The Central Board of Direct Taxes (CBDT) has recently issued a notification regarding the new format and declaration procedure of new Form 15G & Form 15H. The revised procedure has been made effective from the 1st October, 2015.

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

The tax payers can now generate and submit Form 15G/Form 15H online provided their banker created a link on their respective bank’s Internet Banking portal.

In this post, I have provided detailed step by step detailed instructions on how to fill Form 15G or Form 15H?

How to fill new Form 15G?

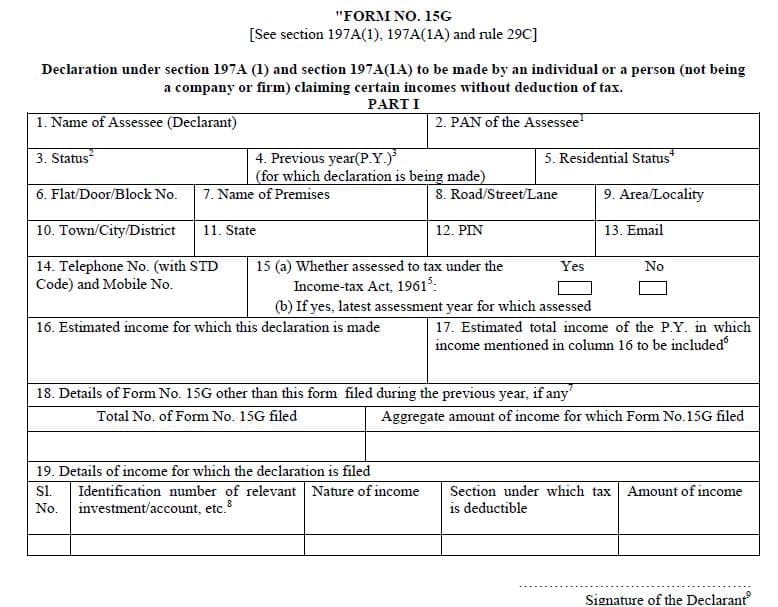

New Form 15G has two parts / sections;

Part 1 – This section is to be filled by the person (individual) who wants to claim certain ‘incomes’ without TDS.

Let us now go through each point of Part-1 of Form no 15G.

- 1 – Name of the individual who is making the declaration.

- 2 – PAN (Permanent Account Number) of the tax assessee. The declaration is treated as invalid if an individual fails to furnish his / her valid PAN.

- 3 – Status – Declaration can be furnished by an individual or a person (other than a company or a firm).

- 4 – The financial year to which the mentioned income pertains to.

- 5 – Residential status ie Resident Indian or NRI etc.,

- 6 to 14 – Your Address & contact details.

- 15 (a) – Mention ‘Yes‘ if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment

year out of six assessment years preceding the year in which the declaration is filed. - 15 (b) – Mention latest Assessment Year for which Income Tax Return has been submitted and processed.

- 16 – Estimated income for which this declaration is made. (For EPF Withdrawal Enter the EPF amount you will receive. This includes only Employee and Employer contribution. This should not include EPS or Pension.)

- 17 – Estimated total income of the P.Y. (Present / Financial Year) including the income mentioned in point no 16.

- 18 – In case any declaration(s) in Form No. 15G is filed before filing the new declaration during the Financial year, you have to mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

- 19 – Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings Schemes, life insurance policy number, employee code, etc.,

- Example : For EPF Withdrawal –

- Identification Number is your Provident Fund Account Number.

