What is Khatha?

Khatha literally means, account. It is a document that shows a property owner having an account with the Municipality or any civic authority (BBMP -Bruhat Bangalore Mahanagara Palike) for paying taxes. The details of a it include the property owner’s name, size/measurement of property, location,built-up area, vacant or occupied etc., and is essentially required to calculate the total tax payable on that property.

You need it to apply for electricity (BESCOM) and water (BWSSB) connections, for trade and building licenses, building plan approval. It is also one of the important documents to be submitted to a bank when you are applying for a loan.

Difference between A Khatha and B Khatha?

There is no B-Khata as such. Few years back, the extent of area under BBMP jurisdiction was extended and City Municipal Councils / Village Panchayats were brought under BBMP limits. This is when property owners’ details were entered in B-Register maintained by BBMP and acknowledgments were issued just to facilitate tax collection process.

The point to note is, not all B-register properties are unworthy. I personally involved in one property deal wherein the seller of a property had all the required documents like Conversion order, uptodate betterment charges receipts etc and it’s just that his property was not under BBMP limits earlier. He got his property converted to A-Khatha. But, ofcourse money/ time needs to be invested and may have to face lot of bureaucratic hurdles.

Types of Applications:

Khata registration for newly allotted plots or Khatha for the first time.

Khata for transferred properties.

Khata for bifurcated properties.

Khatha for amalgamated (combined) properties.

Required documents for Katha Applications

For Khatha Registration

| Category of Property | Documents to be enclosed with the application |

| 1)Properties allotted by Bangalore Development Authority / Karnataka Housing Board (KHB) | Application in prescribed form |

| Attested copy of the title deed | |

| Copies of previous tax paid receipts (if any) | |

| Possession certificate | |

| Sketch showing the location of property | |

| 2) Revenue Pockets, BDA Reconveyed areas, Gramathana, high rise buildings (both apartments and commercial complexes) | Application in prescribed form |

| Title documents, flow chart of the title | |

| Copies of previous tax paid receipts | |

| Proof of betterment charges paid | |

| Khatha extract issued by previous authority | |

| Property location map, measurements of property |

NOTE: In case of revenue properties where conversion has not been obtained and approval of the competent authority for formation of layout has not been obtained, Khatha Registration will not be done unless they are regularized by the Government. However for the said properties assessment will be made for property tax and entered in the ‘B’ Register.

Khatha Transfer

For Transfer of Katha from one person to another based on the documents like sale deed, will, gift deed, family partition, release deed, in respect of properties already having khatha:-

- Application in prescribed form

- Title documents, flow chart of the title

- Copy of upto date tax paid receipt

- Affidavit regarding / inheritance / gift / court decree.

- Original Death certificate in case of Kathadar’s death

Required documents for Khata Bifurcation

- Application in prescribed form

- Copies of Registered title deed

- Tax paid receipts

- Sketch showing the bifurcation of the property and its measurements

- NOC from BDA if the property is located in BDA layout (for vacant lands)

Required documents for Khatha Amalgamation

- Application in prescribed form

- Copies of Registered title deed

- Tax paid receipts

- Sketch showing the amalgamation of the property and its measurements

- Affidavit regarding proof of blood relationship

- NOC from BDA if the property is located in BDA layout (for vacant lands)

My experience:

I had applied for Khata transfer in 2008 at BBMP, Bommanahalli office through a middleman. Along with the application I had submitted Sale deed, last property tax paid receipt, previous owner’s Khatha details, Encumbrance Certificate (EC) and required fee. I got Khatha transfer done in 15 days after few follow-ups.

On Khatha registration;

I had bought BDA auction site in HSR Layout for which I got Khatha registration done at Bommanahalli BBMP (CMC) office. I had submitted registration application, Possession certificate,Sale deed, Latest Encumbrance Certificate (EC) reflecting the current owner name and Demand Draft (DD) for khatha registration and property tax.

