A few days ago, I had published an article on new Kisan Vikas Patra. I had received requests from many investors, Friends’ parents and blog visitors to compare the features of Kisan Vikas Patra (2014) with that of Varishtha Pension Bima Yojana (2014) scheme. KVP is a small savings scheme and VPBY is a pension plan. So, it may not be prudent enough to compare both the schemes.

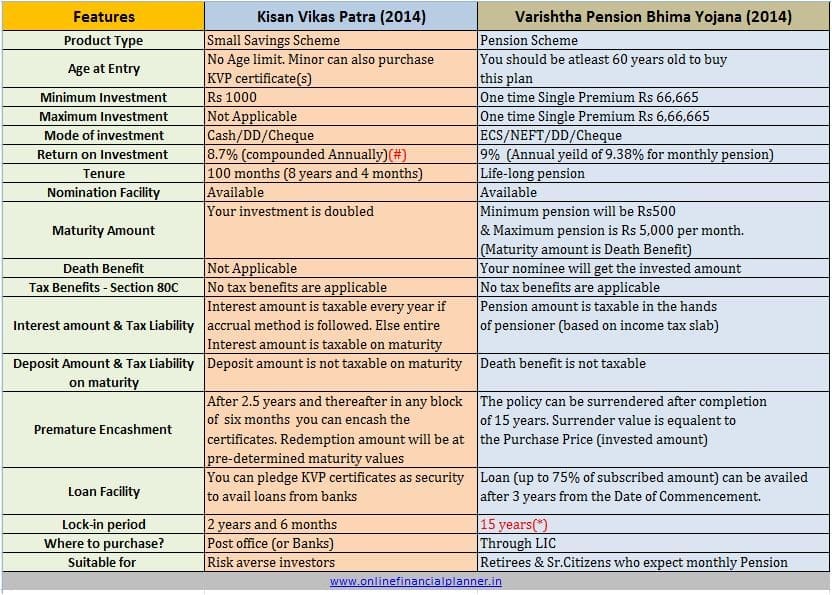

However, I have tried to list some of the important features of both the schemes as below. Kindly go through them before before buying any of these schemes. If you need more information or details on KVP / Varishtha Pension Plan then kindly leave your query in Comments section.

(You may visit my posts on ” New Kisan Vikas Patra ” and ” Varishtha Pension Bima Yojana ” for more details).

Features of New Kisan Vikas Patra & VPBY :

(Click on the image to open it in new browser window)

# Return on KVP Investment is 8.7% if your taxable income is nil. For 10%, 20% and 30% tax brackets, the returns are 7.8%, 6.91% and 6.01% respectively.

* The VPBY policy can be surrendered after completion of 15 years. The Surrender Value payable will be the refund of Purchase Price. Under exceptional circumstances, if the pensioner requires money for the treatment of any critical/terminal illness of self or spouse then the policy can be surrendered before the completion of 15 years.The Surrender Value payable shall be 98% of Purchase Price.

Hello sir

Can u tell me abt vpby actually I’m confused

Hw to apply nd Whts d processor …

Dear Swati..i am not very sure if this scheme is still open for subscription. I believe that the end date is 15-Aug-2015.

VPBY is an absolute NO.

You can earn way more by investing the amount in an FD.

All Pension Schemes including Govt. ones are a trap to soak your hard earned money & pay you a fraction of the actuall interest on the name of pension.

Dear Trishito,

I prefer to build my own portfolio with investments across various Asset categories for my Retirement Goal.

For long-term goals, it is advisable to invest in risk-oriented financial products to achieve positive inflation-adjusted/tax-adjusted returns.

sir,

what are the current interest rate on KVP & VPBY .

Is VPBY another name of senior citizen saving scheme.?

Dear Vijay,

Your investment in KVP doubles in 8 years 4 months (Returns of around 8.67%). VPBY interest rate is 9%.

nice comparison…….

Thank you Siddhartha. Do share the article with your friends too!

excellent

Thank you!