Health Insurance or Mediclaim insurance is a must-have for all. Considering the rate at which medical costs are rising, it is very important to have sufficient medical insurance coverage. Absence of health insurance may wipe out your savings. Having sufficient coverage will safeguard you and your dependents from getting into financial crisis during hospitalization or critical illnesses’ treatments or accidents.

Besides medical coverage, health insurance plans can provide Tax benefits to you. In this post, let us understand the Tax deduction benefits that are available for Health Insurance (or) Mediclaim plans.

The premium paid towards medical insurance is tax deductible under section 80D (u/s 80D) of the Income Tax Act, 1961.

You can claim tax deductions, provided you are paying the premium on a mediclaim policy which is in the name of

- Yourself (and / or)

- Your Spouse (and / or)

- Your Parents ( Parents need not be dependent on you) (and / or)

- Dependent Children

Tax deduction of Health Insurance Premium (Section 80d)

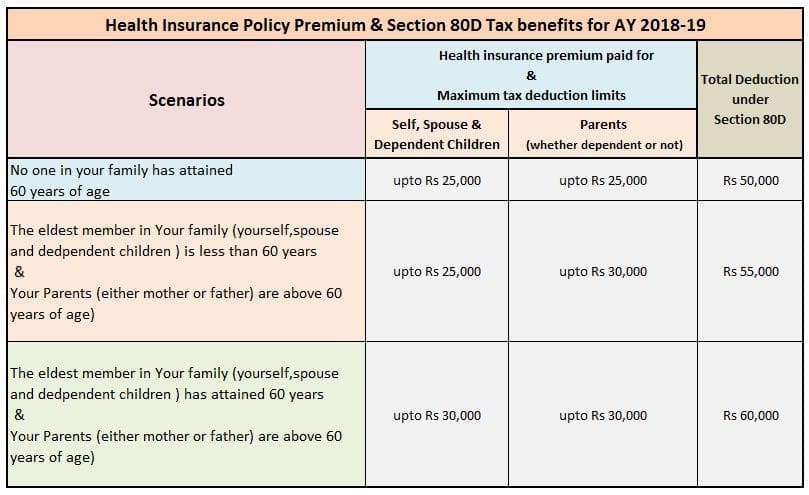

Health insurance premium paid for Self, Spouse or dependent children is tax deductible upto Rs 25,000. Earlier the limit was Rs 15,000 and this limit has been increased to Rs 25,000 in Budget 2015-2016. If any one of the persons specified is a senior citizen and Mediclaim Insurance premium is paid for such senior citizen then the deduction amount now is Rs. 30,000. From Financial Year 2015-2016, this limit is increased to Rs 30,000 from Rs 20,000 (applicable in FY 2014-2015).

Below table shows you the quantum of tax deductions applicable on health insurance premiums. The below limits are applicable for Financial Year 2017-2018 (or) Assessment Year (2018-2019).

Let us understand the above scenarios with couple of examples..

Example 1 : Mr Reddy (30 years) has employer’s mediclaim coverage. He pays Rs 8,000 as premium. The coverage is applicable for Mr & Mrs Reddy and their son. He has also included his parents (father 55 years & mother 52 years) under his employer’s medical insurance scheme. For parents coverage he pays Rs 16,000. He wants to know how much he can claim as total tax deduction under Section 80d?

Since no one in the family has attained 60 years of age, Mr Reddy can claim a tax deduction of Rs 24,000 (Rs 8000 + Rs 16,000).

Example 2 : Mr Gupta (45 years) is a self-employed person. He has taken Health insurance plan and pays a premium of Rs 26,000. He also pays Rs 31,000 towards his parents’ coverage ( his Father’s age is 62 years & mother’s age is 58 years). What is the total tax deduction application in his case?

Mr Gupta can claim a total tax deduction of Rs 55,000 only (Rs 25,000 + Rs 30,000)

Important points on Medical insurance policies & Tax benefits

- You can claim tax deductions on mediclaim plans provided by your employer or on policies taken by you (independent of your employment). The tax deduction is applicable on both health insurance and mediclaim policies.

- Premium amount can not paid in cash. Mode of payment can be anything (through credit card, net banking etc.,) except cash payment.

- You can take medical insurance policy on your dependent children and claim tax deductions too. If they are aged above 18 years and employed then they can not be covered. Male children if not employed then they can be covered upto 25 years. Whereas, female children can be covered until she gets married (only if she is unemployed).

