We all know that medical treatment has got more expensive, is getting more expensive and may continue to be more expensive. Health care has become a costly affair. We should have health insurance to protect us from extra financial burden during medical emergencies.

Whether you are self-employed or salaried, your family and you should have a stand-alone health insurance policy (even if you have an employer’s group medical cover).

Health Insurance or Mediclaim policies are offered by General or Non-life insurance companies in India. There are around 24 General insurance companies in India. 4 out of 24 companies are stand-alone health insurance companies (Star health, Max Bupa, Religare Health and Apollo Munich).

When it comes to health insurance, there is no one-size fits-all plan that you can rely on. Medical Insurance is a contract based policy with legal jargon thrown in. Besides this, a Health Insurance policy has medical terminologies. Of the numerous medical insurance plans in the market, you may find that each one is unique in some way or the other, with its own benefits and limitations.

You have to do lot of research before you find the right and best health insurance plan for you. You have to make a comparison of health insurance plans offered by multiple companies. This is where I believe that health insurance comparison websites could be very beneficial.

Top Health Insurance Comparison Websites / Portals

Below are some of my personal favorite Medical or Health Insurance comparison portals :

1) Coverfox.com

This portal is owned by Coverfox Insurance Broking Pvt Ltd. As per my experience, it is the most user-friendly health insurance comparison portal. It provides geo-mapped hospital network comparison to check if ‘cashless treatment facility’ is available at the hospitals located in your area (these search results are provided based on the PIN Code).

There is no need to give personal details like email / mobile number to get the comparison search results, which I feel is a very useful feature of this portal.

You can filter the search results based on premium, room rent limit, co-pay clause, pre-existing diseases or based on the preferred company.

If you click on ‘know more‘ option (as highlighted in the above image) you can find more details of ‘what is covered?‘ and ‘what is not covered?‘ in the selected health insurance plan. You can hover over ‘cashless treatment available at’ option to get details of networked hospitals list (as shown in the below image). Plan’s product brochure / policy wordings are also provided under the link ‘read complete terms..’ option. You can buy shortlisted health insurance plan online.

2) Medimanage.com

Medimanage is owned by Medimanage Insurance Broking Pvt. Ltd. It is India’s first boutique health insurance broker and company claims itself to be the No. 1 Health Insurance Broker in India.

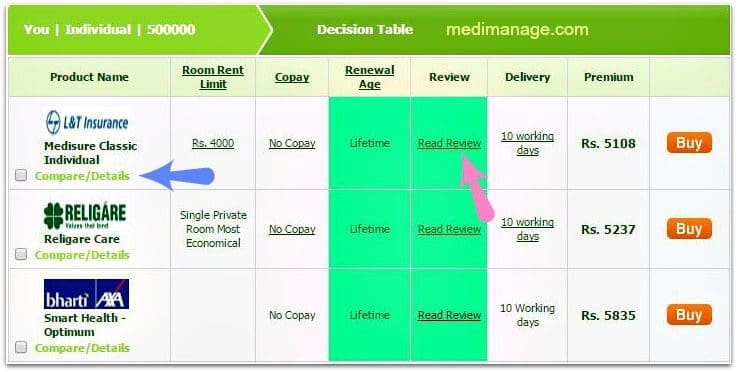

This portal will show you shortlisted health insurance plans based on your requirements. You can find details like room rent limit, co-pay, renewal age and premium under ‘decision table’. Hover over ‘read review’ to know the positives and negatives of a specific medical insurance plan. You can also compare multiple plans based on certain features. You can buy shortlisted health insurance plan online through this portal also.

This is India’s first IRDA approved insurance comparison site. You have to provide your personal details like email / phone no but no OTP (one-time password) is sent to your mobile. You may choose to give some dummy contact details to get the list of health insurance plans.

You can find details about plan specific key features by clicking on ‘+’ option. You can also download Policy brochure and policy wordings documents through this option.

If you ‘shortlist’ a plan, the company’s representative may contact you for completing the purchase.

