The Ministry of Labour and Employment, Government of India, has recently made a few amendments in the Employees’ Provident Fund Scheme, 1952 (PF Scheme). These guidelines are mainly related to ‘early withdrawals‘ from Provident Fund & provisions related to PF withdrawals. These latest EPF withdrawal rules are effective from 10th February, 2016.

Amendments are related to;

- Full EPF balance cannot be withdrawn before attaining the Retirement Age.

- Continuity of EPF membership.

- Increase in Age limit to withdraw 90% of PF balance.

- Partial withdrawal of EPF amount on Resignation.

- Increase of retirement age.

Let’s discuss in detail about these new PF withdrawal rules.

Latest Update (20-Apr-2016) : “Govt rolls back new EPF withdrawal norms and old system will continue. The notification which was issued on 10th Feb, 2016 has been cancelled.” So, the existing rules will be continued..

Kindly click on the below image to download the latest notification.

Latest EPF Withdrawal Rules

- Full EPF balance cannot be withdrawn (limit on early PF withdrawals)

- Existing rule : The EPF members (employees) can withdraw the full EPF balance after 60 days of unemployment. (The EPF balance consists of employee’s contributions + employer’s contributions + interest amounts. Every month 12% of your “salary” is contributed towards EPF account.)

- New Rule : The EPF members cannot withdraw full PF amount before attaining the age of retirement. The maximum withdrawal on cessation of employment cannot exceed an amount aggregating employee’s own contribution and interest accrued thereon. You can withdraw your contributions + interest portion only. The employer’s portion can be withdrawn after attaining the retirement age (58 years).

- Existing rule : The EPF members (employees) can withdraw the full EPF balance after 60 days of unemployment. (The EPF balance consists of employee’s contributions + employer’s contributions + interest amounts. Every month 12% of your “salary” is contributed towards EPF account.)

- Continuity of your EPF membership

- Existing rule : If an employee withdraws full EPF amount after resigning from the job, his/her PF membership is deemed to be terminated. That means he/she is not a member of EPF scheme after the full withdrawal.

- New Rule : An employee can only withdraw his share on resigning from the job. You cannot withdraw full EPF amount before attaining the retirement age. So, you will still be the member of EPF even if you cease to be an employee of a EPF covered establishment. I believe that concept of ‘In-operative EPF a/c‘ may cease to exist.

- Retirement Age

- Existing rule : The retirement age is considered as 55 years.

- New Rule : The age of retirement has now been increased from 55 to 58 years.

- EPF Withdrawal provisions

- Existing rule : You (employee) can withdraw the full PF amount on retirement from service (55 years) or on cessation of employment and not being employed for at least 60 days.

- New rule : As discussed above, the retirement age has now been increased from 55 to 58 years and the option of full EPF withdrawal on resignation will not be allowed. You can withdraw your contributions + interest portion only.

- 90% of EPF balance

- Existing rule : You can withdraw up to 90% of your entire PF balance (employee share + employer share) on attaining 54 years of age or within one year before actual retirement, whichever is later.

- New rule : You would now be able to avail this option only on attaining the age of 57 years. The age has now been increased from the current 54 years to 57 years.

Budget 2016 & EPF Scheme New Rules

Budget 2016 is negative for the salaried class. As per the Budget 2016 proposal, at the time of retirement, 40% of the EPF lump sum withdrawal is tax-exempted, 60% of the corpus is subject to taxes as per the applicable Income Tax Slab. To avoid this, the EPF member has to invest this 60% balance in an Annuity life insurance product.

However, this 40:60 tax rule is applicable only on the corpus created out of contributions made after 1st April, 2016. also, the EPF member who is investing in Annuity dies and when the original Corpus goes in the hands of his heirs, then there will be no tax.

The Budget 2016-17 proposal of levying income tax on 60% of EPF balance has been withdrawn by the government. So, no tax will be levied on PF withdrawals at the time of retirement. The other Budget proposal to make 40 per cent of the total withdrawal from the National Pension Scheme (NPS) will however remain unchanged. (Latest news : 08-March-2016)

Your EPF contributions / savings are meant for your retirement. Dipping into the corpus before you retire prevents your money to gain from the power of compounding.

