Two New Money Back policies (Table no 820 & Table no 821)were recently launched by LIC (Life Insurance Corporation of India). Let us understand how these plans work and how much returns can we expect from these kind of policies.

What are Money Back Policies?

The money-back policy from Life Insurance companies is a popular type of life insurance. It provides life coverage during the term of the policy and the maturity benefits are paid in installments by way of survival benefits in every 5 years.

LIC’s New Money Back Plans’ Features:

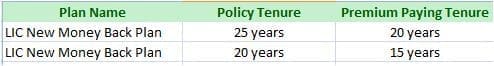

LIC is offering new money back policies in the form of two plans.

The main features of these plans are

- Death benefit: On death during the policy term (provided the policy is in full force), death benefit, defined as sum of “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional Bonus (FAB), if any, shall be payable. Where, “Sum Assured on Death” is defined as higher of 125% of the Basic Sum Assured (SA) or 10 times of annualized premium. This death benefit shall not be less than 105% of the total premiums paid as on date of death.

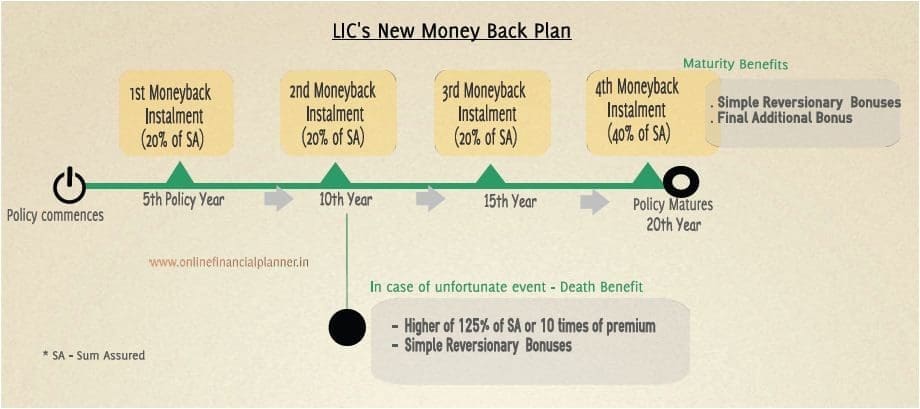

Death Benefit = Higher of 125% of SA or 10 times of premium) + Yearly Bonuses + FAB - Survival Benefits (SB): In case of Life Assured surviving till the end of the policy then 20% of the Basic Sum Assured is paid as survival benefit. This is paid at the end of each of 5th, 10th & 15th policy year for 20 year plan. ( For 25 years plan, SB is paid at the end of each of 5th, 10th, 15th & 20th policy year)

- Maturity Benefit: In case of Life Assured surviving the stipulated date of maturity, 40% of the Basic Sum Assured along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable.

Maturity Benefit = (40% of Sum Assured) + Yearly Accrued Bonuses + FAB

How does LIC’s New Money Back Plans work?

Let us understand how a 20 year LIC’s new money back policy work. (Both the plans are similar except for the tenure)

Money back Policies – Return Calculator :

Let us now calculate the returns of the 20 year LIC new money back plan. I have used IRR (Internal Rate of Return) function of MS Excel.

Life insurance premium quote – Money back Vs LIC’s Online Term Insurance :

In the above example, we have seen that the policy holder (30 years old) has to pay a premium of Rs 7,752 for a Sum Assured of Rs 1 Lakh. The expected return from this policy is around 5%. For a premium of Rs7,500 the policyholder can get Rs 75 Lakh coverage through LIC’s e-Term plan (online Term insurance plan).

Kindly note these important points:

- The average return on money back policies will be around 4% to 6%. You may find better investment avenues in the financial markets.

- LIC declares Simple Reversionary Bonuses every year. Generally the bonus will be at the rate of Rs 30 to Rs 40 per Rs 1000 Sum Assured. In the above calculation, I have assumed LIC may declare Rs 40 as bonus for the next 20 years. (FYI – LIC bonus rates)

- Remember the yearly bonuses are accrued but are not reinvested. So, the power of compounding is missed.

- LIC generally declares Final Additional Bonus if a policy term is more than 15 years. It may be around 5 to 7% of the sum assured (it may vary depending on the tenure, sum assured amount and plan).

- Few advisors/agents suggest the investors to use Survival Benefits (Money back installments) to reinvest in similar traditional policies. Please analyze your insurance requirements and then decide.

