A well balanced life is very much essential for personal effectiveness, peace of mind and living well. We all would like to maintain a balance between professional and personal life. Both are equally important to lead a successful, happy and healthier life. We need to have right and well-balanced diet to be healthy and fit.

Investing in Balanced Mutual Funds is not much different. Balanced funds are also known as Hybrid Mutual Funds. Personally I prefer investing in balanced funds to achieve my medium and long-term goals. I am a strong advocate of Balanced Funds. (Read : My Mutual Fund Portfolio)

Whether you are a novice or an experienced investor, investing in balanced funds can be fruitful. They can give you Diversified Equity funds like Returns but with a lower risk profile.

I have published an article on ‘ Best Balanced Mutual Funds ’ in 2014. It’s around 2 years back. So, let’s have a re-look at some of the Top and Best Performing Equity Oriented Balanced Funds.

In this post, let us discuss – What are Balanced Funds? What are different types of Balanced Funds? Which are the best Balanced Mutual Funds (equity oriented schemes)? How is the performance of Regular Plans Vs Direct Plans of Balanced Mutual Fund Schemes?

What are Balanced Funds?

Mutual funds are broadly classified as either Equity or Debt, based on where a fund’s corpus is invested.

- Equity funds primarily invest in stocks/shares.

- Debt funds primarily invest in Bonds, Government securities and Fixed interest bearing instruments.

- Whereas, Balanced Mutual Funds invest in both equity and debt instruments.

Types of Balanced Mutual Funds

Balanced mutual funds can be Equity oriented or Debt oriented hybrid plans.

If the average equity exposure of a balanced fund is more than 60% and the remaining 40% is in debt products then it is treated as an Equity Oriented Balanced Fund. This means major portion of the fund’s assets are invested in equity (stocks).

If the average debt exposure is around 60% and equity is 40% then these funds are treated as Balanced funds – Debt oriented. (These proportions can vary among different balanced fund schemes).

Top 5 Best Balanced Mutual Funds

As per my last review on Balanced Funds, I have suggested below schemes;

- HDFC Balanced Fund

- TATA Balanced Fund

- HDFC Children’s Gift Fund – Investment Plan

- HDFC Prudence Fund

- ICICI Prudential Balanced Fund

- Reliance Regular Savings Fund – Balanced option

If you have already invested or have active SIPs in any of the above balanced funds, you may continue with your investments. But, kindly note that there are certain drawbacks with Children oriented MF Schemes. So, you may have a re-look at HDFC Children’s Gift Fund. (Read: Children’s Gift Funds – Comparison & Review)

If you are planning to make fresh investment s or SIPs, you may consider below Best Balanced Mutual Fund Schemes.

- There are around 59 Balanced Schemes (source – moneycontrol). The Balanced Fund Category has given an Average Returns of around 13.3% and 8.5% in the last 3 and 5 years respectively.

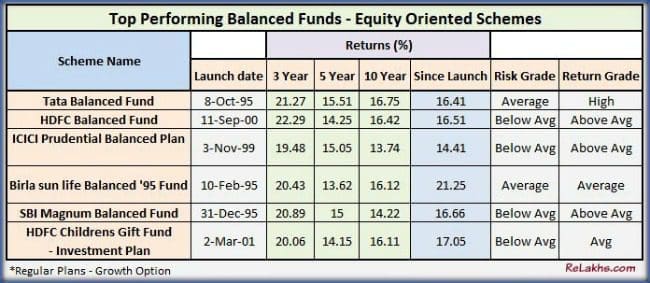

- TATA Balanced Fund has been one of the best balanced funds for a long-time. The fund has been a consistent performer. The fund has retained a four or five-star rating for the last seven years. The Fund’s strategy has been to allocate a slightly higher equity allocation. The current equity allocation is around 70% of the Fund’s portfolio. The fund’s equity portfolio consists of primarily mid-cap companies. It has HIGH return grade with AVERAGE risk grade.

- HDFC Balanced Fund’s returns and portfolio strategy is similar to that of TATA balanced fund. It also has around 70% equity allocation and has been primarily investing in Mid-cap oriented company shares. However, the fund has slightly reduced its allocation to mid & small cap companies over the last couple of years. The returns from TATA balanced fund & HDFC balanced fund are as good as some of the top performing pure Equity Funds. HDFC Prudence fund is also an another consistent performer from HDFC fund house. However, this fund now has a HIGH risk grade with an AVERAGE return grade. So, given a choice you can prefer HDFC Balanced Fund to HDFC Prudence Fund.