- If you are paying health insurance premiums of your in-laws then you can not claim tax deductions. However your spouse can pay the premiums from her taxable income and get the tax benefits.

- If you are paying medical insurance premiums on behalf of your sister or brother then you can not claim tax deductions.

- Only premium amount can be claimed as a tax deduction. Do not include the service tax amount.

Preventive Health checkup & Section 80D

Preventive health checkup (Medical checkups) expenses to the extent of Rs5,000/- can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above.

Example – Mr Mehta (65 years) has mediclaim policy and paid Rs 25,000 as premium . He also spent Rs 6,000 towards health check-up. He wants to know what is the total tax deductible amount?

Since he is a senior citizen, the medical insurance premium to the extent of Rs 30,000 can be claimed as tax deduction under Section 80D. Even though he incurred Rs 31,000 ( Rs 25 k + 6k) as expenses, he can only claim tax deduction to the extent of Rs 30,000 only.

Budget 2015 : Deduction u/s 80D on health insurance premium will be Rs 25,000, increased from Rs 15000. For Senior Citizens it has been increased to Rs 30,000 from the existing Rs 20,000. For very senior citizen above the age of 80 years, not eligible to take health insurance, deduction is allowed for Rs 30,000 toward medical expenditure.

Difference between Mediclaim (Section 80d) & Medical Allowance (Section 10):

Do not get confused between your medical reimbursement allowance and mediclaim expenses. Medical allowance is provided by your employer. It is part of your employment agreement (salary structure) between your employer and yourself.

You can get medical allowance upto Rs 15,000 as an exempted income from your Gross salary. To claim this, you need to submit medical bills to your employer and get the allowance benefit. The medical reimbursement allowance is exempted under Section 10 of the Income Tax Act.

If you have submitted medical bills (to your employer) towards medical allowance and also paid premium towards your mediclaim (health insurance) then both of them will be listed in your Form-16 under different sections as shown below (click on the images to open them in new browser window).

(Continuing with Mr Mehta’s case, Mr Mehta incurred Rs 6000 as medical check-up costs. Upto Rs 5000 can be part of his tax deduction under Section 80d as mediclaim premium and the remaining Rs 1000 can be exempted under Section 10D as medical allowance provided he is employed).

If your employer provides medical insurance then in most of the cases it is automatically included in your Form-16. If you have independent mediclaim policies (or) you hold medical insurance plan as a self-employed person then do not forget to claim tax deductions. Show your medical insurance premiums under Section 80D while filing Income Tax Returns.

Budget 2018-19 Update :

- The premium paid by Senior citizens on Health Insurance policies of up to Rs 50,000 (current limit is Rs 30,000) can now be claimed as tax deduction u/s 80D for FY 2018-19.

- The Standard deduction of Rs 40,000 will be provided for all salaried individuals in lieu of Transport and Medical re-reimbursement allowances from FY 2018-19.

- Continue reading :

Related Articles :

- Difference between Individual (Personal) & Employer based Group Health Insurance Plans

- Best Family Floater Health Insurance Plans

- Best Health Insurance plans for Senior Citizens

Please share your comments. (Image courtesy of digitalart at FreeDigitalPhotos.net)

SIR , I HAVE NOT ANY HEALTH INSURANCE POLICY . CAN I CLAIM MEDICAL CHECK UP upto RS 5000/- as tax rebate. for this rebate health premium is neccessary or not, and can i show this medical expenses in cash recipt ?

Dear KULDEEP,

Yes, you can claim up to Rs 5,000 towards health check-up expenses, even if you do not have any health insurance policy.

This deduction can be claimed even amount has been paid in cash.

@Sreekanth will that amount count in 80 C or 80D?

Dear Pragya..its u/s 80D only.

Dear Sreekanth. I am a government servant. I don’t get medical allowence as part of my salary. But my medical bills are fully reimbursable as per actual expenditure. What will be the tax implication in that case. For example in FY 2016 17 I got nothing as medical allowence as part of my salary. But I had incurred medical bills of 195000. I submitted the bills and got the entire amount reimbursed. How much tax I will have to pay and under which section ?

Thanks

Mansi

Dear Mansi,

If the reimbursement is not part of your salary as allowance, then it is completely taxable.

