EPF is a popular savings scheme that has been introduced by the EPFO under the supervision of the Government of India. All Organizations with 20 or more employees are required by law to register for the EPF scheme, while those with fewer than 20 employees can also register voluntarily.

The total assets under management by the EPFO are more than Rs 11 lakh crore (US$157.8 billion) as of 2018-19. The number of active PF members under Employees’ Provident Fund Organisation (EPFO) are around 4,50,60,972.

When an employee quits an Organization, he/she can Withdraw the accumulated EPF amount (or) Transfer the EPF a/c balance to the latest (new) EPF account.

But, an interesting fact is – “A sum of Rs 27,000 crore is lying as ‘unclaimed amount‘ in the EPF accounts”. That’s a huge amount!

The reasons for not claiming EPF Scheme benefits can be due to ignorance/ negligence on part of the EPF members, procedural delays by the EPFO or ‘no-claim’ made by the nominees/legal-heirs after the death of the subscribers.

In this article, let us understand – Why is it important to transfer or withdraw old EPF Account Balance? Whether interest is payable on your in-operative EPF account? How long can you hold your funds in EPF account without withdrawing them? What happens to your EPF amount if you do not claim it? Is it true that such unclaimed EPF monies get transferred to Senior Citizen Welfare Fund…?

Why should you Transfer or Withdraw Old EPF Account Balance?

If you have forgotten or ignored claiming your old EPF Account balance then its advisable to either get the funds from your dormant EPF account transferred to your latest EPF account (if currently employed and contributing to the EPF scheme) OR withdraw the accumulated PF balance.

Kindly note that failing to withdraw your EPF amount if you are no longer contributing to it can lead to serious consequences. Let’s understand..

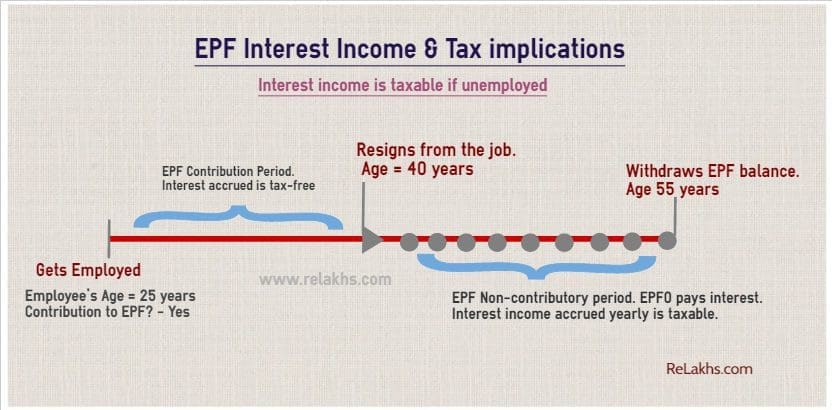

1 – Any interest income accrued on EPF post retirement / resignation is taxable in your hands.

- The ITAT (Income-Tax Appellate Tribunal) in one of its recent orders has clarified that the EPF interest income is taxable, if PF member is not employed. ‘Any interest income accrued on EPF post retirement / resignation is taxable in your hands.’

- If you resign / retire / get terminated from your job, but do not withdraw your EPF immediately then interest income earned on your EPF balance is taxable during this non-contributory period. The interest income earned during your employment remains tax-exempted though.

- For example : Let’s say you have joined a company and started contributing to EPF Scheme at the age of 25 years. After remaining employed till the age of 40 years, you decide to quit and start your own business venture. However, you decide not to withdraw your EPF immediately (as EPFO pays interest income even if one does not contribute to EPF). At the age of 55, you decide to withdraw EPF. In this scenario, what are the tax implications on the accumulated EPF interest income and withdrawal of PF balance?

- The interest income accumulated during your employment period (from 25 years of your age till 40 years) is tax-free income.

- Interest income earned during the non-contributory period (i.e., from 40 years till 55 years) is a taxable income (though your total service period is more than 5 years).

- The interest accrued in each financial year during the non-contributory period should be declared in your Income Tax Return under the head ‘income from other sources’ and taxes (if any) have to be paid. So, interest income is taxable in the year in which it is accrued (on yearly basis).