- ICICI Prudential Balanced & Birla Sunlife Balanced ’95 funds have also been performing well. These funds have given returns of around 13.74% & 16.12% in the last 10 years respectively.

- I have replaced Reliance Regular Savings Fund – Balanced option scheme with SBI Magnum Balanced Fund.

- Watch out for lock-in period and Exit Load on HDFC Children’s Gift fund. The investments in this fund have to be made in the name of Children who are below 18 years of age.

- Two more balanced funds to watch out for are L&T Prudence and Franklin India Balanced Funds. Let’s have an eye on their performances.

Balanced Funds : Direct Plans Vs Regular Plans – Returns Comparison

Below table gives you an idea about why investing in Direct plans is beneficial. The returns on Balanced Funds – Direct Plans are higher than the Regular plans. The difference in returns is as high as 1% in most of the cases.

(Read: What are Direct Plans of Mutual Fund Schemes? How to invest in Mutual Fund Direct Plans online?)

The main benefits of investing in a balanced fund are;

- Diversification : The funds are invested in both equity and debt financial securities leading to diversification of investments.

- Asset Allocation & Re-balance : Balanced funds regularly re-balance the portfolio based on market conditions & asset allocation limits. An investor is, thus, saved the hassle of manually re-balancing the portfolio. But it is prudent not to remain invested in these funds till your reach your Financial Goal target year. You may have to switch to safer investment avenues as you reach your target year.

- Low volatility : Balanced funds are less risky compared to pure Equity funds. Equity portion will provide the capital appreciation through stock prices appreciation and dividend income. Whereas, Debt portion can provide stability through interest income and appreciation in Bond prices.

- Long Term Capital Gains : In terms of taxation, the balanced mutual funds that invest at least 65% in equity ((Equity oriented) attract no tax liability on Long Term Capital Gains. The units of these funds should be held for more than 12 months.

- You can consider balanced funds for your medium to long-term goals like Retirement Planning or for Kid’s Higher Education goal planning.

Though Equity oriented Balanced funds have low risk profile compared to pure Equity funds, but it does not mean that they are totally risk-free. You may have to remain invested for longer period to get decent returns.

Do you invest in Balanced funds for your medium or long-term financial goals? Kindly share your views / comments.

(References : moneycontrol.com, valueresearchonline.com, morningstar.in & freefincal.com) (Image courtesy of Sira Anamwong at FreeDigitalPhotos.net) (Post Published on : 14-June-2016)

Join our channels

Dear shirkant,

Please tell me where to Invest Rs. 10 lakh for future security of my retirement.

I am 67 years old .

Is it equity linked mutual fund or something else.

Can I start now.

Dear Divakaran Ji,

Are you totally dependent on the income generated by this Corpus?

Do you have any other source of income to meet your living expense?

Is this investment for wealth accumulation or for regular income withdrawals?

Dear Srikanth,Stock market is daily making high.New investment in equity mutual funds has become risky.It is high time if you rewrite one year old article on balanced mutual funds.Thanking you.

Dear Jawahar Ji..will soon try publishing a latest article on Balanced funds.

Hi Sree,

First and foremost you are doing a fabulous job by assisting people to invest healthy. I learnt a lot from your blog. I also went through other sites which you suggested. I am very thankful to you.

i invested in ELSS scheme,SBI Magnum tax gain, regular growth plan – 50 K(with nill knowledge, since Bank manager suggested).Later realised there are better schemes.

later i went through your blog and other articles.

My goal is to invest 1- 1.5 lakhs for period between 1.5 -3 years. Risk is moderate. Expecting returns >9%. I come under 20% tax slab.

Here comes my query,Is investing in Debt Short term or Balanced Fund ideal? Not sure which fund to decide,i will definitely keep money more than one year.

I believe in that case Balanced funds will give more returns after one year than short term debt funds. Is my understanding correct?

I thought of the below:

Balanced fund – HDFC Balanced fund

Debt Short term – HDFC Short tem fund

please suggest if there are any better funds than the above.

Really appreciate your contribution to my plan

Thanks,

Bhavana

Dear Bhavana,

Thank you for your kind words and appreciation!

Let’s first understand the fact that returns from debt funds or equity oriented funds are not fixed/guarenteed.

Equity balanced funds can give more returns or even less returns than a debt fund in one year.

So, ideally you need to pick a category based on your investment objective and time-frame.

You may consider a balanced fund if you have a longer / medium term view, say 5 years +.

Read:

What are Debt funds? Types of debt funds.