Hi Sreekanth,

I have Medical Insurance policies where payments for the same are due in Jan and Feb of each year. These Payments are however made for a policy that covers me from Feb of one year to Feb of another year.In this case (Payment made in Feb 2017 will cover me from Feb 2017 to Feb 2018)

My query is that how can i claim tax benefit when my Employer only accepts proofs of payments made for policies only in FY (April 2016 to March 2017). Is it only the payment that matters here irrespective of the coverage year or both have to match.

Can i show proof of payment done in Jan and Feb 2017 for FY (April 2016- March 2017) which covers me from Feb 2017 to Feb 2018?

Thank you for your help.

Dear Wasif,

Only the payment in the respective Financial year has to match, for claiming tax deduction.

You can submit the previous premium receipt to your employer.

In case, they do not accept it, you can pay the premium in Feb 17, and can claim it when filing your income tax return for AY 2017-18.

Hi Sreekanth,

Thanks for you help in advance!

My dad is a retired employee of a bank which offers a mediclaim policy for its retired employees and their spouses as a group policy. My dad has purchased this policy for himself and my mother.

The insurance company has declined to provide premium receipts since its a group policy. How can I claim tax relief for this?

Dear AD,

Has the premium been charged? (or) is it a part of retiral benefit which is borne by your father’s ex-employer?

It has been charged and paid for by us.

Dear AD,

If the premium has been charged and paid by you, you have the right to get receipt for it.

I have mediclaim insurance with premium over 25000 for me, spouse and child (none over 60). The company provides mediclaim insurance as part of CTC (premium about 4600). This covers me, spouse, child AND MOTHER (age 70). How much deduction can I claim – 25000 or 25000+4600 or 25000+(4600/4)?

Dear Atul,

You may have to get the premium bifurcation for your company group cover.

IF it is difficult to bifurcate the premium in a floater a, it then relies on the IT officer to assess the case, if you claim Rs 25k + 4600.

I have more than RS.20000 medical bill for this financial year. But as per rule I can only declare RS.15000. Please let me know whether I can claim that extra while E-filing. If yes then under which section.

Dear Sandip,

If you are referring to medical allowance, you can not claim the balance.

Sir, I do have another related to conveyance allowance which is 1600 max per month. Do we need to submit bills for this too ? And, If we submit can this too be exempted from tax ?

Dear Karthi ..Yes, conveyance allowance of up to Rs 1600 per month can be claimed, no bills are required.

Dear Sir, I paid for my mother’s cataract surgery of which only a partial amount of 20,000 out of total of Rs.40,000 has been reimbursed by the insurance policy that I had opted for. Can I claim the tax exemption of Rs. 15000 (under section 17(2)) out of the remaining 20,000 amount which has not been reimbursed by the insurance Provider. If yes, then how would I furnish the original bills if asked for by my employer as the Bills are with the insurance company.

Dear Hitesh,

If you get medical allowance as part of your salary, then medical reimbursement of up to Rs 15,000 can be claimed as exemption.

You may request your insurer to provide you with copies of bills or return the original bills so that you can claim the balance amount with your employer.

Hello Sir, Do you have any sample document that can be submitted to the corporate company, which can be submitted as the supporting documentary evidence against preventive medical health check up expenses claimed under section 80 D ?

Dear Karthi,

You can submit photocopy of of the bill paid towards health-check-up to your employer.

Thank you Sir. Is this health checkup is interlinked to medical insurance premium or without taking any premiun also, whether I can make use of this. I would like to go for preventive medical health check up for myself and my spouse, parents. How much I am eligible to claim for each of them , during filing my tax?

Dear Karthi..Without taking insurance also you can claim 80D if you have incurred health-check-up expenses. It is up to Rs 5k per family.

Hi Sreekanth Reddy,

I take my father for doctor check up every 3 months. A receipt is given as Consultation Fee. Each consultation is charged Rs.500. Can i claim Rs 2000 (4 visits * Rs.500) under Preventive health check-up.

Dear Raj,

Wikipedia explains the meaning of Preventive Health Check Up perfectly “Preventive healthcare (alternately preventive medicine or prophylaxis) consists of measures taken for disease prevention, as opposed to disease treatment“.

Further, it adds ” Health, disease, and disability are dynamic processes which begin before individuals realize they are affected. Disease prevention relies on anticipatory actions that can be categorized as primary, secondary, and tertiary prevention“.

If you believe that ‘doctor check-ups’ fall under this definition then you can claim tax benefit.