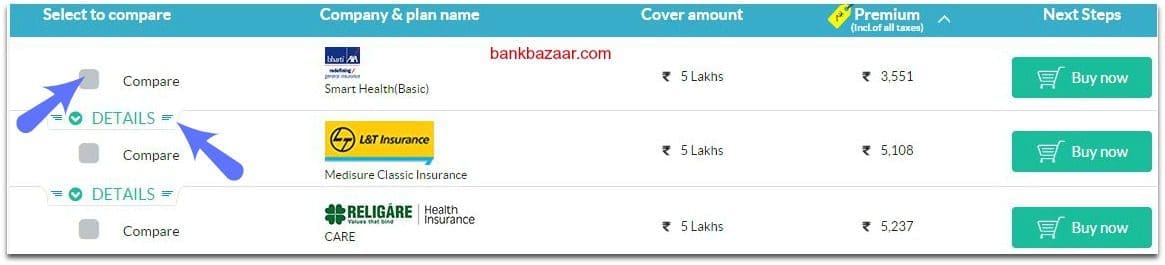

You can find coverage details and critical factors of the medical insurance plans under ‘details’ section. Product brochures are also provided. You also have the option to compare shortlisted health insurance plans.

Some more Health Insurance Comparison Websites are as below;

- Policybazaar

- Policylitmus

- Policybachat

- Policyx

- Easypolicy

On portals like Policybachat, Policyx or Policybazaar , it is mandatory to provide a valid mobile number to get the premium quotes of various medical insurance plans. An OTP (one time password) is sent to the mobile number for verification purpose. Personally, I do not like to share my contact details before I could shortlist a plan.

Few points to ponder upon

- After shortlisting a medical plan, suggest you to visit the insurance company’s website and go through the latest product brochure and policy wordings.

- Online purchase through these portals is optional. You may utilize these portals to just compare and get the knowledge about the various medical plans at one place.

- If you decide to buy through any of these medical insurance comparison portals or aggregators, stay cautious if they try to hard-sell any ONE company’s product(s) only.

- Do check out if they assist you during ‘claim settlement’ time.

- Make sure the comparison portal is offering you a wider choice.

- Check with them if they charge extra service fee, over and above the insurance premium.

- Whether you buy through the Health Insurance Comparison Websites or through a trusted Insurance agent, make sure you go through and understand the key features of short listed plans. These critical features can be like hospital room eligibility, co-payment clause, maternity clause, Pre-existing diseases clause, sub-limits, non-allopathic treatment cover, policy renewal clause, free health-check up details, day-care procedures, if pre / post hospitalization expenses are covered etc.,

My suggestion is that all insurance must be purchased only after suitable research is done, irrespective of the purchase being done through an agent or online.

I hope you find this post informative. Kindly share your comments.

Continue reading :

- Best Health Insurance plans for parents / senior citizens

- Best Family Floater Health Insurance Plans – Details, Checklist & Comparison

- Top Up Health Insurance Plans – Super Top Up Health Insurance Plans – Details & Benefits

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net) (This post is for information purposes only.)

Very well written, and got some information, which I was not aware of. Thanks a lot for making aware us of nitty gritty of financial planning.

sir .my name is pardeep azad Singh and my age is now 24-25 ..and my monthly income is 20thousand …I went to make a policy for 5-6 years…what policy is good for me…

Dear pardeep ..Kindly visit the comparison portals and you may shortlist the plans based on your affordability and requirements.

While taking a health policy with any company , i am always confused in the TRUST part. When you go to them for a claim for any disease like cancer or tumour, they always have the right to say that it was a preexisting disease, so it cant be claimed. Isn’t true?

Dear Pramod,

If that’s the case then health insurance industry would have been a history by now, let’s not generalize it.

Can’t call it as their RIGHT, if it is so they may have to prove it.

Sir, I checked the health insurance plan in these website, but there is not mention of Companies like LIC,other public sectors. would you please guide me which plan is best provided by public sector companies.

Dear RANJEET ..Kindly note that LIC offers life insurance policies and it is a life insurance company and not a General insurance company.