- Nature of Income: TDS on EPF Withdrawal

- Section: 192A

- Amount: Mention your EPF amount(Employer + Employee)

- Example : For EPF Withdrawal –

- Verify, declare and sign the form. (Kindly note that if you are submitting form 15G for this Financial year 2015-16 then Assessment year would be 2016-17)

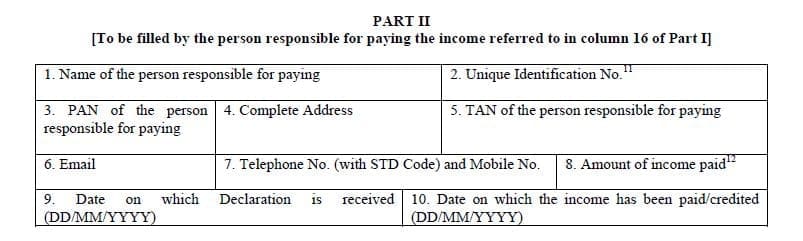

Part 2 – This section is to be filled by the person / institution responsible for paying the income. Example can be a bank who pays ‘interest income’ on a depositor’s Fixed deposit.

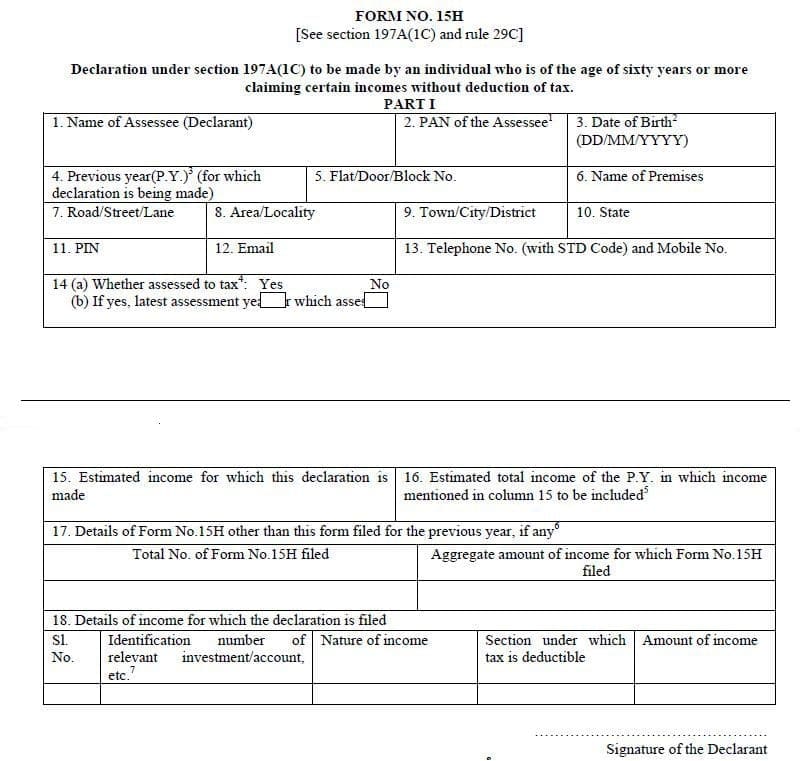

How to fill new Form no. 15H?

Form 15H is for senior citizens who are 60 years or older and Form 15G is for everybody else. New Form 15H is also divided into two parts;

Part 1 – This section is to be filled by the Senior Citizen (individual) who wants to claim certain ‘incomes’ without TDS.

The details that needs to be furnished in new Form 15H are same as the one in new Form 15G except for the point no. 3, wherein you (senior citizen) need to provide your Date of Birth in the form.

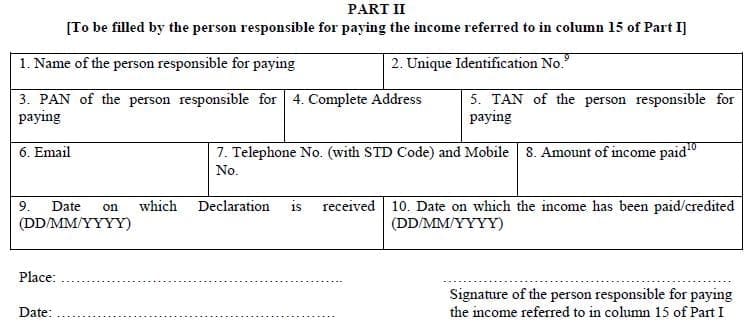

Part 2 – This section is to be filled by the person / institution responsible for paying the income. Example can be a bank who pays ‘interest income’ on a depositor’s Fixed deposit.

