You may have seen or noticed commercials of Mutual Fund Schemes that end with a standard disclaimer – ‘Mutual Fund investments are subject to Market Risk. Past performance may or may not be sustained in future. Past performance is not indicative of future returns.’

The two terms which are important here are ‘Returns’ & ‘Risk’ (or Volatility).

A mutual fund scheme invests in Equity and/or debt securities. These are the underlying assets of a mutual fund scheme. The returns generated by these securities can be VOLATILE.

So, when picking the right and best mutual fund scheme, it is advisable to

- To analyze the past performance of the funds (measure returns) & also

- To evaluate how VOLATILE these returns are? How consistent are the returns?

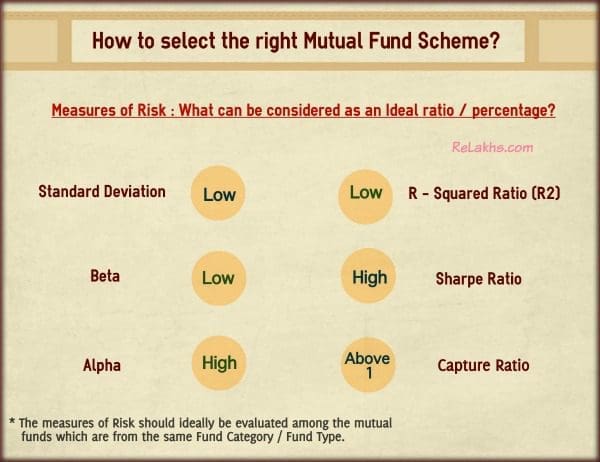

The volatility of returns generated by a mutual fund scheme can be measured by some important risk ratios like;

- Standard Deviation

- Beta

- Alpha

- Sharpe Ratio

- R-Squared Ratio

- Upside & Downside Ratios

Actually, these ratios are referred to as ‘measures of Risk’. But, they measure the volatility associated with a financial instrument. This volatility leads to RISK i.e., you may or may not get the desired returns to achieve your financial goal(s).

When short-listing the best mutual fund scheme, you can analyze the funds on four parameters;

- Compare the returns generated between Fund A and Fund B.

- Analyze and evaluate the volatility of returns between Fund A & Fund B based on measures of Risk.

- You can also compare returns of Fund A with the returns of its Benchmark index / Fund Category.

- You can evaluate the measures of Risk between Fund A with that of its Category or Benchmark index.

How to select the best Mutual Fund Scheme based on Measures of Risk/Volatility?

Let’s now discuss more details about these ratios and try to understand their importance when selecting the right and best mutual fund scheme. You need to give importance to both returns and measures of volatility while short listing mutual fund schemes.

Standard Deviation

- Standard deviation for a mutual fund tells you how much variance there is in the fund’s returns.

- Based on SD you can analyze the consistency of returns generated by a mutual fund scheme.

- It’s useful in a long-term sense (longer time period).

- A Standard deviation of say 20 means that fund will generate plus or minus 20% from its long term average returns.

- If a fund has say a 12% average rate of return and a standard deviation of 4%, its return will range from 8-16%.

- Higher the Standard Deviation, higher the fluctuations in returns. So, you need to look out for a fund with a low Standard Deviation.

Beta

- Beta gives you an idea on the correlation between a fund’s performance and its Index.

- It tells you how much a fund’s performance would swing compared to a benchmark. (SEBI made it mandatory for fund houses to declare a benchmark index. For example: The benchmark index for HDFC Top 200 is S&P BSE 200.)

- High Beta or low Beta, which one is good? If you are a risk-averse investor, low Beta is good. High Beta does not mean the fund’s performance is better than its index. It just indicates that returns can be volatile (up or down) when compared to the fund’s benchmark index.

- If a mutual fund has Beta of 1 that means the performance of the fund will perfectly match the performance of its benchmark index.

- If a fund has a beta of 1.5, it means that for every 10% upside or downside, the fund’s NAV would be 15% in the respective direction.

- The Beta can be a negative figure too, which indicates that there is no correlation between the performance of fund and its benchmark index.

Alpha

- Alpha gives you an idea whether the fund has out-performed its benchmark index or not.

- It measures the fund’s performance (returns) and risk relative to its benchmark index.

- Alpha is measured as a percentage so an alpha of 10 means the fund outperformed its benchmark by 10%.

- So, ideally you would like a fund to have HIGH Alpha. Higher the Alpha the better.

R-Squared Ratio (R2)

- R-Squared measures the relationship between a portfolio and the Fund’s benchmark.

- Kindly note that it is not a measure of the performance of a portfolio. However, it measures the correlation of the Fund’s Portfolio’s returns to the Benchmark’s returns.

- Most of the Large cap & Index funds will have high R-Squared ratio.

Sharpe Ratio

- It measures the returns with respect to risk taken by the Fund. It is a risk-adjusted measure.

- A good Fund should be able to generate decent returns without taking too much risk.

- Ideally, a fund with high Sharpe Ratio is better. (Treynor ratio is similar to Sharpe Ratio.)

Upside & Downside Capture Ratios

- These ratios show us whether a given fund has outperformed i.e., gained more or lost less than the broad market benchmark during periods of market strength (bull phase o upside) and weakness (bear phase or downside), and if so, by how much.

- An upside capture ratio of over 100 indicates a fund has generally outperformed the benchmark during periods of positive returns for the benchmark. Meanwhile, a downside capture ratio of less than 100 indicates that a fund has lost less than its benchmark in periods when the benchmark has been in the red. (courtesy : mornigstar.com)

- Ideally, you would like a fund to have higher Upside capture ratio (>100) and lower downside capture ratio (<100). Lower the downside capture ratio, better the ‘DOWN-SIDE PROTECTION’.

- Some funds may give you the best returns when markets are UP but they do not necessarily go on to out-perform when the markets FALL. So, we need to identify the funds which outperform in both the scenarios. Identifying the funds that ‘lost the least when markets tanked’ should also be given importance.

- Capture ratio is calculated as Upside Ratio divided by Downside ratio. For example, a fund with an upside-capture ratio of 100% and a downside ratio of 80% would have an upside/downside ratio of 1.25. Any ratio above 1 means that a fund does a good job of capturing gains during bull phases while lessening the impact of bear markets.

There are certain other Risk ratios like;

- Sortino Ratio : It is a variation of Sharpe Ratio. It factors in only the downside or negative volatility.

- Omega Ratio : The Omega ratio is a relative measure of the likelihood (probability) of achieving a given return, such as a minimum acceptable return or a target return.

Where to get information on important Measures of Risk Ratios?

Where to find the values of these Risk Ratios? Are there any online portals which provide details on these measures of risk?

Yes, the details are readily available on portals like Valueresearchonline & Morningstar.

How to Compare Mutual Funds Performances based on Risk Ratios? (Fund A Vs Fund B)

- Visit Valueresearchonline portal and click on ‘Fund Compare‘. Let’s compare two Large Cap oriented Funds – i) SBI Bluechip Fund & ii) Birla Sunlife Frontline Equity Fund. (Read : What are Large / Mid / Small Cap Fund Categories?)

- You may click on ‘Returns’ tab to analyze the Funds’ performances.

- You may click on ‘Risk Stats’ tab to evaluate the performances of these funds on various Risk ratios.

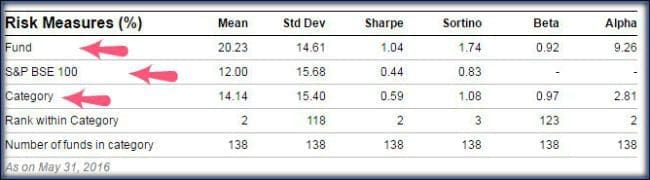

Fund A Vs Benchmark Index Vs Fund Category

- Click on any individual Mutual Fund Scheme link and you can find details about risk ratios related to that specific Fund, its Benchmark Index and also of Fund Category in the same table. Below details are for SBI Blue Chip Fund Vs S&P BSE 100 (its benchmark index) Vs Category (Large-cap).

You may also find risk ratios’ details in Morningstar portal.

- Visit Morningstar.in portal and click on ‘Tools‘ menu option.

- You may click on ‘Fund Risk Measures’ to know the details of Risk ratios of a Fund. You can click on ‘Category Risk Measures’ to evaluate the category wise measures of volatility.

