The primary functions of a commercial bank are accepting Deposits and also lending funds. Deposits are savings, current, or time deposits.

Banks take in funds, called Deposits, from those with money, pool them, and Lend them to those who need funds. Banks are intermediaries between depositors (who lend money to the bank) and borrowers (to whom the bank lends money).

The amount banks pay for deposits and the income they receive on their loans are both called Interest. The difference between advances and deposits is the income earned by the banks.

The banks offer/charge certain ‘rate of interest’ on deposits and loans. The rate of interest charged by a financial institution for lending money is known as ‘Lending Rate‘.

The method to arrive at Lending Rate has changed drastically over the last decade or so. Banks & Financial Institutions have been using the below Lending Rates;

- BPLR (Benchmark Prime Lending Rate)

- Base Rate (Base Rate replaced BPLR w.e.f July, 2010)

- MCLR – Marginal Cost of Fund based Lending Rate (MCLR has been in effect since April 1, 2016.)

Related Article : ‘What is MCLR? | Details, Components & Review‘

What is the need to calculate the Lending rate using different methods? – The basic idea here is to improve the transmission of monetary policy adopted by the RBI and to make the methodology of lending rates selection by banks more transparent.

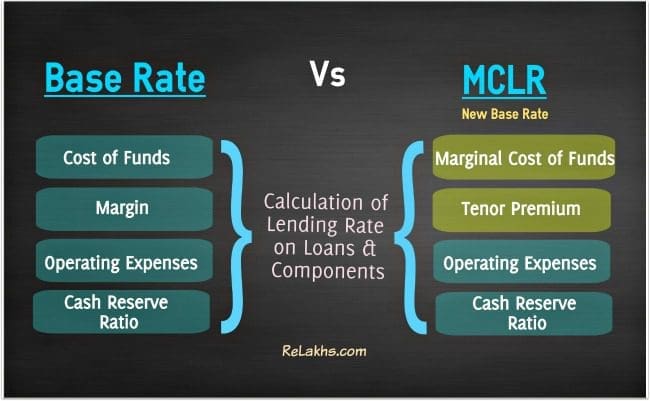

Prior to 2016, the base rate or Standard Lending Rate calculated by the banks based on the below components;

- Cost of funds (interest rates offered by banks on deposits)

- Operating expenses to run the bank.

- Minimum Rate of return ie margin or profit

- Cost of maintaining CRR (Cash Reserve Ratio).

As you can see, the banks do not consider ‘Repo Rate’ in their calculations. They primarily depend on the composition of CASA (Current accounts & Savings Accounts) and deposits to calculate the lending rate. Most of the banks followed average cost of fund calculation. So, any cut or increase in rates (especially key rate like Repo Rate) by the RBI was not getting transmitted to the bank customers immediately.

Hence, MCLR was introduced in 2016.

- MCLR is lending rate calculated based on cost of raising new funds for the bank which include the cost of maintaining CRR/SLR, operating costs of banks and tenor premium.

- As MCLR is closely linked to repo rate, it improves the transmission of RBI’s repo rate cut to the end borrower.

As per the RBI’s guidelines, it is mandatory for the banks to consider the repo rate while calculating the MCLR with effective from 1st April, 2016. So, what is this Repo Rate? What is the link between Repo Rate & your Loan EMI?

What is Repo Rate?

When we need money, we take loans from banks. And banks charge certain interest rate on these loans. This is called as cost of credit (the rate at which we borrow the money).

Similarly, when banks need money they approach the RBI. The rate at which banks borrow money from the RBI by selling their surplus government securities to the central bank (RBI) is known as “Repo Rate.” Repo rate is short form of Repurchase Rate. Generally, these loans are for short duration (up to 2 weeks).

It simply means the rate at which RBI lends money to commercial banks against the pledge of government securities whenever the banks are in need of funds to meet their day-to-day obligations.

Banks enter into an agreement with the RBI to repurchase the same pledged government securities at a future date at a pre-determined price. RBI manages this repo rate which is the cost of credit for the bank.

Example – If repo rate is 5% , and bank takes loan of Rs 1000 from RBI , they will pay interest of Rs 50 to RBI.

Impact of Repo Rate cut or hike

Higher the repo rate, higher the cost of short-term money and vice verse. Higher repo rate may slowdown the growth of the economy. If the repo rate is low then banks can charge lower interest rates on the loans taken by us.

So whenever the repo rate is cut, can we expect that both the deposit rates and lending rates of banks to come down to some extent?

This may or may not happen every time. The lending rate of banks goes down to the existing bank borrowers only when the banks reduce their internal base rates (Base Rate/MCLR), as all lending rates of banks are linked to the base rate of every bank. In the absence of a cut in the base rate, the repo rate cut (or the quantum of rate-cut benefit) does not get automatically transmitted to the individual bank customers. This is the reason why you might have observed that your loan EMIs remain same even after RBI lowers the repo rates.