If you require any assistance in completing new Form 15H / 15H declarations, kindly leave your comments or queries.

Latest News (04-June-2016) : With effective from 1st June, 2016, rental income has also been allowed to be included in the Form 15G/ 15H declarations. The scope of income that can be included in the above forms is as under:

(i) Amount received from EPF withdrawas

(ii) Dividend Income

(iii) Interest other than Interest on Securities

(iv) Sum received from Life Insurance Policy

(v) Sum received from National Savings Scheme &

(vi) Rental income has also been allowed to be included in the declarations.

(Download new Form 15G and new Form 15H in PDF format.)

Continue reading :

Dear sir, Mujhe parsanal loan chaiye emergency ke liye please

Dear Sir,

i have worked in my previous company for 2.5 years and joined a new company and now i am working there . i have applied for PF withdrawal from my previous company,they are looking for 15G form.

please help for column 15,16,17.

My total Contribution : 64523

Current CTC :5.92 Lakh.

Pls suggest.

Thanks in advance

Dear Neeraj..In case, you are contributing to EPF in your new Company then you have to transfer old EPF a/c monies to new EPF a/c.

EPF withdrawal before 5 years, is a taxable income.

SIR I AM 21 YEARS OLD AND STILL NOT EARNING. I HAVE PAN CARD. MY FATHER WAS A GOVT. SERVICEMAN AND RETIRED IN 2016. HE GIVE ME 25 LAKHS RUPEES FROM HIS RETIREMENT AMOUNT FOR MAKING FD IN SBI AT 6.50% INTEREST . NOW I WANT TO KNOW IS THIS AMOUNT IS TAXABLE TO ME . AND WHAT IS THE MAX AMOUNT THAT I CAN INVEST IN FD.

Dear RAJA ..There is no maximum limit as such..

Yes, interest income is a taxable income.

Kindly read :

Taxes on FDs/RDs

Do I need to file income tax return?

Hi Sreekanth,

Can you please go through the below scenario and advice on my queries

I worked with a company based out of Chennai from Jul 2008 until May 2012 (Approx 3 Yrs and 11 Mths) , Later was on an onsite assignment from May 2012 till Dec 2015 Approx (3 Yrs and 8 Months) so no income in India and No PF contribution. Again was back to work in Chennai during Jan 2016 and resigned from the company in same month.

Since Feb 2016, I am working as a consultant / sole proprietor and have filed my tax for FY 2015-16 and for FY 2016-2017 it is yet to be completed.

I am in plan to withdraw my PF amount and have been asked to fill form 15G as well. can you please clarify on the below queries .

1. with the above case as the no of years of continuous active service of the PF account is less than 5 , will the accumulated pf amount approx 1,67,000 will be taxed ?

2. As of today, if claimed the withdrawal amount will be credited in to my account in the current Financial year 2017 – 2018 hence the AY should be filled as 2018-2019 in Form 15G or should this be current AY 2017 2018 – Kindly confirm.

3. As II am yet to file my Tax for AY 2017 -2018 (FY 2016-2017) , can the last assessment year be marked as AY 2016-2017.

4. with regard to the field 22 . Estimated total income from the source – I dont have such incomes – but got some interest credit in my savings account for the fund maintained through the year – should I be mentioning that here.

5. Please clarify on the estimated total income of the previous year field – should this be the approx income (Profit) i would be getting as a part of this Financial year FY 2017 – 2018 out of my consultancy work + amount in field (22) – correct me if i am wrong

Regards

Mithun

Dear Mithun,

1 – Kindly read : EPF Withdrawals & new TDS rules.

2 – AY would be 2018-19.

3 – If you are filing your taxes for AY 2017-18, suggest you to mention the same.

4 – Yes, you can include interest income as well.

5 – Estimates is fine..