- Below details are for SBI Bluechip Fund (Click on ‘Fund Risk Measures’) (Morningstar provides information on Capture ratios, but the benchmark index for all the comparisons is S&P BSE 100)

Conclusion:

Performance (Returns) is not everything. If a fund generates high and abnormal returns but takes too much risk (unwarranted) then the returns may plummet (or) the performance may not be consistent. So, as a mutual fund investor you would like to invest in a product which balances risk and returns.

It is prudent to analyze both returns and risk ratios before shortlisting the best Mutual Fund Schemes.

Do you evaluate your MF Schemes based on these measures of Volatility? Kindly share your views and comments. Cheers!

Continue reading :

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net. References : Valueresearchonline, morningstar & Freefincal.com) (Post Published on : 23-June-2016)

Sir,

Excellent job.Your blog is great help for beginners like me.No websites like value research, money control . etc. offer this kind lucid explanations.Salute to your efforts.Kindly review my SIP’s

1. ABSL pure value-5k (Do I need to switch/review as it is under performing recently ?)

2. Reliance small cap-2k

One more silly doubt…Why nobody is encouraging investing small lumpsums like 10k , 20 k frequently in large cap MF’s like Axis Blue chip etc.. as an alternative to multiple FD’s?

Dear SARAN,

Thank you for your appreciation!

May I know your investment objective(s) and time-frame?

Kindly read :

* Best Mutual Funds 2018-19 | Top Equity Funds post SEBI’s Reclassification

* Why your Best Mutual Fund Schemes may not remain as ‘the best’? | Categorization & Rationalization of MFs

I am 30 yrs old.My objectives are to create corpus for

1.Children education

2. Post retirement planning

3. Buy home in short term (in 4-5 years) through fd like investment in equity mfs

Dear Saran,

You may kindly continue with your SIPs in two of your existing funds.

Ideally, we should not compare a fixed income product FDs with Equity Funds (large-caps).

You may kindly go through below articles :

* Retirement Planning in 3 Easy steps

* Calculate how much you need to invest for your Kid’s Education

* List of Best Investment Options in India

Hi Sreekanth Sir,

I am 29 years old. Currently I am investing in blow mutual funds and planning to invest for 5 years.

1.BIRLA SUN LIFE FRONTLINE EQUITY FUND -GROWTH-DIRECT PLAN – GROWTH – 1500 K

2. DSP BlackRock Micro Cap Fund – Direct Plan – Growth – 2500 K

3.SBI Blue Chip Fund – Direct Plan – Growth – 1000 K

4. Kotak Select Focus Fund – Direct Plan – Growth – 1000 K

5.Mirae Asset Emerging Bluechip Fund-Direct Plan – Growth-Growth – 1000 K

6.Franklin India Smaller Companies Fund – Direct – Growth – 1000 K

7.Sundaram Rural India Fund Direct Growth – 2000 K

8.Principal Emerging Bluechip Fund – Direct Plan Growth – Growth – 2000 K

9. ICICI Pru Value Discovery Direct growth – 1000 K

I am investing in mutual funds for my daughter studies.

Could you please let me know my portfolio looks good or do I need to make any changes?

Thanks in Advance !

Dear Nagesh,

You may retain either of two large cap funds (Birla frontline or SBI bluechip).

You may consider discontinuing Sundaram fund.

Kindly read : MF portfolio overlap analysis tools.

Hi Sreekanth Sir,

Thank you so much for your reply.

Currently on every month (SIP) I am investing in below equity fuds.

1.BIRLA SUN LIFE FRONTLINE EQUITY

FUND -GROWTH-DIRECT PLAN – GROWTH 1500 K

2. DSP BlackRock Micro Cap Fund – Direct Plan – Growth – 2500 K

3.SBI Blue Chip Fund – Direct Plan – Growth – 1000 K

4. Kotak Select Focus Fund – Direct Plan – Growth – 1000 K

5.Mirae Asset Emerging Bluechip Fund-Direct Plan – Growth-Growth – 1000 K

6.Franklin India Smaller Companies Fund – Direct – Growth – 1000 K

7.Sundaram Rural India Fund Direct Growth – 2000 K

8.Principal Emerging Bluechip Fund – Direct Plan Growth – Growth – 2000 K

9. ICICI Pru Value Discovery Direct growth – 1000 K

Now I am planning to make few changes in my portfolio. I decided

to stop investment in BIRLA SUNlife, Franklin india smaller and Icici pru value

discovery equity funds.

After making changes My Portfolio looks below.

1. DSP BlackRock Micro Cap Fund – Direct Plan – Growth – 2500 K

2.SBI Blue Chip Fund – Direct Plan – Growth – 4000 K

3. Kotak Select Focus Fund – Direct Plan – Growth – 4000 K

4.Mirae Asset Emerging Bluechip Fund-Direct Plan – Growth-Growth – 2000 K

5.Sundaram Rural India Fund Direct Growth – 1500 K

6.Principal Emerging Bluechip Fund – Direct Plan Growth – Growth – 2000 K

Please suggest me whether I am taking right decision or not?

Thanks in Advance!

Dear Nagesh,

If your investment time-frame is around 5 years, you may reduce allocation to mid/small cap funds.

Hi Sreekanth,

Thank you so much for your reply.I appreciate your time and efforts.

I did not get your answer. Can you please elaborate more.

please let me know what changes do i need to make in my portfolio?

Thanks in advance

Dear Nagesh,

You have invested in mid-cap funds like Principal Emerging, Mirae Emerging, and small cap fund like DSP micro cap.

Advisable to stay invested in these kind of mid/small cap funds for longer period (beyond 5 years).

In case, if you need money after 5 years, you may reduce SIP amount to these and re-allocate the amount to SBI Bluechip or Kotak funds.

(or) you may even drop one mid/small cap fund and can consider opting a balanced fund.

Excellent article for newbies like me. Technical terms, definitions and concepts have been explained in very easy to understand language. Best thing I like about ReLakhs articles is easy examples with images/screenshots. These articles are very helpful for learning how and why stocks perform(ed) the way they do.

Thank you Sreekanth!

Keep ’em comin…

Dear Karan,

Thank you for your appreciation!

Keep visiting ReLakhs and kindly do share the articles with your friends!

Hi, Sree. I am Saravanan. My age is 34 and I’m a beginner to this Mutual Funds type of investment. I would like to invest around 5000 per month in SIPs for the long term of 17 years time frame for child education and marriage. Can you please suggest some mutual funds with the sharing ratio.

Dear Saravanan,

Suggest you to go through below articles :

Kid’s education goal planning.

Best Equity funds.

Thank You so much for your valuable efforts and giving in detail explanation. Your blog topics are to the point and very simple to understand.

I am planing to invest lump sum of 15 lakhs. But I am not sure how should I allocate my investment to various funds.

I can stay invested for about 7+ years.

Please suggest good fund.

Dear Mayank,

You may set up STP (systematic transfer plan) from liquid fund to equity or hybrid funds.

For ex : HDFC Liquid fund to HDFC balanced fund for next 12 months or so and you may remain invested in this fund for next 5 years.

Same way you may consider one aggressive MIP Fund.

You may make a small lump sum investment in Dynamic bond fund.

Read :

Best Equity funds

Best MIP Funds

Best debt funds

Hi Sreekanth,

I am a 37 yr old salaried individual and started monthly SIP in the following portfolio:

DSPBR Tax Saver Fund (Direct Growth)- 6000/-

Franklin India Smaller Companies (Direct Growth) – 4000/-

Franklin India High Growth Companies (Direct Growth)- 5000/-

Mirae Asset Emerging Bluechip Fund (Direct Growth)- 5000/-

ICICI Prudential Value Discovery (Direct Growth)- 5000/-

I wanted to invest another 4000/- in DSPBR Micro Cap but found that new SIP registration is closed. Can SBI Small and Mid Cap be a suitable replacement for the DSPBR Micro Cap? If not please suggest a suitable small cap fund that I can use.

Also I have a sum of 9Lakh that I need in 3 years time. Please suggest a suitable debt fund. My primary goal for this sum is capital preservation and indexation benefit in taxation with slightly more return than a bank FD (if possible).

Thanking you, with best regards,

Anirban

Dear anirban,

You may invest additional sum in Franklin Smaller cos fund itself.

Kindly read :

Best Equity funds.

Best Debt funds.

Best MIP Funds.

