Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

In order to reduce the cost of compliance and ease the compliance burden for both, the tax payer and the tax deductor, the Central Board of Direct Taxes (CBDT) has simplified the procedure for self declaration and introducing new Form 15G and new Form 15H in new format. The procedure for submission of the Forms by the deductor has also been simplified.

The revised procedure shall be effective from the 1st October, 2015.

What is Form no. 15G / Form no. 15H?

If your total income is below the taxable limit, you can submit Form 15G and Form 15H to the bank or any deductor requesting them not to deduct any TDS on your interest. Form 15H is for senior citizens who are 60 years or older and Form 15G is for everybody else.

Form 15G/H help customers to avail exemption from TDS on interest earned on investments like bank fixed deposits or EPF withdrawals in a financial year. A fresh form 15 G/H to be submitted in each new financial year by the start of every financial year.

The maximum interest income not charged to tax during the financial year where form 15 G/H is submitted at bank(s) is as below :

- Upto Rs 2,50,000/- for residents of India below the age of 60 years or a person( not being a company or firm ).

- Upto Rs 3,00,000 for senior citizen residents of India who are between the age of 60-79 years at any time during the FY.

- Upto Rs 5,00,000 for senior citizen residents of India who is 80 years or more at any time during the FY.

New Form 15G & Form 15H

- Under the simplified procedure, a payee / an individual can submit the self-declaration either in paper form or electronically.

- The deductor (Example – Bank) will not deduct tax and will allot a Unique Identification Number (UIN) to all self-declarations in accordance with a well laid down procedure.

- The particulars of self-declarations will have to be furnished by the deductor along with UIN in the quarterly TDS statements.

- The requirement of submitting physical copy of Form 15G and 15H by the deductor to the income-tax authorities has been dispensed with.

- The deductor will, however be required to retain Form No.15G and 15H for seven years.

- The revised procedure shall be effective from the 1st October, 2015.

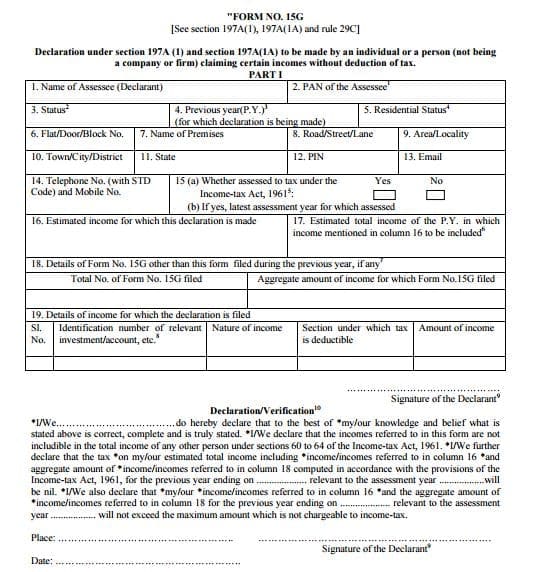

Click on the below image to ‘Download‘ new Form 15G and new Form 15H in PDF format. The attached file also has detailed instructions on how to fill new Form 15G & new Form 15H.

Continue reading :

- How to fill New Form 15G / Form 15H? – Step by step guide.

- Latest TDS rates chart for FY 2016-17 or AY 2017-18.

(References : PIB & incometaxindia.gov.in)

Join our channels

My mom’s annual family pension for 2017-2018 is 2,07,168/- while the interest an all her FDs is 1,01,513/-.

So total income coming around 3,08,681/-

Can she submit 15G form ? her age is less than 60 years.

Dear sadhli ..Is she going to claim any Tax deductions??

For Senior citizens the only condition is that their TAX LIABILITY Should Be Nil.

Even if the Interest Income (including submissions to all institutions) exceeds the maximum Limit ,they can submit the Form 15 H.The total income means not GROSS INCOME. IT IS GROSS INCOME MINUS ALL ALLOWABLE DEDUCTIONS.IT IS THE TAXABLE INCOME.Means the tax liability should be NIL.

Thanks for the input but she is 55 so it’d 15G form and not 15H for which I needed your help.

Regarding Tax Deduction, no she does not claim any tax deductions but she has one ELSS of 5000/-(tax benefit).

I am still not clear as to why her gross and taxable income would be different as she is not wrking and getting only family pension from my dad’s employer. Then is it necessary for her to have any allowable deductions ?

thanks in advance.

Dear Sadhli,

I mis-read it as 60 years..

Yes, Form 15G is applicable in her case.

Kindly note that Family pension income is taxable.

As, her total income is above basic exemption limit (Rs 2.5 Lakh), she cant submit Form 15g.

There has been a slight mistake in my mother’s Form 15G for the FY 2017-18. In column 15 of Part I by mistake YES has been checked instead of NO. My mother does not file her annual return so till date is not assessed to Income tax. The fault is on part of the bank authorities, but now they are refusing to accept their mistake.

Now, Sir, please guide me about the procedure to correct or rectify that error. and whether that error will ever cause any trouble or not ?

Dear ABHISEK,

I believe that should be ok. If possible, you may submit new Form 15G online..Check out if your bank provides online provision..

Would it cause any serious problem ?

Dear Sir,

I was working with an organization for a period of 2 years from 2009-2011. after quitting the job did my own practice, and have rejoined in another firm currently. Till date i have not withdrawn my epf of the period 2009-2011.

