Life is an unpredictable journey. It can take sharp, fatal turn at moments, which are capable of leaving one physically, mentally, emotionally and financially bruised.

Many of us ignore buying a personal Health Insurance plan (Mediclaim). Most of us also think that the mediclaim coverage provided by the employer (if salaried) is sufficient enough to cover any unforeseen medical expenses.

In my experience, the average medical cover opted (personal health insurance) or provided by an employer (group mediclaim) is generally in the range of Rs 3 Lakh to Rs 5 Lakh. Do you really think that this coverage is sufficient? What if the claim amount is more than the coverage amount? Can you afford to pay for the medical expenses out of your pocket? Do you agree that medical expenses are increasing at a very fast rate every year?

But, we are also aware of the fact that the premiums of health insurance plans and medical treatment costs are increasing every year. For some of us, the premiums are unaffordable. Also, it is not practically possible for everyone to increase the premium of their existing plan, or buy another regular health insurance policy.

So, what are the available options? How to get higher coverage at affordable premium rates? How to deal with the inflating costs of medical treatment?

I have been suggesting that having a health insurance plan is not the end of your ‘medical insurance’ planning. In fact, it is your first-line of defense only. Considering the ever-increasing medical treatment expenses in India, you have to plan for a mediclaim /family floater + a Super top up plan + an Emergency fund for unforeseen consequences.

HDFC Ergo’s ‘my:health Medisure Super Top Up Plan’ is one of the very few Super Top up plans that are currently available in the market . Before discussing about this Super Top up health insurance plan, let’s first understand – what are Top-up & Super Top up plans??

Top Up Vs Super Top Up Health Insurance Plans

For example – Let’s say you have an Employer’s Mediclaim policy for Rs 3 Lakh and also a Top up Health cover for Rs 10 Lakh with the threshold limit (deductible) of Rs 3 Lakh.

If there is a claim for Rs 5 Lakh, your mediclaim policy (employer’s) will pay Rs 3 Lakh and the remaining claim amount of Rs 2 Lakh will be covered by your Top up policy.

So, such Top up health insurance policies come handy when the threshold of the existing health cover is already used or exhausted and there are some medical costs left to deal with, which would otherwise exert pressure on your financial savings. (To buy a Top up plan, it is not mandatory to have an existing health insurance policy. The threshold limit is the mandatory deductible, which can be borne by you or by your existing health insurance policy i.e., your company’s or personal regular health insurance policy)

How does Top Up Health insurance plan work?

Top up plans work on ‘per hospitalization’ basis. A Top up plan will pay you, if your claim amount for a single hospitalization is above the threshold limit.

Example – Mr Kejriwal has a personal Health Insurance policy of Rs 3 Lakh and also has a Top up health cover of Rs 10 Lakh sum assured, with the threshold limit of Rs 3 Lakh.

Scenario 1 – If there is a single claim of Rs 2 Lakh in a year, his regular policy will pay Rs 2 Lakh.

Scenario 2 – If there is a single claim of Rs 5 Lakh in a year, his regular policy will pay RS 3 Lakh and top up plan will pay the remaining Rs 2 Lakh.

Scenario 3 – If there is a single claim of Rs 10 Lakh in a year, his regular policy will pay Rs 3 Lakh and the remaining claim amount of Rs 7 lakh will be paid by the Top up plan.

Scenario 4 – If there are two claims in a year, one for Rs 3 Lakh (Claim 1) & another for Rs 2.5 Lakhs (claim 2), regular policy will pay the claim 1 amount (Rs 3 Lakh) and the total coverage is exhausted, the claim 2 amount (Rs 2.5 Lakh) is not covered by regular as well as the top up plan. (Though he has Rs 10 lakh as a top up cover, it is not applicable for 2nd claim as the threshold limit is Rs 3 Lakh. Top up cover will pay only if the bill amount is more than Rs 3 Lakh)

What are Super Top up Health Insurance Plans?

We are now clear that the Top up plans work on ‘per claim’ or ‘per single hospitalization’ basis, they are beneficial as long as the single claim amount is above the threshold limit.

