coverage, health insurance plans can provide Tax benefits to you. In this post, let us understand the Tax deduction benefits that are available for Health Insurance (or) Mediclaim plans.

The premium paid towards medical insurance is tax deductible under section 80D (u/s 80D) of the Income Tax Act, 1961.

You can claim tax deductions, provided you are paying the premium on a mediclaim policy which is in the name of

- Yourself (and / or)

- Your Spouse (and / or)

- Your Parents ( Parents need not be dependent on you) (and / or)

- Dependent Children

Tax deduction of Health Insurance Premium (Section 80d)

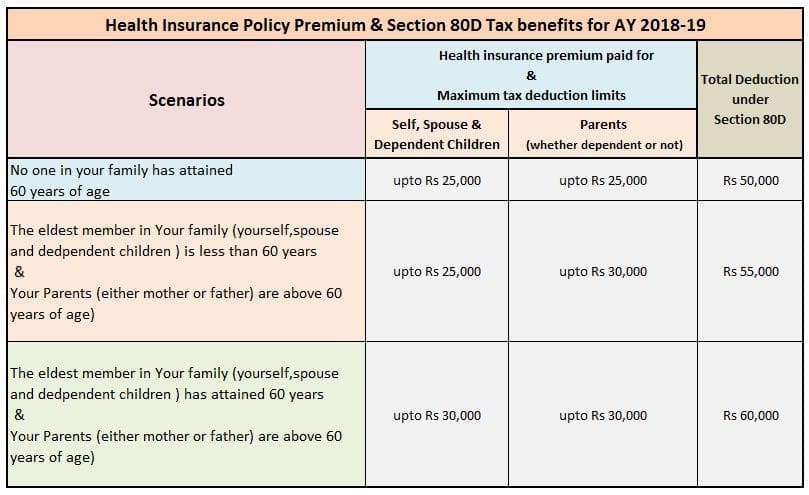

Health insurance premium paid for Self, Spouse or dependent children is tax deductible upto Rs 25,000. Earlier the limit was Rs 15,000 and this limit has been increased to Rs 25,000 in Budget 2015-2016. If any one of the persons specified is a senior citizen and Mediclaim Insurance premium is paid for such senior citizen then the deduction amount now is Rs. 30,000. From Financial Year 2015-2016, this limit is increased to Rs 30,000 from Rs 20,000 (applicable in FY 2014-2015).

Below table shows you the quantum of tax deductions applicable on health insurance premiums. The below limits are applicable for Financial Year 2017-2018 (or) Assessment Year (2018-2019).

Let us understand the above scenarios with couple of examples..

Example 1 : Mr Reddy (30 years) has employer’s mediclaim coverage. He pays Rs 8,000 as premium. The coverage is applicable for Mr & Mrs Reddy and their son. He has also included his parents (father 55 years & mother 52 years) under his employer’s medical insurance scheme. For parents coverage he pays Rs 16,000. He wants to know how much he can claim as total tax deduction under Section 80d?

Since no one in the family has attained 60 years of age, Mr Reddy can claim a tax deduction of Rs 24,000 (Rs 8000 + Rs 16,000).

Example 2 : Mr Gupta (45 years) is a self-employed person. He has taken Health insurance plan and pays a premium of Rs 26,000. He also pays Rs 31,000 towards his parents’ coverage ( his Father’s age is 62 years & mother’s age is 58 years). What is the total tax deduction application in his case?

Mr Gupta can claim a total tax deduction of Rs 55,000 only (Rs 25,000 + Rs 30,000)

Important points on Medical insurance policies & Tax benefits

- You can claim tax deductions on mediclaim plans provided by your employer or on policies taken by you (independent of your employment). The tax deduction is applicable on both health insurance and mediclaim policies.

- Premium amount can not paid in cash. Mode of payment can be anything (through credit card, net banking etc.,) except cash payment.

- You can take medical insurance policy on your dependent children and claim tax deductions too. If they are aged above 18 years and employed then they can not be covered. Male children if not employed then they can be covered upto 25 years. Whereas, female children can be covered until she gets married (only if she is unemployed).

- If you are paying health insurance premiums of your in-laws then you can not claim tax deductions. However your spouse can pay the premiums from her taxable income and get the tax benefits.