These new rules may FORCE you to accumulate a portion of your PF fund till you attain the retirement age. Besides above new rules, kindly note that the withdrawals from the EPF within five years of joining are taxable.

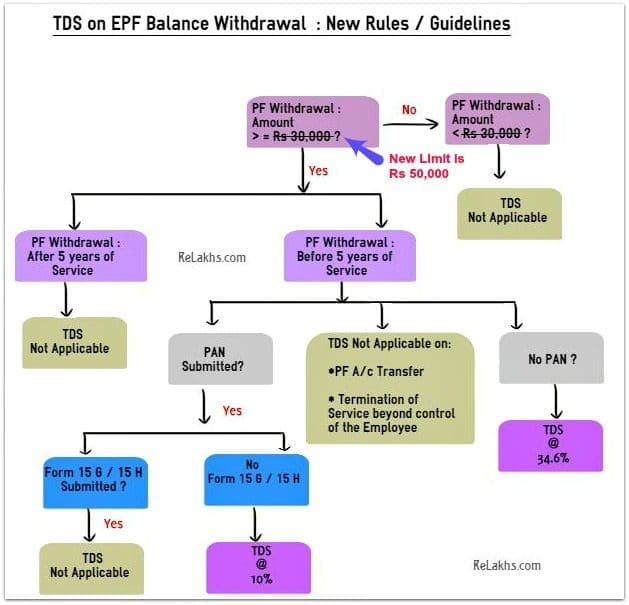

TDS has been made applicable if one withdraws PF within 5 years. (Budget 2016 update : In case of payment of accumulated balance due to an employee in EPF, the TDS limit is being raised from Rs 30,000 to Rs 50,000. So, TDS is not applicable if the PF withdrawal amount is less than Rs 50,000. This new amendment is applicable with effective from 1st June, 2016.)

If you would like to retire early or would like to start a business after being employed for few years, you may surely not like these new EPF withdrawal rules.

Proposed EPF Withdrawal Rules with effective from 1st August, 2016

- The proposed new withdrawal rules will be implemented from 1st Aug 2016.

- The amended rules do not allow an employee to withdraw the entire amount from his or her PF account till the subscriber attains the age of 58, the age of retirement.

- According to the new rules, he/she can only withdraw the contribution to the PF and interest accrued on it. The employer’s contribution and interest can only be withdrawn after attaining the age of retirement.

- Based on the public feedback/backlash, it has been decided that ‘Full PF accumulations (Employees + Employer’s share + interest) will be paid to the EPF member on fulfilling any of the following conditions;

- Housing purpose of a member.

- Medical treatment – Self / family member suffering from TB, Leprosy, Paralysis, cancer or Heart operation.

- Marriage of children.

- Professional education of children (like Medical/Engineering/Dental).

- If EPF member joins an establishment belonging to or under the control of the Central or State Government and becomes a member of Contributory PF or any old age Pension scheme. (I believe this rule may again lead to lot of confusion and we may witness backlash from PVT sector employees.)

Latest Update (30-March-2016) : The Employees Provident Fund Organization (EPFO) has decided to provide Interest on Inoperative Accounts from 1st April, 2016. This move will benefit over nine crore such account-holders having total deposits of over Rs 32,000 crore. Inoperative accounts are those wherein the PF contributions have not been received for 36 months. EPFO had stopped payment of interest to such accounts from April 1, 2011.

Latest Update (27-June-2018) : EPF Subscribers who resign from their service can now withdraw 75% of their total Provident Fund (PF) kitty after one month from the date of cessation of service. This will be considered as a Partial PF withdrawal (Advance).

You may like reading another interesting article : How is Interest calculated on my EPF A/c?

(Reference : Govt notification, Asan Ideas for wealth – Facebook Group & pwc.in)

Dear Sreekanth Reddy if I resign my Job after having 7 years of Service in IBM can I claim full PF amount after 60 days of exit with TDS or not if I am unemployed more than 3 months and if I get a Job after claiming full PF amount still I can be member for PF by contributing myPF amount along with Employers share Thanks

Dear ASHOK,

Yes, you can withdraw full PF balance after 60 days.

If you join a new company and start contributing to EPF again then your contribution years will be counted from one and not from 7.