The public sector General or non-Life insurance companies are National Insurance, Oriental, United India, etc.,

Hello Sreekanth,

Just wanted to drop a note of thanks and let you know that your blogs are very well written and are extremely useful. You’ve helped me select my health insurance plan. Thank you, again.

/rgds

Dear Anand..Thank you so much for your appreciation and kind words. Kindly share the articles with your friends and keep visiting 🙂

Dear Sir,

This is continuation of the query just posted.I just forgot to report that in last six years ,we underwent no serious illness warranting to lodge a claim under this Baroda Health Policy

Dear dipankar Ji,

Always advisable to have higher medical cover. Suggest you to go for the plan for self too, if it meets your requirements.

In case if you would like to take a Diabetic specific cover then, kindly read this article ; Are you suffering from Diabetes or Hypertension? Let Health insurance take care of your worries

Dear Sreekanth,

My wife ,aged 59 ,being account holder of BOB,is having Baroda Health Policy for last six years which also covers me as a spouse.I am now 66 years of age.The Yearly Premium is Rs.7214/- for Rs. 5.0Lakh coverage.Should we have go for additional cover ? Only I have sugar marginally high and taking medicine(Metformin) for it.As I am also an account holder of BOB now ,should I take a similar Baroda Health policy which is under National Insurance Co.If both these two policies are in force,do we get double coverage i.e. Rs.10 Lakh? Kindly advice on Baroda Health Policy with particular reference to our queries.

Thanking you in anticipation,

DIPANKAR ROY CHOWDHURY

Also,while looking for comparison it seems that most of the comparison websites promote specific companies with whom they get most of promotion funding. Thus, looking for some honest suggestions Thanks !

Dear Sree,

I am a 38 years man, working in a private company for 10 years. I want to make a mediclaim policy of 2-3 lakhs (max) for my family spouse34, 14,7. I am diabetic, and hypertension as well, but only takes medicines (no insulin injection). Which policy will be better for us? what are the hidden clause that I should look into?

Please suggest best cheap and best medicalaim policy asap.

Dear Manoj,

You may consider taking a separate Diabetic specific mediclaim policy for self

Your spouse & kids can opt for Family floater plan.

Kindly read below articles;

Diabetic Insurance plans.

Best Family Floater Health insurance plans.

Evaluate these important factors when buying a health plan.

Hi,

I have an existing company policy of Cigna TTK – which covers my parents and me for Rs. 2.5 Lac expenses.

I wanted to buy a Super top up plan for them – they are aged – 60 and 61 right now.

1. If I disocntinue with employer – will the super top up plan hold on its own ? without a base policy – i want insurance to ahve this flexibility

2. I found https://goo.gl/RkTVzS but

a. None of them provide Domicliry treatment. Not even my base policy so I am kind of stuck here .

b. I am not sure if the less premium one Rs. 28K approx – L&T insurance is good or not? I mean does it settle claims easily. Am I missing any sublimits that they may have.

c. Room rent limit – My base policy haas but top policy dont have. What happens in that case with the overall bill if it enters scenario 4 – i.e. expenses go beyond base sum assured

3. Should I go for a new polciy altogether considering the base polcciy has 3 main restrictions –

a. room rent limit

b. No domcialiry support

c. Less cover

Waiting for a detailed reply.

Thanks Much

amanpreet

Dear Amanpreet,

1 – Yes. But kindly note that you have to bear the expenses (if any) till the threshold limit. If you are not comfortable, consider buying seperate mediclaim policies or family floater plan (if they do not have any health complaints) and then a Super top up plan.

2 – You may have to go through the respective Plan brochures, policy wordings & terms & conditions documents to have clear idea about sub-limits or any other clauses. Kindly get in touch with the customer care of respective companies as well. I believe that Max normal mediclaim policies have no sub-limit clauses.

3 – Advisable (YES).

good website, very helpful…thanks..Shreekant

Dear Sree,

I am a 26 years man, working in a private company for 3 years. I want to make a mediclaim policy of 2 lakhs (max) for my grandmother aged around 75-80 yrs. She is diabetic, and hypertension as well, but only takes medicines (no insulin injection). Which policy will be better for her? what are the hidden clause that I should look into?