Currently i am drawing taxable salary, but will be withdrawing my epf . I have few queries for the same

1) do i need to submit form 15g

2) will my withdrawal be taxable and at what rate

3) in form 15 which AY should be written for previous years accumulated EPF withdrawn now.

Dear Neha,

Are you contributing to EPF scheme now in your current job? If yes, you have to transfer your old EPF monies to new account.

Suggested readings :

EPF withdrawal & new TDS rules

How to fill Form 15g?

Sir ,

Thanks for your previous reply..

Now my income figures are as below

Total annual Interest from F D :- Rs. 180000

pension amount for the whole year + post office pension scheme :- Rs. 50000

Now my question is that , Which figures shall put in the Form 15 H Column Number 15 , 16 and 17

I am going to fill form online in April 2017 then what will be P Y in column 4

Thanks a lot for your prompt reply

Dear Raman Ji,

Col 15 – Rs 1.8 Lakh

Col 16 : 1.8 Lakh + Rs 50k

Col 4 – FY 2017-18

Thanks Sir ,

Form 15 H , Column no.4

“Previous Year (PY) (for which declaration is made) ”

You have replied as

” FY 2017-18″..

Is it right Sir, Please, confirm it.

I am extremely sorry and excuse me Sir as I have doubted it.

Thanks a lot for your prompt help.

Dear Raman,

It is the year for which declaration is being made, so it is 17-18 only.

Dear Sir, Through your mail I came to know that 15G is valid for local residents only. I am settled in Gulf since 2007 & since then every year I am furnishing 15G to my bank. Now what is the solution?

with best regards

Pradipta Lahiri

Oman

Dear Pradipta,

Mis-use of Form 15G (may be due to ignorance) is not acceptable.

Suggest you to consult a CA and check about the corrective measures.

Dear Shrikanth. Sir,

My Fixed deposit has already matured on date 01/03/2017 and again automatically renewed for one more year in SBI. I am Senior Citizen. My question is shall I submit Form 15 H before 31 st March 2017 or in the month of April 2017 and up to what date?

If i dont submit Form 15 H before 31 st March 2017, will tax be deducted?

Note :-I have already submitted form 15 H in the month of November 2016.

Please advise me ,

thanks

Dear Raman,

As you have already submitted the Form 15H for FY 2016-17, you can submit the form again in April 2017 on the renewed FD.

Pls confirm 15G/15H is applicable for NRI or not. Some Banks accepts the 15 G/15H from NRI

Please note 197 A sub para 1(A) states the following:

(1A) Notwithstanding anything contained in section 193 or section 194A or section 194K, no deduction of tax shall be made under any of the said sections in the case of a person (not being a company or a firm),if such person furnishes to the person responsible for paying any income of the nature referred to in section 193 or section 194A or section 194K, as the case may be, a declaration in writing in duplicate in the prescribed form and verified in the prescribed manner to the effect that the tax on his estimated total income of the previous year in which such income is to be included in computing his total income will be nil. Thank you

Dear philpson,

Only a person who is resident in India can submit form No.15G / 15H. So an NRI cannot submit this form.

In the new 15H form, I can see ONLY ONE line to enter FD details;

does it mean that for every FD we have to fill up Separate form ?

I have two FD at same branch of sbbj bank the aggregate interest of which is more then 10000 so should I have to submit separate declaration in form 15G for both FD’s.

Dear Mohseen ..You can submit one Form 15G to the bank.

i am not able submit my pf forms

Hi,

I resigned during August 2015, currently unemployed( but earning scholarship for studies). I need to withdraw my EPF amount(12000). What is the Assessment year to be entered and PY?

Dear Priya,

If you are withdrawing now in this FY 16-17, then Assessment year (AY) is 2017-18.

Sir,

what to fill in the columns 16 & 17, if I am opting for pf withdrawal only at the same time I dont have any income other than the salary from my company and the interests being generated on that saving in bank????

Dear Vikash,

Col 16 – Your expected PF withdrawal amount

Col 17 – Expected salary + interest income.

Read : How to fill new Form 15G?

Hi Sreekanth, I have been working with Accenture for 4 years, and have quit last month to pursue my higher studies. I am withdrawing my PF, and in the Form 15G, Part 2 requires to be filled by the person responsible for paying me my income so far – which is my company. It even requires a signature. How do I get this filled? I have left the company.

Awaiting your response.

Thank you.

Remya

Dear Remya ..It is filled by the EPFO and not your employer.

Read: How to fill Form 15G?

SIR,WHETHER ON EVERY FD RENEWAL I NEED TO FILE FORM15G OR ONLY ONCE IN A YEAR

Dear Neha..Yes, it applies to Renewal of FD also, as the FD Certificate number of the new FD is different and 15G has to be submitted for each FD number.

Hi, while filling the Form 15G under 23 column(New Form 15G) i am confused to give the answer as i have no income from any other sources like Dividends, Fixed Deposit etc which are mentioned in the Column 22. I have given Nill in Column 23 to my Employer while opting for PF withdraw but they are repeatedly asking fill in the Column 23 and ship it once again. Can you please help me out. Appreciate your help in advance.

Dear Manohar,

I believe that above is the new format forms??

No Srikanth above shown are not the updated PF Forms for 15g

Dear Manohar ..Kindly share the new format ones (or links if any) if you have, will surely update the same.