Online Khatha Application:

Now we can apply for Khata through online module.

Visit http://bbmp.gov.in

If you are applying as a group (say all flat owners of an apartment) then this is the best option. You may visit BBMP Citizen Service Centers for more information.

Khatha transfer fees receipt looks like this :

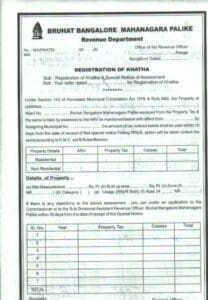

Khatha Registration Certificate looks like this :

Khatha Certificate looks like this :

Kindly share your experiences or comment below if you require more information,will be more than happy to reply. Cheers…!

Continue reading :

Hi Sreekanth,

Definitely a great work, with useful details explained in simple way. Thank you.

Using this detail, I am in the process of applying Khata transfer at Sakala portal. One query though, what is the “Property Type” to be selected for Khata transfer.? Mine is an independent house built on A-khata property in BBMP limits. It is in a private layout where conversion, betterment charges etc are done.

I’ve submitted an application for transfer of B-Khata property — It has a BBMP PID etc but called B-Khata wtf! (hand written application, tax paid receipt latest, registered sale deed copy, EC upto date, B-Khata certificate) at BBMP office. What document will they provide to me as a confirmation of khata transfer completion?

Thanks!

Sunil

Thanks for posting the images of these damn documents so hard to find. Now I know what these criminals look like

Govt makes avenues for corruption for each and every document they invent. As an IT person it’s a no-brainer to make everything depend on property ID and the person’s ID. But the geniuses that crack the civil services etc exams dump their brains in the gutters outside the govt offices before entering

Also, it is very surprising to note that that khata document is a flimsy piece of paper guaranteed not to last beyond few years. If you are preserving it you must take the services of museum professional. Why would they give you anything better anyway? They don’t want to lose that bribe money to remake it for you

Hi Sreekanth,

i purchased a plot with GPA registration in 2021 during covid period, now applied for Khata for the plot, the photo and aadhar number of the owner still shows as GPS holder, is this ok ? or should i submit for the changes . i checked with consultant , he said it is correct to reflect the GPA holder name and aadhar number in khata, please advise if this will have any complications going forward.

Dear Mr Rao,

Ideally, the khatha should show the actual beneficiary’s name and also the GPA’s name.

(This view is based on my experience)

You may re-check with any of the staff members at BBMP.

Sir I have purchased two plots adjecent to each other one in my name other in my wife name in a BDA approved lay out khata transferred in our name now I want to amalgamate both plots as I want construct commercial building on both plots on the advice of brocker for Amalgamation of plots my wife has executed a registered gift deed in my name so far khata not done in my name it is in wife name only now I have changed my plan to amalgamate the plots in me and wife joint names please clarify can it be done in joint names if yes can gift deed executed can be cancelled on mutual concent procedure to be followed without khata transferr as BDA khata is still in my wife name

Dear Mr Methre,

As gift deed is done, you can get the Khatha transferred from your spouse’s name to your name.

Yes, gift deed can be cancelled on mutual consent.

Can a gift deed be cancelled by the donor? – Once registered, a gift deed can not be revoked unilaterally. It must have the signature and consent of the donee (receiver) as well.

Related article : Property Gift Deed – All you wanted to know!

Hi Srikanth reddy,

I am planning to buy land which is under Hulimangala Panchayat area seller is telling it’s B khata with DC conversion. Before purchasing this property which all aspect need to be taken care.

Also if I am approaching any layer for verification of property which all aspects and questions need to be clarified by the layer. My plan is to buy this land and start construction.

Please suggest.

Regards

Nikhil

Dear Nikhil,

Kindly check if you can get e-Khatha on that property?