In the above scenario 4, though Mr Kejriwal has Rs 10 Lakh Top up cover, his claim amount (claim 2) will not be paid. Super Top plans will be useful in these types of scenarios (multiple claims).

Example – Mr Kejriwal has a personal Health Insurance policy of Rs 3 Lakh and also has a Super Top up health cover of Rs 10 Lakh sum assured (total coverage Rs 13 Lakh), with the threshold limit of Rs 3 Lakh.

Scenario 5 – If there is a single claim of Rs 2 Lakh in a year, his regular policy will pay Rs 2 Lakh.

Scenario 6 – If there is a single claim of Rs 5 Lakh in a year, his regular policy will pay RS 3 Lakh and super top up plan will pay the remaining Rs 2 Lakh.

Scenario 7 – If there is a single claim of Rs 10 Lakh in a year, his regular policy will pay Rs 3 Lakh and the remaining claim amount of Rs 7 lakh will be paid by the Super Top up medical insurance plan.

Scenario 8 – If there are two claims in a year, one for Rs 3 Lakh (Claim 1) & another for Rs 2.5 Lakhs (claim 2), regular policy will pay the claim 1 amount (Rs 3 Lakh) and the total coverage is exhausted, the claim 2 amount (Rs 2.5 Lakh) will be paid by his super top up plan (though the claim 2 amount is less than the threshold limit)

Scenario 9 – If there are two claims in a year, one for Rs 5 Lakh (claim 1) & another for Rs 6 Lakh (claim 2), regular policy will pay upto Rs 3 Lakh (claim 1) & super top up plain will pay the remaining Rs 2 Lakh amount (a portion of claim 1). The entire claim 2 amount (Rs 6 Lakh) will be paid by Super top up plan, as the regular policy coverage is exhausted.

So, it is now clear that Super Top up plans consider ‘the total of all the bills’ in a given year. Super Top up plans cover ‘multiple’ hospitalizations and they look at the aggregate claim. This means they put together several cases of hospitalization to calculate the deductible limit (threshold limit).

Also, note that it is not mandatory to have an existing regular or group mediclaim to buy a top up or a super top up plan.The deductible limit makes these plans cheaper when compared to regular plans. Higher the deductible (threshold limit), lower the premiums of top up plans. Generally, Top up plans are cheaper than super top up plans. But, Super Top up plans are better than Top-up plans.

HDFC Ergo my:health Medisure Super Top Up Health Insurance plan : Features

HDFC Ergo’s my:health Super Top Up Insurance Policy provides you with an option of buying a top-up insurance cover which works alongside your current health insurance policy. Your current health insurance policy could have been bought by you individually or provided by your organization.

For Example : If you have an existing health insurance cover of Rs. 3 lakhs from any health insurance policy (corporate or individual) then you could buy an additional insurance cover of say Rs. 8 lakhs through my:health Medisure Super Top Up plan taking your total health insurance coverage up to Rs. 11 lakhs.

At the time of submitting a claim, the first Rs. 3 lakhs of a claim amount will be paid by your existing policy and the rest of the claim up to Rs. 8 lakhs will be paid by HDFC ERGO. So you can claim a total of Rs. 11 lakhs from both the insurers either through one claim or through multiple claims in one year.

Of course if you do not have any insurance policy, you could still buy my:health Medisure Super Top Up Insurance Policy. In such a case, you have to bear the expenses of Rs. 3 lakhs (in the above example) yourself and claim the rest of the Rs. 8 lakhs from HDFC ERGO.

Below are they key features of HDFC my : Health Medisure Plan ;

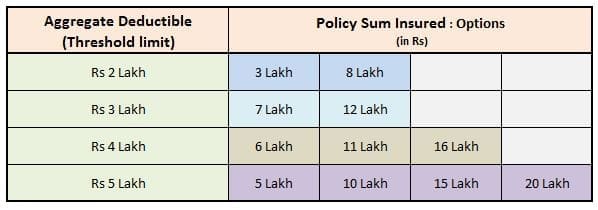

- You have the option to choose a Sum Insured with a wide range of deductibles (threshold limits).