Would appreciate your response to my query: My parents have been in the US since 2015 April as green card holders. In 2016 April, they sent their 15H filing to their bank in India. Do they have to file one this year, too? I have been reading on the internet that NRIs do not have to. Since, I am not sure, I have prepared the 15H papers (due soon). At the bottom of Page 1, of 15H, there is a Declaration, Verification that “I am resident in India within the meaning of section 6 of the Income Tax Act, 1961.” I have researched on the internet, but am not able to figure out whether US my green-card parents are Indian residents or not as per the Income Tax Act, 1961. The bank in India is not of much help. Can you help with some clarification on this matter?

Dear Sundari,

NRIs can not submit Form 15G/H. There is no need to submit these forms.

Dear Subramaniam

My 15H was not accepted by SBI as my pension exceeding Rs.300000/- .

As per manager’s version, if someone’s yearly income exceeds Rs.3 Lakh then he is not eligible to produce 15H to bank . The person can only claim refund from Income Tax department.

Please clarify the rules .

Thank you

D P CHAKRABORTY

Dear Deba Ji.. If there are tax deductions to be claimed and if the net taxable income falls below basic exemption limit then can submit Form 15H.

sir,i too had similar experience from some bank: my pension (2,95,000) plus FD INT (Apprx 90,000) exceeds 3 lacs..Since 15H has no column for 80c and 80d, TDS WAS DEDUCTED.Pleas advise how to give 80c and 80d to avoid tds this year, i will be very thankful to you

Dear BHASKARAN Ji ..Form 15H is submitted based on your projected income & assumed investments.

In case if you can not make investments for tax deduction, you can file ITR with TDS details but without tax deduction and calculate taxes (if any) accordingly.

sir, my investments u/s 80 c and 80 d approx.95000,so net income (Pension 2,95,000+FD int 90,000 less investments 95,000=2,90,000) is less than 3,00,000…My doubt is, in which column in 15 H should i mention 80c and 80d investments. I DONT FIND THE COLUMN TO MENTION THIS INVESTMENT.(Last year tds deducted, this year if you can kindly guide me, i will give 15H duly reflecting investments and avoid TDS.

KINDLY BEAR WITH ME FOR THE TROUBLE

THANKS AND WARM REGARDS

Dear BHASKARAN Ji ..You may mention the expected income as Rs 2.9 Lakh and TDS wont be deducted.

Hi Sudip,

Need your help. We could not file ITR for the account which my father was operating. He expired on 27th July 2014 since than we could not do so. Also he has few FD in SBI bank. Now same account has been transferred at my mother’s name who is 60+. For FD ‘s which my father opened with SBI bank, do I need to submit form 15G/15H? Shall I have to submit separate forms against all the 6 FD accounts of my father.

Looking forward for your responses.

Many thanks.

Jyoti

Dear Jyoti ..You can submit one Form 15H (signed by your mother) if its the same Bank.

Yes Sreekanth, bank is same for all the FD accounts. Also can you please let me know the procedure to file ITR for this account. Really appreciate your quick response.

Thanks,

Jyoti

Dear Jyoti,

Kindly read :

Which ITR form to file?

Do I need to file my Tax return?

Hi

I have a query …..in filling the 15g

i get interest of 1800 on FD every month…and i work in a company and my salary account is in other bank

while filling this column..what should i fill..(should i just mention my interest income or i should mention my salary as well ?)

Estimated total income of the P.Y. in which income mentioned in column 16 to be included *

Dear kumar ..You need mention the total expected income (salary + interest income) in Col 17 and in Col 16 – expected interest income.

what is next after the form 15h has been filled and submitted.

My Mother a pensioner, having 4 nos. FDs in two separate banks. While submitting 15H in two separate bank in column no 16. Estimated Total income what she would write? If Q.1-FD interest earn in one particular bank+Estimated annual pension income? Q.2-FD interest earn in both banks+Estimated annual pension income? Q.3-In the column 17 Total no. Of 15H filed what she would write 2 or 1? Q.4-If column 15 & 17 aggregate amount of income would be same figure? Hope you will reply my queries. Thanks

Dear Sudip,

2 – Yes, you are correct.

3 – While filing 2nd Form 15H – the count is 2.