Hello Mate,

I see a total amount of 50k in the previous employer’s PF account number (35k – Own contribution and 15k – Employer’s contribution) on EPFO website. I received employer’s contribution amount in my bank account and not my PF contribution after i submitted the PF withdrawing documents. May i know how can i transfer the remaining amount from the old PF account to an existing PF account?

Thank You

Sangeeth Reddy

Dear Sangeeth ..That’s probably your EPS (pension) balance. Generally EPS amount is not reflected in Passbook after the transfer. However note that your contribution years will be counted at the time of withdrawal of your EPS.

Dear Sir

I am working from last 7 year in different different organization now my sister marriage is fixed in 24th Nov, How much % of pf i can withdraw as i need money for supporting my family ..

Dear Amarendra ..Kindly read : EPF Partial withdrawals – rules & guidelines.

Hi, could you let me whether it’s 60 unemployment after last working day from previous company Or 60 days of unemployment after submitting the form

Dear kuldip ..Last day at company. Generally this (DOE- date of exit) is reported by the employer to the EPFO.

Dear sir ..i have worked in a Private company for the last Five and half months in CTC based, and now due to cost cutting i lost my job. in that company double PF amount deducted my salary. Is i withdrawal total PF amount?

(28000 is my total salary 3300 pf amount deducted my salary)

Dear Ravi ..If you are unemployed for 60 or more days then you can withdraw full PF balance (Subject to TDS).

Read: EPF withdrawals & new TDS rules.

I have 4.11 months of service at my current organisation,i would like with draw all my PF money.

If i join any new organisation before 60 days any constraint to withdraw.

Dear Bhanu ..Your withdrawal request can be rejected.

I am an employer and I have a doubt concerned for my employee. My employee has the basic salary of 15000 INR per month. He currently has 12% of EPF cut from his salary, and another 12% share is mine. Now we are increasing his basic pay to 16000 INR. But the employee wants his EPF cut of 12% from previous 15000 INR and wants this extra 1000 bucks in his pocket. Is this possible. Is it possible for him to have a cut of 12% from 15000 INR as had been done earlier and we still paying him extra 1000 bucks. Or is there provision of inclusion of some allowance by which he may be exempted from this extra EPF cut ? I hope the question is clear to you.

Dear Abhishek,

You may provide this extra pay in the form of some other allowance/perk (may be subject to taxes to the employee) instead of hiking the basic salary (as both of you are hesitant to include it in the basic salary).

Hi Sreekanth,

I was working in an MNC company for 10 years till feb 2015, after that i havent found a job. I had submitted for entire EPF withdrawal in Jan 2016 and this was credited to my account.

However i hadn’t withdrawn/transferred my previous PF amount to this one, so it was in unclaimed fund. The EPF folks from Delhi had followed up on this, and i was told you need guarantors for the unclaimed fund.

Wanted to know whether we would need 1 or 2 guarantors for this unclaimed amount, as usually the bank requires 2 guarantors.

Appreciate your response.

Dear Savita,

You can submit withdrawal form application, pan card copy, cancelled cheque leaf, Form 15(G) if required to EPFO directly.

You also have to enclose Self declaration (affidavit) stating that you are unemployed and would like to withdraw the PF balance.

Kindly get these documents attested with a gazetted officer (ex- Tahasildar, Bank manager where you have your savings account, MP, MLA etc.,)

Sir,

I have worked for 7 years in different MNC companies. I want to resign and get back my full PF amount . I do not want to transfer my full PF amount in new company. Plesae guide me what i have to do. They will deduct any Tax from my amount.

shekhar

Dear shekhar ..If you are employed and contributing to EPF scheme now, you have to TRANSFER your old EPF accounts monies to the new one.

Read:

How to consolidate old EPF a/cs?

EPF withdrawals & new TDS rules.

Sreekanth ji maine 2.5year job kiya hai MNC company me jan2016 me maine resigned diya or abhi private business kar raha hun kya mere pf ka fund mujhe pura mil payega maine form no.15C bhi submite kiya hai..pls Reply kare

Dear vibhash ..Yes you can get full PF balance.

Dear sir,

I would like to know about PF withdrawal after leaving the current job . and no further job in future . in that case if i want to start my own business,what i have to do. can i withdrawn full PF or partially ?