Best Debt funds.

What are Arbitrage funds?

Best MIP Funds.

Best equity funds.

Hi Sree,

Thanks for your prompt reply. As I said I already gone through all your articles and other suggested sites. I feel like I have theoretical knowledge but not the practical knowledge. Since I have already suggested my risk level and time tenure, I would really appreciate if you suggest me the right fund type and best fund in that type. I really trust your suggestion.

Kindly help!

Regards,

Bhavana

Dear Bhavana,

If your time-frame is say around 5 years, you may pick HDFC Balanced fund or even on large cap fund like Birla frontline equity.

If you have time frame of around 3 to 5 years, you may pick MIP Fund like Birla MIP II Wealth 25 fund.

For short term – you may consider Short term debt funds or even Arbitrage funds.

Hi Sree,

Thanks for your suggestion. I have a query which is nagging me. Here it is, this year due to Trump modifications in IT sector policies I assume there will be affect on Technology. I myself work in Infosys and knew there are steps taking in place to minimise the effect but impact is still there.

So is investing in MF including Technology portfolio ideal for this year returns? If not please suggest MF with out Technology through your expertise.

Thanks much in advance. You are helping me a great deal!!

Regards,

Bhavana

Dear Bhavana,

Suggest you to kindly visit moneycontrol.com and check the latest Portfolios of the funds shortlisted, you may skip the ones which have high exposure to Tech/IT sector.

Hi Sreekanth,

I am 25 years old. I am planning to invest in Low Risks Mutual Funds which can assure me a minimum of 9-10% every year. I can invest max 3000 INR per month, and for duration 10 years. Could you please suggest me best Mutual Funds for my requirement.

Regards,

Rohith

Dear Rohith,

May I know why you would like to invest in low-risk mutual funds, for long-term?

Kindly note that returns from mutual funds are not guarenteed.

Hi Sreekanth,

What i am thinking is, if i invest in low-risk mutual funds for long term, i am assuming that it works similar to PPF. Since PPF interest is 7.9%, is bit low for long term.

Atleast i need 9-10% interest, so falling on Mutual Funds to get it..!

If not this..! Please suggest me one good mutual fund for long term (10 years).

Dear Rohith,

Nothing wrong in expecting lower return/taking lower risk, provided you are confident that you can achieve the required goal amount (if any) with that kind of return.

“‘The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks.’”

You may consider one Large cap fund and one Equity oriented balanced fund.

Read: Best Equity funds.

I have two daughters of 7 and 4 years, iam having a annual income of Rs 5 L , i am 33 yrs, at present i am investing in Kotak select focus fund Rs 6000/m, and planning to invest in HDFC balanced fund Rs 4000/m from next month onwards. For tax i have sufficient cover by lic policy, pf contribution

I need a corpus of Rs 50 L for my daughters studies/marriage.

Will the investment in MF be adequate

Kotak select focus fund equity regular

Dear archana Ji,

Kindly go ahead with your investment plan.

May I know details of LIC policies (Plan name, sum assured, tenure and commencement date).

Read:

Kid’s education goal planning & calculator.

Hai, I am 28 Years Old, i am recently starting SIP following Funds:

1) Axix LT Equty Fund Growth – 1000 (Present Hold Value 4ooo)

2) HDFC Mid-Cap Opportunities Fund Growth – 1000 (Present Hold Value 4000)

3) ICICI Prudential Value Discovery Fund Growth – 1000 (Present Hold Value 6000)

4) Birla Sun Life MIP II – Wealth 25 Plan – Growth – 1000(Present Hold Value 1000)

I was planning to have one more investment in Lumsum (25000/-) of Balanced Fund in BNP Paribas Balanced Fund.

My investments horizon is long of apx 20 – 25 years. this Balanced Fund is Ok are any changes in Fund

Dear Chiranjeevi,

Your portfolio looks fine.

Is BNP Balanced fund a New Fund offer? If so, you may pick a balanced fund from the existing schemes rather than investing in a new fund.

Hi Srikanth,

I am an NRI. If I need to withdraw Rs. 30000/- per month thru SWP, how much amount I should invest. looking for Capital appreciation also. Which fund I can opt?

I mean Debt fund. Because I can’t afford any depreciation from the capital if it is equity linked. SBI Magnum Glit fund-long term-growth is a right choice?

Dear Raj,

Kindly note that even Debt funds like Gilt funds can have capital depreciation, but probability of it happening is lower when compared to Equity funds case.

Kindly read:

Types of Debt funds.

