LIC (Life Insurance Corporation of India) has launched a new Limited Premium, non-linked, with profit Endowment Plan called LIC Jeevan Labh. This plan is available for purchase from 4th January, 2016.

Around the same time last year (in Dec, 2014), LIC had launched a similar plan called LIC Limited Payment Endowment Plan (table no 830). LIC generally launches a lot of new plans during this time of the year when most of the individuals (considering the salaried individuals have to submit their income tax investment proofs) look for investing in Tax Saving instruments.

Key Features of LIC Jeevan Labh Plan

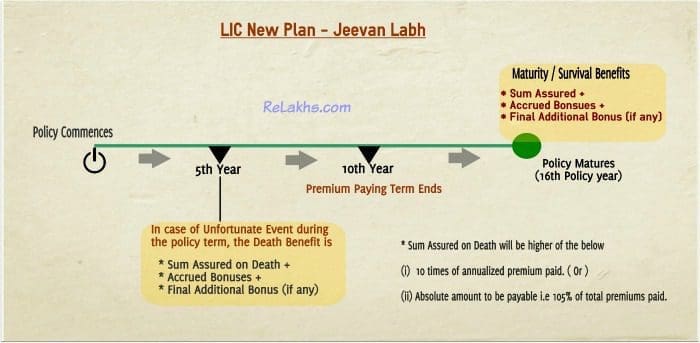

The main feature of this new plan is, the payment of premiums is limited to a term shorter than the policy (limited premium payment – LPP). The maturity amount is payable at the end of the policy term, or on the death of the policy holder whichever is earlier.

- LIC’s new plan Jeevan Labh is a traditional plan. It is a non-linked with profit Endowment Plan.

- Minimum Age at entry: 8 years

- Maximum maturity age : 75 years

- Policy Term options : 16 years / 21 years / 25 years

- Premium Paying Term options : 10 years / 15 years / 16 years respectively.

- Minimum Sum Assured : Rs 2 Lakh

- Death Benefit under Jeevan Labh : The policyholder’s nominee will receive; Sum Assured + Bonus + Final Additional Bonus (if any).

- Maturity Benefit under Jeevan Labh : Sum Assured + Bonus + Final Additional Bonus (if any).

- Optional riders like Term insurance rider (TR) & DAB (Double Accident Rider) are available.

Example of LIC Jeevan Labh Limited Premium Payment Endowment Plan :

Mr. Paswan aged 35 years, plans to take LIC Jeevan Labh for the term of 16 years and the premium payment term (PPT) of 10 years. He chooses the sum assured of Rs 3 Lakh.

In this case, he is required to pay premium for 10 years only. After the PPT of 10 years, he will stop paying premium but the policy will continue till the policy term of 16 years.

The possible events that can happen are :

- On Death of Policy holder – If Mr Paswan dies during the policy term, his nominee will receive the Sum Assured + Accrued Bonuses + FAB (if any). After this, the policy will cease to exist.

- On Survival till maturity – If Mr. Paswan survives till the end of policy term, he will get the Sum Assured + Accrued Bonuses+FAB (if any). The policy will terminate thereafter.

