“RBI (Reserve Bank of India) has cut interest rates.”

“RBI has increased the interest rates.”

“RBI keeps the key rates unchanged..“

Have you heard or seen these kind of headlines? Hmmm, I am sure you might have….

So, what are these interest rates? How are they going to impact our finances? Let us try to understand about these interest rates in this post.

One of the primary functions of RBI is to control the supply of money in the economy and also ‘the cost of credit.’ Meaning, how much money is available for the industry or the economy and what is the price that the economy has to pay to borrow that money. ‘Availability of money’ is nothing but liquidity and ‘cost of borrowing’ is interest rates.

These two things (Supply of money and cost of credit) are closely monitored and controlled by RBI. The inflation and growth in the economy are primarily impacted by these two factors.

To control inflation and the growth, RBI uses certain tools like CASH RESERVE RATIO, STATUTORY LIQUIDITY RATIO, REPO RATE, REVERSE REPO RATE etc.,

What is CRR (Cash Reserve Ratio)?

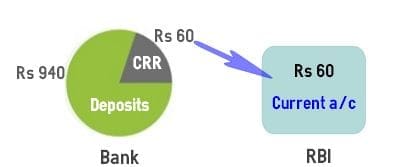

It is the ratio of Deposits which banks have to keep with RBI. Under CRR a certain percentage of the total bank deposits has to be kept in the current account with RBI. Banks don’t earn anything on that.

Banks will not have access to this amount. They cannot use this money for any of their economic or commercial activities. Banks can’t lend this portion of money to corporate or individual borrowers.

Example – You deposit say Rs 1000 in your bank. Then Bank receives Rs 1000 and has to put some percentage of it with RBI. If the prevailing CRR is 6% then they will have to deposit Rs 60 with RBI and they are left with Rs 940. Your bank can not use this Rs 60 for its commercial activities like lending or investment purpose. This Rs60 is deposited in current account with RBI.

If RBI cuts CRR then it means banks will be left with more money to lend or to invest. So, more money can be released into the economy which may spur economic growth.

What is Statutory Liquidity Ratio (SLR)?

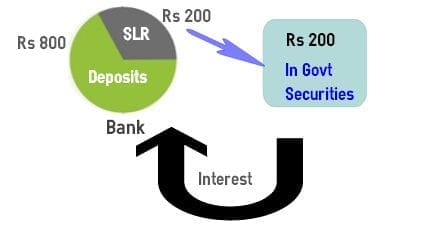

Besides CRR, Banks have to invest certain percentage of their deposits in specified financial securities like Central Government or State Government securities. This percentage is known as SLR.

This money is predominantly invested in government securities which mean the banks can earn some amount as ‘interest’ on these investments as against CRR where they do not earn anything.

Example – You deposit say Rs 1000 in your bank. Then Bank receives Rs 1000 and has to put some percentage of it with RBI as SLR. If the prevailing SLR is 20% then they will have to invest Rs 200 in Government securities.

So to meet both CRR and SLR requirements, bank have to earmark Rs 260 (Rs 60 + Rs 200).

What is Repo Rate?

When we need money, we take loans from banks. And banks charge certain interest rate on these loans. This is called as cost of credit (the rate at which we borrow the money).

Similarly, when banks need money they approach RBI. The rate at which banks borrow money from the RBI by selling their surplus government securities to the central bank (RBI) is known as “Repo Rate.” Repo rate is short form of Repurchase Rate. Generally, these loans are for short durations (up to 2 weeks).

It simply means the rate at which RBI lends money to commercial banks against the pledge of government securities whenever the banks are in need of funds to meet their day-to-day obligations.

Banks enter into an agreement with the RBI to repurchase the same pledged government securities at a future date at a pre-determined price. RBI manages this repo rate which is the cost of credit for the bank.

Example – If repo rate is 5% , and bank takes loan of Rs 1000 from RBI , they will pay interest of Rs 50 to RBI.

So, higher the repo rate higher the cost of short-term money and vice verse. Higher repo rate may slowdown the growth of the economy. If the repo rate is low then banks can charge lower interest rates on the loans taken by us.

So whenever the repo rate is cut, can we expect that both the deposit rates and lending rates of banks to come down to some extent?