- The minimum Sum Assured that you can take is Rs 3 Lakh and the maximum SA limit is Rs 20 Lakh.

- The minimum deductible is Rs 2 Lakh and the maximum is Rs 5 Lakh.

- For example : You can buy HDFC my:Health Super Top up plan with a Sum Assured of Rs 8 Lakh with a deductible for Rs 2 Lakh. You can either have an already existing health insurance plan for Rs 2 lakh or you have to bear the medical costs of up to Rs 2 Lakh in case of a claim during the policy year.

- Like-wise, if you opt for a Rs 20 Lakh super top up plan then the mandatory deductible is Rs 5 Lakh.

- Minimum age at entry is 18 years and the maximum age limit to buy this plan is 65 years.

- Constant premium is applicable from the age of 61 years & above.

- You can also cover your family members as given below in a single Policy on Individual Sum Insured basis ;

Grand Mother, Grand Father, Brother, Sister, Grand Son, Grand Daughter, Daughter in Law, Son in Law, Nephew & Niece. (If Children aged between 91 days & 23 years are included in the policy then both parents must be covered under the policy) - The company claims that this plan provides comprehensive coverage that includes pre and post hospitalization expenses and day care procedures without any sub limits.

- In-patient hospitalization expenses : If the treatment of an illness or accidental injury is taken in a hospital, such medical expenses incurred by you towards your hospitalization on room rent/ICU/Therapeutic Unit, Medical Practitioner fees, Anaesthetist fees, nurse fees, blood, oxygen and anaesthesia are covered under this policy. There are no sub-limits under this plan.

- Pre and Post-hospitalisation medical expenses : All the medical expenses you incur up to 30 days before being admitted into a hospital and for 60 days after you have been discharged from hospital are covered (subject to certain conditions).

- Expenses for Pre existing diseases : The Policy covers expenses incurred for the treatment of diseases that you have before taking the Policy. Such will be covered only after 3 continuous renewals with HDFC Ergo (after 3 policy years).

- Day Care Procedures : The Policy also covers the medical expenses incurred by you for treatment or procedures that requires less than 24 hours of hospitalization, undertaken under general or local anesthesia. There is no static list for day care procedures in the policy as advances in medical science leads to many more being added continuously. So, even if it is a new procedure, it is covered. However, this cover excludes diagnostic procedures and treatments taken in an out-patient department.

- Non-allopathic treatments are not covered.

- You are not required to undergo any medical tests upto the age of 55 years, except if you have declared any pre-existing diseases or ailments at the time of applying for the policy. In such cases and for applicants above age 55 years, one has to undergo the company specified medical tests.

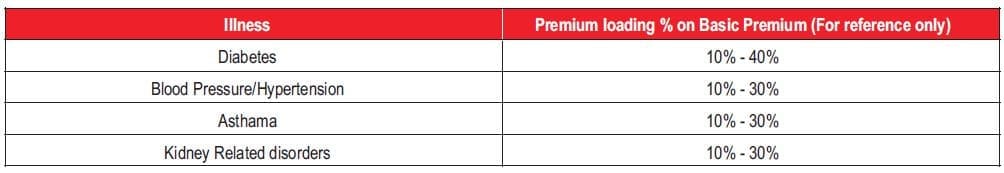

- For the proposers who are above 55 years, ‘Premium Loading‘ can be done based on the medical test results or pre-existing diseases/medical conditions. Below is the indicate range of premium loading ;

- The company is ready to pay a penalty if you do not get any response within 6 Hours on every cashless claim.

- You can take the Policy for a continuous period of two years and get a 5% discount on the total premium amount of 2 years.

- No Claims Experience Loading on Renewal : Even if you make a claim during the Policy year, there won’t be any increase in the renewal premium.

- 10% co-payment will be applicable each and every claim after you have attained the age of 80 years. (For Example, if the co-pay clause says 10% to be borne by you so for Rs 100 as a claim amount, your insurer will pay Rs 90, and you have to pay Rs 10 in such scenario.)