Hi Sir,

Am aged 27 have 2 dependents earning 65kpm

Loans: home loan 26kpm perosnal-3kpm

LIC : Jeevan anand and LIC Eterm 1cr policy (hope my family is covered well)

MF : 5yrs – BSL Frontline equity(1500) and Franklin small companies(1000).

I am ready to invest 10k per month in SIP. this would be for my retirement followed by child’s education of 4kpm

Please suggest a good diversified portfolio . I wanted capital preservation and returns more than 9-10%.

Dear Ruma,

Kindly note that Mutual fund investments are subject to risks and capital preservation may or may not be possible. But if the investments are for long-term, the probability of getting negative returns can diminish, provided one tracks the portfolio regularly.

Kindly consider taking a Family floater health insurance plan (if you do not have one).

The two existing funds are good ones.

You may add one Balanced fund and one Diversified equity fund.

Kindly read:

Kid’s Education goal planning & calculator

Best Equity funds

List of best investment options.

Thanks for prompt reply. I will surely take up that insurance plan.

The two funds that i have are for 5 yrs(vacation) .

Now for retirement ~20yrs: BSL Frontline EQ +ICICI pru multicap+hdfc balanced + VPF (with employer)

2000/1000/1500/2000 target is 50Laks

for child education ~15 yrs: SBI Blue chip + SBI Magnum multicap +ICICI pru balanced

2000/1000/2000 target is 20 laks

Is this portfolio ok? what overlap percentage is acceptable?

Dear Ruma,

You may consider L&T Value fund instead of ICICI Multicap.

Birla Equity fund in place of SBI multicap fund. (These are just suggestions..)

There is no thumb rule as such for overlap %. One can avoid investing in two funds with high overlap % say may be 50% …

Hi Sreekanth,

Firstly, let me thank you for putting up your valuable time in creating such a great website in terms of knowledge.

I am planning to invest in equity funds for 10+ years through SIP route 5k each per month in the below funds (ALL DIRECT PLANS)

1. Diversified – ICICI Prudential Value Discovery Fund

2. Diversified – Birla Sun Life Equity Fund

3. Large cap – Kotak Select Focus Fund

4. Small & Mid-cap – Reliance Small Cap Fund

would you recommend any changes in the above mentioned funds/ portfolio allocation?

In addition to the above SIP, i am also planning to invest in long term debt funds for about 3-5 years in

1. ICICI Prudential Long Term Plan (5L)

2. UTI Dynamic Bond Fund (5L)

or would you suggest liquid/ultra short term/arbitrage funds are better instead of long term debt funds?

Thank you

Dear Tapas,

Your portfolio has higher allocation to Large cap stocks, though there are two diversified equity funds.

You may pick one mid-cap fund, if you would like to build a slightly aggressive portfolio, else a balanced fund for a moderate portfolio.

You may go ahead with Dynamic funds, but do not that even debt funds are associated with some risks.

Read: Types of debt funds.

Hello Sreekanth,

I would like to invest in some good short term fund for the next 1 to 2 years.

Could you please help me choose between the following?

1. Indiabulls short term fund

2. baroda pioneer short term bond fund

Thank you.

Dear Chandan ..Kindly go through my article on, Best debt funds..

Hello Sir, I’m 30 yrs old earning 80k per month and investing 21k per month in MFs. i can further invest 4k more per month. please suggest me whether below portfolio is fine or need to change with any different fund in case i would have taken high risk by choosing below funds. My Goal is to build 50lakhs by next 10 yrs and 1 crore by next 15 years. Below are my portfolio diversification details ?

SIP Details as below(Monthly Basis)

ELSS

Axis Long term equity fund Direct Growth : 2000/-

Large Cap

SBI Blue Chip Fund Direct Growth : 3000/-

Mid Cap

Franklin India Prima fund Direct Growth : 3000/-

Small Cap Franklin India Smaller companies fund Direct Growth : 2000/-

Diversified

ICICI Prudential value discovery fund Direct Growth : 3000/-

Balanced fund

HDFC Balanced Fund Direct Growth(Equity based Balanced Fund) : 3000/-

Debt Fund

Birla Sun Life Short term fund Direct Growth : 5000

Dear Rajesh,

Suggest you to go through below articles & available calculators, to analyze your case.

Retirement goal planning & calculator.

Kid’s education goal planning.

The portfolio looks fine.

Hello,

I want to invest 85000 in sector fund for 3-5 years. I am looking for pharma sector of reliance. I compared SBI , UTI and TATA pharma but distribution of reliance looks good.

Can you suggest is it good choice or not. I know pharma not performing well last 2 years.

I want to do STP of big chunks rather small SIP or lump sum to achieve good NAV.

Dear Swapnil,

Do you have any existing mutual funds in your Portfolio?

Hi Sreekanth,

AGE is 32 My goal is to have retirement corpus around 2.5 crore. I have investment vision of 20 years. Current 2-SIP started in last month of 3000/- each, Can invest upto 10000 more. BSL frontline (3000) SIP HDFC Tax saver (3000) SIP I have already large cap portfolio so I think I should create mid-small cap sip and one sector sip. I am looking for reliance pharma mutual fund. Please suggest your opinion.

Thanks, Swapnil

Dear swapnil,

Kindly go through this article : Retirement goal planning & calculator.

Small/Mid-cap suggestions : Best Equity mutual funds list.

Kindly note that generally investments in sector fund can be associated with high amount of risk. So, if you understand and aware of them, you may go ahead and allocate a small portion of your investible corpus to sector fund.

Thank you Sreekanth.

hii sir,

i m planning to invest in mutual funds and i new to this markets i dont have any idea about it and i want to invest for a short period say 1 year or 18 months kindly suggest me & guide me best mutual fund script to invest thanking you in advance

Dear Pooja,

Ok. May I know your investment objective?

hii sir,

my investment objective is not much defined i require funds for my sisters higher education that is after 1 or 1 1/2 year

Dear Pooja,

If you need this money after around 12 months from now, suggest you not to invest in Mutual funds.

You may consider traditional options like Bank FDs/RDs.

Kindly read:

What are Debt funds?

List of investment options.

HI, I HAVE SOLD A SMALL PROPERTY FOR 30 LAKHS I WANT TO INVEST IN MUTUAL FUND WITH EVERY MONTH PAYOUT, AND TO RE INVEST THIS PAYOUT IN MIDCAP FUNDS (G) FOR BEETER RETURNS.

NEED YOUR HELP TO TELL ME THE PLAN ABOVE I AHAVE MADE IS GOOD OR BAD?

Dear MMP,

May I know your investment objective and time-frame?

Instead of reinvesting the payout, isn’t better to invest the amount directly in the Funds of your choice based on your financial goals????

Kindly read: Best Equity funds to invest in 2017-18.

Hi There,

I am 29 years old and am currently investing towards multiple goals (3+ years, 5+ years and 10+ years) with the following monthly SIPs-

SBI BlueChip- Rs. 6000

ICICI Value Discovery- Rs. 4000

Franklin Smaller Cos- Rs. 4000

DSPBR Microcap- Rs. 4000

I also invest in ELSS- Axis and Franklin- total of Rs. 50,000 per year, with a PPF contribution and going to start a Term Insurance this year.

Now, I am also planning to start investing in a Balanced fund. I am confused between HDFC Balanced and ICICI Balanced. ICICI Balanced has huge overlap with ICICI Value Discovery but is a better fund from what I’ve come to know.

Below are my questions-

1. Can you please suggest if my overall portfolio is good enough or do I need to cut any particular fund?

2. Which balanced fund would you recommend based on my current portfolio and goal horizon? Do I even need balanced fund?

3. Is HDFC Click2Protect a good Term Insurance Policy? Which policy would you recommend?

Thanks.

Dear Amit,

1 – I believe investing in 7 MF schemes may lead to over diversification. However, you can check portfolio overlap among these funds and decide, as all of the mentioned funds are good ones.

Read:

MF portfolio overlap analysis tools

My MF portfolio

2 – HDFC or SBI balanced funds can be considered.

3 – Read : Best online term insurance plans.

Hi sree!

Thanks for the article. really good.

sree is there any article on how mutual fund portfolio is rebalance or what is rebalancing.

Dear Abhee..As of now, I have not yet published ..will try to write one soon. Thanks for the post idea 🙂

Suggested articles:

How to Rebalance Your Investment Portfolio

How and When of Portfolio Rebalancing With Calculators..