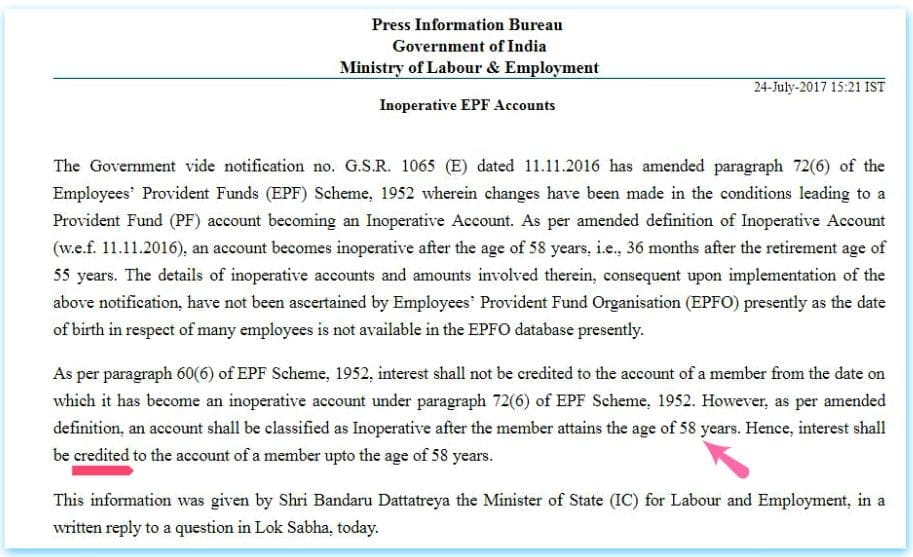

2 – Inoperative EPF Account does not earn Interest

- If an EPF member retires after 55 years of age, then post three years from the date of retirement (i.e., after 58 years), his/her EPF account is treated as “inoperative” and does not earn any interest.

- Kindly note that the EPFO pays interest income on all EPF accounts (active / inactive) till an EPF member attains the age of 58 years.

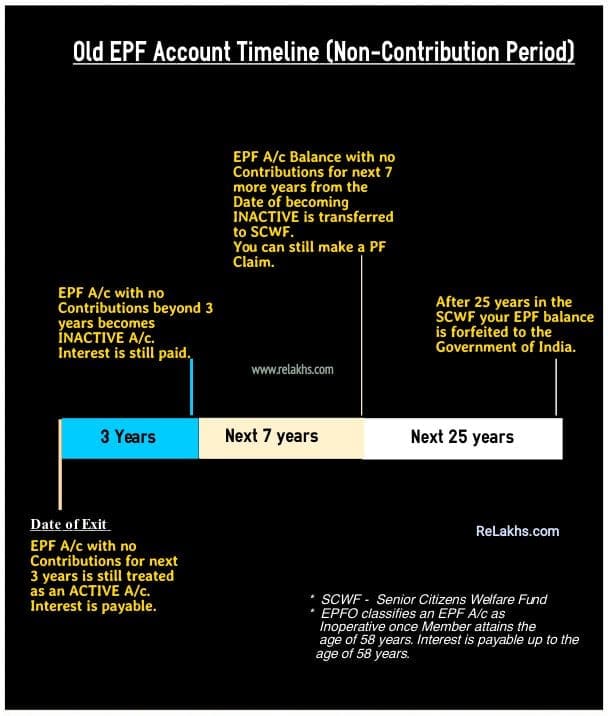

3 – After 7 years of no contributions, your EPF balance is transferred to the ‘Senior Citizens Welfare Fund’

- EPF A/c with no Contributions for 3 years (from your date of exit) is still treated as an ACTIVE A/c. Interest is payable such accounts.

- Accounts with no Contributions beyond 3 years becomes INACTIVE accounts. Interest is still payable.

- Generally, during this period you get email notices from your ex-employers (like Infosys, Accenture, TCS etc.,who have their own Private PF Trusts), advising you to submit PF withdrawal or Transfer claim.