Dear Rahul ..You can withdraw full balance.

what is the time after my resigned for withdrawn my pf money

Dear sourav ..60 days minimum and one should be unemployed and should not be contributing to EPF scheme.

HI Srikanth,

One month back I left one organisation and next few days I joined another one and joined also EPF in the new organisation. Though new organisation so far did not provide any new PF account and due to some financial urgency for purchasing a house my question is :(I have 18 yrs work exp and pF member as well)

1) Can I withdraw partial amount of money from Old Pf account with the last previous organisation ?

2) If so can I apply for partial withdrawal to my nearest PF branch office and what are the documents required?

3) If not now then when I can withdraw partial amount from my PF account ? I have already one active UAN no that is linked to my previous organisations’ PF account.

Dear Tapas,

1 – Yes. You can submit new UAN based form 31 and there is no need to get your Employer’s attestation on it.

2 – Kindly read:

EPF partial withdrawal rules..

New EPF withdrawal forms..

3 – You can also withdraw after linking your new EPF a/c to the existing UAN number. But you have to transfer the old EPF monies to the new EPF account and then can submit partial withdrawal request.

1. my co. is channai based which i have left but my co. is not giving me my EPF Number. how i detect/find my EPF no.

and how i know that i had already registered by that co. or not ?

2. Is two epf no. exist at the same time?

3. when an employer start deduction epf after joining.

Dear kimti Lal.. An employee can not have two EPF a/cs at the same time.

Kindly read this article : Is your company deducting EPF from your salary?

Hi, i am working in a MNC company from jan’14, now i am going to get married in Nov’16, so how much amount can i withdrawn for my marriage, please suggest.

Dear Mohd Zain..Kindly go through this article : EPF partial withdrawals & rules.

I have worked for 4 organizations from Aug’2010 to Jun’2016 and transferred all previous organizations amount to my latest organization EPF account, which is maintained at Bangalore EPFO. I have linked my UAN and and Account and Adhaar got verified from my employer.

My Age: 35

My Residence: Hyderabad (My recent employment’s working location is also Hyderabad, though the EPF Account belongs to Bangalore location)

I have 2 months of service gap from my last employment.

Is it possible to withdraw 100% of my EPF amount?

Am I allowed to withdraw pension amount? if Yes, what is the procedure?

What is the withdrawing procedure (I can Form 11 in my UAN account)

Do I need to physically go and submit required documents to Bangalore office, or my place of residence?

Dear Rama Raju..Ideally EPFO would process your withdrawal request after 60 days from the date of your exit from the last company. In case if you join and start contributing to EPF scheme again then they may reject your application.

Yes, one can withdraw both PF & EPS amounts. Kindly read: New EPF withdrawal forms ..

Thank you Srikanth garu.. for your time and help

Hi my name is jeevith

I want withndraw my P F amount , but i dnt have my pan card amount is around 27000 kindly help me on this

drear sir,

I am working at multinational company from July 2014 to aug2016 and i am resign here so i want to withdraw whole pf amount of current company pf account. And i am join another organization in next month If i am provide only UAN No. to new organization so they create my new pf account with refrance of UAN no. so can i withdraw whole pf amount from current pf account.

1. My current company HR Manager says it is possible. Is this possible??????

2. witch form i want to fill up.

3. AADHAR card updation important.

Dear Hiren,

1 – No. You have to transfer old PF a/c monies to the new a.c.

But i dont want to transfer it.so what i do for withdrawl whole pf.

Dear sir,

My current comp. Hr manager says you have to fiill up form 10c & form 19 for pf withdrawl.

Dear Sir,

I am leaving my current job where my employer was deducting PF, however the new company where i will be joining dont have a PF system.

Can i withdraw my PF after 60days in such a case?

Pls advise

Yes dear Palanimurugan .

Hi Sreekanth,

I had resigned from my previous company on Jan 2016. I had worked for nearly 4 years and 11 months with my previous company. Now if I am withdrawing my PF, whether it will be subjected to IT? Do I need to provide Form 15 also with my other documents for the withdrawal?

Dear SANOJ..Yes, your PF withdrawal will be subject to taxes.

Read: EPF withdrawals & new tds rules.

An employee can join the EPF after the age of 58 years.

Dear Balamurugan..I am not sure about this.