Hello Mr Sreekanth Reddy,

I am a Govt Employee and have recently invested in 3 different MF’s through SIP route. They are:

1)Kotak Select Focus Fund – 2K (growth)

2)HDFC Mid Cap Fund – 2K (growth)

3)UTI MNC Fund – 2K (growth)

I am willing to make my portfolio bigger by investing another 4K in the coming months in SIP. Please suggest if the investment made my me are good decision or not.

Moreover, I have long term plans like buying a house, childrens marriage, education and retirement planning. However, I am clueless how to go about investing and in what MF’s should I invest in the future.

Another question I want to ask here is that I have around 9Lakh in Bank Deposit. 7.8 Lakh in FD and another 1.2 Lakh in Savings. The 7.8 Lakh FD attracts a lot of TDS so it is not a viable option. I want to withdraw 6 Lakh from my Deposit and invest in MF’

s. It is good according to you to invest the whole 6 Lakh as a lumpsump investment into 1 or multiple funds.

If it is good to invest lumpsump I am thinking of investing 3 Lakh into HDFC Prudence Dividend fund which pays out regular dividend. Also 3 Lakh into 1 or multiple Growth Funds. Which route according to you should I take as I am really confused where should I invest my hard earned money into.

My current monthly income is 30 K and 7.5 k every month gets invested in various LIC policies.

Thanks & Regards,

S. Kumar

Dear S Kumar,

May I know your age and time-frame of your Financial goals.

Kindly provide LIC policy details (Plan name, sum assured, tenure & commencement date).

Why would you like to get Regular dividends?

Suggested articles:

Financial planning pyramid..!

Kid’s education goal planing & calculations.

Retirement planning Calculator.

List of important articles on Personal Financial planning.

Current Age: 34 Years

Time Frame: Kids Higher Education: In 20-25 years

Home: In 16-20 years

Childrens Marriage: 25years & 27 years (2 Kids)

Retirement Goals: 3Lakh/annum as per todays value after 26 years i.e., in 2042.

LIC Details:

1) New Money Back Plan (820), Tenure 20 yrs, Sum assured-150000, commencement date: 11/2/16,

2)Jeevan Tarun (834), Tenure 25 yrs, Sum Assured-820000, commencement date: 9/12/16,

3) Jeevan Mitra (133) Triple cover endownment, Tenure 15 yrs, Sum Assured: 200000, commencement date: 21/2/12

4) Jeevan Anand (149), Tenure 15 yrs, Sum Assured: 300000, commencement date: 12/11/11

Regular dividend plan in MF suggested by brocker and I am confused. So, I mentioned HDFC Prudence Dividend fund…

Dear S Kumar,

The existing life cover may not be adequate to you, also these are traditinal low yielding plans.

Suggest you to buy a Term insurance plan and you may discontinue these policies.

Read:

If life is unpredictable, insurance cant be optional.

Traditional life insurance plan – a terrible investment option?

Term insurance plan Vs Traditional plans.

Jeevan Tarun – review

LIC new money back plan – review

Best term insurance plans.

As your goals are long-term & objective is to accumulate wealth/corpus, kindly opt for Growth option instead of Dividend.

Dear Sreekanth garu, very nice article

Please advise me

Through mfuonline I have started investing in the following

Sbi bluechip 3k (large cap)

Sbi magnum multicap 3k

Franklin india flexi cap 3k

Principal emerging bluechip 3k

Dspbr micro cap 3k

I have horizon of 10+ years. I also save in ppf and nps(tier 1) I can go for moderately high risk category.

But after going through analysis of other fund schemes now I have doubts about my choices. Kindly guide me.

I have working spouse, Iam planning to invest from her side also, should the same schemes be chosen for her also?

Dear DC,

Your portfolio looks fine. You may retain one out of the two Mutli-cap funds (preferably SBI multicap). Franklin Flexi & SBI multicap are both diversified funds.

If both of your goals are same, you may pick same schemes.

Kindly read: MF portfolio overlap analysis tools.

Dear Sir

I am new in this field want to invest for tax saving (Rs 10000) and better return plz suggest me which mutual fund would be good for me

Dear Punit,

May I know your investment horizon?

Suggest you to kindly go through below articles;

Best Equity funds for 2017.

MF portfolio overlap analysis tools.

Hi sir I have a long term investment view on wealth creation. I have 4 ELSS Mutual funds via SIP. My age is 25. Please suggest me whether I am investing in right direction or not.

Investment time – 10 yrs, goal – Purchasing a house.

1. Axis Long Term Equity Fund – – Direct(Growth), 1500

2. Reliance Tax Saving Scheme – – Direct(Growth), 1000

3. SBI Magnum Tax Saving Scheme – – Direct(Growth), 1000

4. Franklin India Tax Shield – – Direct(Growth), 1000

Apart from this I have a PPF account with annual investment of around 30000. I have sufficient life insurance so now my only focus is to get better investment returns.

Please suggest any other investment scheme.

Thanks

Dear Anshu,

I believe investing in too many funds that too from same fund category can be avoided.

Kindly check portfolio overlap among these funds and try to limit to may be 2 funds.

Kindly note that units allotted under each SIP of ELSS fund have a lock-in period of 3 years, so you need to plan your withdrawals accordingly.

Read :Best Equity funds to invest in 2017-18.

Hi sreekanth,

good Article

i want to invest in mutual fund.but i am fresher.i have little quest?

demat is compulsory for investment in mf.

if yes, can i go from anglebroking

Dear alpesh ..It is not compulsory.

Hi sreekanth,

Really Good Article….Thanks for sharing information..i read this article today.

I am 30 year old, few months before i got SIP of 3000 Rs in ICICI value discovery Growth…this i have choosen for my retirement. Can u please tell me if i have done right?

Or which is the best fund for retirement at this moment…considering investment for 30 years from now.

regards,

Dear Abhee,

It is a typical multi-cap equity oriented fund with around 60% allocation to Large-cap stocks. I believe that any equity fund which have been performing consistently well can be part of ones long-term portfolio.

It is a good one.

In case, you are planning to add one more SIP for long-term (30 years), you may add one mid/small cap fund.

Read: Best Equity mutual funds.

Hi sree,

How to purchase mutual fund from different AMC using a single platform. I am thinking for using ICICI demat account in this case.Is this a good idea?

please guide.

Dear Abhee,

Personally i do use icici direct for some of my investments, but the transaction charges are on the higher side but with good service.

Kindly check out MF Utility platform for investing in Direct plans.

Read:

MF utility – How to invest in direct plans?

What are Direct plans of MF Schemes?

Ok. I will check.Thanks

Hi Sreekanth,

Thanks for your valuable information. It helped me decide on investing in SIP. I am very new to SIP and I want to invest in SIP plans for two purpose – short term (emergency) which I can withdraw on emergency case so a plan which will give me more returns in short term cases say 1 yr or 2 yrs. And plans for long term say 10 yrs-15yrs for (home,children,education,marriage and retirement). I am 33 yrs old. I would like to invest total 10k for above 2 purpose. One of the plan i would prefer from SBI and ICICI. Please suggest me better plans. Thanks…

Dear Shilpa,

For accumulating emergency fund – you may consider a Liquid fund + an Arbitrage fund.

Kindly read:

Best Debt funds.

Best Arbitrage funds.Long term goals:

Kindly go through below articles –

Retirement goal planning & calculator.

Kid’s education goal planning.

You can consider investing equity oriented plans for long-term goals.

Read: Best Equity funds.

Shreekanthji, very happy diwali to you and your family. I want to check my mutual fund portfolio. My SIPs are as follows :

Axis long term (elss) : Rs. 2000 (horizon 7 yrs.)

Reliance growth : 1000 (with insurance) horizon 10 yrs.

Reliance equity opportunities : 2000 (1000 with insurance) horizon 7 yrs.

Hdfc balance : 2000 (horizon 5 yrs.)

Icici pru value discovery : 2000 (horizon 5 yrs.)

Franklin smaller companies : 2000 (horizon 10 yrs.)

PPF : 10000

Is it ok? My age is 50 yrs.

Dear Pratap,

I believe that there are better funds available in mid-cap space than Reliance growth fund & Equity opp fund.

Read:

Best Equity funds.

MF portfolio overlap analysis tools.

Happy Diwali!

Dear Sreekanth,

I would like to do some bulk Mutual fund investment from my NRI account.