Suggest you to kindly go through below articles :

Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

10 Important Things to do after buying a Real Estate Property

Hi Sir , i have got my katha transfered from a resale flat. there is a mistake in area name. it should have been Hoshalli, but mentioned as Thalagattapura, lookas like the mistake was from my end while applying through online. can this be corrected?

Is there any rule that BBMP can charge 0.5% is sale consideration rather than 2% of stamp duty for property > 1 cr for khatha transfer ? This is what my agent is telling me ! Also asking me to pay in cash although promising receipt for entire amount

Hi Mr Sreekanth,

Kudos to outstanding service. I applied for transfer of Khata for purchase of flat (A khata) through Sakala in Dec 21 & my application was approved on 10 Jan 22. The ward office issued me the Uttara Patra on 12 Jan and told me that the issue of new E Aasthi khata is held up due to technical problems in the software. Is it so, and what would be timeframe for issue of the new format Khata Certificate ?

Hey Arjunan- Even for me the same. I got only the Uttara Patra and nothing a word about the Khata Certificate. Mine was done at the Yeshwantpura ward office.

I was told that they are working on the e-khata platform and not sure when are they going to issue the Khatha Certificate to me 🙁

Hello Shrikanth , Thank you very much for all your information you are providin in your web sites.

I have one question I have 60 by 40 site in Kemgeowda Layout which is still under BDA maintenance not in BBMP. I want bifurcate and sell one portion for the construction purpose. Is only bifucation of kath enogh to sell to the buyer. As buyer perpsitive what they ask aprt from bifurcateed kath. SInce it still under BDA the bifurcation process will be done in BDA office?

Hi, recently i submitted the online application in the Sakala website for Khata transfer, but i see the status as “Rejected” and the Remarks as “This property is a B register property”, does anyone know what this means and what we have to do for Khata transfer to the new owner of the flat.

Dear Chanda,

Suggest you to kindly approach the concerned civic body office (Panchayat/Corporation) and check if its possible to convert it to A-Khatha??

Hi sreekanth…i have a dc converted land in kolar district..and am planning a layout(30×40 sites) on that land..how much do i have to pay to get khatas for the sites?

Dear Rohit,

Kindly contact the concerned office staff @ Panchayat/Municipality.

Hello Sir, I’m planning to purchase plot which comes under gram panchayat. The current owner from whom I’m purchasing have mother deed but he have not done the khata transfer post purchasing the property. Now the owner is willing to pay all the taxes and willing to apply for the khata transfer, please confirm khata transfer can be done or no. The present owner of the site have purchased this site in the year of 2013. Can it be done or no please suggest. What is the process for the same.

Dear Saraswathi,

Can be done in the current owner’s name provided he submits all the required documents to the concerned civic body (Grampanchayat).

Related article : Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

Hi shreekanth reddy..me and my partner purchased a land in kolar district and did layout planning.now we want to distribute plots amongs us..can we get khata on our individual names?or we will get khata in our names jointly?because i want to get the khata on my name separately for the specific plots i am getting after distribution.

Also if you could provide info if there is some kind of form to be filled in order to get the khata of particular site in my own name and not jointly with my other partner.

Dear Rohit,

On whose name(s) the original plot (entire plot) Khatha has been registered with??

Entire land registered in myslf and my partner’s name

And khata for few sites already bn alloted in the joint name of both of us.want to apply for khata for the remaining sites

Dear Rohit,

In case, you both bifurcate the land into individual smaller plots and get them registered in your name, you can get Khatha in your name alone.

Else, the plots have a joint khatha only.

Kindly do consult a civil lawyer in this regard.

Related article : Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

Hello Sreekanth,

Recently I Purchased an Resale Apartment in Alfa Garden, Kodigehalli Main Road, K R Puram and Recently I applied for Khata Transfer via Online. But the Application got Rejected with Remarks Saying “This property comes under B Form Register. kodigehalli village.” Now What I should do Kindly Help me in this.

Thank You In Advance.

Dear Chandramouli,

Did you check with your Seller on this?