- If you are paying medical insurance premiums on behalf of your sister or brother then you can not claim tax deductions.

- Only premium amount can be claimed as a tax deduction. Do not include the service tax amount.

Preventive Health checkup & Section 80D

Preventive health checkup (Medical checkups) expenses to the extent of Rs5,000/- can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above.

Example – Mr Mehta (65 years) has mediclaim policy and paid Rs 25,000 as premium . He also spent Rs 6,000 towards health check-up. He wants to know what is the total tax deductible amount?

Since he is a senior citizen, the medical insurance premium to the extent of Rs 30,000 can be claimed as tax deduction under Section 80D. Even though he incurred Rs 31,000 ( Rs 25 k + 6k) as expenses, he can only claim tax deduction to the extent of Rs 30,000 only.

Budget 2015 : Deduction u/s 80D on health insurance premium will be Rs 25,000, increased from Rs 15000. For Senior Citizens it has been increased to Rs 30,000 from the existing Rs 20,000. For very senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

Difference between Mediclaim (Section 80d) & Medical Allowance (Section 10):

Do not get confused between your medical reimbursement allowance and mediclaim expenses. Medical allowance is provided by your employer. It is part of your employment agreement (salary structure) between your employer and yourself.

You can get medical allowance upto Rs 15,000 as an exempted income from your Gross salary. To claim this, you need to submit medical bills to your employer and get the allowance benefit. The medical reimbursement allowance is exempted under Section 10 of the Income Tax Act.

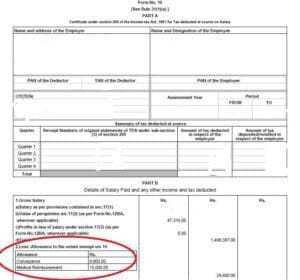

If you have submitted medical bills (to your employer) towards medical allowance and also paid premium towards your mediclaim (health insurance) then both of them will be listed in your Form-16 under different sections as shown below (click on the images to open them in new browser window).

(Continuing with Mr Mehta’s case, Mr Mehta incurred Rs 6000 as medical check-up costs. Upto Rs 5000 can be part of his tax deduction under Section 80d as mediclaim premium and the remaining Rs 1000 can be exempted under Section 10D as medical allowance provided he is employed).

If your employer provides medical insurance then in most of the cases it is automatically included in your Form-16. If you have independent mediclaim policies (or) you hold medical insurance plan as a self-employed person then do not forget to claim tax deductions. Show your medical insurance premiums under Section 80D while filing Income Tax Returns.

Budget 2018-19 Update :

- The premium paid by Senior citizens on Health Insurance policies of up to Rs 50,000 (current limit is Rs 30,000) can now be claimed as tax deduction u/s 80D for FY 2018-19.

- The Standard deduction of Rs 40,000 will be provided for all salaried individuals in lieu of Transport and Medical re-reimbursement allowances from FY 2018-19.

- Continue reading :

Related Articles :

- Difference between Individual (Personal) & Employer based Group Health Insurance Plans

- Best Family Floater Health Insurance Plans

- Best Health Insurance plans for Senior Citizens

Please share your comments. (Image courtesy of digitalart at FreeDigitalPhotos.net)

Dear Sreekanth,

I have taken a family floater group insurance policy including my parent ( Self + Wife + 2 kids and father). I have not received premium of individual member and have paid a total premium of 26000 for one year. How the calculate the premium amount of parent for income tax purpose.

Manish

Dear Manish,

I believe that you can claim tax deduction of up to Rs 25k only.

Family floater plans are linked to the age of the eldest member of the family and higher the age, higher the cost of the premium. Hence, in such cases a floater health insurance policy may not be the best option for families where the eldest member is over 45 years. Hence, it is advisable to buy separate Health insurance plan for Parent(s).

Tax saving under section 80D for paying medical insurance premium can be taken for both self and parent (senior citizen) policies which may not be possible if parents are covered in a single family floater policy.

Related Articles :

Best Family Floater Health Insurance Plans

Best Health Insurance plans for Senior Citizens/Parents

Best portals to compare Health insurance plans.

Evaluate these factors when buying a health plan.

Hi Sreekanth,

Thank you for your immediate response. As I have already taken the policy, can i divide the premium equally amongst the number of members and proportionately consider the premium of my father. For eg: 26000/5 = 5200 and consider this amount against premium paid for father’s mediclaim policy. Is this valid as per Income Tax Law.