At such an old age, I want the coverage to start asap without waiting for 3-4 years.

Also, I have another query. Let consider an example: I have a policy of 2 lakh. She have been hospitalized and the total expenses are 1.5 lakh. The insurance compny will reimburse the full amount, or will pay a part of it (like 25% of surgeon/doctor, y% of ICU, z% of medicines, etc.) If so, I should I proceed?

In pre-hospitalization charges, what are the things that are usually covered? Are there conditions applied as well.

Dear Saurabh,

You may suggest her Senior citizen specific plans or Diabetic specific plans.

Star / ICICI Lombard / Apollo Munich offer diabetic specific plans. Kindly check them out.

Read below articles;

Best Health Insurance plans for Senior citizens.

Best portals to compare health plans.

Evaluate these factors before buying a health plan.

dear sir.please tell me the insurance plan which cover preexisting diseases.my husband had benign brain tumor undergone surgery 1 yr back.it is benign not cancer.now he is fine.i want to take family floater for my husband of 30yrs,mine of 28yrs and my son of 1yr.please tell suggestion sir.i enquired few insurance companies but they rejected for my husband

Dear surekha,

Suggest you take Family floater for Self & your kid.

Kindly read : Best Family Floater Health insurance plans.

And a separate Mediclaim plan for your husband.

It is very tough for me to suggest a plan which can cover the said medical complication. You may have to kindly contact few more companies by yourself and check out.

just go to any Branch of Canara bank/syndicate bank and open an SB.account with 1000/- and all account holders of the respective bank can get health insurance for family for INR 8ooo/-roughly annual premium for 5L family floater cover without any room rent..etc conditions. no health check is needed for avail cover and after 3 years all preexisting deceases are covered. probably the best plan in the world if u ask me. i hv made aound 15 claims in my last 10 years for my family and friends. no problems at all as all these are serviced by reputed TPAs. Insurance is given by United india insurance. Person with any/all bad health will be given policy without extra loading.

request reddy to write on article on bankassurance as it is very cheap and simple products without any health check and cover/entry age upto 80 years in punjab national bank and oriental bank of commerce. 5L cover for 7000/premium for 79 years old person. is it not the best? since all are from public sector enterprises no cheating/false claims..etc

Dear radhakrishna,

Will surely try to publish an article on the suggested topic. Thank you!

But cheap may not always be the best!, especially in health insurance.

Selecting a health plan involves lot of home work and it depends on the requirements of the person/family who are taking it.

Hi Sreekanth,

Though I logged, my question was still under moderator review since yesterday morning. So i thought of posting here:

I have 75L HDFC Click 2 Protect Plus term insurance without any riders. My employer provide 5L insurance to my family including mother. I’m planning to take personal accident insurance and health insurance.

1. Personal accident insurance: Apollo Munich standard seems to provide more insurance coverage compared to others. So for 4 people(me+spouse+2kids) yearly premium is coming around ~10k for 50L coverage. In case of permanent disability, its possible that I might be out of work totally for the rest of my life. In such cases SA would be 50L, which is not at all sufficient to continue same life style (monthly expenses, kids education, home loan etc..). Then what is the use of this policy?

2. Health insurance: It seems I cannot include my mother in the family floater. So health insurance for 4 of us + separate insurance for mother is appr coming around 16K(5L coverage) + 12K(3L coverage) = ~28 K per yr.

so my yearly expenses only for insurances are:

Term insurance = ~11K

Health insurance = ~28K

PA policy = ~10k

Total = ~50K

So appr i will have to spend ~50K only for insurances. This seems to be heavy on pockets. Is this how it works? am I thinking in right direction?

I’m confused, please share your thoughts.

Dear Ravi..Answered your query in the Forum section, click here to view the Q&As.

dear sreekanth

really impresive site

kindly post DETAILED COMPARISON of health plans of CIGNA TTK and MAXBUPA

Dear JAGJIT..Will surely try to post one, thanks for the suggestion. Kindly keep visiting!