Hi Sreekanth,

I was working with my previous 2 employer for more than 5 years and no withdrawn was done. So now when I moved to 3rd organization, I have few queries.

1) Can I withdraw my complete amount, although I don’t fulfill the rule of 60 days of unemployment.

2) If I don’t withdraw and go for the transfer of the complete amount to my current employer, then later on after 3 months, if I want to take a loan on behalf of my PF amount, how much I can take as a loan for purchasing a new flat?

3) Is there any interest I need to pay for the loan I take on my PF amount??

4) Do I need to repay the amount back to the govt, what I am taking as a loan?

5) How much time it takes to process for the loan?

Dear Rohit,

1 – No.

2 – Kindly read: Advances or partial PF withdrawals – rules & guidelines.

3 – No.

4 – If not utilized.

5 – May be around 30 days.

dear sir,

i want to withdraw my pf amount from my last organisation. i had served for 3 years in my last organisation and relived on jan 2016. after that i had joined the another organisation and serve only 3 months i.e july 2016. I want to withdraw my pf from last organisation. so kindly confirm me can i withdraw my full pf??

2- unemployment for two months is mandate in this case?

3-what proof has to be submitted for the unemployment??

Dear nancy,

If you remain unemployed for next 60days, you can withdraw full balance from both the EPF ac/s.

EPFO will come to know about the unemployment, if you stop contributing to EPF scheme.

HELLO SHREEKANTH SIR,

LOT OF THANKS FOR CREATING THIS WEBSITE AND HELPING PEOPLE

MY QUESTION IS

I HAVE BE WORKING FROM JAN 2010 – TILL DATE . I HAVE ALSO INVESTED IN VPF.

NOW I WANT TO BUY A HOME.

IS THERE ANY OPTION TO WITHDRAW ALL THIS AMOUNT WITHOUT RESIGNING THE JOB.

IF YES KINDLY TELL ME THE PROCEDURE.

Dear DAYANANDA,

Kindly read this article : EPF partial withdrawal rules & guidelines.

SIR,

I HAVE FILLED FORM AND GIVEN TO COMPANY FOR SEAL AND SIGNATURE.

WILL THE COMPANY SEND THIS DOCUMENT OR I SHOULD SEND.

CURRENTLY WORKING IN SURAT,GUJARAT BUT PF OFFICE IS IN THANE/MUMBAI.

Dear DAYANANDA..Your employer also can send the documents.

I resigned my job 24-jun-16,now I am unemployment. While withdrawal of if it’s applicable newrules or old one

Dear Arunajyotbi …These proposed new rules have been cancelled.

Hello srikanth sir ,

I have worked in an organization for 4 and half years and resigned on 29 th April.I am currently unemployed.I have submitted my pf withdrawal (form19,form 15g,h)on 12 july 2016 and got a message from EPFO that my claim is being processed on,27 July 2016..I have a doubt that will I get the whole amount or will these new rules will be applied for my claim request as well?,since I will get the amount after the deadline of 1 august 2016..pls help in this query..Thanks in advance..

Dear Sid ..These proposed new withdrawal rules have been scrapped. You will get the entire EPF balance.

Hi Sri sir,

Thanks a lot for the information.By the way you are doing an awesome work by envisioning us with the financial world.Thanks a ton for your help.

Regards,

Sid

I left my previous organization on July 22, 2016 where i was working for more than 5 years and joined another organization immediately on 25 July, 2016. I want to withdraw the Pf amount now. I have few questions here;

1) Can i withdraw complete amount now??

2) If i submit the withdrawal form now when approximately will i be getting the amount?

3) I read in few blogs that only after 2 month of unemployment i can submit the withdrawal form? Is it true?

4) In my case i resigned the old job and immediately joined with other company, so am i eligible to withdraw the PF amount now?

Please help.

Thanks,

Muthu.

Dear Muthukumar,

1 – If you are again contributing to EPF scheme in new org, you have to TRANSFER old EPF a/c monies to the new one.

3 – Yes.

4 – No.

I have worked in a private firm for 15 months and left the job in march 2016. In june 2016 I got job in Coal India Limited, as CIL has CMPF scheme, I no longer need an EPF account. Can I withdraw full amount (employee+employer+interest+pension share) from my epf account

Yes dear Sharad .

will form 19 and 10c enough or I need to fill any other form?