Whether they have been paying the property taxes??

Did you take legal opinion before buying the property?

Hi Sreekanth, am planning to purchase a plot in a layout (doesnt come under BIAAPA) whose KHATA is available online and in manual register for the entire land. When I asked for individual KHATA document for the plot am planning to buy, devloper is insisting that he will get it done 2 days before the registration date and i need not worry about it. Also to prove his point he has provided me individual KHATA documents of some other plot number in the same layout(whose registration is done), the document which he has provided me matches with the data i could fine online on e-swathu, so to verify i visited the gram panchayat office where i could not find manual entry in the register on that particular site. I have known that both manual as well as online katha is necessary, without entry in manual register one cannot pay their property taxes. Is it right..?? Can manual entry be done after now..?? Can u plz advice on how to proceed further..?

Dear Akived,

Keep it simple – You may insist for an individual plot khatha in Seller’s name and then go ahead! (Kindly do take legal advice before buying the plot)

Related article : Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

Hi Srikanth,

your blogs are clear and well understanding for the process of registration and khatha registration and lot.

Hi sreekanth,

We are purchasing a plot in horamavu. It will be a bifurcation plot since owner is selling half the plot and the docs are in bank. I am bit confused that when khata bifurcation happens. Is it after registration r before,..

Dear Archana,

Advisable to request the owner to get khatha bifurcation done (two sites in his name) then get your share registered and then you can get khatha transfer done in your name (for your site).

Related article : Checklist of Important Property Documents in India | Legal Checklist for Property Purchase

Hi Shrikant,

I have taken a land in green zone in vabasandra near ecity. I have done the registered sale deed. I wanted to know on the process and cost involved for khata transfer, mutation and also on DC conversion . Please guide .

Dear Nitish,

I doubt if its possible to get DC conversion for a green zone land now?

Suggest you to kindly take help of a civil lawyer or visit the concerned civic body office (Panchayat/municipality)..

Hi,

If the property is purchased with a home loan (and the EC showing the bank as the current owner), can the Khata be transferred to the owner/borrower’s name or is it transferred on the bank’s name? The original Khata on the previous owner’s name is with the bank.

Thanks in advance!

Hello sir, I’m planning to buy a site in doddagubbi panchayat. It’s a DC converted land. It’s divided into 8 plots. Now, there is a e-khata for this entire land. If we buy any one plot then how do we get individual khata? Owner is telling next year this panchayat will become bbmp. So, no need to get individual khata.if we apply for khata do we get e- khata? For construction of house from whom we should get permission? Without khata in our ne can we do construction?

Dear Ranjit,

Request your seller to arrange for Khatha bifurcation and separate Khatha certificate for 8 individual plots..

Hi Sreekanth,

We are planning to buy panchayati e-katha site near electronic city, the bank loan is approved and advance for site given to land owner in Jan first week, couldn’t get the registration done immediately due to personal reasons.

The registration has closed since mid of Jan.

What is our options here :

1. The owner is backing out from agreed per sft rate as the area listed to become BBMP limits in a year

2. Will the registration open before bank side starts giving us new trouble

Dear Kamal,

Why are the registrations closed since mid of Jan?

Hi Sreekanth,

We have bought a flat in E-City Phase 1,

Would like your inputs on what would be the khata transfer fee rate and would it calculated on the stamp fees paid or on the purchase price of the flat.

Regards,

Keerthi

Dear Keerthi,

Stamp Fee to be paid is 2% of the Stamp Duty that you have paid at the time of your Sale Deed registration.

So suppose you paid a Stamp Fee of around Rs. 5 lakhs at the time of registering your property, the Stamp Fee at the time of Khata transfer would be 2% of 5 lakhs i.e. Rs 10,000 .

For the exact fees, suggest you to visit the concerned Panchayat office

Thanks for the reply Sreekanth. Would there be any other charges apart from the above?