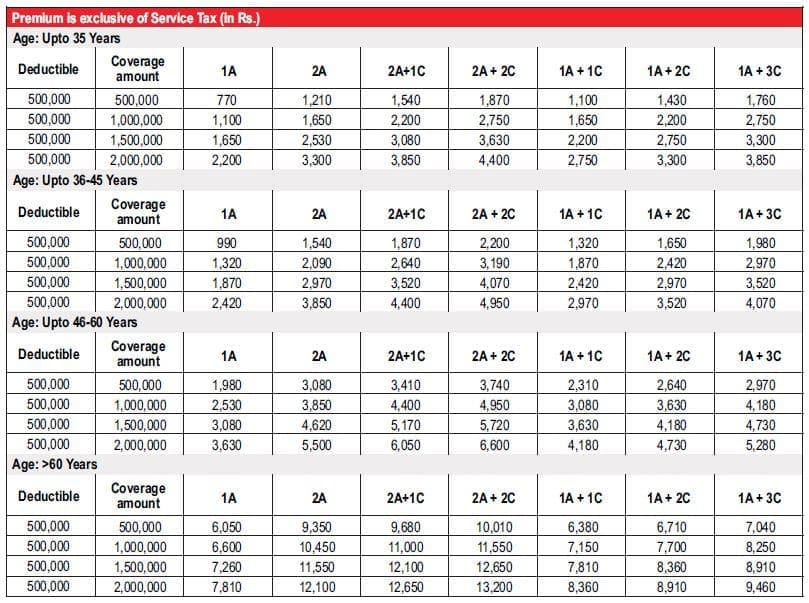

HDFC Ergo My Health Medisure Super Top up plan – Indicative Premium Quotes

Below is an indicative list of premium quotes for different sum assured options & aggregate deductible;

(Source : HDFC Ergo my:health Medisure plan product brochure)

For example : If a policyholder (30 years) wishes to buy HDFC My:Health Medisure policy for a Sum Assured of Rs 20 Lakh with Rs 5 lakh as deductible then the applicable premium is around Rs 2,200.

How does HDFC my:health Medisure Super top up plan work?

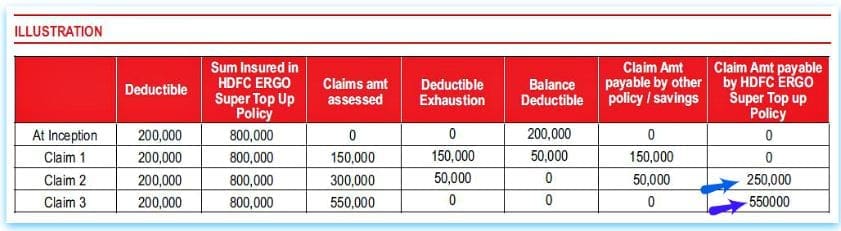

Let’s consider a scenario where in a policyholder buys HDFC Super Top up policy of Sum Assured Rs 8 Lakh with a deductible of Rs 2 Lakh. He has four claim events in a policy year.

Claim 1 -> The policy holder incurs a hospitalization expenses of Rs 1.5 Lakh. These expenses / claim can be met by his regular mediclaim policy (if he has one) or he has to pay them out of his pocket. The balance of ‘aggregate deductible’ will then be Rs 50,000 (Rs 2 Lakh – Rs 1.50 lakh). The super top up plan does not pay any claim amount.

Claim 2 -> The policy holder incurs a hospitalization expenses of Rs 3 Lakh. The expenses / claim of up to Rs 50,000 can be met by his regular mediclaim policy or he has to pay them out of his pocket. The remaining claim amount Rs 2.5 Lakh (Rs 3 Lakh – Rs 50,000) is payable by HDFC. The balance of ‘aggregate deductible’ is NIL.

3 rd Claim -> If the policy holder incurs a hospitalization expenses of Rs 5.5 Lakh. The total claim of Rs 5.5 Lakh is payable by HDFC Ergo. With this, both ‘deductible’ as well as Super top up balance gets exhausted.

