If you are a salaried individual, I am sure your are aware of different types of LEAVES like casual leave, earned leave, sick leave, personal leave etc., Sometimes, you may not avail all the leaves that are available to you and some of your leaves may remain unused.

Most of the companies allow you to encash the unused balance of leaves during your service or during resignation. You are also allowed to encash them on retirement. So, encashing the leave balance is known as ‘Leave Encashment’. (Leave encashment is a defined benefit scheme)

In this post let us understand – When leave encashment is provided? Is leave encashment taxable? What is the tax exemption limit on Leave Encashment? What are the tax implications of Leave Encashment? What are the rules on leave encashment for Government & non-government (Private) employees? How leave encashment is calculated (formula)?

Many organizations provide the facility of encashment of leave either;

- during the period of employment (or)

- at the time of retirement (including separation on account of resignation, retrenchment, VRS etc other than termination) of the employee (or)

- at the time of Termination of the employee.

Tax Treatment of Leave Encashment (or) Leave Salary

For tax treatment of leave encashment under section 10(10AA) of Income Tax Act 1961, the employees have been classified into two types:

- Govt Employees and

- Non-Govt employees (PSU or Private employees)

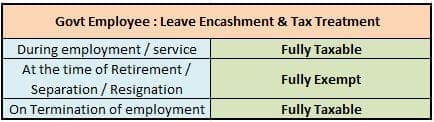

I) Govt Employee & Tax treatment of Leave encashment (LC)

- During the period of employment / service, if an employee encashes any leaves, the entire LC amount is fully taxable.

- At the time of retirement or separation or resignation, LC is fully exempted from Income Tax.

- At the time of termination of employee, it is fully taxable.

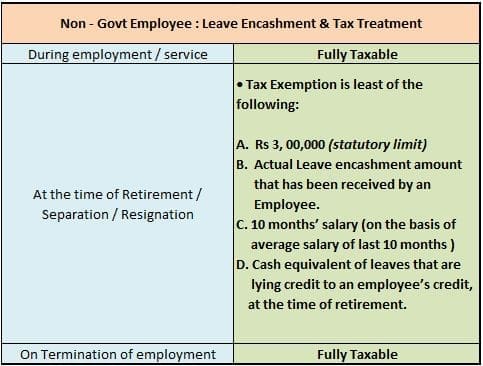

II) Non-Govt Employee & Tax treatment of Leave Encashment

- Any leave encashed during the period of employment / service is fully taxable.

- LC is either fully or partially exempted at the time of retirement or resignation. Tax Exemption on LC availed during retirement or resignation is least of the following:

- Rs 3,00,000.

- Actual Leave encashment amount that has been received by an employee.

- 10 months’ Salary.

- Cash (salary) equivalent of leaves that is available at the time of retirement. Leave calculation is done subject to maximum of 30 leave per completed year of service. (Do note that, least of these is exempted from income tax, the remaining LC balance (if any) is taxable)

- At the time of termination, it is fully taxable.

(Definition of ‘Salary’ for Leave Encashment : Salary = Basic salary + Dearness Allowance + Commission)

The tax treatment and implications of LC are pretty clear regarding a Govt employee.

However, regarding LC by a non-govt employee, we need to do some calculations w.r.t ‘cash equivalent of leaves’ (point no 4).

Cash equivalent of leave at the time of retirement or resignation = { ( ( ( Y * C) – A ) / 30) * S }

- ‘Y’ is No of completed Years of service (you need to exclude part of an year, if any).

- ‘C’ is total no of leaves Credited per year. If company provides 40 leaves per year, for calculation purpose we need to take 30 leaves only.

- ‘A’ is total no of leaves Availed during the service (total no of leaves minus no of leaves that were encashed).

- ‘S’ is average salary for last 10 months.

Important points on Leave Encashment & Taxation:

- Leave credit is only on completed years of service. (If it’s 25 years 6 months, it should be taken as 25 years)

- If leaves are credited at the rate of say 55 days leave for each year of service then calculation shall be made at the rate of 30 days leave only for each year of service . If, however, earned leave is credited at the rate of say 25 days leave for each year of service, calculation shall be made at the rate of 25 days leave for each year of service (w.rt. above ‘cash equivalent of leave’ calculation).

- Exemption limit of Rs. 3 lakh is the maximum that a taxpayer can claim in a lifetime.

- If you have claimed a tax exemption of Rs 1,00,000 during a financial year on receipt of leave encashment then a maximum exemption of Rs 2,00,000 can only be claimed in the future years.

- If you receive LC from two or more employers in the same year, then the aggregate amount of leave salary exempt from tax cannot exceed Rs 3,00,000.

- Leave encashment received by your nominee / legal heir is not taxable.