There is no good or bad financial product as such. You just need to find a suitable product as per your requirements. Before buying life insurance policy try to evaluate if the sum assured is sufficient to cover your life? Is the premium affordable? Can the family members lead the same standard of living in case of any unfortunate event?

“You don’t buy life insurance because you are going to die, but because those you love are going to live.” Life insurance is a must. Choose the right policy and cover.

( You may like visiting my posts on ” How to Get rid off bad insurance?”, & “Best online term insurance plans.”)

(Image courtesy of photostock / FreeDigitalPhotos.net)

Hi Sreekanth,

I have taken two policy in jan 2016 ( Money Back and Jeevan Anand)..Due to financial issues am not able to continue…Is that possibility to get my money back…I have paid almost 1 year( nearly 70 thousand)…please provide the solution.

Regards,

viji

Dear Viji,

New Jeevan Anand : can be surrendered after paying minimum three policy premiums only. The policy acquires 30% of total premiums paid as guarenteed surrender value after 3 years. If you discontinue now, nothing will be paid.

New Money Back policy : This policy can be surrendered only after it accrues cash value after payment of 3 years of premiums.

If you believe that these are wrong choices, suggest you to get them lapsed and accept the losses.

May I know the reason/objective for taking these policies?

Dear Sreekanth,

I get to know from my friend that at the time of claim these company creates problem. And in most of the cases at the time of maturity they don’t give you your maturity amount and indulge you in documentations and search all possibility to not to give you your claim or maturity amount.

I had paid my premium of one year but if this is the reality i will discontinue my policy. Please advise what is the reality their is no mean if i am investing my money in this kind of bull shit things.

Dear Deepak,

If you have given correct and complete information in insurance proposal form (application), they cant dishonor claim(s) (if any).

Have you taken this policy? May I know your requirements?

Mr.Srikanth,

My father was LIC officer and got retired in 1972. We were all small children and he died in 1984.

None of us thought about the money he had been paying. To get back what was paid, whom shall we approach? We are from south. Thank you

Dear Leema,

Do you have the policy numbers? Kindly contact the insurer(s) at the earliest with all the information that you have.

Read:

How to claim unclaimed money?

Mr Sreekanth,

As Lic Term Plan Premium is very high as compare to Private company. from where i should buy pvt company or lic. Lic is saying claim settlement ratio is highest as compare to others. if we buy from pvt company and nominee is not getting exact claim then what is the fun to buy term insurance from pvt company. pls Guide.

Dear sandeep ..Buy it from any company you are comfortable with.

Kindly note that ‘as per the recent amendment to Section 45 of the Insurance Act, If your policy is 3 yrs old, no matter what happens, the life insurance company will not be able to deny the claims. So, your life insurance company has only 3 years in hand to reject the policy based on any mis-representation or mis-statement. Once 3 policy years are completed then the life insurance company has to settle the claims and can not reject them.’

Read:

Best Term insurance plans.

IRDA Claim settlement ratio.

Hi Sreekanth,

One of my friend has taken LIC Money back policy for 25 years and paying premium around 150000 yearly.

He paid just one premium and thinking on whether to continue/lapse as the agent said the return would be huge.

And if we invest the amount in PPF , wouldn’t that be almost same as the maturity amount of LIC by considering SA+FAB+Rev Bonus

Pls advise on this and disadvantage of going with this

Thanks

Dear shakthi,

Kindly let me the purpose of buying the Money back policy? Is it for insurance cover or for maturity returns or both?

Meanwhile, suggest both of you to kindly read below articles:

Term insurance + PPF Vs Traditional life insurance plan

Traditional Life insurance plans – a terrible investment option.

Read all your posts…..very clear and precise.

I am 35 years and had taken 4 policies

@ Lic-Jeevan Ananad, SA-5Lacs

@ Lic-Money back 20 years -SA-5Lacs

@ Birla Sunlife money back -SA-5Lacs

@ Birla Sunlife jeevan Saral-SA-1.70 Lacs

But I would like to discontinue Jeevan Saral and planning to buy a term plan….. Kindly advise about above policies and good term plan

Dear Ashish,

Thank you for reading my blogs.

May I know the reason for discontinuing only Jeevan Saral and not other traditional plans?

Kindly read:

Traditional life insurance plan – a terrible investment option?

How to get rid off unwanted life insurance policy?

Best Term insurance plans.

IRDA’s claim settlement ratio latest data.