Is there any fund that we can consider instead of Bank Savings Account? My intention is to park the money for short term basis and switch to equity funds later. (in my knowledge, NRI investments should keep for 1year to avoid TDS.. is there any exceptional funds?).

Dear Jayan,

If you have to park for short-term basis, you may consider Liquid fund and then can do STP (Systematic Transfer) to Equity oriented funds (as per your requirements).

Kindly note that STPs are considered as normal redemptions. So, taxes are applicable on these transactions (on liquid debt fund).

Kindly go through these links :

Mutual Fund Transactions & Tax implications.

Best Debt funds.

Best Equity funds.

How to select right mutual fund scheme.

NRIs & FATCA Compliance requirement.

Dear Sreekanth,

I am 28 years old recently married, working in Central Govt. with 70k salary per month.

Following are my savings.

1) PPF- 35000/- p.a. started in 2015.

2) ICICI Pru I-Protect term policy- 30 Lakhs coverage – 4478/- p.a. for 33 years (Started in 2016)

Now am planning to invest in Mutual funds for my long time goals (above 8 years).

After so much study i have decided following portfolio for my investments

1) SBI Blue chip fund – 4k

2) Birla Sunlife Front line equity fund – 4k

3) ICICI Pru Value Discovery Fund – 4k

4) Franklin India Smaller company fund – 4k

5) Mirae Asset Emerging Blue chip/UTI mid cap fund – 4k

6) Franklin Tax shield- Every year 30000/- (may vary) as lumpsum for tax saving.

Please give your opinion on my portfolio and their performance in long run.

I am also thinking about fund size of funds sl.no: 2, 3. Is it ok if i have large size funds in my portfolio ?

Thanks.

Gopal

Dear Gopal,

All are good ones.

1 & 2 are large-cap oriented ones. So, kindly check overlap between 1 & 2 and 3 & 6 funds.

Read: MF portfolio overlap analysis tools.

Kindly consider buying a Personal Accident insurance plan (if you do not have).

Read:

Why is PA cover a must?

List of articles on Personal Financial Planning!

Thank You Mr. Sreekanth for your reply.

1) I have calculated portfolio overlap for funds: 1,2,3 and 6 and i found all combinations having overlap ratio below 35% except one combination. Overlap for funds 2 and 6 is around 50%.

Is this portfolio alright ? or do i need to change anything ? Kindly suggest.

2) As you suggested i will go through Personal accident insurance plans and i will buy suitable plan for me.

3) My parents(Farmers: Father-52 yrs & mother: 47 yrs) are dependent on me. They are covered with Central Govt Health Scheme (CGHS) as my dependents. Is CGHS coverage sufficient for my parents ? or do i need to buy any other health insurance plans for them ? If Yes,

Please tell me which Helath insurance plans will be good for people staying in small villages ? Because they are staying at my hometown(village near by Warangal) and I am working in Bangalore.

(Sometimes they are facing difficulties because, for any treatment they have to travel to Hyderabad or Bangalore for CGHS facility due to non availability of CGHS facilities near my hometown).

Thank You and waiting for your kind suggestions.

Regards

Gopal

Dear Gopal,

1 – You may drop one fund where the overlap is >50%.

3 – Sufficient or not, you are the best person to judge/know. Lack of medical facilities is the problem and we can do anything about it. So, you may consider taking stand-alone health insurance mediclaim policies for them. Do they have any health challenges?

Read:

Best portals to compare health insurance plans.

Evaluate these factors when buying health plan.

Dear Sreekanth,

1) If i want to drop fund no:2 then which large cap fund would to better to replace fund no:2 ?

3) As of now, my parents not having any health issues. Recently they have gone for full body check up and they were perfectly alright in all reports.

Thank you Mr. Sreekanth for enlightening people like us for better financial planning. After reading all your articles I am in a position to plan my financial goals. Really your doing wonderful job. All your articles having great stuff. I am suggesting this website to all my friends and colleagues. Finally thanks to my friend for suggesting this website to me.

Dear Gopal,

1 – Did you check their risk ratios 🙂 ?

2 – So, its a good time to buy health insurance for them. May be you can consider – Super top up health insurance plans.

Thank you so much for your kind and motivating words.

By the by, may I know your friend’s name??

Hello Sreekanth,

1) While shortlisting my portfolio I have considered risk factors (Standard Deviation, Beta, Alpha, Sharpe Ratio) and i found they are OK for all funds in my portfolio.

Now i am planning to replace “Birla SL FL equity fund” with Birla Sunlife Top 100 fund”. Is it a good fund to replace ?

2) I will consider your suggestion for buying Health insurance for my parents.

My friend who has told about your website is Madhanagopalan.

Dear Gopal,

1 – Birla Top 100 is a decent fund. But you already have SBI bluechip which is again a Large cap fund. So, kindly check the overlap and take decision.

Thank You Mr. Sreekanth.

Hello Sir ,

Thank you very much for all your advice and guidance to all investor.

I m a NRI .. and Invested in below mentioned SIP ( Rs. 5000 each ) started 2 months back ) for long term retirement goal .

Franklin India Smaller Companies Fund GROWTH

Mirae Asset Emerging Bluechip Fund – Regular Plan Growth Option

PARAG PARIKH LONG TERM VALUE FUND – GROWTH

ICICI PRUDENTIAL VALUE DISCOVERY FUND – GROWTH

KOTAK SELECT FOCUS FUND -GROWTH OPTION

SBI BLUE CHIP FUND – REGULAR PLAN – GROWTH

Kindly advice above MF is ok or can i change the fund .

Thanks

Dear Nithin ,

All are decent funds. But you have 3 Multi-cap funds in your portfolio (ICICI/Kotak/Parag).

So, suggest you to check the portfolio overlap among these funds and if the overlap is on a higher side then you may trim down your portfolio.

Read:

MF portfolio overlap analysis tools.

How to select the right mutual fund scheme?

Hi,

I read your website from time to time. You are doing a nice job by providing valuable investment education to people. Please keep it up.

I would like to know your suggestion on my monthly MF portfolio allocation (Since the beginning of this FY)

1. Axis LT Equity (ELSS) 3000

2. BSL Tax Relief 96 (ELSS) 1000

3. Franklin India Tax Shield (ELSS) 1000

4. HDFC Balanced Fund 1000

5. Mirae Asset Emerging Blue Chip 2000

6. DSPBR Micro Cap 1500

Total 9.5K

I have a plan to limit my ELSS fund count to 2 after monitoring the performance for 2 years while keeping the total ELSS flow intact.

Additionally , can I add one more midcap to my portfolio or continue with Mirae alone (it’s giving me around 80% CAGR till date, although the investment period is so small for this to be of any significance).

Also, would like to know your view on BSL Pure Value fund. It interested me for the value (actually blend) oriented investment approach , which is quite rare in midcap space.

Thanks,

Sayak

Dear Sayak,

Yes, you may trim down your portfolio a little bit.

Read:

Best Equity Tax saving funds.

How to compare and select the right mutual fund scheme based on Risk Ratios?

You may continue with Mirae fund.

Hello sir,

I have been investing 3k per month in DSP Black rock micro cap fund through SIP since last two year.

My investment horizon is between 15 to 20 years.

I have observed that this fund has performed well but some of my friend’s suggested to me to invest in Frankllin Smaller Cap fund which is good fund compare to DSP in terms of Risk as well as Returns.

I have also read your some articals where you also suggest for Franklin smaller cap fund.

Now i am little bit confuse, should i stop my current(DSP) fund and start new SIP in Frankllin India smaller cap fund.

Pls suggest and advice.

Dear Nayan,

Kindly stay invested in DSP micro-cap (considering your time-frame). It’s not possible to invest in all good funds.

It’s a decent fund.

More I read, more in love with your website. Thanks for educating commerce illiterate like me. Admire your hard work and hope you continue to help people like me.

Dear Vicky ..Thank you for your kind words. Kindly share the articles with your friends and do keep visiting!

Dear Mr.Reddy,

I am an NRI , I want to start investing in Mutual Funds with Lumpsum amount, it will be mix of 50% Balance fund , 25 % Midcap or Small Cap & 25% Monthly Investment plan. But, as you know market is at peak now and for next 2 to 3 months its may be on peak and then fall back. Till then I dont want to invest in Equity based mutual funds. Meantime can you please recommend me suitable Short term liquid investment plan/ instrument for 6 months to 1 years other than Fixed deposits, in which I can park these funds and earn higher interest than FDs and at the same time should not have entry or exit loads or Tax liability. The amount I want to invest is more than 10 Lakhs.