- In case of Non-Govt employees, LC received at the time of resignation or retirement is either fully or partially (as explained above) exempted from Income Tax. For example – If leave encashment is Rs 3 Lakh (received by a pvt employee on resignation) and the exemption is say Rs 1 Lakh (as per above calculation) then Rs 2 Lakh is taxable (as per your income tax slab rate) and Rs 1 Lakh is exempted.

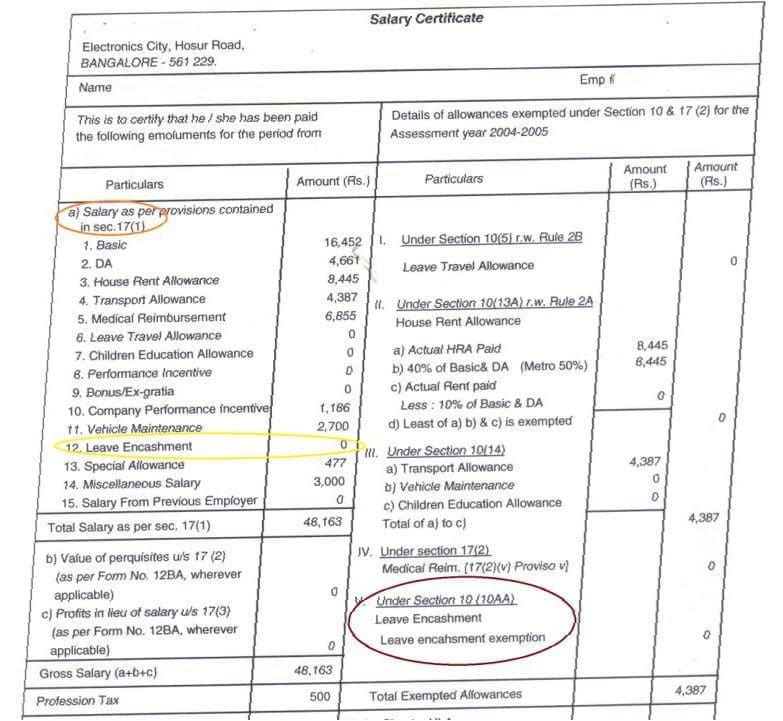

- You can find Details of your Leave Encashment in Final settlement document / Salary Certificate / Form 16. Under Section 17 (1) you can find ‘LC’ amount and details regarding the Leave Encashment exemption can be found under section 10 (10 AAA). Below is a sample of salary certificate.

Continue reading :

- Latest Leave Encashment Taxation rules w.e.f FY 2023-24 | Increased Tax Exemption Limit

- Resignation : Employee Benefits & Personal Finances – Checklist

- 13 FAQs on Gratuity Benefit Amount & Tax Implications

- EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

Join our channels

I was working in department of telecommunications and in 2002 I was given an option to get transferred to BSNL after its establishment and I joined the same. Now on my retirement an amount of leave encashment is credited to me out of which Rs 5 lakh is for the leaves balance while working in Dept of Telecommunications and Rs 2.5 Lakh for the leave balance in bsnl.

In form 16 bsnl gave me exemption on the entire 7.5 lakh but i got a notice from

Income tax dept us 154

Please let me know how the tax should be calculated on this.

And should I deposit the tax or guide me

In this regard pls

Dear Parveen ji,

If it is a tax-exempted amount, you can reply to the compliance notice quoting it as ‘exempt income’.

Kindly read : How to reply to Non-Filing of Income Tax Return Notice?

Hi sreekanth sir,

i have one doubt regarding leave encashment,weather leave encashment provision made during current year(ex:2016-17

) for next year(2017-18) can be allowed as a expenses for computation of income tax in 2016-17 or not.

please guide me ,when that leave encashment will be allowed as expenses in income tax.

please explain me from employer or company point of view.

from :

kranthi kumar

Dear kranthi ..I do not have correct answer from employer view point. You may consult a CA.

Respected sir, I recently retired at the age of superannuation from a nationalised bank. I got leave encashment amount of rupees 844385/-. As I was informed by my employer that an amount of rupees 3 l ac is free under section 10(10aa) but while filling the form no.I of ITR SAHAJ, where this amount of 3 lacs is to be mentioned as there does not seem to be any coloumn. If I enter this amount alongwith 1.50 under section 80c then I presume this won’t solve the purpose. Kindly guide me where the amount of rebate of 3 lacs is to be mentioned in ITR I of sahaj

Dear Ajay Ji ..Kindly refer to our conversation on Facebook.

Dear Sir,

Can you please let me know, what will be the treatment of Leave Encashment on Employee incase he Switched to the another branch of Company.

Ex: An employee is working in Pvt ltd. Company from 1st April to 31st December 2016, on 2nd January 2017, some of the employees are transferred to another company. Current company agrees to Pay Leave Encashment amount as Joining Bonus. Will it be Taxable on part of Employee?

Dear Arif,

If it is treated as a different company then the rules can be applicable as mentioned in the above article.