Hi Sreekanth,

In 28/07/2014 (@Age 26Years) i took a “new money back plan from LIC” for 25 years tenure with an sum assured of 10,00,000.

Can you explain me the what will be returns, interest, bonus, final addition bonus. is it a good decision to go ahead with this plan. If not what will be best way of investing (MF, Shares or any other).

kindly suggest me on this, i was bit confused.

Thank you in advance.

Dear RAJESH ..Do you have sufficient life insurance cover based on your income and/or financial obligations? Do you have term insurance cover?

If returns are your priority then you may discontinue this policy.

Read:

How to get rid off unwanted life insurance policies?

Best Term insurance plans.

Term insurance Vs traditional plans.

Hello Sreekanth ,

I have invested in 3 LIC Endowment Policy

1. Tenure 20 Years

Sum Insured – 100000

Payment Term – 20 Years

Premium Paid for 8 Years

Premium Per Year – 4908

2. Tenure 25 Years

Sum Insured – 1000000

Payment Term – 16 Years

Premium Paid for 5 Years

Premium Per Year – 51000

3. Tenure 25 Years

Sum Insured – 500000

Payment Term – 16 Years

Premium Paid for 5 Years

Premium Per Year – 25000

What should I do with these policies ? I think I won’t be getting huge return on these.

Dear Kapil,

Suggest you to buy a Term insurance plan with adequate life cover and then discontinue these policies.

Kindly read:

Best Term insurance plans.

How to get rid off unwanted life insurance policies.

If life is unpredictable, insurance can’t be optional.

Good day Mr Reddy,

I have been following your site for a while now and find you advice to the point and relevant.

A year back I bought a LIC Money back policy 820 for a period of 20 yrs with premium payable for 15 yrs. I am 29 yrs old and have made 2 yearly premiums till now. Now I think that I have made a wrong financial decision. The sum assured is 5100000 and the yearly premium is around 4lc. I think I am investing at the wrong place.

Your advice will be very helpful. Is it a right investment and what should be my call?

Abhishek

Dear Abhishek,

Oh my god, Rs 51Lakh in Money back policy? I am sure your agent is the happiest man in this world till you discontinue the policy.

As of now you only have the option to let the policy lapse.

One needs to pay minimum three policy premiums to surrender the policy. As the amount is huge, you may surrender the policy after paying the third premium (or) make the policy paid up. Suggest you to buy a Term insurance plan before discontinuing this policy.

Read:

How to get rid off unwanted life insurance policy?

8 ways you could lose income tax benefits.

If life is unpredictable, insurance can’t be optional.

Best Term insurance plans.

Blocks of Financial Planning pyramid.

Term insurance Vs Traditional life insurance plans.

This guy Shreekanth is suggesting everyone to surrender their LIC policies without even considering how much loss the person would be incurring by doing so..It seems like this guy is an agent for private players in the financial sector and has started this blog with the mere intention of rejecting LIC products baselessly and illogically. If he thinks that LIC is befooling people then he should rather file a PIL against the corporation. LIC has benefited so many families over the past so many years, and rejecting all the endowment plans of LIC without any proper reasoning is unfair and biased… LIC is the best when it comes to ease of claim settlement with an added advantage of safe investmentand has been giving good returns in the long term with extended insurance cover to the general public.. .. People have seen enough of Mutual funds and Share market which has been the most volatile and highly risky mode of investment with zero insurance. I would request Mr. SREEKANTH to kindly stop showing off his little and biased knowledge and stop this ‘Hate LIC’ campaign that he has been running from quite some time now.

Dear Mamta,

Thank you for sharing your views.

1 – Kindly let me know if you have done analysis regarding the losses incurred by surrendering Vs extent of wealth erosion that takes place due to low Real rate of return on Traditional plans like these?

2 – You have an allegation that I / ReLakhs may be associated with Pvt insurers, if you can prove this, will stop writing articles the next second 🙂

3 – I am not sure if you have gone through my other blog posts on life insurance, I have always suggested to ignore the traditional life insurance plans like money-back or endowment, be it LIC or XYZ companies. Suggest you to go through my other blog posts and following comments.

4 – Kindly let me know what is biased in this article?

5 – LIC along with some other top insurers do have good claim settlement ratio, but do you believe that average insurance cover held by a common man is enough in case any unfortunate event happens? Can his/her family continue with the same standard of living?

6 – May I know what is meant by insurance? Is life cover or returns, which should be given primary importance when buying a life cover? (assuming low penetration/low avg insurance cover per person in India)?