LIC’s New Plan Jeevan Labh– Returns Calculation

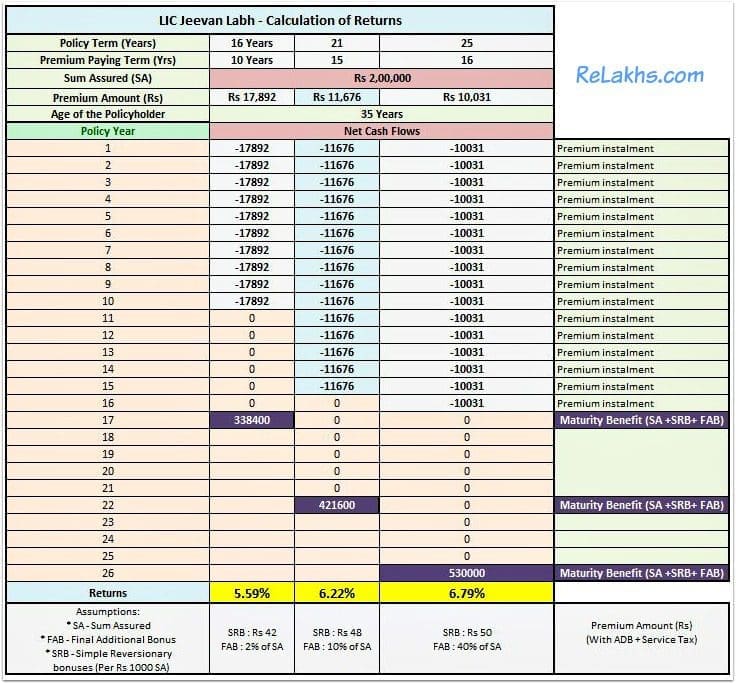

Let us consider an example, Mr. Paswan (35 years) wants to invest in LIC’s new plan Jeevan Labh policy. He is not clear as to which is the best combination (policy term and PPT). He wants to calculate return on investment under various combinations of Policy and Premium Paying Terms.

If Mr Paswan opts for Policy term of 16 years and PPT as 10 years, premium is Rs 17,892. Under this option he has to pay the premiums for 10 years. In the beginning of 17th year he may receive the maturity benefit of Rs 3.38 Lakh (inclusive of Sum Assured, accrued bonuses and final additional bonus). The expected return on his investment is around 5.6%.

Like wise, Mr Paswan will get returns in the range of 6% to 7% under different options of LIC’s Jeevan Labh plan.

(Click on the above image to open it in a new browser window)

Should you invest in LIC Jeevan Labh Scheme?

We are at the fag end of the Financial Year 2015/2016. People generally rush to buy tax-saving plans at the fag end of a financial year. If I have to do my tax planning and investment planning now, I will surely ignore this plan. The premiums paid on LIC Jeevan Labh policy may give you income tax benefit under section 80c, but may not generate decent inflation adjusted returns for you.

- If you are looking for an investment avenue to save some taxes, you may consider buying ELSS Funds for long-term. (Kindly read : Best Equity Linked Tax Saving Funds for 2016)

- If your requirement is to save taxes plus would like to have life cover, you can consider buying a pure Term Insurance Plan. (Kindly read : Top 7 Best Term Insurance Plans)

- Kindly note that the returns on traditional policies like Jeevan Labh are very much dependent on the bonus rates that LIC declares every year. Also, the bonuses are just accrued and paid out at the end of the policy term. (Kindly read : LIC bonus rates 2015-16 & LIC bonus rates 2014-15)

- Kindly think beyond taxes when investing in Financial Products.

I am sure you are now very clear on how much returns can we expect from these kind of endowment policies. Returns of 6% to 7 % that too over a period of 16 to 25 years sounds very low to me. Kindly be aware of financial products before you buy. Let me know your views. Do share your comments. Cheers!

(Kindly note that this post is based on limited information that is available on net. The above details may be changed once more information is available.)

You may like reading my article on : “LIC’s 2015 all plans list – Snapshot & Review“.

Join our channels

Hi Sreekanth,

i recently spoke to LIC agent and he suggested me for jeevan Labh. have to pay 7,363 Rs per month till 10 Years and 16th year i will get 19,44000 Rs. in between i die then 10 lakhs life cover is also there. +10 lakhs more if died in any accident. After reading your suggestions below i am confused now. what should i do as i asked the LIC agent to come and pick 2 months premium this Saturday.

I am 36 years old and have 2 kids (5 and 7 years), to secure there future i planned the above.

i do not want any life insurance cover, i just need a better return but not very long investment than 15 years.

Could you please suggest me any plan, where i can invest monthly and get better maturity amount?

Dear Supriya,

If your objectives are ‘better investment returns’ & ‘not life cover’ then you can mostly ignore this Plan.

Suggest you to kindly go through below articles and revert to me with queries (if any);

* Calculate how much you need to invest for your Kid’s Education

* Traditional Life Insurance Plan – A terrible Investment option?

* Investment Planning – How to create a solid investment plan?

* List of Best Investment Options in India