Thanks & Regards,

Dear Tushar,

Its very tough to predict the MARKETS and not advisable to TIME the markets.

If you are investing for long-term goals, you may JUST DO IT now 🙂

Completely agree with Sreekanth. There is never a better time to invest than now! Yes, technically you can invest in the Debt funds and choose a right time to invest in Equity when the market is Ripe, but given the current situation, there is no significant news in short that may affect the market (Brexit is over). And of you want longer, you may just miss the current bull market!

However, take a step back, don’t invest just because you have 10 Lakhs, create a goal based investment, then check how much %age are you looking month-over-month and then distribute your funds in respective funds to achieve that goal.

Hi Sreekanth,

I am Sankar, 32, Married, 1 male child (3.5yrs), working in a private company with monthly income of 60K.

My Investments are 7K in MF’s for the last 1 yr,

My liability : LIC – 2.5K p.m, Home laon EMI – 21K, House Rent – 6.5K.

Mutual Funds invested in SIP mode are,

1. Axis long Term equity fund – Tax planning (4500/-)

2. SBI magnum midcap fund (2500/-)

Now i want to redistribute the Axis fund (Need advice) i.e., 3k to some other MF + wish to add 3K in some other funds (non TP scheme) as home loan is covering my 80c.

Kindly advice which fund to choose among the following….

I have chosen based on the above article (taking account of Alpha, beta, sharpe ratio, SD, etc) and checking from Valueresearchonline.com:

1. Mirae Asset Emerging blue chip fund – Direct

2. DSP Black rock micro cap fund.

3. Franklin India Smaller Companies Fund – Direct Plan

Else,

suggest me some good fund with good return over a period of 10-15 yrs. I am a high risk taker.

I am planning in SIP mode only for long horizon.

Need your valuable guidance.

Thanks & Regards,

Sankar.

Dear Sankar,

1 – If ok, kindly share details of your lic plans (Plan name, commencement date & tenure).

2 – Both the existing MFs are good ones.

3 – The shortlisted MFs are all mid/small cap oriented funds. You may pick one of them (can allocate a higher portion of your investible surplus) and also consider adding on Large-cap or Balanced fund to your portfolio.

Read:

Kid’s Education goal and calculator.

List of articles on important aspects of Personal Financial Planning.

Dear Sreekanth,

Thanks for the valuable reply.

1. My LIC Plan details (Jeevan anand, January 2011, 21 years term, SA – 5 lacs)

2. I am going to continue the two existing MF’s but i am reducing 2.5 K from Axis LTE fund (investible surplus) and redistributing to Mirae Asset Emerging Bluechip fund or DSP Blackrock (Suggest anyone).

3. As per your valuable suggestion i would like to invest 2.5k in SBI magnum balanced fund (Suggest if any good option is available)

So my final investment of 10k after distribution would be like 25:25:25:25 (Axis LTE : SBI Magnum midcap : 1 Balanced fund : Mirae Asseet Emerging Bluechip fund or DSP Blackrock)

Awaiting for your suggetion and any redistruibution if any (Advice Pls).

Thanks in advance.

Dear Sankar,

1 – Kindly note that you are UNDER INSURED. Consider buying a Term insurance plan and discontinue the existing policy.

Read:

Traditional life insurance plan – a terrible investment option.

Best Term insurance plans.

How to get rid off unwanted life insurance policy?

2 – Ok.

3 – Read : Best Balanced mutual funds.

4 – Consider buying a Personal accident plan for self and health insurance for family (if you do not have one).

Read :

Best Personal Accident insurance plans.

Best Portals to compare health plans.

Dear Sreekanth,

As discussed, i have taken Term Insurance plan for a value of 1 Cr. and stopped the existing LIC premium payment. Not closed the policy.

Also started Mirae Asset Bluechip SIP. Still to reduce the ELSS SIP amount, will do it in the next financial year.

Thanks for the valuable guidance.

All the very best dear Sankar..Keep visiting ReLakhs 🙂

Dear sir,

my question is foolish. I invest in many Equity MF’s through SIP (Reliance mf). i have 34 SIP’s of 100 rupees through my HDFC salery account. Will i be charged for so many ECS/Billers (Netbanking or ATM).

Dear prabhash ..May I know the reason for investing in so many funds? What is your investment objective(s)? / Strategy ?

Dear Sreekanth

My Son wants to invest about Rs 15000/- P.M for long term SIP to substantiate Retirement as he has no PF/Gartuity because of contract service. Pl suggest some MF scheme to invest for 15-20 yrs with little Capital protection or no protection.

Dear Biswa,

Kindly go through below articles;

Retirement planning goal and calculator.

How to select best mutual fund scheme based on the risk ratios?

Best Balanced funds.

Best Equity funds.

Hi, I would like to invest via SIP, 10 k per month for next 10 years.I have goal child education and marriage.

so, basically, money i need after 10 years(education) and atleast after 20 years(yuonger kid marriage).

I have lumsub 8 lakhs but hegitating to invest right now,since market is already in high and it is above 10 yr average.

i am planning – hdfc balance fund – 3 k

franklin snallar cos – 2 k

kotak select focus fund (?, need one diversify fund) – 2 or 3 k

one ELSS (axis LTEG – 2.5 k or Birala sunlife 96 – 2.5 k)

Do,I need to buy any debt oriented fund or not?

is this right time for lumsum or SIP ?

Lumsum works better if market low,SIP work better if market is volatile and u expect fund monthly..

Please advise..

Dear Sonu,

Kindly read – Kid’s Education goal planning & calculator.

May be in next 10 years,we may see new highs w.r.t market indices, who knows…So, let’s not try to TIME the markets.

As you have long-term goals, any time is good time.

You may create STPs (systematic transfer plans) from debt funds to equity funds.

Your MF portfolio selection is fine.

Hi,

I want to save money as emergency fund. So, could you please tell me which mutual funds suits for emergency fund.

I am thinking about mip fund

Dear Abhijit,

MIP funds do invest a small pecentage of their corpus in equity securities. So, can be risky.

You may consider liquid funds / arbitrage funds.

Read:

Best Debt mutual funds.

Best Arbitrage funds.

List of best investment options.

Thanks for your reply.

i have some plan regarding emergency fund. i am sharing with you please find it below

i have decided emergency in two category for me. one is when i require money right at that moment. So, in this case i am expecting i should withdraw money at that moment instantly like withdraw from ATM.

This money i will use for situation like any sudden accident

second type of emergency is like if i loose my job but, in this situation i am not expecting instant cash at that moment…i can wait for 1 day-1 week & the possibility of happening this emergency will be very rare.

For both emergencies, i am planning to invest for long term & won’t withdraw or touch that money for other purpose

Before going to conclusion i want to tell my current investment.

Current Investment:

1. Axis Long Term Equity Fund growth Direct

2. Tata Balanced Fund growth Direct

Above two funds grabbing major portion of my investment.

So, for the first type emergency i am thinking of liquid fund & for second type of emergency i was thinking about MIP but as per your suggestion can i go for

arbitrage fund…?

one more query, for second emergency can we think of Debit fund.

Dear Abhijit,

First type – Liquid fund + Cash at home + Balance in Sweep-in account can be considered.

Second type – MIP is ok.

thank you very much for your suggestion.

Hi,

For Scenario 1, i am considering Escort Liquid Fund / Birla Sunlife Cash / HDFC Liquid Fund

For Scenario 2, am Scenario Birla Sunlife MIP II Wealth 25 Plan

i have gone through your article on liquid fund & MIP fund but those are for last years

could you please check & tell me are above good funds to invest.

one more note i fall in 20% tax bracket then should i select growth option for liquid fund…?

Dear Abhijit,

1 – Still Birla MIP 25 plan is a good pick.

2 – Growth option.

Hi Srikanth,

Regarding Birla Sun Life MIP II – Wealth 25 Plan, i have one observation on mutual fund online site that this fund have sip duration “Daily”.

There is no monthly/quarterly sip option available & minimum sip investment also 1000 Rs.

Could you please confirm.

Dear Abhijit ..Minimum amount is Rs 1000 but monthly SIP is also accepted. Kindly check with your online platform provider.