4 – 16 & 17 – yes.

Thank you sir for your prompt reply. From your article and your comments of others queries I get that in the column 16 & 17 the figure would be same, as it is the Total expected income from all FDs in different banks+income from other sources,Q.1- is it correct? But suppose if my mother had two nos FDs total amounting ₹ 600000/- in SBI and the total interest amount 45000/ she would get yearly from those FDs. So my Q.2- is while submitting 15H in SBI what figure she would write in the column 15(Estimated income for which this declaration is made) 600000/- or 45000/-? Q.3- For other bank FDs the column 15 would be change and 16 & 17 would remain same as SBI 15H. Is it correct?

Sir I understand that column 17(Details of form no. 15H other than this form filled for the previous year,if any) is related to previous year i.e 2016-2017 financial year. In the space under the column 17 (aggregate amount of income for which from no. 15H filled) will be previous year total interest income of all bank FDs+previous year yearly pension income+other income of previous year. Is it correct? Thanks

Dear Sudip,

I believe that it is number of forms in this FY ie 2017-18.

Dear Sudip ..You can declare it as Rs 60k, kindly note that it is an estimated income, so slight difference of figure is ok.

Thank you.

I have opened HUF Saving bank Account in one bank and there are few FD’s.

The interest FDS is estimated to be Rs. 50000/- FOR FY 2017-18

Some interest has also be accured by Saving Bank account. Rs. 5000/- FOR FY 2017-18

THERE IS NO OTHER INCOME.

I have never filed income tax return for this account

PLEASE LET ME KNOW WHAT I HAVE FILLED IS CORRECT ?

15 (a) – Mention ‘Yes‘ if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year out of six assessment years preceding the year in which the declaration is filed. NO

15 (b) – Mention latest Assessment Year for which Income Tax Return has been submitted and processed.

16 – Estimated income for which this declaration is made. 50000/-

17 – Estimated total income of the P.Y. (Present / Financial Year) including the income mentioned in point no 16. 5000/- + 50000 = 55000/-

18 – In case any declaration(s) in Form No. 15G is filed before filing the new declaration during the Financial year, you have to mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

0 0

Dear DARSHAN,

15 a – correct

15 b – NA

16 – Yes

17 – Yes

18 – ok

Thanks a lot Sreekanth Reddy

Can you please tell me when to submit form 15H ,

I have to submit this form against my fds to the bank, for 2017-2018 , so Do i have to submit it now in advance or at the end of the march 2018.

Dear BHARAT ..Ideally at the beginning of a Financial year.

Thank you sir.

I want to also ask you If bank has deducted TDS on fds even after submitting 15H form at the beginning of the financial year.Than what to do?

March end I realize that the TDS has been deducted saying that no form 15H has been submitted for last FY finished, but it is not the case my Mother who is above 60 yrs went and submitted this form to the bank and now the bank staff is different and they deducted the tax saying the same thing above.

How to go about this situation to get our TDS money back after all its all bank’s mistake.

Dear BHARAT,

She can file Income Tax return, declare income & TDS paid details and get Refund (if any).

Read: Misconceptions on TDS

I was in the process to do that online at the Income tax govt. website , but after registration I got stuck and don’t really know what type of declaration and how I should be making the declaration as there are different types of forms and section available.

Dear BHARAT ..Suggest you to consult a CA and file tax return.

Sir in 15H can I mention my pension’s amount? If it is required, then my monthly pension is Rs.13962. So my question is how can I calculate it?

Dear Mr Mukherjee..You can mention the total expected Pension in this FY 2017-18.

Hi Sreekanth,

I have worked in a firm from 8th June 2011 to 8th june 2015. Tried to apply withdrawl via employeer, they have a form 15g which has 24 columns which is diferent from this. in that form what does this column 7.assessed in which ward/circle , 17,18,20,21 means?

Dear RupeeVest ..Ward/Circle are regarding your Income tax return.

Kindly go through this article, can be useful.

Sir,

In Form 15H (means for my mother who is above 60 years)….., how many signatures to be done…..My mother having fixed deposit of 1 lakh.

