For the last few months, state-run companies like IREDA (Indian Renewable Energy Development Agency), NHAI (National Highways Authority of India), NTPC (National Thermal Power Corp), PFC (Power Finance Corporation), HUDCO, REC (Rural Electrification Corp) and IRFC (Indian Railways Finance Corp) have come up with Tax Free Bond issues. All these issues have been oversubscribed. NABARD Tax Free Bonds is the latest issue which is going to be open for subscription from 9th March, 2016 to 14th March 2016.

Several state-run companies raised Rs 30,000 crore through tax-free bonds in FY12, Rs 25,000 crore in FY13 and Rs 50,000 crore in FY14. These funds are utilized to fund infrastructure projects.

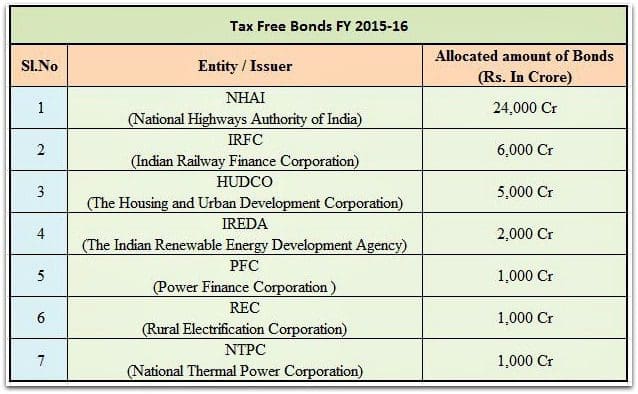

Below are the details of the firms and the maximum allocated amount of funds they can raise by offering new Tax Free Bonds in the current Financial Year (2016).

NABARD Company Profile

- National Bank for Agriculture and Rural Development (NABARD) is an apex development institution in India, having its headquarters in Mumbai (Maharashtra). It was established on July 12, 1982 by a special Act of Parliament and its main focus has since been the upliftment and development of rural India by increasing the credit flow for elevation of agriculture and rural non-farm sector.

- NABARD has a mandate under the NABARD Act to facilitate credit and other facilities for the promotion and development of agriculture, small scale industries, cottage and village industries, handicrafts and other rural crafts and other allied economic activities in rural areas in India with a view to promoting integrated rural development.

- The share capital of NABARD as on March 31, 2015, stood at Rs.5,000 crores with GoI holding Rs.4,980 crores (99.60%) and RBI Rs.20.00 crores (0.40%).

NABARD Tax Free Bonds – March 2016 Public Issue Details

Below are the features and key highlights of NABARD’s Tax Free Bonds public issue;

- Bonds Issue opens on : 9th March, 2016.

- Issue closes on : 14th March, 2016.

- Issue size including over-subscription: Rs 3,500 crore (max).

- Basis of Allotment : For Retail Individual Investor – 60% of the Issue Size.

- Face Value : Rs 1,000 per bond.

- What is the minimum application size? : 5 bonds (Rs 5,000) per individual and in the multiple of 1 bond (Rs 1,000) thereafter.

- What is the maximum application size? : The maximum amount that an individual can apply is Rs 10 Lakh (Retail Category).

- NABARD Tax free bonds are proposed to be listed on BSE (Bombay Stock Exchange)

- Credit Rating of NABARD Bonds : “CRISIL AAA / Stable” by CRISIL and “IND ‘AAA’ / Stable” by India Ratings. (The bonds with such ratings are considered to have high degree of safety regarding timely servicing of financial obligations and carry very low credit risk.)

- Allotment is done based on ‘first come first serve’ basis.

- Can NRIs apply for NABARD Tax free bonds? – Persons Resident Outside India, Foreign nationals (including Non-resident Indians, Foreign Institutional Investors and Qualified Foreign Investors) and other foreign entities are not eligible to invest in this issue. (NRIs were allowed to invest in PFC, REC & IRFC issues)

- These instruments are classified as Tax free, secured, redeemable and non-convertible bonds in the nature of debentures.

- NABARD Tax-Free Bonds will be issued either in Physical or Demat mode.

- Bonds can be held in physical or in dematerialized form, at the option of bondholders but the trading of the Bonds shall be in dematerialized form only.

Interest Rates offered on NABARD Tax Free Bonds 2016

Below are the interest (coupon) rates that are offered for retail investors. Retail Option is for individuals whose application is for Rs 10 lakh or less ; (20 year bonds are not being offered)

- On 10 year duration bonds the Coupon rate is 7.29%.

- On 15 year duration bonds the Coupon rate offered is 7.64%.

- 20 year duration bonds are not being offered in this issue.

(Investors who apply for bonds worth above Rs 10 Lakh & would get 7.04% on 10 year bond & 7.35% on 15 year bonds.)