This may or may not happen every time. The lending rate of banks goes down to the existing bank borrowers only when the banks reduce their base rates, as all lending rates of banks are linked to the base rate of every bank. In the absence of a cut in the base rate, the repo rate cut does not get automatically transmitted to the individual bank customers. This is the reason why you might have observed that your loan EMIs remain same even after RBI lowers the repo rates.

Banks check various other factors (like credit to deposit ratios etc.,) before reducing the Base rates.

( Base Rate is the minimum rate below which Banks are not permitted to lend)

What is Reverse Repo Rate?

Reverse repo rate is the rate of interest offered by RBI, when banks deposit their surplus funds with the RBI for short periods. When banks have surplus funds but have no lending (or) investment options, they deposit such funds with RBI. Banks earn interest on such funds.

Current CRR, SLR, Repo and Reverse Repo Rates:

The current rates are (as in Feb 2020) – CRR is 4% , SLR is 18.25%, Repo Rate is 5.15% and Reverse Repo Rate is 4.9%.

Impact of Repo Rate cut or CRR cut :

Currently crude oil (petrol/fuel) prices, commodity prices and inflation have eased. Against this backdrop, there is a high expectation of RATE CUT this time. So, if there is a rate cut what is the general impact on the economy?

Hope you liked this post. Do track the RBI’s next Monetary Policy review on 2nd December. Analyze the impact of CRR or rate cuts (if any)..Cheers!

Latest News (27-March-2020) : To deal with the hardship caused due to the outbreak of Covid-19, RBI today has made some key policy announcements.

- RBI slashes Repo Rate by 75 basis points to 4.4%.

- Slashes Reverse Repo Rate by 90 basis points to 4%.

- CRR has been reduced by 100 basis points to 3%.

Latest update (05-Dec-2019) : RBI keeps rates unchanged.

Latest update (05-Dec-2019) : RBI keeps rates unchanged.

Latest update (07-Jun-2019) : The RBI cuts Repo Rate by 25 basis points to 5.75% from 6%. This is the third consecutive rate cut from RBI , after a rate cut in February & April of 2019. The reverse repo rate has also been reduced to 5.50 per cent from 5.75 per cent. The CRR has been kept unchanged at 4%.

Latest update (04-Apr-2019) : The RBI cuts Repo Rate by 25 basis points to 6% from 6.25%. This is the second consecutive rate cut from RBI , after a surprise rate cut in February 2019.

Latest update (07-Feb-2019) : The RBI cuts Repo Rate by 25 basis points to 6.25% from 6.50%. The latest Reverse Repo rate has come down to 6%.

Latest News (05-Dec-2018) : RBI keeps Repo rate unchanged at 6.5%, cuts SLR rate by 25 basis points to 19.25% and also keeps Reverse repo rate and CRR unchanged at 6.25% & 4% respectively. These latest CRR, SLR, Repo Rate and Reverse Repo rates will be effective from 1st Jan, 2018.

(A term called as “Basis Points” is often used in monetary policy reviews. What is Basis Point? …. 1% is equivalent to 100 basis points.e.g. If Repo Rate is 7.75% and RBI increases it by 25 basis point, then new rate will be 8% as 25 basis point will be equal to 0.25% )

Continue reading :

- RBI cuts Repo rate : Impact on your HOME LOAN

- Latest Floating Rate Reset Rules on Loans | RBI’s Guidelines

- What if the RBI hikes interest rates? | RBI’s Rate hike – Its Impact on the Economy & Personal Finances

- What is MCLR? – Details, Components of MCLR & Review

- RBI’s latest data on Financial Savings & Liabilities of Indian Households (2016-17) | How & Where do we save & invest?

- Important Macro Economic Indicators you need to track as an Investor!

I have read these explanations multiple times. But this is the easiest and the most interesting explanation to date. Even videos don’t explain so efficiently.

Thank you dear Nikita for your appreciation.. Keep visiting ReLakhs.com!

Thank you sir I really benefit,I was completely zero about economic ..While I read newspaper, especially the business column,I fell bore ,but now I know something…..Sir!! But I have some queries,,,,in the above repo rate explanation,the word ‘ surplus govt. Securities’ I m bit confused ,so if you can help me in simpler way ,I will be very happy…thanks

Dear Gigin,

Government securities are issued by RBI on behalf of Government of India and state governments in India. Banks invest in these Govt securities from time to time.