Dear Manish,

I dont think its allowed (dividing the premium on a proportionate basis..)

Hi Sreekanth, I have paid around 40k towards my dad’s medical checkups+medicine in Cash in A.Y 2018-2019. He is senior citizen and currently doesnt have any insurance. Can I claim this amount for deduction under any section?

Also, Do I need to submit bills for this expenditure anywhere while claiming deduction?

Dear Nishant,

For senior citizens above the age of 60 years, who are not eligible to take health insurance, deduction is allowed for Rs 50,000 towards medical expenditure, u/s 80D (subject to overall threshold limit).

Refer to latest article @ Health Insurance Tax Benefits (under Section 80D) for FY 2018-19 / AY 2019-20

sir,

My father is a retired teacher and his age is 82(super senior citizen). He has no insurance policy. can he deduct Rs.50000/- for medical expenditure (wihout any receipt) under section 80D of incometax act

Dear Anitha ji,

For senior & very Senior citizens above the age of 60 years, who are not eligible to take health insurance, deduction is allowed for Rs 50,000 towards medical expenditure.

I believe that your father can avail the tax exemption.

Kindly go through my latest article @ Health Insurance Tax Benefits (under Section 80D) for FY 2018-19 / AY 2019-20

Mr Reddy,

I am a retired Govt officer in receipt of pension.

For FY 2-17-18, can I claim a deduction upto Rs.15,000/- u/s 80DDB on account f medical expenses ?

As I am retired, “employer” is no longer there. So, do I have to submit any bills/documentation to IT Dept in support of my claim ?

Dear VENUGOPAL ji,

Tax deduction u/s 80DDB is permissible in case of certain ailments only. To claim Tax deductions under Section 80DDB, it is mandatory for an individual to obtain ‘Doctor Certificate’ or ‘Prescription’ from a specialist working in a Govt or Private hospital.

Kindly refer to this article : List of Tax exemptions FY 2017-18

Dear sir, I have a parents insurance which was purchased on march 17. i have already submitted my investment for 16/17. can this be included while filing the returns ? wat is the procedure. please help

Dear maria ..Yes, you can just claim the premium amount in ITR u/s 80D.

Hi,

I have employer’s mediclaim coverage for which I pay Rs 3,795/- for me, my wife and my children. Recently I have added my parents (both senior citizen ) in the employer’s mediclaim coverage and I am paying Rs 22,922/- more for them. Also I have a mediclaim policy from outside and I pay Rs 22,000/- for the same which covers me, my wife and my children.

Could you please confirm how much amount I can claim for deduction under 80 D? 30,000 /- or 47,922 (25,000 + 22,922) ?

As per my employer I can only claim for 30,000/- as there is no policy on my Parent’s name .

I am a retired employee from a private company. I am aged 70 years. I have no medical insurance policy. I have undergone treatment for cataract with IOL surgery in May 2016 with total expenses of Rs.30,000/-. Can I claim deduction of this expenditure in my I..T return for AY 2017-18 (FY 2016-17)?

Dear Satyanarayana ji..There is no provision to claim your expense as tax deduction.

For very senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

Hi,

Could you please explain what will be the tax exemption amount for the below case.

Mr Reddy (30 years) has employer’s mediclaim coverage. He pays Rs 18,000 as premium. The coverage is applicable for Mr & Mrs Reddy and their son. He has also included his parents (father 65 years & mother 62 years) under his employer’s medical insurance scheme. For parents coverage he pays Rs 26,000 extra. He wants to know how much he can claim as total tax deduction under Section 80d?

Dear Mukesh,

He can claim Rs 44,000 (Rs 18k + Rs 26k).

Hello Sir,

For Claiming tax benefit for my parent U/s 80D.

I can take insurance directly in my parent’s name or i should be the primary insured person?

Dear Suresh ..The policy can be in your parent(s) name, you can pay the premium and also can claim tax benefit.

Hello Sreekanth,

My Father is a senior citizen and has taken a medical insurance through his credit card for him and for my mother. I usually pay the credit card bill. Can I claim his insurance in my 80D section ?

Dear Sameer ..I believe that you can claim tax benefit.