Read : Health Insurance Tax Benefits (under Section 80D) for FY 2018-19 / AY 2019-20

hello sir,, i have a health insurence includes my parents (father-62 mother,55)for Rs.2162 paid by employer ,and no other medical allowances .I have spent 20000 /- towards my father health checkup and medical treatment.my self i have spent 10000/- towards health checkup and medicines.how much amount i can get under tax exemption. do i need to provide original bills to my employer.

Dear SRAVANTHI,

For claiming medical allowance, the ceiling limit is Rs 15,000 by producing original bills to your employer.

You can claim premium paid and up to Rs 5,000 towards medical checkup under section 80D.

Dear Reddy,

Greetings for the day. First of all thanks to you providing solutions for the customers.

I am a employee. As per my form-16 my Gross Total Income Rs.380641.00 for the financial 2016-2017

Total deductions Rs.4797.00.

At the end of the year i have forgot to submit the medical bills at my Employer. I have spent Rs.30,000.00 in that year, and also i have health insurance policy it covers Rs.5242.00 under 80D.

If, now i want to file my IT returns. Can i able to add my medical bill’s amount under 80D? If yes, how much amount i can add. Can you please guide me.

Thanks & Regards.

Dear Abdul,

Have you filed your ITR in time?

Even if it is a belated return/revised return, you can claim Rs 5,242 u/s 80D.

But you can not claim the medical allowance.

Kindly read: Income Tax Declaration & List of Investment Proofs

I have a floater policy for myself and my wife. A premium of Apprx 20,000 is paod per annum. Can we both claim rebate of Rs 10,000 each under 80D

Dear Sanjeev..May I know who is paying for the premium?

If I am to claim tax relief against premium paid towards my parents’ mediclaim what proof do I have to show to my employer/while efiling.

Dear Snehashis,

You can submit receipt of premium paid to your employer. There is no need to submit any proofs along with your ITR.

My husband (aged 62, and I am 60) has taken out a family floater policy(himself, wife, son, daughter) a few years ago in his name, for which he pays a premium of approx. 80K a year. Our son (salaried) now wishes to pay the premium and also avail of the tax benefit. 1. Can he pay the premium for this family floater policy even if it is in his father’s name, and avail tax benefit under section 80D? How much tax benefit can he avail under section 80D if he pays the premium?

My son has his own medical policy for which he pays a premium of Rs.3000/- only. Can he claim a tax rebate on this under any section, separately?

Can he also claim medical expenses (health check-up and medicines for himself and also his parents) in any way, under any other section?

Thanks for your advice.

Dear Abha Ji,

General suggestion : Most of the plans provide insurance cover for kids till they attain 18 or 21 years of age. It is prudent to buy individual health insurance plans from the same company and they can get the benefits of policy continuity. The premium on floater plans is dependent on the age of the eldest member in the group.

1 – Yes, he can pay the premium and claim the tax benefits. He can claim max Rs 55k (including his Rs 3k separate policy).

2 – He can claim medical allowance by submitting the bills from his employer for up to Rs 15 pa.The medical reimbursement allowance is exempted under Section 10 of the Income Tax Act.

Thank you. However, in the family floater plan, my son and daughter, though above the 21 and 18 year age, are also covered. That is correct, isn’t it?

I do understand your suggestion that the children should have individual health insurance in their names to get long term benefits. Thank you for this.

From your table it shows tax benefit can be claimed as 35,000/-under section 80D.

How does my son claim the remaining 20,000? Please do specify.

Thanks again

Abha

Dear Abha Ji,

It depends on the Plans Terms & Conditions (reg Kids’ age & coverage).

As the health insurance premium is paid for self+Parents the max he can claim is Rs 25k + Rs 30 K.

I am 62 years old pensioner and also doing consultancy. My wife is 55 and working. I paid Rs 40,000 towards her medi claim policy. can I claim IT benefit for myself?

Dear saurabh Ji..Yes, but subject to the above ceiling limits.

Sir I am a disabled person with disability of 60%. i have mediclaim policy of INR 11879. Can I claim 75000/- under 80U and also 11879 under section 80D?

Dear SATISH ..I believe that can claim both tax deductions.

Dear Sreekanth,

Our company provides group mediclaim insurance coverage for self, spouse & upto 2 children and it pays the premium to the insurer directly and not deducted from the employee. They gave us an option to include the parents and the premium for this additional coverage should be borne by the employee. I’ve opted for the same and my employer deducted the additional premium amount from my salary. Will I be eligible to get tax exemption for that amount which is deducted from my salary?