Hi Sreekanth,

I am looking for a health insurance for my mother who is 56 year old. She is diabetic but under control.

I already have 2 lakh coverage for her from my employer.

Can you please suggest best health insurance plan for her.

Thanks

Debi

Dear Debiprasad,

You may consider diabetic specific plans offered by Star health or Apollo Munich .

dear sreekanth i have a health insurance for my family (family health optima from star health) of 4 lakhs.i want to increase the sum to 10 lakhs.what is your suggestion whether to buy a 2nd insurance policy from another company or increase the star health sum assured.if i buy a 2nd one ,then in case of any medical needs will both the company will provide cashless .pl suggest if 10 lakhs is sufficient (my family is 3 persons me,my wife and 7 yrs old daughter).

2. i have also decided to buy a term insurance plan of 1 cr from met life mera term plan.whether to include my wife to the same plan or buy a separate one for her.

3. regarding accidental insurance plan i am with appolo munich with 50 lakhs cover. now confused again whether to include my wife in the same plan(she will get 25 l cover) or to buy a separate plan for her.we r both doctors and in a low risk category.

pl suggest

Dear DEBAJYOTI,

1 – If you are happy with STAR’s product(s) and their service, and their plan(s) meet you requirements kindly go ahead with them only.

You may also have a look at ‘Super Top-up plans’ and these can be really beneficial to enhance the Sum assured at minimal cost.

Kindly read:

Best Super Top Up health insurance plans.

Evaluate these 11 important factors before buying a health insurance plan.

Best Family Floater health insurance plans.

2 – Consider buying a separate term plan.

3 – Consider buying separate PA plan.

Dear Sreekanth,

Me and wife both diagnosed recently with sugar and on medications. Pre-existing disease not covered for 3-4 years. I am bit confused, that means we cannot claim for that particular disease or total claim free years??!!.

If we do not claim for any ailment at all ,then “No claim bonus” added during this period ?Kindly clarify.

Should I include my mother in family or take separate policy?

Appreciate your advice.

Dear Satish,

Yes, most of the health plans have ‘pre-existing diseases’ clause and the policy holder can’t claim on medical treatments associated with such diseases.

You may consider opting for ‘diabetic specific’ plans offered by companies like Star health/ICICI Pru/Apollo Munich etc.,

Suggest you to get independent mediclaim policy for your mother.

Read:

Best Family floater health insurance plans.

Best portals to compare health insurance plans.

Best Mediclaim plans for parents/Senior citizens.

Dear Sree

Many many Thanks….Cheers

Dear Sree,

But will there be no claim bonus, if we do not claim anything during suppose first 2 or 3 years of policy?Plz.clarify

Thanks

Dear Satish,

It depends on the plan who choose. Kindly go through the plan brochure & policy wordings before shortlisting a health plan.

Read latest article:

Evaluate these 11 vital factors when picking a Health Plan.

Dear Srikanth,

I am Sai Krishna ,M29 . Wife F25 and 2 year old Kid. I stay with my parents of age M56 and F 47 . Request you to pls guide me on following queries.

1. Is it necessary to have a base insurance plan(personal/or through employer) for buying super top up plan or i can pay from my pocket for deductible amount before claiming balance amount through super top up ?

2. I have a insurance cover of 3 lacs from my employer including my dependents . Do you still suggest to go for personal health insurance policy or should i consider only buying a Super Top up cover.

3. If i have to take separate base health cover , should i take it separate one for my parents and for me, my wife and kid ?

4. If Yes for above , which one i should consider . Pls suggest .

Thanks in advance.

Dear sai,

1 – It is not mandatory to have base or group policy to buy a Super Top up plan.

2 – Suggest you to buy an independent health plan and then a Super Top up plan.

3 – Yes.

Read:

Best Family floater health insurance plans.

Thank you srikanth.

For a Base plan of 5 L cover and top up for 25 L cover …. It is working out as under.