Dear Sharad ..Form 15G if required. Enclose pan card copy & cancelled cheque leaf.

Read:

EPF withdrawals & new TDS rules.

How to fill Form 15G.?

I hv applied for efp by required procedure on 12.08.2016, now my epf passbook has new entry on 19.08.2016 that ‘claim settled’. what does it mean?

Dear Sharad ..EPFO has processed your claim and paid the amount.

Hello Sir,

I am working with one organisation since last 6 years and planning to withdraw complete PF for housing purpose at my village. Is it possible withdraw this post 1st August 2016. If so do we have to provide any proof to government for this.

Hi Mr. Sreekanth, I was working in a private sector for two and half years, i left the job on 31st Dec 2012 (3 and half years ago). after tht i started continuing my studies (Ph.D) and Iam not planning for any job befor finishing my PhD. Now i wanted to withdraw that PF amount due to financial probs. is it possible to withdraw the complete amount.?

Dear sunil..Yes you can withdraw your PF amount in full.

Your EPF a/c would have become an INOPERATIVE one.

Kindly submit your withdrawal request through – INOPERATIVE EPF A/C HELP-DESK..

Dear Babasaheb ..Kindly note that the above proposed withdrawal rules have been scrapped.

Read: EPF partial withdrawal rules ..

Hi Sir,

I am currently working with a company and planning to leave in next month or so. i have the PF and VPF both getting detected from my salary. I will be starting my own business later on . is it possible to get the complete amount withdrawn from the PF and how can the VPF be withdrawn and when can i apply for the PF amount

Dear Ashish..Yes you can withdraw complete PF balance amount (subject to taxes, if any).

Read: EPF withdrawals & new TDS rules.

Sir,

My father had been working in a private company(salaried employee(tds under section 192)) for 45 months(3 3/4 years up till march 31,2015) and had to leave due to a combination of retirement policy (age 65) and retrenchment.He was unemployed for more than 60 days after which he took up a job as a consultant(tds under section 194J). The accumulated balance in his rpf account was transferred to his account in September 2015, is it taxable?

Dear Diya ..No it is not taxable.

Thanks for the prompt reply , can you please elaborate the reason as to why its not taxable.thanks.

Hi Srikanth

I am working in a private limited company for the past 12 years. I planned to construct a house in my plot. I wanted to apply for PF. As i understand from this article, i can withdraw the entire amount (Employee contribution + Employer contribution+Interest accumulated). Is it right or is there any change in the new rule ?

How long it will take to get the same credited in my account.

Dear Dinesh,

These proposed new rules have been scrapped.

Kindly read: EPF partial withdrawal rules & guidelines..

I’m going to apply for PF in the month of August 2016, is it possible to get the PF amount within a month

Dear Shakeel ..Mostly YES.

My date of birth is 30th September 1957, I am returning from the service 29th September. My continues service is 30 years. I wish to know when my company will fill up my total withdrawn form for PF

Dear Jitesh Ji,

As you have already crossed 55 years, you can withdraw your entire PF balance anytime now.

The retirement age is considered as 55 years.

I meen when my employer will fill up my form. Before 29th September Or after retirement

Dear Jitesh..What i meant was if you would like to withdraw PF, you can do it right now also.

Sir,

I wish to know that final withdraform (at the time of retirement ) to be filled up after one month. of retirement. Or when.

Dear Jitesh Ji..that, you may kindly check with your employer.

I am employeed in a private limited organisation since 12 years. I want to withdraw full amount of P.F. Towards my daughter’s marriage in first week of December. Can I get full amount accumulated? Will it be taxable ? When can I apply?

Dear Himanshu ..Kindly read: EPF partial withdrawal rules..

Dear Srikanth Reddy Sir

I am currently employed with a co for 13yrs 10 mths. I was previously employed for 4 yrs with another Co from where the PF was transferred.

I plan to quit the job this month and set up my own business. Can I get my entire PF contributions ( Employers and Employees) without any tax?

Dear Anirudh ..Yes you can get ..

Dear Shrikanth Sir,

I had worked with previous for 3.5 years and joined my present company within a month. Now I wish to withdraw my PF for some personal work. So is it possible for me to withdraw of PF????

No dear Raghav . You have to transfer the old EPF a/c money to your new EPF a/c.