If yes, the insurance company didn’t provide any receipt or certificate for the same. Should I need to get any certificate or letter (if you have any sample certificate template, pls let me know) from my employer and submit it for tax exemption?

Awaiting your reply.

Regards,

Vani

Dear Vani,

Yes, you are eligible to claim the deducted amount u/s 80D.

There is no need to submit any investment/expenditure proofs to the IT dept.

If the amount is deducted from your salary, it is more than enough to be considered as a proof.

Read:

Income tax declaration & investment proofs.

Thank you!

Dear Sir, I am a retired bank employee covered by insurance policy with a premium of Rs.20000/-.My parents both above 80 years are not covered.What is the amount I can claim towards medical expenses for my parents and under what section.They are not assessees.

Dear Mr Mehta,

For very senior citizens above the age of 80 years, who do not have health insurance, deduction is allowed for Rs 30,000 toward medical expenditure u/s 80D, besides your Rs20 k premium.

Hi,

I notice many health insurance companies are offering discount for paying 2 and 3 year premiums together, instead 1 year premium.

If i pay 2 or 3 year premium how would be the tax deduction calculated. The receipt date would show a 2016 date, but the premium is paid for 2016:2017, 2017:2018 and 2018:2019.

Can i claim tax deduction together this year itself as receipts dated 2016 may not be considered for tax benefit in 2017: 2018 or later.

Please advise

Dear Divakar,

Once can claim the entire premium (subject to ceiling limit) only in the respective FY when the premium is paid and can not be claimed in the next FYs.

I am Elder Brother of my 2 nos younger sister who are already married. i wish to gift my sisters a Health Insurance Policy as a gift will i be able to get TAX rebate under my income. Both of my Sisters are Married & are having kids i wish to get them avail the CASHLESS Medical Facilities. Please suggest

Dear Dr Prakash..If you are paying medical insurance premiums on behalf of your sister or brother then you can not claim tax deductions.

I have paid 5000 every month for medicines. I have no medical premium. I want to show 60000 deduction in income tax or not

Dear prasad ..If you receive medical allowance from your employer then you can claim up to Rs 15,000 per annum u/s 10.

Dear Sreekanth,

My company has a group medi-claim policy in which self, spouse & children (2) are covered which is provided for free for all employees. As no extra amount is deducted from my payroll, I can not claim 25,000 tax exemption for the same right ?

Also, there is an option for enrolling for voluntary Parent’s policy for which premium (including ST) is deducted from the employee payroll. But the total premium goes up to 46000 for Parents in the highest slab. Can I club the 25000 dependent tax exemption option along with the additional 30000 (senior citizens) under 80D so that I get the entire 46000 tax exempted ? Or I can only get 30000 tax exempted even if both my Parents are dependents and are senior citizens.

Please also confirm whether the service tax with medi-claim premium paid is exempted under 80D or not.

Thanks.

Dear Manu,

If no premium is paid then tax deduction can not be claimed.

You can not club.

Service Tax should not be included.

Hi

I’m salaried employee, single, I haven’t take any mediclaim/health insurance as such apart from Employer’s. I’m planning to take health/Mediclaim policy for myself and parents(as dependents). If i go with group policy covering all of us, would I eligible to apply for all amount covered in 80D exemption ( 25000 self + 25000 parents ) ?

Or i should take separate policy for self and another policy for parents…?

Please guide

Dear Mohanraj ..You can take a floater plan and also can claim tax benefits (subject to aggregate ceiling limit).

But suggest you to take stand-alone mediclaim policy for self and separate or family floater plan for parents.

Read : Best portals to compare health insurance plans.

hi, pls clarify the extra 5ooo that can be claimed for senior citizens wrt mediclaim can it also be claimed for super senior citizens?

Dear sandhya ..Yes, can be claimed.

do we need to support documentary evidence against preventive medical health check up expenses claimed under section 80D

Dear Kuresh,

Do note that you don’t have to submit any deduction or investment proofs to the Income Tax Department whiling filing ITR. Returns are submitted without attaching any files or physical documents. But you must keep them safely these proofs with you for 6 years, lest you receive an Income Tax Notice and the Assessing Officer calls for them.

However, if you are employed then your employer might ask for Bills related to this.

HI Sreekanth,

Father and Mother both senior citizen has seperate health policies for about 26000 each and can individually get deduction for 26000 each in their tax returns. In case I claim the deduction in my tax return, is it 30000 max or 52000?