They can also SELL these securities to RBI as Collateral and borrow money from RBI.

Explain Reverse Repo Rate with example/in diagrammatic form

CAN WE EXPECT RATE CUT IN NEXT RBI MEETING?

Dear adityaraj ..If the inflation is in at expected low levels, mostly yes. Let’s see!

Please explain MCLR also

Dear Amit ..Kindly read my article on MCLR..

Very good information …. nice reading in simple language. A layman can understand financial jugglery after reading your blog.

Thanks

Thank you very much for a very simple explanation Visual ?

Awesome explanation n hv got clear concept over topic .if possible pls clear all budgetary related terms as m bank aspirant n no coaching class help me much

I read the example – impact of cut in rate of crr,SLR and repo rate will increase money supply in market, purchasing power etc. Then this will cause inflation and eventually RBI will go for increasing crr,SLR and repo rates

Then why to cut these rates?

Dear Raghav,

Demand & supply of money are dependent on many factors (internal & external to economy).

Also, various micro & macro factors have their effect on interest rate cycle.

It’s RBI’s responsibility to respond to market factors and manage the supply of money accordingly.

Well managed content …..

Awesome explanation of every topic…….

Thanks… For the examples…

Thank a lot

Very much thank full to you …bcoz it help me alot for the project assesment !!!!?

nice work man ! Keep it up

thanks sir you are amissing

Hi Could you please explain & clarify us what MCLR actually means for a bank or a customer ?

Very Nice and informative blog. It is written in a very simple language so that even non commerce person get idea.

Thank you.

Clear n easy to understand. Tnkz

Excellent explanation with good example ..thanks

I’m a civil service aspirant and a dentist by profession… you have explained the concepts in a crisp and clear manner… thank you very much…

Concept made very clear. Thanks Mr. Sreekanth. I am an IT professional with 20 years experience. I would like to get sound knowledge of Finance terminology and understanding of various aspects of economy of a country, company and institution. Which course do you suggest me to take up and institution name? or which books( hard/soft/blog/websites) you advise me to follow.

Dear Satish,

* Suggest you to start following one personal financial magazine like Outlook money / moneylife.

* follow few good blogs like jagoinvestor, basunivesh, freefincal, stableinvestor, myinvestmentideas, subramoney etc.,

* If not invested, consider investing in Mutual funds to understand how equity & debt markets work.

Thanks Srikanth

Now I have Cler Concept about CRR AND SLR To read ur speech Throughly.

Thank U Very Much

Nice information Mr. Sreekantha. happy to read your blogs.

Nagaraja.C

Bangalore

Nicely explained. Now the rates are good as we have inflation rates in the world economy.

Great job Sreekanth….well explained

Best explanation with examples

Seriously, beautifully xplained!

Cool Man!

A wonderful and in unambiguous language with clarity shall help readers and seekers.

Keep it up.

How simple you have explained the things . Thanks a lot keep sharing the information .

Thank a lot sir

So decrease in CRR, REPO RATE and SLR makes more funds to banks, inturn decrease in loan rates, ppl borrow more, increased purchasing power, leads to growth in economy.

Increase in reverse repo also impact the same..

My doubt in what situation, RBI increases the CRR, REPO and SLR ??

Dear Uam,

In case if inflation is at higher levels, RBI will increase the interest rates accordingly to decrease the money supply. This move can decrease the inflation rate. This is all part of a cycle.

Thank you for providing such a valuable explanation about these terms.

Thanq

helps a lot thanks

How simple you have explained the things . Thanks alot keep sharing the information .

Thank you dear Sunil. Keep visiting 🙂

I have read your post and it define the different hard queries in a very simple way……with detail… 🙂

Thank you Vishal..Keep visiting 🙂

I have read so many articles regarding the blogger lovers but this article is in fact a

pleasant piece of writing, keep it up.

ITS REALLY WELL FURNISHED INFORMATION WITH DEMONSTRATION. KEEP IT UP… AND KEEP SHARING THE INFORMATION.

Dear Vishal,

Thank you and keep visiting.

Do share the article with your friends. Cheers!

Very good information Sreekanth…. Nice reading your blog!

Dear Sudhesh,

Thank you. Keep visiting!

I have been hearing about these terms but never tried to understand them. You have explained in a simple n detailed way.

Sri Ranjani – Thank you. Keep visiting!