Read: Partial EPF withdrawal rules.

Dear Sir

I have left the job in Dec 2015 as the co, in which I was working closed down his business and after having been served three years and three months.

Now i want to withdraw my PF Amount and my previous employer as heard not have contributed his share for the last two or three months.

please suggest how to withdraw the full amount.

Dear shekhar ..

If you are currently not employed, you can submit new Withdrawal forms and can get full PF balance.

Hi Sir, Thank you for your replies to all queries.

I am Venkat and I was working for 3.2 years with XYZ company and I resigned, in that company they were maintaining the EPF account with the name XYZ EPF trust which is located in Delhi.

Please advise can I send the PF withdrawal forms to the same branch in Delhi or also can I submit the withdraw forms at the nearest EPFO offices in HYD to withdraw the amount. Is there any separate rules/procedures for Trust accounts.

Please confirm.

Thank you in advance.!

Dear Venkat ..I believe that you have to send to the Regional office where you EPF a/c is being maintained, as the accounts are still administered in decentralized way. No separate rules as such.

Dear Srikanth,

I left job and joined new company now this month july 7th after 9 years 11 moths, now i want with draw with the reason to buy a flat. so can i withdraw full amount. also i have verified. i have given my uan number and PF number details here in new company.

i came to know if we purchase flat/plot we can withdraw . but KYC document should be registered . my bank account and PAN registered as KYC document but Aadhar not updated. so aadhar card also should be registered for PF withdrawal?

please let me know

Thanks in Advance

Thanks,

Sreeni

Dear sreeni,

Kindly read below articles;

Partial EPF withdrawal rules.

New EPF withdrawal forms.

Thank you Sreekanth

Hi Sreekanth,

My PF account is almost three years old and want to withdraw the amount. If you can clarify few queries please.

1. If the PF amount is less than 2.5L, should I declare only the PF amount or I should include the salary income for the current year in form 15G? Is it like, if I declare the total PF and salary income, then the tax will be applicable as per normal slab as per IT act. in next AY 2017-18?

2. Will the TDS 10% will be on total PF amount, if I don’t submit 15G with PAN card?

3. Is there any time limit set to withdraw the PF? Some say, the forms have to be submitted before 01/08/2016. Id there any such constraints?

Appreciate a quick response.

Regards

Partha Sarathi Samantaray

Dear Partha Sarathi,

1 – Are you currently employed and contributing to EPF scheme?

2 – Read: TDS on EPF withdrawals..

3 – Kindly note that new rules have been scrapped.

I have completed five years in foreign bank want to withdraw EPF for paying loan.

Dear Ritu ..Kindly read: EPF partial withdrawal rules..

Sir….I have completed my 5 yrs in co operative Bank. I have home loan of 20lakh now I want to repay it from my pf account is it possible? I heard pf amt can’t withdrawn before 7 yrs.

Dear Anil..Kindly read: EPF partial withdrawals rules & guidelines.

THANK U SIR

Hi Sreekanth,

I was working in a private company in banglore for 1 year & I have moved to Dubai.

Hence i heard some changes in PF terms & conditions which is changing everyday.

I am in a confusion whether I will get my PF, If I apply it or my PF amount will be credited only after my retirement age?

As of now I dont have any plans working in India.

Friend in India tell me I cant apply some rules have changed & I really dont understand what is the exact rule which is currently going on.

Sorry for bothering.

Dear Anumol,

The proposed new rules have been cancelled. You can withdraw full PF amount.

DEAR SIR,

LAST WEEK,I WAS TRYING FOR WITHDRAW ALL MY PF AMOUNT AND I GOT IF BUT I DID’NT UNDERSTAND ABOUT CALCULATION PROCESS.SUPPOSE IF MY CONTRIBUTION IN PF IS 18000 and company also add 18000 and then interest rate amount also add.but they sent me only 32000 as per our suppose figure.so plz telln me in detail how can i knmow about calculation.

with best regards,

kamalpreet singh

Dear Kamalpreet,

Employer’s contributions has both for EPF & EPS.

Read: EPF components & interest calculation procedure.

Hello Sir,

I have around 4 years of IT experience. I am resigning from my job as I am getting married and have to shift abroad with my husband.(As of now do not have next job)

Can I withdraw all my PF balance and if not then how much can I withdraw from my balance.