Regards

Dear Niti..It is Rs 30,000. In case if you also have health plan in your name then you can claim up to Rs 25000 (self) + Rs 30,000 (parents, both put together).

Medical allowance is not considered as an allowance for tax exemption and medical reimbursement is considered up to Rs 15000.Now my question is if my employer is paying me Rs 1250 per month as medical allowance will i be getting any tax benefits as it will be a taxable income.

Secondly the amount mentioned by you i.e Rs 25000/- ,Rs 30000/- is for individual or does it constitute others as well. I mean to say for example Rs 25000 for myself then Rs 25000 for my spouse etc or its a sum total.

regards

Vikas

Dear,

1 – Yes, if you submit medical bills and get the reimbursement.

2 – Total (for self+Spouse+Kids one column)

But my company CA says it is a fixed allowance(part of salary)which cannot be reimbursed.Medical allowance if considered as a salary part and is fixed monthly which goes in my pocket and it has nothing to do with my illness and there is no requirement of submission of bills but if the company follows a reimbursement policy where actual expense are incurred and submission of bills is mandatory then i can claim medical reimbursement. I also have doubt regarding the preventive health checkup.Is it in addition to Rs 25000+5000 or Just Rs 15000 as a sub limit and if i talk about senior citizen does it apply to them as well Rs 30000+Rs 5000 or Just Rs 30000.

Kindly clarify my doubts

Regards

Vikas

Its 25000 not 15000*

Vikas

Dear vikas,

I am not sure about your company specific policies.

Kindly note that Rs 5,000 is included in the individual’s ceiling limit.

Preventive health checkup (Medical checkups) expenses to the extent of Rs5,000/- can be claimed as tax deductions. This is not over and above the individual limits as explained above.

Example – Mr Mehta (65 years) has mediclaim policy and paid Rs 25,000 as premium . He also spent Rs 6,000 towards health check-up. He wants to know what is the total tax deductible amount?

Since he is a senior citizen, the medical insurance premium to the extent of Rs 30,000 can be claimed as tax deduction under Section 80D. Even though he incurred Rs 31,000 ( Rs 25 k + 6k) as expenses, he can only claim tax deduction to the extent of Rs 30,000 only.

thxx a lot for clearing my doubt.I have seen in many payslips that they mention medical component as (medical)only and not as medical allowance or medical reimbursement.Do they have any specific idea behind it.

Regards

vikas

Dear vikas ..It is medical allowance and can be tax exempt component if an employee produces original medical bills to the employer.

I have paid income tax 17,000 this year.Kindly suggest me how to minimize this amount.I have no health insurance.

Dear Sandip,

Kindly read :

List of income tax deductions for FY 2016-17.

Tax treatment of various Financial Investments.

List of best investment options.

Hi Sreekanth,

I am currently showing approx Rs. 5000 p.a. as my insurance premium. Also I am planning to take a new mediclaim policy for me and my spouse starting on September for which premium will be around 15000 per annum. Under which section can i declare medicliam premium bills. Also I have already declared Rs.15000 as medical bills in investment declaration form and submitted to my employer. Please suggest. TIA.

Dear Vicky,

Medical premium under section 80D.

My Employer is providing the group insurance for the employees. As part of CTC , medical insurance premium amount of 11k is mentioned , so employees paid the premium for the group medical insurance , Can the employees are eligible for Tax Exemption under section 80D of the income tax laws.

Also provide me any link mentioning above so i can clarify with my employer.

Dear Kunal ..Yes, you can claim tax deduction.

Hi!

May you please help me to understand that many of the company offering the fixed medical benefit plan in such cases what ever may be the expense company will pay the fixed reimbursement which may be more or less in the case if the person having such plan and incurred less expense than the reimbursemet so whether in the case person can get the tax benefit!

I HAVE A SISTER WHO IS MENTALLY RETARDED. SHE IS BEING TREATED AT A A PRIVATE HOSPITAL BY A PSYCHIATRIST. UNDER WHICH SECTION I CAN CLAIM A DEDUCTION? 😯 DD OR 😯 DDB? FORM 10-I HAS MENTAL ILLNESS COVERED, BUT IS NO LONGER REQUIRED. FORM 10-IA DOES NOT HAVE MENTAL ILLNESS COVERED. SO , WHERE CAN I GET THE FORMAT? CAN THE PSYCHIATRIST CERTIFY IT? PLEASE EXPLAIN?