In some banks, they are saying only 2 signatures…….and some banks they are saying 3 signatures.

Please tell me in PART II of 15 H, is it necessary to sign by my mother or can i ignore it…….Part I having 2 signature columns and Part II has 1 signature column. Total 3 COLUMNS.

Please tell me sir how many signatures to be done……in 15 H form..

Two signatures , dear Srinivas ..

Part II is to be filled by your banker.

Hi Sreekanth,

I worked for a company in Hyderabad for 5.6 years. I moved to the US in June 2016. But haven’t filed tax for the current assessment year (2017-18). My question is regarding the following sections in 15g:

1. [16. Estimated Income for which the declaration is made]- What income amount should I enter here, Salary or PF?

2.[17. Estimated total income of the P.Y in which income mentioned in column 16 to be included] What should be the income amount here?

3.[19. Details of income for which the declaration is filed] What should I mention. I want to submit 15g only for PR WITHDRAWAL.

Appreciate your advice here.

Thanks in advance,

Kumar

1. [15. Estimated Income for which the declaration is made]- What income amount should I enter here, Pension or Interest?

2.[16. Estimated total income of the P.Y in which income mentioned in column 15 to be included] What should be the income amount here?

3.[17. Details of income for which the declaration is filed] What should I mention.

Dear anupam,

1- For what are you submitting the Form 15g? If it is for bank deposit interest then its Interest income.

2 – Salary income (if any) + col 15 amount + other income, if any.

Dear reddy,

Regret to inform you that being a senior citigen(66yrs) it will be Form 15H instead of 15G.

So the column of 15H furnished below :

1. [15. Estimated Income for which the declaration is made]- What income amount should I enter here, Pension or Interest?

2.[16. Estimated total income of the P.Y in which income mentioned in column 15 to be included] What should be the income amount here?

3.[17. Details of income for which the declaration is filed] What should I mention.

Dear Kumar,

1 – PF

2 – Salary inc (if any) + PF + Other expected income (if any).

3 – PF details

Thank you Sreekanth! Appreciate your advice.

Any suggestion how to calculate the PF amount?

Dear Kumar ..You can check your EPF passbook or give missed call to know your EPF balance.

Hi Sreekanth Reddy,

I had worked in an organisation from 8th April 2015 to 3rd Jan 2017. My Fixed pay was 2,90,000 from Apr 2015 to May 2016. Then it was 3,88,500 from June 2016 to Jan 2017. Do I need to submit Form 15 G. If so, what are the details do I need to fill in that. I had no investments, no RD, no Insurance schemes etc except House rent and Sodexo contribution. Could you pls give me a detailed explanation on this. Thanks in advance.

Dear Fahad..If you are submitting this form for PF withdrawal, suggest you to submit Form 15G irrespective of your eligibility, as EPFO has been asking for this form from all applicants.

Hi Srikanth,

Thanks for the reply. I have one more doubt reg Form 15 G. I had no investments, no RD, no Insurance schemes etc except House rent and Sodexo contribution. So, what should I enter in Column 15 and 16 ?. Need some clarification this. Thanks.

Dear Fahad,

Col 15 – Your last tax assessment year.

Col 16 – estimated EPF withdrawal amount.

Col 17 – EPF withdrawal amount + any other income (Salary or interest on RD/FD/NSC etc). If other income is NIL. The amount in this col would be same as col 16 figure.

Thanks for the valuable information..

Hi Sreekanth,

I just need one information while filling FORM 15H in Estimated total income value how to calculate Interest rate earned on FD??

I mean i have 2 scenarios:

1st I have made FD on APRIL 2016 which got matured in MAR 2016 so it is apparent that i need to show interest earned as my income for FY 2016-17 and Assessment year 2017-18

2nd Scenario i had made a FD in APRIL 2016 which will get matured on SEPT 2017 so interest for that FD will be earned in SEPT 2017 so do i need to show that Full interest as income earned in FY2017-18? Or do i have to split the interest on Pro Rata Basis means APR2016 to MAR2017 and then APR2017 to SEPT 2017 in next FY’s FORM 15H?