Thanks,

Shivi

Dear Shivi,

Yes, you can withdraw full PF balance.

Thanks for your reply Sir.

I would like to ask some more questions.

1.I would like to join next job whenever i get an opportunity(Not in India).Will this effect my PF withdrawal process?

2.How much % tax deduction would happen on PF balance?

Dear Shivi,

1- No.

2 – Read: EPF withdrawals & TDS rules.

I have been with my previous company for 1 year and joined in new company where i am not contributing any PF.

suggest me how to go ahead.

Dear srinivas ..

Read:

New EPF withdrawal forms..

EPF withdrawals & new TDS rules.

i was working for A company for 3 years n 7 months , & i join another company where i have open new salary account so i want to now that can i create a new pf account so that i can withdraw previous pf.

Can u please suggest i would be able to withdraw previous pf or not

Dear khushbu,

If you have joined new company, kindly transfer old EPF a/c money to the new EPF a/c.

Sir/Madam,

I am 53 years old working in autonomous body, where we follow the epf scheme

Sir, I have availed 90 per cent from my epf account for purchase of house. There is very little amount left in my epf account. I have requested the Accounts Section of my office to deduct 50 % of vpf other than 12%, but they have refused to do so and told me that there is rule that an individual is eligible to contribute only 35% of vpf not more than that. Only 7 years of my job is left and I want to contribute some good amount in my pf so that I can spend happy retirement life.

Please guide me whether I am eligible for more than 35% deduction in my epf account.

Thanking you,

Yours faithfully,

Rajesh Chatwal

Institute of Economic Growth

Dear Rajesh Ji,

I believe that there is no limit for VPF, employee can contribute 100% from BASIC and DA. You may request your employer to check with the EPFO.

Hi Srikanth Sir,

I was worked for one of the company called ” A “for 4 years then I left and joined in another company called “B”.

After joining in the “B” company, I have transferred my PF from company “A” to company ” B” and it got transferred successfully.

I was working for 2 years in the Company “B” and left the company 3 months back and now am not working anywhere.

Now am Planning to withdraw my PF , hence I have contacted my immediate ex -employer (Company “B”) , they are asking me to send the FORM-19 ,FORM-10C and Form-15 G.

Can you please advise me is FORM-15G is required for PF withdrawal?? if Yes , could you please explain me why it is required if possible.

FYI:

Working experience :

Company “A” — 4 years ( PF which was already transferred to Company “B” PF account)

Company ” B” — 2 years.

when I asked the same query to my prev employer , they are telling I need to fill the Form-15G , since I was worked only 2 years in that company ( Company ” B” ) , but I have 6 years continuous PF contribution i.e. 4 yrs from company “A” +2 years from company “B”)

Kindly advise me on this sir , as I am not getting proper information anywhere reg Form-15G .

Thanks,

Ravi.

Hi Sreekanth Sir,

Could you please suggest me on my quires .

Thank you sir.

Regards.

Dear Ravi,

I agree with your viewpoint. Your total contribution period is > 5 years.

I have been observing that employers/EPFO have been asking the employees to enclose Form-15G/H irrespective of whether it is required or not.So, suggest you to submit it.

Read:

EPF withdrawals & new TDS rules.

New EPF withdrawal forms.

How to fill Form 15g?

Srikant Reddy Sir

Please help me in this PF Transfer Claim matter.

I have done Online Transfer and my Form 13 has got “accepted” by both my 1st Employer and 2nd Employer. But the “Merger” of my PF Balances does not appear in my PF ONLINE PASS BOOK on Download….it is now more than a week…I wonder whether I can apply for PF Transfer Claim from my 3rd Employer? Will this “Merger of PF Accumulations” in cumulation actually take place ONLINE? How to get to know the Status? (Oh! The System Generated Status of Transfer Claim- is a dead waste!)

Dear shreekanth

I have Resigned from my service on 25/02/2016. I want to widral my pf from both side how it’s possible &if possible pls give me pf widral details.

Dear dipak,

If you are unemployed or not contributing to EPF now, you can withdraw full PF balance.

Read:

New EPF withdrawal forms.

EPF withdrawals & new TDS rules.

Sir

How mach time of withdraw?