Kindly provide your views on the above.

hi sreekanth,

paid LIC of 1term(15000), now could not pay remaining terms.

Any way to get back the paid amount??

Dear srikanth..May I know the Plan name, commencement date & tenure.

HI Sreekanth,

Thank for this wonderful post!

I already had new money back policy(25yrs) starts from 10/1/2012 and now my age is 34 and now i am thinking that i have taken the wrong decision for this lic policy because it doesn’t offer the even reasonable ROI. Could you please suggest me what i need to do like surrender the policy or continue with that. And if i am continue with this policy what return should i expect at the end consider the fact that i am going to reinvest the 15%survival benefit.

dear srikanth sir,

now my dad is 56yrs old , which life insurance policy is suitable can u suggest.

Dear waseem..Is he an earning member of your family? Whether he has any financial liabilities or obligations?

Is he covered with health insurance plan?

Thank you very much.

I have a stupid doubt. Whether LIC is the only Policy which has guaranteed money return by Govt of India and others (23 firms) do not have such one. And why all the firms are giving different returns and confusing the people through different tables???? Suppose if I want to get retirement benefit which policy shall I take?? My dob is 18.04.1076 and I can invest upto 5 k per month. Kindly suggest me the good returns after 15 years duration…..

Dear Sivaram,

Are you talking about guaranteed returns plans?

It is better to design our own portfolio based on the time-frame & resources to accumulate retirement corpus. For protection purpose, just take term plan and invest as much as possible & as frequently as possible in other fin products which can beat inflation and are tax-efficient.

Kindly read:

Best Equity funds.Best Balanced funds.Why insurance is important?

Hi ,

I want to buy money back policy for 20 yrs , for 5 lakhs . How much return i will get after 5 yrs and after 10 years ? ?

is it good to buy moneyback or jivan anand ?

Dear Shivam,

I believe that you have not read/understood the above article. Suggest you to go through it again.

Also go through below articles and revert to me;

Term insurance Vs Traditional life insurance plans

Best online term insurance plans.

Dear Sreekanth,

I wanted to invest in LIC’s money back plan policy of 20 years,wherein I have to pay a premium of 79000 annualy for 15 years only rest 5 years LIC will pay on behalf of me.Money back after 20 years alongwith Bonus will be around 18 lakhs.Is this a good policy…

Dear raviraj,

Kindly read the article once again. Suggest you not to invest in these kind of plans.

Also go through below articles;

Term insurance Vs traditional life insurance plans

Top online term insurance plans.

wanted to invest 50,000/ for 5 years which is the best policy

Dear Ranjith,

Kindly do not mix insurance with investment.

For a 5 year time-horizon, consider investing in a Balanced mutual fund..

If life insurance is your requirement, consider buying a Term plan.

table no. 75

SA 51000

prem. 1805

T-T-pt 75-20-20

DOC 2004

Recived = 10000+10000

Death August 2015

nominee ko ab kitna rs. milga.

Thank you for writing so good articles. And even more tons of thank you for taking out time to answer every silly question people ask you. Best Wishes.

I too had a question. One of sister who is a newly joined LIC agent wants me buy a LIC policy from her. She is a widow and I want to help her by buying a policy. I don’t like these LIC policies but I have to buy in this case. I already have a term policy. I am 33 age, one small kid 1 yrs. Can you please suggest any good LIC policy that I should buy? I have sufficient cash flow at the moment. Thanks again.

Dear Ganesh,

Based on your income + Liabilities (if any) + Financial commitments (goals), reassess your life insurance cover requirement. In case if you are

under-insured, you can buy LIC Term insurance from her.

Do not buy a traditional policy.

Thank you for your appreciation 🙂

Thank You Sree.

Can we take benefit of two or more policies on maturity like if have a Pradhan Mantri Jeevan Jyoti Bima Yojana and LIC Money back plan then on maturity can i claim both the policies ?

Dear Sandeep..Yes, you or your nominee can receive the insurance benefits.

Sreekanth, is it better to take term insurance policy through online or offline mode?

Sudarshan – Good to know that you are planning to buy a term insurance plan. Online term plans are bit cheaper compared to offline plans. If you want a comprehensive coverage with Accident Death Benefit/Total Permanent Disability/Critical Illness riders then go for offline plans.

Sreekanth , its a coincidence. Was searching for review on moneyback policies on net. Here you go…thanks mate for writing an informative post. Keep doing good work.

Thank you Madhu. Kindly share the post with your friends too.