Hi Srinath,

I have account in Mutual Fund Online site. I have checked there only & when i tried to select frequency then i found only one option as “Daily”

that’s why i am asking. So, if you have account in Mutual Fund Online then please check & confirm

For Liquid Funds also i am getting only one frequency option that is “Daily”.

Dear Abhijit ..I am not sure which platform you are referring to? Suggest you to kindly contact the service provider.

Hi Sreekanth,

Thanks for the Blog. I am new to the MF investment.I am just learning about MF from your blog.

I am planning to invest Rs 10 lakhs for my two children future needs. The Time frame would be 10 yrs & 15 yrs.

I am willing to take moderate risk.

Please suggest me on this following

1 ,Is it better to invest in SIP or lump some.

2,How to split the amount Between Large , Mid & Small cap mutual funds

3,please suggest me some good MF in all these categories.(i saw your Best MF to Invest suggest one for my req)

One last question may be a dumb question for ex if a NAV of MF Rs 30 now and after 10 years due to some reason again the NAV is same Rs 30 that mean there is zero returns on that MF

Dear JK,

1 – As you have long-term goals, both can be beneficial. You can create SIPs and then can also make additional lump sum investments as and when you have extra investible surplus.

2 – You can allocate higher % say 40% to mid/small cap fund for long term goals, may be 30% in diversified equity fund and the remaining in a balanced fund. As you are investing for longer period, suggest you not to stick to MODERATE risk. In case if you cant afford to take high risk, you may allocate more to a balanced fund.

Read:

My MF portfolio picks.

Best Equity funds.

What are large/mid/small cap funds?

4 – Yes. (if opted for Growth option).

Hi Sreekanth,

Today I posted a comment on this particular thread but can’t find that here anymore. I didn’t even get subscription email as well. :(. Trying to rephrase it here :

Basically my query was on 4th point on this thread-

Assuming I invest for a goal with 10 years horizon, in a fund having current NAV as ’30’. Now suppose after 3 years NAV becomes 45 and after 5 years it reaches 55. Now I don’t want to redeem the units as the target not reached yet.

It’s advised to move your corpus into safer investment options 1-2 years before the target time. As initial target period was 10 years, the equity funds need to be redeemed in 8th, 9th year. What if the NAV lies between 25-35 during this period. This will be a major loss even after making systematic investment, huge gains mid way and with having long time horizon.

Above example could be really childish and improbable scenario but just a random scenario to learn about growth vs dividend options.

Just framed above example to understand whether growth option should be followed blindly for long term investments or some % allocation should be in dividend option too?

Let me tell you myself and my wife are investing (combined) 50 K per month in equities. Our portfolios are mixed of large cap, mid cap, ELSS, diversified, balanced funds etc. some of these investments are through SIP’s and rest others via STP route (no diff though from equity perspective). All these monthly investments are in growth plans only as we are looking for long term goals and not looking to redeem any of these funds before 8-10 years. Please advise your views on growth vs dividend option and should I reallocate some investment from growth to dividend?

Dear Tarun,

It is not a silly question, but valid one.

But that’s how the investment plan works, we need to be keep on investing in good and consistent investment avenues and hope for the best.

We can’t take away the risk but can try to minimize the impact of loss (can diversify across other Asset classless too).

For fear of risk, if one avoids equities or equity funds (or investments which can beat inflation+taxes) then not investing sufficiently in these options can be more riskier (risk of wealth erosion) than actually investing.

Even if you would like to invest in Dividend option, may I know what would you like to do with the received dividends? (consumption or re-investment)??

Hi Sreekanth,

Thanks for your response.

Regarding your point ‘We can’t take away the risk but can try to minimize the impact of loss (can diversify across other Asset classless too).’

If by other Asset classes you mean other than equity, i.e. debt funds, liquid funds, arbitrage funds, FD’s etc then yes majority of our lump-sum corpus has been invested in these asset classes only. Please let me know if you meant something else with this statement.

regarding next point of ‘fear of risk in equity’, let me tell you that’s not a concern at all. As mentioned earlier, we are investing 50k per month in equities and will invest more n more as and when market goes down. I still believe if I can forget this much amount for long time frame then nothing is better than equity.

Only doubt in my mind is of % allocation between growth and dividend options within equity funds only.

And as you asked – ‘Even if you would like to invest in Dividend option, may I know what would you like to do with the received dividends? (consumption or re-investment)??’

If I invest in dividend option, that would be dividend reinvest only. I am going to invest only that money in equity which can be forgotten for long long time. I am not looking to consume dividend amount for any expense or intermediary goals.

But I am still not sure if I need to make changes in my current investment pattern where all the equity investment is going into growth options only. Do I need to change this pattern for some part of equity investment as in dividend reinvestment? If yes what percentage should go there? What’s your take on growth vs dividend options for investment in equity funds? If it is ok to keep investing in growth option, I’m good with that too. Just looking for your advice as always. 🙂

Dear Tarun,

Different asset classes include Real-estate Property too.

If you have long-term investment horizon, you may kindly opt for Growth option.

Thanks for the response Sreekanth. And yes three years back I made investments in real estate as well for self use but unfortunately neither I got possession yet nor there is any appreciation in the market. 🙁

Dear Sreekanth,

I am new to investing in MFs and have been following your blog for past few days. Thank you very much for guiding all the MF investors.

I currently have Jeevan Saral – annual premium 120k rs – 5 years premiums paid, surrender value 450k- 35yrs maturity – Life insurance sum assured 25lacs and maturity sum assured 51lacs.

We also took out Jeevan anand – annual premium 80k – 4 years premiums paid, surrender value 150k – 21yrs maturity- sum assured is 15lacs.

I want to start investing in MFs looking to build wealth in long term. My age is 31yrs and looking to invest in SIPs for 15yrs. I currently have Life insurance for myself and my wife through an Insurance company other than LIC so do not need insurance. Our main purpose was investment and the LIC agent showed us some graph at the time of buying the policy which assured over 10% return but after reading your posts and through my own research I found this to be incorrect.

Kindly please advise if I should continue to invest in the above LIC policies or should I surrender and invest it in MFs?

The agent said I can withdraw the policy after 10 years, if I withdraw money after 10 years, how would they calculate return? will I get the loyaty addition for each year or just the LA declared at 10th year.

Please advise if it is better to continue till 10 years or to surrender now?

Thank you

Dear JD,

Do you believe that the total Sum Assured on your existing life insurance policies is adequate enough to cover the life risk?

Read:

Traditional life insurance plans – a Terrible investment option.

How to get rid off unwanted life insurance policies?

Kindly buy a Term insurance plan and you may then consider to surrender these plans.

Read: Best Term insurance plans.

May I know your financial goals and your investment time-frame?? (for picking right investment options)

Hi Sreekanth,

I’m a beginner to this Mutual Funds type of investment. I would like to invest around 20,000 per month in SIPs for long term 7 to 10 years time frame. I’m planning to invest in the following schemes, please review my port folio and let me know if I should opt for different schemes or change the amount allotted to each scheme:

1. SBI Blue Chip – Growth – Direct – 2000

2. Frankline Templeton Prima Plus – Growth – Direct – 3000

3. ICICI focused bluechip equity – Growth – Direct – 5000

4. Birla SL Front line Equity Fund – Growth – Direct – 5000

5. Axis long term equity – 2000

6. ICICI Prudential Balanced Fund – 3000

Thanks,

Aruna

Dear Aruna,

You have three large-cap oriented funds (1, 3 & 4). It may not be beneficial to invest in funds which are from same fund category.

Kindly read: MF portfolio overlap analysis tools.

Other three funds are fine.

Read:

Best Equity funds.

Hi Sreekanth,

Thanks for taking the time to answer my query.

After your suggestion and reading further, I’ve removed “Axis long term equity” from my list as my 80C tax section is already full.

I’ve come up with following port folio:

1. SBI Blue Chip – Growth – Direct – 5000 Rs (Large cap – 10 yrs)

2. HDFC Balanced Fund – Growth – Direct – 5000 Rs(Hybrid – Equity Oriented – 3 to 5 yrs)

3. Franklin Templeton Prima Plus – Growth – Direct – 5000 Rs(Multi cap – 10 yrs)

The percentage of overlap accross SBI Blue Chip, ICICI focused bluechip equity and Birla SL Front line Equity Fund is very high (56% – 76%).