My opinion

Below are some of the important points to ponder over;

- Pre-existing diseases & waiting period : Even if you have been covered by an existing mediclaim policy, the ‘waiting period’ will start afresh under Super top up plan. The Pre-existing diseases (if any) will be covered after 3 policy years only.

- Kindly note that only allopathic treatments are covered under this plan.

- Though the company claims that ‘no static list’ for day care procedures is maintained and all types of day-care procedures are covered, you can find a lengthy list of policy exclusions under the heading ‘What the Policy Doesn’t Cover’ in plan brochure. Suggest you to kindly download the brochure and go through this list..click here..

- Kindly do not select a ‘deductible’ which is over and above our existing health insurance plan (if any) as the super top up plan will only pay, whatever are the medical expenses over and above the threshold limi.

- When it comes to health insurance, there is no one-size fits-all plan that you can rely on. Medical Insurance is a contract based policy with legal jargon thrown in. Besides this, any Health Insurance policy has a lot of medical terminologies. So, suggest you to kindly compare this plan with other available Super top up plans (in terms of affordability, features, policy exclusions, pre-existing diseases waiting period, deductible limits, co-payment clause etc.,) and then take a final decision. Below are some of the other super top-up plans.

- Apollo Munich Optima Super Top Up

- United India Super Top up plan

- Cigna TTK Super Top Plan – ProHealth Plus related Plan

Continue reading :

- 11 vital factors to consider when choosing the Best Health Insurance Plan!

- Latest Health Insurance Incurred Claims Ratio 2018-19 Data | Top Health Insurance Companies List

- Difference Between Individual (Personal) & Employer based Health Insurance Plans – Pros & Cons

- Best Health Insurance Comparison Websites / Portals

- Health Insurance Tax Benefits (under Section 80D) for FY 2018-19 / AY 2019-20

y note that this is not a paid or sponsored post. This post is for information purposes only. ReLakhs.com is not associated with HDFC Ergo and we have not received any monetary benefit for publishing this review.

(Image courtesy of fantasista at FreeDigitalPhotos.net) (Reference : Product brochure) (Post published on : 22-March-2018)

Hi,

Please share your recommendation for health insurance plan (self + Wife).

Dear Maninder ji,

Suggest you to kindly post your query at Forum link for a detailed discussion plz.

Top up and Super top up are one and the same. The scenerio explained above is not true. Even top up policies consider multiple claims for calculating Threshold limit.

Dear Sagar,

There are certain differences between Top up and Super top-up plans.

Kindly go through this article @ Top Up Health Insurance Plans – Super Top Up Health Insurance Plans – Details & Benefits

Please do not respond to my previous post. Please consider this post as the correct one. Can you please let me know as to what should be the ideal cover for a super top up policy. Liberty General is offering Health super contra with 10 L as deductible and 1 crore as Sum insured. Is this much cover really required.

Dear Shyam,

It is very tough to actually say how much cover is sufficient as no one can predict the future requirement in case of any unforeseen contingency.

If you can afford it, you may go for it!

But, kindly go through the policy wordings..

Does this plan have a good reputation in the market (Liberty super contra) as compared to other super top ups. I understand that no one can predict any unforseen contingency, but considering medical inflation will it be useful and necessary

Dear shyam,

I am yet to review this plan. The basic features of most of these plans can be similar.

Related article : 11 vital factors to consider when choosing the Best Health Insurance Plan!

Hi,

I found this plan to be a decent one. How is the repute of this insurer.

Can you please let me know as to what should be the ideal cover for a super top up policy. Liberty General is offering Health super contra with 10 L as deductible and 1 crore as Sum insured. Is this much cover really required.

Dear Sreekanth Sir, I am 35 yrs old now and have 10 lakh LIC policy and 50 lakh term insurance. I also have my company and personal health insurance. I have one new born kid. My wife and I have combined monthly income of rs. 1.5 lakh. Can you please suggest if I need some more insurance. thanks.

Dear vishal,

May I know the plan name of LIC?

May I know if you have Personal Accident insurance cover?

Does your Spouse also has Term plan life cover & PA cover?