1. 16 thousand for me,wife and kid.

2. For my parents , 40 thousand. This seems to be burdent on my pocket. Can i go for only top up plan for my parents instead of base plan … Because , i have option to use total 3 lacs cover provided by my company . And then i am planning to take a top up plan with deductable of 4 lacs and cover of 25 lacs..

Is there any disadvantage in this plan ? pls suggest ..

Dear Sai,

Kindly consider buying a Super Top-up plan instead of Top up plan. Hope you are aware of the differences.

Kindly read:

What are Super Top up & Top Up health plans?

The extent of the coverage depends on the medical profile of your family. Kindly take the right products as per your affordability & requirements.

You can also opt for Co-pay clause in a health plan so that the premium can come down.

Read latest article: 11 vital factors to evaluate before buying a health plan..

How is ICICI Prudential iprotect all in one insurance plan ? I am looking for buy it

Dear amit ..Kindly read: ICICI Pru iProtect Smart – review.

Hi Sreekanth,

I am 43 years do not have any health problems as on now and my wife is 43 she is diabetic and has high BP. Can you please suggest me a good health insurance plan for us.Please reply me to my mail address

Dear jagannath,

Its very difficult to suggest a right health insurance plan.

Kindly go through this article and shortlist a good plan based on your requirements : Best portals to compare health insurance plan.

Your spouse can consider taking – Star Health Diabetes Safe plan / ICICI Prudential’s Diabetes care.

Hi

Can somebody suggests me a good portal development co. who have developed

insurance comparison portal or any experienced person with experience of

developing such comparison website may contact us.

We are developing similar kind of portal.

Sanjeev

Mobile: 9650727458

Many insurers create problems during claim settlement to avoid paying. There should be an integrity rating for each insurer.

Medimanage covers very few plans. We need a portal that covers all plans.

Hi SREEKANT

I am a school teacher under west bengal govt. I want to invest in SIP for 10 years and my target is to get near about 1 cr. INR . I have 2 nos. LIC with a mothly installment of 2500 INR. Now I want to stop payment for these and I want to start a term insurance. Please suggest me what to do and how? How many to invest to reach my goal after 10 years? Which term insurance policy is the best for me? Please suggest…..

মিঠুন সরকার

Dear Mithun,

Kindly share more details about your LIC policies (plan name, commencement date, sum assured, tenure etc.,).

Do you have dependents? Do you have health insurance cover? What are your other financial goal(s)??

LIC Jivan An and Policy commenced on 2011, SA 800000/-, for 30 years, and I have 3 family members 1 dependent, I don’t have any health insurance coverage. My other financial goal is I want to have an own house after 5 year.

Dear Mithu,

1 – Your high priority task is to buy a Term insurnce plan at the earliest. Kindly read – Best term insurance plan.

2 – Get personal insurance cover. Read – Best Personal Accident policy.

3 – Get Family floater health insurance plan. Compare health insurance plans by visiting any of the above portals.

4 – Get rid off the existing LIC policies after buying term plan.Suggest you to surrender your LIC jeevan Anand. Read – How to get rid off bad insurance policy?

Also read – The 6 most common personal finance mistakes..

OK, I will manage everything, now how much SIP mutual fund should I invest and where to reach my financial goal Of Rs.1cr.after 20 years, please suggest me.

Dear Mithun..Kindly go through my article – Best Equity funds & Best balanced funds.

Hi Sreekanth

Thanks for reviewing Coverfox and rating it. Glad you liked our work. We have just started on our journey towards making insurance simple not only towards comparison, but ease of buying and post purchase handholding including at the time of claims. Hope to make it simpler. Really respect your work on the financial literacy side. Would love to connect with you to get more feedback on a regular basis. Cheers!

Dear Mahavir,

Thank you for stopping by and leaving a comment. I am really impressed with the website’s features. Greatly appreciate your team’s efforts.

Good one sreekanth

I really appreciate coverfox team. I am following your site since from 3 months and also suggessting people while buying the same. Keep going Mr Mahavir.