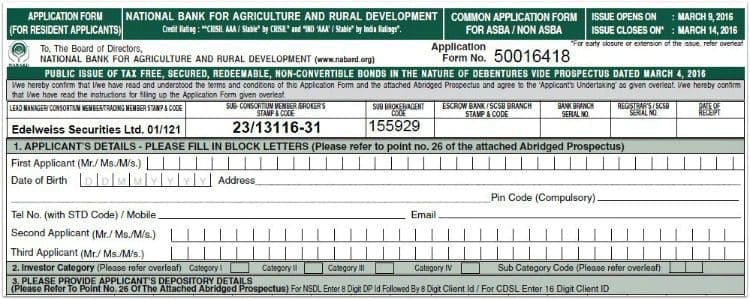

NABARD Tax Free Bonds & Application Form

Click on the image to download the application form.

Should you subscribe to NABARD Tax Free Bonds 2016 Public Issue?

- It is advisable to follow the principle –Think beyond taxes when investing. Do not invest in Tax-Free bonds just because the interest income is tax free. Your investment should match your financial goals requirements.

- If you have time on your side (young or have long-term goals), equity oriented investment avenues (shares, mutual funds etc.,) are the best bets to realize your financial goals.

- If you are in 10% or 20% income slab rate, it may be prudent to ignore TFBs. The interest earned on bank FDs and other types of bonds are not exempted from income tax. It is added to your income and is taxed as per the income-tax slabs. As interest earned from tax-free bonds is not taxed, investors in higher tax brackets mostly earn a better post-tax return than from FDs. But remember, the bank FDs score over tax-free bonds in terms of liquidity as these bonds have longer maturity tenure.

- I believe that ‘lack of liquidity’ is the biggest disadvantage of Tax-Free Bonds. The debt mutual funds can generate higher returns when compared to Tax free bonds and you may redeem them anytime. So, the trade off is between higher returns by MFs and the post-tax benefits of tax-free bonds. (You may like reading – ‘Best Debt Funds to invest in India for 2016‘)

- Budget 2016-17 has proposed to not to issue Tax Free Bonds in the upcoming Financial Year 2016-17. That makes this issue and the IRFC March 2016 issue to be the last two opportunities for the investors in the higher tax brackets to make their investments

- Invest in this issue only if your income tax slab rate is at 30% and you want a steady source of income periodically over a long-term. Also, consider investing only a small portion of your savings towards these bonds..

Do you think one should invest in Tax free bonds? Have you invested in any of the TFB 2015-16 Public Issues?

Kindly share your views and comments on NABARD Tax Free Bonds March 2016 issue.

I would like to know what would be a better investment opportunity (tax benefits inclusive) for me since I fall in 20% bracket other than 5 year FD, PPF, VPF. My first priority is safe investment with decent returns+tax benefits. If I have surplus cash what are the other options. I would prefer more debt and less equity exposure.

Dear Ashish ..Kindly read : List of best investment options!

Dear Sreekanth,

Good evening.

1) If one applies for Rs. 10 lakh in Tax free bond on Initial Public offer, is it possible to get allotted the entire sum.

2) Which is the right tax free bond to purchase now in market? When is it maturing

3) Is there any Tax free bond expected in 2016-17 for investment

Dear Sumathi,

1 – Yes.

2 – Kindly check out this link, click here..

3 – As of now, NO.

when will the tax free bonds for Nabard and IRFC 2016 be alotted

Dear Uday,

The companies may allot the bonds and get them listed within 2 weeks.

Hi Sreekanth,

A question on Category IV retail investor – investors applying for an amount aggregating up to and including 10 lakhs across all series of bonds in tranche I issue. Does this mean you can invest up to 10 lakhs across NHAI, Hudco, Nabard, IRFC etc. Or 10 lakhs in each of these issues from respective companies? If you’re total investment in tax free bonds crosses 10 lakhs and then you would become Category III investor?

Dear RB..Rs 10 Lakh in each of the issue, then this investor falls under ‘retail category’, its per issue criteria.

(Retail investors can invest up to Rs 10 lacs in each issue. If you invest more than Rs 10 lacs in a particular issue, you will be classified as a High Net worth Individual (HNI). HNIs will be offered a lower interest rate/coupon than regular retail investors. )

Hi Sreekanth,

Interest component is yearly compounded or its simple interest in case of these bonds?

Dear Mangesh..Interest is paid periodically and it is simple rate of interest.

I have mentioned it time and again that you are articles are really nice

For this year….now only NABARD and IRFC is pending as far as TAX FREE bonds are concern.

I wanted to know have the govt sanctioned any for year 2016-2017 starting April…..As far as I was following the budget the govt has sanction amount of 31300 CR but that are NOT tax free bonds.

Can you tell me has govt sanctioned any TAX FREE bonds for next year???

Dear Hoshang,

Yes, Rs 31,300 cr has been allocated for issuing bonds in FY 2016-17, but looks like that these are not Tax-free bonds and may be only Infrastructure bonds.