Although the three repo rate cuts this year is good news for borrowers, understandably you will only see a decline in your EMIs after your bank lowers its MCLR. Further, the reduction in MCLR will result in lower EMIs only when the reset date of your home loan arrives.

Usually, a bank offers loan with reset period of six months or one year. On the reset date, your future EMIs will be calculated on the basis of the prevailing interest rate (bank’s MCLR plus margin of the bank) on that date. That’s the main reason, you do not get to see the impact of Rate-cut on your Loan EMI immediately/instantly.

This has made the RBI to come up with recommendations based on ‘External Benchmark’ lending rate. Instead of Banks linking their Base rate to Internal benchmarks, the RBI has been contemplating to get the Base Rate(s) linked to External benchmarks. (Do note that the Reserve Bank has put this direction on hold for now.)

The banks were given below options for the external benchmark;

- Reserve Bank of India policy Repo rate, or

- Government of India 91 days Treasury Bill yield produced by the Financial Benchmarks India Private Ltd (FBIL), or

- Government of India 182 days Treasury Bill yield produced by the FBIL, or

- Any other benchmark market interest rate produced by the FBIL.

Latest update (06-Sep-2019) : RBI makes it mandatory for all Banks to link Loans to External Benchmark Rates. However, this is not applicable to NBFCs (like HDFC, LIC HFL etc.,). The existing borrowers will be given an option to port to new Lending rate. The interest rate under the loans linked to an external benchmark will be reset at least once in 3 months

What is Repo Linked Lending Rate?

So, when the bank links its Lending Rate to an external benchmark like Repo Rate, it is considered as Repo Linked Lending Rate.

And, SBI is going to be the first bank to launch a home loan product that will be linked to Repo-Rate. This Repo-linked Lending Rate home loan will be available w.e.f 1st Jul, 2019 (subject to certain eligibility criteria).

SBI will offer new home loan at: Repo Rate + 2.25% (mark-up) + Spread

RLLR = Current Repo Rate + Mark-up

The home loan borrower will have to shell out an additional 40-55 basis points (0.4 to 0.5%) as the Spread, depending on one’s risk score as assessed by the bank.

Given the current Repo-rate is 5.75%, the new RLLR-linked home loan interest rate can be;

RLLR = 5.75% + 2.25% + 0.4% to 0.5% = 8.4% to 8.5%

Will Repo-linked Lending Rate be beneficial to the borrowers?

Should you opt for Repo-linked home loan? – Kindly go through below points before making your decision;

- First things first, banks are here to make profit and not for charity. So, whether it is Base Rate, MCLR or now RLLR, they will charge markup to RLLR and add/adjust the SPREAD as per their business strategy.

Based on the available information, it looks like, the ‘reset-clause’ may not be available for new RLLR loans. SBI’s Repo-linked Lending Rate home loan may not come with the ‘reset-clause’. The interest rate under the loans linked to an external benchmark will be reset at least once in 3 monthsWithout the re-set clause, the effect of any Repo Rate cut/hike by the RBI will be instant on your Loan EMIs.So, brace for the high volatility in your loan EMI payments. Therefore, you (borrowers) should opt for this product only if you are comfortable with higher and more frequent changes in the home loan rates.- A spread could be charged on the basis of your risk scores and other parameters. So, borrowers with good Credit Score, high income, high loan value etc., may negotiate with the bank/Lender to get a better interest rate (RLLR+Spread).

- If you are a new home-loan borrower, compare MCLR and RLLR rate (if any) offered to you by your banker and then take a decision. (As of now, SBI will offer new home loan interest rate with both the options i.e, MCLR or RLLR.)

While calculating the MCLR, banks have to factor-in the cost of deposit, operating cost etc. apart from repo rates. This reduces the transmission of policy rate changes to borrower.

With a possible shift towards external benchmark(s) for new retail floating-rate loans, you can expect the impact of rate cut/hike on your loan(s) to be instant.

Will it be beneficial in terms of better rates to the borrowers? – It is too early to comment but I believe that Banks are smart-enough to play with the ‘SPREAD’ to keep their margins in-tact. Also, before signing your home loan agreement, do go through the fine-print of your home loan features, eligibility criteria and T&Cs.

Latest News (04-Oct-2019) : RBI cuts Repo Rate by 25 basis points to 5.15% from 5.4%. This is the fifth consecutive rate cut from RBI , after a rate cut in February, April, June & August of 2019. The repo rate now stands at 5.15 per cent, the lowest since March 2010. The reverse repo rate has been revised to 4.9%.