You may enhance your health insurance sum assured by opting Super top up plan.

Dear Sir, I have Jeevan Anand for 5 Lakh and Jeevan Tarang for 5 Lakh. I have taken accident rider on my existing health insurance from Apollo and company is giving separate accidental insurance.

I have 50 lakh term insurance. My wife does not get any insurance from company. She has her personal health insurance and critical illness insurance. Thanks sir so much.

Dear Vishal,

As your spouse is an earning member of your family, she may too consider taking a Term life insurance plan.

Kindly note that Accident rider may not provide the required risk cover.

Suggest you to kindly go through this article :

Best Personal Accident Insurance Policies in India : Details & Comparison

Hi, I am under 60 as of now, but my father is 83. Can I buy this (HDFC ERGO) super top up, and have him covered too in my policy?

Please let me know at the earliest as I am 58 years old, and will soon be 59.

Dear vandana,

The maximum age at entry is 65 years, so I don’t think you can include your Father under this plan.

But they do say you can include grandparents in family floater version. The person who is buying it, i.e., me is going to be under 65 alright, but if I have to use it for my grandparents it would be impossible for them to be less than than 85. The FAQ of the site does not mention parents, but then it also does not mention family floater and inclusion of family members subject to certain conditions.

Thank you for reply though. It is much appreciated. I tried calling them up but they are not very clear about this subject. Somebody senior needs to answer this, because I think HDFC Ergo is the only private insurance company offering health insurance products for 80 plus people.

Dear vanny,

With this Policy, as per the product brochure, one can be insured from the age of 18 years to 65 years. You can insure your children from the age of 91 days to the age of 23 years. Your

parents and parents in-law can also be covered in the same Policy on an Individual Sum Insured basis and in a separate Policy on floater Sum Insured basis.

(Age as on last birthday as at Policy inception date to be considered.)

Regarding the age limit for parents/grand-parents (beyond 65 years), HDFC team can only provide the correct and valid information.

dear Srikant,

I have taken week back same plan for my parents age 53 and updated as they asked in handbook cured medical history updation from Pneumonia 2 years back. via email with discharge summery. Now i have got e mail they are taking it in as pre existing condition but i think it should be not count in preexisting condition because like if cured from maleria in past then you should not count in malarial pre existing condition. Please advice and allredy written to ERGO and waiting for reply.

Thanks

Dear Mr Yadav,

Are they ‘loading’ on the premium?

As per the product brochure – ‘The Policy covers expenses incurred for the treatment of diseases that you have before taking the Policy. Such will

be covered only after 3 continuous renewals with us.’

So, kindly wait for them to get back to you. Do share the status update, can be useful to other blog readers as well, thank you!

Sir, No still they dont ask for any loading. I have declare my point because there was a line for declaration of the your medical history if that is fully cured already thats why i have send details of discharge summary to just inform. Pneumonia is not any pre existing type condition?

Dear Mr Yadav,

According to IRDA , pre-existing diseases have been defined as “any condition, ailment or injury or related condition(s) for which the insured had signs or symptoms, and/or was diagnosed, received medical advice or treatment within 48 months prior to the first policy issued by the insurer.”

Though the maximum period prescribed is four years, companies may offer products with shorter waiting periods under the ‘pre-existing’ clause.

Hi Sreekanth,

My employer provides me with a 5 lakh health insurance. I am wondering if i should go for a second health insurance policy (personal) vs a super-top up policy.

Please advise…

Also, I am unable to understand if a critical care illness policy is worth considering the fine print. Should we go for a super top-up plan instead?

Cheers!

Dear Kaushik,

May I know if you have dependents or any medical history?

The order of preference can be – stand-alone mediclaim cover (kindly do not depend entirely on employer provided cover), then you may consider opting for Super top up plan, keep building an emergency fund and then you may consider taking a Critical illness cover (especially if your family has a medical history).

Thank you for your reply.

My only dependent is my wife. No family history of critical illness.

Dear Kaushik,

If so, advisable to buy a regular family floater plan (self+wife) and then a Super top up plan (on a priority basis..).