Dear ADNAN,

I believe that mental illness / mental retardation is covered under Section DD.

You can claim up to Rs 75,000 for spending on medical treatments of your dependents (spouse, parents, kids or siblings) who have 40% disability. The tax deduction limit of upto Rs 1.25 lakh in case of severe disability (80% or more) can be availed.

Form For people having Autism, Cerebral Palsy or multiple disabilities, form number 10-IA needs to be filled up.

There are two other formats for person suffering from mental illnesses and all other disabilities. As of now, even I am unable to trace out these templates.

I think neurologist or civil surgeon can sign the forms, not sure if a Psychiatrist is eligible to provide the necessary certification.

Hello Sreekanth

My employer doesnt give medical reimbursement under section 10.

But i have spend 15,000 towards my medicine bills.

Should i

1. Deduct this from the taxable income shown in form 16 and then file my return

2 Or should i show my taxable income same as form 16 provided by my employer and show 15,000 in section 80 d.

Dear Manas,

1 & 2 – It is not allowed (if medical allowance is not part of your salary structure or if you have not submitted your medical bills to your employer during the Financial year).

Sir

I have a daughter who is above 18 and studying and i have declared her dependency on me. i have saving under section 80 more than 150000 & she is covered under my medical claim policy. She also files her ITR separately so can she claim 5000 rs relief under preventive health maintenance . Please reply

thanks

Yes dear neeraj.. . Health Check-up expenses for entire family i.e. self, spouse and dependent children is limited up to Rs 5,000. So, if she is dependent on you then you can claim this (subject to overall aggregate limit under section 80d).

Hi Sreekanth, I have paid the medical insurance premium for myself, wife and son. But instead of me can my wife claim the tax deduction in her return though she has not paid the premium? Thanks, John.

Dear John..If you have paid then only you can claim the tax deduction.

I am retired Bank employee. For retired bank employees Bank is providing cashless medical reimbursement insurance(arrangement with UIICo) upto 400000 for me & my wife and I have paid lower premium of 2200 by debit to my SB a/c with the Bank. Can I claim this amount under S 80D.

Dear PRADEEP ..Yes you can claim it.

i have brought an single premium insurance in March 2014 which is for 10yrs. I have forget to include this in 80c excemption on 2014-15 assessment year and filed my returns.

The premium amount I paid is still haven’t been claimed for excemption.

Can I revise the 2014-15 year and claim refund now.(or) can I include In this assessment year 2016-2017.

Dear Raja,

You can not include it in AY 2016-17.

But can RECTIFY your previous ITR, if it has been processed.

Thanks for your reply.

The assement for year 2014-2015 have been submitted on june 2014 and processed .

Can i revise the same now.

Is there any time frame that i can revise only within one year.

Dear Raja..Let me correct my previous comment.

If your return has been processed than you can not revise your income tax return.

is service tax is deductible on medical insurance premium covered u/s 80D ?

e.g. if i paid total premium 18000 (16000 premium + 2000 s.tax) then deduction will be 18000 or 16000?

Dear nishant ..Its Rs 16,000.

Dear Sir,

Can husband and wife both claim mediclaim insurance premium u/s 80D part payment 50% of total premium if payment is through their joint account

Dear Nalini ..Yes, both of you can claim ..

A mediclaim policy is in the name of my parents. However, i have made the payment of the premium for policy in my parents name. Am i eligible to claim the benefit u/s 80D for the premium paid??

Dear Anant ..Yes, you can claim the tax deduction.

The premium paid towards health insurance policies for your parents qualifies for deduction under Section 80D of the Income Tax Act.

Dear sir ,

I am a 48-year-old teacher and I had paid 8000 Rs. Medi-claim premium in the previous Financial year. I forgot to submit the premium certificate to an employer and in form no. 16 there is no entry of Mediclaim premium. While filing a tax return can I claim that amount in the 80D section? What have I to do now ? Please help.

Dear Arun,

Yes you can claim it when filing your income tax return now and can get REFUND (if any) of taxes paid.

Dear Sir,

My brother is incurring a tax of rs.4700……He is a salaried employee who is not getting any medical allowance or reimbursement. BUt in the financial year 2015-16 we incurred medical expenses in a private hospital for my dad about Rs. 8900/- Can he claim a deduction for such medical expenses. We didnot inform the employer. Now during the filing time (A.Y 2016-17) i want to claim deduction for such expenses. Can i claim it or not. If yes under what section and how much amount

Dear Hemanth,

Now, you can not claim medical allowance.