Dear Sir,

I had paid medical treatment exps for myself rs-15000 and for my parents rs-20000, under which section i can take benefit.

Regards

Adil

And employer mention in my salary description detail, Medical Allowance -15000

Dear Mohd..You can claim them under section 10 by submitting the bills to your employer.

On 31st March 17, I had revised my ITR-1 and claim under deduction 80 d,

Is it correct or incorrect

Please clarify as request

Dear Mohd ..You can claim medical insurance premium paid and/or expenses incurred for health check ups u/s 80d.

If you have claimed medical allowance u/s 80d, then it is incorrect.

HI

I have paid for a health insurance on 25th of march 2017, can i claim it in next financial year ? or should i have to claim it in the current financial year itself ?

Regards

Dear REGHU,

It is applicable for FY 2016-17 only.

I am a Retd. PSU Bank Official and drawing monthly Pension. Group Mediclaim Policy of United India Insurance Co. Ltd. has been taken by Indian Banks Association (IBA) on behalf of all Indian PSU Banks for both serving employees & ex-employees. Whether Premium under this Policy deducted from my Pension Account by my Employer Bank is deductible u/Sec 80D?

Dear Ranjit Ji,

I believe that you can claim the premium paid u/s 80D.

iss that Doctor consultancy fee receipt,without doctor pescription medical store bills,dental checkup,optic will consider for tax benefit

Dear Anu..Are you referring to Medical allowance? If yes, then can be submitted.

I am a diabetic patient, my age about 57 years. I have senior citizen parents. I want to know how much exemption/ eligible in income tax benefit under section 80D

Dear MOHAN …Are you or your parents covered with any Medical insurance cover?

Sir, whether the expenditure, incurred for the purpose of Medical Treatment by the Single Son of a ailing, senior citizen and widow mother, is liable to get Tax deduction?

Dear Satinath,

For very senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

Read: Income tax deductions list.

Hi,

I have bought a medical insurance policy for 3 years and have paid consolidated premium amount for all three years coverage. Now I need to avail tax benefits under 80/D. Insurance company won’t provide each year premium.

Pls suggest me how to proceed.

Dear Kumar..Yes, you can claim only one time, in the FY in which you paid the premium amount.

please clarify whether we need to keep bills/receipts for claiming expenses upto Rs 5000

towards preventive health checkups as I paid the same in cash.

Dear Vasudeva Rao..Yes, you need to keep them for future use (if any).

Hi Sreenath Reddy ,

I have not taken any Medical Insurance .My company has asked me to provide the Insurance ?Investment details .As i have not taken any Insurance it is possible for me to take a new one and claim it during this FY itself?

Yes, it is possible dear Parameswar.

Kindly read:

Best portals to compare Health insurance plans.

Evaluate these factors when buying a health plan.

How do I prove that a test is not prescribed by a doctor? If the reports state the test referred by as ‘Self’, will that suffice. I had done a master checkup and some related tests on my own as prevention in Sep 2015. The assessment for this year 2016-17 is also over and refund received. Can I revise and claim this deduction now? I may not have the bill but I have all the reports. Can I claim now and what will the procedure be? Kindly advise.

Also this year I have done some tests on my own but they are not master health checkups. I presume they should also qualify. Please confirm.

Thank you

Dear Geetha,

Test referred by as ‘self’ also should be fine.

As the assessment has been done, you can REVISE your ITR now.

Yes, you can claim up to Rs5k for AY 2017-18 also.

Thank you

I am a salaried employee

I have a medical insurance (Cashless mediclaim). The medical premium is eligible under section 80/D.

Can I also show medical bills for tax benefit under section 17(2) of income tax act?

Dear Nikhil..If you receive medical allowance, you can submit the bills to your employer and can claim tax exemption up to Rs 15k pa.

i am retired bank employee. I have mediclaim policy where domiciliary treatment expenses are also covered. Whether domiciliary expenses reimbursed are taxable. If so what is the limit

Dear Thobbi Ji..I believe that they are tax-exempt.

I am a salaried employee

I have a medical insurance (Cashless mediclaim). The medical premium is eligible under section 80/D.

I have also another policy (Fixed health plan). Is the premium eligible under section 80/D or Section 80/C

Dear Anil..What is Fixed health plan?