I’ve choosen SBI Blue Chip as it is low risk fund and has low overlap againt FT Prima plus compared to ICICI focused bluechip equity and Birla SL Front line Equity Fund.

But I’m little worried about the consistancy as during the 2008 fall of stock market, SBI Blue Chip performance was low compared to its peers(Birla and ICICI).

Later it seems to deliver good performance after the new manager appointed in 2010.

1. Do you think I can still bet on SBI Blue Chip fund for long term time frame? If not, could you please suggest any alternative fund?

2. Over all, I’m investing 15000 per month. I just equally distributed the amount across all the funds. Should I increase/decrease the amount invested in each of these

funds to achieve the better retuns? (for ex: 1. SBI – 7000 Rs 2.HDFC – 3000 Rs 3.FT – 5000 Rs)

3. If at all I wanted to invest in another SIP, which one do you suggest? (except the one listed above)

Thanks,

Aruna.

Dear Aruna,

1 – It is a decent fund with low risk profile.

2 – The time-horizon is different for balanced fund, so kindly check the allocation % as per your expected/required goal amount/corpus amount.

3 – One Mid-cap or Small cap for >10 year period. Ex- DSP micro cap or Franklin smaller cos fund.

Hi Sreekanth,

Thanks so much for all your patience and for all your help in answering my queries.

Aruna.

Hi Sreekanth,

Thank you for your time in writing down details about such kind of mutual funds. I completely believe that mutual funds when invested in long run generate lot of wealth.

vs real estate with facts and figures why real estate is a dull investment

I hope this would be useful for your readers

Thank you dear Vipul for sharing the article. All the best!

Sree, can you share your views on Mirae Asset Emerging Bluechip Fund – dirct plan

Comparing with peers it is showing good metrics

Download Data

Fund | Rating

Fund Risk Grade

Standard Deviation

Sharpe

Ratio

Sortino

Ratio

Beta

Alpha

R-Squared

Franklin India Prima Fund – Direct Plan | Below Avg. 17.06 1.53 2.43 0.99 18.44 0.79

HDFC Mid-Cap Opportunities Fund – Direct Plan | Below Avg. 17.18 1.50 2.61 0.95 18.44 0.72

Mirae Asset Emerging Bluechip Fund – Direct Plan | Low 16.46

Dear Harish ..On risk parameters, Mirae fund looks good.

One of the confusion I have faced when having multiple MF, especially Large Cap Funds is that of the portfolio overlap. If you have large number of Large cap funds, if they not selected carefully, may have portfolio overlap. Meaning, large of the individual stocks have the same configurations in various MFs. So diversification of sectors within the Large Cap may not happen leading to similar returns. I was trying hard to find out the best tool for the same and came across thefundoo.com It has a amazing way to depict the overlapping.

I was wondering, if other can also share some of the outlook and dilemma in resolving these portfolio overlaps.

Dear Manja,

In any two given equity funds, one may notice some percentage of overlap. But the key point is to avoid holding two funds with higher overlap say 75% overlap. As there is no point in holding two funds with same portfolios.

Kindly read:

MF portfolio overlap analysis tools.

Thanks Sreekanth. Realized that thefundoo.com is already there in your suggestion list.

This overlap comparison tools have added a new dimension to my Investment. Realized that 2 funds in my portfolio are more or less the same, stopping the SIP for one of them and quickly to research to find another suitable one. I will come back with my picks, do help in suggestion.

Dear Sreekanthji, I want to invest in Mutual Fund to accumulate savings and compound the value, say for 5 to 7 years. In this connection, which fund would be suitable for me. Apart from other funds, do suggest me suitable funds from SBI Mutual Fund. I can invest a maximum of Rs.5,000/- only per month. Thank you.

Dear Kamal,

You may consider HDFC Balanced fund + Franklin Prima plus + SBI Bluechip fund.

Hi Srikanth,

Which is the best option in MF investment – Growth plan or Dividend re-investment plan. I read dividend re-investment will give us more value than Growth on long run. Pl. guide me.

Thanks,

Harinath

Dear harinath,

The Dividend Re-investment option can be slightly more tax efficient than the growth option for short-term (less than 12 months in case of equity funds).

But this again depends on quantum and frequency of dividends declared by the scheme.

If you would like to keep it simple then you may go with the GROWTH option. If holding period is not more than 12 months, it might really not make much difference.

Hi Sreekanth! I am planning to invest for long term and I have high risk tolerance and want maximum return possible.

I have decided to go with small cap or mid cap funds. However, I can not decide which mutual fund to go for.

Can you please suggest me which mutual fund is best among – DSPBR micro cap , Franklin I smaller co. , Reliance small Cap.

I compared them I find out even though DSP Micro cap seems like it gave more returns but it was more volatile then Franklin I smaller co. Which could make it look like that DSP have higher return. However in comparing absolute returns Franklin seems better option.

Can you please suggest me what your thoughts are on these mutual funds and also please suggest me long term small cap mutual fund that I can have in my portfolio.

Thank you,

Vishal.

Dear vishal,

Franklin Smaller companies is good pick. Personally, I have invested in this fund.

Read: Best Equity funds.

Dear Sreekanth,

I have read your blog and others too. Your articles on mutual funds are really good for first time as well as advanced investors. I have already invested in SIP as follows:

Axis bank long term equity (ELSS): Rs 2000

Franklin Templeton prima plus: Rs 2000

HDFC balanced Fund: Rs 1000

Franklin Templeton smaller com fund: Rs 1000

I want to invest Rs 2000 more in SIP. Should I go for large cap or diversified fund, or mid cap or micro cap? Please suggest a good fund as well.

Regards

Dr Dipon Sharmah

Dear Dr Dipon,

May I know your investment objective and horizon??

MF portfolio looks fine.

Read: MF Portfolio overlap analysis tools.

My investment horizon is 10 years. And my basic objective is wealth creation with less risk. Please suggest a good fund in addition to those mentioned above.

Regards

Dr Dipon Sharmah

Dear Dipon..Suggest you to make additional investments in any of the existing funds itself. Axis LTE (if for tax saving) else Franklin Prima plus.

Nice article Srikanth. One observation is for normal investors it is difficult to understand these standard deviation, beta ratios. Hence I adopted few strategies when I filter mutual funds for investment. Highest returns in last 10 years, 5 years, 3 years and 1 year. Second is ranking from Crisil and value research online. 3rd is checking how other investors are invest (AUM> Rs 100 Crores). How such fund is peforming in various market cycles. These would help investors to pickup right fund suitable to them.

Dear Suresh..Thanks for sharing your views. But, besides return analysis, it would be better if one also evaluates the MFs on various risk parameters too. The information as mentioned in the article is readily available, so it is same as comparing the returns, here the investor has to just compare the risk ratios.

Hi,

How One Time Investment for any SIP based mutual fund possible as mentioned by Immanuel David?

Thank you,

shankha

Dear shankha,

You mean to say that is it possible to do lump sum investment in a SIP fund? Kindly rephrase your query?

Dear Sreekanth,

Your analysis of technical jargon relating to mutual funds is excellent and very useful for layman

Thanks

Thank you dear Sanjeev..Keep visiting 🙂

Age:33 Male ,had 1cr term cover and 15 lac mediCal cover,married, twin girls age 3 yrs,

Hi ,8 months back i have started below Investments thru monthly SIP of 1st every month in view of 15 years long term goal(House,child education, marriage,retirement).Apart from that whenever i have exces money after all my monthly needs..will invest equally in below funds of 25th of month.pleae suggest.

Axis long term equity- 10K

UTI Mid cap – 5K

HDFC Balanced:5K

Franklin india high growths:5K

Icici focussed blue chip equity -5K

Dear Gangadhra..Kindly stay invested, your MF portfolio looks fine.

Read: List of articles on the key aspects of Personal Financial Planning.

Hi Sir,

Im planning to invest in MF or some investment and forget (for at least 10 to 12 years) Rs 2(two) lakh rupees as a gift for my sisters daughter who is turning 8 years coming august. as this is a one time investment which the fund will be helpful for her education or towards her needs on that time upon maturity. could you please help me to choose a fund and if there is another option please let me know. im unable to select as im new to this MF, shares etc. whatever you suggest i will invest accordingly.

Thx and regards

David

Dear Immanuel,

You may consider investing in a Diversified Equity fund like Franklin Prima plus + in one balanced fund like HDFC Balanced fund.

Kindly read: Kid’s education goal planning calculator article..