Please clarify.

Thank you

Dear Pritesh,

It depends on whether you are following ‘accrual basis’ or total interest shown in FY in which FD matures.

Kindly read: FDs & RDs – Taxes

Thank you, Query has been resolved. Your Article on FD& RD is very impressive-detailed information has been provided.

My father need to fill form 15H, bank asked to put all income in the form 15H.

SBH bank asked him to fill Pension amount ( say X ) and FD interests (Y ) = Total SBH

Question 1 – is it right to fill pension amount as well along with FD interest or it should be just FD interest in that bank alone.

Now Karnataka bank where he holds couple of FD there as well:

if he fills Pension amount (X) + FD interest in karnataka bank (Z) = Total Karnataka

Question 2: will now he look wrong to IT department as in both banks he is adding X as pension amount and it should not overall look like 2X together from both banks.

Please help with clarifications here.

Dear Madhava,

1 – Yes, pension income is also treated as taxable income. So, need to include this.

2 – No, it wont be treated like that way.

Hello Relakhs,

I need some information regarding filling the PF withdrawal documents as I have moved to Australia in June 2016, and have the following queries.

1. Which address do I specify in all the forms, whether it should be my new address in Australia or my parental address back in India?

2. I worked with Dell till 30th March 2016 and did not file my Income tax returns for the year. Do I need to fill the returns in order to get the PF withdrawn?

3. I worked from 20th April till May end with IBM, will I have to fill separate forms for PF withdrawal?

4. Do I require to fill form 15G, in case yes can you provide a sample format for the same?

Kind Regards,

Kapil bandlish

Dear Kapil,

1 – Advisable to provide Indian address.

2 – You can mention the last assessment year of your tax filing. No, it is not mandatory to file ITR to get PF withdrawal.

3 – Yes. Else, you may have to first Consolidate the PF accounts and then apply for withdrawal from the latest EPF account.

4 – EPFO is asking for Form 15G from all the applicants. Click here to view sample filled Form 15G example.

Read :

EPF withdrawals & new TDS rule.

New Composite EPF Withdrawal form.

Hi,

I was working in a firm for continuous 5 years and in between I went to abroad during 2013 and returned back during 2015. I would like to with draw PF. In the last assessed colum which year should I mention? Should it be 2015 to 2016 to the assessment year during my abroad travel?

Please advise.

Dear Vijayanand,

The year in which you last filed your income tax return.

Hi Sreekanth,

I have few more doubts I will list down below

1) Do I need to file Returns for the year I was not in India? Pls advise.

2) I am filling 15G for PF withdrawl, in Column 16 : Estimated Income what all should I include if I dont have NSS FD. But I have LIC Policy, Home Loan only. Do I need to include Salary received as well?

3) In the Financial year 2015 to 2016 till Oct 2015 I was in one firm. From Nov 2015 I was in other firm I need to submit PF withdrawls to both the firms. In form 15 G, estimated income column 16 what I should I fill for each firm – Please advise

Dear Vijayanand,

1 – Depends on your Residential Status & if you have taxable income in India. Read : Do I need to file my ITR?

2 – LIC policy details not required, but have to include salary.

3 – Did you transfer your EPF amount from old EPF to new EPF account?

cHi Sree,

Thanks, I was non resident during 2014 to 2015 assess year 2015 to 2016 – I filed as No Income in India for Taxing.

in Column 16 for 15 G – will include Salary

Firm 1 : March 15 to Oct 15 (resigned during Oct 15)

Firm 2: Oct 15 to Jul 16 (resigned during Jul 16)

Salary received from Firm 1 (from March 15 to Oct 15) in Form 15 G for Firm 1

Salary received from Firm 2 (from Oct 15 to Jul 16 or March 16) in Form 15 G for Firm 2 — Check and advise

Hope this is correct

I have not transferred by my PF to new Firm.