Read: Income tax declaration & investment/expenses proofs.

hi sreekanth,

1. is it mandatory that i buy a health insurance plan to claim benefit of 80d

2. what if i go to a normal physician and get tests done and buy medicine.

i have receipts of both.

3. can i claim the benefit?otherwise without health plan?

Dear shashi,

1 – Without buying Medical insurance plan, you can only claim up to Rs 5,000 under Preventive Health care provision.

2 – That you can claim under Medical allowance. Kindly understand the difference between Medical Allowance Vs Mediclaim (section 80d).I have provided some points on this in the above article.

Dear Sir

I have mediclaim policy of 18,000 per annum to me & my family (spouse+ 2 children). In addition to this, i have paid another Rs. 70,000 for treatment to my wife (surgery) where insurance not covered. can i claim this amount as deduction under which section.

Dear Krishna,

If your employer provides you MEDICAL ALLOWANCE then you can claim it.

You can get medical allowance upto Rs 15,000 as an exempted income from your Gross salary. To claim this, you need to submit medical bills to your employer and get the allowance benefit. The medical reimbursement allowance is exempted under Section 10 of the Income Tax Act.

Actually I am looking for term insurance along with critical insurance cover, pls suggest best available solution. My limit of Rs.1,50,000/- under 80 C is already done, hence looking forward to get benefit of Rs.25,000/- under 80 D. I am the oldest in my having, at present 49 years old. All this is required to secure loan of apporx 20 L in total.

Dear Manoj,

Kindly read: ICICI iProtect smart term plan – review.

Even if i have not purchased any medical policy, am i eligible to claim deduction of rs.5000 under preventive health checkup????

Dear Madhur..Yes, provided you have actually incurred the expenses.

Thank You.

I have incurred around 3500 but have receipts for 2500 only.

Do we have to submit any reciepts?

Dear Madhur..No need to submit any bills along with your ITR. Kindly keep them for your future reference..

1) Please elaborate on the correct DEDUCTION to claim MEDICLAIM u/s 80D. Should Service Tax @14.5% be also included in the deduction? There are conflicting views & after reading these I am quite confused. My Actual ptemium paud is around Rs 23,100 + Servuce Tax amounting to around Rs 1,500. Can I claim the entire amount of Rs 24,600 approximately?

2) My wife is not claiming any MEDICLAIM deduction under 80D in her ITR. Can she claim for medical checkups @5000×3 persons for ALL 3; Family Members namely herself, me and our adult/employed son who are both claiming MEDICLAIM Deductions individually? Are Bills payment proofs necessary to claim this deduction. We have not retained these and are not available.

3) I am claiming U/S 80D deduction of the BASIC MEDICLAIM coverage anounting to Rs 23,100. My adult/employed son is separately claiming for an additional ‘ SUPER TOP-UP POLICY PREMIUM amounting to Rs 21,000 from sane insurance company. He has a separate individual Receipt for the SUPER TOP-UP POLICY. Hope this is allowed. Please confirm.

Dear S. K.,

1 – I believe that ST should not be included.

2- She can claim provided she submits the bills/medical reports. Expenses up to Rs 5,000 on preventive health checkups can also be used to claim a tax deduction (Its not 5000X3).

3 – Yes.

Dear Sir,

I am a self employed, married with one son. My Father (Age 69), Mother (65) are retired.

I m planning to buy a policy for health insurance for all of us. Policy is in my name with total 5 members.

Can my father pay the premium and take tax rebate in section 80d. His age is 69.

Kindly advise.

Dear Vinay,

You may suggest your parents to take stand-alone mediclaim policies.

And three of you, can take a Family floater plan.

Read:

Best Health insurance plans for parents.

Best Family floater health insurance plans.

Evaluate these factors when buying a health plan.

Best portals to compare health insurance plans.

Can i claim medical reimbursement (medicine, doctor consultancy, checkup, testing etc) even if am not employed or self employed.

Dear Uday..You can claim medical tests etc under Preventive health care benefit.

R/sir,

we have mediclaim policy on name of my husband and mother in law. so can i claim tax benefit for that policy under section 80D

Dear Neela,

Are these separate policies (two independent policies)?

If you are paying health insurance premiums of your in-laws then you can not claim tax deductions. However you can claim tax benefit on the premium paid on your spouse’s policy.

Kindly note that your husband can claim tax deduction on the premium paid towards his mother’s policy.