- EPF A/c Balance with no contributions for next 7 more years from Date of becoming INACTIVE is transferred to SCWF (Senior Citizens Welfare Fund). Interest is payable but at a reduced rate. You can claim your PF balance easily, provided your ex-employer maintains all your records correctly and up-to-date. It can turn out to be a time-consuming process.

- What is SCWF? – A “Senior Citizens’ Welfare Fund (SCWF)” has been established under the Finance Act, 2015, to be utilized for such schemes for the promotion of the welfare of senior citizens.

- The unclaimed money lying under Small Savings Schemes, Employees Provident Fund, Public Provident Fund schemes, Life and non-life insurance schemes or polices maintained by insurance companies and accounts of Coal Mines Provident Fund is transferred into Senior Citizens’ Welfare Fund.

- After 25 years in the Senior Citizens Welfare Fund, your EPF balance then gets forfeited to the Government of India. This event is called ‘escheat’ in legal terminology.

Considering these factors, it may be best for you to transfer or withdraw your EPF balance soon after leaving your company. (You are entitled to withdraw your entire EPF balance after 2 months of unemployment / non-contribution.)

Continue reading :

- EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?

- EPF a/c interest calculation : Components & illustration (Employees’ Provident Fund)

- How to make EPF Death Claim by Nominee of a Subscriber? | EPF/EPS/EDLI Scheme Benefits

- How to check if my Employer is depositing EPF amount with EPFO / Trust?

(Post first published on : 07-January-2021)

Sir I left job 9 years back

i want to withdraw money from pf

help me

Pls.may old account number is Ishu sar 2008 to 2013

Pls.may old account number is Ishu sar.

Hi Sreekanth,

Again will there be any chance to contact you for a word.

Dear Lakshmi,

Plz note that I provide suggestions through my blog/forum only.

For a detailed discussion(s), you may reach me through Forum page..

Sir I want withdraw my pf from 3 different old pf account but I dont know process.

sir

I had worked in a school 2012 to 2014 while working time I didn’t get UAN number, member ID only I know,I lost my registered mobile number, now after my marriage I shifted to my husband’s native and I m working in another school hear I’m getting UAN number how I merge or claim old pf amount

Hello Srikanth,

My last job ended in 2017 after 22 years of continuous employment. After that I couldn’t get another job. I had not withdrawn my EPF balance then, thinking its safe to keep money with EPFO till I really need it. Since its more than 3 years since the last contribution, looks like my EPFO account has become ‘inoperative’ (not able to access it online like last year).

Now I am 51 years old, still looking possibilities of getting another job. My question is, will I still receive interest on accrued balance till age of 55 or its altogether stopped for being ‘Inoperative’ account? In that case should I withdraw entire corpus accumulated? or any another way I can keep the money EPFO returning me interest on accrued balance.

Appreciate your response. Thank You.

Hi Sreekanth,

Reposting as last submission was garbled.

Appreciate the very informative article.

My query is about tax on interest earned during non-contributory period.

I worked for 25 years.

My last job ended in 9 March 2020.

My last EPF contribution is credited in passbook on 1 April 2020.

I have not withdrawn.

1. Will interest for FY2019-20 , accrued till 31 March 2020 , but credited in Jan 2021 be taxable ?

2. Will entire interest accrued for FY2020-21 be taxable in AY2021-22? it is yet to be credited as it normally gets credited after Oct in next year.

3. Let us say I start job again in FY2021-22, on July 1, 2021, and my passbook shows contribution from Aug 1,2021.

Till what date should interest accrued be taxable in this year ?

Thanks.

Hi Sreekanth,

Appreciate the very informative article.

My query is about tax on interest earned during non-contributory period.

I worked for 25 years. My last job ended in 9 March 2020. My last EPF contribution shoill entire interest accrued for FY2020-21 , be taxable in AY2021-22? it is yet to be credited as it normally gets credited after Oct in next year.

3. Let wn in passbook on April 1, 2020. I have not withdrawn.

1. Will interest for FY2019-20 , accrued till 31 March 2020 , but credited in Jan 2021 be taxable ?

2. Wus say I start job again in FY2021-22 on July 1, 2021, and my passbook shows contribution from Aug 1,2021. Till what date should interest accrued be taxable in this year ?