Thanks

Dear Vijayanand,

If you are filing form 15 g now in FY 2016-17, you have to disclose the income expected in this FY.

Dear Sir,

i want to fill form 15G for PF withdrawal but little confuse on some filed.

Kindly guide me so that i can correctly filled.

I leave my job Aug 2016 & now not doing any job and i want to withdraw my PF.

1>What should i filled in filed 3 ie assessment year(for which declaration is being made

2>filed -22-Estimated total income from sources mention below (i have no shares,no interest on securities,no interest on sums,no mutual fund,no withdrawal from NSS

3>what should i mention in field 23 if my last year(15-16) total salary earned is 524590 for year 1st Apr 15 to 31st Mar 16 & total PF amt will be Rs268464/ and in pension it will be Rs46000

i suppose that forms 15g/h are to be submitted every quarter-in Column 16 of the form one has to mention Estimated Total income for which that declaration is to be submitted -does it mean the estimated income in the particular quarter? Again Column 17 asks for Total income for the PY -are we to mention there the estimated total income of the whole financial year in which the amount shown in 16 is apart?

Dear PPRadhakrishnan ..One has to mention the total estimated income for the current Financial Year.

Hello Sreekanth,

My query is regarding withdrawal of Provident Fund. I worked for 4 years (June 2010 to May 2014) in one of the firm based in India and in June 2014 I moved abroad permanently. Now I am planning to withdraw the Provident Fund Amount ( Total 4 Lacs).

My queries are –

1. Whether TDS will be deducted when I withdraw Provident Fund as my overall tenure as PF member was less than 5 years.

2. Can I avoid TDS deduction on my Provident Fund by submitting form 15G?

Thanks in advance for your help.

Kind Regards,

Sharad

Dear Sharad,

1 – Yes, TDS is applicable.

2 – TDS can be avoided but the withdrawal amount is still subject to Taxes.

Read:

EPF withdrawals & new TDS rules.

TDS & Misconceptions.

Thanks Sreekanth for answering to my query.

Hello Sree , thanks for your time for such a candid clear Information’s . I have switched my job and am a continues service member of EPF+pension scheme from last +5 years so now I would like to withdraw my PF+pension. here are my queries below .

1) PF office accept new UAN based PF and Pension forms or not if yes could you pls share the forms pls .

2) As I mentioned above do I need to fill form 15G as I have +5year of PF if yes is their any 15G form available with easy format kindly share.

3) Apart from that am I entitle to withdrawn complete amount of my PF+Pension or is their any hidden part available during withdrawn . I have everything updated in my UAN (Adhar,bank account ) and approved via employer .

4) Can I send the form via speed post or courier to regional PF office or only from post .

I am waiting for your reply to speed up my process .

Kindly advise please .

regards ,

Piyush Sharma

Dear Piyush,

1 – If you have joined a new organization and continuing with EPF scheme, then you can not withdraw PF balance, you have to transfer the old EPF a/c monies to the new PF a/c.

As requested : New EPF Withdrawal Forms – Form 19 UAN, Form 10C UAN & Form 31 UAN

2 – It is not required. But looks like the EPFO/ employers are collecting Form 15G from everyone.

3 – If unemployed for min 60 days, you can withdraw full PF balance and EPS too.

4 – Speed post.

Hi srikanth

This is Praveen i have a doubt regarding my EPF withdrawal could u please help me. My query is I worked 2.4 years sal 3laks/anum ,I resigned my job 2months back am not doing anything now and not filed any IT returns till and there is no investment to me now I would like to withdrawal my EPF amount was 50k so should I need to submit 15G

Dear Praveen,

May not be required. But I believe that employers/EPFO is asking for Form 15G from all the applicant.

I JOINED IN 16-08-2011 TO 30-04-2012 I LEFT ,After i joined another organsation sep-1-2012 first organsation pf amount transferred to new pf account sep-30-2016 leaving the company can i withdrawn pf amount

Dear balaa..If you are employed and contributing to EPF scheme, you can’t withdraw full PF balance.

Read: EPF partial withdrawal rules..