Best Debt funds.

Best MIP Funds.

What are Arbitrage funds?

Thanks Sreekanth. I’ve gone thru all the articles. But still I haven’t take a firm decision to opt which fund from this categories.

Could you pls. give me some fund options to suit to my requirement?

Dear Raj,

You may consider SWP of MIP MF plan.

Dear Sir, I am a new investor in MF and investing lump sum in Balanced funds (SBI magnum, HDFC balanced fund) with SWP option. I am looking for good long term tax free return with less risk ( below avg).

Can you please suggest me a way to invest small amount of money which accumulates time to time in my savings account from several FD and ECS. I am not looking for SIP as this is not regular accumulation. I do not want to keep this amount idle in savings account. Is there any investment option in mutual fund so that I can keep toping up with such small amounts time to time in a less risk/moderate risk fund and get tax free return with SWP.

Thanks in advance.

Dear Amit,

You may consider an Arbitrage Fund, the withdrawals or SWPs after 1 year are tax-free. (kindly note that the units should be 12months + old to get tax free gains).

Read: What are Arbitrage funds?

Thank you so much for your valuable suggestion.

Hi Sreekanth,

One my friend is planning to invest in mutual funsd who is staying currently in U.S.Is he allowed to invest in MF as an U.S NRI?If yes,which AMCs are allowed.

Dear Giri,

Kindly go through this article : FATCA compliance & NRI MF investments!

Hi Sreekanth,

Thanks for providing information .My below question still remains ..Can you let me know AMCs which are accepting U.S NRI Fresh investments so that he can choose funds from those AMCs.

Dear Giri,

AMCs accepting investment from US based NRIs includes – L&T, UTI, PPFAS, Sundaram and Canara Robeco. (list is not exhaustive)

It is a bad idea. PFIC tax requirements are a killer. Advise your friend to look for US domiciled funds like Mathews which invest in Indian equities.

Hi Sreekanth,

I am 30 years old & recently started doing SIP in following Funds:

1) HDFC mid cap – 5000

2) ICICI ELSS – 5000

3) SBI Midcap (which actually is small cap) – 5000

I was planning to have one more sip of apx Rs 5000. I am confused between Balanced, Large or Multi cap.

I did some research and found that in long run Balanced funds beats large cap & almost same returns for multi cap. Do you suggest i should go for Balanced instead of large or multi cap as it give little safety for downside performance of market as well.

My investments horizon is long of apx 15 – 20 years.

Regards,

Shruti

Dear Shruti,

Your current portfolio has mid/small & multi cap (though it is an ELSS fund). so, it makes sense to add an equity oriented balanced fund to the portfolio.

But do note that past performance may or may not be repeated in the future 🙂

Dear Srikanth,

Thank you for educating MFs online. I am 36 years old. I am writing my portfolio for retirement plan( retirement at 60yrs) : tata retirement savings fund moderate(D) -2000/-, SBI magnum balanced (D)-2000/-, ICICI prudential balanced(D)-1000/-, PPF SBI -1000(15 yrs),NPS ICICI bank -4000/-

Kindly look into them and advice me.

Dear Sivarama,

If you are planning for accumulation of Retirement Corpus (24 years from now), you may consider GROWTH option instead of Dividend option.

You may consider one balanced fund, one diversified fund and one mid-cap fund.

Read:

Retirement Planning & calculator

Why NPS is not a good investment option?

Best Equity funds.

How to select the right mutual fund scheme?

MF portfolio overlap analysis tools.

Dear Sreekanth,

Is it better to invest in HDFC Balance Fund lumpsum or do you recommend going the SIP route in Balanced fund ? Can you please tell which method is better and why?

Sreekumar

Dear Sreekumar,

May I know your investment time-frame?

Kindly read : Is creating wealth through Systematic Investment Plan (SIP) a hoax?

Dear Sreekanth, thanks for your reply. My investment timeframe for equity focussed balanced fund is 5-6 years. Is that OK ? I have a plan to go for aggressive MIP also for around 3 years. Kindly advice whether its good to go via lumpsum or SIP for both? Also 1 more doubt, when is best time to invest in MIP and balanced fund, when markets down or up? Also better to go lumpsum or SIP? Thanks in advance bro!

Sree

Dear Sreekumar,

Obviously when markets are down, but it is next to impossible to TIME the markets.

The next few months can give you good opportunity to make your investments. Suggest you to invest lump sum amounts in few installments over the next say 2 to 3 months.

Read : Best MIP Funds.