Thanks.

It is garbled , please delete this, I will post again.

My father has his name wrong with old employer, ended it and the same wrong name name continued with new job also. now, when we changed name, it only changed in the new member id and not the old member id and so we can’t merge them. Please help!!

Another excellent article, thank you Sreekanth. Could you help advise on the below please?

I have not claimed my previous EPF for 10 years now. There was no UAN then and it was difficult to follow up my previous employer’s HR team. Now, is there a way I can make a claim for withdrawing this EPF amount OR get it transferred to my current employers UAN?

I did not find the link of inoperative epf account link the epfo site..can you pls help me

Dear SS,

Yes, they have removed the online provision..

You can submit a grievance request to the EPFO about your old EPF a/c withdrawal/claim, via this link..

Related article : EPF Whatsapp Helpline Number for Grievance Redressal | Whatsapp Contact numbers of EPFO Regional Offices

Hi Sreekanth,

This is excellent information. I have been so confused about inactive EPF accounts. This is really helpful. Thank you for sharing.

Dear Deepesh,

I am glad that you find this post useful and informative.

You may kindly share this post with your friends! Thank you!

Very informative and well compiled! If you are coming back to india in say 4-5 years it is better to keep money in EPF as interest rate is higher than PPF and FD?

Dear Mr Jain,

Kindly note that the Interest payment on PPF is non-taxable.

Interest accumulated on EPF during non-contribution phase is taxable.

Good info Srikanth

Thank you dear Sreeni!

Hi Sreekanth,

I have worked for 3.3 years for one organization and next 3 years 11 months with another one.So, reading through the articles here, I have understood that my accumulated service is more than 5 years. If am correct, will I be eligible to withdraw my total pf amount tax free, as I have not withdrawn it since Sep 2014 (my last working day and stopped working from then).

Another question is my PAN got my father’s name and on kyc also updated successfully.Where as my Aadhar has got my husband’s name and now on what basis would they consider the data while verifying the records with epfo at the time of with drawal, because relation ship is wrongly showing as husband agausnt my father’s name and no where my husband’s name and my marital status not updated by me because I have felt not to change again all the details of surname etc…Please suggest me if that relation ship field mismatch matters or only father’s name is sufficient and I don’t have cheque book and passbook is the one left.Can I claim now.

Dear Lakshmi,

May I know if you have got the PF funds transferred from old EPF a/c to the latest one (or) they are remaining the funds in respective accounts??

Ideally, your personal details should be same across PAN, Aadhaar and EPF UAN (name format, date of birth etc)

Hi Sreekanth,

Thanks for your reply and yes, oldpf account got transferred and consolidated amount is also shown in the passbook. I hope my question was not clear about the details as available on aadhar are my husband’s name and my PAN gt my father’s . Will that be an issue?

Dear Lakshmi,

I believe, this should not create any issue!

Thank you so much for responding!

One final question and for the last!

Am not sure based on what, how and who( may be my latest ex employer) had updated relationship status. On my UAN profile it is shown as ‘Husband’ and mentioning my father’s name. So, won’t there a chance of rejection due to mismatch of this, because Aadhar got my husband’s name.

It is something like this:

Name

XXXXXX LAKSHMI XXXXXX

Date Of Birth

XX/XX/1900

Gender

FEMALE

Father’s/ Husband’s Name

XXX XXXXXXX REDDY

Relation

HUSBAND

Is International Worker

NOT AVAILABLE

Qualification

NOT PROVIDED

Marital Status

NOT PROVIDED

Permanent Address

Not Available

Current Address

Not Available

Differently Abled

NO

So, with the above details I coildnot edit any of those except DOB/Name/Gender.

Now shall I get my father’s name changed on my PAN/replace Husband’sname with Father’s / on UAN should any details get updated and what is the process.

Sorry since there is no possibility of posting the screenshot here, though I have tried, such a lengthy message.

Dear Lakshmi,

You can get the personal details updated/changed in UAN profile by contacting your employer.