Continue reading : ‘5 Key Macro Economic Indicators you need to track as an Investor!‘

(Post first published on : 24-June-2019)

Hi Sreekanth & Pradeep,

Whats would be your advise to new home loan applicants – choose MCLR or RLLR?

Ex:

MCLR – 8.6% ROI for loans >30L upto 75L – No processing fees [legal, documentation, valuation, mortage etc still remain] + property insurance.

RLLR – 8.4% ROI for for loans >30L upto 75L – 12~15K processing fees [legal, documentation, valuation, mortage etc are additional] + property insurance.

Has SBI disclosed the reset-clause for RLLR & how does it impact?

With all these I agree that this whole process is just an eye-wash for the common middle class tax payers / borrowers.

-KUnal

Dear Kunal,

Are these rates offered by SBI? or which banker?

I believe there is no ‘reset clause’ with SBI repo rate linked home loan..

MCLR based rates had 2 random numbers, MCLR itself and the spread. Now RLLR has 3 random numbers.

Unless the bank comes out and explains what is the basis of the markup and the spread they have fixed, these random numbers will only add to the pain of the borrowers who plan to repay their loans. For others, mostly crorepatis it just doesnt matter because they are never going to repay.

The spread is usually dependent on the credit-worthiness of the borrower.

With MCLR based rates, the spread is 0.10 to 0.20%, so how can they fix the spread for RLLR at 0.4 to 0.55% for the same borrower?

Has the borrower suddenly became credit-risk if we chooses RLLR loan?

Will the RBI governor ask this simple question to the bank?

Will any TV anchor ask this question to the bank MD?

I have seen in the past 3 years with SBI that whenever their benchmark rates go down to 8% they simply fix higher spread such that the final rates are always at 8.5%.

If fixing the spread is at the bank’s convenience why do we even have this argument of rate reduction not passed on?

Indian banking system is the biggest farce in the world.

Dear Pradeep,

Thank you for sharing your views!

I still remember our discussion on MCLR when it was came into effect 🙂

Banks/Financial Institutions will play with Spread and/or Mark-up to their advantage.

But, may I know your view on this – If we compare base rate Vs mclr rates, dont you think that the borrower gets a slight benefit of few basis points on interest rate??

Absolutely Sreekanth, base rate borrowers were left in the lurch ever since MCLR came in. I think they are still paying 9% + spread!!!

My numbers are from SBI website.

When the borrowers took loan on Base Rate, the interest rates were high, banks were paying 9-10% for 1 year, 2 year, 5 year deposits. But that was 5-6 years back. So the borrowers paid 10% on their loans then and now still paying 9%.

Is there any deposits for which SBI pays 9% today? No because even a 5 year deposit of 2013-14 would have matured and redeemed.

How much do SBI pay for FD today? 6.5-7%

So the deposit rates have come down by 2.5-3% and but the base rate is down by just 1%.

And MCLR is 8.45% which as you say, is ‘slight’ benefit for the borrower because the rates are still only 1.5% less compared deposit rate reduction of 2.5-3%.

Do remember Savings account rates are just 2.75-3.5% now and every account is supposed to maintain minimum balance these days as high as 5000Rs. Else they deduct charges.

Fast forward to 2019, RLLR is coming in to sort of replace MCLR. SBI wont say it, but they will not reduce MCLR anymore even if there is room for it. So new and existing borrowers will be forced to go to RLLR.

So my question remains, if banks have no logical explanation for their markup, spread, etc then why is RBI making noise?

How do banks calculate the rates?

Final rate is fixed at 8.5%, Repo Rate is 5.75% today, so they simply add 2 random numbers to RR to reach 8.5%.

Tomorrow if repo rate goes down to 5.5%, their markup and spread will be increased to set the final rate at 8.5%.

If I as a common man can see through this fraud, the bureaucrat sitting in RBI cannot see it? The govt anyway is forcing out the knowledgeable economists out of RBI saying they are not cutting rates. But cutting rates is to beneficial to whom?

They want people to homes.

If I were you, I will write a hard hitting article on the rate trajectory from past 10 years full of statistics proving how the borrowers are being taken for a ride.

Dear Pradeep,

Agree with your view on ‘regulation of Spread’.

RBI should make it clear regarding the possible threshold limit on Mark-up/Spread and the Banks should also come up with clear logic for setting up certain amount of Spread.

May I request you one thing – Why can’t you submit a well researched article to us and I would be more than happy to publish it (if I like it!). Let me know your opinion!

Sure Sreekanth, I will do it.

Give me sometime, I will come up with an article with nothing more than historical facts. I myself is interested to see what is in store.

Thanks for inviting me!!!

Sure..Thank you!